Document 11043217

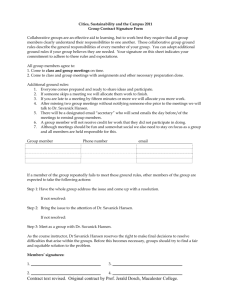

advertisement

•

HD28

M414

Dewey

ALFRED

P.

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

Exchange Rate Dynamics with Sticky Prices:

The Deutsch Mark, 1974-1982

by

Alberto Giovannini*

and

Julio

WP# 1522-84

J.

Rotemberg**

February 1984

MASSACHUSETTS

INSTITUTE OF TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

Exchange Rate Dynamics with Sticky Prices:

The Deutsch Mark, 1974-1982

by

Alberto Giovannini*

and

Julio

WP# 1522-84

J.

Rotemberg**

February 1984

*Graduate School of Business, Columbia University, New York

**Massachusetts Institute of Technology, Cambridge, Massachusetts

Revised

November 1983

EXCHANGE RATE DYNAMICS WITH STICKY PRICES:

THE DEUTSCHE MARK, 1974-1982

Abstract

This paper estimates simultaneously dynamic equations for the

Deutsche Mark/Dollar exchange rate and the German wholesale price index,

which emerge from

a

model in which German prices are sticky.

This

stickiness is due to costs of adjusting prices of the form posited by

Rotemberg (1982).

The main results of the empirical analysis are two:

First, the

version of the model where prices are perfectly flexible is rejected.

Second, real exchange rate variability is mostly accounted for by nominal

exchange rate variability.

We find substantial overshooting of the

exchange rate to monetary innovations like those which appear to by

typical in Germany.

Alberto Giovannini

523 Uris Hall

Graduate School of Business

Columbia University

New York, NY 10027

Julio J. Rotemberg

E52-250

Sloan School of Management

Massachusetts Institute of

Technology

Cambridge, MA 02139

irlARlES

APR 1 7 1984

RECEIVED

Revised

November 1983

EXCHANGE RATE DYNAMICS WITH STICKY PRICES:

THE DEUTSCHE MARK, 1974-1982

by

Alberto Giovannini

Columbia University

and

Julio J. Rotemberg

Massachusetts Institute of Technology

1.

Introduction

The idea that purchasing power parity holds with flexible exchange

rates at every moment in time has been shown by the data since 1974 to

be wrong.

Real exchange rates are not constant, and, moreover, their

changes tend to persist (see Frenkel (1981)).

Also, nominal exchange

rates fluctuate much more than price indices.

One possible explanation

for these phenomena, which is advanced in Dornbusch (1976), is that the

prices of goods produced for the domestic market change slowly.

his deterministic model,

a

Then, in

once and for all increase in money leads to an

instantaneous depreciation which "overshoots" the new steady state

exchange rate.

Afterwards, the price level slowly increases and the

This paper is a revised edition of the first chapter of A. Giovannini 's

We

doctoral dissertation at the Massachusetts Institute of Technology.

are grateful to A. Zanello and L. Polman for helping us with various

computational problems, and to L. Dyer for excellent research assistance.

Financial support from the Ente Einaudi and the National Science

Foundation is gratefully acknowledged.

074353G

exchange rate appreciates.

Our paper attempts to estimate

this type on German data since 1974.

slowly.

a

model of

We too assume that prices move

On the other hand, our paper differs in important respects both

from Dornbusch's original formulation and from its empirical

implementation by Frankel (1979) and Driskill and Sheffrin (1981)

.

First, we consider also the impact of nonmonetary variables both on

steady states and on the paths of price levels and exchange rates.

In

particular we focus on the effect of changes in prices of various

imported goods and on changes in real wages.

The latter'

effect on

s

exchange rates has been the focus of work Sachs (1980) among others.

Second, our specification of the stickyness of prices relies on

explicit costs of price adjustment on the part of firms.

These costs of

price adjustment are akin to those in Rotemberg (1982a) and attempt to

capture the fear on the part of firms that customers will desert them if

they follow erratic pricing policies.

Finally, we do not impose the assumption that money is

walk.

a

random

This is simply false for Germany as is noted by Driskill and

Sheffrin (1981).

Hence the response of exchange rates and prices to

monetary shocks differs from the responses considered by Dornbusch (1976)

and his followers.

So, we let the data inform us as to the plausible

Then

stochastic processes followed by the forcing variables we consider.

we assume that exchange rates and prices respond optimally in that

private agents are assumed to also know the stochastic processes of the

forcing variables.

While we feel that these differences constitute important

improvements over previous work we must point out at the outset some

important caveats.

First, the period since 1974 is only partially

a

period of "flexible" exchange rates between Germany and the rest of the

world which we aggregate into

a

dollar region.

This is so because within

Europe exchange rates are only allowed to move within bands.

So, whether

flexible exchange rate models can explain DM exchange rates is an

empirical question.

Second, from the theoretical point of view our model

fails to explicitly take into account the intertemporal budget constraint

that makes the present value of current account deficits equal to the

current stock of net foreign assets.

Unfortunately, explicit use of the

budget constraint appears at the present time to lead to models too

complicated for estimation.

Instead, we assume, as is standard practice

in empirical exchange rate models, that there is perfect asset

substitutability:

that is that the expected yield in domestic currency

of investing at home and abroad is the same.

We do this also for

tractability, since the specification of imperfect substitutability

models is econometrically difficult.

Moreover, the assumption perfect

substitutability, while statistically rejected by several authors, could

be a reasonable approximation of the data.

The structure of the paper is as follows.

model and its so]ution, Section

3

Section

2

presents the

estimates the model using German data,

for the period from June 1974 to February 1983.

