Snacking In Ireland & UK – Full Report March 2014

advertisement

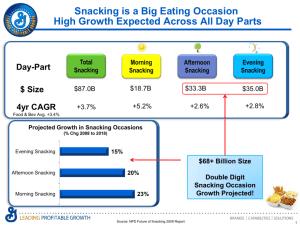

Snacking In Ireland & UK – Full Report March 2014 Contents Introduction & Research Objectives..................................................................................... 1 Research Method .................................................................................................................... 2 Executive Summary ................................................................................................................. 4 Key trends impacting snacking ............................................................................................. 6 Consumer Definition of a Snack ............................................................................................ 9 The changing role and function of snacks ........................................................................ 10 Planned versus Impulse Snacking - Occasion based marketing.................................... 12 How often are we snacking? ............................................................................................... 13 What do we snack on? ........................................................................................................ 14 At home versus out of home snacking………………………………………………………..20 When do we snack ............................................................................................................... 23 Spend on snacking occasions ............................................................................................. 24 Motivations to Snacking – Why do we snack? .................................................................. 26 Snacking and the Youth Segment ...................................................................................... 41 Appendix I –Total Snacking Occasion Specifics ............................................................... 45 Appendix II – Out of Home Snacking Specifics ................................................................. 47 Appendix III – Segment Deep Dives.................................................................................... 49 Appendix IV – Individual Snack Categories ...................................................................... 63 Appendix V – Category Deep Dives .................................................................................. 66 Appendix VI – Need State Deep Dives .............................................................................. 72 Appendix VII – Attitudes to Snacking ................................................................................. 84 Appendix VIII – Regional Differences………………………………………………...…..……85 Introduction & Research Objectives This report looks at snacking patterns in Ireland and the UK and is based on consumption data and not sales data. The primary research objective was to understand the snacking occasion in order to identify opportunities for Irish food and drink companies. The more specific objectives were defined as: Understanding the consumer Gain a detailed profile of consumers Deep dives into key categories To track patterns of snacking throughout the day and across the week Understand the key snacking need states across the segments Purchase decision making Identify snacking purchase channels 1 Research Method There were two phases to the research: Phase One: Qualitative In Ireland, there were four standard focus groups with the key younger life stage segments (aged 16 – 35 years) In the UK, there were several online discussion groups with the sample broken out by life stage and region, with 56 respondents involved in the five day discussion based on five topics. Phase Two: Quantitative There were two parts to this phase: Firstly, there was an online survey with adults aged 16+ across Ireland and the UK. Total sample of 3,000 respondents, who were nationally representative. This produced 7,358 snacking occasions. Secondly, in order to understand snacking behaviour of the younger population, we asked Mums to complete a diary of kids aged 10 – 15 years. This resulted in 4,886 snacking occasions. In total we have 12,244 snacking occasions. We have continued to keep the adults and youth data separate in this report. The research was carried out on our behalf by Coyne Research. 2 Meet the Segments In the online adult survey, we looked at six segments: 1. Young adults, aged 16 – 24 years 2. No kids, 25 – 39 years 3. Young families, 17 – 39 years 4. Child free, 40 – 59 years 5. Established families, 40 – 59 years 6. Silvers, 60+ years (We also had the Youth booster of 10 – 15 year olds) For further information on this study please email info@bordbia.ie or telephone 01 6685155. Note: Findings from the study were very similar across Ireland and the UK. Therefore figures outlined, unless specified, are average across the markets. Where there are major differences between regions we have highlighted them in the report. 