Document 11072062

advertisement

MIT Sloan School

of

Management

WORKING PAPER

Working Paper 4330-02

January 2002

THE RELATION BETWEEN AUDITORS' FEES FOR

NON- AUDIT SERVICES AND EARNINGS QU.\LITY

MIT

Sloan School of

Management

50 Memorial Drive

Cambridae, Massachusetts 02142-1 347

MIT

Sloan School of Management

Working Paper 4330-02

January 2002

THE RELATION BETWEEN AUDITORS' FEES FOR

NON-AUDIT SERVICES AND EARNINGS QUALITY

Richard M. Franlcel, Marilyn

5

2002 by Richard M. Frankel, Marilyn

F.

F.

Johnson, Karen K. Nelson

Johnson, Karen K. Nelson.

Short sections of text, not to exceed two paragraphs,

permission provided that

full credit

including

may

.AJl

rights reserved.

be quoted without explicit

© notice is given to the source.

MASSACHUStirSINSlllUlt

This paper also can be downloaded without charge firom the

Social Science Research

OFTECHNGLOGY

Network Electronic Paper Collection:

http://papers.ssm.com/abstract_id=296557

JUL 2 3

2002

LIBRARIES

The Relation Between Auditors' Fees for Non-Audit Services

and Earnings Quality

Richard M. Frankel

MIT

Sloan School ofBusiness

50 Memorial Drive, E52.325g

Cambridge, MA 02459-1261

(617)253-7084

frankel@mit. edu

Marilyn F. Johnson

Michigan State University

Eli Broad Graduate School of Management

N270 Business

College Complex

East Lansing. MI48824-1122

(517) 422-0152

johnl614@msu.edu

Karen K. Nelson

Stanford University

Graduate School of Business

Stanford CA 94305-5015

(650) 723-0106

knelson(a}gsb. Stanford, edu

January 2002

thank Bill Beaver, Walt Blacconiere, Larry Brown, S. P. Kothari, Tom Linsmeier, Roger Martin, Maureen

McNichols, Joe Weber, two anonymous reviewers, and seminar participants at the University of California at

Berkeley, Carnegie Mellon University, Georgia State University, Michigan State University, Northwestern

University, and the 2001 Stanford Summer Accounting Camp for helpful discussions and comments. Karen Nelson

acknowledges the support of the Financial Research Initiative at Stanford University Graduate School of Business.

We thank First Call for providing the analyst forecast data. Waqas Nazir, Nora Richardson, and Xiaoyan Zheng

We

provided valuable data collection assistance.

The Relation Between Auditors' Fees for Non-Audit Services

and Earnings Quality

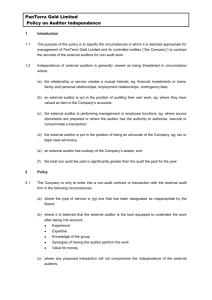

Abstract:

quality.

We

examine the association between the provision of non-audit services and earnings

Because of concerns regarding the

credibility, the Securities

effect

of non-audit services on financial reporting

and Exchange Commission recently issued revised auditor

independence rules requiring firms to disclose in their annual proxy statement the amount of fees

paid to auditors for audit and non-audit services. Using data collected from proxy statements

filed

between February

more non-audit

and

is

5,

services

2001 and June

from

15,

2001,

their auditor are

we present

more

to report larger absolute discretionary accruals.

likely to just

filing date.

These

meet or beat

We also find that the unexpected

to total fee ratio is negatively associated

results are consistent with

strengthens an auditor's economic

analysts' forecasts

However, the purchase of non-audit services

not associated with meeting other earnings benchmarks.

component of the non-audit

evidence that firms purchasing

with stock returns on the

arguments that the provision of non-audit services

bond with the

client

and that investors price

this effect.

Keywords: Auditor independence, Auditor fees, Earnings management. Discretionary accruals

Data Availability: The data used in

this

study are from the public sources identified in the

text.

I.

INTRODUCTION

This paper provides empirical evidence on the relation between non-audit services and

earnings quality.

We test hypotheses concerning:

of non-audit services from

to the disclosure

its

of non-audit

auditor and

fees.

(1) the association

eammgs management, and

In the past decade there has

between a firm's purchase

(2) the stock price reaction

been a dramatic increase

proportion of fee revenue auditors derive from non-audit services, yet

we know

little

in the

about

how

non-audit services are related to earnings quality.' Concern about the effect of non-audit services

on the financial reporting process was a primary motivation for the Securities and Exchange

Commission (SEC)

to issue revised auditor

rules require firms to disclose the

amount of all

The provision of non-audit

reporting

by providing

independence rules on November

audit

and non-audit fees paid

services to audit clients

may increase

15,

to

2000. The

its

the quality of financial

the auditor with information about the client's business that

performing the audit (Antle

et al.

auditor.

is usefiil in

1997; Pitt and Birenbaum 1997). Non-audit services

increase the auditor's investment in reputational capital

(Aminada

that the provision of non-audit services strengthens the auditor's

1999).

may also

A competing view is

economic bond with the

client,

thereby increasing the auditor's incentive to acquiesce to client pressure (Simunic 1984; Parkash

and Venable 1993; Firth 1997).

The

the

SEC

first set

of tests focuses on one dimension of earnings quality of particular concern

in recent years (Levitt 1998),

i.e.,

management's deliberate intervention

process in the form of earnings management.

We

examine the propensity

to

to

in the earnings

meet or beat

earnings benchmarks and the level of a firm's absolute discretionary accruals to assess whether

' From 1993 to

1999, the average annual g^o^vth rate for revenues for management advisory and similar services was

26 percent, compared to 9 percent for audit services (SEC 2000).

the provision of non-audit services

non-audit services

may

is

The provision of

also affect investors' perceptions of audit quality. If investors require

compensation for perceived changes

(Simunic 1984).

associated with earnings management.

in audit quality,

We assess whether the disclosure

adjustments

in firm

value will occur

of non-audit fees conveys value-relevant

information to the market by examining the share price reaction to disclosure of non-audit fees.

The

the

analysis

SEC between

is

based on auditor fee data collected from 3,074 proxy statements

February

two measures of non-audit

5,

2001, and June

services.

The

first

15,

2001.

measure

(FEERATIO). The second measure disaggregates

audit

client

(RANKAUD) components,

both of which

We

is

filed

with

use the fee disclosures to construct

the ratio of non-audit fees to total fees

total fees into its

we measure

non-audit

(RANKNON)

and

as the percentile ranks for each

of a given auditor.

Results from the

first set

of tests indicate a significant positive association between the

purchase of non-audit fees and earnings management.

significantly higher for firms just

FEERATIO

and

RANKNON are

meeting analyst forecasts. In contrast, both measures are

we

negative and significant for firms just missing analyst forecasts. However,

association

between

increases in earnings

either

FEERATIO

or

find no

RANKNON and two other earnings benchmarks,

and small positive earnings. The

results also indicate that

FEERATIO

RANKNON are significantly higher for firms with high absolute discretionary accruals.

results are robust across several alternative specifications,

more non-audit services manage earnings

and indicate

to a greater extent

small

and

These

that firms purchasing

than other firms.

