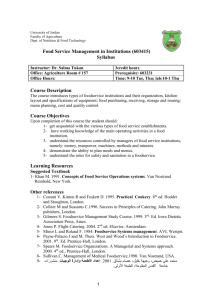

Irish Foodservice Channel Insights November 2011

advertisement