3 Executive Summary Key trends that are impacting both on a global and local snacking level are Migration and broadening of tastes; Recession and austerity; Health & Wellness and the obesity epidemic and Busy lives Consumer Definition of a Snack “Something, usually smaller than a meal that is eaten between, or outside of, regular meals for any reason” Snacking is considered a personal occasion (I decide when, where and what I’ll eat). It is convenient in terms of portability, not requiring utensils and little or no preparation. Drinks on their own are not considered a snack but accompany 42% of snacks, with hot drinks being the most popular beverage of choice. We are starting to see a new emerging role for snacks amongst the younger demographic. Snacks are now increasingly being seen by them as a ―boost‖ (as opposed to the traditional mindset of a ―treat‖). They are moving to a more constant grazing throughout the day and less likely to have three set meals, therefore requiring the snack to perform a broader, more nutritive function. Snacking is becoming more “planned” From the research we can see that people are anticipating their snacking needs more, particularly as they get older. Seven out of ten snacks are purchased in a supermarket, with 59% bought as part of the larger shop. In terms of total snacks, the leading pack format was multipack at 34% but when we look at out of home snacks alone, this figure drops to 28%. 4 How often: On average we snack 2.55 times per day, with Young Adults (16 – 24 year olds) being the highest snackers at over three times a day and the Silvers being the least likely to snack at 2.2. times per day. What: The top three snacking categories across all markets are confectionary (21%), crisps and (15%) and fruit (12%) Where: Four out of five (78%) snacking occasions occur at home and 22% are out of home. 72% of total snacks are purchased in the supermarket. When: We snack regularly throughout the day, with the peak period being between 3pm and 6pm accounting for almost one quarter (23%) of all snacking occasions. Why: Five key need states were identified for snacking – To energise (26%), as a habit (22%), indulge (21%), nourish (18%) and for health and wellbeing (13%) How much: On average we spend €2.13 per snack in the Republic of Ireland and £1.59 in the UK. In the Republic of Ireland, the Silvers are the top spenders on snacks and the Youth group the lowest. In the UK, the biggest spenders are those without children and the lowest are the Youth Segment. 5 Key trends impacting snacking On a global level, we are seeing four key trends impacting snacks, which also came across in the research: - Migration and Broadening of Tastes - Recession and Austerity - Obesity Epidemic - Busy Lives Migration and Broadening of Tastes: More people are travelling, with new tastes being discovered from other countries and brought back home. This has resulted in an explosion of choice within grocery and expanding offerings from familiar brands and products, with the rise of ethnic products on shelf. There is an increased interest in the rise of ―super foods‖ sourced at home and aboard. In particular, natural ingredients such as guarana, goji, green tea etc., which offer new health benefits to the consumer. Recession and Austerity While austerity has brought about greater emphasis on cost, discounters have opened up a world of choice for shoppers. From the research, Mums in particular felt this abundance of value foods was a key difference from previous generations. In the past, once the snacks were all eaten, that was it for the week, but now it is more affordable to have snacks in the house on an ongoing basis. 6 Health & Wellness and the Obesity Epidemic It was generally agreed that health is a key consideration today and there is a need to fight against the obesity epidemic. The younger demographic in particular were informed about nutrition and healthy eating. The media is playing a large role in influencing consumers about what to eat and cook, in terms of celebrity chefs, magazines and cooking demonstrations. Slimming clubs and points schemes are very much part of everyday life and helping consumers to be more informed about snacking. The healthy lunch box policies implemented by schools are also impacting what children are allowed to snack on and influencing general attitudes around what is good to eat. Busy lives People are under pressure trying to maintain a work/life balance. They are looking for ways to make feeding themselves and their families easier. Whether this means more eating on the go for the consumer or having convenient solutions which are readily available to eat at home—people crave convenience. 