Understanding the Frozen Category From a Consumer Perspective

advertisement

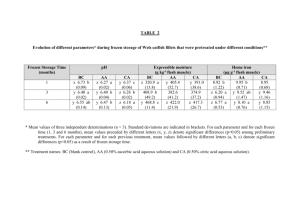

Understanding the Frozen Category From a Consumer Perspective Waves 24th April 2014 Agenda What is ‘Frozen’ to consumers: In home Packaging In store Overview of challenges and barriers Key issues for category sub-segments Conclusions Research Objectives: ‘To understand underlying shopper and consumer dynamics driving the performance of the frozen food category (both at total category level and at key sub category level: frozen meat/burgers; chicken products; pizza; ready meals; fish; vegetables) in UK and Ireland so as to inform future marketing and consumer strategies’ 3 Online discussion forum: 33 consumers over 5 days (21 UK and 12 Ireland) Including: Supermarket visit where they took photos of the aisle and any interesting frozen products In home interviews: 30 consumers London / M25 (7), Manchester (7), Nottingham (6), Cork (3) and Dublin (7) Accompanied shops: With 20 of the above, ranging from ‘top up’ to ‘stock up’ visits In Home Perspective What is frozen? Anything entering the consumer's freezer is part of frozen: Est at least half is not bought frozen So anchored in ‘my freezer’ Core benefit of convenience belongs to the device not the category Convenience: Choice / Options Poor aesthetics: Just doesn’t look as nice (as fresh) Perceived poorer quality (than fresh) Very functional and lacks emotional appeal Easy /quick meal Snacks to keep you going Meal / Menu tailoring Freezer plays a role on most days Less waste: Lasts longer Precise amounts Can be a guilty pleasure Consumer creates unique category, ‘my frozen’ Whatever is in my freezer: Yes, ‘bought frozen’ Probably more bought fresh Bakery is key, fuelled by offers and minimising waste Others eg pastry And for some more portions & leftovers Consumer overview of products from their freezer Issue Veg Fish Prods Pizzas Poultry Prods Meat / Burgers Ready Meals Who is core user? Adults Children & Adults All + Guests Children Adults Teens & Adults Usefulness ***** *** ***** *** **** Confidence in product ***** **** ***** *** ** * Kids love them and teenagers can cook them (if bought frozen) ** **** (if bought fresh) Role of brands Whether bought frozen? Key: Key: Key: Birds Eye, McCains, Green Isle Birds Eye, Donegal Catch, Youngs Goodfellas Dr Oetker Chicago Pizza Express All All Most (not Pizza Express ‘treats’) Limited: (Big Als) All Critical but minimal: Own label popular: (Birds Eye, Finest) + Weight Watchers, Healthy Living and some non frozen brands entering Minority Most (offers in fresh key) Meat the key component of buy fresh and freeze: Almost all consumers did this, using up valuable space And all think they do it more now: Due to offers (eg 3 for £10) Innovation in jar / packet sauces Local butchers / meat shops doing deals too A behaviour given impetus by horsemeat scandal Important everywhere, even more in Ireland The casual ‘snacks and light meals’ category Articulated repeatedly by consumers and defined by usage (not product): Snacks and ‘in between meal’ meals Fish finger buttie, nuggets to keep the kids going after school, etc Very casual and extremely valuable Not reflected in store Opportunity exists here Case Study: Single D, Stretford Karen has a busy life and wants lots of instant food available; quite erratic lifestyle as working and caring for father. Heavy Iceland & Asda shopper (but uses several other stores too) 12 Case Study: Family with two young children under 10, D Maria has a very strict weekly budget and a heavy user of frozen; but husband thinks fresher is better and they buy a lot of fresh meat to freeze on offer (at Tesco). Limited repertoire of meals (lots of fresh mince that is frozen); spag bol several times a week with sauces “everything comes out of a jar or packet in this family” 13 Case Study: Family with older teens Claire is a lighter (almost heavy) frozen food user but says she ‘works her freezer hard’. She has teenage children and several in their 20’s who regularly return with partners in tow. She need lots of food options to cater for a wide range of tastes and fads; and people just turning up. ‘Discovered’ Aldi last year and goes every Sunday for main shop. 14 Freezers: Out of sight