Perceptions of Frozen Food UK & Ireland ‘14

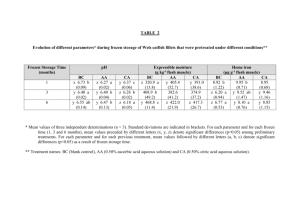

advertisement

Perceptions of Frozen Food UK & Ireland 24th April ‘14 Stephanie Moe Agenda Frozen Food Performance Bord Bia’s Work to Date: Future of Frozen Background to Current Research Perceptions of Frozen Foods Growing the success of Irish food & horticulture FROZEN FOOD PERFORMANCE Irish Market for Frozen Food Source: Kantar Worldpanel Jan. 2014 Market slow to recover from January 2013: -3% Buyer numbers holding steady: 99% buy frozen Drop in Average spend per shopper (€262 from €269 in 2012) Promotions: Prices -2.3% on average since 2012, 21% of packs sold on deal across frozen Volume decreasing across fish, pizza and ready meals despite promotional activity Clear need to drive value back into the market Growing the success of Irish food & horticulture The UK Total Frozen Market is worth £5.7bn, and is growing at 2.1%: Trip Spend is driving the growth as well as an increase in shoppers Frozen Grocery Components of Spend Trends – 52 w/e 31st March 2013 vs. 30th March 2014 Key Performance Indicators Total Frozen Value up 2.1% worth £118.9m 5,627,925 5,746,851 118,926 2.1 Reb alan Penetration % ced #### 99.1 99.1 0.02 0.0 N/A Purchase Frequency 47.28 47.38 0.10 0.2 AWP (Spend per Buyer) 217.2 219.6 2.40 1.1 4.59 4.63 0.04 1.0 52 w/e 03 Mar 13 52 w/e 02 Mar 14 Expenditure (£000s) Penetration % Trip Spend Actual Change % Change Contribution (£000s) 11903.39 £0 54157.73 Purchase Frequency Trip Spend #### #### £20,000 £40,000 £60,000 £80,000 £100,000 £120,000 £140,000 #### Expenditure (£000s) £5746.9m +2.1% Increase of £118.9m AWP (Spend per Buyer) Penetration % * £220 +1.1% Contribution = £64.1m 99.1% +0% Contribution = £54.9m Trip Spend Purchase Frequency £4.63 +1% Contribution = £52.5m 47.4 trips +0.2% Contribution = £11.5m * Penetration contribution includes population growth of 1% 5 © Kantar Worldpanel Poultry and Game continues to show strongest year on year performance, with Frozen Confectionery also performing well while Frozen Meat continues to struggle Frozen Grocery Sector Expenditure Share and YOY – 52 w/e 31st March 2013 versus 30th March 2014 YOY % 57.2 Frozen Prepared Foods 56.7 1.4 18.6 Frozen Confectionery 5.2 19.1 13.5 Frozen Fish 0.1 13.3 5.8 Frozen Poultry+Game 8.0 6.1 4.9 Frozen Meat -2.0 4.7 52 w/e 31 March 13 52 w/e 30 March 14 6 © Kantar Worldpanel Tesco and Morrisons are the retailers seeing the biggest share decline in Frozen. Aldi have seen the biggest increase in share and Waitrose has seen double-digit growth Frozen Grocery Retailer Expenditure Share and YOY – 52 w/e 31st March 2013 versus 30th March 2014 YOY % 25.6 24.6 Total Tesco 14.9 14.8 Total Asda 12.1 12.2 Total Sainsbury's -2.2 14.5 14.7 Total Iceland 2.7 2.9 Total Waitrose Total Marks & Spencer 23.5 2.9 3 Lidl 3.8 13.0 3.5 4.2 Aldi Total Independents & Symbols -3.9 4.1 3.9 The Co-Operative 1.3 3.2 10.0 9.4 Total Morrisons -1.9 6.5 0.8 0.8 -8.5 1.1 1.1 5.5 52 w/e 31 Mar 13 52 w/e 30 Mar 14 7 © Kantar Worldpanel Aldi and Waitrose lead the market in terms of growth, with Lidl also performing well. Independents & Symbols, Morrisons, The Co – Operative and Tesco are in decline. Frozen Grocery Retailer Expenditure YOY – 52 w/e 31st March 2013 versus 30th March 2014 Aldi 23.5 Total Waitrose 13.0 Lidl 6.5 Total Marks & Spencer 5.5 Total Iceland 3.8 Total Sainsbury's 3.2 TOTAL MARKET 2.1 Total Asda 1.3 Total Tesco -1.9 The Co-Operative -2.2 Total Morrisons Total Independents & Symbols -3.9 -8.5 8 © Kantar Worldpanel Asda is the only Big 4 retailer to over-trade in Frozen, with Sainsbury's and Tesco significantly under trading. Iceland continues its strong over-trade alongside Aldi. Retailer Expenditure Share of Total Grocery & Frozen Grocery – 52 w/e 30th March 2014 26.6 24.6 14.5 14.8 15.0 14.7 12.2 10.8 9.4 5.3 4.5 3.9 2.1 Total Tesco Total Asda Total Sainsbury's Total Morrisons The CoOperative Total Iceland Total Grocery 2.9 3.3 4.2 2.8 3.0 1.2 Total Waitrose Aldi Lidl 0.8 Total Independents & Symbols Total Frozen 9 © Kantar Worldpanel 25/04/2014 10 © Kantar Worldpanel Frozen share of in store space declining… Morrisons the strongest supporter of Frozen, Waitrose increased space slightly Total Frozen | Share of Store Space | MAT 2010 2012 6.7% 6.6% 6.6% 5.8% 5.2% 4.8% 4.2% 4.5% 4.8% 4.4% 4.0% 3.0% 3.1% Copyright ©2012 The Nielsen Company. Confidential and proprietary. 