Section 4 presents

simulations of the responses of the endogenous variables to

shocks, under the rational expectations assumption.

contains some concluding remarks.

a

variety of

Finally, Section 5

The appendices describe the solution

of the model and the data used in the empirical section.

.

The Model

2.

Our economy is populated by a large number of monopolistically

competitive firms, each producing

good that is differentiated from

a

other domestic goods, and from foreign goods.

Each firm faces the

following demand curve for its product:

where

is demand for good

Q.

i

at time

The first term in the right

t.

hand side of (1) represents substitution between domestic and foreign

goods, and captures substitution both by domestic residents and by

foreigners.

P,

is the index of domestic goods prices,

weighted average of

P.

P

's.

is

the price of foreign consumption goods

each domestic producer does not face

by foreign residents.

a

geometrically

This implies that although our country is "small,"

taken as exogenous.

represents

a

a

perfectly elastic demand schedule

The second term on the right hand side of (1)

real balance effect on domestic demand, Q

foreign activity, and N

is a

stands for

random variable which affects demand for

1

.

goods

On the cost side, we assume that all domestic goods, together with

imported intermediates and labor are used in the production of each good

i.

Marginal costs of production of good

(2)

with W

Q lt

Pp

(1-ot

-a

dt

the nominal wage rate, P M

a

)

w

i

is:

_,_

2

a

t(VW

N

2t

the foreign currency price of imported

When p =

variable affecting productivity.

is a random

intermediate goods, and N„

we have the constant variable costs case.

Real wages relative to the CPI are given by:

W

(3)

where K

is the real

= K

t

CE^) 1

t pJ t

"*

consumption wage at time

is assumed to be

K

t.

This assumption is consistent with

exogenous throughout the paper.

recent empirical findings (von Jurgen (1982)).

Domestic producers are assumed to observe M, P

the time of their pricing decision:

,

P

N

,

Q

E and K at

,

price setting is synchronized.

In the absence of costs of changing prices, domestic producers

would charge

P.

at which marginal cost equals marginal revenue.

,

In

natural logarithms, it is equal to

(4)

Pit

=

lTJ^

+ (1

-

{[pA(Y

K)a

+

" *)

+ a ]e

2

l

1

+

t

VV

-

-

[0(1

+ [p(1

Aa ]p

dt

i

\)(y

-

d) +

(1

"

M(Y

"

d)

Mo^lp^

-

+ a P

+ a k + pdm + Pfq + n

t

t

i t

t*

2 Nt

where lowercase letters are the logs of the variables represented by the

= n„

corresponding uppercase letters, and n

+

Pn^-

However, we follow Rotemberg (1982a) by assuming that monopolists

They are assumed to

also have convex costs of changing nominal prices.

solve the following problem:

00

(5)

Max E _Z

t

Q

P

J

[n(p

it+j

)

-

w.(p.

2

.

t+

-

p.

t+

.)

-

c.(p

it+

.

-

P^^Y

where p stands for

constant discount factor, and

a

is the expectations

E

operator, conditional on information available at time

terms in the square bracket represent

around p.

,

a

second order approximation

of the profit function of producer

of changing prices;

3

i,

in the absence of costs

i

the third term represents the decrease in current

Setting c./w- =

profits to be accounted for by price changes.

every

The first two

t.

c,

for

we have the final expression of the domestic producers'

objective function:

Min E

(6)

t

P

JQ

J

2

[(P it+j

"

P it+j

)

+ c(p.

t+

.

-

2

P it+:hl )

]

Solution of the problem in (6) leads to the equation describing

equilibrium price dynamics for each domestic producer:

/I

<•-,->

(

?

p

t it +

)

"

+ c + pc.

^~

(

l

where for everyJ variable x,

x t±

}

.

t t+j

P it +

_

1

-

1

P it-1 " -p7 P it

p

indicates the expectations of x at

time t+j, conditional on information available at time

Equation (7)

t.

can now be aggregated to obtain the equilibrium dynamics of the domestic

price level:

pA(Y

(8)

tPdt+1

"He"

[1 + C + PC "

1_

pel

-Xl\

p ^dt-1

+

[p(l

-

A)(y

-

d)

+

PY )

(1

d)

"

{[P(1

-

-

-

or

(1

A)(Y

WOjlp^

2

-

A) +

-

1

p^

a9

~Kt

+ PV)

d) +

"

+ a

(1

°

A)a

"

+ a k

1

+ a

l

t

+ pdn>

t

]e

2

t

+ pfq^ +

under the assumption that exogenous variables in (8) are of exponential

order less than 1/p, it can be shown that equation (8) has one stable

n^

and one unstable root and that in this case there exists a unique stable

path that leads to the steady state (Blanchard and Khan (1980)).

domestic price level is

The

function of all future values of exogenous

a

variables, which for domestic producers include m, p

p

,

,

q

,

k,

e

and

n.

The model is closed with the specification of asset markets

equilibrium.

Domestic and foreign bonds are assumed to be perfect

substitutes.

Therefore, the ex-ante real interest differential is zero:

(9)J

e

y

where

t

i

and

i

-

t+1

=

e

t

i

-

i

t

t

are the domestic and foreign interest rate, respectively.

Finally, we have the money demand equation:

m

(10)

where n„

is a random

-

t

Ap

dt

-

(1

-

A)(e

t

+ p

)

ct

= aq

variable affecting velocity.

-

t

bi

t

+ n

3t

In order to obtain

the dynamics of the exchange rate, we need assumptions about equilibrium

output.

The hypothesis is that domestic firms are never rationed in the

labor market, and intermediate goods market, and supply whatever quantity

of the good they produce is demanded.

