Price and Value Study September 2009

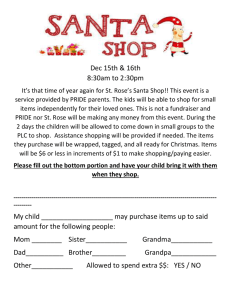

advertisement

Price and Value Study September 2009 Context and Background With the current economic climate, Price is becoming an increasingly significant factor in all sectors including food and drink. Bord Bia’s “Feeling the Pinch” study in January 2009 found almost 9 in 10 consumers agreed that they pay more attention to grocery prices in that last 6 months than previously note (increase of 9%). In this study almost 9 in 10 claim to be shopping around for value more than before In light of these findings, Bord Bia commissioned this study in order to understand consumer and shopper attitudes to price and promotions to assist clients and help them compete more effectively. Methodology We surveyed a total of n=1,810 main household grocery shoppers, online, in the Republic of Ireland The sample was representative in terms of sex, age, social class and region. The Interview length was between 15 and 20 minutes The fieldwork was conducted between 3rd and 12th August 2009 MARKET UNDERSTANDING Attitude To Shopping – Value (Base: All Main Grocery Shoppers, n= 1,810) (Q2) Value Orientated Statements Strongly Somewhat Somewhat Disagree Disagree Agree I regularly purchase brands on promotion as part of my grocery shop Strongly Agree I tend to shop around for value more than I used to for groceries I generally shop around for best deals when it comes to grocery shopping I often choose which store to do my grocery shop in on the basis of value for money Value is the main reason I tend to Shop where I shop Value-oriented statements attract significant levels of endorsement in the current climate. Clear behavioural shift Attitudes To Shopping – Quality (Base: All Main Grocery Shoppers, n= 1,810) (Q2) Quality Orientated Statements Strongly Somewhat Somewhat Disagree Disagree Agree Having a wide range or selection of items is the main reason I choose store for grocery shopping Strongly Agree The quality of the items I buy is more important to me than the price I pay for them I tend to choose products that are healthy for me and my family regardless of cost I prefer to purchase brand I know rather than looking for best price I tend to choose the store that is closer to me for my grocery shop In relative terms quality orientated statements attract lower levels of endorsement than value statements. Few can categorically dismiss price as a factor in decision making Attitudes To Shopping - Budget (Base: All Main Grocery Shoppers, n= 1,810) Budgeting Statements Strongly Somewhat Somewhat Disagree Disagree Agree Strongly Agree I often spend more than I had planned to when grocery shopping I have a set budget for my grocery shop and stick to it … strict adherence to a budget is not the norm as yet, but would be intriguing to see how this behaviour develops over time … SHOPPER SEGMENTATION Attitudinal Segmentation Process Factor Analysis Segmentation Factor 1=Value Based 1. Indulgers -Shop around for best deals - Regularly purchase brands on promotion -Shop for value more than I used to - Value is main reason where I shop - Often choose store to shop on basis of value for money -I have a set budget for my grocery shop and stick to it Factor 2=Brand Based -Prefer to purchase brands I know - Tend to choose the store that is closest to me -Quality of items I purchase is more important than the price I pay -I tend to choose products that are healthy for me and my family regardless of price -Often spend more than I had planned to when grocery shopping Factor analysis performed to establish core themes emerging within respondents answering patterns to attitudinal statements. Two distinct themes emerge (value and brand). Cluster Analysis Attitudinal Statements 2. Compromisers 3. Strugglers 4. Value Hunters The defined factors (value & brand) then were fed into a cluster analysis process where 4 distinct attitudinal segments emerged. Penetration Of Attitudinal Segments (Base: All Main Grocery Shoppers, n= 1,810) Compromisers 28% Strugglers 27% (582,836) (604,432) Indulgers 20% Value hunters (431,730) (539,663) 25% Quality Oriented Value Oriented ( ) Population Number from CSO Estimates 2009 Consumers defined by their relative emphasis on quality vs value ….. Most/Least Likely To Say By Segment Indulgers • Most likely to say: – I prefer to purchase brands I know rather than looking for best value. – The quality of items I purchase in more important than the price I pay. – I tend to choose product that are healthy for me regardless of cost. • Least likely to say – Value is the main reason I choose to shop where I shop. – I often choose which store to