FISCAL GUIDELINES & GRANT TERMS 2016-17 Early Achievers Grant

advertisement

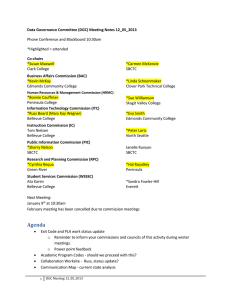

FISCAL GUIDELINES & GRANT TERMS 2016-17 Early Achievers Grant The State Board for Community and Technical Colleges reserves the right to make changes to this document due to, but not limited to, federal, state, or local legislation or policy changes. BUDGET & INVOICING GUIDANCE .................................................................................................. 2 Budget Categories ....................................................................................................................... 2 Salaries, Wages, & Benefits .................................................................................................... 2 Goods & Services .................................................................................................................... 2 Travel....................................................................................................................................... 2 Tuition ..................................................................................................................................... 3 Books ....................................................................................................................................... 3 Misc. ........................................................................................................................................ 3 Budget Revisions ......................................................................................................................... 3 Invoicing ...................................................................................................................................... 3 GRANT TERMS & FINANCIAL INFORMATION .................................................................................. 4 General Financial Information .................................................................................................... 4 Allowable Activities ..................................................................................................................... 4 Expenditure Accounting.............................................................................................................. 4 Wrap-Around Support Services .............................................................................................. 4 Monitoring .................................................................................................................................. 4 Publicity and Publications ........................................................................................................... 4 Records Retention....................................................................................................................... 5 Termination................................................................................................................................. 5 Termination for Cause ............................................................................................................ 5 Savings .................................................................................................................................... 5 Fiscal Contacts............................................................................................................................. 5 FY17 Early Achievers Grant Fiscal Guidelines Page 1 of 5 BUDGET & INVOICING GUIDANCE 2016-17 Early Achievers Grant Budget Categories The following list identifies possible budget categories (also known as a budget line or line item) for Early Achievers Grant. Salaries, Wages, & Benefits Salaries, wages, and benefits associated with the single point-of-contact for Early Achievers Opportunity Grant recipients. See Early Achievers Grant- State Funding Program Guidelines for a list of eligible duties that may be paid from this grant. In your budget narrative, include each position title to be funded by the grant and the percentage of effort/FTE/hourly wage/stipend information. Examples: Early Achievers Opportunity Grant Manager, .2 FTE; Financial Aid Coordinator, $30/hr A maximum of $1,500 per FTES may be spent in the salaries/wages, benefits, goods/services, and travel budget categories to support the single point of contact. Goods & Services Goods and Services to be used by personnel budgeted to the grant and other necessary goods and services needed for grant activities. Example: office supplies and materials, information marketing for recruitment of students The cost of any items purchased that will not be used exclusively to support this grant must be split among other funding sources. A maximum of $1,500 per FTES may be spent in the salaries/wages, benefits, goods/services, and travel budget categories to support the single point of contact. Travel Expenditures for transportation, meals, hotel, and other expenses associated with traveling related to allowable grant activities. Reimbursement for travel costs must be within OFM travel rates and regulations which can be found in the State Administrative and Accounting Manual (SAAM) at http://www.ofm.wa.gov/policy/10.90.htm. Example: Travel to off-campus meetings A maximum of $1,500 per FTES may be spent in the salaries/wages, benefits, goods/services, and travel budget categories to support the single point of contact. FY17 Early Achievers Grant Fiscal Guidelines Page 2 of 5 Tuition Tuition and required fees (lab fees, technology fees, etc.) for eligible students. See Early Achievers Grant- State Funding Program Guidelines for more information regarding tuition. Colleges must budget a minimum of $4,800 per FTES in this category. Books Required books and/or instructional materials for eligible students. The college must receive and maintain receipts for all purchases. Colleges may budget $1,000 per FTES in this category. If needed, colleges may move funds from this category to the tuition category to help cover required fees. Misc. The miscellaneous budget category may be used for: funds to support general student support for faculty to teach student success classes, tutoring, counseling, retention strategies emergency support services such as emergency childcare, emergency transportation, or other emergent student costs. Colleges may budget a maximum of $1,000 per FTES in this category. If needed, funds can be moved to the tuition