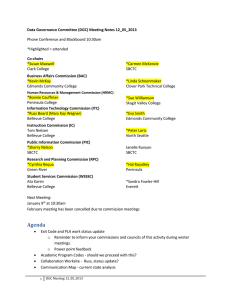

FISCAL GUIDELINES & GRANT TERMS 2015-16 Faculty Learning Community Initiative Grants

advertisement

FISCAL GUIDELINES & GRANT TERMS 2015-16 Faculty Learning Community Initiative Grants The State Board for Community and Technical Colleges reserves the right to make changes to this document due to, but not limited to, federal, state, or local legislation or policy changes. CONTENTS BUDGET & INVOICING GUIDANCE ................................................................................................................ 2 Budget Categories ..................................................................................................................................... 2 Salaries, Wages, and Benefits ............................................................................................................... 2 Goods and Services ............................................................................................................................... 2 Travel..................................................................................................................................................... 2 Contracts ............................................................................................................................................... 3 Budget Revisions ....................................................................................................................................... 3 Invoicing .................................................................................................................................................... 3 GRANT TERMS & INFORMATION .................................................................................................................. 4 General...................................................................................................................................................... 4 Allowable Activities ................................................................................................................................... 4 Allowable Costs ......................................................................................................................................... 4 Expenditure Accounting............................................................................................................................ 4 NACUBO Code ....................................................................................................................................... 4 Records Retention..................................................................................................................................... 4 Savings ...................................................................................................................................................... 4 Contacts .................................................................................................................................................... 4 FY16 FLC Fiscal Guidelines & Grant Terms Page 1 of 4 BUDGET & INVOICING GUIDANCE 2015-16 Faculty Learning Community Initiative Grants Budget Categories Based on the budget activities below, you must determine how much of each activity will be budgeted in each budget category (also known as a “budget column”). The following is an overview of each budget category. Salaries, Wages, and Benefits Salaries, wages, and benefits associated with staff directly involved in grant activities and paid in full or in part from this grant. Grant funds may be used to pay to provide a nominal amount of pay for faculty or staff to coordinate the FLC but may not be used to compensate for FLC members’ time while participating in FLC activities. In your budget narrative, please be sure to include position title to be funded by the grant, percentages of effort/FTEF/hourly wage/stipend information, and a brief description of duties as they relate to the grant. Examples: Faculty stipend, 1 stipends at $100, coordination of FLC activities Faculty Lead, 4 hours at $30/hr, coordination of FLC activities Goods and Services Goods: Items with an individual acquisition cost of $5,000 or less or a useful life of less than one year or services necessary to carry out grant activities. Services: Services of a routine nature necessary for carrying out grant activities. Note: Contracts with other public entities/community colleges are considered services and must be budgeted here. Examples: books or other resources, office supplies, professional memberships, registration fees for applicable training/workshops, working meals for state/CTC employees, refreshments Travel Expenditures for transportation, meals, hotel, and other expenses associated with traveling related to allowable grant activities. Reimbursement for travel costs must be within OFM travel rates and regulations which can be found in the State Administrative and Accounting Manual (SAAM) at http://www.ofm.wa.gov/policy/10.90.htm. Please note, if grantee reimburses travel to a sub-grantee/sub-contractor under this grant, the same OFM travel rates and regulations must be applied. Examples: Travel to Faculty Learning Community meetings, travel to applicable trainings/workshops/conferences including the Pacific Northwest Higher Education Assessment, Teaching and Learning Conference FY16 FLC Fiscal Guidelines & Grant Terms Page 2 of 4 Contracts Professional or technical services provided by a consultant (contractor) to accomplish a specific study, project, task, or other work statement. Please note that the rules that apply to the grantee (the college) under this grant must also be applied to the contractor. Example: Contracts for subject matter experts Budget Revisions SBCTC approval of a revised budget is required if there is more than a 10% variation in expenditure levels by main budget categories. Budget revisions must be submitted to SBCTC via the Online Budget & Invoicing System (OBIS – http://apps.sbctc.edu/obis) no later than June 15, 2016. See the OBIS user manual (available in the “Resources” section of OBIS) for information on how to create and submit a budget revision. Invoicing Funds for this grant must be claimed on a reimbursement basis. No payments in advance of or in anticipation of goods or services provided under this grant shall be requested or paid. All costs must be reported for the period incurred. Reimbursement requests must be submitted at least quarterly, but not more than monthly using the Online Budget and Invoicing System (OBIS – http://apps.sbctc.edu/obis2). All costs must be submitted for reimbursement in accordance with the schedule shown below. For expenses incurred: July 2015 – September 2015 October 2015 – December 2015 January 2016 – March 2016 April 2016– June 2016 FY16 FLC Fiscal Guidelines & Grant Terms Invoice no later than: October 31, 2015 January 31, 2016 April 30, 2016 July 14, 2016 Page 3 of 4 GRANT TERMS & INFORMATION 2015-16 Faculty Learning Community Initiative Grants General Funding for these grants are provided from state funds. Allowable Activities Activities authorized under this sub-grant are as approved in your project request. Allowable Costs All expenditures submitted for reimbursement under this grant must be necessary and reasonable for proper and efficient administration of the grant. Applicable Washington State Regulations The State Administrative and Accounting Manual (SAAM) must be followed: http://www.ofm.wa.gov/policy/default.asp Expenditure Accounting These funds must be kept in an account separate from all other funding sources. For colleges these funds must be accounted for in grant and contract (fund 145). SBCTC reimbursement for this grant must be coded to object SX (611100 for colleges in ctcLink). NACUBO Code The following are suggested NACUBO codes. Colleges may use other codes as appropriate. Professional Development: 144 Records Retention Financial management systems shall reflect accurate, current, and complete disclosure of all cost expenses for grant activities. Grant recipients must maintain books and records, supported by source documentation, that sufficiently and properly reflect the source of funds and all costs expended for program purposes. These records and financial statements are subject to inspection, review, reproduction, and/or audit by SBCTC or its designee for at least six years after the dispersal of funds, the termination or expiration of the contract, or the resolution of litigation or audits related to the program, whichever is latest. Additional information on records retention may be found on the web: http://www.sbctc.ctc.edu/docs/general_retention_schedule.pdf Savings In the event funding from the state is withdrawn, reduced, or limited in any way after the effective date of this contract and prior to normal completion, the SBCTC may terminate the grant without notice, subject to renegotiation at the SBCTC’s discretion under those new funding limitations and conditions. Contacts If you have any questions, please contact: Michele Rockwell / 360-704-4343 / mrockwell@sbctc.edu Susan Wanager / 360-704-4344 / swanager@sbctc.edu FY16 FLC Fiscal Guidelines & Grant Terms Page 4 of 4