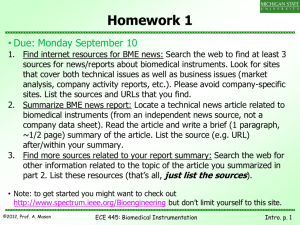

i.t;

advertisement