Voluntary Disclosure, Cheap Talk and Debt Financing: Evidence from Prosper.com Michael Iselin

advertisement

Voluntary Disclosure, Cheap Talk and Debt

Financing: Evidence from Prosper.com

Michael Iselin

Ohio State University

Fisher College of Business

2100 Neil Avenue

Columbus, OH 43210

Andrew Van Buskirk

Ohio State University

Fisher College of Business

2100 Neil Avenue

Columbus, OH 43210

May 2010

(Preliminary and Incomplete, Please do not cite)

___________________________

All data is publicly available from Prosper.com. This version of the paper was written solely by Michael Iselin, any

errors or omissions are solely his responsibility. At the current time Andrew and Michael are working on revising

the paper.

Abstract

This paper analyzes unverifiable voluntary disclosure as a potential source to mitigate

information asymmetry in a debt market. The setting utilized to investigate these questions is the

Prosper.com marketplace. Thanks to its policy of transparency I am able to get data on almost

300,000 loan requests from people who both received and were denied funding. I find that

lenders do rely on certain characteristics of unverifiable disclosure, which takes the form of a

description, in making their lending decisions. However, I also find that these same description

characteristics are not associated with the ex post probability that a loan is fully repaid. Taken

together these results suggest that the lenders in this marketplace might not be acting rationally

with respect to these description characteristics. I then condition on the presence of sophisticated

investors and find that the description characteristics are now much less important in making

funding decisions. This paper contributes to the literature on voluntary disclosure, the literature

regarding cheap talk and also to the relatively new line of literature examining person-to-person

lending on the web.

-1-

1. INTRODUCTION

Providers of capital resources face two major problems in the decision of which firms to

invest in and how much to charge for the use of their capital. Both of these problems are a result

of information asymmetry between the borrower and the lender. The first problem arises

because borrowers generally have superior information relative to investors which can create a

‘lemons’ problem in the market. In the extreme case the market may completely fail (Akerlof,

1970). The second potential problem is a hold up problem. Once the investors provide capital to

a firm, the managers within that firm have incentives to expropriate the capital. They can do this

through the consumption of perquisites or other benefits that increase the utility of the borrower

and reduce the return to the investors.

One potential solution to both of these problems is disclosure on the part of the borrower.

Disclosure can narrow the information gap between investors and borrowers. If the disclosure is

verifiable it can also serve a monitoring role to protect against asset expropriation. However,

disclosure will only help mitigate the information asymmetry problem if the investor can rely on

the disclosure. This paper examines the impact of voluntary disclosure, which may be nothing

more than ‘cheap talk’, on both the likelihood of receiving debt financing as well as the ex-post

event of default by the borrower. I take advantage of the unique setting provided by the online

Person-to-Person (P2P) lending marketplace operated by Prosper.com to answer these questions.

I first examine whether characteristics of the description that accompanies a loan request

(listing) are used by lenders in making their lending decision. I find that listings that have longer

descriptions with more numeric characters are more likely to be funded. This finding is

interesting because in this setting the descriptions are completely unverifiable. Given this

finding I then ask the question of whether or not this behavior is rational. This is done by

-2-

examining the extent to which these same description variables predict ex post probability of a

loan being fully repaid. Here I find that the three main description variables are not significantly

associated with loan repayment. Taken together these findings suggest that in the Prosper.com

marketplace lenders are behaving irrationally with respect to this description language.

One possible behavioral explanation for this phenomenon is that lenders read the

descriptions and can relate to the environment described by the borrower. As an example, there

are some listings that detail severe health issues that brought on insurmountable medical bills.

There may be some lenders in the marketplace that can relate to the disease described or

mounting medical bills in general and want to help out by providing this borrower with a loan.

This type of behavior is something that I hope to be able to test in the future by examining

whether certain lenders have a propensity to lend to similar type borrowers.

The remainder of the paper proceeds as follows. I present background information about

the Prosper.com marketplace and other relevant literature in Section 2. I develop my hypotheses

in Section 3. Section 4 discusses my sample selection and research design. I move on to a

discussion of the results in Section 5 and Section 6 concludes the paper.

2. BACKGROUND INFORMATION AND LITERATURE REVIEW

Prosper.com Marketplace

Prosper.com is one of several online P2P lending websites that opened for business over

the past several years1. P2P lending communities give individual lenders the ability to invest in

unsecured debt markets. They also give borrowers a new source of financing, which can be

especially useful for those borrowers who are unable to obtain financing through traditional

1

Other online peer-to-peer lending websites include Zopa.com, Kiva.org, and Lendingclub.com. The reason this paper focuses on Prosper.com is

the company’s transparency policy and the vast amounts of data that Prosper.com makes available for public use as a result of this policy.

-3-

pipelines. Prosper.com is one of the most successful P2P lending communities and they have a

policy of transparency and openness in an effort to reduce the information risk that lenders must

bear. As a result of this policy, they make available for public download all data that appears on

the website since the inception of the company in February 2006. The data is updated on a daily

basis and it offers the opportunity to study some interesting questions with respect to debt

financing. This paper takes advantage of the setting provided by Prosper.com to examine

voluntary disclosure and cheap talk as it relates to debt financing in these P2P marketplaces.

Propser.com opened its virtual doors in February of 2006 and has attracted over one

million members and funded over $200,000,000 in personal loans since that date2. If an

individual wants to take advantage of the financing source provided by Prosper.com she3 can

become a member of the website and create a listing. In creating the listing she must specify the

amount of the loan she is requesting, the maximum interest rate she is willing to pay, the length

of time she would like her listing to remain open4. Additional verifiable information provided to

potential lenders in the listing includes the borrower’s credit grade, home ownership status,

amount and number of current delinquencies, delinquencies in the last 7 years, inquiries within

the last 6 months, public records in the last 10 years and total credit lines. The borrower can

choose to provide an estimate of her income which is displayed in the listing and is also used to

calculate a debt-to-income ratio (the income portion of which is not verified by Prosper). She

can choose to post a picture with the listing. She may also write a description with the listing

which might include the purpose of the loan, a self-reported budget demonstrating her ability to

2

These figures are as of the date of the data download for this paper in late August 2010.

For the sake of consistency and brevity in the description of the lending process I use feminine pronouns she and her to refer to the borrower and

masculine pronouns he and him to refer to the lender.

4

Prosper.com allows borrowers to request loans in any amount from $1,000 to $25,000. Maximum interest rates accepted by the borrowers was

restricted to state maximums ranging from 6% to 36% until April 15, 2008 at which point the maximum rate for all states but one was increased

to 36% (Rigbi 2010). Listings could be set for a duration of 3, 5, 7 or 10 days until April 15, 2008 at which point Prosper.com changed its

policies and set the duration of all listings 7 days.

3

-4-

repay the loan, narrative describing why she is a good candidate for the loan, or anything else she

feels might increase her chances of receiving funding. It is this voluntary disclosure in the form

of the written description that is the focus of this paper. The written description is unverifiable

which provides the borrower with an incentive to say anything that will increase the likelihood

that her loan is funded. In response to this incentive, rational lenders should treat the content as

nothing more than cheap talk and not place any weight on the description when assessing the risk

associated with the listing. However, to the extent that borrowers can convince lenders that the

content in the description is truthful, information included in the description might be able to

close the information gap that exists between the lender and the borrower.

