Document 11045200

advertisement

6"

^

M.I.T.

LIBRARIES

-

DEWEY

^)fe4>^7

ALFRED

P.

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

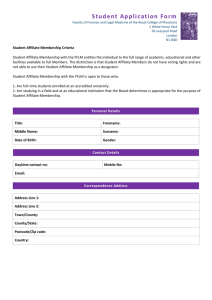

AN EMPIRICAL ASSESSMENT OF THE

FACTOR PROPORTIONS EXPLANATION OF

MULTINATIONAL SALES

S. Lael

Brainard

Massachusetts Institute of Technology

WP#3624-93-EFA

November 1993

MASSACHUSETTS

INSTITUTE OF TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

AN EMPIRICAL ASSESSMENT OF THE

FACTOR PROPORTIONS EXPLANATION OF

MULTINATIONAL SALES

S. Lael

Brainard

Massachusetts Institute of Technology

WP#3624-93-EFA

November 1993

JAN

2 5 1994

AN EMPIRICAL ASSESSMENT OF THE

FACTOR PROPORTIONS EXPLANATION OF

MULTINATIONAL SALES "

*

Abstract

This paper provides empirical evidence that challenges the factor proportions

explanation of multinational activity.

volumes

were used

proportions and income

that

to demonstrate that

affiliate

on intra-industry ratios and total

a substantial part of trade is explained by factor

tests

similarities rather than differences are applied to affiliate sales with

Some

support for the factor proportions hypothesis

is

derived by

production destined for export to the parent's market, which

is

the

surprisingly similar results.

comparing

The same

category of activity most likely to be motivated by factor proportions considerations, with

that destined for sale in the local market.

Affiliate production destined for export

moderately more responsive to factor proportions differences.

activity differ

more

in their

home

is

However, the two types of

responses to transport costs and destination market income.

Overall, the evidence suggests that only a small part of multinational activity into and out of

the

US

in the late

1980s can be explained by factor proportions differences.

JELNos. F12, F21, F23

"The author takes sole responsibility for the use and interpretation of the data, and for any

errors therein.

am

Andrew Bernard, Julio Rotemberg, and Bill 2^ile for helpful comments

and to Lilan Cheng for excellent research assistance. I am also grateful to Steve Landefeld,

Betty Barker, David Belli, Ned Howenstine, Arnold Gilbert, Smitty Allnut, and Viji

Canagasuriam at the BEA, Nick Orsini at the Census Bureau, and Jim Harrigan at Penn State

**I

grateful to

for their generosity in providing data, and to the National Science Foundation for support

under grant SES-91 11649.

Introduction

I.

The imperfect competition models of the

early 1980s provided an explanation for trade based

on

similarities

between countries rather than differences. They also provided a more natural framework for treating multinational

Although these models diminished the importance of factor proportions

enterprises.

in explaining trade flows,

consistent with empirical evidence, they maintained the primacy of factor proportions in explaining multinational

activities.

Yet in recent years,

this explanation

investment (FDI) and multinational

appears increasingly

A

activities.

large and

at

odds with observed patterns of foreign direct

growing share of multinational

industrialized nations as both the source and destination markets, rather than flowing

1961 and 1988, over half of

countries; this share

all

had risen

direct investment outflows generated

to nearly

70 percent by 1988

from North

activity involves

to South.

Between

by G-5 countries was absorbed by other G-5

(Julius, 1990).

This paper provides empirical evidence that challenges the factor proportions explanation of multinational

activity.

The same

part of trade

is

tests

on intra-industry

The

export to the parent's market.

The

total

volumes

that

were used

to demonstrate that a substantial

predictions of the factor proportions hypothesis for multinational sales

by distinguishing between

and out of the

and

explained by factor and income similarities rather than differences are applied to affiliate sales with

surprisingly similar results.

investigated

ratios

US

in the late

affiliate

further

production destined for sale in the local market and that destined for

Together, the evidence suggests that only a small part of multinational activity into

1980s can be explained by factor proportions differences.

factor proportions explanation for the location of multinational activity focuses

characteristic of

is

on

vertical

expansion

North-South flows (Markusen, 1984; Helpman, 1984; Helpman and Krugman, 1985; Ethier and

A

Horn, 1990; Ethier and Horn, 1991).

factor proportions

factor proportions are identical, the differential in

model with differentiated products predicts

GDP shares

that

when

of the source and destination countries and their joint

income should be the only determinants of trade volumes, and there should be no multinational activities. However,

this

paper finds that equations using only the differential in

share of variation in the

signs and significance.

The

volume of multinational

This finding

factor proportions

is

model

GDP shares

sales as in the

and joint income explain roughly the same

volume of

trade,

and the coefficients have similar

inconsistent with a factor prof)ortions explanation of multinationals.

further predicts that the intra-industry share of trade flows should be

decreasing in factor proportions differences, while multinational activities should arise only in a single direction

between countries with large factor proportions differences.

lower than those of trade on average, they are

still

Although intra-industry

significant,

which

ratios

of

affiliate sales are

strongly counter to the factor proportions

is

Further, tests reported below on

explanation, and they are {wsitively correlated with intra-industry ratios of trade.

intra-industry ratios of trade and affiliate sales find that both are inversely related to factor proportions differences,

and

that a greater share

of the variation

similarities in factor pro[>ortions

The

of

than of trade

affiliate sales

is

explained by

and transport costs.

alternative to the factor proportions hypothesis formulates location advantages in terms of proximity

to customers or specialized suppliers,

scale

in intra-industry ratios

which motivate horizontal expansion across borders

at the

expense of reduced

Proximity-concentration models predict

(Knigman, 1983; Horstman, Markusen, 1992; Brainard, 1992).

multinational activities will arise between countries with high transport costs and trade barriers in industries with

low plant

tests

on

scale economies,

the total

and involve increasing two-way

volumes and intra-industry

predictions, both for

income and

ratios

factor differences

more

activity the

of trade and

roughly consistent with these

affiliate sales are

and for transport

costs.

The

tests find that freight factors

a strong negative effect on trade flows and a negligible or weakly positive effect on

The paper

affiliate

The

The

similar are factor proportions.

have

affiliate sales.

further evaluates the factor proportions explanation of multinational activity

by comparing

production destined for sale in the local market with that destined for export back to the parent market.

factor proportions

model predicts

that all varieties

of a

final

good produced by

a foreign affiliate should be

exported back to the headquarters market, while the proximity-concentration hypothesis predicts that multinationals

will substitute overseas production for trade in final goods, so that flows of final

will be zero.

