Discussion of Investment and the Cross-Section of Equity Returns by Clementi and Palazzo

advertisement

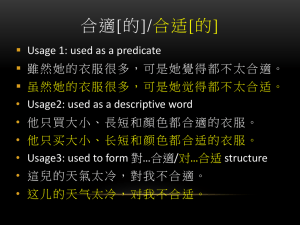

Discussion of Investment and the Cross-Section of Equity Returns by Clementi and Palazzo Xiaoji Lin Ohio State University AFA January 4, 2015 1 / 14 Context: Value premium in investment-based models I Operating leverage and costly (ir)reversibility of investment I I Investment-speci…c technology shocks I I Belo, Lin and Bazdresch ’14, Favilukis and Lin ’14 Financial frictions I I Papanikolaou ’11, Papanikolaou and Kogan ’14, Li ’14 Labor market frictions I I Carlson, Fisher and Giammarino ’04, Zhang ’05, Cooper ’06, Liu, Whited and Zhang ’09, Imrohoroglu and Tuzel ’14 Gomes and Schmid ’10, Belo, Lin and Yang ’14 This paper: questions the quantitative e¤ect of the operating leverage channel 2 / 14 Context: Value premium in investment-based models I Operating leverage and costly (ir)reversibility of investment I I Investment-speci…c technology shocks I I Belo, Lin and Bazdresch ’14, Favilukis and Lin ’14 Financial frictions I I Papanikolaou ’11, Papanikolaou and Kogan ’14, Li ’14 Labor market frictions I I Carlson, Fisher and Giammarino ’04, Zhang ’05, Cooper ’06, Liu, Whited and Zhang ’09, Imrohoroglu and Tuzel ’14 Gomes and Schmid ’10, Belo, Lin and Yang ’14 This paper: questions the quantitative e¤ect of the operating leverage channel 2 / 14 Summary of the …ndings A standard investment-based model as in Zhang ’05 I calibrates adj. costs to match …rm-level investment dynamics I generates a negative value premium I produces a positive correlation between size and BM 3 / 14 Model calibration Technology dividend: dt = pt est +zt kt0:6 it :00005ktfit 6=0g aggregate: zt+1 = :95zt + :007"z;t+1 idiosyncratic: st+1 = :90st + :009"s;t+1 :02 i2t kt :00385 SDF log Mt+1 = log :9965 t = (3:15 t "z;t+1 1 2 2 t :0072 15:75zt ) 4 / 14 Results moments book-to-market …rm-level std i/k value premium data 0.757 0.089 1.883 model 0.782 0.087 -0.003 5 / 14 Outline of my discussion 1. Calibration of idiosyncratic volatility 2. Pro…t volatility and wage rigidity as a way of generating operating leverage 3. Asset pricing tests in this class of models 4. Real in‡exibility and/or …nancial in‡exibility 5. Partial equilibrium vs. general equilibrium 6 / 14 Comment 1: Idiosyncratic volatility Revisit Zhang ’05 moments book-to-market …rm-level std i/k value premium data 0.757 0.089 1.883 Zhang’05 0.663 0.065 2.040 Zhang’5 w/t f 0.372 0.065 -0.200 Operating leverage is crucial for a sizable value premium in Zhang ’05. 7 / 14 Comment 1: Idiosyncratic volatility Calibrated idiosyncratic volatility appears too small Conditional idiosyncratic volatility 0.009 in the paper vs. 0.17 in Zhang ’05 and 0.08-0.19 in the data (Imrohoroglu and Tuzel ’14) moments book-to-market …rm-level std i/k cross sectional std i/k cross sectional std return value premium data 0.757 0.089 0.08-0.11 0.12-0.2 1.883 model 0.776 0.082 0.005 0.003 -0.002 high idioVol 0.832 0.087 0.085 0.181 0.862 The XS return volatility: .12-.20 (Campbell et al ’01; Vuolteenaho ’01) 8 / 14 Comment 2: Pro…t volatility Model implied pro…t volatility appears smaller than the data pro…t = output f = pt est +zt kt f =) std (pro…t) = std (output) elasticity of pro…t wrt shocks is 1 What happens if we introduce wage rigidity pro…t = where wt = output-labor expense = est +zt kt nt wt 1 + (1 =) std (pro…t) wt n t ) target wage std (output) elasticity of pro…t wrt shocks bigger than 1 Wage rigidity helps generate sizable value premium w/t relying on …xed costs (Imrohoroglu and Tuzel ’14 and Favilukis and Lin ’14) 9 / 14 Comment 3: Asset pricing tests A: 1964-2012 B: 1927-2012 12 Predicted excess returns(%) Predicted excess returns(%) 12 10 8 6 4 2 0 0 10 8 6 4 2 2 4 6 8 10 12 0 0 2 4 6 8 10 12 10 / 14 Comment 3: failure of the CAPM This class of single factor model can’t produce the failure of the CAPM 6 Predicted excess returns(%) 5 4 3 2 1 0 0 1 2 3 4 5 6 Fix: introduce a second aggregate shock to a¤ect cash ‡ows 11 / 14 Comment 4: Financial in‡exibility and (or) real in‡exibility 13 13 12 12 11 11 10 10 9 9 Mkt+Iss CAPM An aggregate …nancial shock (external equity issuance shock) captures the XS returns across BM portfolios 8 8 7 7 6 6 5 5 4 4 3 4 6 8 Data 10 12 3 4 6 8 Data 10 12 Model insight: the in‡exible substitution between debt and equity is an important driver of the value premium (Belo et al ’14) 12 / 14 Comment 5: Partial equilibrium vs. general equilibrium Interesting questions: 1. Can the mechanisms in partial equilibrium models carry through in general equilibrium models? 2. With price of risk being endogenous, can general equilibrium models quantitatively generate value premium? 3. What new predictions can we learn when required to jointly explain both micro/macro quantities and asset prices? 13 / 14 Conclusion An interesting paper I More analysis on the calibration of idiosyncratic volatility I More analysis on the failure of CAPM 14 / 14