Bulgaria Market Overview Bord Bia, Frankfurt November 27

advertisement

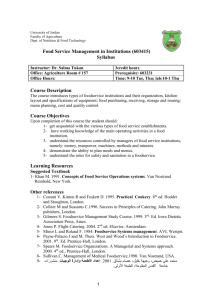

Bulgaria Market Overview Bord Bia, Frankfurt November 27th 2008 Bulgarian Market Overview • Population: 7.26 million – Sofia (Capital) 1,148,400 – Plovdiv 342,000 – Varna 311,800 – Burgas 189,300. • Language: Bulgarian • Currency: Lev €1 = 1.96 BGN (ECB, October 2008) • Joined the EU on 1 January 2007 Market Overview • GDP Growth - real growth rate 6.2% 2008(e) (IGD, 2008) • Inflation rate: 4.5% (2008(e)) (IGD, 2008) • Unemployment: 8.5% (2008(e)) (IGD, 2008) • Grocery Retail Spending per capita is increasing; up from €581 in 2004 to €981 in 2008 (e) (IGD, 2008) • VAT: 20% • VAT on Medicines: 7% • Bulgaria’s middle class has been expanding since the 1990’s and now accounts for 10% of the population. However the wealthiest 10% of Bulgarian’s earn 27% of total salary, making Bulgaria’s generally price sensitive (IGD, 2008). Irish Food Export Performance Irish Food Exports to Bulgaria (2007) Total value of exports: €4.3 million Beverages 28% Meat 2% Dairy 15% Vegetables and Fruit 13% Sugars 4% Misc. edible products 37% Source: CSO Food and Drink Statistics 2007 Other 1% Key Consumer Trends in the Market • Solid growth in retail sector: 22% growth between 2006 and 2008(e). • Per capita spending is increasing but is still significantly lower than in Western Europe. • Over half of retail sales in Bulgaria are generated through the food retail sector. 2006 (€) 2007 (€) 2008 (e) (€) Total Retail Market (billions) 11.22 12.20 13.80 Grocery Retail Market (billions) 5.89 6.43 7.20 Grocery Retail Spend/capita 786 878 981 Source: IGD Country Presentations, 2008 Retail Grocery Market • Grocery Retail Value: €7.20 billion and was number 8 in the list of top Eastern European markets (Russia, Turkey, Poland, Romania, Czech Republic, Hungary and Ukraine) and number 64 globally (IGD, 2008). • Small grocery stores are the most popular retail format with 60% of all value. This has held steady since 2003 (IGD, 2008). • Discounters: only entered the market in 2006 and account for just 1% of total retail sales value. Penny Markt largely makes up this 1%. • Sunday trading is not prohibited but stores are generally only open Monday to Friday 10am to 8pm and Saturday 10am to 2pm. Retail Grocery Market • Supermarkets: Fantastico (Bulgaria) is the third largest retailer with over 32 supermarkets and cash and carry’s. They are in process of launching their new brand “Delicatessen” which is a premium range (IGD, 2008). • Cash & Carry sector: Dominated by German chain Metro. The Metro group had sales of €441 million in 2007 and grew sales by 17.% in 2007. They currently have 8 stores but is the best known retailer in the country due to its high advertising spend. • Hypermarket: Kaufland (part of the Lidl and Schwarz group) is the 2nd most important retailer in the country with over 35 stores and a further 12 planned, despite having only entered the market in 2006. Source: IGD Country Presentations, 2008 Top Retailers 2007 Retailer Total Sales (€m) Grocery Sales (€m) % Change Grocery Sales 2007 v 2006 Grocery Retail Market Share*(%) No. of Stores Sales Area (sqm) Metro 441 441 +17.6% - 8 63,730 Lidl & Schwarz 318 318 +191.7% 4.9% 35 140,000 Fantastico 203 198 +17.8% 3.1% 32 92,000 Rewe 169 169 +22.4% 2.6% 29 29,000 CBA 168 168 +34.4% 2.6% 170 52,500 Piccadilly 110 110 +17.8% 1.7% 12 23,800 Maxima 40 40 +37.9% 0.6% 23 103,500 Elemag 22 22 +4.8% 0.3% 3 6,100 Source: IGD Analysis, Country Presentation, Bulgaria, 2008 Retail Market Share Fantastico 14% Rewe 11% Lidl & Schwarz 22% CBA 11% Piccadilly 7% Metro 31% Source: IGD Analysis Country Presentation Bulgaria Elemag 1% Maxima 3% Private Label Private Label Share % (2007) % Private Label 15.01 14.51 10 4.99 4.84 4.35 3.58 0.79 0 n Fa co ti s ta e ew R y ill d a cc i P n la f au K d BA C Source: IGD Analysis Country Presentation