7 8 Consumer Definition of a Snack There was broad scale consensus across markets and demographic segments as to snacks’ main characteristics. It is defined as: ―Something, usually smaller than a meal that is eaten between, or outside of, regular meals for any reason ‖ The main reasons to snack were for energy, nourishment, health & wellbeing, to indulge and as part of an everyday habit. Snacking is considered a largely ad hoc personal occasion (versus meals which have traditionally been more planned and often a shared occasion). People decide when they wish to snack on and when, without consulting others. Snacks are convenient in terms of portability, requiring little or no preparation time and not requiring utensils. Snacks in general contain less than 300 calories. Meals are definitely not snacks as they require preparation, utensils, sitting down and a have a broader nutritional function. Beverages on their own are not considered a snack In the main, beverages were not considered snacks as snacks should satisfy hunger versus thirst. Smoothies and healthy shakes were most like a snack but still a meal in ―liquid form‖. However drinks do form part of the snacking occasion with 42% of adults 9 consuming a drink with a snack e.g. coffee and muffin, tea and biscuits or a sandwich and water. Hot drinks (tea and coffee) make up half of the beverages. Northern Ireland is more likely to have a drink with snacks at 44%, compared with Great Britain at 40% and Republic of Ireland at 43%. The choices of drinks with snacks do vary by cohorts (see appendices for full breakdown by segments). The Youth drink juice/milk while older cohorts snack with tea and coffee, or alcohol. Bottled water, carbonated soft drinks and coffee all show higher incidence of consumption out of home, while tap water and tea are more favoured in home. The changing role and function of snacks We are starting to see two different interpretations emerging as to what the role of a snack should be. In general, everyone is eating the same snacks. Therefore it is not what people snack on that is changing, but more what people expect their snacks to deliver. Younger consumers demand more from their snacks in terms of the benefits which they provide. 10 44% of young adults want snacks that will get me through the day and one third (33%) prefer to snack during the day rather than overeat later on. Traditional Mindset: Very much consider snacks as ―treats‖ such as confectionary or biscuits. They are typical of the older segments and C2DE. They may even omit ―fruit‖ due to the lack of sin or guilt involved. Emerging View: Snacks are now increasingly being seen as ―boosts‖ by a younger population, typically ABC1. They consider a wider range of foods as snacks (fruit, seeds, nuts) and have a wider range of usage occasion. They are also moving towards a more constant grazing throughout the day. Amongst younger segments there is appears to be a growing reliance on snacks to perform a broader, more nutritive function than in the past. 11 Planned versus Impulse Snacking - Occasion based marketing The majority of snacking occasions recorded come from formats - i.e. multipacks - are bought that as part of a pre-planned purchases. The occasions may be impulse. In particular this occurs more with the older, more experienced generations. They anticipate snacking occasions and purchase in advance to forestall impulse, which allows them to: Stock up on healthier options. Achieve cost efficiencies through buying in bulk. Choose cost effective channels (the supermarket). The younger population, who have less of a routine in their daily lives, snack on impulse for two main reasons: Caught short by unexpected situations (ability to anticipate these increases with age) Tempted by appetising offerings. 12 How often are we snacking? Across Ireland and the UK, the average number of snacks consumed per day is 2.55. The Republic of Ireland averages at 2.50 snacks, Great Britain at 2.56 and Northern Ireland at 2.63. Looking at the segments, it is the Young Adults that are biggest snackers, averaging 3 snacks per day, followed by Young families at 2.9. Both of these segments are adjusting to relatively new, chaotic lifestyles which lack a fixed routine. In terms of social classes, ABC1/F50+ snack 2.48 times per day compared with C2DE/F50 at 2.62 Females are slightly more likely to snack at 2.61 occasions versus males at 2.46. 13 What do we snack on? Over one third of all snacks consumed across Ireland and the UK are confectionary and crisps. Our top five snacks are confectionary; crisps (including popcorn and nuts), fruit (dried and fresh), breads and rolls and sweet buns. Within confectionary, two thirds of this is made up of milk chocolate. 14 *** see appendices for individual snack category breakdown If we look at what we snack on by cohort, we can see that Young Adults are more closely aligned with Fast Food, Confectionery and Non-Confectionery bars. The Youth show very high incidence of more robust snacks; Sandwiches/Breakfast Cereals. Biscuits and Sweet Bakery is the preserve of older Cohorts (aged 40+), who are also the highest consumers of fruit. 