Document 11037772

advertisement

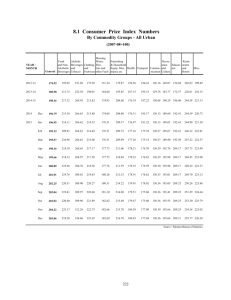

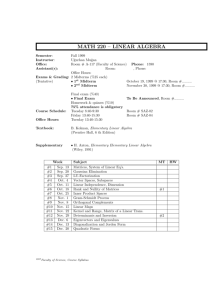

Understanding the UK Retail Dynamics Dublin – February 26 2009 Edward Garner Communications Director Worldpanel UK © WorldpanelTM division of TNS 2009 Consumer Downturn Grocery Price Inflation – TNS Calculation 12 w/e periods year-on-year 9.0 9.3 8.9 8.1 8.5 8.3 8.4 6.8 5.8 4.9 4.6 5.0 27 -J an -0 24 8 -F eb 23 -0 -M 8 a 20 r-0 -A 8 p 18 r-0 -M 8 a 15 y-0 8 -J un 13 -08 -J u 10 l-0 8 -A ug -0 07 -S 8 ep 05 -0 -O 8 c 02 t-0 8 -N o 30 v-0 -N 8 o 28 v-0 -D 8 e 25 c-0 8 -J an -0 9 3.8 4.4 Based on year-on-year comparisons of price paid for over 75,000 identical products including promotions and in the proportion that British households are purchasing them Total Till Roll Great Britain Consumer Spend Total Till Roll Total Grocers Total Non-Grocers 12 Weeks to 27 January 2008 12 Weeks to 25 January 2009 % chg £000s £000s 32,293,173 33,122,046 2.6 21,304,445 22,662,135 6.4 10,988,728 10,459,911 -4.8 Grocers +6.4% Non-Grocers -4.8% © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Significant (top 20) grocery switching flows Tesco Asda Waitrose -ve Morrisons M&S -ve Somerfield Sainsbury‘s Netto Aldi Iceland Switching limited to 11 retailers only Lidl RST (grocery) 12we 28 Dec 2008 Significant (top 20) grocery switching flows Clear movement to the value end of the spectrum Discount Retailers Lidl Aldi Asda Iceland Premium Morrisons Retailers Tesco Somerfield Sainsbury's Waitrose M&S RST (grocery) 12we 25 Jan 2009 (TNS P02) Switching through price tiers in the Big 4 Trading down a reality, but branded steals from standard OL Premium Own Label Branded Standard Own Label Value Own Label Switching limited to Big 4 retailers and 4 tiers RST (grocery) 12we 25 Jan 2009 (TNS P02) © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Total Grocery 4-weekly Targeted Own Label Shares 4 3.5 3 2.5 Premium OL 2 Healthy OL 1.5 1 © WorldpanelTM division of TNS 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Total Grocery 4-weekly Targeted Own Label Shares 4 3.5 3 Value OL 2.5 2 Premium OL 1.5 Healthy OL 1 Latest 12-wk % Change Total Top 4 -10% Premium Private Label Sales Trends 90 70 60 50 40 30 20 10 Tesco Finest Sainsbury Taste the Difference Asda Extra Special © WorldpanelTM division of TNS 2009 Safeway/MorrisonsThe Best 2009 2008 2007 2006 2005 2004 2003 2002 0 2001 Sales (Expenditure £m) 80 0 © WorldpanelTM division of TNS 2009 Jan 25 2009 Sainsbury Dec 28 2008 Asda Nov 30 2008 120 Nov 02 2009 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 20 Feb 24 2008 40 Jan 27 2008 60 Dec 30 2007 80 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Total Grocery Budget PL Trends - 4-wkly £m Latest 12-wk % Change +43% 100 Tesco +32% +60% +92% Morrisons Chilled v. Frozen Trends - Value 550 500 450 400 £m 350 300 250 200 150 100 1997 1998 1999 2000 2001 2002 2003 2004 Frozen Prepared Foods © WorldpanelTM division of TNS 2009 2005 2006 2007 2008 2009 Latest 12-wk % Change Chilled v. Frozen Trends - Value +3 550 500 450 400 £m 350 300 +9 250 200 150 100 1997 1998 1999 2000 2001 2002 Chilled Convenience 2003 2004 2005 Frozen Prepared Foods © WorldpanelTM division of TNS 2009 2006 2007 2008 2009 Priorities Organic Fairtrade Provenance Health Local Food Food Miles The environment Price © WorldpanelTM division of TNS 2009 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 Latest Quarter Till Roll Totals - Share of Total Grocers Tesco Asda Sainsbury Morrisons 31.2 30.7 16.9 17.2 16.3 16.2 11.6 11.9 Total Co-op 4.4 Waitrose 3.9 3.7 Somerfield 3.6 3.3 4.3 Aldi 2.6 Tot Indepts 2.5 2.3 Lidl 2.2 2.3 Iceland 1.8 2.0 0.7 Netto 3.0 0.7 0.4 0.5 Farm Foods 12 w/e 27 Jan 08 © WorldpanelTM division of TNS 2009 12 w/e 25 Jan 09 Latest Quarter Till Roll Totals Expenditure Trends Total Hard Disc 17 Iceland 14 10 Morrisons Asda 8 Tot Grocers 6 Sainsbury 5 Tesco 5 Total Co-op 3 Tot Indepts 1 Waitrose Somerfield 12 w/e Jan 25 2008 y/y % Change 1 -1 © WorldpanelTM division of TNS 2009 Annual Till Roll Totals Expenditure Changes £000s Tesco 1,581,410 Asda Morrisons Sainsbury Total Hard Disc 1,186,150 884,523 746,430 710,773 © WorldpanelTM division of TNS 2009 52 w/e Jan 25 2008 y/y £ Change Tesco - Penetration vs. Spend 87.9% 1280 1270 1260 Spend £ 1250 1240 1230 1220 1210 1200 1190 1180 85 85.5 86 86.5 Penetration % 87 © Worldpanel division of TNS 2009 Jan 25 2009 27 x 52 wkly periods ending TM 87.5 88 Tesco Demographic Signatures Till Roll Outlet Share within Demographic Group - MAT to January Social Class 40 35 30 25 20 15 10 5 0 Class AB Household Size Class C1 