Freezers are squeezed into the home Very few have them in the garage Storage space; the frozen cupboard Involves rummaging about Product ‘shoved in’ Hard to manage Freezers appear chaotic And at times, uncared for and almost unusable And with mystery products…… Manchester: In comparison fridges are much neater Nottingham: Consider this example:C2, older family with 4 children in Cork Packaging Issues Packaging Challenges Reaction to packaging re-enforces poor perceptions of the category Uncared for product Packs take up too much space, esp when part used (eg 4 of 8 pieces left) Many repackage: Positive: reduce waste; enhance convenience Negative: because pack won’t fit in Packaging at odds with needs: With freezer space at a premium, offers (which promote more, not cheaper) can appear at odds with consumer needs Discounters viewed more favourably; usually a better price for the same size If original packaging doesn’t fit, some keep instructions (and some do not) Squashed and damaged Packaging gets ripped open – and cannot be resealed Frequently packaging does not help freezer management Difficult to open, impossible to reseal Exposed product commonplace Many examples of loose product 23 In Store Perspective Frozen Aisle: Usual rules don’t apply Looks uninviting Very functional, unemotional Not tactile; no permission or encouragement to explore and handle Perceived lack of POS / offers At the end ‘I just want to get home’ Be quick or even avoid altogether Clinical and uninviting environments, esp Tesco Macclesfield These cabinets look empty due to light reflection; Asda, Cheshire Dublin Clarehall Poorly stocked Sainsburys in Kings Lynn 26 Discounters and some others integrate freezers better: -No frozen aisle -Creates more welcoming category environment Lidl, Artane Supervalu, Kilester Lidl, Fishponds, Bristol Tesco, Barking Side ‘flags’ used here to indicate frozen aisle by price point thought more colourful Open freezers more inviting: Doors seen as a barrier to product; “I only open them if I want something.” Asda, Feltham Offers grab attention and bring colour; suggest retailer is making an effort Lidl Iceland Tesco Morrisons Role of Offer Freezers Mentioned spontaneously Recognised as mixing things up Meal ideas; covering all the bases Many like them but ‘a bit weird’ Healthy Living curry next to pizza Debate as to whether they encourage you visit the aisle or help you avoid it Jumbled up offer freezers These examples Tesco Macclesfield and Tesco Dublin Artane Cross Ben & Jerrys and Faggots; Tesco Macclesfield The Crunchie dividing wall; Tesco Artane Cross, Dublin 31 Implications of store experience Rarely lingering in the frozen aisle Typically ‘get in get out’ New strategies needed Frequent opportunities for purchase avoidance, eg: Someone stood in the way of cabinet Uncertain whether pack will fit in my freezer Innovation not being noticed The Wider Perspective: Issues impacting frozen Wider food-retail issues impact frozen: Much less ‘stock up’ shopping: Stores are everywhere 22 of 33 say now going more frequently Growth of discounters Easier frozen experience 19 of 33 using them a lot more So easy, part of convenience Convenience stores living up to name No longer for distress purchasing They have offers too (inc fresh) Frozen very limited The frozen aisle; Tesco Metro, Cheadle Hulme, Manchester Frozen not living up to potential Category specific issues: Broader factors: Language of chilled superior Freezer enables fresh Packaging needs improving Improve shopabaility Awareness of innovation needed Less stock-up shopping Growth of discounters Convenience living up to name Cooking in media rarely features frozen Combine to inhibit category positives: Convenience Less waste Better value Consumer review of frozen category sub-segments Category Perceptions Important to get beyond the initial frozen category reaction Superficial perceptions not strong: Poorer nutrition Cheap (and nasty) But attitudes differ by sub-segment Frozen Vegetables: The most positive segment; can be better than fresh Peas the benchmark Carrots less so (soggy) Mixed and other greens appreciated Pack size a key issue; can be compounded by offers Innovation seen positively and is about: Pack sizes (eg Single Steamers) Sauces (eg cauliflower