Once a listing is finalized and published on Prosper.com it is then the lender’s move in

this game. Lenders face the task of sifting through hundreds of listings that may be active at any

given time and determining which, if any, they will choose to fund. Appendix B contains a

screenshot of two actual listings from Prosper.com with different descriptions. The difference

between these two descriptions is clear; Listing 1 has a detailed monthly budget showing the

borrower’s ability to repay the loan without affecting her usual monthly expenses, while the

description in Listing 2 is essentially left blank. However, given that there is no monitoring

mechanism in place to verify the information provided in the description the monthly budget in

Listing 1 could be completely falsified in an effort to make the listing appear less risky and more

creditworthy.

Once a lender finds a listing that he determines to be offering a suitable return relative to

his risk assessment of that borrower he can make a bid to fund a portion of the amount requested.

The bid by a lender includes the amount that he is willing to invest (lenders can offer to invest

anywhere from $50 to the entire amount of the loan request) as well as the minimum interest rate

-5-

that he is willing to accept. If there are enough lenders that place a bid on a given listing such

that all of the bids aggregate to at least as much as the amount requested then Prosper.com writes

a loan, takes money from each of the lenders’ accounts and provides the funds to the borrower.

The interest rate that the borrower must pay on the entire loan and that all the lenders receive

regardless of the interest rate in their individual bid is the minimum acceptable rate associated

with the last winning bidder5. All Prosper loans are fixed rate, fully amortized, unsecured loans

that have a maturity of three years.

The Prosper.com marketplace suffers from information asymmetry. Lenders only get

access to a subset of the relevant characteristics that might predict borrower credit risk. The

credit grade that Prosper.com provides potential lenders is a noisy mapping of borrowers’ actual

FICO credit score. Throughout the sample period credit scores map into credit grades as

follows, 760 or above is defined as AA, 720-759 as A, 680-719 as B, 640-679 as C, 600-639 as

D, 540-599 as E, less than 540 as HR, and NC if no credit score is available6. This noisy

mapping leaves lenders unable to precisely differentiate between a borrower with a credit score

of 680 and one with a score of 719. Iyer et al. (2010) provide evidence that that within a given

credit category (40 points in credit score) lenders are able to infer about a third of the difference

in credit score that is captured by the borrower’s exact credit score using other information

provided in the listing. Even if the lenders did have all the information from the credit report, the

borrower still has an information advantage about whether she will be able to repay the loan at

this point in her life regardless of what her credit report says.

Only a very small number of borrowers in this marketplace ever receive multiple loans so

the average borrower does not have an incentive to build a reputation in the market. The loans

5

If a listing requested $1000 and there were 4 bidders A, B, C and D each offering $400 at minimum acceptable interest rates of 8%, 10%, 12%

and 14% respectively. Then the loan would be written at 12% and would be funded by $400 form A, $400 from B, and $200 from C.

6

Prosper has since refined the credit grade definitions using a proprietary formula after its registration with the SEC in July 2009

-6-

are unsecured so there is no collateral that the borrower risks losing. The main negative

consequence to the borrower of defaulting on a loan from Prosper.com is the adverse affects it

has on the borrower’s credit rating. Given these institutional details the environment created in

the Prosper.com marketplace it seems clear that borrowers have an informational advantage that

they might be able to exploit in attempting to get their listing funded.

Prosper.com Literature

Freedman & Jin (2008) is one of the first studies to examine behavior of borrowers and

lenders in the Prosper.com marketplace. They examine the risk perception applied by lenders to

observable borrower characteristics and find evidence that lenders’ perceptions of these risk

factors are generally consistent with theoretical associations as well as ex-post performance.

Additionally, Freedman & Jin (2008) show evidence that lenders understand the difference

between credit grades presented in borrower listings, however, they claim that the lack of a

precise FICO credit score limits the usefulness of the credit grade at mitigating the information

asymmetry between borrowers and lenders.

Due primarily to the information asymmetry in this market, it has been documented that a

number of lenders are unable to accurately assess risk and make loans that eventually go into

default. However, there is also evidence that lenders who make mistakes learn over time. If a

loan from a lender’s portfolio has gone into default lenders are much less likely to make an

additional loan, and contingent on them making another loan they are less likely to lend to

someone else within the same credit grade. This learning occurs over time and speeds up as

lenders become more experienced in the market (Freedman & Jin 2011).

Shen, Krumme & Lippman (2010) investigate herding behavior in the Prosper

marketplace and provide evidence that at times lenders tend to herd and bid on listings that have

-7-

already received several bids. Miller (2010) examines the effect of a change in the credit

information available to lenders in the Prosper market. Her sample falls in the very early months

of Prosper’s existence and is almost entirely before the period examined in this paper. She

documents that the additional credit information provided decreased the probability of default by

as much as ten percent.

Two papers that are closely related to this paper are Larrimore et al. (2011) and

Herzentstein et al. (2008). Larrimore et al. uses Linguistic Inquiry and Word Count (LIWC)

software to analyze the listing descriptions. The paper relies on uncertainty reduction theory

which lead them to hypothesize that longer descriptions and concrete words will be positively

associated with funding success. The authors then rely on the elaboration likelihood model

(Petty & Cacioppo 1986) to hypothesize that providing quantitative information will increase

funding success, but providing humanizing details or justifications will decrease funding success.

The authors focus on the development of trust in the Prosper.com setting through language use.

Herzenstein et al. (2008) examine the determinants of funding success including financial

strength, loan decision variables, demographics, and effort indicators. One of the effort

indicators examined in the paper is the description associated with the loan listing. However, the

variable is operationalized by manually classifying the description as either no personal

information, general personal information, or specific personal information. The results from the

tests show that providing general or specific information increases the likelihood of funding.

The textual analysis that my paper performs will be along a slightly different dimension and

there are some additional tests that are performed regarding investor sophistication to provide a

new level of depth to the theory explaining investor behavior. Additionally as suggested in

-8-

Larrimore et al. (2011) my paper goes on to examine the impact of listing characteristics on ex

post loan default.

Voluntary Disclosure

One primary source of demand for disclosure in the debt market is the information

advantage that firms possess relative to external stakeholders. As relates to investors and the

capital markets the information asymmetry problem can boil down to a ‘lemons’ problem

(Akerlof 1970). Firms have private information about the riskiness of a project. The market

then offers financing at a rate that equates the expected return of the loan to the expected risk of

all projects in the market. However, at this rate only those firms with high risk projects are

willing borrowers. Knowledge that lower risk projects will not enter the market causes lenders

to revise their conditional expectation of risk and also the interest rate upwards until in the

extreme case the entire market collapses. This paper examines whether voluntary disclosure in

the form of a listing description might help mitigate the information asymmetry problem in the

Prosper.com marketplace.

A famous result in the disclosure literature is the unraveling result in which all firms end

up disclosing their private information to differentiate themselves from other firms whose private

information is not as good (Grossman & Hart (1080); Grossman (1981); Milgrom (1981)).

There has been work showing when this result might not hold including in the presence of

uncertainty about whether the firm received a signal (Dye 1985) or costs associated with

information disclosure (Verrecchia 1983). The problem in the Prosper setting is that disclosure

is unverifiable. Therefore, a borrower can disclose anything she wants and should rationally do

so to improve the chances of her loan being funded. However, a rational lender would then

-9-

respond to this incentive to lie by treating any disclosure as cheap talk and assigning no weight

to the disclosure in determining his estimate of risk for the listing.