2007 Class C2 Class D 2008 Class E 2009 Housewife Age 40 35 30 25 20 15 10 5 0 Age under 28 2007 Age 28-34 40 35 30 25 20 15 10 5 0 1 in HH 2 in HH 2007 3 in HH 4 in HH 2008 5+ in HH 2009 No. of Children Age 35-44 2008 Age 45-64 Age 65+ 2009 40 35 30 25 20 15 10 5 0 No Children 2007 © WorldpanelTM division of TNS 2009 1 Child HH 2008 2 Child HH 3+ Child HH 2009 Tesco PL Lifestyle Indices Tesco Finest Tesco Value “I regard myself as a connoisseur of food and wine” 150 87 “Price is the most important factor when buying a product” 80 129 Share indexed on Total Trade – 52 w/e Sep 7 2008 © WorldpanelTM division of TNS 2009 52 w/e Sep 07 2008 Shopping Missions - Occasions Index Tesco Extra Trolley Part Store 86 Trolley Full Store 148 Basket Category Top Up 51 Basket Category Stock 40 Destination Non Food Destination Food 38 14 © WorldpanelTM division of TNS 2009 52 w/e Sep 07 2008 Shopping Missions - Occasions Index Tesco Express Trolley Part Store Trolley Full Store 54 38 Basket Category Top Up 216 Basket Category Stock Destination Non Food 225 201 Destination Food 336 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Nov 19 2006 Dec 03 2006 Dec 17 2006 Dec 31 2006 Jan 14 2007 Jan 28 2007 Feb 11 2007 Feb 25 2007 Mar 11 2007 Mar 25 2007 Apr 08 2007 Apr 22 2007 May 06 2007 May 20 2007 Jun 03 2007 Jun 17 2007 Jul 01 2007 Jul 15 2007 Jul 29 2007 Aug 12 2007 Aug 26 2007 Sep 09 2007 Sep 23 2007 Oct 07 2007 Oct 21 2007 Nov 04 2007 Nov 18 2007 Dec 02 2007 Dec 16 2007 Dec 30 2007 Jan 13 2008 Jan 27 2008 Feb 10 2008 Feb 24 2008 Mar 09 2008 Mar 23 2008 Apr 06 2008 Apr 20 2008 May 04 2008 May 18 2008 Jun 01 2008 Jun 15 2008 Jun 29 2008 Jul 13 2008 Jul 27 2008 Aug 10 2008 Aug 24 2008 Sep 07 2008 Sep 21 2008 Oct 05 2008 Oct 19 2008 Nov 02 2008 Nov 16 2008 Nov 30 2008 Dec 14 2008 Dec 28 2008 Jan 11 2009 Jan 25 2009 Tesco Private Label Weekly Sales £m 40 35 30 25 20 15 10 5 0 Finest © WorldpanelTM division of TNS 2009 Nov 19 2006 Dec 03 2006 Dec 17 2006 Dec 31 2006 Jan 14 2007 Jan 28 2007 Feb 11 2007 Feb 25 2007 Mar 11 2007 Mar 25 2007 Apr 08 2007 Apr 22 2007 May 06 2007 May 20 2007 Jun 03 2007 Jun 17 2007 Jul 01 2007 Jul 15 2007 Jul 29 2007 Aug 12 2007 Aug 26 2007 Sep 09 2007 Sep 23 2007 Oct 07 2007 Oct 21 2007 Nov 04 2007 Nov 18 2007 Dec 02 2007 Dec 16 2007 Dec 30 2007 Jan 13 2008 Jan 27 2008 Feb 10 2008 Feb 24 2008 Mar 09 2008 Mar 23 2008 Apr 06 2008 Apr 20 2008 May 04 2008 May 18 2008 Jun 01 2008 Jun 15 2008 Jun 29 2008 Jul 13 2008 Jul 27 2008 Aug 10 2008 Aug 24 2008 Sep 07 2008 Sep 21 2008 Oct 05 2008 Oct 19 2008 Nov 02 2008 Nov 16 2008 Nov 30 2008 Dec 14 2008 Dec 28 2008 Jan 11 2009 Jan 25 2009 Tesco Private Label Weekly Sales £m 40 35 30 25 20 15 10 5 0 Value Finest Tesco Discount Brands © WorldpanelTM division of TNS 2009 Average Price per pack in Tesco Discount similar to promoted standard own label £ price per pack 1.27 0.91 0.87 Discount brands PROMOTED Standard own label 1.65 1.35 0.66 Value FULL PRICE Standard own label RST (grocery) 12we 28 Dec 2008 © WorldpanelTM division of TNS 2009 PROMOTED Brands FULL PRICE Brands Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 Latest Quarter Till Roll Totals Expenditure Trends Total Hard Disc 17 Iceland 14 10 Morrisons Asda 8 Tot Grocers 6 Sainsbury 5 Tesco 5 Total Co-op 3 Tot Indepts 1 Waitrose Somerfield 12 w/e Jan 25 2008 y/y % Change 1 -1 © WorldpanelTM division of TNS 2009 12 w/e Periods © WorldpanelTM division of TNS 2009 28-Dec-08 25-Jan-09 02-Nov-08 30-Nov-08 05-Oct-08 10-Aug-08 07-Sep-08 15-Jun-08 13-Jul-08 20-Apr-08 18-May-08 24-Feb-08 23-Mar-08 27-Jan-08 02-Dec-07 30-Dec-07 07-Oct-07 04-Nov-07 12-Aug-07 09-Sep-07 17-Jun-07 15-Jul-07 22-Apr-07 20-May-07 25-Mar-07 28-Jan-07 25-Feb-07 03-Dec-06 31-Dec-06 08-Oct-06 05-Nov-06 13-Aug-06 10-Sep-06 16-Jul-06 21-May-06 18-Jun-06 26-Mar-06 23-Apr-06 29-Jan-06 26-Feb-06 04-Dec-05 01-Jan-06 06-Nov-05 11-Sep-05 09-Oct-05 17-Jul-05 14-Aug-05 Asda Year-on-Year Trends - Till Roll £% 10 9 8 7 6 5 4 3 2 1 0 Asda Demographic Signatures Till Roll Outlet Share within Demographic Group - MAT to January Social Class Household Size 25 25 20 20 15 15 13.9 10 C2DE Large households 10 5 5 0 Class AB Class C1 2007 Class C2 Class D 2008 Class E 2009 Housewife Age 30 25 20 15 10 5 0 Age under 28 2007 0 1 in HH 2 in HH 3 in HH 2007 4 in HH 2008 5+ in HH 2009 No. of Children 25 20 15 Younger With children 10 5 Age 28-34 Age 35-44 2008 Age 45-64 Age 65+ 2009 0 No Children 2007 © WorldpanelTM division of TNS 2009 1 Child HH 2008 2 Child HH 3+ Child HH 2009 Trading Indices - Asda 52 w/e Dec 28 2008 Broad Areas indexed on Total Groceries Total Total Total Total Total Total Total