conduct my grocery shop on the basis of value for money. – I generally shop around for the best deals when it comes to grocery shopping. – I have a set budget for my grocery shop and stick to it Compromisers 28% • Most likely to say: – I prefer to purchase brands I know rather than looking for best price. – I tend to shop around for value more than I used to for groceries. – The quality of items I purchase in more important than the price I pay. – I regularly purchase brands on promotion as part of my grocery shop. • Least likely to say – Value is the main reason I choose to shop where I shop. – I have a set budget for my grocery shop and stick to it While both groups have a degree of quality orientation, Compromisers are changing their behaviour to find value more than they did previously and are influenced more by promotions Most/Least Likely To Say By Segment Strugglers 25% Value Hunters • Most likely to say: – I tend to shop around for value more than I used to for groceries. – I generally shop around for best deals when it comes to grocery shopping. – I regularly purchase brands on promotion as part of my grocery shop. • Most likely to say: – Value is the main reason I choose to shop where I shop. – I generally shop around for the best deals when it comes to my grocery shopping. – I often choose which store to conduct my grocery shop on the basis of value for money. • Least likely to say – I tend to purchase brands I know rather than looking for best price. – I tend to choose the store that is closest to me for my grocery shop. – I often spend more than I had planned to when grocery shopping • Least likely to say – The quality of items I purchase is more important to me than the price I pay for them. – I tend to choose the store that is closest to me for my grocery shop. – I prefer to purchase brands I know rather than looking for the best price. Strugglers are certainly value-conscious, and they actively seek VFM but stop short of claiming it is the main reason they choose where to shop. Quality Orientated Statements By Segment (Base: All Main Grocery Shoppers, n= 1,810) Index vs. Total (Total = 100) Quality Orientated Statements Based On Strongly Agree Value Indulgers Compromisers Strugglers Hunters Having a wide range or selection of items is the main reason I choose store for grocery shopping 139 118 100 53 The quality of the items I have is more important to me than the price I pay for them 217 125 58 21 I tend to choose products that are healthy for me and my family regardless of cost 216 137 63 16 I prefer to purchase brand I know rather than looking for best price 250 128 50 17 I tend to choose the store that is closer to me for my grocery shop 233 133 50 11 I often spend more than I had planned to when grocery shopping 134 107 83 79 I have a set budget for my grocery shop and stick to it 71 88 106 129 Budget Orientated Statements Indulgers are evidently less price-conscious with a significantly greater emphasis on quality over value… Value Orientated Statements By Segment (Base: All Main Grocery Shoppers, n= 1,810) Index vs. Total (Total = 100) Value Orientated Statements Based On Strongly Agree Value Indulgers Compromisers Strugglers Hunters I regularly purchase brand on promotion as part of my grocery shop 60 91 110 113 I tend to shop around for value more than I used to for groceries 32 85 119 146 I generally shop around for best deals when it comes to grocery shopping 34 74 125 157 I often choose which store to do my grocery shop in on the basis of value for money 22 66 120 172 Value is the main reason I tend to Shop where I shop 26 72 113 178 As the name suggests, Value Hunters place singular emphasis on the quest for value – a stark contrast with Indulgers Segmentation Profile - I (Base: All Main Grocery Shoppers, n= 1,810) Index vs. Total (Total = 100) Total Sample Gender Indulgers Compromisers Strugglers Value Hunters Male Female 109 107 91 98 93 94 107 102 18-24 25-34 35-44 45+ 89 100 89 122 100 100 103 100 90 93 103 107 118 107 96 86 72 95 110 115 118 103 93 90 115 94 119 147 79 70 115 88 113 100 89 100 85 106 94 87 105 115 85 100 94 87 116 115 Age Dep Kids Yes No Lifestage Young & Single Early Settlers Mid Age, no kids Empty Nesters Young families Mature families Value seeking and family commitments go hand in hand! Main Grocery Shop Outlet by Segments (Base: All Main Grocery Shoppers, n= 1,810) Index vs. Total (Total = 100) Total Sample Indulgers Compromisers Strugglers Value Hunters Tesco 88 107 95 100 Dunnes Stores 110 110 105 76 Lidl 50 67 125 142 SuperValu 136 109 91 64 Aldi 29 43 114 200 SuperQuinn 200 125 50 25 Convenience 300 200 100 0 Average number of stores shopped