With a multistage production process,

will generate

one-way trade

two-way trade

while the

US

affiliates

compare the share of

that multinationals

model predicts they will generate

home

on

multinationals export 13 percent of their overseas production to the

US,

affiliate sales

exported back

of foreign multinationals export 2 percent of their

total affiliate

market

small in both directions:

The amount of

owned by US

to the parent

model further predicts

in intermediates, while the proximity-concentration

in intermediates.

aggregate, foreign affiliates

the factor proportions

goods back

production destined for export back

US

is

production to their parents. Tests that

home with

the share destined for local sale

confirm that the two types of activity differ moderately in

their relation to factor proportions differences in a

home. However, they

that is roughly consistent with a factor proportions explanation for the share exported

in their responses to transport costs

more

The

of

its

tests

SIC

differ

and destination market income.

use data on bilateral flows of trade and

trading partners at the 3-digit

way

affiliate sales in

level, as well as direct

both directions between the

measures of transportation costs.

US

The

and 27

analysis

focuses on bilateral flows rather than multilateral flows as would be suggested by theory, due to data limitations.

In addition, a cross-section approach

that for

which the data on

is

taken because most of the independent variables vary at intervals longer than

affiliate sales is available.

Two Models

n.

Guided primarily by findings from case study

framework explaining the decision

to

research, the managerial literature has developed a conceptual

produce abroad rather than export as optimal

in

markets characterized by the

conjuncture of internalization, ownership, and location advantages. In recent years, trade theorists have incorporated

these insights into general equilibrium models.

Broadly, two types of models have emerged to explain the location

Both focus on the choice between exporting and investing across borders

decision.

firms benefit from internalization due to multi-plant economies of scale.

I

starting

from the premise

that

briefly contrast their predictions for the

patterns of trade and of multinational sales.

Factor Proportions

i.

Markusen, Helpman (1984), Helpman and Krugman, and Ethier and Horn (1990) explain

expansion across borders in terms of relative factor endowments and technological parameters.

^

'

vertical

The Helpman

and Helpman, Krugman model incorporates multinationals into a differentiated products, factor proportions model

'

factor

somewhat more concerned with organizational questions against the background of a

proportions motivation for overseas production; they model firm configurations as trading off economies of

Ethier and

Horn

are

scope against increased costs of managerial control and coordination.

^

In the

Markusen model,

factor

explaining multinational production.

endowments

are symmetric, but sector-specific capital plays a key role in

of trade by assuming that the production process in the differentiated products sector can be separated into multiple

stages,

and there are multi-plant economies of scale associated with a firm-specific input which has a public goods

character.

I

briefly review the

and then go on

main predictions of the pure trade model

to discuss the extension to multi-plant firms.'

here,

which

will be familiar to

most readers,

Consider a two-sector, two factor, two-country

world, where countries are distinguished only by their relative factor proportions differences and their relative

incomes. Tastes are homothetic and identical, and there

is

a constant-retums-to-scale,

homogeneous goods

sector,

and a differentiated products sector characterized by Chamberlinian monopolistic competition and increasing returns.

by a

In such a world, there is intra-industry trade in differentiated products motivated

trade in the

homogeneous product, and

countries.

Then,

trading partners.

the net factor content of trade reflects the relative factor

if either there is specialization in the

differentiated products, the total

More

taste for variety

volume of

trade

is

and one-way

endowments of the

production of homogeneous products, or

if all trade is in

a decreasing function of the relative size differential of the

generally, the share of intra-industry trade in total trade

is

a decreasing function of factor

proportions differentials.

When

the production process in the differentiated products sector

is

separable, so that firms can place

headquarters activities in one market and manufacture in either market, the pattern of production will depend on

the factor intensities of each stage of the production process and the relative factor

economies.

If headquarters

activities

and production

have different factor

activities

endowments of

intensities,

the

two

single-plant

multinationals will arise to exploit potential factor cost differentials, for large factor proportions differences.

When

factor

equilibrium, there

is

endowments are

no incentive

sufficiently similar that factor price equalization obtains in the trade

for cross-border investment,

headquarters activities are relatively more capital-intensive.

and the pure trade equilibrium

When

results.

Assume

factor prices are not equalized under trade,

some

of the firms in the differentiated sector locate their headquarters in the relatively capital-abundant economy and

production in the relatively labor-abundant economy, and export back to the headquarters market.

In general

equilibrium, the ability to geographically separate firms' activities in the differentiated sector leads to an enlargement

'

These predictions are derived

in

Helpman, Krugman, 1985.

4

of the factor price equalization

set.

Because cross-border investment

is

motivated solely by factor price differentials,

multinational activities arise only in a single direction within an industry, in single-plant firms, between economies

with strong factor proportions differences.

With a two-stage production process, the existence of multinationals

generates interindustry trade of final goods, and one

would expect

direction between countries with different factor proportions.

may

at

to see multinational activities arising in a single

With

additional stages of production, multinationals

generate interindustry trade of both final goods and intermediates, but again in one direction within an industry

''

each vertical stage.

The

empirical implications of this framework are quite strong.

arise only in

one direction between countries

in an industry

different factor proportions that factor price equalization

predicts that multinationals will

it

and only between economies

would not

are sufficiently different that firms have an incentive to

First,

move

result

under trade. Second,

have sufficiently

proportions

if factor

their plants abroad, the creation

With an additional stage of production,

diminishes the share of intra-industry trade.

that

of multinationals

MNEs may

interindustry trade of intermediate goods in one direction and of final goods in the reverse direction.

increasing role for

Similarly,

it

MNEs

may weaken

weakens the

link

between country

size dispersion

the link between factor proportions differences

and the

total

generate

Third, an

volume of

and the share of intra-industry

trade.

trade.

With

a two-stage production process, the intra-industry share of trade will be positively related to factor proportions

differentials if the headquarters

otherwise.

With an

market

is

a net importer of the final differentiated goods, and negatively related

additional production stage, the intra-industry share tends to decrease with increasing factor

proportions differentials because the additional trade in intermediates

ii.

is inter- industry.

Proximity-concentration Tradeoff

Another group of

paf>ers uses the

same

differentiated products

framework

to explain horizontal expansion

across borders motivated by considerations of access to the destination market at the expense of production scale

economies (Krugman; Brainard, 1992). Consider the same two-sector, two-country world, but assume

that factor

proportions are identical, and firms in the differentiated products sector choose between exporting and cross-border

expansion as alternative modes of foreign market penetration.

The

differentiated sector

is

again characterized by

increasing returns at the firm level due to

production

facilities

some

input, such as

with undiminished value, but

now

R&D,

can be spread

that

there are scale

economies

among any number of

at the plant level,

concentrating production lowers unit costs, and a variable transport cost that rises with distance.

whether

to

such that

Here, the decision

expand abroad via trade or via investment hinges on a trade-off between proximity advantages and scale

advantages from concentrating production in a single location.

