The Netherlands Market Overview -Food Industry Day- 27 November 2008

advertisement

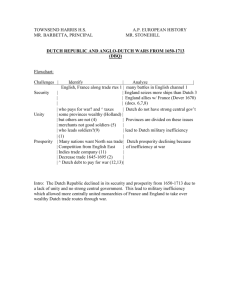

The Netherlands Market Overview -Food Industry Day- 27th November 2008 Presentation Outline Market Overview The Dutch Consumer Retailing Foodservice Entering the Dutch Market Bord Bia Programmes ‘09 Demographics • With a population of 16.4 million, and a land area of just 41,526 sq km, the Netherlands has the highest population density in Europe. • The highest population density is within a 50km catchment area that includes Amsterdam, The Hague and Rotterdam; the Ranstad. • 7.1 million households • 68% of households are of 2 person or less Dutch Economy • The Dutch economy had been performing well until recently, although the long term effects of the global financial crisis remain to be seen. • Measures of performance: – 7.5m Labour force – Unemployment [2.6% - July 2008] – Inflation: [+2.8%] – GDP: [€481b] – GDP growth: [+2.15%] Source: Euromonitor/cbs.nl Effects of the Economic Downturn? • Falling Consumer Confidence • Renewed Focus on Price? 20 10 0 -10 • Pressure on Retailer Margins -20 due to food inflation -30 • Rationalisation programmes – C1000 2007 -40 J F M A M J J A 2008 S O N D J F M A M Consumer Confidence Index Source: CBS J J A S Irish Exports +8% 2006 180 2007 160 140 -9% 120 €m +1.1% 100 80 60 40 -47% 20 +12% 0 Meat Dairy Seafood Consumer Foods Beverages Irish Food & Drink exports registered a steady performance in 2007 Total value of €374m, a 6% increase on 2006 Meat: €173.6m; Dairy: €80.3m; Consumer Foods: €33.3m; Drinks: €9.2m - The Dutch Consumer - Key Lifestyle Trends Time pressure impacting eating & shopping habits among young Dutch • Young Dutch consumers (18-34) are leading busy lives and food preparation time is limited. • They like foods that are easy to prepare and are more favourable to meal components and convenience meals than older Dutch. Marketing of foods as fresh offers competitive advantage • Dutch consumers are very interested in fresh produce. • They have a strong preference for fresh over frozen meals and see fresh as very important on a label. Competitive Prices. • Price is very important to the Dutch consumer. “The Dutch seek out promotional offers, they’ll look for the best value for money within store, quality isn’t as important as price.” Source; PERIscope, 2008 Key Lifestyle Trends Time saving/convenience products • Six in ten 18-34 year olds claim they rarely have time for breakfast – which may represent an opportunity to market convenience breakfast or on the go breakfast options to this age group. • Younger Dutch consumers are looking for easy to cook and prepare options. • Older Dutch are more likely to make an extra effort for meals and have good cooking skills more sophisticated meal components may appeal to this group. Low involvement in local foods and high interest in new foods may make it easier to break into the Dutch market. • Dutch consumers lack of interest in local produce and in country of origin may make it easier to launch Irish products. • Irish products that offers convenience and freshness will resonate well with Dutch consumers who are particularly interested in new foods. Source; PERIscope, 2008 Consumer Trends Price Conscious … • The average food spend on a evening meal for 4 is €6.80 (source Albert Heijn) Shopping Patterns … • Many Dutch customers travel to the supermarket by bicycle, so bulk buying is not so prevalent • Small houses and therefore kitchens - not everyone has room for a chest freezer Lifestyles …. • Number of working women and smaller households are increasing • Driving demand for easy to prepare meal solutions - Retailing in the Netherlands- General Observations Supermarketchannel channel Supermarket consumersales: sales:€€30.5 30.5billion billion ••consumer sharefresh freshfood: food:48% 48% - -share numberofofstores: stores:4.700 4.700 ••number privatelabel labelshare: share:24%* 24%* ••private discountershare: share:17.9% 17.9%(Aldi (Aldi8.9% 8.9%/ /Lidl Lidl4.5%) 4.5%) ••discounter averagesales salesarea areaper perstore: store:730 730sq sqmm ••average grossmargin: margin:20% 20% ••gross netmargin: margin:2% 2% ••net • • • • • Very dense retail environment Distinction between different retailers is relatively