In this case, equilibrium domestic

output is given by aggregating (1):

=

(11) q

t

(e

t

+ P^ )(Y " d)(l

t

-

A)

-

[v -

(y

-

d)A]p

dt

+ fq^ +dm

+ ti^

t

the dynamics of the exchange rate are obtained by substituting (11) into

money demand, and using the relation (9):

(12)

,

ejl

"

t t+1

ad

where n

= an

-

1

-f^H

+

/b + n„

+

(

-^)(l

i

Pct

+

(1

i^ )(1

a(y

d))]

-

P/ ,

+ a( * " d))

-

H

-

f£ - |( Y -

(y - d)A)

L

dt b

+

r\

+

fi

t

.

This completes the specification of the model.

In matrix form, the

two equations describing the dynamics of the economy can be written as

follows:

(14)

t Y t+1

= Ay

t

+ Bz

t

where:

ct

Nt

't-1

yt

A =

1

P

—

pc

=

m.

t

pA (y

[1

=

Z

-

d)

+ c + r

pc

I [A

-

-

0^(1

1

+ PY

a(Y

A) +

1

-

a,

-

k)a

(Y " d)A)]

-

A)(y

-

[p(l

-

-

d)

+

(1

+

1

pc(l + Py

1

+

1- L^)d

(

b

+ «(Y

"

d)l

cr

2

]

4

p(l

-

\)(y

-

d) +

d) +

-

(1

(1

-

\)a

a.

1,

B =

pc(

(

1^)(1

pc(i + Py)

+ Py)

1

+ a(Y - d)),

o

o

a.

Pd

pc(i + py)'

pc(i + Py)'

ad

af

o

1

pc(i + Py)

-

pc(i + Py)

1

1

b

'

The solution of (14) is:

(16)

p at

dt

=

"'oPdt-i

at i

"

(

L)

r21

j

8

-

J

<r->

1 ( _) z

z w

j

ii

t it+j

it+i

=Q

k=Q 21

[

.

r

]

oo

Iw 1Z

i2

[

22 i=l

1

j=0

(

rJ

22

)J

z

t lt+J

it + i

]

and

LI

s ^I.lCjf-)^^]

fc).

22 i=l

j=0 22

1

(17)

= £<*dt-i-

t

-

where the

uj'

s

,

J

2

z

-) 5:

r 2

(j

J

1Z

(r-)

J

t 1C

Z

i2

it+iJ

22 i=l

j=0 22

and the

4' s

i

are listed in Appendix

1,

J

unstable roots of A and the z.'s are the elements of the

and J

z

are the

vector in

i

(14).

Equations (16) and (17) indicate that the short run dynamics of the

real exchange rate are indeed determined, among other things, by domestic

price setters' expectations about the evolution of variables determining

profits

4

.

For example, given an anticipated future change in the price

of imported intermediate goods, domestic producers would balance the loss

10

of abruptly changing prices when the increase in input costs conies by,

with lower profits today, by partially increasing today's prices.

Short

run fluctuations of the real exchange rate are not exclusively due to

financial disturbances (which would exclusively shift asset demands),

although these shocks play

a

fundamental role here too.

Furthermore,

and more importantly, unanticipated nominal shocks do have significant

real effects, as domestic producers are unwilling to instantaneously

adjust output prices to the long run equilibrium level.

In the long

run, once and for all increases in the money stock can be shown to have

no real effects.

Another important feature of short run equilibrium is that, although

steady state employment is always increased by lowering the consumption

wage, these policies are relatively ineffective in the short run.

Domestic producers do not decrease the relative price of domestic goods

instantaneously, thus giving rise to

with not expansionary effects.

a

short run increase in profits,

In this sense,

short run unemployment can

be considered "Keynesian."

3.

Estimation

This section is divided in two parts.

In subsection a) we present

the estimates obtained from the Euler equations (8) and (12).

b) presents the time series properties of the forcing

variables q

,

i

,

p

,

p„, m and k.

Subsection

11

Exchange Rate and Domestic Price Level Euler Equations

3. a.

The Euler equations we actually estimate are given by:

E (P$

t

3 Pdt + l

(8')

"

Pdt

-

$

+

+

Vdt-1

°

•

k

+

(1

-

(12')

(1

+ p)$

E

t

[e

3

a )p^ +

t

2

?

"

t+1

CI

-

-

<D

1

-

"

$ )e t

7

JL

Ji~

+

pH 3

+

(1

fi

t

1

-

4 )p dt

Vt

fi

<t»

2 p^ t

e

t

1

'Mt

"

JL

+ $ m

'

?

+

«.>

\

+ 5

t

+ $ q^ + n

6

t

t

-

l)p*

]

= °"

]

=

t

where

<t>

V

(

V

(

(1

;

"'

*6 "

and the

(})'s

(

(1

r

l

3

+

<j>

}

+

<t>

2

7

7

+ p)

$3 +

+ P)

«t>

(1 + p)

<t>

3

<t>

"l "

°2

(i + P )

V2

+

3

^

<{.

<t>

+

3

+

7

}

+

2

(J)

<t>

<t>

+

2

7

H.

7

^6

(

(1

+ p)

«J>

+

3

are given in the Appendix.

+

(()

2

}

(|»

2

The price equation is slightly

different from (8) since, for estimation the equation must be

normalized.

The normalization we choose has the advantage of making it

easy to test for the absence of costs of changing prices by testing

whether

<)>

is zero.

Note, however, that without other a priori

restrictions it is not possible to recover all the

the $'s and the a's.

ty'

s

and the a's from

We therefore also reestimate (8') and (12')

12

and a_ are given by .25 and .11 respectively.

assuming that a

These

values are those which are consistent with the estimates of Dramais

(1980).

<h

+

<J>

This, in addition to identifying D which is given by (1 +

(see Table 1), and thus all the

<t>'s,

+

p)(()„

also imposes an additional

constraint.