In the absence of factor proportions differences

between the two economies, the magnitude of variable

transport costs and the size of scale economies at the plant level relative to the firm level will determine the location

and configuration of production chosen by firms.

Suppose there

is

a simple fixed cost associated with each plant

of F; exporting costs of e^*" per imit, which incorporates both freight factors associated with distance, D, and

barriers, T; per unit variable costs, V(w,r), that are declining in the

amount of

the firm-specific input,

tariff

r,

and

increasing in local wages, w; and costs associated with production of the input C(w,r). Then, with n„ firms in each

market, firms will adopt multinational configurations with plants in both markets

if the increase in variable profits

associated with producing close to consumers in both markets outweighs the additional plant fixed cost.

Combining

the no-defection condition with free entry yields the equilibrium condition:

F(w)

(1)

which simplifies by assuming

price index (which

is

do not take

increasingly accurate as the

a multinational equilibrium,

is

that firms

where

all

^

(i-^n->pxi..))

into account the effect

number of firms

of their potential deviation on the market

increases)'.

Comparative

firms have production facilities in both markets,

is

statics establish that

more

likely the smaller

the fixed production cost relative to the corporate fixed cost, and the higher are transport costs and trade barriers.

Here, as the corporate cost goes to 0, an equilibrium with multi-plant firms

a fixed

number of

firms, the dual-plant equilibrium

is

more

An

*

is

two-way multinational

never sustainable.

In addition, for

likely to hold the larger is the foreign market.

an equilibrium, multinational production completely supplants trade in

corporate services, and there

is

activity in the

final

same

goods, there

is

In such

trade only in 'invisible'

industry.

equilibrium characterized by single-plant, national firms arises under reverse conditions.

Firms

Brainard (1992) gives equilibrium conditions taking into account the effect on the market price index.

6

maintain a single-plant production configuration as long as the increase in fixed costs to open a second plant in the

foreign market outweighs the associated increase in variable profits.

are characterized by the exact reverse conditions as in equation (1).

prevail the higher

is

With

The

single-plant equilibrium

the fixed plant cost relative to the corporate fixed cost

the distance between the markets.

Here, there

factor proportions are equal, all trade

is

two-way trade

intra-industry, as

is

in final

free entry, the equilibrium conditions

is

more

likely to

and the lower are the transport cost and

goods

in the differentiated sector, and, if

would be predicted by a

differentiated products

model

of trade.

In the intermediate range of parameter values, there

coexist with national firms.

In the

is

mixed equilibrium, some

a third equilibrium in which multinational firms

fraction, a,

and exports, and the remaining fraction has production

of firms in each market has a single

both markets.

For a given

and trade

barriers, the

production

facility

number of

firms, the prop)ortion with a single plant rises the smaller are transport costs

facilities in

greater is the fixed plant cost, the smaller are the savings in variable costs from additional

larger

is

is

investment, the

the corporate cost for the two-plant configuration relative to the single-plant configuration, and the smaller

the size of each market.

multinational production.

Thu£,

this

mixed equilibrium, there

In the

The

is

both two-way trade in

final

goods, and two-way

share accounted for by multinational production rises with distance and trade barriers,

and declines with production fixed

activity

R&D

costs.

model explains horizontal expansion across borders motivated by market

access: multinational

can arise in the absence of factor proportion differences and in two directions in the same industry, and

is

undertaken by multi-plant firms.

Of course,

the

two models are not mutually exclusive.

concentration tradeoff are combined,

considerations.

will

emerge

firms

As Brainard (1992) shows

make

in a

also

and a proximity-

on both

hybrid UKxlel, this implies that vertical single-plant multinationals

relative to proximity advantages that national firms

may

factor proportion differences

the decision whether to produce abroad based

for sufficient factor proportions differences,

Single-plant vertical multinationals

When

would

emerge

when

concentration advantages are sufficiently strong

prevail in the absence of factor proportions differences.

for strong factor proportions differences

when proximity

advantages are sufficiently strong that horizontal multinationals would form in the absence of factor price

differentials.

Thus, the addition of factor proportions differences increases the likelihood of concentrating

production in a single location, leading to the coexistence of single-plant multinationals with either multi-plant

multinationals or single-plant national firms.

With a

three-stage production process,

when

factor proportions

considerations dominate, multinationals arise in a single direction between countries and generate interindustry trade

in intermediate

way

and

trade in final

final

goods, while when considerations of proximity dominate, multinational sales supplant two-

goods of unequal magnitudes and may generate intra-industry trade

to a multi-country context,

one would expect

to see a

countries that are dissimilar and a pref)onderance of

in intermediates. Generalizing

preponderance of one-way multinational sales between

two-way

activity

between countries with similar endowment

ratios.

Related Literature

III.

This paper

is

the first to investigate the empirical validity of differentiated products, factor proportions

models of multinationals. The empirical research on multinationals has focused mainly on foreign direct investment

flows, and

much of

the older research

it

has been preoccupied with responses to differentials in corporate income taxation.

on non-tax determinants focused on hypotheses based on

foreign direct investment

is

conceived in terms of physical capital.

Much

factor proportion differences,

These empirical

efforts

of

where

were not successful

at

explaining the location of multinational activity.^

This literature missed two

critical characteristics

foreign direct investment and trade flows

is

of multinational activity.* First, the comparison between

a conceptual mismatch.

When

multinational activities are considered

as a substitute for trade in the presence of trade barriers, for instance, the relevant

trade flows and multinational sales rather than investment.

the current account,

and

this is

Although trade and investment are connected through

an interesting connection from a macroeconomic perspective,

measure of the extent and location of overseas production.

'

comparison should be between

FDI

is

not a good

Second, by their very nature, multinationals cannot

See Caves (1982) for a survey.

With the notoble exceptions of Swedenborg (1979) Blomstrom

and Grubert and Mutti (1991).

'

8

et. al.

(1985) and Lipsey and Weiss (1981)

adequately be incorporated into perfect competition trade nnxiels.

The

literature has so far not directly addressed

the predictions of imperfect com[>etition, general equilibrium models for multinationals.

There

are,

however, several empirical findings

US

per worker ratios of

that are relevant.

parents and their affiliates are inversely correlated, which

proportions account, but capital-labor ratios are uncorrelated.

for

Kravis and Lipsey (1982) find that payroll

Swedish multinationals, Swedenborg (1984) finds

is

consistent with a factor

Using cross-section and time

that affiliate sales are increasing in

series firm-level data

wage

She also finds

exports are uncorrelated, and both increase in the natural resource intensity of the industry.

neither

related to per capita income,

is

which has been used

to

proxy capital-labor differentials

differentials while

that

in the empirical trade

literature.