limited, hence the intense focus on price Price war started by Albert Heijn (end of 2003) to provoke shake-up in the Dutch retail scene – Super de Boer biggest casualty. Price wars have since eased in intensity – but price remains an important tool for promotion. Renewed emphasis on price due to economic climate? Source: Retail Insights/Deloitte Retail Developments in 2008 • Ahold sells its 73% stake in Schuitema – acquires 58 C1000 stores for rebranding. • C1000 rationalisation programme – 20% of jobs to go • Growth of Superunie through addition of soft discounter Ko-op Consult, reaching a combined market share of approx 35% • Jumbo’s rapid growth coming to a halt • Margins coming under pressure Retail Spending • Grocery retail market was worth €28.3 billion in 2007 (Foodstep) 35 34 • Food and drink accounts for an estimated €23.8 billion of this spend Food accounts for 15.2% of total household expenditure (Deloitte) • Grocery spend in 2008 is forecasted at €30.3 billion (GfK) Grocery Retail Market €billion 33 • 32 31 30.3 30 29 28 28.3 27.2 27 26 25 24 23 22 21 20 2006 2007 2008e Market Shares Hoogvliet 2% Spar 2% Other 9% Dekamarkt 2% Sligro Retail 2% Albert Heijn 29% Co-op Codis 2% Albert Heijn C1000 Aldi Super de Boer Plus Jumbo Ko-op Consult 5% LIDL Ko-op Consult Co-op Codis LIDL 5% Jumbo 6% C1000 14% Plus 6% Super de Boer 7% Sligro Retail Dekamarkt Hoogvliet Spar Other Aldi 9% Jumbo, Plus and Ko-op Consult belong to Superunie, which has a combined market share of around 35% Source: Deloitte Who’s who in Retailing • Top 5 retailers accounting for almost 65% of the market • Select number of retail chains have nationwide presence – Albert Heijn, C1000 & discounters • Strict planning legislation has slowed growth of larger out of town store formats • No general prohibition on below-cost pricing, although the government has promised an agency to monitor predatory pricing. # 1 Albert Heijn # 2 Superunie # 3 Schuitema/C1000 # 4 Discounters #5 Super de Boer Retail Market Segmentation Relatively low cost Bas v.d. Heijden Jan Linders Nettorama Aldi Poiesz Digros Dirk v.d. Broek Jumbo Lidl Middle-market Price Relatively low service Vomar Deen Hoogvliet C1000 BoniPlus Golf Em-Té Coop Relatively high service Albert Heijn Service Super de Boer Relatively high cost # 1 Albert Heijn •• MarketLeader Leaderwith with30% 30%market marketshare share Market Ownedby byAhold Ahold •• Owned MemberofofAMS-Sourcing AMS-Sourcing(Euro-shopper) (Euro-shopper) •• Member 800stores storesplus, plus,ininvariety varietyofofstore storeformats: formats: •• 800 AH,XL, XL,To ToGo Go AH, 58larger largerC1000 C1000Stores Storesacquired acquiredas aspart partofof •• 58 Ahold’ssale saleofofSchuitema, Schuitema,increasing increasingmarket market Ahold’s shareby byup upto to5% 5% share Albert Heijn cont... Strongfocus focuson onPrivate PrivateLabel Label(differentiation (differentiation&&margin margingeneration) generation)––accounts accountsfor forapprox. approx.50% 50%ofof - -Strong range. Actively Activelypromotes promotesPL PLrange rangeas asalternative alternativetotoA-brand A-brandequivalents, equivalents,eg: eg:blind blindtaste tastetests. tests. range. Widediversity diversityA-brands A-brandsused usedtotostrengthen strengthenprice priceimage. image. - -Wide Challengefor forsuppliers suppliersisistotooffer offer‘unique’ ‘unique’products, products,strong strongbrands brandsororproducts productswhich whichcannot cannoteasily easilyby by - -Challenge offeredininaaprivate privatelabel labelversion version offered Aholdowns ownsthe theGall Gall&&Gall Galloff-sales off-saleschain chain - -Ahold Storeshave havehistorically historicallyoffered offeredaahigh highlevel levelofofservice serviceand andquality qualitywith withprices pricesatatthe theupper upperend endofofthe the - -Stores market market Extensiveprivate privatelabel labelininstores storesincluding includingpremium premiumrange range‘Excellent’ ‘Excellent’ - -Extensive Pioneeringnew newstore storeformats formatsand andscanning/payment scanning/paymenttechnologies technologies - -Pioneering # 2 Superunie €8.1billion billioncombined combinedturnover turnoverinin2007 2007 •• €8.1 Purchasingorganization organizationfor for16 16supermarket supermarketchains, chains,with withthe theaddition additionofofKoop KoopConsult