Toiletries Healthcare Household Ambient Groceries Fresh+Chilled Alcohol Frozen © WorldpanelTM division of TNS 2009 120 112 111 101 97 96 93 Year-on-Year Expenditure Trends Asda Strong performance in ‘Fresh’ Total Alcohol 12.2 Total Fresh+Chilled 10.1 Total Ambient Groceries 10.0 TOTAL GROCERIES 9.8 Total Frozen 8.7 Total Toiletries 8.4 Total Household Total Healthcare 7.3 3.2 © WorldpanelTM division of TNS 2009 52 w/e Jan 25 2009 % Change Year-on-Year Expenditure Trends Organic Strong performance in Organic 11 Asda 5 Morrisons Tot Grocers -1 Sainsbury -1 Waitrose Tesco -2 52 w/e Jan 25 2009 % Change -7 © WorldpanelTM division of TNS 2009 Premium Private Label Sales Trends 12 wk y-o-y trend +6% 30 Still growing premium PL 20 15 10 5 Asda Extra Special © WorldpanelTM division of TNS 2009 2009 2008 2007 2006 2005 2004 2003 2002 0 2001 Sales (Expenditure £m) 25 Ap r -0 20 7 -M ay -0 17 -Ju 7 n 15 -07 -Ju l-0 12 7 -A ug -07 09 -S ep -0 07 -O 7 c 04 t-07 -N o 02 v-07 -D e 30 c-07 -D ec -0 27 -Ja 7 n-0 24 8 -F eb -0 23 -M 8 a 20 r-08 -A pr18 08 -M ay -0 15 -Ju 8 n 13 -08 -Ju l-0 10 8 -A ug -08 07 -S ep -0 05 -O 8 c 02 t-08 -N o 30 v-08 -N o 28 v-08 -D ec -0 25 -Ja 8 n-0 9 22 - Period 2 Change - Columns Asda, Rolling Source of Change in Spend Return to Switching Gains 350000 300000 250000 200000 150000 100000 50000 0 -50000 12 weeks ending Category Departures Category Level Changes © WorldpanelTM division of TNS 2009 Shoppers Won Shoppers Held Total Switching Ap r -0 20 7 -M ay -0 17 -Ju 7 n-0 7 15 -Ju l-0 12 7 -A ug -07 09 -S ep -0 07 -O 7 ct07 04 -N o 02 v-07 -D ec -07 30 -D ec -0 27 -Ja 7 n-0 24 8 -F eb -0 23 -M 8 ar08 20 -A pr08 18 -M ay -0 8 15 -Ju n-0 8 13 -Ju l-0 10 8 -A ug -08 07 -S ep -08 05 -O c 02 t-08 -N ov -08 30 -N o 28 v-08 -D ec -08 25 -Ja n-0 9 22 - Net switching - Spend Net Switching Volumes to Asda 40000 30000 20000 10000 0 -10000 -20000 -30000 12 weeks ending Aldi © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Apr 24 2005 May 22 Jun 19 2005 Jul 17 2005 Aug 14 2005 Sep 11 2005 Oct 09 2005 Nov 06 2005 Dec 04 2005 Jan 01 2006 Jan 29 2006 Feb 26 2006 Mar 26 2006 Apr 23 2006 May 21 2006 Jun 18 2006 Jul 16 2006 Aug 13 2006 Sep 10 2006 Oct 08 2006 Nov 05 2006 Dec 03 2006 Dec 31 2006 Jan 28 2007 Feb 25 2007 Mar 25 2007 Apr 22 2007 May 20 2007 Jun 17 2007 Jul 15 2007 Aug 12 2007 Sep 09 2007 Oct 07 2007 Nov 04 2007 Dec 02 2007 Dec 30 2007 Jan 27 2008 Feb 24 2008 Mar 23 2008 Apr 20 2008 May 18 2008 Jun 15 2008 Jul 13 2008 Aug 10 2009 Sep 07 2008 Oct 05 2008 Nov 02 2008 Nov 30 2008 Dec 28 2008 Jan 25 2009 BOGOF Sales by Outlet £000s 100,000 90,000 80,000 70,000 60,000 Sainsbury 50,000 Tesco Asda 40,000 Morrisons Tot 30,000 20,000 10,000 0 © WorldpanelTM division of TNS 2009 Apr 24 2005 © WorldpanelTM division of TNS 2009 Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2009 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Feb 24 2008 Mar 23 2008 Jan 27 2008 Dec 02 2007 Dec 30 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Jan 28 2007 Feb 25 2007 Dec 31 2006 Nov 05 2006 Dec 03 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Jan 01 2006 Dec 04 2005 Nov 06 2005 Oct 09 2005 Sep 11 2005 Aug 14 2005 Jul 17 2005 Jun 19 2005 May 22 2005 BOGOF Sales for the Top 4 Multiples £000s 180,000 160,000 140,000 120,000 100,000 80,000 60,000 40,000 20,000 0 © WorldpanelTM division of TNS 2009 Smart price Own brand Brown/white bread Potatoes Crisps Oranges Cola Baked beans Sausages Yoghurt Eggs Cornflakes Frozen peas Tea bags Margarine 30p £0.72 64p (2.5 kilo) £1.98 (2.5 kilo) 47 p (12 pack) 1.39 40p kg £0.99 kg 18p 2 litres £0.39 2 litres 18p can 31p can 48p 8 pack (454g) £1.88 8 pack (454g) 36p (6x125g) £0.98 (6x125g) 82p (6) £1.36 (6) 70p (750g) £1.14 (750g) 84p (907g) £1.52 (kg) 28p (80) £1.29 (80) 21p (500g) £0.79 (500g) Basket cost £5.86 £14.74 © WorldpanelTM division of TNS 2009 Asda launches "most aggressive ever" Christmas price cuts The supermarket's offers include: Wines at 3 for £10, and spirits from £5. Pork joints reduced to £2 per kg Christmas puddings at £1 Packs of six mince pies at two for £1 Two litres of Coke at three for £3 Cadbury's selection boxes (normally £2.98) at two for £3 Wednesday, 26 November 2008 © WorldpanelTM division of TNS 2009 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Sainsbury Weekly 3 Point Centred Moving Average Sainsbury Baseline Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Share (Expenditure) Sainsbury Share of Till Roll Grocers 19 18 17 16 15 14 13 12 2004 2 3 4 5 6 7 8 9 10 11 12 13 2005 2 3 4 5 6 7 8 9 10 11 12 13 2006 2 3 4 5 6 7 8 9 10 11 12 13 2007 2 3 4 5 6 7 8 9 10 11 12 