15 16 Confectionary Deep Dive Confectionary makes up one in five of our adult snacking occasions at 21%. Milk chocolate accounts for 2 in 3 confectionery occasions. Dark chocolate is higher within the health & wellbeing need state. Jellies and hard sweets see minimal consumption. Only a third (32%) of confectionery snacks are accompanied by a drink, with tea representing the majority of these occasions, followed by coffee and soft drinks The key confectionery need-states are nourishment and indulgence. Young Adults are by far the highest consumers – over a quarter of all Young Adult snacks are from this category. Over three quarters (77%) of confectionery consumption was during leisure or down-time. Other activities include working, studying, housework or while travelling. Only one in four (23%) confectionery snacks is consumed out of home with work and car the main out of home locations. Later day parts are key confectionery consumption times particularly from 3pm on. Top purchase drivers for confectionary: 17 Crisps Deep Dive Crisps are seen as an excellent on the go snack –convenient, affordable & portable. However healthy would be the key barrier to increasing consumption. Currently they make up 15% of all snacking occasions with standard crisps making up over half of these occasions. 42% of crisp snacks are accompanied by a drink – almost one quarter of this (24%) is with fizzy drinks and one fifth (21%) are with alcohol. Four out of five crisp snacking occasions (81%) take place at home, mainly watching TV, listening to radio or while on the internet (51%). If out of home consumption, it will be when walking, playing sport or on transport. Highest preferences for crisps are found in Northern Ireland, where 18% of all snack occasions are crisps, compared with 12% in ROI and 16% in Great Britain. Evening and night time are key consumption time, with over one quarter of occasions (26%) taking place between 6pm and 9pm Top purchase drivers for crisps: 18 Fruit Deep Dive Across the markets, fruit makes up 12% of all snacking occasion, with fresh fruit representing three quarters of the fruit snacks. Only one in five fruit snacks are accompanied by a drink (mainly tea, coffee bottled or tap water). 72% of all fruit consumption as a snack takes place at home. Of the out of home consumption (28%), two thirds occurs in the workplace. Child free (40 – 59 years) and Silvers are more likely to snack on fruit. In terms of time of day, morning (29% between 7am and 12pm) and afternoon (27% between 3pm and 6pm) are popular fruit occasion, with less consumption at night versus average. Key purchase drivers for fruit 19 At home versus out of home snacking Out of the 7,358 adult snack occasions, 78% of those are taking place at home, with 22% outside of the home. It is the Silver cohort (87%) that is more likely to snack at home and the Young Adult and No Kids more likely to snack outside the home at 27% and 28% respectively. It comes as no surprise that more out of home snacking happens in the earlier part of the day and also in the earlier part of the week with school and work being key locations. 84% of all OOH snacks occur between 7am and 6pm. 85% of all out of home snacks occur during the week. Under one in ten out of home snacks are consumed in the car. 20 Key differences for out of home snacking versus total snacking 1. Where the snack was purchased: For total snacks, more than seven in ten snacks are bought in the supermarket. However for out of home snacks below, less than half are bought in the supermarket with one fifth bought in a convenience store. 2. Packaging Formats: If we look at packaging formats for the total adult snacks, more than half are either multi-pack or single serve. 21 However when we look at out of home snack, we see multipacks drop from 34% to 28% and individually sold snacks rising to 28%: 3. For total snacks, 59% were bought as part of a wider shop, with other items bought. This drops to 34% for out of home snacking. 4. We are more likely to over index on confectionery and fruit, with preference for coffee, fizzy drinks and water versus in home (See appendices for further figures) 22 When do we snack? Based on the adult study, we snack evenly throughout the week and the weekend. Our snacking needs decline slightly at the weekend due to more later rising times, longer meals etc. Snacking is evenly spread across day parts up until 9pm with afternoon being the peak snacking occasion with almost a quarter of snacks (23%) taking place during this three hour period. Over a fifth of snacks are consumed in the morning, before 12pm and a further fifth in the evening between 6 and 9pm. 23 Spend on snacking occasions The question we asked respondents was ―How much did you spend on the snack‖ and people would have included a drink (if consumed) as part of the overall spend. Half of all snacks, across segments, came in at €2.13/£1.57. Silvers are highest spenders in ROI and amongst the lowest in UK. In both markets Child Free (40-59) spend highest amount on each snack while males and C2DE spend more versus their counterparts. UK market more homogenous in terms of minimum and maximum spend while greater differences are evident across demographics in ROI. 24 In the UK, the biggest spenders are those without children and the lowest spenders are the Youth segment. 25 Motivations to Snacking – Why do we snack? We have identified five key need states based on the 12,244 snacking occasions. As you can see below, Energising is the number one need state representing more than one quarter of all snacking occasions: Young adults, closely followed by Young Family, are most prolific snackers for energy needs. Over a third of Silvers’ snacking is driven by habit. Nourishment and Energy are rationale behind younger No Kids segment. Youth record high Health & Wellbeing snacking. 