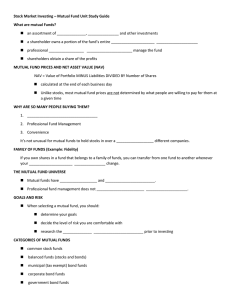

Do Mutual Fund Managers Trade on Stock Intrinsic Values?

advertisement