13 2008 2 3 4 5 6 7 8 9 10 11 12 13 2009 2 Price Index Retailer Price Track - Total Grocery 107 106 105 104 103 102 101 100 Sainsbury © WorldpanelTM division of TNS 2009 Total Grocery Budget PL Trends £% within Outlet 8 7 Asda 6 5 Tesco 4 3 Morrisons Sainsbury 2 1 0 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 97 98 99 00 01 02 03 04 05 06 07 08 © WorldpanelTM division of TNS 2009 Premium Private Label Sales Trends 12 wk y-o-y trend -12% 90 70 60 50 40 30 20 10 Tesco Finest Sainsbury Taste the Difference Asda Extra Special © WorldpanelTM division of TNS 2009 Safeway/MorrisonsThe Best 2009 2008 2007 2006 2005 2004 2003 2002 0 2001 Sales (Expenditure £m) 80 Trading Indices - Sainsbury 52 w/e Dec 28 2008 Broad Areas indexed on Total Groceries Total Total Total Total Total Total Total Healthcare Toiletries Fresh+Chilled Alcohol Household Ambient Groceries Frozen © WorldpanelTM division of TNS 2009 122 118 110 100 94 91 70 Year-on-Year Expenditure Trends Sainsbury Total Frozen 12.2 6.9 Total Healthcare Total Ambient Groceries 6.2 Total Fresh+Chilled 5.5 TOTAL GROCERIES 5.2 Total Toiletries 4.5 Total Household Total Alcohol 3.0 1.4 © WorldpanelTM division of TNS 2009 52 w/e Jan 25 2009 % Change Worldpanel Lifestyles - Sainsbury Share Index I Am Prepared To Pay More For Organic Food I Regard Myself As A Connoisseur Of Food And Wine The BBC Is An Institution That I Can Rely On I Am Prepared To Pay More For Quality Ingredients I Think Of Myself As A Brand Loyal Consumer I Feel Good About Buying Fair Trade Products Country Of Origin Is Important To Me When Choosing Groceries It Is Worth Paying A Bit More To Shop Where I Can Get In And Out Quickly I Find It Hard To Spend All The Money That I Earn I Buy Free Range Products Whenever I Can I Eat Out Regularly I Don't Tend To Compromise On Quality If I Can't Find What I Want I Think We Should All Try To Buy More Fair Trade Products I Always Pay My Credit Card Bills In Full I Try To Buy Environmentally Friendly Products I Read The Ingredients On The Pack Before Buying I Never Go Out Without Putting On My Makeup It Is Important To Me Which Brand I Buy I Don't Mind Paying For Quality I/My Partner Enjoy Cooking To Entertain Friends And Family Till Roll Share indexed on All Shoppers – 52 w/e Nov 30 2008 © WorldpanelTM division of TNS 2009 129 124 121 119 119 119 118 117 117 117 116 115 114 114 114 114 113 113 112 111 Fairtrade © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 20 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Jan 01 2006 Dec 04 2005 Nov 06 2005 Oct 09 2005 Fairtrade Prepacked Bananas Market Share 100 90 80 70 60 50 40 30 Total Grocers 10 0 © WorldpanelTM division of TNS 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 90 Jan 27 2008 Dec 30 2007 Dec 02 2007 20 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Jan 01 2006 Dec 04 2005 Nov 06 2005 Oct 09 2005 Fairtrade Prepacked Bananas Market Share 100 Sainsbury 80 70 60 50 40 30 Total Grocers 10 0 © WorldpanelTM division of TNS 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Waitrose Jan 27 2008 Dec 30 2007 Dec 02 2007 20 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 90 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Jan 01 2006 Dec 04 2005 Nov 06 2005 Oct 09 2005 Fairtrade Prepacked Bananas Market Share 100 Sainsbury 80 70 60 50 40 30 Total Grocers 10 0 Free Range Eggs © WorldpanelTM division of TNS 2009 Hens Eggs - Pricing Trends Ave. Price per Egg 34p 32p 30p 28p 26p 24p 22p 20p 18p 16p 14p 12p 10p 8p 6p Non-Free Range Free Range © WorldpanelTM division of TNS 2009 Organic 2009 2008 2007 2006 2005 2004 2003 2002 2001 4p Hens Eggs - Organic Share Trends Share - £% 9 8 7 6 5 4 3 2 1 Organic © WorldpanelTM division of TNS 2009 2009 2008 2007 2006 2005 2004 2003 2002 2001 0 Hens Eggs - 'Free Range' Share Trends Share - £% 60 58 56 54 52 50 48 46 44 42 40 38 36 34 32 30 Free Range © WorldpanelTM division of TNS 2009 2009 2008 2007 2006 2005 2004 2003 2002 2001 28 © WorldpanelTM division of TNS 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Free-range Eggs Market Share 100 90 80 70 60 50 Total Grocers 40 30 © WorldpanelTM division of TNS 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 70 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Free-range Eggs Market Share 100 90 80 Sainsbury 60 50 Total Grocers 40 30 © WorldpanelTM division of TNS 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 70 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Jan 29 2006 Free-range Eggs Market Share 100 Waitrose 90 80 Sainsbury 60 50 Total Grocers 40 30 Sainsbury Demographic Signatures Till Roll Outlet