ConsultininJuly July •• Purchasing Combinedmarket marketshare shareofofapprox approx35% 35%with withthe theaddition additionofofKoop KoopConsult Consult •• Combined Accountmanagement managementrequires requirescontact contactboth bothatatSuperunie SuperunieHQ HQlevel leveland andwith withindividual individualmembers members •• Account 85%ofofall allproduct productlines linesare arepurchased purchasedcentrally centrallyby bySuperunie Superunie •• 85% PartofofEMD EMDpurchasing purchasinggroup group •• Part Formidableplayer player––‘togetherness ‘togethernesswins’ wins’ •• Formidable Superunie cont... Privatelabel: label:Perfekt, Perfekt,O’Lacy, O’Lacy,Plus, Plus,Markant MarkantMerk Merk&&premium premiumPL PLbrands. brands. Private Strongfocus focuson onbuying buyingprice price •• Strong Economyofofscale scale––members members(often (oftenlocal localstore storechains) chains)benefit benefitfrom fromsimilar similar •• Economy tradeterms termsas asbigger biggerplayers playerssuch suchas asAlbert AlbertHeijn. Heijn. trade Able&&ready readytotocounter counteraggressive aggressivepricing pricingby byAH AH •• Able Able&&ready readytotoconfront confronteven evenmajor majorsuppliers suppliers(e.g. (e.g.boycotts boycottsofofkey keySKU’s) SKU’s) •• Able Jumbo in Amstelveen Successfuland andrapidly rapidlygrowing growingmember memberofofSuperunie Superunie ••Successful Currentlythe the66ththlargest largestindividual individualretailer retailerininits itsown own right rightwith withaa ••Currently marketshare shareofof5.9%, 5.9%,up upfrom from4.2% 4.2%inin2007 2007(Deloitte) (Deloitte) market Significantcapital capitalinvestment investmentininnew newCDC CDCand andstore storeexpansion expansion ••Significant Jumbo’s current strategy includes: • • • Every Day Low Prices – ranked #1 by GfK for price/service ratio Aggressive Growth: Quality in fresh products 45 stores (’04) High levels of customer service. 98 stores (’06) 114 stores (’07) 118 Stores (Current) Jumbo Turnover: 2002: €413 mln 2003: €616 mln 2004: €735 mln 2005: €811 mln 2006: €972 mln 2007: €1264 mln Source: Retail Analysis photo gallery Lower Price Higher Service Level Lower Service Level Higher Price Jumbo Ranks #1 in Price-Service ratio (Source: GfK) # 3 C1000 Totalofof387 387stores storesnationwide nationwide(450 (450inin ••Total 2007) 2007) Thecompany companyowns ownssupermarkets supermarketsand and ••The provideswholesale wholesaleservices servicesto to provides independentand andassociated associatedretailers retailers independent operatingunder underthe theC1000 C1000trade tradename. name. operating Focuson onFresh Fresh––often oftensells sellsmeat meatas as ••Focus “lossleader” leader” “loss Changes at C1000 SchuitemaN.V N.Vwas waspreviously previously73.2% 73.2%owned ownedby byAhold, Ahold,with withthe the •• Schuitema remaining26.8% 26.8%held heldby byC1000 C1000store storeowners. owners. remaining §§ InFebruary February2008, 2008,Ahold Aholdsold soldits itsstake stakeininSchuitema Schuitemato toCVC CVCCapital Capital In Partners,and andacquired acquired58 58Schuitema Schuitemastores storesas aspart partofofthe thedeal. deal. Partners, Reducedturnover turnoverby by15%. 15%. Reduced §§ C1000had hadaamarket marketshare shareof of14.5% 14.5%inin2007, 2007,but butthis thisshould shoulddrop dropto to C1000 around10%-12% 10%-12%with withAhold’s Ahold’sacquisition acquisitionofofthe the58 58stores stores around Currentlyconsidering consideringrationalisation rationalisationprogramme, programme,including including20% 20%staff staff •• Currently reduction,as asresult resultofofturnover turnoverloss lossand andcurrent currentmarket marketconditions. conditions. reduction, # 4 Discounters HardDiscounters Discounters Hard Aldi&&Lidl Lidl––14.4% 14.4%combined combinedmarket marketshare share •• Aldi Increasinglyplaying playingthe therole roleofofaaservice servicesupermarket supermarket •• Increasingly Introducingaalimited limitednumber numberofofAAbrands brands •• Introducing Movedinto intofresh freshmeat, meat,luxury luxuryfoods, foods,ready readymeals, meals,fruit fruit •• Moved andveg veg and Hard Discounter SoftDiscounters Discounters Soft Formulas;DirK DirKvan vander derBroek, Broek,Digros, Digros,Bas Basvan vander der •• 33Formulas; Heijden Heijden Dirkvan vander derBroek