5.3% 5.1% 5.0% 3.0% 2.6% TESCO EXTRA TESCO SUPERSTORE TESCO EXPRESS Prepared for: Nielsen State of the Nation Source: Store Observation Service w/e 05-Jan-13 TESCO METRO ASDA SAINSBURY'S SAINSBURY'S MORRISONS SUPERSTORE LOCAL WAITROSE 11 …and freezer types vary by store format Are packaging designs and product formats tailored to your customer’s needs? Total Frozen | Share of Store Space | MAT 37% TESCO EXTRA 50% 45% TESCO S/STORE 44% TESCO EXPRESS 9% Copyright ©2012 The Nielsen Company. Confidential and proprietary. SAINSBURY'S S/STORE 18% 3% 4% 70% 67% 41% SAINSBURY'S LOCAL 34% 8% 18% 91% 35% MORRISONS 3% 26% 32% ASDA WAITROSE 9% 74% 4% 7% 8% 84% TESCO METRO ICELAND 5% 10% 5% 4% 29% 8% 82% Freezer Type 1 – Door only Freezer Type 2 – Well with Freezer Door above Freezer Type 3 – Well without Freezer Door above Freezer Type 4 – Well with Shelves above 28% 4% 4% Type 1: Convenience Stores | Type 2: Asda and Waitrose | Type 4: Iceland, Morrisons and Sainsbury’s Prepared for: Nielsen State of the Nation Source: Store Observation Service w/e 05-Jan-13 12 BORD BIA FOCUS ON FROZEN Exploring the future of frozen food ‘What key opportunity spaces may emerge for frozen food over the next five to ten years?’ Key drivers shaping landscape . Emerging trends Opportunity areas Opportunities for ten key markets: the US, the UK, Ireland, Germany, France, Brazil, Japan, Sweden, India and China Growing the success of Irish food & horticulture Opportunities under four broad platforms Cool living Preserving goodness Responsible choices New frontiers © 2013 Bord Bia, The Futures Company Mapping opportunities The timeline below gives an indication of close, or how far away, key opportunities are for frozen food manufactures. Those that are closer in represent potential territories for ‘quick-wins’. Those that are further out are more reliant on scientific or technological progress, and are areas where consumer needs are still emerging. New diets Perfect portions Spectrums of cool Positively frozen Wholesome kids Sophisticated Shortcuts 1 to 2 years © 2013 Bord Bia, The Futures Company Anytime, Anywhere Safeguarding nutrition Low impact frozen Frozen theatre Rethinking the pack Frozen gastronomy 5 years and beyond Cool living Key opportunities Sophisticated shortcuts New diets Anytime, anywhere © 2013 Bord Bia, The Futures Company Preserving goodness Key opportunities Wholesome kids Positively frozen Safeguarding nutrition © 2013 Bord Bia, The Futures Company Responsible choices Key opportunities Perfect portions Low-impact freezing Rethinking the pack © 2013 Bord Bia, The Futures Company New frontiers Key opportunities Spectrum of cool Frozen theatre Frozen gastronomy © 2013 Bord Bia, The Futures Company BACKGROUND TO PERCEPTIONS RESEARCH Background to Consumer Perception Research Larger stores shrinking frozen/Smaller store formats growing (poor frozen presence) Limited innovation in product offering Poor overall growth compounded by equine DNA issue Missing part of jigsaw: consumers perceptions & usage of frozen Growing the success of Irish food & horticulture Background to Consumer Perception Research contd Need to understand Positive/ negative perceptions (barriers) of both frozen products and the frozen category Who, what when where why and how they use frozen? Commissioned Waves Research in late 2013, in-field early 2014 Desired Outcome : Enhanced understanding of target consumer Help to inform future messaging, packaging Deeper understanding can help to partner with retailers for future growth Growing the success of Irish food & horticulture Waves: Andrew Vincent Helen Clark