Share within Demographic Group - MAT to January Social Class Household Size 25 20 20 15 15 10 10 5 5 0 Class AB Class C1 2007 Class C2 Class D 2008 Class E 0 1 in HH 2009 Housewife Age 2 in HH 2007 3 in HH 4 in HH 2008 5+ in HH 2009 No. of Children 20 20 15 15 10 10 5 5 0 Age under 28 2007 Age 28-34 Age 35-44 2008 Age 45-64 Age 65+ 2009 0 No Children 2007 © WorldpanelTM division of TNS 2009 1 Child HH 2008 2 Child HH 3+ Child HH 2009 Ap r- 0 7 Ma y-0 17 -Ju 7 n 15 -07 -Ju l-0 12 7 -A ug -07 09 -S ep -0 07 -O 7 c 04 t-07 -N o 02 v-0 7 -D ec -07 30 -D ec -0 27 -Ja 7 n-0 24 8 -F eb -0 23 -M 8 ar0 20 -A 8 pr08 18 -M ay -0 15 -Ju 8 n 13 -08 -Ju l-0 10 8 -A ug -08 07 -S ep -0 05 -O 8 c 02 t-08 -N o 30 v-0 8 -N o 28 v-0 8 -D ec -0 25 -Ja 8 n-0 9 20 - 22 - Net switching - Spend Net Switching to Sainsbury from Waitrose 15000 10000 5000 0 -5000 -10000 -15000 12 weeks ending © WorldpanelTM division of TNS 2009 Ap r- 0 20 7 -M ay -0 17 -Ju 7 n-0 7 15 -Ju l-0 12 7 -A ug -07 09 -S ep -07 07 -O c 04 t-07 -N o 02 v-0 7 -D e 30 c-07 -D ec -0 27 -Ja 7 n-0 24 8 -F eb -0 23 -M 8 ar0 20 -A 8 pr08 18 -M ay -0 15 -Ju 8 n-0 8 13 -Ju l-0 10 8 -A ug -08 07 -S ep -0 05 -O 8 c 02 t-08 -N ov -0 8 30 -N o 28 v-0 8 -D ec -0 25 -Ja 8 n-0 9 22 - Net switching - Spend Net Switching to Sainsbury from M & S 30000 25000 20000 15000 10000 5000 0 -5000 12 weeks ending © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 -5 Store sell-offs -10 -15 -20 12 w/e Periods © WorldpanelTM division of TNS 2009 28-Dec-08 25-Jan-09 02-Nov-08 30-Nov-08 07-Sep-08 05-Oct-08 15-Jun-08 13-Jul-08 10-Aug-08 Now stable 20-Apr-08 18-May-08 24-Feb-08 23-Mar-08 30-Dec-07 27-Jan-08 04-Nov-07 02-Dec-07 09-Sep-07 07-Oct-07 15-Jul-07 12-Aug-07 22-Apr-07 20-May-07 17-Jun-07 25-Feb-07 25-Mar-07 31-Dec-06 28-Jan-07 0 05-Nov-06 03-Dec-06 10-Sep-06 08-Oct-06 16-Jul-06 13-Aug-06 21-May-06 18-Jun-06 26-Mar-06 23-Apr-06 01-Jan-06 29-Jan-06 26-Feb-06 06-Nov-05 04-Dec-05 11-Sep-05 09-Oct-05 17-Jul-05 14-Aug-05 Morrisons+Safeway Year-on-Year Trends - Till Roll £% 10 5 Sustained growth Net New/Lost Repeat Total © WorldpanelTM division of TNS 2009 25 Jan 09 28 Dec 08 30 Nov 08 02 Nov 08 05 Oct 08 07 Sep 08 10 Aug 08 13 Jul 08 15 Jun 08 18 May 08 20 Apr 08 23 Mar 08 24 Feb 08 27 Jan 08 30 Dec 07 02 Dec 07 04 Nov 07 07 Oct 07 09 Sep 07 12 Aug 07 15 Jul 07 17 Jun 07 20 May 07 22 Apr 07 Actual Contribution (000,000s) Morrisons Growth from both existing and new shoppers 300 250 200 150 100 50 0 -50 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Nov 19 2006 Dec 03 2006 Dec 17 2006 Dec 31 2006 Jan 14 2007 Jan 28 2007 Feb 11 2007 Feb 25 2007 Mar 11 2007 Mar 25 2007 Apr 08 2007 Apr 22 2007 May 06 2007 May 20 2007 Jun 03 2007 Jun 17 2007 Jul 01 2007 Jul 15 2007 Jul 29 2007 Aug 12 2007 Aug 26 2007 Sep 09 2007 Sep 23 2007 Oct 07 2007 Oct 21 2007 Nov 04 2007 Nov 18 2007 Dec 02 2007 Dec 16 2007 Dec 30 2007 Jan 13 2008 Jan 27 2008 Feb 10 2008 Feb 24 2008 Mar 09 2008 Mar 23 2008 Apr 06 2008 Apr 20 2008 May 04 2008 May 18 2008 Jun 01 2008 Jun 15 2008 Jun 29 2008 Jul 13 2008 Jul 27 2008 Aug 10 2008 Aug 24 2008 Sep 07 2008 Sep 21 2008 Oct 05 2008 Oct 19 2008 Nov 02 2008 Nov 16 2008 Nov 30 2008 Dec 14 2008 Dec 28 2008 Jan 11 2009 Jan 25 2009 Morrisons Private Label Weekly Sales £m 8 7 6 5 4 3 2 1 0 The Best © WorldpanelTM division of TNS 2009 Nov 19 2006 Dec 03 2006 Dec 17 2006 Dec 31 2006 Jan 14 2007 Jan 28 2007 Feb 11 2007 Feb 25 2007 Mar 11 2007 Mar 25 2007 Apr 08 2007 Apr 22 2007 May 06 2007 May 20 2007 Jun 03 2007 Jun 17 2007 Jul 01 2007 Jul 15 2007 Jul 29 2007 Aug 12 2007 Aug 26 2007 Sep 09 2007 Sep 23 2007 Oct 07 2007 Oct 21 2007 Nov 04 2007 Nov 18 2007 Dec 02 2007 Dec 16 2007 Dec 30 2007 Jan 13 2008 Jan 27 2008 Feb 10 2008 Feb 24 2008 Mar 09 2008 Mar 23 2008 Apr 06 2008 Apr 20 2008 May 04 2008 May 18 2008 Jun 01 2008 Jun 15 2008 Jun 29 2008 Jul 13 2008 Jul 27 2008 Aug 10 2008 Aug 24 2008 Sep 07 2008 Sep 21 2008 Oct 05 2008 Oct 19 2008 Nov 02 2008 Nov 16 2008 Nov 30 2008 Dec 14 2008 Dec 28 2008 Jan 11 2009 Jan 25 2009 Morrisons Private Label Weekly Sales £m 8 7 6 5 4 3 2 1 0 Value The Best © WorldpanelTM division of TNS 2009 Latest Quarter Till Roll Totals Expenditure Trends Total Hard Disc 17 Iceland 14 10 Morrisons 8 Asda Tot Grocers 6 Sainsbury 5 Tesco 5 Total Co-op 3 Tot Indepts 1 Waitrose Somerfield 12 w/e Jan 25 2008 y/y % Change 1 -1 © WorldpanelTM division of TNS 2009 Trading Indices - Morrisons 52 w/e Dec 28 2008 Market Sectors indexed on Total Groceries Fresh Fish Chilled Bakery Products Canned Goods Fresh Meat Fresh Poultry+Game Biscuits Savoury Home Cooking Pet Care Hot Beverages Haircare © WorldpanelTM division of