Broekand andDekamarket Dekamarkettotomerge mergeinin2009 2009 •• Dirk Combinedmarket marketshare shareofof4.1% 4.1%- -purchasing purchasingvia via •• Combined Superuniesince sinceJuly July2008 2008 Superunie Soft Discounter # 5 Super de Boer Formerlyknown knownas asLaurus, Laurus,the the •• Formerly holdingcompany companyadopted adopted the thename name holding ofits itsonly onlyremaining remainingretail retailformat format of atthe thebeginning beginningof of2008 2008 at Partowned ownedby byCasino Casino(around (around •• Part 45%),ititsold soldoff offits itsKonmar Konmarand and 45%), Edahformats formatsduring during2006 2006 Edah Consistentwinner winnerof ofSupermarket Supermarket •• Consistent ofthe theyear, year,but butlost lostsignificant significant of marketshare shareas asaaresult resultof ofAlbert Albert market Heijn’sprice priceoffensive. offensive. Heijn’s Super de Boer cont... had315 315stores storesatatthe theend endofof2007, 2007,176 176ofofwhich which •• ItIthad areindependently independentlyowned. owned. This Thisrepresents representsaa are reductionofof47 47stores storesover overthe theprevious previousyear year reduction SinceJanuary January2006, 2006,Laurus/Super Laurus/Superde deBoer’s Boer’sstore store •• Since rationalisationprogramme programmehas hasincluded: included: rationalisation Thesale saleofof41 41Konmar Konmarsuperstores. superstores.12 12were were –– The divestedtotoJumbo, Jumbo,and andaafurther further29 29totoAhold, Ahold, divested splitbetween betweenAlbert AlbertHeijn Heijnand and split Schuitema/C1000 Schuitema/C1000 Thesale saleofof223 223Edah Edahdiscount discountstores storestotoS+S S+S –– The Winkels,aaconsortium consortiumincluding includingthe thedomestic domestic Winkels, SligroFood FoodGroup Groupand andB.V B.VSperwer. Sperwer. Sligro Retail Consolidation Wholesale/Retailoutfit outfitSligro Sligroconsidering consideringmerging mergingits itsretail retailformats formatsGolff Golff •• Wholesale/Retail (0.9%Market MarketShare) Share)and andEm-Té Em-Té(1.3%) (1.3%) (0.9% Decisiondue dueQ1 Q12009 2009 •• Decision Resultingchain chainwould wouldhave have140 140stores storesand and2.2% 2.2%market marketshare. share. •• Resulting Brand vs Private Label • NL still behind GB in PL but gaining ground • Private label market share has grown significantly in recent years to counter the discounters • Increased to approx 24% in 2007 • PL better margins to retailers and as a weapon in the price war • Demand is in fresh, household articles, sauces, sweets and crisps. • Increasing segmentation in PL – Good, Better, Best • Increasing opportunities to cater for niches that are not of interest to A-brand manufacturers (Excluding fresh; Including Dairy and Ready Meals) January 2005 - January 2008 Source: IRI Nederland The Dutch Retailers: Albert Heijn Private label range Private Label Source – Nielsen, 2008 Private Label • Source – Nielsen, 2008 Working with retailers - Establishing contact - Parallel approach with retailer & distributor - Quality standards – BRC accreditation - Contractual arrangements - Language - Promotions - Shelf space is limited – must have USP to displace competitor - Foodservice in the Netherlands- Foodservice Foodservice Horeca €13.6b €18.9b Food-to-go Catering €3.4b €1.9b Source: Foodstep Horeca .... Facts and Figures • Total Horeca turnover is €13.6 billion, representing 7.2% growth on 2006. • 4 channel categories – Hotel chains (Van der Valk, Golden Tulip, NH Hotels) – Restaurants (La Place) – Bars/pubs – Catering/fast food (McDonalds, Burger King) • About 300,000 people are working in about 42,000 companies. • Supply chain management – at various stages of evolution Horeca Market Dutch horeca market Horeca Hotels & lodging Restaurants Bar/pubs Cafeteria/fast food Bed & breakfast Bistro Bar/pub Ice cream parlour Hotel-bar Restaurants Discotheque Snack bar/Cafeteria Hotel-restaurants Bar-restaurants Coffeeshop Fast food restaurants Hotel-café-restaurants Motorway restaurants Kiosk Pension Lodging accommodation Shoarma/Grillroom Horeca at a recreation ground Lunchroom Horeca at a sports accommodation Crêperie Beach club Meeting point Party centre Station restaurants Party catering Foods/snackprovider not earlier mentioned Top 10 Horeca Players Rank Company Turnover (€m) Outlets 1 Van de Valk 470 54 2 McDonalds 462 226 3 Golden Tulip 299 74 4 Center Parcs 271 8 5 La Place 244 427 6 Servex 335 315 7 Accor 235 53 8 NH Hotels 220 220 9 Best Western 207 53 10 Land Greenparks 169 43 Foodservice to 2010 The three most important changes: 1. Rising commodity prices: grains, oil, meat, fish and dairy to become extremely expensive. Consumer prices to rise drastically, leading to greater emphasis on price competition and many outlets seeking alternative suppliers. 