Bulgaria, 2008 ro et M ke ar M T- t Foodservice Trends • • • • • Bulgaria’s foodservice market is growing but the pace at which it is growing has slowed in the past year due to the economy. High oil prices and new laws aimed at raising the standards of foodservice to those of EU levels have held back the market. Pizza saw the highest segment growth in 2005 across full service restaurants, fast food outlets and in 100% home delivery/takeaway sector. However, the chains saw no progress at all. Fast food suffered one of the most unprofitable years in business in 2005 particularly McDonald’s saw a fall in turnover and transactions. It is believed that while growth in the market will slow, there are still huge opportunities for growth in the coming years. Source: Euromonitor, 2007 Foodservice Trends • • • Tourism is expected to continue to influence the foodservice sector. 4.5 million foreign tourists visited in 2005. The increase is leading to rapid expansion of foodservice around tourist destinations. Some 70% of all visitors will eat at a restaurant while there so has led to growth of full service restaurants. In Sofia, the capital, there is a greater presence of chains though independents continue to dominate. An increase in the number of shopping malls is helping this growth as well with companies such as “Happy Bar & Grill”, “Pizza Hut” and “Onda Coffee Break” Consumer foodservice market was worth US$1,370mn in 2005 or €1.1 billion with over 348 million transactions conducted. Source: Euromonitor, 2007 Chain Consumer Foodservice Brand Shares (2005) by number of outlets and market share 90 30 80 25 70 60 20 50 15 40 30 10 20 5 10 O M Sh el l Se le ct Ha pp V V y Ba IVA r& G M ril cD on l al d Jim 's m y 's Lu ca n Ne o de li At a la Tr o p n ti c Du s H nk o u se in D on ut Pi zz s a H Su ut bw ay KF C G oo dy 's 0 Source: USDA Report on Consumer Foodservice Bulgaria, adapted. 0 No of Outlets Share Foodservice Establishments • Onda Coffee Break – First company to enter and launch in the specialist coffee shop sector and was still the only company operating in this sector in 2003. – In 2005 they opened three more outlets, all in Sofia. – Despite higher prices, it attracts people for the innovative coffee, tasty food, excellent service and modern interior. – They may face challenges in the future as more competition continue to enter the market. (Starbucks due to enter the market in November 2008.) Source: Euromonitor, 2007 Foodservice Establishments • Happy Bar & Grill – In 2005 accounted for the largest share of the chained consumer foodservice market at 26.8% and had 20 outlets in Bulgaria. – Have an extensive bar menu and specialise in cocktails. – Food menu options include: grilled chicken and pork dishes. – www.happy.bg Source: Euromonitor, 2007 Foodservice Establishments • Trops House – Offers traditional Bulgarian food – Established in 1994 – Operates 8 fast food outlets, and 3 delicatessens. Reasons for targeting Bulgaria • • • Strong growth in GDP +6.2% (2007) Rising personal income levels Increased foreign tourism is increasing the demand for western produced high quality goods Barriers/challenges in supplying Bulgarian market • • • Distance to market and increased logistic costs Local language barrier (Bulgarian). Can hinder trade enquiries and delay progress Low disposable income €3,646 per capita per annum Bord Bia services 2009 • Bord Bia market mentor (Mr. Kieran Fahy) available for Eastern Europe market and trade related queries: • Services include: Itinerary Development, Category Analysis, Media review and translation services, Product Price auditing and tracking, Product retrieval, Buyer networking, Distributor searches Kieran Fahy Sarospatak ut 32 1125 Budapest Hungary Tel: +36 706 144871 Email: Kieran.fahy@freemail.hu Also: Liam MacHale Bord Bia Wöhler Str. 3-5 60323 Frankfurt, Germany Tel +49 69 710 423 255 Email: liam.machale@bordbia.ie