The residuals obtained when the expectations operators are

eliminated from the left hand side of (8') and (12') have

interpretations.

number of

If technology, money demand and output demand were all

deterministic functions, then n

case, these residuals

variables.

a

and n

would be equal to zero.

In this

would simply be due to innovations in the forcing

That is they would be due to the revisions in expectations

that take place when q^

+1

,

k

t+1>

and P

are realized.

i^+1> P^

t+1

Nt+1

These residuals would thus be uncorrelated with any information available

at time t.

This suggests as

a

natural estimator the instrumental

variables procedure of Hansen (1982) and Hansen and Singleton (1982).

As

Hansen discusses, this procedure is simply three-stage least squares if

one is willing as we are to assume also that the residuals are

conditionally homoskedastic.

This is a particularly reasonable

assumption in our case since our focus on short run fluctuations leads us

to estimate with previously detrended data.

Hansen (1982) also derives

a

portmanteau statistic J which permits the testing of the overidentifying

restrictions.

Unfortunately we cannot seriously entertain the hypothesis

that the cost function and demand functions are deterministic.

and n

Thus n^

also form part of the residuals of (8') and (12').

Insofar as these residuals are independently identically distributed

they are presumably also uncorrelated with certain instruments available

at t.

This would still allow us to use three stage least squares.

13

Another possibility is that the structural residuals of the cost and

demand equations are serially correlated.

in (8') is the sum of two components, e

where u

)

and n

The first, £

.

independently identically distributed.

is

residual in (12') is given by e„

where n

+ n

1r

is the

,

is given by (p n

Then, suppose that n

expectational revision.

u1

Suppose that the residual

+

Similarly the

+ u„

is p„fi

Quasi-

.

differencing (8') and (12'):

pVPdt+z-PiPdt+P

(p

"

dt+r p iPdt )

*

+ [l-(l +P )i3-i 7 -a 2 ](p* t+1 -p lP t )

(8")

VvrPi-V

+

e

(12-)

t+2

-

(4>

1

+

Vvfrf

+

c^-dcp'^^-p^)

+

P2H

£

P^^

+P 2 )e t+1 +

t+l

= £

2t + l

+

f>4 (m

+ U

= £

-

^^-P^)

+ a

+ u

e

it + i

m

"

it+r p i

2

(

PNt + rp/Nt )

it

(l-S-t» A )(P dt+1 -P2 P dt )

t+ rp2 t )

2t + 1

n-d^v^^vfpi^

+

vd^O

+

p 2 £ 2t

Clearly (8") and (12") can still be estimated by three stage least

squares as long as only instruments available at

u

's

are uncorrelated with them.

t

are used and the

However, now the residuals have

a

moving average component.

The estimators are obtained by using two lags for p., e, p

q

,

i

,

k and m as

,

Pvp>

instruments and constraining p to be equal to the

discount factor corresponding to

5

per cent per year.

The monthly data

which we use, from June 1974 to February 1983, is described in

Appendix

2.

The results are reported in Table

1.

Column

I

shows the

14

estimates obtained from (8') and (12').

Column II shows estimates from

the same equation when the a's are constrained.

the results obtained from (8") and (12").

Column III represents

Finally the last column

presents estimates obtained by constraining the a's in (8") and (12").

In columns

I

and II, the coefficient estimates are essentially unchanged

when we constrain the a's.

Quasi-differencing improves the DW statistics

of the exchange rate equation somewhat.

When a's are fixed, however,

the roots do not have the desired property that one is stable while the

The estimates of column II do have this property so

others are unstable.

we use those in our simulations.

The estimates of

<))„

are substantively and significantly different

from zero thus underlining the importance of the price dynamics captured

This significance is undoubtedly due

by the costs of changing prices.

in part to the absence of purchasing power parity in the data.

the other coefficients also have the required signs.

<|>_

and

4> ,

the coefficients of q

,

.

from zero, but have the wrong sign.

ad

(

"

- ).

values of

Most of

The exceptions are

They are insignificantly different

The sign of

<|>,

is the sign of

Other studies (Goldfeld (1973), Rotemberg (1982b)) have found

a

and d below

reported in columns

I

1.

This is consistent with the negative

(J),

and II.

Finally, it must be noted that the J statistic rejects the

overidentifying restrictions imposed by (8') and (12').

This may well

be due in part to our assumption of perfect substitutability between

domestic and foreign assets.

While this assumption may represent

a

good

approximation, it has been statistically rejected by Hansen and Hodrick

(1980) among others.

15

16

Time Series Properties of Exogenous Variable s

3.b.

In this subsection we explore the time series properties of the

forcing variables in order to obtain simple forecasting equations.

These simple forecasting equations can then be attributed to private

This allows us to compute the effects of innovations in the

agents.

forcing variables on the paths of e and p..

First, we consider the vector autoregressions having as variables

p

,

,

e,

q

,

i

,

p

,

p„ and m.

Using monthly data from the middle of 1974

to February 1983, one can accept at the 5% level the hypothesis that q

i

,

p

,

p

,

are not caused in the Granger sense by any other variable

against the hypothesis that they are caused by all the variables in the

system.

The level of money, however, is significantly influenced by the

past values of other variables.

We also considered

money and interest rates are first differenced.

a

system in which

Since this partially

first differenced system is more consistent with univariate evidence

presented below, it probably leads to more reliable tests of hypotheses.

In this second system one can accept for each forcing variable that it is

not caused by any other variable against the hypothesis that they are

caused by all of them.

These results obtain for vector autoregressions

using four, five and six lags.

This doesn't lead us to believe that

these variables are, in fact, independent.

It just means that,

for

forecasting purposes, univariate time series models of these variables

are probably adequate.

This conclusion is tempered somewhat by the fact

that within the vector autoregressions certain individual variables

appear significantly causally prior to other variables.