in regularly for groceries 2.8 3.1 3.3 3.6 Value chasers over index on discounters, but also shop across a broader repertoire of stores. Pen Portrait - Indulger • John is 55 years old and lives in Clontarf. He is married to Elaine and they have two children, Brian and Emma. Brian is 26 and has just started working for a Bank in the city centre. Emma is 24 and is currently doing her masters in UCD. Both Brian and Emma have their own places in town, but loving coming home every couple of weekends for a home cooked meal and a “catch-up”. • John is a senior manager in an Insurance company in the city centre and drives his Saab 93 to work every morning. He enjoys playing golf with his friends on Saturdays, and usually eats out with his wife and friends on a Saturday night. He plans to retire in 5 years, and has invested his money wisely despite the recent economic problems. • Elaine generally does the main grocery shopping in Superquinn on a Sunday afternoon, and John often gets requests from Elaine to pick up certain things from Marks & Spencer’s in the city during the week. John also finds himself regularly having to nip out to the local Spar in the evening time to pick up extras, and his local off license for a bottle of wine. • John always purchases the brands he knows and likes. He does not have time for looking for the best deal, especially as he is generally just shopping for himself and Elaine. He has however become more aware of the healthier options available to him, but would only ever look for these alternatives within brands that he knows and trusts. Pen Portrait - Compromiser • Sean is 30 years old and is a primary school teacher in Galway. He recently bought a new apartment, where he lives and rents the spare bedroom to a friend of his. He is currently single, but has been seeing Jane on and off for a while. • Sean likes socialising with his friends at the weekend, and plays football on a Wednesday night with the lads to keep fit and enjoy the craic. He does however notice the few Euro less in his account every month since the introduction of the pension levy. He still has enough money to pay his mortgage and go out at least one night every weekend, but he is having to face up to the reality and consequent fears of the downturn. • He is not in the eye of the economic storm, but the carefree consumerism that he enjoyed in recent years is being replaced by a certain degree of conservatism and financial prudence. He now feels obliged to cut back for fear of what might happen in the future. He realises for the first time that nothing is certain. • Sean generally shops in Dunnes Stores, but he has noticed that the new Tesco in town does some great offers on meat and beer. He also tends to make about one trip a month to Aldi, where he tends to purchase some specialiity cheeses, foreign beer, washing powder in bulk, detergents and have a look at the special items they have on sale. • Sean is swayed by promotions on brands that he likes. He generally does not use all the food he buys on promotion and has to throw it out when it passed the best before date. Pen Portrait - Struggler • Marie is 35 years old and is a housewife from Monaghan. She is married to Barry, who works in a local factory. Barry recently had to take a 20% cut in salary, but avoided being made redundant; a number of his colleagues were let go. • Marie and Barry have 3 young children, aged 6, 3 and 2. Marie has contemplated looking for some part time work to help out, but there is very little out there at the moment and the cost of child care means there is little point in pursuing this at the moment. She has certainly noticed how much more difficult it is to make ends meet, and had to cancel their summer holiday earlier this year. • Marie shops mainly in Tesco nowadays, given the money she can save with the new ‘change for good’ campaign. She saves almost €50 on her weekly shop now compared to what she used to pay in Superquinn. She visits Lidl on a regular basis as she finds it great to stock up on a number of items for the kids, as well as washing powder and some toiletries. She finds it hard now to justify shopping in Superquinn except for special occasions. • Marie is fearful for the future of her family, and doesn’t know what would happen if Barry lost his job. She sticks very closely to her shopping list and would rarely go over budget unless there was a promotion on something like meat, tea or nappies, something that will be used up in the future. Pen Portrait – Value Hunter • Siobhán is 42 years old and is from Limerick. She is married to Jim who is a self employed joiner but is struggling to get consistent work at the