26 Health and Wellbeing, Nourishment and Indulgence are evenly distributed across the week. The Everyday Habit need-state is somewhat more prevalent at weekends while snacking to Energise is more likely in the later week parts. 27 Time of the day by Need States Typically we can class the need states into certain times of the day: 1. Energising (accounts for 26% of all snacking occasions): Definition: ―To boost physical or mental energy levels‖. The energising need state can be broken down into physical energy accounting for 15% of all snacking occasions and mental focus at 11%: Physical energy snacks are sought for an immediate redress of blood sugar levels, to redress low batteries so that you can keep going and also in a proactive manner for stamina and endurance for an upcoming activity. Mental focus snacks are required to refresh body or mind through sugary or sweet food boosts. Who: Young adults are the most frequent “energising” snackers, followed by younger families and the no kids cohort. 28 When: Energising snacking does occur throughout the day but most noticeably peaking in the afternoon from 3pm-6pm. It appears to be less likely at the weekend. Physical energy boosting snacks are often consumed on an ad-hoc basis since it is a highly functional occasion. All day grazing predominantly occurs to ensure that energy levels are topped up. Mental Focus snacks are often consumed to combat slumps, therefore featuring at 11am mid-morning and 3pm mid-afternoon. Where: This need state has a high out of home consumption (25%) with work being the key location. Cafés/Coffee shops are also another prominent location. Physical Energy boost is needed before and after sports activities so as to boost energy levels and replace energy. Activities include working or studying or long drives and thus these snacks are often consumed at the activity point i.e. the work or study desk or petrol stations. What: Generally in line with the total snack consumption with confectionary at 21%, crisps at 14% and fruit at 13%. 29 What are the motivations to purchase energising snacks: Physical energy boosting snacks need to be accessible, filling and tasty. Mental Focus snacks need to be quick, fresh and easy to eat. Brands that are associated with energising snacking*: * Brand examples arrived at through qualitative word association exercise 30 2. Habit & Boredom (22% of all snacking occasions) Definition: As the need state suggests, these snacking occasions occur from everyday habits, routines and also boredom. It is a state with an aimless search for food as snackers look for something tasty to pass the time. These include substantial food types to subdue hunger. Who: This is a need state which experienced mainly by the older cohorts particularly the silvers who are +13% above the total everyday habit snackers. When: There is a slightly higher frequency in the morning and the evening time. Since it is a sociable occasion for the Silver cohort, they are more likely snacking with a partner or friends. The weekend is a key time for the younger cohort as they have downtime from work. Where: Almost eight out of ten (79%) instances of habitual or boredom snacking occur in the home and this is because the need state is often experienced during activities of watching TV to what we call ―Mindless munching‖ or when studying. For the younger cohort this ―mindless munching‖ is used as a procrastination tool to avoid study. What: Whilst there is a lower incidence of confectionery snacking versus the total, it is still the most snacked upon food. However there is an over index on sliced bread, toast and rolls which reflects that need for a substantial snack to subdue hunger. 31 Nearly 85% of these snacks are prepared at the time of eating as snackers are willing to spend more time preparing i.e. Slicing cheese, heating in a microwave. This also helps to prolong the snacking occasion which helps the younger cohort with their avoidance of studying. Purchase Motivations: With almost three quarters (73%) of these snacks being purchased in the supermarket, ingredients and products must be accessible in home. Taste and how filling the snack is are also important. Brands: 32 3. Indulgence (21% of all snacking occasions) Definition: To make me feel better / to give myself a reward/ to treat myself. Why: Treat or reward snacks are often justified on the basis of having been ―earned‖ through exercise, study, hard work. Alternatively they are used as a deliberate attempt to boost mood and emotional state. Treating and rewarding sub state makes up the two thirds of the Indulgent need state at 14% of all snacking occasions. The cravings sub state describes how self-indulgence can be used to counter act feeling under the weather physically or emotionally. Cravings make up 7% of total snacking occasions. Who: The older child free cohort are more likely to snack to indulge, followed by established family. These cohorts are more likely to have the indulgent snacks within their household. The least likely cohort to snack because of indulgence are the Young Adults as they claim to make more health conscious snacking decisions. When: Nearly one quarter of all indulgent snacking takes place in the evening between 6-9pm and is less likely to be see in the earlier day parts. An interesting point to note is that these occasions are spread over the week and are only marginally higher at the weekend. Cravings can appear throughout the day therefore there is a constant snacking over the course of the day with an average of 3.4 snacks being consumed. Where: Again eight out of ten indulgent snacking incidences occur in the home. When out and about, locations such as the beach and park have a higher incidence. 