The two variables which we concentrate on, p, and e, do not cause

the forcing variables in any of the systems we consider.

This is

a

17

Table

2

Significance Levels for the Absence of Causality From X to

Y in Partially First Differenced Vector Autoregressions

VARIABLE Y

VARIABLE X

P XI

p

q

i

m

p„

N

— —

.73

.19

.74

.46

.58

p*

rc

.59

- -

.22

.70

.15

.99

q*

.47

.88

.65

.15

.59

.95

.47

.55

31

m

k

Pd

e

.98

.68

.65

18

precondition for the applicability of the Hansen and Sargent (1980)

formulae.

Table 2 presents the significance levels for the tests that the

coefficients of variable x are zero in the regression explaining variable

y.

These significance levels are obtained from the partially firsts

As can be seen, changes in money are

difference model with six lags.

significantly (at the 5% level) causally prior to changes in the prices

of imported intermediates while changes in interest rates are

significantly causally prior to changes in money.

causal relation on

latter one.

a

We neglect the former

priori grounds while we focus specifically on the

So, we attribute to the agents on section 2 univariate

JL

-'-

forecasting rules for q

k,

,

p

_t_

.A,

,

p„ and

i

.

Instead we assume they

forecast m using also information on past interest rates.

We employ Box-Jenkins techniques to obtain parsimonious

representations for the stochastic processes followed by these variables.

Parsimony is essential here since the forecasting formula of Hansen and

Sargent (1980) becomes very complex as one enriches the parametrization

of these processes.

The application of these principles to monthly data from 1974:7 to

1983:2 lead us to an AR(2) for p" which, when estimated by OLS gives:

4=

1

-

175

4-1

"

(.095)

Similarly p

p"

*ct

(.093)

222

PMt-2

forecasted by an AR(2)

.

p

r

ct-l

.

DW=2.08

R 2 = .93

(0.95)

is also well

=1.247

-

-

.283

(.093)

p

.

„

*ct-2

DW = 2.03

R2 =

.95

:

19

is well explained by just one lag of itself so that:

instead q

q" =

q" .

t_1

.948

t

univariate autoregressions cf

1

suggesting the presence of

for the process followed by

i

-

i

t-1

=

.325

(i

R 2 = .91

(and m) have coefficients which sum to

i

A parsimonious representation

unit root.

a

is:

i

r i t_2

t_

DW = 1.85

-248

"

)

U t _ 2 -i t _ 3

DW = 2.00

)

R 2 = .12

(.094)

(.094)

The most parsimonious process for money which eliminates all significant

serial correlations seems to be:

m

t

"

=

Vi

-

064 (m

t-r m t-2

}

(.093)

-

.086

(

m

t.2

"m

t- 3 )

+

(.097)

+

.068 Ci*.

r i*. 2

)

-

-238 Ci^.

2 -^. 3

)

(.118)

(.113)

+

378 (m -3" m

)

t-4

t

(.096)

-

.023 (i*_ -i*_ )

4

3

(.118)

-

-268 (i*_ -it- 5

4

5

(.113)

DW = 2.00

R2 =

Finally, the real wage k is well forecasted by an AR(3)

k

=

.294 k

(.096)

+

.194 k

(.097)

t_ 2

+

.164 k

(.092)

t_ 3

DW = 2.06

R 2 = .27

.21

.

20

4.

Simulations

In this section, we use the estimates of the parameters of the

mociel

presented in the previous section to simulate responses of the

price level and the exchange rate to

a

variety of shocks.

In the simulations, we substitute the estimates obtained from Euler

equations into the solution of the model, equations (16) and (17).

Furthermore, we apply the Wiener Kolmogorov prediction formulae as in

Hansen and Sargent (1980) to express the infinite summations in (16) and

(17)

in terms only of present and past realizations of the exogenous

variables, using the estimates of the autoregressive parameters of these

variables

These simulations differ from simulations of rational expectations

models as for example in Lipton and Sachs (1980), in that we specify

a

realistic process followed by exogenous variables, rather than implicitly

assuming

a

random walk.

some persistence.

Given our estimates, unanticipated shocks have

Some of the shocks, however, eventually fade away.

By describing the effects of innovations in the processes governing the

exogenous variables, we perform an exercise similar to impulse responses

in vector autoregressive models.

However, these simulations differ from

impulse responses as all the cross equation restrictions arising

from the rational expectations hypothesis are imposed here.

These

restrictions are bound to improve the efficiency of the forecasts under

the rational expectations assumption.

In this sense our simulations can

be thought as constrained impulse responses.

Figures

1

stock of money.

to 4 illustrate the effects of a unit increase in the

Starting from steady state (all endogenous and

21

I

VO

1

00

50

O 00

-0 50

Figure

1

1

:

Money

rJO

O 7S

0.35

-O OS

-0 50

Figure 2: Domestic Prices

(Innovation in Money)

22

>>

o

4 3

2 ?

3

-1 3

Figure 3: Nominal Exchange Rate

(Innovation in Money)

».-»

O

4 3

2 ?

0.3

-1.0

Figure 4: Real Exchange Rate

(Innovation in Money)

23

exogenous variables = 0),

observed.

Figure

1

a

unit disturbance in the money process is

shows that the money stock does increase further

after the shock, and eventually reaches

is due to the fact that,

a

permanently higher level.

as discussed abcve,

This

the data indicates the

presence of nonstationarity of the money stock, and therefore we have

estimated the money process, together with the foreign interest rate

Figure 2 shows the response of the

process, in the first differences.

As stressed above (Section 2), the price level reacts

price level.

immediately to the innovation in the exogenous variable; after the shock,

long run equilibrium is reached in a very smooth fashion, despite the

sizeable swings in the stock of money.

response.