cheese) Items that help me cook from scratch (eg stir fry & casserole products, herbs) Frozen ‘Potato’ Products: To consumers separate to vegetables and part of ‘snacking’ Includes Yorkshires No quality concerns and better than I could make (esp chips, Yorkshires) An invaluable category Quick ‘cheat’ food Options for families Innovation largely seen as about potato formats (eg baked potatoes) Frozen Pizzas: Popular and performs well Many prefer frozen over fresh Convenient and easy; good to have in for the unexpected Innovation, flavours and bread formats, viewed very positively Merchandising dull if displayed side on but very positive if viewed from ‘above’ (this example Dunnes) Frozen Fish Products: Easier and family-friendly way to access fish A positive relationship with frozen; (some know it is frozen when caught) Attitudes to frozen quite different to fresh; breaded an important association (but less than for poultry) Concerns over quality (mushy / grey) and portion size Fish product innovation: Consumer sees three types To address perceived poor quality (eg Iceland) Coatings; but more of the same! ‘Real’ innovation eg sauces, clear packaging, etc Frozen Poultry Products: Majority eating chicken but relatively poor attitudes to frozen poultry products given extent of fresh purchase Concerns over meat quality / reconstituted / injected Perceptions anchored in breaded ‘Childish’ driven by nuggets and goujons ‘Outdated’ Chicken Kiev been around for ages Lacks adult brands; though Big Als very popular in Ireland Poultry Innovation Poor: Innovation very limited and only seen at the value end (eg mimicking KFC, joint alternatives) Consumers found it difficult to find ‘interesting’ products from this segment Quality cues missing from frozen Free Range, freedom food, organic, etc Consumer sees greater innovation in fresh (prepared chicken, DIY coating, etc) “To be honest there is only so much you can do with a piece of chicken and some breadcrumbs. I’ve noticed a trend to try and imitate the traditional Saturday night takeaway. For example, KFC do a chicken bucket for approx £12 and this can be bought in Iceland for £5.” (C2, heavy, pre-family) Frozen Meat / Meat Products: Meat being used by many Esp bags of chops Chicken / Mince less prevalent Good value but fresh offers eroding; and can be too cheap Awareness of quality issues: Looking at water, meat and fat content Horsemeat had greatest impact here Meat products (sausages, pies & pasties) thought poor and fresh better Very little innovation recognised: Greggs pasties an exception Occasional cooking enablers And meat substitutes Burgers: Many negative perceptions Lack of trust evident A unique situation; very seasonal & greatest quality concerns Fresh burgers seem readily available and easier to judge quality Some claim to make their own “Fresh offer the image that they have been prepared before your eyes, unlike frozen burgers where there is uncertainty surrounding the processes!” (C2, heavy, pre family) “I think what happens is that now I don't trust any burgers and just because a thing is cheap I still have the right to know what is in them as it is my choice what I give my family to eat and if there horse meat in my burgers I should be told this on the package no matter what I pay for them.” (D, heavy, older family) Frozen Ready Meals: When explored consumers found many ‘interesting’ products Several commented that this surprised them Consumer needs to be engaged in a conversation to get past more negative initial reactions: Impossible to judge quality Concerns over additives, fat & salt Portions are shrinking A guilty pleasure Convenience is key and teenagers an important user group Innovation Surprising: Consumer needs permission to explore Several positive aspects to innovation: Tasty and adventurous flavours Brands starting to matter (eg Bisto, Sharwoods and more established Weight Watchers, Healthy Living) Colourful But innovation lacks consumer visibility and little experimentation was reported Consumer Overview of Frozen Category Sub-segments Issue Veg Fish Prods Pizzas Poultry Prods Meat / Burgers Ready Meals ***** *** **** *** * *** Frozen at source a positive Makes fish accessible Sooo useful Peas & chips Fish fingers Perceived quality The