33 Mums report that this occasion is frequent once the children are in bed. Professionals use this occasion after a long hard day’s work and students engage during their study period or to reward themselves for studying. The craving snacking occasion is typically craved after nights out and following alcohol consumption. Youths have the lowest level of empathy and failed to identify boosting mood with treat/reward snacks. These snacks are typically consumed in the home associated with warmth and comfort/ the couch and even bed. What: As you’d expect, milk chocolate and hard sweets consumption is very high. This is followed by all crisps including standard but also the likes of tortilla chips and puffed snacks. Fresh sponges, cakes and cupcakes take third place followed by biscuits and ice cream. Only 13% of these snacks are pre-prepared as few are willing to spend time and effort to prep their treats. Therefore supermarket and convenience store purchases are high. A higher than average bulk buying is seen as many ensure they have these treats at home in their cupboards. Purchase Motivations: For cravings, we look for convenience of the snack, taste and how indulgent the snack is. For treats and rewards we focus on indulgence, how familiar with are with the brands and promotions / offers. Brands: These types of brands are often stocked up on a weekly basis in the supermarket which allows foraging at home when the snacking need state arises. 34 Convenience is also a big player as snackers stop on their way home from work or college to pick up a treat. There is a high incidence of confectionery, fast foods and biscuit/bakery with a particular focus on brands by the snacker. 35 4. Nourishment (18% of all snacking occasions) Definition: ―To subdue hunger‖. Whilst nourishment sounds like it has health cues this need state relates to snackers looking to subdue hunger and in particular provide a satisfying taste sensation instead of meals. Managing hunger makes up the majority of this need state and accounts for 14% of total snacking occasions. It’s one that is associated with a high number of snacks particularly in home and in the evening time. Social sustenance accounts for only 4% and is associated with social occasions and nightlife. Therefore this occasion is usually from lunchtime until late night when people meet out of home or in the home. Who: The common theme for those snackers looking for nourishment is that they don’t have children. Those with busy daily routines in work and college mean that they may skip meals or require something to subdue hunger during the day. The least likely cohort to engage with the nourishment need state are the silvers. When: These snacking occasions are spread out throughout the day with a high incidence at main meal times since they are often used to replace a meal. There is a slightly higher incidence of nourishment snacking after 9pm. 36 Where: Again there is a bias to in-home consumption (80%) around the main meal times. This extends further to snacking in someone else’s home. There is a minimal increase in snacking whilst driving or on public transport in comparison to other need states. When we look at the in home consumption we can see that it is an occasion that is typically planned for. These options are purchased in the weekly shop so that when the need state arises snackers can forage in their cupboards. In relation to out of home snacking which occurs earlier in the day, supermarkets are too time consuming and snackers look to vending machines and also convenience stores. Activities such as having visitors over for tea/coffee is a common occasion for this need state. Also social events such as meeting friends out of the home, going to the pub and social events. Cinema visits and movie nights also come in to play. What: There is a high preference for milk chocolate and confectionery is the most commonly consumed nourishment snack. Crisps and salted snacks are +2 above the total and there is also a preference for bread and toast. Very low levels of planning for this occasion as snackers are less likely to prepare in advance they purchase in supermarkets and convenience stores. Purchase Motivations: Hunger snacks need to be accessible as they are subduing hunger so snackers want something to hand. This doesn’t 37 need to be too filling but substantial enough