We interpret this

evidence as consistent with the argument that the provision of non-audit services strengthens an

auditor's

economic bond with the

client.

The earnings management analyses

also indicate that

RANKAUD

is

negatively

associated with meeting analyst forecasts and absolute discretionary accruals. Moreover, the

percentile rank of total fees

discretionary accruals.

to the auditor

not associated with either meeting analysts forecasts or absolute

is

Taken

together, this evidence suggests that the

have different implications

for audit quality.

The

components of fees paid

audit fee evidence

consistent

is

with the argument that audit fees increase an auditor's investment in reputational capital.

Results from the event study indicate a negative association between share prices and the

annoimcement of higher than expected non-audit

the evidence

is

sensitive to the

However, the

fees.

assumed expectations model

for non-audit fees.

marginally significant negative association between share prices and

RANKNON.

However, we find

statistically significant

between share prices and a proxy that

FEERATIO. These

of

We find a

FEERATIO

and

evidence of a negative association

explicitly controls for the expected

some

results provide

statistical significance

component of

consistent with the argument that investors perceive the

provision of non-audit services to strengthen an auditor's economic bond with the client.

The remainder of the paper

rules

organized as follows. Section

II

discusses the

SEC's new

on auditor independence and develops our hypotheses. Section EH describes the research

design. Section

IV presents the empirical

n.

SEC

is

results.

Section

V

summarizes and concludes.

BACKGROUND AND HYPOTHESIS DEVELOPMENT

rule on auditor independence

In

November 2000,

the

SEC

issued Final Rule S7- 13-00, Revision of the Commission

's

Auditor Independence Requirements. The Rule defines independence as "a mental state of

objectivity

and lack of bias" and adopts a two-pronged

independent. The

to as

first

prong

independence "in

fact."

is

test to

determine

if

an auditor

direct evidence of the auditor's mental state,

However, mental

is

commonly referred

states are not directly observable,

and thus the

second prong provides for an assessment of independence "in appearance" based on observation

of external

facts.

The Rule

specifies that the

SEC

will not consider an auditor to be independent

with respect to a particular client "if a reasonable investor, with knowledge of all relevant facts

and circumstances, would conclude that the auditor

judgment" (SEC 2000, Section

impartial

The Rule provides four guiding

These principles

state that

is

I).

principles for

independence

not capable of exercising objective and

is

impaired

making independence determinations.

when an

auditor: (1) has a

conflicting interest with the audit client; (2) audits the auditor's

management

The Rule

(3) functions as

or an employee of the audit client; or (4) acts as an advocate for the audit client.

also identifies situations in

certain financial or

under prior

own work;

mutual or

rules.

employment

which the auditor

is

not independent of the client because of

relationships, although these restrictions are

In addition, the

Rule

identifies

more hmited than

and prohibits certain non-audit services

that

it

believes impairs independence regardless of the size of fees they generate.

Finally, the

February

5,

Rule requires companies to disclose

in

proxy statements

filed

on or

after

2001, information regarding fees billed by the auditor for the most recent year.

These fee disclosures are intended

to

provide information useful to investors in evaluating

whether the magnitude of fees for non-audit services has impaired the auditor's independence.

Firms are required to disclose:

(1)

under the caption ''Audit Fees'" the aggregate fees billed for the audit of the annual

financial statements and for reviews of the quarterly financial statements;

(2)

under the caption ''Financial Information Systems Design and Implementation

Fees" the aggregate fees billed for professional services rendered for (i) directly

indirectly operating or supervising the

network, or

company's information system or

or

local area

designing or implementing hardware or software that aggregates

financial statement source data or data significant to the financial statements; and

(3)

(ii)

under the caption "All Other Fees" the aggregate fees billed for

rendered by the auditor other than those described in (1) and

all

(2).

services

Firms are also required

to disclose if the audit

committee (or the board of directors

if there is

no

audit committee) considered whether the provision of non-audit services is compatible with

maintaining the auditor's independence.

Hypothesis development

The provision of non-audit services and earnings management

Auditors

reliability

only

if the

facilitate contracting

between investors and management by

of the financial statements. However, the auditor's monitoring

auditor

is

independent (Watts and

Zimmerman

1986).

compromised when

and reports a misstatement, and independence

auditors

bond between auditor and

audit services.

He

client.

services can impair independence

is

the joint probability

considered

by creating an economic

Simunic (1984) models the joint demand

for audit

defines a decrease in auditor independence as "any situation

incentives such that a self-interested auditor

findings."'^

is

report misstatements they have discovered.

fail to

The provision of non-audit

valuable to investors

DeAngelo (1981) defmes

independence within a broader framework of audit quality. Audit quality

that the auditor discovers

is

attesting to the

He shows

that

when

the

is

more

and non-

which

alters

likely to ignore, conceal, or misrepresent his

same auditor provides both

services and the auditor retains a

portion of the cost savings from "knowledge spillovers," the auditor will be economically bonded

to the cHent.3

Parkash and Venable (1993) and Firth (1997) present empirical evidence using

U.S. and U.K. data, respectively, that firms act as if the purchase of non-audit services

2

Other definitions of independence are also discussed

in the literature.

Magee and Tseng

(1990, 322) state that a

lack of independence implies that "an auditor's decisions are not consistent with his or her behefs about a reporting

and Baiman et al. (1991) developed a conceptual framework for analysing auditor

independence as collusion between the auditor and the manager.

policy." Antle (1982, 1984)

^

Subsequent empirical work, however,

fails to

(Pahnrose 1986; Abdel-khalik 1990; Davis

fmd evidence

et al. 1993).

consistent with the existence of "knowledge spillovers"

jeopardizes independence. Both studies find that firms requiring high quality audits because of

high agency costs will be less likely to purchases non-audit services from their auditor. Gore

al.

et

(2001) present evidence also using U.K. data of a positive association between the provision

of non-audit services and earnings management. They also document that non-Big Five auditors

allow

more earnings management than Big Five

The agency

contrast,

literature

views auditor bias

an evolving body of experimental

auditors.

be a deliberate form of misrepresentation, hi

to

literature suggests that

psychological heuristics

unintentionally and unconsciously lead auditors to bias judgments. Beeler and

present experimental evidence that audit partners are

client is a

budgeted

going concern and

to the audit

when

to revise

downward

there are contingent

more

likely to initially

their initial estimate

Hunton (2001)

assume

that the

of the number of hours

economic rents arising from the provision of

non-audit services. The authors attribute these fmdings to an information processing bias

as predecisional distortion

of information. Bazerman

et al.

known

(1997) argue that the self-serving bias

poses a similar threat to independence and concludes that "the problem

lies

not in our desire to

be unfair, but in our inabihty to interpret information in an unbiased manner."

PoUcy makers

of the American

histitute

Of fundamental

of Certified Public Accountants

importance

in

two

(POB

2000, 119) states

that:

understanding the conflict of interest that arises from the

provision of non-audit services to audit clients

really serving

Board (POB)

offer similar arguments. For example, the Public Oversight

different sets of clients:

is

the fact that in so doing the audit firm

management

in the

is

case of management

consulting services, and the audit committee, the shareholders and

all

those

who

rely on

the audited fmancials and the firm's opinion in deciding whether to invest, in the case of

the audit.

