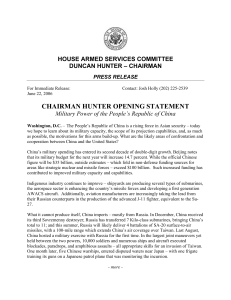

CRS Report for Congress and South Korea: U.S. Policy Choices

advertisement