Document 11077001

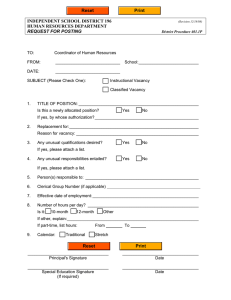

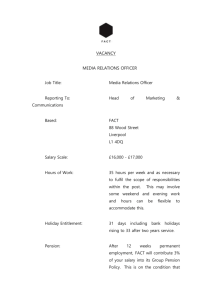

advertisement