Creating a Smart Refund and ID Card Solution SBCTC BAR Meeting

advertisement

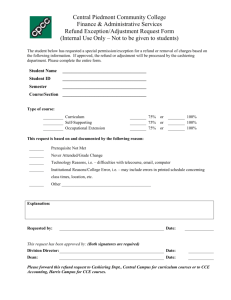

Creating a Smart Refund and ID Card Solution SBCTC BAR Meeting October 18, 2013 Introductions Tal Vaadia Jessica Sidla Regional Sales Manager Relationship Manager Campus Banking Campus Banking (970) 682-2755 Office (320) 259-0788 Office (970) 310-6363 cell (320) 492-0307 Cell tal.vaadia@usbank.com jessica.sidla@usbank.com Scott Smith Regional Sales Manager Campus Banking (503) 775-1051 Office (503) 332-1778 Cell scott.smith10@usbank.com The Strength of U.S. Bank • 4th Largest Retail Branch Network VT NH ME MI RI PA WV • Founded 1863 (celebrating 150 years) MA NY AK HI NC OK NM SC MS TX AL GA LA FL • $354 Billion in Assets • Serving 25 States with Retail Branches • 3,084 Branches, 25,000+ Surcharge free ATMs – 184 branches in WA – 715 Surcharge Free ATMs • 18 Million Customers – Over 1 Million Existing U.S. Bank Customers in WA VA CT NJ DE MD DC 25,000 ATMs 3,000+ Branches Worldwide Acceptance 33.3 Million An Unmatched Reputation • Ranked #1 in Campus Card partnerships by CR80News • Experienced in integrating with multiple card system providers • Awarded by private and public sector organizations for our innovative solutions and performance excellence – 2011 PayBefore award for best prepaid mobile app – 2012 PayBefore award for most innovative prepaid program – 2013 PayBefore award for most effective solution – Contour Campus Card Campus Banking History In 1996, U.S. Bank begins offering banking through student ID cards • ID card tied to checking account as an ATM & PIN-based debit card In 2007, U.S. Bank launches the Visa-branded Maxx Card • • • • Signature debit card tied to checking account Instantly issued by ID card office Unembossed with Visa card number Dual Magnetic Stripe for easy integration In 2011, U.S. Bank launches the MasterCard branded Contour Card • • • Prepaid debit card Instantly issued by ID card office Coordination with institutions financial aid refund disbursements Campus Banking & Refund Disbursement Services Overview Fully Outsourced Refund Disbursements Options – Transparent Choice in Selecting Refund Method – Same-day Funds Availability – Live agent support for students and parents – Error resolution (returned checks, failed ACH, etc) – One Card with both Campus & Bank Acct/Refund Access • Instant issued through College ID Card Office • Dual Magnetic Stripe for Ease of Integration/PCI Compliance • Unembosed Card – Mailed Card (not integrated with College’s ID Card) • Cards are personalized • Can be co-branded with College logo • Only mailed to students who opt in REFUND CHOICES Student Refund Options Happy With Your In House Refund Program? No Problem!! The Campus Contour Experience: Instantly Issued Through Campus Card Office • College Continues to process ACH and Check transaction • Campus Contour creates a 3rd option for refunds • Complements your in house process • How we do it: • Integrate Contour with college ID card • USB sends daily text file of all registered card/account holders to College • College securely transmits Contour refund instructions to U.S. Bank • Student accounts are funded same day • U.S. Bank settles with College via a single ACH –Funds are floated by U.S. Bank (batch processing) –No cost to college Title IV Requirements There are three ways that a school may disburse FSA funds directly to the student or parent: 1. Issuing a check or other instrument payable to and requiring the endorsement or certification of the student or parent (a check is issued if the school releases or mails the check to a student or parent, or notifies the student or parent that the check is available for immediate pickup). 2. Initiating an electronic funds transfer (EFT) to a bank account designated by the student or parent, including transferring funds to stored-value cards and debit cards. 3. Disbursing to the student in cash, provided that your school obtains a signed receipt from the student or parent. Title IV Requirements • Addresses access to funds (fee free ATMs) • Convertible to cash • Appropriates fees, and disclosures • Must provide security (FDIC Insurance) • Defines ownership of funds • Prohibits marketing as Credit Product • Must provide choice (opt-in) U.S. Bank Complies with Title IV • Convenient and free access to funds – U.S. Bank and MoneyPass ATMs – Teller withdrawal at any MasterCard bank branch • Timely access to funds – U.S. Bank provides paper check disbursement within the time frames specified in 668.164(e) for any student that has not made a disbursement selection online. • Third Party Servicer Audit – U.S. Bank retains Ernst & Young to perform and submit the required annual audits U.S. Bank MasterCard Account Overview Low Cost, High Quality •100% Opt-In •Not a credit card •EVERY student qualifies for an account •No enrollment fee •No monthly fee •No minimum balance •No overdraft fees •No fees for making purchases •Free U.S. Bank & MoneyPass ATM withdrawals •Free mobile and internet banking •Invite parent/spouse to fund the account •Peer to Peer transfer 24/7 Customer Service & Account Access • Internet Banking • Phone through IVR • Live Customer Service Representative • 3,000+ U.S. Bank branch locations • 25,000+ ATM locations • Email and Cell Phone Alerts • Mobile account access & text banking • Withdraw funds at ANY bank teller Committed to Financial Wellness • Marketing communications about the Student ID card & Refund Options • Online access through U.S. Bank and MasterCard sites • Topics can include: – Establishing and maintaining good credit – How to use prepaid accounts – Creating budgets – Using technology to manage finances – Investing for the future Current Campus Card Partners Austin Peay State University Bellevue College Benedictine University Bethel University California State University Fullerton California State University San Bernardino Capital University Carroll University Central Washington University College of Mt. St. Joseph Colorado State University Pueblo Concordia University Chicago Creighton University Drury University Everett Community College Fairleigh Dickinson University Gonzaga University Hamline University Harris-Stowe State University Henderson State University Iowa State University John Carroll University Johnson County Community College Kern Community College District Kirkwood Community College Metropolitan State College of Denver Michigan Technological University Milwaukee Area Technical College Minnesota State University Moorhead Missouri Baptist University Missouri Western State University Morehead State University Normandale Community College North Carolina State University North Dakota State University Northern Kentucky University Northwest Missouri State University Northwestern University Oakland Community College Pacific University Pasadena City College * Roger Williams University * San Diego State University San Francisco State University * San Jose State University Seattle University Southwest Minnesota State University St. Cloud Technical & Community College Saint Louis University South Texas College * Thomas More College Truman State University University of Central Missouri University of Denver University of Missouri-Kansas City University of San Diego University of Wisconsin-Eau Claire University of Wisconsin-Stevens Point Washburn University Washington State University Waukesha County Technical College Webster University Wisconsin Lutheran College Xavier University * Pending contract Questions? Thank You APPENDIX How Does It Work? School • Issues Card* • Upload Student Information* • Provide Disbursement File US Bank • Host ezDisburse Account Center • Disburse Funds • Monitor and Resolve Exceptions • Live Agent Phone Support * IDMS Card Production Solution available to automate these functions.