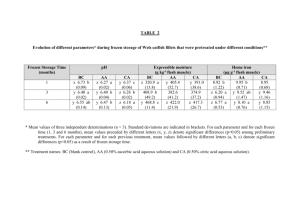

The future of frozen food

advertisement