PPMS Meeting Minutes February 28, 2014 Edmonds Community College

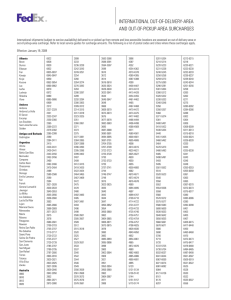

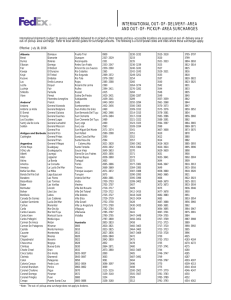

advertisement

PPMS Meeting Minutes February 28, 2014 Edmonds Community College 1. Welcome a. Mark Cassidy – Acting President 2. PPMS Business Information a. Fall Meeting Minutes approved b. Spring Meeting Date: May 8-9 i. Columbia Basin PPMS Business Information c. DRS Advisory Committee – Sheryl Gordon i. No update – Sheryl Gordon sent email February 14th. d. Health Care Authority Advisory Committee – Patsy Rammel i. ACA Codes ii. SBCTC will do default: 1. Admin/Exempt, Classified and Faculty to Y2 2. Hourly and Students to N2 3. Adjunct Faculty will not be coded due to the flexibility and work load. 75% rule for Adjunct – Y2 Presume for a full 12 month period less than 75% - N2 Code as per the Fed’s definition of “Educational Organization” Do worksheet for each new hire PS0035 – code 74 3. Group broke up into 3 groups – roundtable discussions Benefits – 2 year averaging process; determinations & notifications; part-time faculty eligibility process; insurance/benefits eligibility: best practices for all employees Payroll – Automating payroll processes; TLR; Fiscal Year reporting of health premiums; reconciliations: Health Equity/HAS, HCA HR/Other – Recruiting, unemployment process; employee classifications 4. ctcLink Update a. See attached power point 5. John Boesenberg – SBCTC a. Various House and Senate bills – most are clean-up bills – nothing of major concern for our system. b. Revenue forecast is flat – more than likely no salary increase. Could have budget reduction. c. Employer health care premium – lower for 2014/2015 – but still withinthe percentage acceptable for the unions. d. Surcharges adopted by legislature – helped close the budget. i. $50.00 spousal surcharge – other insurance must be equal to Uniform Medical Classic cost. ii. $25.00 tobacco surcharge per employee – if employee or dependent smokes 1. Marijuana is not included as a tobacco product iii. Surcharges are affective as of July 1, 2014 iv. Health Incentive - $125.00 deducted from the employee’s annual deductible for 2015. 1. Attest to tobacco and spouse through My Account online or paper 2. HCA will track people 3. New code on PS0005 a. Pretax charge 4. Daily Tran log – to capture the changes daily 5. Enrollment forms will have the attestation of smoking and spouse surcharge. 6. Make sure everyone attests to the 2 questions 7. If no response – default and will be surcharged 8. There will be a 60 day amnesty – to have employees answer before defaulted 9. Charge will be billed 2 times a month v. ACA codes 1. Do worksheets a. If status changes – change code on screen PS0035 b. Code 74- Y2 and N2 2. SBCTC is asking for a standard methodology across board a. This is only a reporting mechanism – does not change how we establish their eligibility for benefits. Our eligibility rule is less than 75% - so adjunct faculty is covered by the Fed rule. 6. HCA – Amy Corrigan a. See attached Power Point i. Surcharges for tobacco and spouse ii. Wellness incentive – have to be approved by legislature 1. Work with the Wellness Program at your individual college 2. Lying at attestation – HR issue 7. Spring Meeting – possible breakout sessions a. HCA b. ACA – Best Practices c. HR-Recruiting d. Payroll – short topics – lead person e. Benefits – samples f. Modeling HRMC – Qtr or Monthly meetings