.

.

It is

obvious that in serving these different chents the

And

it is

problem, regardless of whether,

The above arguments imply

quality

owed

fhm

is

subject to

one client or the other.

equally obvious that the existence of dual loyalties creates a serious appearance

conflicts of interest that tear at the firagile fabric of loyalty

to

in particular cases, the fabric actually tears apart or not.

that the provision of non-audit services results in

and an increased likelihood the auditor

will

lower audit

waive earnings management attempts.

An

auditor concerned about the possible loss of non-audit fee revenue

may be

less likely to disagree

with management's accounting choices, giving firms greater leeway to manage earnings.

A competing viewpoint suggests that the provision of non-audit services strengthens audit

quality

and can thus reduce earnings management. Academic research and policy arguments

provide support for this view. For example, a

1

997 White Paper submitted

Standards Board by Pitt and Birenbaum (1997, 4) states

.

.

.the

overwhelming economic

interest

to the

also

Independence

that:

of accounting firms

in their reputational capital

provides a powerful incentive to safeguard independence. Non-audit services increase the

firm's investment in reputational capital, contribute importantly to the quality of audit

services and provide other benefits to clients and the public.

Arrunada (1999) formally models the argument

that non-audit services increase audit

quaUty by providing information about the client firm's business that complements the audit

function and increasing an audit firm's investment in reputational capital. Using similar

arguments

to

DeAngelo

(1981), he

audit firms because the gains

the reputational losses that

shows

that reputational penalties constrain the behavior of

from acquiescing

to

any one

would be imposed by other

reputation for independence. Relatedly,

Dopuch

et al.

demands

client's

clients

who

are outweighed

value the audit firm for

by

its

(2001) analytically demonstrate that the

increase in reputational capital resulting from the provision of non-audit services will increase

auditor independence and audit quality provided that the probability of misstatement risk

is low."*

In addition to the reputational cost arguments, institutional factors support the contention

that non-audit fees

legal sanctions

'^

do not adversely effect auditor independence.

from poor quality

audits.

First, auditors

face significant

Aggregate legal claims against the Big Six auditing

Although reputational incentives may constrain the behavior of an individual employee seeking

to

maximize

whose

value of the audit firm, they are less effective in constraining the behavior of an individual employee

compensation depends on retaining a particular

client (Trompeter, 1994).

the

firms exceeded $30 billion at the end of 1992.^ Second, no evidence exists that the provision of

non-audit services poses a threat to auditor independence (Antle

et al.

1997;

Walhnan

1996).

Third, investors do not appear to be concerned about the provision of non-audit services (Antle et

.

al. 1

997). Finally, insurers perceive

non-audit services (Antle

no additional legal

liability arising fi-om the

provision of

et al. 1997).

Because of the competing views on the provision of non-audit services,

we

test the

following hypothesis, stated in null form:

HI: The provision of non-audit services

earnings management.

to audit cUents

is

not associated with

The provision of non-audit services and shareholder wealth

The provision of non-audit

services

may affect

For example, the provision of non-audit services

investors' perceptions of audit quality.

may reduce

the probability of truthful audit

reporting if the non-audit services generate economic rents. If investors require compensation for

a perceived increase in the probability

of nontruthfiil reporting, then a loss in firm value

occur (Simunic 1984).* In addition, a perceived reduction in audit quality

share price adjustments due to a

earnings stream (Teoh and

of non-audit services

downward revision

Wong

may improve

may trigger negative

in the perceived persistence

1993).^ Alternatively, the

will

of the firm's

knowledge gained by

the provision

the auditor's ability to detect accounting irregularities.

As

a

However, see Coffee (2001) for a discussion of how three recent legal developments - The Private Securities

Reform Act of 1995, the Supreme Court's decision in Central Bank of Denver N.A. v. First Interstate

Bank of Denver, N.A., and the Private Securities Litigation Uniform Standards Act - have resulted in a significant

^

Litigation

decrease in auditors'

^

For research

liability for securities fraud.

that relates uncertainty to valuation, see

Barry and BrowB (1985).

(1991) and Dechow et al. (1996) present evidence that companies

receiving accounting enforcement actions by the SEC for manipulating earnings experience a decline in stock prices

around the announcement of the enforcement action. The stock price response for our sample is not expected to be

^

Consistent with these arguments, Feroz et

al.

as extreme, however, because we do not focus on a sample of firms identified by the

Accepted Accounting Principles.

SEC

as violating Generally

result, investors

from

services

may

infer higher audit quality

an increase

their auditor, leading to

Given the two possible shareholder

we

services and perceived audit quality,

H2: There

is

services

is

from

one

their auditors,

from

in firm value.

between non-audit

following hypothesis, stated in null form:

test the

of non-audit

to the disclosure

fees.

reduced audit quality and thus penaHze firms purchasing non-audit

that the equilibrium carmot

services

firms disclose the purchase of non-audit

interpretations of the relation

no share price reaction

If investors infer

when

may

question whether this

be sustained,

i.e.,

However, even

their auditor.

if

(i.e.,

a viable equilibrium.

One answer

firms will not continue to purchase non-audit

such an equilibrium cannot be sustained, a stock

price response to the disclosure of non-audit fees can

equilibrium can be sustained

is

still

occur. Alternatively, such an

firms will continue to purchase non-audit services from their

auditor despite the negative share price effects) if choosing another firm to provide the services

would be

costlier or

produce fewer benefits. Non-audit services

may be more

costly and produce

fewer benefits when purchased from a firm that has less specific knowledge of the company

the auditor.

More

generally,

managers

may continue

to

engage low quality auditors even

market penalizes them for doing so because such a penalty

high quality auditor (Simunic 1984; Becker

et al.

is

tlian

if the

lower than the cost of engaging a

1998).

m. RESEARCH DESIGN

Sample description

Table

1

,

Panel

A summarizes

the sample selection procedure.

of 4,701 definitive proxy statements on the SEC's

February

5,

2001 and June

1

5,

2001

.

From

Our

initial

sample consists

EDGAR database with a filing date between

this total,

we

exclude 1,124 proxy statements

filed

fmancial institutions (SIC codes 6000-6999) because of the unique procedures required to

by

estimate discretionary accruals for these firms. In addition,

do not

relate to an annual

we

meeting of shareholders because the

disclose auditor fees in these proxy statements. Finally,

we

exclude 51 proxy statements that

SEC

does not require fums

exclude 71 proxy statements

indicating that the firm changed auditors during the year because the change

amount of fees

billed.

components of auditor

Of the remaining

fees.^

to

is

likely to affect the

3,455 observations, 218 do not disclose the required

We match

the firms with fee data to Compustat, resulting in a final

sample of 3,074 firms.

Panel

B

of Table

1

details the fi-equency

of proxy filings by month. Firms must

proxy statement prior to the annual shareholders meeting which typically occurs three

months

after the fiscal year end.

statement in

March

or April, corresponding to a

the time-period clustering, Panel

sample

is

The majority of the firms

C of Table

1

(median) rafio of audit fees

statistics

A

reports statistics for the

by the new auditor independence

ranges from a

rule.

minimum

The mean

of 0.02

to a

of 1.00. Only eight percent of sample firms engaged their auditor to provide fmancial

(IS).