best way to buy some Poor, shrinking portions (some think better than chilled) Perceived innovation Acceptable n/a Overall rating of frozen segment Key issues Iconic product Buying more frozen nowadays? Juvenile Can’t judge meat quality Concern over ingredients The Pizza itself Nuggets & Kiev None Curry, Chilli, Lasagne, Spag Bog Good Poor Concern Variable, being Improving Good Poor; needed Little scope Quite good More Much more More Less lifted by brands (inc Healthy Living) (even better when explored) Some more / Some 49 less Conclusions and suggested actions Conclusions and Actions In Store (Shopability) Products (Communication and Innovation) Consumers (Empathy) Consumers: Empathy Only one key element of what’s in my freezer Competing with fresh Recognise role of snacking, light meals and home cooked Communicate and innovate around these situations Products: Communication & Innovation Dial up quality and taste cues; borrow from fresh (esp poultry) Packaging innovation to improve convenience Fish products: Maintain innovation momentum (not there yet) Poultry: Innovation needed (lacking) and communicate cues of fresh Meat & meat products: Reassurance communication needed Ready Meals: awareness / engagement needed (innovation is ahead of knowledge) In Store: Shopability Re-evaluate visual, verbal and spatial cues Tap into ‘get in get out’ mind-set Consider: Fragmentation of category to encourage involvement Products based on usage not ingredients Appendix: Frozen in respondents own words….. The language of frozen food What is frozen food all about……..? “quick and tasty and generally suited to reheating in a microwave” (C2, lighter, post family) “Frozen food is convenience food, you know it won’t go off and it’s readily available to use” (C2, heavy, young family) “buying a product what you don’t know when you will eat it, but then it’s easy enough to cook in the microwave” (D, heavy, post family) “It’s the handiest thing to have in the freezer, once I have them there’s always a dinner there. So handy especially when you’re a working mam” (C2, heavy, young family) “Frozen food cuts down on waste, I got sick of throwing out veg that had turned” (C2, lighter, “i tend to sway towards fresh as much as possible, you think it’s better for you” (C2, young family) lighter, older family) “Quick and easy to cook and most people like it” (C2, heavy, older family) “It’s ready fast after a long day at work” (C2, heavy, older family) The language of frozen food What product best sums up frozen food and why? “ready meals - they are helpful when I don’t have time to make a proper meal” (D, heavy, post family) “.......the obligatory fish fingers and chicken nuggets for the grandchildren” (C2, lighter, post family) “frozen chicken – because I can do a curry or stir fry – something quick with it” (C2, lighter, older family) “The bulk buy start-type meals...the type of thing you can just shove in the oven and snack on whilst cooking or before going on a night out” (C2, heavy, pre family) “I have a lot of frozen chicken and beef as it is really convenient to be able to cook staples after work” (C2, lighter, pre family) “I think mixed veg sums up frozen food for me, they are so handy to have and once added to any dish they complete the meal” (C2, heavy, post family) Shopability of frozen in respondents own words….. “Cold is the first word I’d use, it’s my least favourite aisle and I usually grab and run when I go down this section!!” (C2, lighter, older family) “Cold! Boring, not inspiring, plain, lots of deals and offers on show” (C2, lighter, pre family) “Yes there are a lot of deals in the frozen aisles but there are more meal deals in the fresh aisles!” (C2, heavy, young family) “I find it easy to go through the shop without looking at freezers if I don't need items as they’re not at my eye level and there not jumping out at me. recently Lidl have started to do special offers freezers.” (C2, heavy, post family) “I would never open (freezer) doors unless I’m going to buy it. …..With door you have to decide you want it” (C2, Post family, Heavy) Macro trends: In respondents own words…. “Asda, once or twice. Tesco Metro three to five times. Sainsburys and Waitrose once. Farmfoods once.” (D, heavy, post family) “It’s so easy to cook