There

is

explanations of trade.

exceeded

its

body of empirical research

a large

investigating factor proportions

Several researchers have found that the strength of the

empirical predictive power.'

differentiated products have

The

HOS

and differentiated products

theoretical

framework has

predictions of a factor proportions framework elaborated to include

met with more success (Helpman, 1987), but more recently Hummels and Levinsohn

(1993) have questioned the robustness of the results and their interpretation.

None of this work

distinguishes trade

mediated by multinationals from arms-length trade.

Data

IV.

As

is

well

known

countries are daunting.

Analysis

activity

US

of empirical trade, limitations due to incomparability of trade data across

Limitations on multinational sales data are even worse.

(BEA) compiles

between the

in the field

The US Bureau of Economic

the most complete set of data disaggregated by industry, but

and

its

trading partners.

it

covers only bilateral

In order to fully exploit this data set, the analysis below

confined to two-way bilateral relationships. Ideally, of course, a single equation would be used to

multilateral relationships.

'

the

The

analysis focuses

on a cross-section of industry-country

test a full set

hypothesis.

of

pairs for 1989.

See Deardorff (1984) for a survey, and Bowen, Learner, Sveikauskas (1987) for the most complete

HOS

is

test

of

Trade flows and

i.

The

Kong,

They

Argentina, Australia, Austria, Belgium, Brazil, Canada, Columbia, Denmark, France, Germany,

Hong

Ireland, Italy, Japan,

at the 3-digit

Mexico, Netherlands,

SIC

level

was obtained from

level of aggregation available,

which

is

and production structure, and minimize missing

New

Zealand, Norway, Philippines, Singapore, South Korea,

Kingdom, and Venezuela. Data on both

Census Bureau.

the

Data on

wholesale and

sets

retail trade,

between the 3-digit and 2-digit SIC

data includes

utilities,

lowest

at the

which over SO

were excluded, along with

because the 'nontradeable' nature of these activities requires a local presence. Matching

292 were dropped because

all

US

affiliates

Because the multinational data

I

is

is less

familiar than the trade data,

in the analysis,

which

will

I

sales

allocated to wholesale trade.

The

Tlie data

will describe

affiliates

in

it

the 27 countries

and 64 industries included

The reverse

is

sales

in the

true of trade flows:

and imports (20 percent). The

sample

imports

The share of both imports and exports accounted

for

is

total

some

on

the outward side.

detail here.

be termed 'tradeables", gross trade flows are

positively correlated with gross affiliate sales in both directions, but the correlation

and exports (60 percent) than for inward

(BEA

on multinational

did not have matching trade data).

on the inward side but only majority-owned foreign

For the industries included

billion.

was compiled

Industries for

levels.

manufacturing probably understates the true values because some proportion

sales

imports and exports

of classifications yielded data on 64 industries, covering manufacturing and primary industries

categories 150 and

in

bilateral

affiliate sales

percent of revenues are accounted for by services, including finance and

two

countries were selected to

data.

in geographical coverage, income,

Spain, Sweden, Switzerland, Taiwan, United

the

The

data includes trade and multinational sales for 27 countries in total.

maximize diversity

include:

affiliate sales

is

much

stronger for outward

total level

of outward sales for

$ 542 billion, well above that for inward sales of $ 393

$ 380 billion, exceeding exports totalling $269 billion.

by intra-firm

transfers

is

roughly equal

at

one quarter.'

When

imports and exports to and from unrelated parties are included as well as those to and from affiliated parties, the

'

US

There may be some double counting

in the

two-way estimates, since some

parents and foreign-owned affiliates, but for intra-firm trade

10

it

US

affiliates are classified

should be very small.

both as

of trade mediated by

ratio

affiliates is

32 percent on the import

and 37 percent on the export

side,

comparisons must be taken as rough approximations, however, as the

BEA

data on firm trade

On

industry of affiliate sales, while the trade data are classified by the actual product.

foreign affiliates

owned by US

by foreign-owned

parents generates $0. 13 of

US

affiliates in the

down by

Table lA breaks the data

ratios

of sales to trade

in

to

country.

It

US

exports, and $0. 15 of

shows the

statistics for

an industry breakdown.

by

In both cases, trade mediated

countries,

22 percent of outward

sales are to

Netherlands accounting for an additional 43 percent of the

exports, with Japan a close second at 16 percent, and Mexico, the

The

additional 22 percent.

the

of

UK, Norway, Germany, and

Canada accounts

percent.

for

ratio

for 14 percent,

The order

is

somewhat

affiliate sales to

Brazil.

On

exports

is

different for imports

lower than that on the outward

The

last

side, but is

two columns of Table

affiliates

industry codes are listed

affiliate sales variables

UK, Germany,

Canada similarly accounts

UK, and Germany

UK

is

France, and the

for 21 percent of

together accounting for an

particularly high for Ireland,

accounts for 25 percent of

-

affiliate sales,

with Japan accounting for 24 percent, Canada accounting

for 19 percent.

The

ratio

of affiliate sales

to

imports

extremely high for particular countries, such as the Netherlands,

The

1

A report Grubel-Lloyd indices of intra-industry

ratios are aggregated across industries

US

ratios

of trade and similar

by country as follows:

Estimates of the share of trade mediated by multinationals seem to vary widely.

include trade between

parties in the

and trade separately.

UK.

indices for affiliate sales.

'

BEA

affiliate sales, the

and Germany, Japan, and the Netherlands together account for an additional 33

22 percent, and Mexico, Taiwan, and Germany accounting

Switzerland, and the

imports.

imperfect).

is

2.5 on average, and

the inward side, the

imports, while $1 of sales

from the trade and

Canada, with the

total.

by the

average, $1 of sales by

affiliate sales

Descriptions of the

affiliates is subtracted

is classified

of inward and outward

minimize the overlap between the two (although, as noted above, the match

Comparing

is

level

US

US

exports and $0. 11 of

each direction, and aggregate intra-industry ratios for

Table IB gives the same

in the appendix.

generates $0.08 of

US

These

side.'

The

estimates here do not

parents and foreigners other than affiliates, or between foreign parents and unaffiliated

US. For 1989, the

ratio

of merchandise exports shipped by

(excluded) to exports shipped to foreign affiliates (included)

11

is 1.3;

US

parents to foreigners other than

the analogous ratio for imports is 1.1.

f^Min(X°Jc!j)

nx.

(2)

where X^' and X^° are inward

=

^

affiliate sales in industry j

from country

c

and outward

affiliate sales to

country c

respectively for the affiliate sales ratio, and total imports and exports respectively for the trade ratio (net of trade

mediated by

affiliates).

Table IB reports ratios averaged by industry, which are calculated analogously by

aggregating over countries within industries.