Although the mean (median)

0.02 (0.00), untabulated fmdings indicate that this ratio

incurred these fees.

^

or January fiscal year end. Despite

of the fee data. Panel

to total fees is 0.51 (0.49), but

information systems design services

is

our sample filed their proxy

in

reveals that the industry composition of our

three categories of fees required to be disclosed

fees

to four

similar to that of the firms on Compustat in 2000.

Table 2 presents descriptive

maximum

December

file their

The noncompliance

The mean (median)

rate for our

17 percent reported by Abbott et

sample

al.

is

ratio

of other fees to

thus 6 percent

(i.e.,

218

-^

is

ratio

of IS fees

to total

0.28 (0.17) for firms that

total fees is 0.47 (0.48),

3,455), well

below

the

with 96

noncompliance

rate

of

(2001). However, their sample includes only proxy statements filed between

2001 and March 16, 2001. We find that the noncompliance rate for our sample dunng this time period is

noncompliance rate for proxy statements filed after March 16, 2001 is 5 percent. Abbott et al.

(2001) report that firms failing to disclose auditor fees are significantly smaller and more likely to have a non-Big

Five auditor. As shown below, small firms and firms with a non-Big Five auditor report lower fees for non-audit

February

5,

13 percent, while the

services.

10

percent of the sample reporting fees in this category. Finally, the

audit fees

the

(i.e.,

sum of IS and

other fees) to total fees

mandatory disclosures of fee

In addition to the

mean (median)

ratio

0.49 (0.51).

is

data, approximately one-third

sample (1,052 firms) voluntarily disclose information on the composition of other

provide a parsimonious description of this data,

related, e.g., audits

(iii)

of the

To

fees.^

these fees into four categories:

(i)

audit-

of employee benefit plans, regulatory audits, and preparation of registration

statements and other

consulting,

we code

of non-

SEC

combined

filings, (ii) tax, e.g., preparation

audit-related

and

tax, consisting

and

of tax forms, and tax-related

filing

of fees fi^om both of the previous two

categories, and (iv) other advisory, e.g., general consulting services,

and information technology

consulting for systems not associated with the financial statements. '°

B of Table

Panel

2 reports descriptive statistics of the components of other fees. Audit-

related fees are disclosed

by 13 and

1 1

percent of the sample, respectively, while 6 percent of the sample reports combined

audit-related and tax fees.

ranging from a

combined

by 21 percent of the sample. Tax and other advisory fees are disclosed

The

voluntarily disclosed fees are a substantial portion of other fees,

mean (median) of 46

audit-related

and tax

fees.

(45) percent for other advisory fees to 95 (100) percent for

Untabulated regression results confirm that the likelihood

of voluntary disclosure increases significantly with the magnitude of other fees relative

fees.

Moreover, conditional on the

Young

are

more

likely to disclose

ratio

of other fees

to total fees, firms audited

components of other

fees,

to total

by Ernst

&

while firms audited by the other

Big-Five auditors and by non-Big Five auditors are less likely to disclose.

^

The SEC's proposed

auditors.

rule on auditor independence contains a representative list of non-audit services provided by

These services include non-financial statement accounting and auditing, business controls and re-

engineering,

ta.x,

financial, information

distribution, legal services,

^°

The majority (60

generally include

and

systems technology, employee benefit, corporate finance, marketing and

litigation support.

percent) of firms disclosing other advisory fees are clients of Ernst

ta.x

fees with other advisory fees.

11

& Young, and these firms

Table

summarizes the fee data

3

Among

audit firms combined.

the

of the Big Five audit firms, and for

for each

Big Five,

total fees billed to the

differ in the

composition of total

fees.

one-third of total fees billed for any of the Big Five auditors,

by non-Big Five

The composition of fees

auditors.

& Young earns

Ernst

auditors.

KPMG.

In contrast, total

sample firms audited by non-Big Five auditors are only $64 million. The Big Five

and non-Big Five also

billed

other

sample firms range from

$1.77 billion for PricewaterhouseCoopers to just over $700 million for

fees billed to

all

Audit fees comprise no more than

compared

to

58 percent of total fees

Big Five

also varies across the

only six percent of its revenue from IS services, but

bills

more

for

other services (66 percent) than any other auditor. Non-audit fees range from 67 percent of total

fee

revenue for Arthur Andersen

to

75 percent for PricewaterhouseCoopers.

The remaining columns of Table

ratios

of fees billed

substantially

for the

in

each category

from non-Big Five

3 report,

auditor, the

Once

to total fees.

auditors.

by

The median

median of the

client-specific

again, Big Five auditors differ

ratio

of non-audit fees to

non-Big Five auditors, while for Big Five auditors the

total fees is 0.30

ratio is at least 0.50.

Thus,

at least

half of the Big Five's audit clients pay non-audit fees in excess of audit fees. However, note that

the

median

ratio

of non-audit fees

to total fees is

lower than the proportion of total fee revenue

derived from non-audit fees. Thus, a relatively small

disproportionate

The

the

SEC

in

data

amount of each of the Big Five

summarized

for a

auditor's non-audit fee revenue.

Tables 2 and 3 differs markedly from 1999 data considered by

formulating the rule on auditor independence

that non-audit fees

clients

in

number of clients account

(SEC 2000)." The

earlier data suggests

comprise ten percent of total revenues, with almost three-fourths of audit

purchasing no non-audit services. In contrast, our findings indicate that non-audit fees

" The SEC

obtained their data from the "Special Supplement: Annual Survey of National Accounting Firms

Public Accounting Report (March 3

1

,

2000) and from reports

12

filed

with the AICPA's

SEC

Practice Section.

-

2000,

comprise approximately 70 percent of total fee revenue (Table

purchasing non-audit services (Table

compile the 1999 data

this

comparison

may not be

2,

3),

with 96 percent of audit clients

Panel A). Although the categorization of fees used to

comparable

strictly

illustrates that the actual

to that required

under the

new SEC

magnitude and frequency of non-audit services

rule,

is

considerably greater than prior estimates.

Model

specification

Measures of non-audit service fees

We use the auditor fee disclosures to develop two measures of non-audit services.

first

measure

is

(FEERATIO). The SEC's purpose

the ratio of non-audit fees to total fees

requiring the fee disclosures

is

The

in

to provide investors with information to evaluate "whether the

proportion of fees for audit and non-audit services causes them to question the auditor's

independence" (SEC 2000, Section

Moreover,

III.c.5).

this ratio

has been used as a proxy for

auditor independence in prior research (Scheiner 1984; Glezen and Millar 1985; Beck, et

al.

1988; Parkash and Venable 1993; Barkess and Simnett 1994; Firth 1997). However, this

measure

is

invariant to the scale of the fees, and thus does not capture the relative financial

importance of the chent to the auditor. In addition,

which cross-sectional variation

in the ratio

is

it

is

not possible to determine the extent to

driven by the level of non-audit fees as opposed to

audit fees.