Healy & Palepu (2001) point to six forces that have been studied in prior literature that

affect managers’ disclosure decisions: capital market transactions, corporate control contests,

stock compensation, litigation, proprietary costs, and managerial talent signaling. This study

focuses on capital market transactions as an incentive for voluntary disclosure. Unfortunately,

capital markets transactions do not occur in a vacuum, which has made it difficult for prior

studies to determine whether it is truly capital market transactions that are driving voluntary

disclosure or whether there may be a correlated omitted variable problem in the form of one of

these other forces. The unique setting of this paper provides a distinct advantage in that by

looking at individual borrowing and lending in what is typically a one shot game, the other five

forces should not play any role in an individuals’ incentive to disclose. The potential drawback

to this setting is the inability to extrapolate any results to a corporate environment.

Cheap Talk

The Prosper.com marketplace and specifically the descriptions posted with listings relate

to the literature in economics on cheap talk. Cheap talk is defined as communication between

two or more players in a game that does not directly affect the payoffs of either player (Crawford

& Sobel 1982). This is precisely what we have with the listing descriptions; there is no

verification of what is said and the borrower’s only incentive is to say whatever she thinks will

increase the chances that her listing gets bid on by potential lenders. The economics literature

has been inconsistent in assessing the value of such cheap talk. Some say that when talk is cheap

there is no incentive for the sender of information to tell the truth, and thus the talk should not be

relied upon at all. Others argue that communication can help in coordination and lead the

- 10 -

players to Nash equilibria that are pareto-efficient within the set of possible equilibria (Farrell &

Rabin 1996). Which of these two views will prevail in the Prosper.com marketplace is an open

empirical question that this paper attempts to answer.

The seminal work in the cheap talk literature is Crawford & Sobel (1982) in which the

authors develop a model that suggests messages with no direct payoff incentives can be

informative when players’ goals are closely related. Closely related goals refer to the degree to

which the optimal outcome for one agent given any realization of the private information is also

optimal for the other agent. Another finding of the model is that players’ preferences do not

have to be perfectly opposed, but only sufficiently opposed by some finite degree to break any

equilibrium that has the receiver of the information paying any attention to the cheap talk. In this

case the cheap talk cannot convey useful information and the only equilibria involve the sender’s

message being completely ignored by the receiver. Regardless of the alignment of preferences

there is always an equilibrium in these games where the receiver completely ignores the cheap

talk. The interesting question becomes whether cheap talk can help the players coordinate and

reach an alternate equilibrium that pareto dominates this ignoring equilibrium.

Dickhaut, McCabe & Mukherji (1995) examine cheap talk in an experimental setting.

The results from their experiment are consistent with the predictions of the Crawford & Sobel

model. When preferences of the sender and receiver are closely aligned the senders disclose

more and as preferences diverge messages tend to become less informative.

Farrell (1987) builds on the work of Crawford & Sobel (1982) and examines cheap talk

in a natural-monopoly industry where the payoffs are similar to the “battle of the sexes” game.

The model developed in this paper shows that while cheap talk can help to achieve coordination,

it cannot achieve complete coordination if there is even the slightest bit of conflict in

- 11 -

preferences. This is similar to the prior findings that when goals are not perfectly aligned cheap

talk cannot be completely trusted in equilibrium.

Cooper, Dejong, Forsythe & Ross (1989) provide experimental support for the

conclusions of the model in Farrell (1987). They run an experiment using a one shot, symmetric

“battle of the sexes game” with no communication, one round of one-way communication, one

round of two-way communication and three rounds of two-way communication. The one round

of one-way communication was most effective at obtaining coordination, followed by the three

rounds of two-way communication and the one round of two-way communication. The game in

this experiment has strong, but not perfect, alignment of preferences.

In the Prosper.com marketplace the borrower’s primary goal is to get her loan funded.

Conditional on funding she wants to receive the loan at a low interest rate. On the other side of

the game the lender’s goal is to earn an interest rate that exceeds his expected risk of the loan.

These two goals are clearly not perfectly aligned and it would appear that they are actually closer

to perfectly opposed than perfectly aligned. Based on the intuition from Crawford & Sobel

(1982), it is unlikely that any equilibrium behavior would have the lender relying on the

borrower’s cheap talk (listing description).

3. HYPOTHESIS DEVELOPMENT

In the Prosper.com marketplace individual lenders have to decide whether or not to bid

on any one of hundreds of active listings on the website at any given time. These lenders are

more likely to be repaid and earn a positive return on their investment if they are able to use the

information from the listings to accurately identify the credit risk of the individual borrowers.

Several pieces of hard information taken from the borrower’s credit report would obviously go

- 12 -

into this risk assessment. The lender would then compare that risk assessment to the maximum

interest rate specified in the listing to determine whether the potential rewards outweigh the

potential risks. However, one piece of information that is provided in the listings that may or

may not enter into the lender’s risk assessment is the description provided by the borrower.

In this setting it is clear that the goals of the borrower and the lender are not perfectly

aligned, the borrower wants to receive funding at the lowest rate possible and the lender wants to

provide funding at a rate of return that exceeds the expected credit risk of the borrower. This

observation and the findings in Crawford & Sobel (1982) as well as other literature on voluntary

disclosure and rational behavior lead me to my first hypothesis:

H1: The characteristics of the listing description are not associated with the probability

that the listing becomes fully funded.

If lenders rely on the descriptions in equilibrium then they must believe that the expected

return of the loan is correlated with information in the description. Due to data limitations I am

unable to calculate the expected return of a loan, but I can observe whether or not the loan

defaults ex post. If a borrower defaults on a Prosper.com loan her personal credit score is

affected just as it would be if she defaulted on conventional bank loan, so borrowers do have an

incentive to repay the loans they receive. However, incentives to repay the loan do not translate

directly into incentives for honesty in the description. Borrowers might be willing to say

anything in the description posted with their listing in an effort to increase the likelihood of

funding regardless of their ability to pay the loan back. When a borrower makes a listing she

either believes that she will be able to fully repay the loan, or she is concerned that she might

have trouble repaying the loan. In either case if she is posting a listing she wants to have the

loan funded; with funding as her goal it would not be smart to post as part of her description any

information that demonstrates her inability to repay the loan. The strong incentives for the

- 13 -

borrower to get the listing funded and the lack of direct incentives for honesty lead me to my

second hypothesis:

H2: Given that a listing is funded, the characteristics of the listing are not

associated with the ex-post event of default.

There has been some work done examining whether sophisticated investors in the capital

markets (institutions, analysts) are better able to process information (Hand 1990; Walther 1997;

Bartov et al. 2000). The Prosper.com marketplace is made up of a wide variety of investors.

Some lenders have invested as little as a couple hundred dollars in the market while others have

hundreds of thousands at stake. Similar to the evidence in the capital markets I expect that

lenders who spend more time and money in the Prosper market are likely to use the information

provided in the listings in a more efficient manner. As such, I develop several proxies for

sophisticated lenders in the Prosper marketplace and use those proxies to test my third

hypothesis:

H3: Sophisticated investors are less likely to use information contained in the

listing description in determining their risk assessment of the listing than the

average investor.

Finally, I utilize the nature of the Prosper.com market and the fact that the interest rate on

any given loan is determined by an auction type mechanism. An alternative way to examine

whether descriptions affect funding decisions is to examine the impact of description

characteristics on the final interest rate charged. Again for the same reasons stated above

regarding funding success I arrive at my final hypothesis:

H4: Given that a listing is funded, the characteristics of the listing description do not have

an impact on the final interest rate charged on the loan.