The

affiliate sales.

In both cases, the average ratio

is

higher for trade than

intra-industry ratio of affiliate sales exceeds 30 percent for 5 countries

UK, and

is

a 17 percent correlation between the two indices.

Transport Costs

ii.

Two

SO percent. There

is for

(UK, France, Germany,

Japan, and Canada) while that for trade exceeds 30 percent for 18 countries, with Mexico, France, the

Ireland exceeding

it

Most of

types of variables have been used to proxy for freight factors in past research.

work on

the

gravity equations uses measurements of physical land and sea distances between national 'economic centers" to

proxy for transport costs (Bergstrand, 1986, 1989), following the procedure outlined

more

industry level, a

OECD

on a fob

basis

import values reported on a cif basis by the importing country, and the associated value repmrted

by the exporting country.

I

The

results are disappointing,

which Harrigan

however, with freight factors for some

attributes in part to inconsistent reporting procedures.

use an alternative formulation of freight factors, which uses data on freight and insurance charges

reported by importers to the

values.

the

Harrigan (1993) approximates variations in freight factors by product, by using the ratio

industries exceeding 5(X) percent,

Below

Linneman (1966). At

accurate measure of transport costs should reflect specific product characteristics, as well

as geographical factors.

between

in

US

Census Bureau. The

Since no comparable data

is

available from exporters, and there

differences in charges for transporting the

transport, these values are used in the

industry trade (95 ftercent of

all

freight factors are calculated as the ratio

same goods between

outward equations for

all

the

is

no reason

of charges

import

to expect systematic

same locations based on

the direction of

industry /country pairs for which there

industry-country pairs), as well as in the inward equations for

12

to

all

is intra-

industries.

The

resulting series appears

in

more accurate than

either of

its

two predecessors, yielding values between

99.8 percent of the industry-country pairs for which freight factors are reported.

compared with a mean ranging between 140 and 270 percent

series.

The

series also

for different

It

has a

and 100 percent

mean of

8 percent, as

methods of correcting the OECD-based

seems reasonable, with high average values for countries such as Philippines and Singapore,

and for industries such as iron ore and concrete, asbestos, and cut stone, and low average values for countries such

as

Canada and Mexico, and

for industries such as electronic

components and

Country Variables

iii.

Data on national income and per capita income are taken from the

Detailed factor endowments data

capital-labor ratios

following

V.

scientific instruments.

and per worker

GDP

is

IMF

Financial Statistics.

constructed using the methodology outlined by

ratios are constructed using data

Bowen

from the Penn Mark

V World

Empirical Estimates

embedded

in differentiated products models.

However, the

first

same industry and increasing

in the similarity

between the markets

-

and income

distinguish them,

I first

multinational sales.

I

-

-

arising in

two directions

that multinational sales look

arising in a single direction and increasing in factor proportion differences.

To

apply the tests that have been used to assess the differentiated products model of trade to

then exploit the distinction between multinational sales destined for the local market and those

destined for export back to the

home market

in

an attempt to evaluate a factor proportions explanation of

multinational activity.

i.

are

and differently with respect to proximity

and concentration advantages. In contrast, the factor proportions explanation predicts

like inter-industry trade

activities

predicts that multinational sales behave like

differentiated products trade with respect to factor proportions differences

more

Tables

Hummels and Levinsohn.

Both the proximity-concentration and factor proportions explanations of multinational

in the

(1982), and

Comparing

the Total

Volume of Trade with

13

the Total

Volume of

Affiliate Sales (Table 3)

Helpman (1987) develops two

of 14

OECD countries. More recently,

by Hummels and Levinsohn. The

first

tests

of differentiated products models of trade and applies them to a sample

these have been replicated and extended to a sample of non-OECD countries

assumes

that all trade is in differentiated products.

proportions differences, the theory would predict that the volume of trade

This yields an equation explaining the

trading partners.

(3)

where

V^^ is the bilateral

volume of

total

^^

Ju^yJ 1

Y,*y,

Y^

trade, Y; is

income

world income. This equation

pairs over time.

A

is

volume of trade between countries u and

in country

i

and Y,

is

world income.

of the two countries and the greater

among

similar equation should apply to the total

it

i:

'

tested either for trade

concentration, differentiated products mode, but

determined by the relative size of

^*^'^

bilateral trade is greater the smaller is the difference in size

relation to

is

In the absence of factor

The volume of

is their size in

a group of countries or for a set of country

volume of multinational

would not explain multinational

sales in a proximity-

by

sales motivated

factor

proportions differences.

Figure

1

shows the

distribution of total

volumes of

affiliate sales

and trade and compares them

to

income.

Figure la shows the distribution by income. Both multinational activity and trade are skewed towards the countries

whose incomes are most

distribution

similar to the

by per capita income.

US, but

Both

the bias

affiliate sales

incomes and disproportionately so relative to income.

complicated here, since there

is

is

more extreme

for affiliate sales.

and trade are greater

The

Figure lb shows the

for countries with similar per capita

difference between affiliate sales and trade

is

more

disproportionate trade with the 5 countries with the highest per capita incomes but

also with the half with the lowest incomes.

Below

relying

is

on

I

modify equation

it

explains the bilateral volume of trade in particular products, by

the assumption that preferences are identical

a uniform elasticity of

demand

(3) so that

demand among

and homothetic. In the differentiated products model, there

different varieties of a product

for imported varieties within an industry should

and constant expenditure shares, so

depend similarly on

differences in industry elasticities by including dummies.

In addition,

I

relative country sizes.

allow for

include freight factors, which can easily

be incorporated into a pure differentiated products model of trade (Helpman, Knigman).

14

I

that the

The equation

to

be

estimated for affiliate sales

MTOTJ

(4)

where MTOTi^

is

is:

=

o^TGDP,*o^SHDIF,*o^FF|*Y^

the log of total affiliate sales (net of imports) between country

is

the log of the total

shares of country

income of country

i

and the US, and EV

i

and the US, SHDIFj

is

sectors, a proximity

by

model would predict a

to

be equal.

to differ.

affiliates),

rising

I

would

Past research

The same equation

GDP

TGDPj

minus the sum of the squared income

1

on

is

all activity is in

rises

trade

volumes

where the

then used to explain the

differentiated products

trade and multinational sales as the

as their joint

transport costs rise, while a factor proportions model

Below

TTOT/. When

volume of

becomes increasingly similar and

trading partners

of product j,

report results for the case

where they are allowed

trade (net of trade mediated

US

SHDIF

coefficients are constrained and

volume of

and the

j.'"

TGDP

and

the log of

is

i

a variable specific to industry

constrained the coefficients on

total

'^z.P'^^i,

income of the

and a declining volume of trade as

volume of trade

predict only a rising

as relative

income

shares converge.