DeAngelo (1981) argues

that auditor

quasi-rents specific to a particular client,

dependent on each client

studies

have used the

is

ratio

independence

and suggests

is

inversely related to the value of

that the relative

magnitude of fees

a potential surrogate for independence. Lacking fee data, prior

of client sales to

total sales

Lys and Watts 1994; Reynolds and Francis 2001).

13

audited by the auditor

(e.g.,

Stice 1991

Om second measure of non-audit services

is

the percentile rank,

(RANKNON).

by

Firms

of the amount of non-audit fees disclosed by each firm

auditor,

in the highest percentile receive a

percentile receive a rank of

revenue to mitigate error

rank of 100 while firms in the lowest

We use percentile ranks rather than scaling by total audit

1.

in the

measurement of the

relative

firm

magnitude of client-specific quasi-

rents (Johnston 1984).

Although our study focuses on the provision of non-audit services, prior

generally does not

1997). Indeed,

make

some

between audit and non-audit fees

studies suggest that audit fees can also create

between the auditor and

may

a distinction

client

(e.g.,

literature

Hansen and Watts

economic dependence

(DeAngelo 1981; Simunic 1984). Alternatively, higher

audit fees

increase the auditor's investment in reputational capital, thereby increasing the loss from an

impairment of independence (Arrunada 1999). Several prior studies document a positive

correlation

between audit and non-audit

1995). Thus, in addition to

amount of audit

Our

RANKNON, we

fees disclosed

tests include

DeAngelo (1981) argues

fees (e.g.,

by each firm

Simunic 1984; Palmrose 1986; Craswell

include the percentile rank, by auditor, of the

(RANKAUD).

two additional auditor variables discussed

that

surrogate for audit quality.

even when quasi-rents vary across

The most common proxy

in the prior hterature.

clients, auditor size serves as a

for auditor size is an indicator variable for

Big Five auditors. Prior research fmds that Big Five auditors are less likely

management than non-Big Five

1998; Francis et

al.

auditors

(e.g.,

(e.g.,

Beck

et al.

to

allow earnings

DeFond and Jiambalvo 1991,1993; Becker

1999). Prior research also suggests that independence

length of auditor tenure

et al.

is

et al.

decreasing in the

1988; Lys and Watts 1994). Thus, in addition to the

fee-based measures discussed above, our analysis includes a Big Five indicator variable

(BIGFIVE) and

a variable measuring the

statements of the

number of years

company (AUDTEN).

14

the auditor has audited the financial

Estimation equations

We use two complementary approaches to identify firms managing earnings.

research

(e.g.,

documents

Burgstahler and Dichev 1997; Burgstahler and

companies

to

meet

levels, consistent

SEC and the POB

simple benchmarks. Both the

for public

Eames 1998; Degeorge

First Call,

between actual eamings per share and the

announcement of annual eamings, and

we

last

we

equity. 1'

calculate

in net

eamings surprises

eamings and small

relevant

benchmark during

(SURPRISE) and

'-

for the

at

zero in the distribution of

in contrast to prior research,

all

we

find

to

be a

focus the analysis on small eamings surprises

(INCREASE). '3

(1999), the bin width

variable times the negative cube root of sample size.

we

no

non-financial firms

sample firms. Because zero eamings does not appear

the sample period,

al.

by scaling net

income by beginning of the year market value of common

small mcreases in eamings

Consistent with Degeorge et

and Dichev

profits

evidence of a discontinuity in the distribution of eamings levels, either for

2000 or

as the difference

Similarly, following Burgstahler

eamings surprises and earnings changes. However,

in

2000).

meet or beat analysts' expectations

Untabulated results confirm a significant discontinuity

on Compustat

POB

(SEC 2000;

available consensus (median) forecast prior to the

identify firms reporting small increases in

income and the annual change

meet

and project a smooth eamings path creates

identify firms that just

as those reporting a surprise of 0.00 or 0.01.

to

expressed particular concern that the pressure

analysts' expectafions

Using data obtained from

1999)

eamings

with firms managing earnings

pressure on auditors to permit their clients to meet those objectives

(1997),

et al.

a significantly higher than expected frequency of firms with shghtly posifive

eamings changes, and eamings

surprises,

Prior

is

The

twice the interquartile range of the scaled eamings

resulting bin width

is

0.02 for both the change in eamings

and the level of eamings.

'3

We do not

find significant results

absence of a discontinuity

when we

in the distribution

repeat the tests below for firms reporting small profits, but given the

of earnings

this result is

not siuprising. Doubling the bin width to 0.04

produces a significant discontinuity; however, the interpretation of this finding is not

significant results using the wider bin width to identify firms reporting small profits.

15

clear.

We

also do not find

Prior research identifies several factors that influence firms' incentives to meet or beat

Matsumoto (1999)

earnings benchmarks.

prospects, and institutional ownership are

benchmarks.

We measure

company operates

in a

litigation risk

reports that firms with high litigation risk, growth

more

likely to

(LITRISK)

as

be concerned about missing earnings

an indicator variable equal

high risk industry identified by Francis

et al. (1994).

market-to-book ratio (M/B), and insfitutional ownership (%E<^ST)

held by institutions (reported by Spectrum), hi addition,

less likely to report positive earnings surprises,

indicator variable

(LOSS) equal

to

one

if the

Brown

may be more

Growth

one

is

the percentage of shares

firm reported a loss in 2000.

likely to beat earnings

assets

(CFO) because

benchmarks and may

and financing

and poor

performance are additional determinants of non-audit fees identified by Firth

(1997).''*

model includes an indicator variable (FIN/ACQ) identifying fums

(reported

by

Securities

net

CRSP

value-weighted market index

income divided by average

market value of equity

total assets.

Data Corporation).

(LOGMVE). We

(ANNRET), and return on

Finally,

we

Thus, our

that issued securities or

two measures of firm performance, the percentage compounded monthly return

for the

firms

also be better

activity

company during 2000

the

and thus our regression model includes an

able to afford outside consulting services. Acquisition

acquired another

if the

(2001) finds that loss firms are

We control for operating cash flow scaled by average total

with higher cash flow

is

to

assets

for

We include

2000 adjusted

(ROA), defined

control for firm size using the log of the

estimate the following logit model,

where

BENCHMARK indicates the earnings benchmarks, SURPRISE or INCREASE:

'"*

In the next section,

results

we

discuss the estimation of a

of this analysis are reported

in the

model of non-audit

Appendix.

16

as

fees similar to that of Firth (1997).

The

^fi,

Prob {BENCHM'iRK

)

=

F

+ ^.FEEHiTIO (or /S.^RANKNON + P,,RANKAUD

+ P^BIGFIVE + p,A UDTEN + p.LITRISK + P,

)^

MB

(1)

P^LOGMVE + p, %INST + p.LOSS + p^CFO

V+ P,qFIN/ACQ + p,,ROA + ^,2 ANNRET +u

+

Our second approach

managing earnings uses discretionary accruals

to identifying firms

estimated with a cross-sectional modified Jones (1991) model (see

Becker

et al.

1998; Bartov

2001

et al.

