CRS Report for Congress Diamonds and Conflict: Policy Proposals and Background

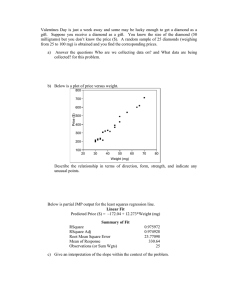

advertisement