Figure

3

shows the exchange rate

As predicted by the theory, the exchange rate is by far more

volatile than the domestic price level.

The simulations, which use the

estimated parameters, do indeed provide support to the theory outlined

above.

At the time of the increase in the stock of money, the nominal

exchange rate overshoots its steady state level as the theory, following

Dornbusch would predict.

The initial depreciation is four times larger

than the steady state effect on the exchange rate.

The large

fluctuations in the nominal exchange rate generate big swings in the real

exchange rate, as shown in figure

Figures

shock:

5,

5

4.

to 8 illustrate the simulated effects of another financial

an increase in the U.S., treasury bills rate.

As shown in figure

the estimated reaction of German monetary authorities implies that an

increase in U.S. interest rates is followed by

a

large monetary

contraction in Germany.

a

real depreciation of the

This does not prevent

exchange rate as shown in figure

8.

24

10

1

30

0.S0

-0 40

-1 CO

Figure 5: Foreign Interest Rate and Domestic Money

(Innovation in Foreign Interest Rate)

<:-

o

4 3

2.5

0.8

-1 O

Figure 6: Domestic Prices

(Innovation in Foreign Interest Rate)

25

20

21 3

12.5

3 S

-5 e

Figure 7: Nominal Exchange Rate

(Innovation in Foreign Interest Rate)

30

O

21 3

12 5

3.8

-5 ©

Figure 8: Real Exchange Rate

(Innovation in Foreign Interest Rate)

26

Finally, figures

9

to 12 show the effects of a real disturbance,

the form of an increase in the real wage.

in

Here again the exchange rate

responses to the shock is much larger than the price level response, as

the path of the real exchange rate demonstrates (figure 12).

Sone of the

increase in costs is immediately passed into higher prices, which cause

an excess demand for domestic money.

For money market equilibrium, the

domestic interest rate increases relative to the foreign interest rate,

thus implying expectations of exchange rate depreciation, and an

instantaneous appreciation of the exchange rate.

27

J

20

O 24

48

0.11

-0 25

1

II

6

Figure

9:

1*

31

Real Wages

Figure 10: Domestic Prices

(Innovation in Real Wages)

26

31

28

••»

020

-0

015

-0 110

-0 205

-0 300

Figure 11: Nominal Exchange Rate

(Innovation in Real Wages)

100

000

-0.100

-O 200

-O 300

Figure 12: Real Exchange Rate

(Innovation in Real Wages)

29

5.

Concluding Remarks

This paper has specified and estimated a model of sticky prices in

an open economy, under the assumption of rational expectations.

In the

simulations, we have allowed the data to inform us as to the stochastic

processes followed by exogenous variables.

Such

a

model can shed light

on important structural parameters like the relevance of overshooting.

This ability is to some extent independent of whether the model forecasts

well.

Thus we disagree with the view that the poor forecasting

performance illustrated by Meese and Rogoff (1983) completely invalidates

structural estimation of exchange rate models.

It is our opinion that a

large class of exchange rate models, those which do not assume perfect

wage and price flexibility and purchasing power parity, have so far

received little attention from empirical researchers.

For that reason,

it is too early to make general statements about the empirical relevance

of flexible exchange rate theories.

Our empirical analysis is partially successful.

Estimates of the

parameters of the model from the Euler equations do indicate that the

empirical significance of costs in adjusting prices, the fundamental

feature of our model, is considerable.

parameters are very imprecise, and in

However, the estimates of many

a

few cases, of the wrong sign.

This latter phenomenon may be due to some simplifications on which our

model is based, for analytical tractability

:

among these, the exogeneity

of real wages, and the perfect substitutability hypothesis in assets

markets are the most questionable.

Simulations of the model, using the parameter estimates obtained

from Euler equations estimation, and the estimates of autoregressive

.

30

processes for the exogenous variables, show that the data yields

predictions of the effects of disturbances that match the predictions of

the theory.

By far the largest proportion of short run real exchange

rate volatility is accounted for by fluctuations in the nominal exchange

rate:

effects

through this mechanism, nominal disturbances have important real

31

APPENDIX

1

:

The system of equations (14) has a unique convergent solution if

and only if two eigenvalues of A have real parts whose absolute values

are greater than one while the other eigenvalue's real part is smaller

than one in absolute value.

This is so because the system has only one

initial condition namely P Hn

If there are more "stable roots there are

-

infinitely many convergent solutions while on the other hand, the

convergent solution if all roots are explosive may not satisfy the

initial condition.

The solution to the system (14) as long as these

conditions are met uses the Jordan canonical form of A:

-1

12

11

J

12

11

(lxi)

(1X2)

(lxi)

A

A

21

(2xi)

22

(2X2)

r

L

l

(1X2)

r

L

22

(1X2)

2i

(2xi)

C

L

ll

2

is the stable root

C

L

'22

12

21

C

22

(real part less than 1), and J

diagonal matrix containing the unstable roots.

is the

A and the eigenvector

matrix C are decomposed accordingly.

Following Blanchard and Kahn (1980):

where y

'21

= C

C

(16)

12

(2x2)

where

and J

11

(lxi)

'dt

'

r

U

-l

r

L

22 21 P dt-l

"

r

L

-l

T

,-(i+l) r

22.V2

i=0

comes from the partition of B:

L

Z

22^2t t+i

32

B =

~[Y 2 T

We will write equation (16) by expressing all the eigenvectors as

functions of the eigenvalues and the elements of A.

premultiply both sides of (15) by

C,

solve for each of the elements of C.

To do this

normalize the eigenvectors, and

Substituting into (16), the price

and exchange rate equations are:

8

=

p,*

*dt

e

•

t

^ph,

dt-1

"W

t~

i

= to?