4. SAMPLE SELECTION & RESEARCH DESIGN

- 14 -

Sample Selection

In an effort to provide lenders with as much information as possible Prosper.com has a

policy of transparency. In accordance with this policy the website makes available for download

all loan listing and performance data on its website. This study takes as a starting point all data

downloadable from Prosper.com from a download that occurred in August 20107. The richness

of the data environment and the ability to get data on every listing ever published on

Prosper.com (both those that turned into loans and those that did not) makes this a unique and

ideal setting to test differences between borrowers that received a loan and those that requested a

loan but were unable to acquire it. The data availability is an aspect that differentiates this

setting from traditional lending markets. It is nearly impossible to get information about

individuals or firms who requested a loan but were denied in the traditional markets.

To generate the set of listings used in the sample I begin with all listings posted on

Prosper between 6/1/2006 and 9/30/2008. The website opened to the public in February of 2006;

however there were several changes in the information made available to lenders in April and I

choose June 1 as a starting date to allow lenders ample time to adjust to the new information

environment. On October 15, 2008 Prosper.com was forced to stop allowing new listings by the

SEC until it filed a registration statement. There were only a handful of listings posted in

October and with news leaking about the SEC investigation, it is likely that those listings were

treated differently by potential lenders. Prosper.com successfully filed its registration statements

with the SEC and reopened for lending in July 2009, but this came with more changes to the

information environment provided to lenders so I exclude this later period from my sample. I

then require listings to have complete data for all of the control variables used in the study which

brings the final sample of listings to 289,887.

7

http://www.prosper.com/tools/DataExport.aspx

- 15 -

This study focuses on the description provided in these listings, and one very important

piece to this paper is the choice of how to proxy for the information contained in these listings. I

do this in three ways. First I execute a count of both the total characters (Total_Chars) in each

listing as well as the total numeric characters (Total_Numbers) in each listing. I rank these

counts into quintiles and scale the quintiles to fall between 0 and 1 (R_Chars1 and R_Num1

respectively) to ease interpretation of some of the test results. Second, it might be the case that

very long prose or a lot of numeric information alone provides useful information but a

combination of the two is what lenders are interested in. Thus I define a variable Info which is

equal to 1 if the listing falls in the top two quintiles of both R_Chars1 and R_Num1. Finally, I

scan the listings for specific categories of words including Education, Family, Business, Budget,

Health, Consolidate, Car and Relist. The individual words in each of these categories can be

found in Appendix A. Each of these variables is set equal to 1 if any of the words within that

category show up in the listing and zero otherwise. This is a first attempt to dive deeper into the

descriptions to extract the content of the message being provided.

Research Design

I will test H1 using the following logistic regression model with the dependent variable

Loan taking the value of 1 if a given listing was fully funded and a loan was written and 0 if the

listing went unfunded or was withdrawn for any reason.

Where GradeXX is and indicator variable that takes a value of 1 if the borrower’s credit grade is

XX and 0 otherwise (XX {AA, A, B, C, D, E, HR/NC}. Desc is one or more of the description

variables described in the previous subsection. The control variables include Amount, and DtoI

both of which are expected to be negatively associated with funding success; MaxRate which

- 16 -

should be positively associated with funding success as borrowers willing to offer a higher rate

are more likely to attract bidders. I include five variables from the borrower’s credit report,

CurDel, Del7Yrs, Inq6Mos, Pub10Yrs, and TotalLines all of which are expected to be negatively

correlated with funding success as they all are indicative of greater credit risk. Finally I include

four other variables that the borrower has some control over when she initially posts her listing,

GroupMem (Freedman & Jin 2008) and Image (Pope & Syndor 2011) have both been shown to

impact funding success. HomeOwner is an indicator of whether the borrower owns a home,

which may provide evidence of the borrower’s past creditworthiness and incentives to keep her

credit report clean, and Duration, as listings that are open for a longer time period have more

time for lenders to bid on them and thus might be more likely to be funded.

To empirically test H2, that the description is correlated with the ex-post event of default,

I must restrict my sample to only fully funded loans. I also choose to further restrict the sample

to include only loans originated between 6/1/2006, the first date on which I consider any data,

and 7/31/2007. This new end date restriction is put in place to allow the loans 3 years to fully

mature and repayment to take place. If I were to include loans originated in 2008 or 2009 these

loans would not have matured yet and thus I would expect the probability of default to be lower

given the shorter period that the loan has been outstanding (Miller 2011). By setting a restriction

on the latest a loan can be originated to be included in the sample I avoid the problem of having

some loans included in the sample that have not had sufficient time to fully mature.

The empirical test of my second hypothesis is very similar to that of my first, with the

difference being the sample that I use to run the regression and the dependent variable. In H2 I

am interested in the relationship between the listing description and the ex-post performance of

the loan. To get at this question I construct a binary variable, Paid, which takes a value of 1 if

- 17 -

the loans was paid in full and 0 if the borrower defaulted or the loan was charged-off at an

amount less than the full amount owed to the lenders. After constructing this variable I again run

a logistic regression model with the same control variables as before and using all of the different

description variables as well.

In this model some of the control variables are included for slightly different reasons.

Individuals with high DtoI have more strain on their income in the form of other debt and are

thus less likely to be able to repay an additional loan. A loan with either a higher Amount or a

higher Rate requires more resources to fully satisfy and thus is less likely to be fully paid off.

Contrary to the purpose for creating groups, prior literature documents that group membership

actually reduces the likelihood that a loan is paid off, thus GroupMember is also included as a

control variable (Freedman & Jin 2008).

To test H3 I first need to develop a proxy for sophisticated investors. To do this I take

advantage of the database of bidding activity that is made available. For my first two proxies I

sum the total amount of money invested by each lender and use the distribution of this sum. For

each of the first two proxies I assume that individuals who invest more money in the

Prosper.com marketplace take their participation in the marketplace more seriously and are more

sophisticated in how they use the information available to them. The first proxy, Ppct95_25,

takes the value of 1 if at least 25% of the amount requested is bid on by lenders above the 95th

percentile of the distribution. Using this variable assumes that as people who have a greater

dollar amount invested in Prosper loans in total take a greater dollar position in a given loan the

average lender on that loan becomes more sophisticated. The second proxy, Invest95_2, is

closely related although instead of requiring a 25% investment in terms of dollar amount it

requires that at least 2 lenders above the 95th percentile place bids on the loan. Finally, I

- 18 -

construct a third proxy which takes the value of 1 if any bidder placed a bid greater than $2,000

on the loan8.

After computing the above variables to use as proxies for the presence of sophisticated

investors I then run the following model to test H3:

Where Desc is one of the description variables, Sophisticated is one of the above mentioned

proxies for sophisticated investors and Controls include all of the control variables from the

initial test as well as interactions with each of the credit grade dummies and each of the control

variables with Sophisticated. The coefficient of interest here is 3 where 3 < 0 is evidence that

sophisticated investors rely less on the information contained in the descriptions.

Finally, instead of examining funding success as the outcome variable another way in

which information contained in the descriptions could play a role in the market is through the

interest rate charged on the loan. To test this alternate avenue I first need to condition on a

listing being funded because the only way that an interest rate gets adjested below the MaxRate

is when the listing is fully funded. After doing this I end up with 26,070 loans. Then to test

whether the description characteristics impact the ActualRate I run the following regression

Where ActualRate is the final interest rate that is charged on the loan. All other variables in the

model are the same as the funding success model. A negative and significant 1 is evidence

consistent with the description characteristics reducing the final interest rate. Given the time

8

The choice of 95th percentile and 25% of the loan as well as 2 lenders and a $2,000 bid are admittedly arbitrary.

