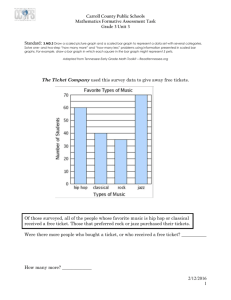

GAO SOCIAL SECURITY DISABILITY Ticket to Work

advertisement