to manage hunger. It also has to be quick to prepare or involve minimal preparation. For social sustenance it’s all about visibility of the snack (I’ll know I want it when I see it) and on pack cues> 38 5. Health & Wellbeing (makes up 13% of all snacking occasions) Definition: ―To nourish and care for the body‖. This need state exists as snackers look to nourish and care for the body and also provide a feeling of balance. Rejuvenation makes up 8% of all snacking and is associated with older cohorts and it revolves around boosting physical and emotional health & wellbeing. Healthy stamina on the other hand is only 5% of snacking occasions and is a more proactive or functional need state. It can be image driven and therefore it is relevant to the younger cohorts. This need state has the highest incidence of preparing foods on the day although less likely at time of snack. One quarter of all snacks in this state are pre-prepared. Who: The youth cohort is the most significant snacking group of healthy snacks however we must remember that it was mums who answered and therefore they have the control as to what they want their children to eat and what they get as snacks. Younger adults are the second most likely to be health conscious looking for snacks to care for the body. Silvers take third place as they look to proactively manage health via snacking. When: We see a lot more of the healthy snacking occurring in the early morning particularly from 7am -12pm. However it tapers off as the day goes on as intentions gradually decline over the day. It is generally more common in the later week but less so at the weekend. 39 Where: A higher incidence of health & wellbeing snacking takes place at work when out and about but still we see the majority snacking in home. This occasion is also relevant before or after sports training or the gym. It can also be the default snacking mindset for some and can accompany almost any activity e.g. studying, travelling. What: Snackers look to substitute non-stodgy, non-filling healthy alternatives which an provide energy and fight hunger i.e. Snack solutions without negative impacts on health. Again confectionary is top at 21% but we see a higher incidence of jellies and dark chocolate. Fruit comes in at 14% which includes dried fruit. Non-confectionery bars take third place with the likes of cereal bars and flapjacks. For some this category can be bland hence a preference for the diet targeted sweeter snacks. Purchase Motivations: Health and wellbeing snacks must be non-stodgy, non-filling healthy alternatives to provide energy and fight hunger i.e. snack solutions without negative impacts on health. 40 Snacking and the Youth Segment We asked mums to complete a diary on behalf of one / two kids (aged 10 – 15 years) and their snacking habits. In total we recorded 4,886 snacking occasions. Key differences in this segment from the total adult survey are: 1. More out of home snacking – 26% of their occasions are out of home versus 22% of adult occasions. For their out of home snacking, two thirds of this take place in school. 2. Higher snacking in the afternoon : The youth segment has the same peak snacking period as adults: 3pm – 6pm. However the percentage of snacks at this time is higher with 31% of their snacks take place in the afternoon compared with 23% of adult snacks. This can be attributed to the need to snack after school to boost energy levels. 41 3. Not responsible for purchases of snacks: It is the mother who purchases more than three quarters of their snacks (unlike the adult population where 74% of snacks are purchased by themselves). 4. Where snacks are purchased: Youth snacks are more likely to be purchased in a supermarket, accounting for almost nine out of ten of their at home snacks. 5. Higher spend in Britain among youths than Ireland: The cost per snacking occasion (which could include a drink) is €1.86 in Republic of Ireland and £1.62 in the UK, which means that the British youths are spending more on snacks than the Irish. 42 6. Multipack formats more prominent – 44% of their snacks are from multipacks (compared with 34% of all adults’ snacks). 7. Beverage choice varies: Drinks continue to accompany 42% of their snacks (which is the same figure as the adult population). However the difference is the choice of beverages: 43 8. More variety and healthier snack options: They under index on confectionary and fruit categories and over index on dairy / eggs and sandwiches. Slightly healthier snacking could be attributed to the control of the parent on their snacking choices. 44 Appendix I – Total Snacking Occasion Specifics 45 46 Appendix II - Out of Home Snacking Specifics 47 48 Appendix III – Segment Deep Dives 49 50 51 52 53 54 55 56 57 58 59 60 61 62 Appendix IV Individual Snack Categories 63 64 65 Appendix V Category Deep Dives 66 67 68 69 70 71 Appendix VI - Need State Deep Dives 72 73 74 75 76 77 78 79 80 81 82 83 Appendix VII – Attitudes to Snacking 84 Appendix VIII – Regional Differences 85 86 87 Snacking in Ireland & UK March 2014 For further information please contact info@bordbia.ie or Tel: 01 6685155