TNS 2009 124 117 115 111 108 105 105 104 104 103 Year-on-Year Expenditure Trends Morrisons Total Toiletries 12.1 10.7 Total Fresh+Chilled Total Healthcare 10.4 Total Ambient Groceries 10.3 TOTAL GROCERIES 9.5 Total Alcohol 9.4 Total Frozen Total Household 7.0 1.7 © WorldpanelTM division of TNS 2009 52 w/e Dec 28 2008 % Change The Morrisons Difference Morrisons Yorkshire Shoppers Lifestyle Statements:I Like To Use The Café/Restaurant 156 It Has A Butchery Counter 148 I Can Use The Childcare Facilities 143 It Sells Cheap Petrol 132 There Is A Fresh Fish Counter 131 It Has A Delicatessen 129 It Sells Lottery Tickets 129 It's Nearest My Home 128 Prices Are Always Low 125 It Has An In-Store Bakery 124 I Like The Layout Of The Store 123 It Offers Cashpoints, Dry Cleaning etc You Can Easily Find What You Want Outlet Share Index 52 w/e Apr 20 2008 © WorldpanelTM division of TNS 2009 121 119 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 0 © WorldpanelTM division of TNS 2009 Waitrose Weekly 3 Point Centred Moving Average Waitrose Baseline Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Share (Expenditure) Waitrose Share of Till Roll Grocers 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 Worldpanel Lifestyles - Waitrose Share Index I Regard Myself As A Connoisseur Of Food And Wine I Am Prepared To Pay More For Organic Food Country Of Origin Is Important To Me When Choosing Groceries It Is Worth Paying A Bit More To Shop Where I Can Get In And Out Quickly The BBC Is An Institution That I Can Rely On I Look Out For Supermarkets That Are Less Crowded And Less Stressful I Try To Support Regional Food Producers I Am Prepared To Pay More For Quality Ingredients I Eat Out Regularly I Believe In A Holistic Approach To Medical Treatment I Always Pay My Credit Card Bills In Full I Buy Free Range Products Whenever I Can I Feel Good About Buying Fair Trade Products I Try To Buy Local Produce Whenever I Can The Brand Name Of The Clothes I Wear Is Important To Me I Don't Tend To Compromise On Quality If I Can't Find What I Want I Think Of Myself As A Brand Loyal Consumer I'm Prepared To Pay More For Products That Make Life Easier I/My Partner Enjoy Cooking To Entertain Friends And Family It Is Important To Me Which Brand I Buy Till Roll Share indexed on All Shoppers – 52 w/e Nov 30 2008 © WorldpanelTM division of TNS 2009 223 191 168 162 162 160 159 156 151 146 145 145 141 141 141 140 140 140 139 139 Organic © WorldpanelTM division of TNS 2009 Total Organic Products £m’s 100 90 80 70 60 50 40 Annualised Value = £1,300m Latest 12 weeks 18% decline 30 20 © WorldpanelTM division of TNS 2009 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 0 1998 10 Total Organics-£ Spend by Frequency Group 13% of Organic buyers purchase once during the year & account for only 1% of spend 12% of Organic buyers represent 63% of money spent on Organics 27+ 12 17 13-26 Occasions 63 19 7-12 Occasions 2-6 Occasions 39 20 1 Occasion 10 13 7 1 % Homes Buying % Spend © WorldpanelTM division of TNS 2009 52 w/e Nov 2 2008 © WorldpanelTM division of TNS 2009 Organic Indices Waitrose 444 Sainsbury 151 133 M&S Tot Grocers 100 Tesco 99 67 Asda 62 Total Co-op Morrisons 51 43 Tot Indepts 39 Somerfield Lidl 24 Aldi 21 Netto 7 Farm Foods 4 Iceland Share of Organic Indexed on Total Grocery Share - 52 w/e Dec 28 2008 0 © WorldpanelTM division of TNS 2009 I Visit Different Shops For The Best Prices Netto 150 Lidl 136 Aldi 129 Farm Foods 127 Iceland 124 Somerfield 115 Morrisons 105 Total Co-op 100 Tot Indepts 99 Tesco 95 Asda 95 Sainsbury 94 M&S 93 Waitrose 89 © WorldpanelTM division of TNS 2009 Outlet Share Index 52 w/e Nov 30 2008 Trading Indices - Waitrose Broad Area Total Total Total Total Total Total Total Fresh+Chilled Ambient Groceries Alcohol Household Frozen Toiletries Healthcare Market 128 88 86 84 55 49 42 Market Sector Fresh Fish Chilled Bakery Products Chilled Drinks Chilled Convenience Fruit+Veg+Salads Fresh Meat Fresh Poultry+Game Pickle+Tbl Sce+Condiment Packet Breakfast Frozen Confectionery Hot Beverages Sweet Home Cooking 52 w/e Dec 28 2008 228 163 160 141 138 123 121 108 107 107 106 105 Fresh Stuffing Chilled Gravy+Stock Chilled Olives Chilled Prepared Fish Fresh Soup Chilled Rice Chilled Pate+Paste+Spread Chilled Cooking Sauces Chilled Vegetarian Vegetable in Jar Chilled One Shot Drinks Fresh Other Meat & Offal Wet/Smoked Fish Ambient Olives Chilled Sausage Meat Chilled Burgers+Grills Herbal Tea Tonic Water Honey Vinegar © WorldpanelTM division of TNS 2009 1382 749 556 410 351 299 281 274 273 265 241 240 239 239 228 227 218 216 201 196 © WorldpanelTM division of TNS 