_i

dt

dt-i

^

(t-)

J

-

8

oo

)J

z

1

z (

}

(

+

t it

it+j

J

il

J

21

k=Q

21 i=1

-

.

21

=1

li

il

T-

=

UJ

P J 22 J 21

<J.

=

UJ

(J

2

11

4»

+ a (*

2

1

- J

P<D (J

21

22

3

-

21

2

(J

P<t>

gl

21 "

"

(

*1

P4>

(J

3

((

P<t>

'

(

J

~

3

(J

»1

~

p4>

(J

UJ

3

22

2

2

J

)

2

J

2i )

21

22

'

J

)a

22

22

21

)a

J

-

"

22

)a

-

"

22

fl

UJ

31

21

p$ (J 22

3

UJ

"

J

'

(-J

3

)a

i

J

21

}

i

"

J

21

}

J

J

21

)

)

t « (a

1)

22

IX)

ID

-

l)

21

1

)

i

J

z

z

lt+ J

(r-)

t rt+j

J

j=Q 21

where:

J

22

)

(

]

-

rJ

22

}

°°

1

z w

1

J

t it+j

i?

(r-^it-H

i2

=1

j=Q 22

[

.

ii

J

z

i

c-p-) ^

t it+j

(r-)

j

lt+i

iz

j

j=Q 22

22 i=1

]

33

V2

41

"

V*!

"

*J*2

42

P4>

Vg

:

61

at

V*!

I

-

J

(J

22

3

22

-

c+i

J

p<t»

62

p<t)

(J

3

(J

3

J

-

22

21

)

21

)

J

-

22

(<

J

-

"l

p<t)

(

(J

*1

J

-

22

- J

UJ

P 3 (J 22

72

((,

LU

81

(J

p().

3

h7

)

21

)

}

2]

21

)

)

<K

p$ (J 22

3

~"

"

-

*2

(<t>

-

J

-

(^

0,

J

1

21

)

J

21 )(^

J

J

22

21 "

22 )[<t> 2

*11

(J

-

J

21

)[(|)

(J

2

<D

22

(J

2

J

-

-

21

J

<V

(<!>!

•12

)

21

21

}

a

^82

^°

J

-

22

-

J

-

22

3

22

21>

LU

71

}

)

21

j

-

21

21

J

-

p$ 3 (J 22

51

U)

J

3

'

W

-

p$ (J

J

"

22

)

+ a

1)

J

"

22

-

22

1)

-

21

+ a

J

21

)

J

1

21

}

-

(«|»

2

-

((|»

2

1

J

22

)]

)]

34

(<J»

hi

J

-

1

<t>

2

(J

i 22

<t,

2

«31

(»

<t>

(

2

(J

)(<l»

J

-

J

-

22

21

(<t)

^51

J

"

l

J

-

22

21

gl

J

22

J

(»,

*71

-

J

"

J

(

22

"

-

J

V

J

*1

<t)

(

J

21

22 )

)

a

2

a

1

}

V*i

-

V4 V*!

"

2

"

2

<t>

J

"

22

6

($

21

$

J

J

"

22

-

4

7

J

"

22

(0

21

21

21

21 )(^

22

J

(J

2

*1

'

J

22

"

J

J

'

21

)(

22

21

21

»l

• J

22

}

J

-

22

)

}

J

-

21

}

21

22

}

)]

22 )l

)

J

21

21>

21

J

1

'

J

J

)

J

(J

)[

-

"

<t>

22>

J

-

4 72

^81

5

V

l

'62

2

M<i>

'52

*6l"

)

22

5 <D 2

(J

- J

2

22

21

V

Uj

21

)[0>

)(<t)

<t»

=

2

- J

)

21 )(^

22 ai

(J

- J

)

2

22

21

a

1

J

J

"

J

)0,

J

<t»

(<J>

"

1

"

«4l

4 42 =

J

-

22

22

-

21

22

)

21 )(*j

21

(J

1

4 32

J

-

J

J

-

((Jjj

J

1

22

-

((^

)(4>

21

1

}

J

22

)]

}

35

J

'82

x

<j>

2

=

+

= P(l

E

(|)

1

3

3f

A

=

^5

*6

7

J

21

(^-g-^U

\)(y

-

C(l + PY)

_ ad -

-

-

22

r

E Pf

= Pd

1

-

-

a

d) +

(v - d))

(1

\)Oj + a

2

1

,

36

Appendix

2:

The Data

This paper presents an empirical analysis of the dollar mark

exchange rate, but unlike earlier work, aggregates the rest of the world

(for Germany) as a single dollar area.

Data for P

,

is computed using geometrically weighted averages

Q

of the individual series from the countries appearing on table A2

.

1

below.

Table A2

.

Weight

Country

U.S.A.

.157

France

.275

Italy

.184

Netherlands

.252

United Kingdom

.132

The weights are the average from 1974 to 1981 of the ratio of the value

of imports plus exports of each country with Germany over the total

trade of Germany with these countries.

In 1981 the 5 countries in Table

A2.1 represented 45 percent of the total trade of Germany.

countries'

and q are aggregated using the respective

indices for P

exchange rates vis

a

Individual

vis the U.S. dollar.

Most of the data is obtained from the International Financial

Statistics (IFS) tape.

The index of wages in Germany and the index of

intermediate inputs prices are computed using data from the Deutsche

Bundesbank, Monthly Report

,

various statistical supplements.

.

.

37

The exchange rate is the price of

a

U.S.

dollar in Deutsche marks,

line rf in IFS (average over the month)

The domestic price level is line 63 of IFS, the index of wholesale

prices

is computed

P

aggregating the various countries indices of

consumer prices, line 64 in IFS.

P„ is a weighted average of the IFS index of all commodities prices

excluding oil, line 76a, and the index of the dollar price of oil for

Saudi Arabia, line 76aa.