and/or books budget categories. Additional funds may not be added to this category. Budget Revisions SBCTC approval of a revised budget is required if there is more than a 10% variation in expenditure levels by main budget categories (individual budget cells). Budget revisions must be submitted to SBCTC via the Online Budget & Invoicing System (OBIS – http://apps.sbctc.edu/obis2) no later than June 15, 2017. Please see guidance on how to format budget narrative explanations: http://www.sbctc.edu/college/_e-grantbudget-fiscalinfo.aspx Invoicing Funds for this grant must be claimed on a reimbursement basis. No payments in advance of or in anticipation of goods or services provided under this grant shall be requested or paid. All costs must be reported for the period incurred. Reimbursement requests must be submitted at least quarterly, but not more than monthly using the Online Budget and Invoicing System (OBIS – http://apps.sbctc.edu/obis2). All costs must be submitted for reimbursement in accordance with the schedule shown below. For expenses incurred: July – September 2016 October – December 2016 January – March 2017 April – June 2017 FY17 Early Achievers Grant Fiscal Guidelines Invoice no later than: October 31, 2016 January 31, 2017 April 30, 2017 July 13, 2017 Page 3 of 5 GRANT TERMS & FINANCIAL INFORMATION 2016-17 Early Achievers Grant General Financial Information State funds for these grants are provided to the State Board of Community and Technical Colleges (SBCTC) from the Washington State Department of Early Learning (DEL). The following state and federal regulations must be followed: Applicable Washington State Regulations The State Administrative and Accounting Manual (SAAM) must be followed: http://www.ofm.wa.gov/policy/default.asp Allowable Activities Activities authorized under this sub-grant are as approved in your project request. Expenditure Accounting These funds must be kept in an account separate from all other funding sources. For colleges these funds must be accounted for in grant and contract (fund 145). SBCTC reimbursement for this grant must be coded to object SX (611100 for colleges in ctcLink). Wrap-Around Support Services Funding for wrap-around support services (budgeted and invoiced in the “Miscellaneous” budget cell) may be considered revenue or reimbursement. If considering it as revenue, it must be coded as 0499 (343300 for colleges in ctcLink) and used to fund future Early Achiever Grant activities. If non-Early Achiever Grant funds have already been spent funding can be used as reimbursement for those expenses. Monitoring SBCTC or the Department of Early Learning (DEL) may schedule monitoring visits during and after the grant period to evaluate the fiscal progress and performance of the program and provide technical assistance. The purpose of monitoring is to ensure regulatory and contractual compliance on the part of grant recipients. To ensure compliance with grant requirements and to ensure that financial records support program expenditures, SBCTC or DEL staff will schedule on-site visits. Publicity and Publications The college must submit to SBCTC all advertising and publicity matters relating to this grant in which the State of Washington or the Department of Early Learning’s (DEL’s) name, state seal or logo is mentioned or used or language is used from which a connection with the State of Washington or DEL may, in DEL’s judgment, be inferred or implied. The college shall not publish or use such advertising and publicity matters without the prior written consent of SBCTC and DEL. All publications funded, in whole or in part, under this grant must use the DEL logo and must acknowledge credit as either providing “funding in partnership with” or “funded by” DEL. The full-color or black-and-white DEL logo, provided by the DEL, shall appear in its entirety, without modification. FY17 Early Achievers Grant Fiscal Guidelines Page 4 of 5 Records Retention Financial management systems shall reflect accurate, current, and complete disclosure of all cost expenses for grant activities. Grant recipients are to maintain books and records, supported by source documentation, that sufficiently and properly reflect the source of funds and all costs expended for program purposes. These records and financial statements are subject to inspection, review, reproduction, and/or audit by SBCTC or its designee for at least six years after the dispersal of funds, the termination or expiration of the contract, or the resolution of litigation or audits related to the program, whichever is latest. Additional information on records retention may be found on the web: http://www.sbctc.ctc.edu/docs/general_retention_schedule.pdf Termination This grant may be terminated by the SBCTC upon giving notice in writing to the grant recipient at least thirty (30) days in advance of the date of termination. If the grant is terminated for any reason, all reports and data gathered by grant recipient prior to termination shall at the option of the SBCTC, become the property of the SBCTC. If termination shall occur pursuant to this section, reimbursement to grant recipient shall be made on the basis of work performed prior to the effective date of termination as mutually agreed upon by both parties. Determination of final adjustments, either payments or refunds, shall also be mutually agreed upon by both parties. Termination for Cause If for any reason, the grant recipient violates any terms and conditions of the Perkins program, SBCTC will give the grant recipient notice of such failure or violation. Grant recipient will be given the opportunity to correct the violation or failure within thirty (30) days. If failure or violation is not corrected, this grant may be terminated immediately by written notice from SBCTC. Savings In the event funding from state, federal, or other sources is withdrawn, reduced, or limited in any way after the effective date of this contract and prior to normal completion, the SBCTC may terminate the grant under the "Termination" clause, without the thirty-day notice requirement, subject to renegotiation at the SBCTC’s discretion under those new funding limitations and conditions. Fiscal Contacts If you have fiscal questions, please contact: Susan Wanager: 360-704-4344 / swanager@sbctc.edu Michele Rockwell: 360-704-4343 / mrockwell@sbctc.edu FY17 Early Achievers Grant Fiscal Guidelines Page 5 of 5