2009 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 Long-Term Share of Till Roll Grocers 4 2 1 Aldi Lidl © WorldpanelTM division of TNS 2009 Netto 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 0 1993 Share (Expenditure) 3 © WorldpanelTM division of TNS 2009 Kwik Save Weekly 3 Point Centred Moving Average Kwik Save Baseline Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Share (Expenditure) Kwik Save Share of Till Roll Grocers 2 1.5 1 0.5 0 Kwik Save + Discounters © WorldpanelTM division of TNS 2009 28-Dec-08 02-Nov-08 30-Nov-08 05-Oct-08 07-Sep-08 13-Jul-08 10-Aug-08 15-Jun-08 18-May-08 23-Mar-08 20-Apr-08 24-Feb-08 27-Jan-08 02-Dec-07 30-Dec-07 04-Nov-07 07-Oct-07 12-Aug-07 09-Sep-07 15-Jul-07 17-Jun-07 22-Apr-07 20-May-07 25-Mar-07 28-Jan-07 25-Feb-07 31-Dec-06 03-Dec-06 08-Oct-06 05-Nov-06 10-Sep-06 13-Aug-06 18-Jun-06 16-Jul-06 21-May-06 23-Apr-06 26-Feb-06 26-Mar-06 29-Jan-06 01-Jan-06 06-Nov-05 04-Dec-05 09-Oct-05 11-Sep-05 17-Jul-05 14-Aug-05 19-Jun-05 Kwik Save + Discounters Combined Market Share £% 8 7 6 5 4 3 2 1 0 Net New/Lost Repeat © WorldpanelTM division of TNS 2009 Total 25 Jan 09 28 Dec 08 30 Nov 08 02 Nov 08 05 Oct 08 07 Sep 08 10 Aug 08 13 Jul 08 15 Jun 08 18 May 08 20 Apr 08 23 Mar 08 24 Feb 08 27 Jan 08 30 Dec 07 02 Dec 07 04 Nov 07 07 Oct 07 09 Sep 07 12 Aug 07 15 Jul 07 17 Jun 07 20 May 07 22 Apr 07 Actual Contribution (000,000s) Aldi 160 140 120 100 80 60 40 20 0 -20 Net New/Lost Repeat © WorldpanelTM division of TNS 2009 Total 25 Jan 09 28 Dec 08 30 Nov 08 02 Nov 08 05 Oct 08 07 Sep 08 10 Aug 08 13 Jul 08 15 Jun 08 18 May 08 20 Apr 08 23 Mar 08 24 Feb 08 27 Jan 08 30 Dec 07 02 Dec 07 04 Nov 07 07 Oct 07 09 Sep 07 12 Aug 07 15 Jul 07 17 Jun 07 20 May 07 22 Apr 07 Actual Contribution (000,000s) Lidl 70 60 50 40 30 20 10 0 New Aldi Shopper Indices - 12 w/e Dec 28 2008 144 128 126 122 117 Hwife Aged under 28 Hwife Aged 28-34 Hwife Aged 35-44 Hwife aged 45-64 Housewife Age © WorldpanelTM division of TNS 2009 Hwife Aged 65+ New Aldi Shopper Indices - 12 w/e Dec 28 2008 145 128 122 111 No Children 1 Child HHs 2 Child HHs © WorldpanelTM division of TNS 2009 3+ Child HHs © WorldpanelTM division of TNS 2009 © WorldpanelTM division of TNS 2009 Co-op buys Somerfield for £1.57bn The Co-operative Group (Co-op), the UK's fifth largest supermarket chain, has agreed to buy rival Somerfield. The Co-op said the £1.57bn ($3.1bn) purchase would strengthen its position in the UK retail market. Manchester-based Co-op, a mutual outfit run on behalf of its 2.5 million members, also said the deal was done on a cash-free and debt-free basis. With more than 4,300 UK retail outlets, it employs 85,000 people. Bristol-based Somerfield has about 900 stores. The latest figures from research firm TNS, show that in the 12 weeks to the middle of June, the Co-op had 4.4% of the UK grocery market, and Somerfield 3.7%. © WorldpanelTM division of TNS 2009 Co-op / Somerfield Store Sales n Morrisons 34 n Waitrose 13 n Tesco 7 n Musgrave 6 n Spar 6 © WorldpanelTM division of TNS 2009 Fairtrade Indices Total Co-op 362 Waitrose 292 278 Sainsbury M&S 165 Tot Grocers 100 Asda 45 Morrisons 45 Tesco 35 28 Somerfield Lidl 13 Tot Indepts 10 Farm Foods 6 Netto 4 Aldi 1 Iceland 0 Share of Fairtrade Indexed on Total Grocery Share - 52 w/e Dec 28 2008 © WorldpanelTM division of TNS 2009 Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 0 © WorldpanelTM division of TNS 2009 M&S Weekly 3 Point Centred Moving Average M & S Baseline Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Share (Expenditure) M&S Share of Retailer ShareTrack Grocers 6 5 4 3 2 1 0 © WorldpanelTM division of TNS 2009 M&S Weekly 3 Point Centred Moving Average Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Sales (Expenditure) M&S Retailer ShareTrack Sales £000s 140,000 120,000 100,000 80,000 60,000 40,000 20,000 Trading Indices – M&S 52 w/e Dec 28 2008 Broad Area Total Total Total Total Total Total Total Fresh+Chilled Ambient Groceries Alcohol Frozen Toiletries Household Healthcare Market 166 75 61 33 21 11 1 Market Sector Chilled Convenience Chilled Bakery Products Fresh Fish Fresh Poultry+Game Biscuits Ambient Bakery Products Fruit+Veg+Salads Take Home Confectionery Chilled Drinks Frozen Fish Fresh Meat Take Home Savouries 436 379 334 168 149 141 129 123 109 99 87 85 Fresh Stuffing Chilled Gravy+Stock Mens Mass Fragrances Seasonal Biscuits Chilled Prepared Fish Chilled Ready Meals Chilled Rice Chilled Sausage Meat Chilled Desserts Ambient Christmas Pudding Chilled Prepared Salad Chilled Prepared Frt+Veg Chilled Cakes Chilled One Shot Drinks Chilled Burgers+Grills Other Chilled