However, all results are robust to any combination of 90th, 95th, or 99th percentile with 10%, 25% or 50% of the loan

amount and 1 or 2 lenders. Also whether I use $1,000, $2,000 or $3,000 the results are qualitatively unchanged.

- 19 -

effect that may be present I cluster all standard errors in each of the regression models at the

year-week level.

5. RESULTS

The final listings sample contains 289,877 listings that fall within my sample period and

have sufficient data to run the tests. Table 1 Panel A shows that only about 9% of all listings are

funded and turn into loans. Some other points to note from the descriptive statistics presented in

Table 1 are that 26% of listings have Info =1 (they fall in the top two quintiles of both

Total_Chars and Total_Numbers). Most of the listings (44.2%) are created by borrowers with

either HR credit grades or no credit grade available. Moving to Panel B the univariate

comparison shows the following listing variables are all significantly greater for listings that

were funded (Loan=1) and those that weren’t (Loan=0): Info, Total_Numbers, Total_Chars,

Education, Family, Business, Consol, and Relist. Budget and Car are smaller for the loan sample

than the no loan sample. Table 2 confirms these findings in a correlation matrix. Loans are

fairly evenly distributed across all credit grades with the fewest loans originating from GradeA

(11.3%) and the most originating from GradeC (19.8%).

Table 3 formally tests H1 in a multivariate setting. Model (1) shows that all control

variables come through in the expected direction; and as the credit grade improves from HRNC

to AA the intercept increases monotonically. In Models (2) – (4) we see that Info, R_Chars1,

and R_Num1 all come through with positive and significant coefficients. This is consistent with

lenders paying attention to some attributes of the description even though it is unverifiable and

not monitored. This result appears contrary to the prediction of rational behavior. The effect in

all three of these models is also economically significant as can be seen from the odds ratios on

- 20 -

the variable of interest. Holding all else equal moving from Info=0 to Info=1 increases the

probability of funding success by 56%. Moving from the first to the fifth quintile in R_Chars1

(R_Num1) increase the probability of funding success by 113% (55%).

In Model (5) the categorical description variables are included and we see that Education,

Business, Health and Relist are all positively related to funding success. Whereas Budget is

negatively related to funding success. This last finding is surprising as I would expect a monthly

budget that demonstrates the borrower’s ability to repay the loan might be one of the more

salient features of a description. One potential reason for this finding is that around the

beginning of April 2007 Prosper changed the default description to include the phrases “Purpose

of loan:” “Monthly Net Income:” and “Monthly Expenses:”. This was done to encourage

borrowers to provide this type of information in the description. The phrase “monthly expenses”

is one of the keywords in the Budget category and this change likely caused the distribution of

listings for which Budget=1 to be skewed towards the later portion of the sample. If there is a

time trend where fewer listings are funded in the later portion of the sample period the Budget

variable might be picking that up. These categorical variables are only a first pass at diving

deeper into the description characteristics. The coefficient on Info is still positive and significant

even after these additional variables are included indicating that there are likely other aspects of

the description (correlated omitted variables) that need to be operationalized and accounted for in

future analyses.

Placing weight on the description characteristics in making funding decisions is only

irrational behavior if those same characteristics are not associated with the actual return of the

loan. Due to data limitations I am unable to calculate the actual return to the individual loans,

but I can observe whether the loan was fully repaid or if it was defaulted or charged off. Table 4

- 21 -

Panel A shows that of the 11,598 observations in my loan sample 58.8% of them are fully repaid

meaning the remaining 42.2% defaulted or were charged off. Panel B shows that in a univariate

comparison loans that are paid off in full have shorter descriptions with fewer numeric

characters. This initial finding coupled with the findings in Table 3 is inconsistent with rational

behavior on the part of the lenders.

Table 5 examines this relationship in a multivariate setting. The evidence here suggests

that after including the control variables the negative relationship noted previously is no longer

significant. While not completely opposite to how the description is being used in the funding

decision it is still inconsistent with rational lenders placing weight on the description in making

funding decisions. A second finding that seems contrary to how lenders are using listing

information is that loans with higher rates are more likely to default. Intuitively this seems to

make sense. The benefit to a borrower who faces a higher interest rate from defaulting is greater,

so all else equal a borrower with a higher rate might be more likely to default. In Table 3 the

evidence suggests that higher rates are more likely to get funded. I believe the disconnect

between these two findings isn’t driven by irrational behavior, but instead with my inability to

capture the actual return for the loans. Even though higher rates are more likely to default,

because the rate is higher it is possible that the expected return to those loans is still higher, thus

justifying the lenders observed behavior of funding loans with higher rates.

After documenting that lenders do seem to put some weight on the description when

making their lending decisions I next move to test H3. The thought is that while the average

lender is persuaded by description content more sophisticated investors may act more rationally

and place less emphasis on the writing. Table 6 provides evidence in support of this hypothesis.

Regardless of whether I use Ppct95_25, Invst95_2, or Bid2000 as my proxy for the presence

- 22 -

sophisticated investors the coefficient on the interaction between Info and this proxy is

significant and negative (-.311, -.326, and -.157 respectively)9.

I analyze an extension of both H2 and H3 in Table 7 by asking whether the presence of

sophisticated lenders impacts the degree to which description content predicts loan repayment.

The evidence provided here is consistent with Table 5, even in the presence of sophisticated

market participants neither the main effect of Info nor the interaction comes through

significantly. This provides further support for H2 that the description characteristics do not

impact the likelihood of loan repayment in the future.

Moving on to my final hypothesis I examine whether, conditional on receiving funding,

description attributes impact the final interest rate charged on a loan. Table 8 presents the results

of the regression. The coefficient on Info in Model (1) is negative and significant, suggesting

that holding all else constant moving from Info = 0 to Info = 1 decreases the average interest rate

charged by 0.5%. Similar results are seen in Models (2) and (3) using R_Chars1 and R_Num1 as

the description variables. Finally, looking at Model (4) we see that including language referring

to a budget also significantly reduces the interest rate by an average of 0.2%. This finding is

more consistent with expectations on how a budget might impact the lenders’ decision in this

market.

6. CONCLUSION

This paper examines unverifiable voluntary disclosure in the Prosper.com marketplace

and how that disclosure correlates with both funding success and loan repayment. I provide

evidence that lenders do pay attention to the descriptions posted with loan requests in making

9

This finding is robust to using either R_Num1 or R_Chars1 as the description characteristic and to using any of the alternative cutoffs for

sophisticated investors discussed in Footnote 10.

- 23 -

funding decisions. However, contingent on being funded these same characteristics do not have

any explanatory power in predicting loan repayment. This contradictory finding is inconsistent

with lenders using the description in a rational manner.

I make a first attempt at digging a little deeper into the text of the descriptions to examine

what specifically within the description is being used in the funding decisions. There is still a

long way to go in this respect. I hope to extend this paper in future drafts to include a much

more thorough and rigorous analysis of the text in the descriptions to allow me to make more

complex predictions about when this unverifiable disclosure might actually impact lenders

decisions.

The paper contributes to the literature on both voluntary disclosure and on cheap talk by

examining a setting where these two literatures intersect. I show that consistent with the

predictions of Crawford & Sobel (1982) equilibria in which cheap talk is relied upon do exist in

practice. I also provide empirical evidence that when disclosure is unverifiable the famous

unraveling result may not hold in practice. This might be an area where additional theory work

could be done (in the same spirit as Dye (1985) and Verrecchia (1983)) examining how the lack

of verifiability of disclosures might lead to different predictions regarding the extent to which

disclosures are provided and how they are used by other parties.

