Five-Year Online Strategic Plan – Special Education Component IDEA 2004 Requirements and

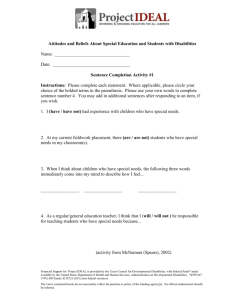

advertisement