2. Sustainability: Still relatively small, but importance growing rapidly 3. Health and Wellness: already an important trend – will become even more so. Source: Foodservice Instituut Nederland The “7 Cs” in Foodservice On a scale of 1 to 100, how important are the following trends in Foodservice? Consumer Importance 2007 Projected Importance 2020 Source: Foodservice Instituut Nederland Food-to-Go • Total Food-to-Go market estimated at €3.5 billion in 2007 • Largest channel is petrol stations, which account for over €1.9 billion thereof. • Other major channels include Servex (railway station outlets) and drivethrough outlets, and food-to-go counters in retail stores • Exploitation of Food-to-Go concept in the Netherlands remains limited to date – high potential for growth in the next 10 years, led in particular by retailers. • Key Drivers: - Growing number of people commuting to work - Growth in times and distances being travelled - Growth in time spent in heavy traffic - Greater variation in working hours Source: Foodservice Instituut Nederland Food to Go Source: Foodservice Instituut Nederland Catering ... Facts and Figures • Total Catering turnover is €3.4 billion • 4 channel categories • Business • Institutional • Educational • Others (leisure, travel) • Dedicated service providers • Albronn • Sodexho • Compass Dutch Catering Market Dutch catering market Catering Business catering Institutional catering Nursing home Basic care Nursing home Medical care Educational catering Leisure Other Travel Supporting horeca Amusement parks funfairs Inflight catering Horeca within retail trade Museum Ferry Petrol stations Cinemas and Film theatres Railway catering Hospital Psychiatric hospital Medical children's home Medical day-care center Institution for disabled Penitentiary Theatres Exhibition and conference areas Vending machines Route to Foodservice Foodservice Horeca €13.6b Food-to-go €18.9b €1.9b Catering Service providers - wholesalers Source: Foodstep €3.4b Foodservice – Key Players Wholesale Market €5-6billion 10-15% 15-20% 2% 1% Foodservice - Key Players 10-15% Wholesale Market 10-15% 5% 4% 15-20% €5-6b 2% 1% - Entering the Dutch Market - Opportunities • Affluent & concentrated market of 16.4 million • Cost of production in NL is high - land, labour costs, regulations • High level of food imports • Ireland’s image is excellent • English widely spoken, easily accessible, logistics manageable • €uroland • Demand for innovation in convenience - Irl and UK ahead Challenges • Sustained price-reduction activity will reduce margins for both retailers and manufacturers, who will both aim to reduce their cost base • Environment cues …. Number of new products launched in around organic, animal welfare • Price – Price – Price …Value for money • Market segmentation …Value / mainstream / premium • Private label growth is set to continue, spearheaded by Albert Heijn Tips for the Dutch Market • Understand the Category from a Dutch perspective • Parallel Approach (Distributor:Retailer/Foodservice) • Formal business arrangements: Contracts are very strong • Know your bottom Price • Don’t go immediately to No.1 retailer • PL as an option to enter this market - Bord Bia Activities in 2009 - Development & Knowledge Hub • Undertaking Category Analysis Reviews – Identifying new market opportunities • Business Mentoring – Assisting companies in their initial steps to market entry – Business mentors will be of a high calibre, with a strong background in retail and/or foodservice • Directory of food manufacturers in the Netherlands – Identify market opportunities for consumer food products/ingredients • Trade Directory/Market Insight • Networking Opportunities – Irish Netherlands Business Association - Netherlands Market Overview - Declan.fennell@bordbia.ie Tel: +31 20 575 34 84