).

j

Discretionary accruals

DeFond and Jiambalvo

(DACC)

are equal

1994;

to:

DA CC = TA-[a + fi, [AREV - AREC] + '^^PPE)

where

all

variables are scaled

by

total assets at the

defined as net income less cash from operations,

the

oc.

change

Pi,

and

industry

in net receivables,

JSi

and PPE

is

beginning of the year, and

AREV is the change

is

in net

TA

identified using two-digit

model

at the

is total

revenues,

gross property, plant, and equipment.

are obtained from estimating the following

membership

(2)

The

accruals,

AREC

is

estimates of

industry level, where

SIC codes:

TA^a + p.AREV + p.PPE + e

(3)

We use the absolute value of discretionary accruals (ABSDACC) to measure the

combined

effect of income-increasing

(Warfield

et al.

1995; Becker et

al.

and income-decreasing earnings management decisions

1998; Reynolds and Francis 2001), and estimate the following

empirical model:

ABSDACC = « + PPEERATIO (or JS^^RANKNON + p.^RANKAUD) + /3,BIGFIVE

+ j3,AUDTEN + P.CFO + J3,ABSCF0 + J3^ACC + p^ABSACC

+ p^LEVERAGE + P^LITRISK + p,,M/B + P,,LOGMVE + /?,, %INST

+ P,,LOSS + P,,FIN/ACO + p,,ANNRET + e

We also present results for a partition

discretionary accruals

of the observations into firms with income- increasing

(DACC~) and income-decreasing

17

discretionary accruals

(DACC~).

(4)

Prior research shows that discretionary accruals models

fail to

completely extract non-

discretionary accruals that are correlated with firm performance. '^ Thus,

measures of firm performance,

all

of which are deflated by average

operations (CFO), the absolute value of cash from operations

and the absolute value of total accruals (ABSACC).

the ratio of total Habilities to total assets

be associated with discretionary accruals

Becker

et al. 1998).

We also

we

control for four

total assets:

(ABSCFO),

cash from

measured

control for leverage,

(LEVERAGE), because

as

prior research finds leverage to

(DeFond and Jiambalvo 1994; DeAngelo

The remaining control

(ACC)

total accruals

1994;

et al.

variables in equation (4) are as defined above.

Descriptive statistics

Table 4 reports descriptive

FEERATIO

is

buy more non-audit

sample firms partitioned

A of Table 2,

median of

findings reveal that

FEERATIO

RANKNON as well as RANKAUD.

In addition, clients

of Big Five

is

0.51.

services, consistent with the findings reported in

of the dependent variables in our regression models,

are significantly higher for firms

The remaining

at the

The

which, as shown in Panel

positively correlated with

auditors

statistics for the

Table

3.

All three

SURPRISE, INCREASE, and ABSDACC,

purchasing more non-audit services.

variables in Table 4 indicate that non-audit fees are significantly correlated

with several economic characteristics of the sample firms. High

FEERATIO

cash flows, but lower total accruals. In addition, firms in the high

significantly higher litigation risk, growth,

engage in financing and acquisition

and

acfivities.

median FEERATIO, but stock performance

significantly larger than other firms.

is

FEERATIO

institutional shareholdings,

Profitability

is

tests that

group have

and are more

also higher for firms

lower. Finally, high

The empirical

firms have higher

FEERATIO

likely to

above the

firms are

follow control for these factors.

'^ For example, Dechow et al.

(1995) show that discretionary accruals are biased for extreme values of earnings and

cash flows. For further discussion of these research design issues, see McNichols (2000).

18

EMPIRIC.4L RESULTS

IV.

management

Association between non-audit fees and earnings

Benchmark tests

The

first test

of the earnings management hypothesis examines the association between

The

firms that just meet or beat earnings benchmarks and the purchase of non-audit services.

findings, reported in Table 5, are mixed.'^

audit fee measures

These

The association between SURPRISE and the non-

FEERATIO and RANKNON

results suggest that firms purchasing

is

more non-audit

analysts' expectations, consistent with the earnings

(2000) and

POB

indicating that

the other

The

(2000).

positive

coefficient estimate

and

significant at the 0.01 level.

services are

more

management concerns expressed by

on

variables,

meet

the

SEC

RANKAUD is negative and significant;

low audit fees are also associated with earnings management

two auditor-related

likely to just

BIGFIVE and AUDTEN,

activity.

are significant.

Neither of

The

results for

the remaining controls indicate that firms reporting small positive earnings surprises have greater

litigation risk

The

and

institutional

ownership, are

basic premise of the

benchmark

missing benchmarks. Earnings management

benchmark but not

for

fmns

that just

larger,

analysis

is

thus

and are more

is

that firms

presumed

likely to report a profit.

manage earnings

to exist for firms that just beat the

miss the benchmark. Therefore,

we

estimate the

firms that just miss analysts' expectations (forecast errors of -0.01 or -0.02).

results indicate that

FEERATIO

and

0.01) in the "just miss" regressions;

'^

The

to avoid

model

The untabulated

RANKNON are negative and significant (p-values

RANKAUD

results are presented after the deletion

of statistical

is

iasignificant.'^

outliers.

However,

all

These

less

than

results provide

inferences are qualitatively similar

if outliers are retained.

'"^

We

also estimate the

specification, both

coefficient

model

FEERATIO

on RANTCA.IID

is

for firms that beat analysts' expectations (forecast errors of 0.02 or 0.03).

and

RANKNON

are insignificant (p-values of 0.70

negative, with a p-value of 0. 12.

19

for

In this

and 0.71, respectively). The

additional evidence consistent with a correlation between non-audit fees and earnings

management

to beat analysts' expectations.

Statistical inference in the regression containing

affected

by

multicollinearity because there

two independent

variables.'^ Thus,

untabulated results confirm that

surprises (p-value

=

significant (p-value

auditor,

0.09).

=

The

0.19).

we

is

RANKNON and RANKAUD could be

a high degree of correlation (+0.72) between these

estimate the

model using each variable

The

separately.

RANKNON is positively associated with small positive earnings

coefficient

hi addition,

on

we

RANKAUD is negative but not statistically

estimate the

model with

of the amount of total fees disclosed by each firm

the percentile rank,

(RANKTOT). Reynolds and

by

Francis

(2001) argue that larger clients create greater economic dependence regardless of the source of

fees.

However, we find

that the coefficient

on

RANKTOT is

suggesting that the composition of fees paid to the auditor

Contrary to the robust evidence for the

SURPRISE

is

msignificant (p-value

=

0.62),

relevant.

model, there

is

no evidence

that firms

paying higher non-audit fees are more likely to report small increases in earnings. Specifically,

both

FEERATIO

and

are consistent with

RANKNON are insignificant in the INCREASE regressions.

Gore

et al.

(2001)

who

find a positive association

Our results

between the purchase of

non-audit services and meeting analysts' expectations for U.K. firms with a Big Five auditor, but

no association between non-audit services and reporting small earnings increases or small

profits.'^

the

The

results for the control variables in the

SURPRISE

regressions are consistent with

regressions with two exceptions; firms reporting a small increase in earnings

have poor market performance and do not

'^

INCREASE

attract institutional

Correlations between the auditor fee meastires and auditor proxies

'^

owners.