The weights are chosen from the geographical composition of

Germany's imports, using data from the Deutsche Bundesbank Monthly

Report

For the period 1974-1982 we computed the average share of

.

imports from OPEC, in total imports less finished goods.

The average

value share of imports from OPEC is 22 percent.

i

is the U.S.

Q

is the

treasury bill rate, line 60c in IFS.

weighted average of industrial production indices, line

66c, expressed in dollar terms, by dividing each country's index by the

real dollar exchange rate.

M is line 34 in IFS

K is the index of wage costs in industry, per man/hour, divided by

the CPI

.

The former is from Bundesbank Monthly Bulletin

,

the latter is

IFS line 64.

Theory requires that all series be realizations of stationary

stochastic processes.

All series have been demeaned and detrended by

regressing the log of each against

a

constant, time and time squared.

All seasonally unadjusted data has been adjusted by regressing each

series on 11 monthly dummies.

s

38

FOOTNOTES

The presence of real balances in the demand function for good i

Then real money

can be justified by making money yield utility.

balances are a proxy for the marginal utility of income.

In our model,

since money demand is explicitly specified in equation (10), nothing

would be lost if d were zero.

2

3

Constant terms are not reported for simplicity.

This approximation is spelled out in Rotemberg (1982(a)).

4

This feature distinguishes this model from the traditional

Dornbusch (1976) specification. There, the inflation rate depends only

This is due to Dornbusch' s assumption that

on the current value of m.

changes in m last foreever so that current m is the best forecast of

future m.

Driskill and Sheffrin (1981) have interpreted Dornbusch'

continuous time model as saying that p is predetermined at t and thus

doesn't depend on any current variables. For monthly data it is more

plausible, and an equally correct interpretation of the continuous time

model, to assume that p does indeed respond to m

.

Estimation of Euler equations for an exchange rate model with

flexible prices is carried out in Glaessner (1982).

The covariance matrix of the estimates is computed using the

This

technique described in Eichenbaum, Hansen and Singleton (1984).

requires that one obtain the parameters of the vector moving average of

To do

order 1 followed by the products of instruments and residuals.

this we first fit a vector autoregression of order 1 to the product of

instruments and residuals.

Then we explain these products by the lagged

residuals of the vector autoregression. The coefficients of these

This

lagged residuals are treated as the moving average parameters.

procedure is only valid asymptotically as long as the order of the

vector autoregression grows with the number of observations in such a

We use this method

way that, asymptotically, its order is infinite.

because the simpler procedure of Hansen (1982) does not always lead to a

positive definite covariance matrix.

39

REFERENCES

Blanchard, 0. J. and C. M. Kahn, "The Solution of Linear Differential

Models Under Rational Expectations," Econometrica July 1980.

,

"Expectations and Exchange Rate Dynamics," Journal of

Dornbusch, R.

1976.

Political Economy

,

,

Dramais, "Trans-Log KLEM Model for France, Germany, Italy, and the

U. K.," Working Paper No. 41, Mimeo DULBEA, 1980.

Driskill, R. A. and S. M. Scheffrin, "On the Mark:

Economic Review December 1981.

Comment," American

,

Eichenbaum, M.

L. P. Hansen and K. J. Singleton, "A Time Series Analysis

of Representative Agent Models of Consumption and Leisure Choice

Under Uncertainty," manuscript, 1984.

,

A Theory of Floating Exchange Rates

Frankel, J. A., "On the Mark:

Based on Real Interest Differentials," American Economic Review

September 1979.

,

Frenkel, J. A., "Flexible Exchange Rates, Prices, and the Role of 'News':

Lessons from the 1970s," Journal of Political Economy 89, August

1981.

"Formulation and Estimation of a Dynamic Model of

Exchange Rate Determination: An Application of the General Method

of Moments Technique" Mimeo, December 1982.

f7laessner, T. J.

Goldfeld, S. M.

"The Demand for Money Revisited," Brookings Papers on

Economic Activity 3, 1973.

,

,

Hansen, L. P., "Large Sample Properties of Generalized Method of Moments

Estimators," Econometrica July 1982.

,

Hansen, L. P. and R. J. Hodrick, "Forward Exchange Rates as Optimal

Predictors of Future Spot Rates: An Econometric Analysis," Journal

of Political Economy

1980.

,

Hansen, L. P. and K. J. Singleton, "Generalized Instrumental Variables

Estimation of Nonlinear Rational Expectations Models," Econometrica

1982.

Hansen, L. P. and T. J. Sargent, "Formulating and Estimating Dynamic

Linear Rational Expectations Models," Journal of Economic Dynamics

and Control

1980, Vol. 2.

,

Lipton, D. and J. Sachs, "Accumulation and Growth in a Two-Country

Model:

A Simulation Approach," NBER Working Paper No. 572,

October 1980.

,

,

40

Meese, R. A. and K. Rogoff, "Empirical Exchange Rate Models:

Fit Out of Sample?", Journal of International Economics

February 1983.

Do They

,

14,

Rotemberg, J. J., "Monopolistic Price Adjustment and Aggregate Output,"

Review of Economic Studies 1982(a).

,

"Sticky Prices in the United States," Journal of Political

Economy 90, December 1982(b).

,

Sachs, J., "Wages, Flexible Exchange Rates and Macroeconomic Policy,"

Quarterly Journal of Economics 1980.

,

von Jurgen, R.

"Mehr Beschaftingung durch Reallohnzuruckhaltung,"

fur

Weltwirtschaft Kiel, Marz 1982.

Institut

,

,

3 5

0^

18

1

1

•

6

"I

Lib-26-67

MIT LIBRARIES

TOflO

•%fitoEftj*

ODD 175

Ifll