GAO VETERANS’ PENSION BENEFITS Improvements Needed

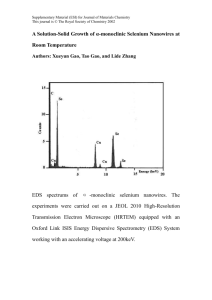

advertisement