BIGFIVE and AUDTEN

are less than

±

0.30.

Although our sample includes clients of non-Big Five auditors, 96 percent of the firms included in the Table 5

regressions are audited by a Big Five auditor. We also report below that our results are robust to exclusion of firms

with a non-Big Five auditor.

20

Discretionary accruals

The second

test

tests

of the earnings management hypothesis examines the relation between

discretionary accruals and the purchase of non-audit services. Table 6 reports

for the absolute value

of discretionary accruals in Panel

summary

statistics

A and for the separate partitions of

income-increasing and income-decreasing discretionary accruals in Panel B. The positive and

significant coefficients

more non-audit

on

services

FEERATIO

and

manage earnings

AUDTEN are negative and significant,

RANKNON in Panel A indicate that firms purchasing

to a greater extent

indicating that

than other firms.

low audit

fees

RANKAUD and

and longer tenure of the

auditor are associated with greater earnings management. Additionally, discretionary accruals

are correlated with firm performance, leverage, firm size,

Following Reynolds and Francis (2001),

model separately

results,

for income-increasing

presented in Panel

B

of Table

6,

we

and

institutional shareholdings.

also estimate the discretionary accruals

and income-decreasing discretionary accruals. These

reveal that

FEERATIO

significant for firms with positive discretionary accruals,

RANKNON are positive and

and

and negative and significant

for firms

with negative discretionary accruals. Assuming that companies with positive (negative)

discretionary accruals are attempting to

finding that firms purchasing

manage earnings up (down),

more non-audit

these results confirm the

services are better able to achieve their earnings

objectives. In contrast, the coefficient estimate

on

RANKAUD is negative (positive) and

significant for firms with positive (negative) discretionary accruals, suggesting that firms paying

high audit fees manage earnings less than other firms.

for firms

AUDTEN is

also positive and significant

with negative discretionary accruals. The results indicate that

total accruals (cash

flows) are positively associated with income-increasing (income-decreasing) discretionary

accruals. In addition, litigation risk

is

higher for firms with

21

more

positive discretionary accruals.

To examine

we

the robustness of our results to alternative

measures of discretionary accruals,

repeat the analyses in Table 6 using discretionary working capital accruals, defined as total

accruals less depreciation expense, and discretionary operating accruals, defined as

The untabulated findings

before special items less cash firom operations.

reported in Table

6.

Our

results are also robust to the inclusion

are correlated with discretionary accruals.

much of the

are similar to those

of two additional variables

We include the Altman Z-score

fmancial distress, and the change in inventory because

as a

we

estimate the

model separately

Consistent with the resuhs discussed above,

significant, but that

we

proxy

Thomas and Zhang (2001)

cross-sectional variation in discretionary accruals can be explained

inventory. Finally,

for each of the

find that

income

that

for

suggests that

by changes

in

ranked fee variables.

RANKNON and RANKAUD are

RANKTOT is insignificant.^^

Additional sensitivity analysis

Estimations for several alternative specifications indicate that the findings are generally

robust.

First, to further

ensure that the results are not driven by cross-secfional variation between

we

firms with a Big Five and non-Big Five auditor,

repeat the analyses in Tables 5 and 6 using

only the sample of firms with a Big Five auditor. The untabulated results are consistent with

those reported above. Second,

control, with

no change

partitioned at the

and the

ratio

R.\NKTOT

in inferences.

The

We

also estimate the

size,

measured using

results are qualitatively

work by Chimg and Kallapur (2001)

of the

IS

repeat the analyses with the log of total assets as the firm size

median value of firm

log of total assets.

20 Concurrent

we

either the log

unchanged, except that

reports no association

client's total fees to the auditor's total fees.

insignificant even though

models separately

for the

sample

of market value or the

FEERATIO

and

between absolute discretionary accruals

This result

is

consistent with our finding that

RANKNON and RANKAUD are individually significant.

Chung and

Kallapur (2001) also find no association berween absolute discretionary accruals and the ratio of client non-audit

fees to the auditor's total fees. We re-estimate the model using this measure instead of R,ANKNON and also find

insignificant results.

The difference

in these findings is consistent

quasi-rents with error, suggesting that our use of ranked variables

22

with the fee data measuring the client-specific

is

appropriate.

RANKNON are insignificant in the upper half of the

Thus,

we

find

management

Third,

fees

some evidence

is

we

FEERATIO

disaggregate

SURPRISE

regressions.

between non-audit fees and earnings

into

two components -

the ratio of other fees to total fees

SEC

services to their audit clients.

ISRATIO and OTHRATIO

for

fees.

to

that

independence, the preliminary

on June 27, 2000 prohibited auditors from providing these

The fmal

component of non-audit

the ratio of IS fees to total

(OTHRATIO). Because of concerns

of IS services poses a particularly strong threat

independence rules issued by the

the IS

in the

not significant for larger firms.

(ISRATIO) and

the provision

that the association

sample

rules relaxed the ban, but require separate disclosure of

We repeat the analyses

in Tables 5

FEERATIO. Only OTHRATIO

is

and 6 substituting

consistently significant in the

untabulated results, possibly because relatively few firms report IS fees.

To

control for systematic industry differences,

identified in Table

results

1

.

We

we

also repeat the analyses using a

include fixed-effects for the industries

common

from both of these specifications are consistent with our primary findings.

Market reaction

to the disclosure of

non-audit fees

The second hypothesis concerns

hypothesis using an event study.

information became public,

we

To

the valuation effects of non-audit fees.

identify the event date,

search the

the necessary fee data then

we use

i.e.,

We test this

the earliest date at

which the

fee

EDGAR database to identify frnns that filed a

preliminary proxy statement disclosing auditor fees.-' If we

-'

sample of 1,943 firms. The

fmd

a preliminary

proxy containing

the release date of the preliminary proxy as the event date; if

Approximately 10 percent (314 firms) of the definitive proxy statements

release of a preliminary proxy statement.

23

in

our sample were preceded by the

not,

we

To

use the release date of the definitive proxy.

we

eliminate observations if the proxy

We

obtain returns data fi-om the 2001

events,

market model prediction

errors.

was

mitigate the effects of confounding

filed within

CRSP

tape.

two days of 10-K, 10-Q, or S-K.^^

Abnormal

Market model coefficients

returns are event date

are estimated fi-om firm-level

regressions of raw retiims on Nlc'SE size-decile portfolio returns over the 100-day period ending

30 days prior

to the event.

Because stock prices

will react to the

new

information contained in

the auditor fee disclosures, tests of the shareholder wealth hypothesis require a proxy for the

unexpected component of non-audit

fees discussed

above

to estimate the

The

fees.

first set

of tests uses the measures of non-audit

following regressions;

ARET = a, +

/?,

FEER4 TIO + £,

(5)

ARET = j3,+/3, MNKNON + p.RANKNON + e

The

fee measures in equations (5)

if non-audit fees

and

assume uniform prior expectations, and

(6)

contain a large unexpected component relative to

component. Anecdotal evidence suggests

audit fees (e.g.,

We

proxy for unexpected non-audit

assumes

fees.

that non-audit fees vary with

Appendix provides

assumes

details

(FEERESEDUAL)

This prediction error

large, positive

unexpected shock.

using previously released data

is

the residual fi-om a

model

to

that

agency costs (Parkash and Venable 1993; Firth 1997). The

that the publicly available data items in our

when

expected firm-specific

were surprised by the magnitude of non-

we

model

are those used

by investors

to

form

also estimate the following model:

Approximately 20 percent (614 firms) of the sample firms were deleted for

similar

its

are appropriate

on the empirical estimation of the model. This alternative proxy

expectations of non-audit fees. Thus,

^^

that investors

Weil and Tannenbaum 2001), consistent with a

also derive a prediction error

(6)

these observations are included in the analysis.

