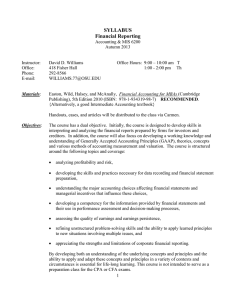

ACCOUNTING & MIS 523 FINANCIAL ACCOUNTING III WINTER QUARTER 2009

advertisement

ACCOUNTING & MIS 523 FINANCIAL ACCOUNTING III WINTER QUARTER 2009 OFFICE HOURS: Tuesday and Thursday 10:30 11:30 and by appointment E-MAIL: OFFICE: 454 Fisher Hall murdock.3@osu.edu TELEPHONE: (614) 292-1720 FAX: (614) 292-2118 INSTRUCTOR: Professor Richard J. Murdock COURSE MATERIALS (Recommended) Spiceland, J. David, James F. Sepe and Lawrence A. Tomassini Intermediate Accounting, Fourth Edition (revised), McGraw-Hill/Irwin New York NY, 2006 ISBN 0-07-321542-6. or Keiso, Donald E., Jerry J. Weygandt and Terry D. Warfield Intermediate Accounting, Twelfth Edition, John Wiley & Sons, 2007 ISBN 0-471-74955-9. COURSE DESCRIPTION This is the last course in the three course intermediate accounting sequence. As such, it assumes that you have mastered the procedures and concepts introduced in the two previous courses and extends them to deal with complex measurement and disclosure issues. This course emphasizes the development of the oral and written skills necessary to succeed in both accounting and management. COURSE OBJECTIVES The course is designed to provide a forum to ensure the student develops the oral and written skills necessary to succeed in the accounting profession. Daily participation in the class discussion is expected. The objectives of this course include providing you with an appreciation for and working knowledge of: (1) inventories, (2) operational assets, (3) deferred income taxes, (4) pensions, (5) alternative measurement techniques and (6) disclosure considerations. Related objectives include improvement of your skills in (7) accounting research, (8) oral communications, (9) written communications and (10) group decision-making. COURSE GRADING Midterm I Midterm II Quizzes Presentation Handouts Homework Participation Final Examination 100 300 100 100 100 100 100 300 Total 1,200 TEACHING PHILOSOPHY AND CLASSROOM PROCEDURES The University awards three credit hours for this course. It is the University's (and my) expectation that each student spend at least TWO hours outside of class for every credit hour. Hence, you should expect to spend a minimum of SIX (6) hours each week in addition to class time on Accounting 523. The homework assignments are made with that time frame in mind. It is my belief that the most efficient use of classroom time is to reinforce and/or clarify what the student has already tried to learn on an individual or group basis prior to the beginning of each class. This strategy requires that both the student and the instructor combine their talents to achieve the objective. Optimal learning requires: a) the student to wholeheartedly prepare for class by doing the assigned readings and working all assigned problems; b) discussion of the materials by instructor and the student; and c) the instructor to underscore the most important points via comments or very short lectures. Obviously, the problems are not ends in themselves. They only cause us to focus on central issues and explore the many alternatives available. Given the above, your success depends on your participation. Participation of the mind is essential in each class. Participation by mouth is expected periodically. I will call on you if you don't voluntarily participate. This is not a threat. It is, however, the only way I believe you become properly trained to succeed in the professional environment. I also expect you to attend all of the classes during the quarter. With only 19 scheduled meetings for the quarter, each class is very important to your development as an accounting professional. Therefore, you will be penalized twenty-five (25) points for each unexcused absence in excess of one. EXAMINATIONS Examinations in this course are all closed book and in class. They will consist of objective format questions and long and short problems. Unexcused absences will result in a grade of "zero" for the missed exam. If you miss the midterm examination for a valid reason (e.g. sickness), you must provided appropriate documentation. Your grade will be determined by the method the instructor assigns at the time the absence is judged excused. The final examination will be administered at the time (and place) scheduled by the university. If you miss the final examination and have an excused absence, you will be required to take a make-up examination at a date and time determined by the instructor. You must take a final examination to receive a grade for the course. QUIZZES Quizzes in this course are closed book and in class. There are no make-up quizzes. There will be a minimum of six 20 point quizzes. Your lowest quiz grade will be dropped when determining the number of point earned for quizzes. HANDOUTS AND PRESENTATION Handouts and the presentation will be done on a team basis. The team assignments will take place after the second week of class. For some handouts and the presentation, you will examine new pronouncements and consider their potential impact on the future of the accounting profession. HOMEWORK Homework assignments are based on the Spiceland text. They are intended to prepare you for class discussion and will be collected on days when we do not have a quiz. Answers to the assigned problems will be posted on Carmen throughout the quarter. TENTATIVE ASSIGNMENT SCHEDULE The assignment schedule for the quarter may change slightly depending upon the progress of the class during the quarter. To view the current assignment schedule, click on the assignment schedule in Carmen. OFFICE OF DISABILITY SERVICES If a student needs to take an examination at the Office of Disability Services (ODS), all required paperwork must be completed by the end of the second week of classes. The student should then be able to take the examination at the ODS facility during a scheduled time approved by the instructor. TELEPHONE LIST To facilitate class interaction, a listing of telephone numbers and e-mail addresses will be available on Carmen later in the quarter. TENTATIVE ASSIGNMENT SCHEDULE AMIS 523 WINTER 2009 Date 1/6/2009 1/8/2009 √ Topical Coverage Inventory Basics and Pictures Q Dollar Value LIFO Chapter Suggested Homework 8 E 8-10, 8-11, 8-12 8 P 8-1, 8-3, 8-10 1/13/2009 Inventory Estimates and Errors 9 E 9-21, 9-25; P 9-3, 9-10, 9-13 1/15/2009 MIDTERM – 100 Points 9 P 9-7, 9-12, 9-14 Important Items From 521 & 522 1/20/2009 Operational Assets - Acquisition 10 E 10-6, 10-8, 10-9, 10-28; P 10-2, 10-4, 10-9 1/22/2009 Operational Assets - Disposition 10 P 10-5, 10-6, 10-10 1/27/2009 Special Assignment No class or office hours 1/29/2009 Q Operational Assets - Utilization 11 E 11-7, 11-9, 11-10, 11-14; P 11-7, 11-11 2/3/2009 Operational Assets - Impairment 11 P 11-2, 11-5, 11-6, 11-12 2/5/2009 MIDTERM II – 300 Points 8-11 2/10/2009 Accounting for Income Taxes 16 2/12/2009 Accounting for Income Taxes FIN 48 2/17/2009 Pension Basics 17 E 16-5, 16-17, 16-26; P 16-6 P 16-8, 16-9, 16-10, 16-11 E 17-6, 17-7, 17-8, 17-15, 17-18 2/19/2009 2/24/2009 Pension Costs 2/26/2009 Employee Benefit Plans 17 E 17- 27, P 17-19, Handout 3/3/2009 Error Corrections 20 E 20-3, 20-7, 20-11, 20-28; P 20-13 3/5/2009 Statement of Cash Flows 21 E 21-20, 21-23, 21-25, 21-26; P 21-3 3/10/2009 Statement of Cash Flows 21 P 21-7, 21-13, 21-14 3/12/2009 Presentations on FAS 157 3/16/2009 Final – 300 Points (1:30 Class) All 1:30 - 3:18 p.m. 3/18/2009 Final – 300 Points (3:30 Class) All 3:30 - 5:18 p.m. NOTE: Q denotes quiz on this date FAS 158 P 17-4, 17-6, 17-9, 17-11, 17-14