The

affiliate sales

data suggests a strong similarity between the volumes of trade and affiliate sales: the volumes of gross

and gross trade flows have a correlation of 56 percent, although netting out trade mediated by

Columns

reduces the correlation to 33 percent.

affiliate sales net

ff3=ff4=0.

The

of trade using equation

coefficient

(4).

on RELSH, which

is

1

on

TGDP and SHDIF to differ.

through 3 of Table 3 report estimates of the volunw of

Column

1

reports an estimate of the equation with 0^=02 and

the product of

be predicted by a differentiated products model, and the

TGDP

and SHDIF,

The explanatory power of the equation remains

This result probably reflects collinearity between the

adds freight factors and industry dummies.

share differential rises to unity.

The

coefficient

Columns 4 through 6 of Table

'"

Trade flows mediated by

As explained above, however,

The

fit

on

is

highly significant, as would

Column 2

elasticity is close to 1.

permits the coefficients

constant, but all of the significance

resides in the share differential variable, with the elasticity slightly larger than

the first equation.

affiliates

on

the scaled share differential in

SHDIF and TGDP

variables.

Column

3

of the equation improves markedly, and the elasticity on the

the freight factor

is

significant at -0.35.

3 report analogous estimates of trade volumes net of internal transactions.

affiliates are netted

from both the

affiliate sales

the trade mediated by affiliates includes products

are not sensitive to the use of net versus gross flows.

15

and trade flows to avoid overlap.

from other industries. The results

In

the

column

same

4, the coefficient

on

the product of the share differential and joint

size as in the affiliate sales equation,

coefficients to differ in

and the

column S does not improve

the

The

addition of freight factors and industry

of the trade equation even more than the

the freight factor

is

TGDP is over twice

affiliate sales equation.

nearly twice that of affiliate sales and

In sum, the relative share variable performs as

is

The

is

significant

nearly identical.

is

of the equation. In contrast to the

fit

both variables retain significance, and the elasticity on the

probably reflect collinearity.

of the equation

fit

GDP, RELSH,

that

elasticity

Allowing the

affiliate sales equation,

on SHDIF, but again

dummies

in

and of

the results

column 6 improves

the

fit

of trade volumes with respect to

highly significant.

would be predicted by a

trade in explaining both the volumes of trade and of affiliate sales.

The

differentiated products

model of

finding that the responses of trade and

affiliate sales to the relative share variable are nearly identical suggests either that the predictions

of a differentiated

products model absent factor proportions differences or with specialization in the homogeneous product sector for

trade apply equally well to affiliate sales, or that the [wsitive relationship between relative

border transactions

is better

relative share variable

explained by a different model.

Similar to the findings in

income shares and cross-

Hummels, Levinsohn,

performs almost too well, considering that the group of countries includes those for

factor proportions are sufficiently different

multinational activity to prevail.

from the

US

that

In addition, although the

is

whom

one would expect inter-industry trade and one-way

volume of both

increasing transport costs, the elasticity of the trade response

the

affiliate sales

and trade contracts with

nearly twice that of affiliate sales, weakly consistent

with the proximity hypothesis.

ii.

I

Comparing

Intra-Industrv Ratios for Trade and Affiliate Sales (Table 4)

next turn to the second

test

developed by Helpman, which allows for the co-existence of differentiated

products trade and factor proportions trade.

predicts that the share of

two-way

The

differentiated products

model

in a factor proportions

framework

trade in total bilateral trade should increase with factor proportions similarities,

holding relative country size constant, and

and decrease with factor proportions

affiliate activity

should arise only in a single direction within an industry

similarities.

Figure 2a plots the Grubel-Lloyd index of intra-industry trade against a similar index of intra-industry

16

averaged across industries by country, which

affiliate sales

correlation between the

two

indices.

defined in equation

is

it is

somewhat stronger

is

a clear positive

Figures 2b and 2c plot each of the indices against income-per-worker ratios

by country, as a rough proxy of factor proportions differences. In both

but

There

(2).

for affiliate sales.

Although

cases, there

is

a clear negative relationship,

what would be predicted by a differentiated

this is precisely

products-factor proportions model for trade, the existence of intra-industry affiliate sales and their negative

relationship with per

worker income are strongly counter

the analogous intra-industry indices averaged across countries

The

figures suggest that freight factors have

little

to

this

Figures 3a and 3b plot

model.

by industry against average industry

no influ^ice on

negative relationship on intra-industry ratios of trade.

of

to the predictions

This

freight factors.

intra-industry ratios of affiliate sales

and a

roughly consistent with the predictions of the

is

proximity-concentration hypothesis.

Helpman and Hummels, Levinsohn

test the relationship

between factor proportions differences and

industry ratios of trade for a multilateral sample of country pairs over time.

fit

I

stick

with cross-section analysis and expand the equations to include freight factors.

equation for multinational sales

MJNTRaI

,j.

MINTRAjJ

is

US

their equations to

two-way

i:

in country

affiliate sales to total affiliate sales (net

differential in per capita

differentials.

i

and

MAXGOP; is the reverse.

the trading partners'

endowments of

estimating

as well as freight factors.

I

in

both directions in industry

US

is

is

the

minimum

the country with the highest

GDP

MAXGDP takes the place of the constant. CAP

capital ratios

high-skill workers,

illiterate

Since the

GDP, and

between per capita

measures per capita

In addition,

of exports)

MINTRA^J = 2*min(N0UTiJ,NINi>)/(N0UTj'-l-NINi*). MINGDPj

MINGDP is simply

LAB3

first

is:

the absolute value of the differential

differentials,

The

In both

niCAPi*iiJABli*njIAB2,+n^IAB3t+njLAND,*n^MINGDP,*it.,MAXGDP,

and country

US GDP and GDP

in the sample,

is

=

the ratio of

between the

of

modify

I first

the bilateral and industry-specific nature of the data and then present results for the country aggregates.

cases,

j

Here

intra-

LAB2

between country

i

and the US,

measures per capita unskilled,

labor differentials, and

LAND

LABI

is

the

literate labor

measures per capita arable land

allow for differences in industry responses by including industry-specific variables, D',

Analogous equations are used

to estimate

TINTRAjJ, the

to total trade flows (net of internal transactions) in both directions in industry j

17

ratio

of two-way trade flows

between the

US

and country

i.

The

first

three

columns of the upper panel of Table 4 report estimates of intra-industry shares of

MINTRA. Column

sales,

1

reports an estimate of equation (5). Intra-industry ratios of affiliate sales are decreasing

in differences in the relative

in

income

The

abundance of

skilled labor

and of

levels, but the coefficient

coefficient

on the

on

MAXGDP is

freight factor is negative but insignificant.