24

this reasoti.

Results are qualitatively

ARET = j8,+j3, FEERESID UM + £

Overlapping event dates

effects

may produce dependence

of cross-sectional dependence on significance

coefficients

by estimating

the event date.

Because

all

(7)

across firm-events.

levels,

we

Non-event dates are taken from the

control for the

create distributions of regression

models on 200 non-event-dates beginning

the

To

intervals [r-141, ?-2]

at

date /-141, where

and

/ is

[t+2, t+6l].

firm-observations are shifted to non-event dates as a block, firm-observations in each

non-event date regression are temporally related as they are in the event date regression.

Summary

reported in Table

statistics

7.

The

from the empirical estimation of equations

coefficient estimates on

FEERATIO

and

(5)

through (7) are

RANKNON are negative but

not significant after controlling for cross-sectional dependence (two-tailed bootstrap p-values are

0.14 and 0.15, respectively). In contrast,

expected portion of non-audit

These

results provide

fees, is negative

is

that non-audit fees

explicitly controls for the

and significant (bootstrap p-vsLlue=0.02)P

modest evidence consistent with investors reducing valuations

compensation for a perceived reduction

analysis

FEERESIDUAL, which

may have

in audit quality.

However, an important caveat

as

to this

implications for the market's expectations of future cash

flows unrelated to audit quahty. For example, high non-audit fees

quality or that the firm faces difficulties previously

unknown by

may

signal poor

investors.

management

Distinguishing this

"performance" explanation from the "audit quality" explanation could be resolved by an

^'*

examination of the subsequent accounting performance of sample firms.

23

One

observation (Viador Inc) was found to be influential and deleted. The

of an interim

stock price.

company announced

the appointment

on May, 1, 2001, the same date its proxy statement was filed, leading to an 127% increase in

Because this company had relatively low non-audit fees, its inclusion would increase the significance of

CEO

the results.

2'*

One

is that over 99

of the proxy statement, thus pre-empting

factor that suggests that investors are responding to a perceived reduction in audit quality

percent of our sample had released fiscal

least a portion

2000 earnings

prior to the fihng

of the performance-related information content of the fee data.

25

at

V.

SUMMARY AND CONCLUSION

This paper provides evidence on the association between non-audit fees and earnings

management, as well as evidence on

fees.

We

to just

find that firms purchasing

meet or beat

accruals.

more non-audit

find

we

ratio.

likely to

by implication, lower

engage

in earnings

the extent that earnings

management

is

is

one

attribute

of non-audit

We also find evidence that the stock market

decreasing in the unexpected component of the

disclosure requirements

may

quality earnings.

that firms

paying high (low) non-audit (audit) fees are

management, we do not address the

magnitude of non-audit and audit fees

SEC

likely

This result indicate that investors associate non-audit fees with lower

Although our evidence indicates

more

more

to report larger absolute discretionary

interpret these results as suggesting that the purchase

reaction to the disclosure of non-audit fees

quality audits and,

services from their auditors are

and

services is associated with lower quality earnings.

non-audit to total fee

announcement of non-audit

to the

no association between the purchase of non-audit services and the

meet prior year's earnings. To

of earnings quality,

market reaction

analyst earnings expectations

However, we

ability to just

the stock

is

related issue of whether the

associated with financial statement fraud. Additionally,

alter the existing

equilibrium in the audit services market. For

example, the disclosure of fee data could increase the competitiveness of the audit market by

reducmg

the cost to firms of making price comparisons and negotiating fees. In addition,

irrespective of the relation

between non-audit services and earnings

quality, firms

purchase of non-audit services to avoid the appearance of non-independence.

26

may reduce

the

APPENDLX

Estimation of Unexpected Non-Audit Fees

In this appendix,

we

The purpose of this model

market reaction

tests.

develop a model

is

to estimate the

We base

examine a company's decision

We

quality audits

FEERATIO.

unexpected portion of non-audit fees for use

in our

our model on Parkash and Venable (1993) and Firth (1997)

to

and

They argue

restrict the

estimate the following

who

purchase non-audit services from their auditor, conditional on

the level of auditing services purchased.

demand high

to explain cross-sectional variation in

that

companies facing high agency costs

purchase of other services from their auditor.

model using

all

observations with the necessary data:

13

FEEMTIO = ^aJND,

+ fi.BIGFIVE + jS.AUDTEN + p.ROA + P.LOSS

1=1

+ p.ANNRET + p, %INST + p,CFO + p^LEVERAGE + p^INVREC

+ P^FIN/ACQ + P.LOGiVIVE + j3,,PI/B + v

We include industry intercepts, IND„ for each of the

Panel

C

of Table

1

.

.An indicator variable

auditors are able to provide

AUDTEN,

the

company, controls

may proxy

for

for the possibility that

services and/or charge a

premium

agency costs as well as the potential

We include two measures

defined as net income divided by average total assets, and

equal to one if the firm reports a net loss.

the

to 13 industries identified in

compounded CRSP monthly

Big Five

for their services.

of the

of the relationship between the auditor and chent.

from the purchase of outside consulting.

ROA,

1

that the auditor has audited the financial statements

for the length

Performance

(BIGFIVE) controls

more non-audit

number of years

/=

(Al)

We also

for the firm to benefit

of accounting performance,

LOSS, an

indicator variable

include stock return performance,

return in calendar 2000. Institutional ownership

percentage of shares held by institutions (reported by Spectrum), and

total liabilities to total assets.

27

ANNRET,

(%INST)

LEVERAGE

is

is

the

the ratio of

We include

ability to

operating cash flow scaled by average total asset

purchase outside consulting services. In addition,

INVREC

complexity of services performed by the auditor.

as a percent

thus

we

of total

assets.

include, and thus

Rapidly growing companies

we

include

FIN/ACQ, an

company

securities or acquired another

in 2000,

statistics

is

to control for firms'

control for the extent and

inventory plus accounts receivable

may demand more

consulting services

indicator variable for firms that issued

and the market to book

control for firm size with the log of market value of equity

Summary

we

(CFO)

ratio

(M/B). Finally,

(LOGMVE).

from the estimation of equation (Al) are reported in Table Al

model explains 31 percent of the cross-sectional variation

we

in

FEERATIO, comparable

.

The

to the

explanatory power of the models in Parkash and Venable (1993) and Firth (1997). The results

indicate that firms in three industries, food, extractive,

services, while firms in the

retail,

purchase fewer non-audit

computer industry purchase more non-audit services. Consistent with

Parkash and Venable (1993) and Firth (1997),