Convenience Ambient Vgtrn Products P/P Fresh Meat+Veg+Pastry Special Treats Canned Hot Meats © WorldpanelTM division of TNS 2009 5233 1350 1309 1178 1166 997 725 640 634 546 510 505 472 441 427 386 377 376 367 353 Share of Total Grocers Fresh+Chilled Tesco Sainsbury Asda Morrisons 31.2 30.9 18.8 18.3 15.6 15.8 12.2 M&S 12.5 6.5 6.0 5.5 Waitrose 5.2 Total Co-op 4.4 4.3 Somerfield 4.0 4.0 Aldi 1.7 2.3 Lidl 1.8 2.0 Iceland 1.3 1.4 Tot Indepts 1.4 1.4 Netto 0.6 0.6 Farm Foods 0.2 0.2 52 w/e 30 Dec 07 © WorldpanelTM division of TNS 2009 52 w/e 28 Dec 08 Trended Loyalty Breakdown Waitrose % M&S% 100% 80% 60% 40% 51.6 54.2 53.8 20% 17.9 15.6 13.8 30-Dec-07 28-Dec-08 0% 31-Dec-06 30-Dec-07 28-Dec-08 52 w/e periods 31-Dec-06 High Loyal (>50%) Medium Loyal (>20%) © WorldpanelTM division of TNS 2009 Low Loyal (>0%) Key Topics n Tesco – Slowing n Asda – not just C2DE n Sainsbury – Mass/Up/Market n Morrisons – Surge n Waitrose – The Ethical consumer n Discounters – Flocking n M&S n Home Delivery © WorldpanelTM division of TNS 2009 0 Tesco Internet Sainsbury Internet © WorldpanelTM division of TNS 2009 Asda Internet Weekly 3 Point Centred Moving Average Waitrose+Ocado Internet Jan 25 2009 Dec 28 2008 Nov 30 2008 Nov 02 2008 Oct 05 2008 Sep 07 2008 Aug 10 2008 Jul 13 2008 Jun 15 2008 May 18 2008 Apr 20 2008 Mar 23 2008 Feb 24 2008 Jan 27 2008 Dec 30 2007 Dec 02 2007 Nov 04 2007 Oct 07 2007 Sep 09 2007 Aug 12 2007 Jul 15 2007 Jun 17 2007 May 20 2007 Apr 22 2007 Mar 25 2007 Feb 25 2007 Jan 28 2007 Dec 31 2006 Dec 03 2006 Nov 05 2006 Oct 08 2006 Sep 10 2006 Aug 13 2006 Jul 16 2006 Jun 18 2006 May 21 2006 Apr 23 2006 Mar 26 2006 Feb 26 2006 Share (Expenditure) Home Delivery Share of Till Roll Grocers 2.4 2.2 2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 Internet Demographic Signatures Till Roll Outlet Share within Demographic Group - MAT to November Social Class Household Size 5 6 4 5 4 3 3 2 2 1 1 0 Class AB Class C1 2006 Class C2 Class D 2007 Class E 2008 Housewife Age 6 5 4 3 2 1 0 Age under 28 2006 Age 28-34 0 1 in HH 2 in HH 2006 3 in HH 4 in HH 2007 5+ in HH 2008 No. of Children Age 35-44 2007 Age 45-64 Age 65+ 2008 7 6 5 4 3 2 1 0 No Children 2006 © WorldpanelTM division of TNS 2009 1 Child HH 2007 2 Child HH 3+ Child HH 2008 Internet Grocery Lifestage Signatures Outlet Share of Grocers within Demographic Group 7 6 5 4 3 2 1 0 Pre-Family Young Family 0-4 Years Middle Family 5-9 Years 52 w/e Nov 05 2006 Family 10+ Years Older Dependents 52 w/e Nov 04 2007 © WorldpanelTM division of TNS 2009 Empty Nesters 52 w/e Nov 02 2008 Retired Grocery Internet Household Income Signatures Outlet Share within Demographic Group 7 6 5 4 3 2 1 0 £0 - £9999 pa £10000 £19999 pa £20000 £29999 pa 52 w/e Nov 05 2006 £30000 £39999 pa £40000 £49999 pa £50000 £59999 pa 52 w/e Nov 04 2007 £60000 £69999 pa £70000 + 52 w/e Nov 02 2008 Grocery Internet Council Tax Band Signatures Outlet Share within Demographic Group 8 7 6 5 4 3 2 1 0 Band A Band B Band C 52 w/e Nov 05 2006 Band D 52 w/e Nov 04 2007 Band E Band F 52 w/e Nov 02 2008 © WorldpanelTM division of TNS 2009 Band G+H Till Roll - Duplication by Tesco Internet Buyers Waitrose Internet 3.0 Asda Internet 8.5 Sainsbury Internet Tesco 500 447 5.4 415 71.7 110 Waitrose 9.2 88 Sainsbury 37.2 85 Asda 36.7 80 Morrisons 24.7 Buyers also Buying 64 Duplication Index 8 w/e Jan 25 2008 © WorldpanelTM division of TNS 2009 Till Roll - Duplication by Sainsbury Internet Buyers Waitrose Internet 4.1 Asda Internet 8.0 Tesco Internet Sainsbury Asda Morrisons 421 19.6 408 75.0 171 Waitrose Tesco 683 12.0 50.8 115 78 28.8 21.8 Buyers also Buying 62 57 Duplication Index 8 w/e Jan 25 2008 © WorldpanelTM division of TNS 2009 Reminders © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing not just C2DE © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing not just C2DE Massmarket Upmarket © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing not just C2DE Morrisons Surge Massmarket Upmarket © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing not just C2DE The Ethical Consumer Morrisons Surge Massmarket Upmarket © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing Flocking not just C2DE The Ethical Consumer Morrisons Surge Massmarket Upmarket © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing Flocking not just C2DE The Ethical Consumer Morrisons Surge Massmarket Upmarket © WorldpanelTM division of TNS 2009 Reminders Tesco Slowing Flocking not just C2DE The Ethical Consumer Morrisons Surge Massmarket Upmarket © WorldpanelTM division of TNS 2009 Thank you ed.garner @tns-global.com © WorldpanelTM division of TNS 2009