3 uses the capital-labor ratio differential,

the coefficients

trade

on

DKL.

significant, as predicted for trade, but those

is

are also decreasing in differences

endowments

worker income

contrary to prediction.

The

MAXGDP

on

coefficient

on

are insignificant.

differential,

of the equation

fit

the factor proportion differential proxies are negative and significant, as

The

in differences in

Following Hummels, Levinsohn, column 2

In both cases, the

by a factor proportions, differentiated products model.

which

They

Relative capital

insignificant.

replaces the factor proportions variables with a single measure of the per

column

weakly decreasing

illiterate labor,

unskilled labor, and increasing in arable 'and ratio differentials.

literate,

affiliate

on

coefficients

falls

DGPL, and

moderately, but

would be predicted

MINGDP

for

are both positive and

are positive and significant in the equation with

DKL,

freight factors remains negative, but is significant only in the

equation with the per worker income differential.

Columns 4 through 6 of

trade.

The

the upper panel of Table 4 report analogous estimates of intra-industry ratios of

signs and magnitudes of the coefficients on the factor pro()ortions differentials are similar to the affiliate

sales equations, but the significance

labor

is

lower.

Compared

ratios is explained.

DGPL, and column

Column

of the coefficient on

literate,

to the affiliate sales results, a smaller fraction

on

DKL.

three equations, the coefficient

wrong

on high

skilled

Similar to the affiliate sales

the factor proportions differential variables are negative and significant, consistent with

on

MINGDP

is

is

half that of affiliate sales in both cases.

sign in the equations with

DKL

equations, the coefficient on freight factors

and

is

In

positive and significant, as predicted, and the magnitude of the

coefficient is less than half that in the corresponding equation for affiliate sales.

the

greater and that

of the variation in intra-industry trade

ratio differential,

a differentiated products model, but the magnitude of the response

all

is

5 replaces the factor proportions differentials with the per worker income differential,

6 replaces them with the capital-labor

equation, the coefficients

unskilled labor

DGPL

and

is

18

coefficient

significant in the equation with

negative and significant and

affiliate sales equations.

The

much

on

MAXGDP has

DKL.

In all three

larger than that in the parallel

Roughly similar

is

used instead, so

results obtain for the signs

do not report them here.

I

and significance of the coefficients when a

tobit specification

Overall, the results of both equations are consistent with the

predictions of a differentiated products, factor proportions model for trade, modified to incorporate transport costs,

but the affiliate sales equation

Moreover, there

that

is

squarely

at

odds with the predictions of the same model for

affiliate sales.

a surprising similarity between the responses of the shares of intra-industry affiliate sales and

is

of trade to differences in particular factor proportions. Indeed, intra-industry shares of affiliate sales and trade

appear to differ most in their responses to freight factors and income differences.

The lower panel of Table 4

reports estimates comparable to those in

Helpman and Hununels, Levinsohn,

which use as the dependent variable the Grubel-Lloyd coimtry aggregate intra-industry

find that the intra-industry index of trade

ratio.

Both

sets

had the predicted negative relationship to variables measuring factor

proportions differences two decades ago, but conclude that the relationship has since deteriorated.

Hummels, Levinsohn

find that

The

contrary to theory.

Columns

and 4 use the

fiill

pair effects are controlled for, the relationship

and scales by the

total

volume of

CMINTRA,

which

is

becomes

positive,

intra-industry trade across

trade, as in equation (2).

set

and columns 4 through 6 repeat the same

tests for trade,

CTINTRA. Columns

of factor differentials, while columns 2 and S include only the per worker income

and columns 3 and 6 include only the capital -labor

factor,

volume of

In addition,

through 3 of the lower panel of Table 4 report results for the aggregate intra-industry ratio of

1

multinational sales,

when country

intra-industry index for each country aggregates the

industries within a country

of authors

ratio differential.

1

differential,

Each equation includes a coimtry

freight

averaged across industries."

Similar to the industry-level results, the coefficients on both types of literate labor are significantly negative

in the affiliate sales equation in

be attributable

MINGDP

is

I

1.

The

coefficient

on the

capital differential is insignificant, but this

to collinearity with other factor variables, similar to the industry equations.

as predicted and significant, while those

of the equation

"

column

is

very good

-

on

around 78. Replacing the

MAXGDP and

list

FF

In addition, the sign of

are positive but insignificant.

19

The

fit

of factor differentials with a single income per worker

experimented with both weighted and simple averaging; the results are not sensitive so

weighted average.

may

I

report only the

DGPL,

differential,

results,

in

column

with some sacrifice in

and a

2,

capital labor differential,

DKL,

in

column

3 yields surprisingly similar

Similar results are also obtained using per capita income differentials, so

fit.

I

do

not report them here.

The

estimates of the intra-industry shares of trade in columns 7 through 9 are very similar to the

Levinsohn findings (with the exception of the freight

factor).

differentials are largely insignificant, with the exception

and arable land (which

However, the

is positive).

coefficient

on

Surprisingly, the

the freight factor

is

In

all

three equations, the coefficients

of unskilled,

MINGDP

and

literate labor

(which

on

Hummels,

the factor

marginally negative)

is

MAXGDP variables do not fare

negative and significant, as would be expected.

much

These

better.

results are

robust to the use of per capita income differentials.

The

of the intra-industry share equations together with the

results

of multinational activity

that a significant part

of factors, rather than differences, which

is

of country-wide intra-industry ratios suggest

than

and trade flows are

fairly similar,

even

complementarity. The similarity breaks

both

total

inconsistent with a factor proportions account.

that the predictions

Indeed, the estimates

of the differentiated products model for trade

down

mediated by

affiliates,

which may

in the responses to increases in freight factors,

much

Comparing

The two

tests

Affiliate Production for

however. While

affiliate sales

Export and Local Sale (Tables 5 and 6)

above do not rule out a factor proportions explanation of multinationals; they simply establish

does not account for a significant amount of multinational

would be

careful test of the

affiliate sales

smaller magnitude, and intra-industry ratios are essentially unaffected.

iii.

differences

fits

in part explain

flows and intra-industry ratios of trade diminish significantly with increasing transport costs,

diminish by a

it

motivated by similarities in income and proportions of certain types

after controlling for trade

their

that

volume equations make a strong case

does trade. The roles of relative incomes and income shares in determining

affiliate sales better

it

is

total

tested using data

HOS

activity.

of factor proportions

from input-output matrices and factor endowments, along the

hypothesis for trade in Bowen, Learner, and Sveikauskas (1987).

industry categories do not permit the degree of vertical separation that

which would require

Ideally, the role

would be necessary

lines

of the

Unfortunately, the

for such a rigorous test,

factor intensities data not only for individual products, but also for separate activities within

20

each product's business system.

activities

However, some

light

based on whether their primary market

distinction

between horizontal

cost differences.