This paper also contributes to the relatively new line of literature examining the

Prosper.com marketplace and more broadly Person-to-Person lending. I document that several

characteristics of the description posted by borrowers are not associated with the likelihood of

loan repayment in the future. Given this finding it might be interesting to remove the description

from the website and only provide verifiable information about the borrower’s credit history in

- 24 -

an effort to prevent the lenders from becoming distracted by information that is not pertinent to

the riskiness of the loan.

- 25 -

References

Akerlof, G. 1970. The market for ‘lemons’: quality uncertainty and the market mechanism.

Quarterly Journal of Economics 90: 629–650.

Bartov, E., Radhakrishnan, S. and Krinsky, I. 2000. Investor sophistication and patterns in stock

returns after earnings announcements. The Accounting Review (January): 43-63.

Cooper, R., DeJong, D., Forsythe, R. and Ross, T. 1989. Communication in the Battle of the

Sexes Game: Some Experimental Results. Rand Journal of Economics, 20: 568-587.

Crawford, V. 1998. A Survey of Experiments on Communication via Cheap Talk. Journal of

Economic Theory, 78, 286 – 298.

Crawford V. and Sobel J. 1982. Strategic Information Transmission. Econometrica, 50:

1431-1452.

Dickhaut, J., McCabe, K. and Mukherji, A. 1995. An Experimental Study of Strategic

Information Transmission. Economic Theory, 6: 389-403.

Dye, R., 1985. Disclosure of nonproprietary information. Journal of Accounting Research, 23:

123–145.

Farrell, J., 1987. Cheap talk, Coordination, and Entry. Rand Journal of Economics, 18: 34-39.

Farrell, J. and Rabin, M. 1996. Cheap Talk. Journal of Economic Perspectives, 10 (3): 103-118)

Freedman, S., Jin, G. 2008, “Do Social Networks Solve the Information Problems for Peer-toPeer Lending? Evidence from Prosper.com,” Working paper, University of Maryland.

Freedman, S., Jin, G. 2011. Learning by doing with asymmetric information: Evidence from

prosper.com. NBER Working Paper.

Grossman, S. 1981. The Role of Warranties and Private Disclosure about Product

Quality,’ Journal of Law and Economics, 24: 461–483.

Grossman, S. and Hart, O. 1980. Disclosure Laws and Takeover Bids. Journal of Finance 35:

323-334.

Hand, J. 1990. A test of the extended functional fixation hypothesis. The Accounting Review

(October): 764-780.

Healy, P., Palepu, K. 2001. Information Asymmetry, Corporate Disclosure, and the Capital

Markets: A Review of the Empirical Disclosure Literature. Journal of Accounting and

Economics 31: 405 – 440.

- 26 -

Herzenstein, M. Andrews, R., Dholakia, U., Lyandres, E. 2008. The Democratization of Personal

Consumer Loans? Determinants of Success in Online Peer-To-Peer Lending Communities.

Working paper, University of Delaware.

Iyer, R., Khwaja, A., Luttmer, E. and Shue, K. 2010. Inferring Asset Quality: Determining

Borrower Creditworthiness in Peer-to-Peer Lending Markets. Working Paper.

Jensen, M., Meckling, W. 1976. Theory of the firm: managerial behavior, agency costs and

ownership structure. Journal of Financial Economics, 3: 305–360.

Lambert, R., Leuz, C., Verrecchia, R. 2007. Accounting Information, Disclosure, and the Cost of

Capital. Journal of Accounting Research 45 (2): 385 – 420.

Pope, D. & Syndor, J., 2011. What’s in a Picture? Evidence of Discrimination from

Prosper.com. Journal of Human Resources, 46 (1): 53 – 92.

Larrimore, L., Jiang, L., Larrimore, J., Markowitz, G. and Gorski, S. 2011. Peer to Peer Lending:

The Relationship Between Language and Features, Trustworthiness, and Persuasion Success.

Journal of Applied Communication Research, 39 (1): 19 – 37.

Milgrom, P. 1981. Good News and Bad News: Representation Theorems and

Applications, Bell Journal of Economics, 12: 380–91.

Miller, S. 2010. Information and Default in Consumer Credit Markets: Evidence from a Natural

Experiment. Working Paper.

Miller, S. 2011. Risk Factors for Consumer Loan Default: A Censored Quantile Regression

Analysis. Working Paper.

Petty, R. and Cacioppo, J. 1986. Communication and persuasion: Central and peripheral routes to

attitude change. New York: Springer-Verlag.

Pope, D. and Syndor, J. 2011. What’s in a Picture? Evidence of Discrimination from

Prosper.com. Journal of Human Resources 46 (1): 53 – 92.

Rigbi, O. 2010. The Effects of Usury Laws: Evidence from the Online Loan Market. Working

Paper, Ben-Gurion University of the Negev.

Shen, D., Krumme, C. and Lippman, A. 2010. Follow the Profit or he Herd? Exploring Social

Effects in Peer-to-Peer Lending. IEEE International Conference on Social Computing.

Stiglitz, J. and Weiss, A. 1981. Credit Rationing in Markets with Imperfect Information.

American Economic Review, 71 (3): 393 – 410.

Verrecchia, R. 1983. Discretionary disclosure. Journal of Accounting and Economics 5: 365–

380.

- 27 -

Walther, B. 1997. Investor sophistication and market earnings expectations. Journal of

Accounting Research (Autumn): 157-179.

- 28 -

Appendix A: Variable Definitions

Variable

ActualRate

Amount

Bid2000

Description

The final interest rate that the borrower pays on a funded loan.

The amount of the requested loan.

A binary variable taking the value of 1 if there was at least one bid

greater than $2,000 on the listing and 0 otherwise

Budget

A binary variable taking the value of 1 if the description contains

any of the following words: (Budget, Monthly Expense) and 0

otherwise

A binary variable taking the value of 1 if the description contains

any of the following words: (Business, Company, Invest) and 0

otherwise

A binary variable taking the value of 1 if the description contains

any of the following words: (Car, Truck) and 0 otherwise

Business

Car

Consol

CurDel

A binary variable taking the value of 1 if the description contains

any of the following words: (Consolidate, Consolidating) and 0

otherwise

The number of current delinquincies taken from the borrower's

credit report

Del7Yrs

The number of delinquincies in the past 7 years taken from the

borrower's credit report

DtoI

Debt to Income ratio reported in the Prosper.com listing. This is

calculated using self reported annual income along with debt figures

from the borrower's credit report.

Duration

The number of days that the listing will remain open before it either

expires and is removed from the website or becomes funded and

turns into a loan

Education

A binary variable taking the value of 1 if the description contains

any of the following words: (School, Education, Class, College,

Undergraduate) and 0 otherwise

Family

A binary variable taking the value of 1 if the description contains

any of the following words: (Family, Child, Children, Kids,

Husband, Wife) and 0 otherwise

GradeXX

A binary variable taking the value of 1 if the credit grade associated

with the listing is XX and 0 otherwise. Here XX {AA, A, B, C, D,

E, HR/NC}

A binary variable taking the value of 1 if the borrower is a group

member and 0 otherwise.

GroupMem

Health

A binary variable taking the value of 1 if the description contains

any of the following words: (Medical, Hospital, Doctor, Health) and

0 otherwise

- 29 -

Homeowner

A binary variable taking the value of 1 if the borrower is a

homeowner and 0 otherwise.

Image

A binary variable taking the value of 1 if the borrower provided an

image with the listing and 0 otherwise.

