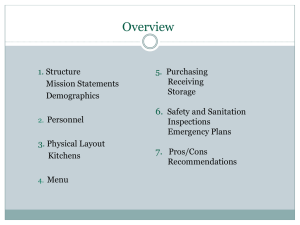

c Topics U.S. Foodservice Industry Overview

advertisement

c U.S. Foodservice Industry Overview November 27th 2008 1 Topics Foodservice v Retail Performance Foodservice Segments Foodservice Consumer Trends 2008 Outlook 2 1 Technomic Inc. ü Source of presentation data ü Leading US strategic consulting & research firm ü Particular expertise in US foodservice 3 Foodservice Share of Industry Sales Grown* Foodservice $207B 45% Retail $258B 55% 1987 = $465B *Retail Foodservice $350B 49% Retail $362B 51% 1997 = $712B Foodservice $541B 51% Retail $520B 49% 2007 = $1,060B sales equivalent, excludes sales of alcoholic beverages Source: Technomic 4 2 Retail vs. Foodservice Factor Retail Units 31,000 supermarkets Segmentation Syndicated Data Some Foodservice Close to 1 million 18 major segments; multiple subsegments Nielsen, IRI None Private Label Share 15 - 20% Around 35% Product Selection Consumer Operator Source: Technomic 5 Definitions Segment Definition Limited Service (LSR) No table service Fast service orientation “Buy before you eat” system Quick Casual (QC) Sub-segment of LSR Freshly prepared, wholesome quality Check average: $6-9 Table service Full Service (FSR) Midscale Limited/no alcohol service Check average: $6-10 FSR Casual Dining Lunch, dinner focus Table service. Full bar service Check average: $10-25 FSR Fine Dining Dinner emphasis, white tablecloth Main Course $20+ Source: Technomic 6 3 Leading LSR Growth Segments Sales $B 2007 Growth 15.6% Beverage Bakery Café Mexican Sandwich 13.0% 6.3% 5.7% Examples $15.4 $4.1 $11.8 $6.9 7 Source: Technomic Full Service Restaurants (FSR) Establishments with a broad menu Table, counter &/or booth and a waitstaff Typically open for multiple dayparts, and often serve beer, wine and liquor 8 4 Casual Dining Dominates Full Service 2006 Sales: $193B* * Includes alcohol White Tablecloth $8B 4% Casual Dining $129B 67% Midscale $56B 29% Source: Technomic 9 Leading FSR Segments 2007 Growth Italian Seafood Mexican Varied Menu 4.0% 3.4% 1.5% 4.1% Source: Technomic Sales $B Examples $14.8 $9.4 $6.4 Independents Independents $42.7 10 5 Consumer Mega-Trends and Operator Responses 6 Consumer Mega-Trends Demographic Behavioral 1. Multi-Generational Demands 4. Convenience 2. The Minority Influence 5. Balance 3. Diverging Incomes 6. Customisation Source: Technomic 12 6 Younger Consumer Dynamics Heavy users of LSR Greater exposure to “ordering in” and “chain restaurants” when growing up Restaurants often viewed as “third place” location, for socialising Technology often incorporated into foodservice experiences 13 Older Consumer Dynamics Higher per-capita expenditures on FAFH More than just food important during the restaurant experience Consuming less “kid-friendly” foods Increasing importance of healthier foods More “traditional” tastes Seek points and rewards (value emphasis) 14 7 Minority Growth Significant Hispanics: 18% population by 2020 81% of the population increase from 2000 to 2020 will be from minority groups % Population Growth Through 2020 Asian 68% Hispanic 68% African American White 26% 5% Source: U.S. Census Bureau 15 Half FAFH Spending Comes from Highest Income Group Share by Income Levels (000) 50% 34% 29% 24% 23% 14% 16% 10% <$20 $20-49 Share of Households Source: U.S. Census Bureau $50-69 $70+ Share of FAFH Spending 16 8 Value Has Multiple Meanings Lower Income Income Lower Groups Groups Higher Higher Income Income Groups Groups Low Price Price Low Dining Dining Experience Experience 17 Operator Strategies: Addressing Consumer Convenience Demands More locations Longer hours Greater menu variety (choice) Ease of ordering, pickup for takeout Improved physical aesthetics Aware of time limits Better employee training 18 9 Balance Consumers are constantly weighing the advantages, disadvantages of conflicting alternatives in their daily life § Work and family § Familiar vs. adventurous foods § Health vs. indulgence 19 Example: Enabling Balance Operators increase the “portability” of many foods, allowing customers to multi-task § Taco Bell introduces the “Crunchwrap Supreme” § Product made for maximum portability § Dashboard dining 20 10 Operator Strategies: Addressing Health & Wellness Operators focus on consumers’ health & wellness “Hot Buttons” § § § § § § § Fresh Fats Organic Natural Functional foods Nutrients/supplements Choice 21 Operator Strategies: Addressing Customisation Desires Provide consumers with opportunities to put “personal touches” on menu items Employee training focusing on relating to customers at the “individual” level Increased emphasis on CRM (Customer Relationship Management) § Local store marketing § E-marketing § Frequent diner/loyalty programs 22 11 Changing Landscape 2008: What’s Happening? LSR FSR Slowing unit expansion Slow/no unit expansion Focus on unit economics Focus on unit economics More lower-priced options Menu price stabilisation Snack occasion, breakfast, dinner expansion More bundling Late night meals (4th meal) Cross-segment competition Promotions Takeout 24 12 Outlook for 2009 Continue to be very challenging Consumer anxiety slow to dissipate Fast food / casual dining outlets doing best Aggressive price promotions Casualties? 25 Thank You 13