Below

I

can be shed on this issue by distinguishing between

by proximity advantages and

activity motivated

which corresponds roughly

local or export-oriented,

is

vertical activity motivated

produced abroad are exported back

to the headquarters market,

A

significantly different factor proportions.

by factor

be consistent with overseas production destined for export

as the category

most

all varieties

of a

final

good

and such activity arises between countries with

proximity-concentration explanation predicts that overseas production

substitutes for trade in final goods, so that exports back to the

home

to a

exploit this distinction in an attempt to evaluate the factor proportions hypothesis.

Recall a factor profwrtions explanation of multinational activity predicts that

export

affiliate

home market should be

to third markets,

so

I

zero.

Both explanations could

focus on affiliate sales destined for

likely to reflect factor proportions considerations

and contrast

it

with local sales

as the least likely category.

Table 5 reports the shares of

affiliate

production destined for the local market and for export back to the

parent market for inward and outward sales, averaged by country and by industry.

ratios suggests that for the

directions, but particularly

affiliate sales

US, multinational

on the inward

sales account for

92 percent of total

sales are destined primarily for the destination

On

side.

on aggregate, while exports back

ratio

with the exception of Canada.

On

US

of sales destined for sale back

side,

the inward side, only

percent of their production to their parents.

The

side,

and iron ore on the inward

side.

Figure 4a plots the share of inward

of

illiterate

inward

which

fits

Many

home

is

the inward side, local

highest for Singapore,

Hong

a factor proportions explanation fairly well,

Taiwanese and Brazilian

wood

affiliates

export more than 5

home market

products, and other transportation equipment on the

of these industries are resource intensive.

affiliate sales

same

On

to the foreign parent account for only

exported to the parent against the difference in the ratio

labor to unskilled literate labor in the source market relative to the

affiliate sales sold locally against the

market in both

industries with the greatest ratios of exports to the

are iron ores, nonmetallic nonfuel minerals, lumber and

outward

account for only 13 percent.

on aggregate, while exports

Kong, Canada, Taiwan, and Mexico on the outward

the aggregate

the outward side, local sales account for 64 percent of total

to the

affiliate sales

2 percent. Broken down by country, the

A simple glance at

US

factor proportions differential.

21

ratio,

and 4b plots the share of

The share exported

to the parent

market exhibits a clear positive relationship to the factor proportion

relationship.

differential,

while the local share has a negative

Similarly, figure 4c plots the share of outward affiliate sales exported to the

in the ratio of unskilled literate labor to skilled labor in the destination

the share sold locally.

Again, the share exported

home

market relative

US

to the

against the difference

US

and 4d plots

ratio,

increasing in factor proportions differences, while here

is

the share sold locally appears uncorrelated.

I

next present equations that examine these relationships more rigorously.

importance of factor proportions differentials in determining

with their importance in determining

(6)

OXShI

where

all

=

A

destined for export to the

the

home market

affiliate sales sold locally:

X^CAP|*XJLABl^*k^B2^*X^LAB3^*kJHND|*)i^GDP^*k^USGDP*X^F|*ef,

the independent variables are in logs, and

back to the US.

affiliate sales

The equations compare

OXSH

is

the share of total outward sales comprised of exports

similar equation explains the share of outward sales destined for the local market,

OLSH.'^

Table 6 reports estimates for equation (6) for the share of outward sales destined for the local market

column

1

and the share of

sales destined for export

back

to the

US

in

column

share accounted for by local sales decreases in differences in per capita

arable land, while

it

increases in differences in

the share accounted for by exports back to the

illiterate labor,

and decreases

of activity the greater

is

endowments of

US

endowments of

literate unskilled

and

capital, skilled labor,

illiterate labor.

increases in differences in per capita

in differences in unskilled, literate labor.

destination market

2, using a tobit specification.

in

The

and

In contrast,

endowments of

capital

and

In addition, local sales are a larger share

income and the greater are transport

costs, consistent with a proximity-

concentration hypothesis, while sales for export are unaffected by income levels and

fall

with increases in transport

costs.

Estimates of the levels of each type of sales suggest that the difference in responses to factor proportions

differences

is

one of degree rather than kind. Column 3 reports an estimate of the log of the

destined for the local market,

level of

becomes

Gross flows are used

of outward sales

using equation (6), and column 4 reports the same equation for the log of the

outward sales destined for export

capital differentials

'^

OUTL,

level

to the

US, OUTX. Compared

insignificant in the local sales equation,

in this section.

22

to the share estimates, the coefficient

and the coefficient on tmskilled

on

literate labor

differentials

becomes

The two flows

insignificant in the export sales equation.

differ

most

magnitude of

in the

their

responses to destination market income and to freight factors, with local sales three times more responsive to

income, and export sales three times more responsive to freight factors.

Comparable estimates

for

inward sales are reported

columns 5 through 8 of Table

in

a tobit estimate of the share of inward sales destined for sale in the

US, INLSH, based on equation

6 reports an estimate of the share destined for export back to the parent,

response to increases in unskilled,

the

US

on

moderately abundant in unskilled

is

likely to

literate labor differentials,

be destined for export back to the parent the poorer

sales:

falls.

on outward

INXSH.

The

(6),

reports

and column

shares differ in their

with local sales falling and export sales rising. Since

literate labor, this

the freight factor are consistent with the results

Column 5

6.

implies that affiliate production in the

is

US

the parent's market in this resource.

sales

is

The

above and with a proximity hypothesis

results

for local

the share destined for local sale increases with the freight factor, while the share destined for export

The

the size of the

equation

on income are inconsistent, however: the share exported

coefficients

is

home

inward export

sales,

decreasing in the

INX,

illiterate

in

The

level equations for

colunm 8 provide

little

inward local

additional insight.

sales,

The

The

fit

INL,

in

of the export share

column

7,

and for

levels of both types of sales are

labor differential; given the relative scarcity of this resource in the

US,

this implies that

countries which are relatively abundant in illiterate labor are not fertile ground for corporate headquarters.

coefficient

on

GDP

is

significantly positive in both equations,

and

that

on

home

to the source country increases with

country market, while the share sold locally actually decreases.

particularly poor, however.

more

freight factors

is

The

significantly negative,

although smaller in the local sales equation.

A few inferences can be drawn from the two sets of estimates.

in high-skill labor differentials (to countries scarce in high-skill labor)

(to countries

abundant in

illiterate labor).

Outward

Outward

sales

and increasing

sales destined for export

of both types are decreasing

in illiterate labor differentials

back to the

US

differ

from those