moment; it’s mainly cash in hand. They have 4 children, aged 16, 11, 8 and 4. • Siobhán always seems to struggle paying the bills, even in the “good times”, but this is especially the case at the moment as Jim tries to look for something more consistent. She is fearful for the future given the amount of negative media out there about the future of the construction industry. She found it hard to fork out for new school books for her children recently. Life is a financial struggle and money influences decision making in every aspect of life. • She has started going back to Tesco since she heard from friends about the savings they made, but she shops in other places also. She tends to do 1 grocery shop per week, generally on a Saturday morning when Jim looks after the kids. She goes to Tesco, then Lidl to stock up on the household goods she needs. She also goes to Dunnes Stores when they advertise special offers that are relevant to her. Shopping around for the best deals is a constant theme. • Siobhán is long since converted to purchasing mainly private label groceries and has always felt the Tesco and Dunnes Stores own label goods are the same as any others. She is very good at sticking to her shopping budget and always knows exactly where she will get the best value for the groceries she needs. Purchase Frequency For Main Food Categories (Base: All Main Grocery Shoppers, n= 1,810) Frozen Cheddar Frozen Tea Boxes of Beef Bread Water Cheese Chicken Bags Chocolates Burgers More than once a week 61% 17% 10% 8% 3% 2% 2% Once a week 29% 24% 47% 22% 18% 3% 13% Once every 2 weeks 5% 13% 24% 16% 24% 4% 12% Once a month 2% 11% 9% 14% 28% 11% 16% Every 2-3 months 1% 8% 4% 12% 16% 22% 13% Every 6 months 0% 6% 2% 6% 5% 23% 9% Once a year 0% 2% 0% 4% 2% 21% 5% Less than once a year 0% 3% 0% 4% 1% 9% 6% Never 1% 16% 3% 14% 3% 5% 24% AVERAGE PER MONTH 6.2 2.7 3.3 2.1 1.8 0.6 1.2 Of the categories researched, not surprisingly Bread has the highest purchase frequency per month, with Boxed Chocolates the lowest Average Times Per Month Main Categories Purchased In Multiples (Base: All Main Grocery Shoppers, n= 1,810) Index vs. Total (Total = 100) Total Sample Average Times Purchased Per Month Indulgers Compromisers Strugglers Value Hunters Bread 94 98 103 104 Cheddar Cheese 88 101 104 104 Water 100 106 96 98 Frozen Chicken 94 96 96 114 Tea Bags 97 105 100 97 Frozen Beef Burgers 86 100 98 113 Box Of Chocolates 127 121 88 68 Interestingly there are no significant differences in monthly purchase frequency across the segments for the categories of interest, with the exception being Boxed Chocolates for Indulgers and Compromisers, and Frozen Chicken and Burgers for Value Hunters Category Purchase Tendency Towards Private Label and Branded Items (Base: All Main Grocery Shoppers, n= 1,810) On a 10 point scale, where do you belong in terms of your purchasing of <category> for your household? Tend to buy Private Label (1-3) Tend to buy Branded (4-7) (8-10) Tea (n=530) Boxed Chocolates (n=561) Bread (n=605) Cheese (n=603) Frozen Meat (n=602) Water (n=573) Tea, Chocolate and Bread show strong tendencies towards branded purchases, while water is the most prevalent private label purchase Branded Purchase For Categories By Segment (Base: All Scoring 8-10 (branded) in terms of Private Label vs. Branded purchasing) Branded Incidence Total Index vs. Total (Total = 100) (Base on Score 8-10 from Q1a) Indulgers Compromisers Strugglers Value Hunters Bread 133 120 88 69 Cheese 148 114 76 67 Chocolate 117 103 98 97 Frozen Meat 121 126 82 84 Tea 114 106 79 86 Water 142 130 85 55 There is a strong over index for Indulgers and to an extent Compromisers among general ‘Branded’ grocery shoppers Private Label Purchase For Categories By Segment (Base: All Scoring 1-3 (Private Label) in terms of Private Label vs. Branded purchasing) Private Label Incidence Total (Base on Score 1-3 from Q1a) Index vs. Total (Total = 100) Indulgers Compromisers Strugglers Value Hunters Bread 70 70 85 175 Cheese 39 65 113 157 Chocolate 111 78 111 122 Frozen Meat 94 63 106 138 Tea 56 78 89 167 Water 66 71 111 149 Unsurprisingly, strong over index across all categories for Value Hunters among general ‘Private Label’ purchasers Category Purchase Routine Vs Experimentation (Base: All Main Grocery Shoppers, n= 1,810) On a 10 point scale, where do you belong in terms of your purchasing of <category> for your household? Tend to buy same… (1-3) Experimenter… (4-7) (8-10) Tea (n=530) Water (n=573) Bread (n=605) Frozen Meat (n=602) Cheese (n=603) Boxed Chocolates (n=561) Both tea and water show a stronger degree of loyalty towards the same brand relative to the other categories.