Info

A binary variable taking the value of 1 if both the quintile rank of

characters and of numeric characters falls in the top two quintiles

Inq6Mos

The number of credit inquiries in the last 6 months taken from the

borrower's credit report

Invst95_2

A binary variable taking the value of 1 if at least 2 lenders who fall

above the 95th percentile in terms of total dollar amount invested in

Prosper.com chose to bid on the loan and 0 otherwise

Loan

A binary variable taking the value of 1 if a listing was successfully

funded and 0 otherwise.

The maximum interest rate the borrower is willing to pay that shows

up on the initial listing.

MaxRate

Paid

A binary variable taking the value of 1 if the borrower completely

repaid his obligation and 0 if the borrower defaulted on or has yet to

repay any portion of his obligaton.

Ppct95_25

A binary variable taking the value of 1 if at least 25 percent of the

amount requested was funded by borrowers who fall above the 95th

percentile in terms of total dollar amount invested in Prosper.com

loans and 0 otherwise

The number of public records in the past 10 years taken from the

borrower's credit report

Pub10Yrs

R_Chars1

The quintile rank of the number of characters contained in the

description with the ranks normalized between 0 and 1

R_Num1

The quintile rank of the number of numeric characters contained in

the description with the ranks normalized between 0 and 1

Relist

A binary variable taking the value of 1 if the description contains

the word Relist and 0 otherwise

TotalLines

The number of lines of credit currently open and available to the

borrower taken from the borrower's credit report

- 30 -

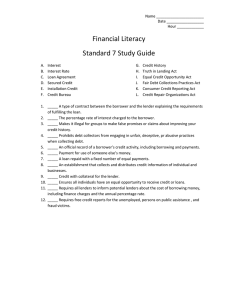

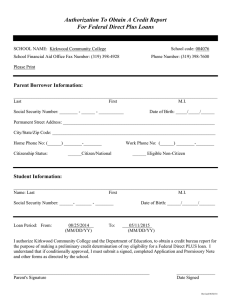

Appendix B: Two Screenshots Prosper.com Listings

Listing 1

- 31 -

Appendix B (cont.)

Listing 2

- 32 -

Table 1: Descriptive Statistics

Panel A: Full Sample

Variable

N

Loan

Info

Total_numbers

Total_chars

Education

Family

Business

Budget

Heatlh

Consol

Car

Relist

GradeAA

GradeA

GradeB

GradeC

GradeD

GradeE

GradeHRNC

Amount

DtoI

MaxRate

CurDel

Del7Yrs

Inq6Mos

Pub10Yrs

TotalLines

Homeowner

Groupmem

Image

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

289,877

Mean

0.090

0.263

32.822

1061.290

0.127

0.378

0.295

0.650

0.148

0.143

0.808

0.013

0.030

0.036

0.057

0.105

0.149

0.180

0.442

7432.850

0.529

0.196

3.886

11.276

4.182

0.667

24.805

0.332

0.284

0.508

Std Dev

0.286

0.440

28.702

742.169

0.333

0.485

0.456

0.477

0.356

0.351

0.394

0.114

0.171

0.187

0.232

0.307

0.356

0.384

0.497

6283.830

1.367

0.087

5.324

16.567

4.940

1.390

14.313

0.471

0.451

0.500

- 33 -

Lower

Quartile

0

0

10

540

0

0

0

0

0

0

1

0

0

0

0

0

0

0

0

3000

0.15

0.130

0

0

1

0

14

0

0

0

Median

0

0

30

851

0

0

0

1

0

0

1

0

0

0

0

0

0

0

0

5000

0.25

0.185

2

5

3

0

22

0

0

1

Upper Quartile

0

1

46

1397

0

1

1

1

0

0

1

0

0

0

0

0

0

0

1

10000

0.4

0.254

6

16

6

1

33

1

1

1

Panel B: Loan vs. No Loan Sub-Samples

Variable

Info

Total_numbers

Total_chars

Education

Family

Business

Budget

Heatlh

Consol

Car

Relist

GradeAA

GradeA

GradeB

GradeC

GradeD

GradeE

GradeHRNC

Amount

DtoI

MaxRate

CurDel

Del7Yrs

Inq6Mos

Pub10Yrs

TotalLines

Homeowner

Groupmem

Image

Loan (1)

Mean

Std

0.364

39.180

1266.000

0.151

0.395

0.397

0.585

0.153

0.149

0.800

0.034

0.117

0.113

0.149

0.198

0.182

0.116

0.125

6221.000

0.332

0.212

1.430

5.817

2.882

0.405

24.146

0.445

0.399

0.652

0.481

35.210

823.800

0.358

0.489

0.489

0.493

0.360

0.356

0.400

0.182

0.322

0.317

0.356

0.399

0.386

0.320

0.330

5596.300

0.954

0.076

3.370

12.296

3.898

0.926

14.335

0.497

0.490

0.476

No Loan (0)

Mean

Std

0.253

32.190

1041.000

0.124

0.376

0.285

0.656

0.148

0.143

0.809

0.011

0.022

0.029

0.048

0.096

0.146

0.186

0.474

7552.600

0.549

0.194

4.128

11.816

4.310

0.693

24.870

0.321

0.273

0.493

0.435

27.900

730.500

0.330

0.484

0.451

0.475

0.355

0.350

0.393

0.105

0.146

0.167

0.214

0.295

0.353

0.389

0.499

6335.200

1.399

0.087

5.419

16.835

5.013

1.425

14.309

0.467

0.445

0.500

Difference (1 - 0)

Mean

T-Value

0.111

6.990

225.000

0.026

0.020

0.112

-0.071

0.006

0.006

-0.009

0.023

0.095

0.085

0.101

0.102

0.036

-0.070

-0.349

-1331.600

-0.217

0.018

-2.698

-5.999

-1.428

-0.288

-0.724

0.124

0.126

0.159

35.74 ***

31.09 ***

42.57 ***

11.40 ***

6.14 ***

35.54 ***

-22.25 ***

2.32 ***

2.46 ***

-3.54 ***

20.31 ***

47.43 ***

42.51 ***

44.95 ***

40.31 ***

14.63 ***

-33.23 ***

-154.14 ***

-36.2 ***

-33.25 ***

36.32 ***

-115.39 ***

-72.36 ***

-54.85 ***

-45.19 ***

-7.78 ***

38.89 ***

40.05 ***

51.16 ***

Notes: This table presents descriptive statistics for the full sample of listings (Panel A) as well as two sub-samples of the full sample,

Loan (those listings that were fully funded and turned into loans) and No Loan (those listings that went unfunded at the time the listing

expired). The full sample is composed of all listings on Prosper.com created between 6/1/2006 and 9/30/2008. All variables are defined

in Appendix A. The difference in means across the two sub-samples is tested using the Satterthwaite T-Test that allows for unequal

variances across the two groups. ***, **, & * represent significance at the 1%, 5%, & 10% levels respectively.