from scratch now – there’s help everywhere and we’re always discussing recipes at work.” (C2, lighter, older family) “We shop around a lot and look out for good deals. I do a main shop once a month in either Aldi or Tesco and we use our local Asda for top up shopping. That usually happens about 3 times a week so I can get fresh produce.” (C2, heavy, young family) “My husband and I are both self employed and I suppose that although we manage to pay all our bills, we are conscious about getting value for money. When I did a weekly shop, I wasted a lot of food by just throwing it out and I was more inclined to buy a lot of rubbish (cakes, biscuits). I find that shopping everyday you are more inclined to buy what you need and probably have fresher products as well.” (C2, heavy, young family) “I find these stores are better value for money, I can do a full shop at Aldi for half the price of Tesco... I wouldn’t dream of going to Tesco now.” (D, heavy, young family) Fish Products: In respondents own words…. “I would like to see the amount of ice glaze on prawns reduced as you are just paying for water. Also scampi – make it clear whether it’s reformed or whole tail. Some brands do make this clear. I don’t like over regular shape of fish fillets as it suggests that it’s more like processed rubbish, I’d like less and compact packaging” (C2, lighter, older family) “I think it's easy to feel a bit cheated …... You see some nicely packaged fish fillets with a tasty image on the front with big succulent fillets and then you open to see tiny grey-ish fillets. That can be a bit disappointing!” (D, lighter, pre-family) “Some products needs more fish in relation to the amount of batter, on the other hand Tesco own fish products need to be bigger in size , there is a good amount of fish to batter but the product needs to be bigger.” (C2, lighter, young family) “Totally agree about the ratio of batter/breadcrumbs to fish. I don't buy any coated fish now (other than fish fingers - can't beat a fish finger butty) However, probably would if they could get it right.” (C2, lighter, post family) Poultry Products: In respondents own words…. “The Birdseye chicken range has newer products ie: chicken chargrills in different flavours, peri peri, garlic, southern fried and I have seen a new chicken burger which is much thicker and more meaty than the usual chicken burger.” (D, heavy, older family) “Tenders, goujons, dippers, nuggets, fingers, popcorn, strips (whether they are breaded or southern fried) I just don’t know how many more names they can come up with to mask chicken. Ok they may be different shapes but at the end of the day they 99% taste the same.” (C2, heavy, pre family) “I believe that chicken Kiev, chicken dippers, nuggets, chicken breast etc have been around for a number of years and that the only difference that I can see would be the packaging. An example of this would be Birds Eye Chicken Breasts in crumb/batter. I realize that there are a lot more than I've mentioned but I haven't seen much change over the last few years.” (C2, heavy, young family) “To be honest there is only so much you can do with a piece of chicken and some breadcrumbs. I’ve noticed a trend of the supermarket to try and imitate the traditional Saturday night takeaway. For example, KFC do a chicken bucket for approx £12 and this can be bought in Iceland for £5.” (C2, heavy, pre-family) Ready Meals: In respondents own words “I'm very conscious about my diet. I wont eat frozen ready meals so I just don't go there and tempt myself with the idea of eating a roast in 10 minutes. They're usually pretty low in nutritional value and flavour despite having flavour enhancers” (D, lighter, pre family) “I think you can easily buy fresh meat and there are so many fresh / jars / packets of sauces that easily make a good meal without the need to buy ready meals.” (C2, heavy, young family) “If you’re on the go…from time to time but its not something you want to be eating 5 days a week.” (C2, lighter, Pre-Family) “Chicken in red wine sauce sounds delicious. I will look out for that next time I am shopping.” (C2, lighter, older family) “I saw the Bisto cottage pie in Lidl ..it was on offer and looked nice so I bought one for my husband to try.” (C2, heavy, post family)