- 34 -

Table 2: Pearson Correlation Matrix

Loan

Info

Total_numbers

Total_chars

Education

Family

Business

Budget

Heatlh

Consol

Car

Relist

Amount

DtoI

MaxRate

CurDel

Del7Yrs

Inq6Mos

Pub10Yrs

TotalLines

Homeowner

Groupmem

Image

0.072

0.070

0.087

0.023

0.011

0.070

-0.043

0.004

0.005

-0.007

0.058

-0.061

-0.045

0.060

-0.145

-0.104

-0.083

-0.059

-0.014

0.076

0.080

0.091

0.678

0.682

0.129

0.262

0.236

0.193

0.184

0.093

0.190

0.101

0.022

-0.012

0.104

-0.009

0.021

-0.001

0.016

0.037

0.015

0.171

0.253

0.635

0.077

0.211

0.180

0.389

0.154

0.098

0.348

0.092

0.037

-0.012

0.154

-0.038

0.014

0.007

0.016

0.071

0.036

0.109

0.234

0.229

0.352

0.356

0.141

0.259

0.106

0.247

0.138

0.035

-0.003

0.116

0.007

0.034

-0.023

0.010

0.013

-0.013

0.241

0.334

0.085

0.054

-0.006

0.047

0.047

0.051

0.018

-0.016

-0.005

0.002

-0.015

0.010

-0.041

-0.032

-0.016

-0.060

0.051

0.094

0.099

0.001

0.168

0.034

0.076

0.043

-0.007

-0.007

0.043

0.071

0.049

-0.010

0.045

0.039

0.066

0.112

0.139

-0.045

0.045

-0.001

0.004

0.048

0.155

0.013

0.006

-0.053

-0.036

-0.027

0.005

-0.004

0.065

0.112

0.172

0.012

0.048

0.581

-0.018

-0.007

0.003

0.189

-0.077

0.013

-0.002

-0.016

0.081

0.017

-0.285

0.047

0.032

0.072

0.036

-0.044

-0.015

0.045

0.086

0.045

-0.023

0.040

0.029

-0.009

0.078

0.082

0.087

0.016

0.101

-0.009

0.014

-0.073

-0.035

-0.004

-0.040

0.054

0.002

0.012

0.056

0.011

-0.004

-0.002

0.144

-0.087

-0.007

-0.019

-0.027

0.059

0.007

-0.149

0.092

Amount

DtoI

MaxRate

CurDel

Del7Yrs

Inq6Mos

Pub10Yrs

TotalLines

Homeowner

Groupmem

Image

-0.019

-0.002

0.036

-0.002

0.004

0.005

0.006

0.004

0.010

0.075

0.058

0.095

-0.128

-0.184

-0.138

0.020

-0.065

0.108

0.193

-0.076

0.013

-0.030

-0.028

-0.037

0.012

-0.028

0.002

-0.009

-0.001

-0.014

0.047

0.055

0.049

0.050

0.026

-0.053

-0.012

0.063

0.438

0.043

0.178

0.223

-0.108

0.085

-0.040

0.021

0.155

0.229

-0.062

0.041

-0.045

0.028

0.144

0.048

0.044

-0.025

0.041

-0.031

0.039

-0.029

0.315

-0.028

-0.030

-0.040

-0.011

0.125

Notes: This table presents the Pearson correlation matrix of all the variables for the full sample of listings on Prosper.com created between 6/1/2006 and 9/30/2008.

- 35 -

Table 3: Analysis of the Effect of Disclosure of Funding Success

(1)

Parameter

info

R_Chars1

R_Num1

Education

Family

Business

Budget

Heatlh

Consol

Car

Relist

GradeAA

GradeA

GradeB

GradeC

GradeD

GradeE

GradeHRNC

Amount

DtoI

MaxRate

CurDel

Del7Yrs

Inq6Mos

Pub10Yrs

TotalLines

Homeowner

Groupmem

Image

Duration

Clusters

N

2

Pseudo-R

Odds Ratios

Info

R_Chars

R_Numbers

Coeff.

(2)

St. Err.

Coeff.

0.444

St. Err.

0.024 ***

Funding Success (LOAN = 1)

(3)

Coeff.

St. Err.

0.757

(4)

Coeff.

0.032 ***

0.438

-0.817

-1.351

-1.993

-2.935

-3.862

-4.772

-5.625

-0.0002

-0.237

9.610

0.142

-0.076

-0.008

-0.032

-0.072

-0.008

1.092

0.456

0.065

0.122

0.110

0.111

0.112

0.120

0.138

0.151

0.000

0.025

0.534

0.019

0.008

0.001

0.004

0.010

0.001

0.029

0.017

0.007

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

-0.700

-1.252

-1.924

-2.883

-3.816

-4.727

-5.579

-0.0002

-0.237

9.478

-0.075

-0.009

-0.031

-0.077

-0.009

0.137

1.024

0.365

0.057

0.117

0.106

0.106

0.109

0.118

0.137

0.150

0.000

0.025

0.532

0.008

0.001

0.005

0.010

0.001

0.020

0.029

0.016

0.006

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

-0.857

-1.422

-2.105

-3.067

-4.007

-4.920

-5.775

-0.0002

-0.241

9.425

-0.076

-0.009

-0.029

-0.074

-0.008

0.142

0.991

0.292

0.054

(5)

Coeff.

St. Err.

0.485

0.029 ***

St. Err.

0.120

0.109

0.109

0.112

0.121

0.141

0.153

0.000

0.025

0.534

0.008

0.001

0.004

0.010

0.001

0.020

0.029

0.016

0.006

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

-0.788

-1.347

-2.058

-3.009

-3.935

-4.837

-5.686

-0.0002

-0.236

9.377

-0.074

-0.009

-0.031

-0.078

-0.009

0.131

1.076

0.392

0.057

0.037 ***

0.119

0.109

0.108

0.111

0.119

0.138

0.150

0.000

0.025

0.529

0.008

0.001

0.004

0.010

0.001

0.020

0.029

0.016

0.006

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

0.057

0.024

0.111

-0.462

0.066

0.032

-0.008

0.655

-0.665

-1.194

-1.719

-2.682

-3.628

-4.577

-5.439

-0.0002

-0.237

10.017

-0.079

-0.009

-0.031

-0.078

-0.009

0.132

0.876

0.348

0.059

0.022

0.017

0.017

0.038

0.022

0.021

0.023

0.046

0.117

0.105

0.114

0.118

0.127

0.146

0.162

0.000

0.025

0.549

0.008

0.001

0.004

0.010

0.001

0.020

0.027

0.016

0.006

Year-Week

289,877

Year-Week

289,877

Year-Week

289,877

Year-Week

289,877

Year-Week

289,877

0.612

0.613

0.613

0.613

0.614

1.559

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

***

1.625

2.131

1.550

Notes: This table presents the results of the logistic regression of LOAN on several characteristics that might impact the funding success of a listing. All variables in the regression are defined in Appendix A. Standard errors in

all models are clustered by Year-Week. The regressions are run without an intercept because the indicators for the 7 credit grades are perfectly colinear. For the sake of brevity odds ratios are presented for the variables of

interest only and all odds ratios presented are significant at least at the 5% level. ***, **, & * represent significance at the 1%, 5%, & 10% levels respectively.

- 36 -

Table 4: Descriptive Statistics – Loan Sample

Panel A: Full Sample

Variable

Paid

Info

Total_numbers

Total_chars

Education

Family

Business

Budget

Heatlh

Consol

Car

Relist

GradeAA

GradeA

GradeB

GradeC

GradeD

GradeE

GradeHRNC

Amount

DtoI

MaxRate

CurDel

Del7Yrs

Inq6Mos

Pub10Yrs

TotalLines

Homeowner

Groupmem

Image

N

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

11,598

Mean

Std Dev

0.588

0.396

40.544

1377.780

0.163

0.437

0.433

0.386

0.170

0.144

0.708

0.045

0.099

0.091

0.117

0.167

0.180

0.158

0.187

6114.670

0.404

0.204

2.187

7.326

3.451

0.467

23.308

0.402

0.660

0.655

- 37 -

0.492

0.489

41.313

907.820

0.369

0.496