Ohio State University Fisher College of Business

advertisement

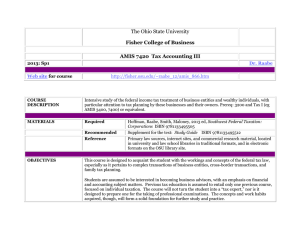

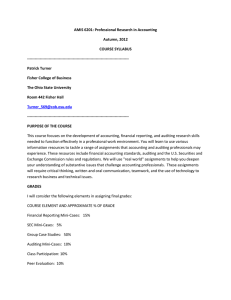

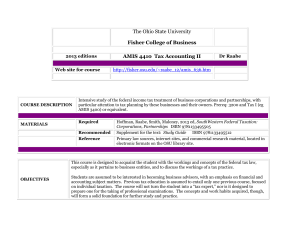

Ohio State University Fisher College of Business AMIS 7784 Tax Research Spring 2013 Web site for course Dr. Raabe http://fisher.osu.edu/~raabe_12/amis_646.htm COURSE DESCRIPTION Case studies requiring an in-depth examination of the tax aspects of situations frequently encountered by businesses and individuals. Prereq: AMIS 7400 or equivalent MATERIALS Required Reference LEARNING OBJECTIVES Raabe, Whittenburg, Sanders, Federal Tax Research, 9th ed (2012), ISBN 1-111-22164-2 Primary law sources, internet sites, and commercial research material, located in university and law school libraries in traditional formats, and in electronic formats on the OSU library site. This course is designed to: Develop knowledge about the various sources of federal tax law. Apply a systematic tax research methodology in solving complex taxpayer-oriented tax problems. Develop critical thinking skills in analyzing various tax law sources, allowing construction of alternative solutions to tax problems in a manner that will help to attain taxpayer financial and tax planning goals. Strengthen speaking and writing skills, as needed by practicing tax professionals. Strengthen professional communication skills through collegial discussion and teamwork. Students are assumed to be interested in becoming business advisors, with an emphasis on financial and accounting subject matters. Previous tax education is assumed to entail only one previous course, focused on individual taxation or tax planning. The course will not convey any specific technical tax concepts that have not already been addressed in other OSU tax courses. The concepts and work habits acquired, though, will form a solid foundation for further study and practice. PROCEDURES There are a number of scheduled tutorials as to content, but most of the course is carried out in a laboratory format. Students work in assignment groups of two. Most of the work uses documents found through online resources. Groups should sit together during class time, and at least one member should connect a laptop to the internet before class starts. Assignments are detailed below. Because of our limited class time, it is imperative that you do the assigned reading BEFORE the class meeting. In this way, our time can be directed toward the material that you have found to be the most difficult. Regular class attendance will improve your chances of meeting the course objectives. ACADEMIC MISCONDUCT Academic misconduct will not be tolerated. According to University Rule 3335-31-02, all suspected cases of academic misconduct will be reported to the Committee on Academic Misconduct. DISABILITY SERVICES The Office of Disability Services verifies students with specific disabilities and develops strategies to meet the needs of those students. Students requiring accommodations based on identified disabilities should contact the instructor at the beginning of the quarter to discuss his or her individual needs. All students with a specific disability are encouraged to contact the Office of Disability Services to explore the potential accommodations available to them. GRADES Some assignments can be completed electronically. Send those to raabe.12@osu.edu by 11pm of the indicated due date. Major assignments Ground rules: open book, work in teams, half of the points on content, half on format-spelling-professionalism. Assignment 1, 10 points Assignment 2, 15 points Assignment 3, 25 points Assignment 4, 25 points Worksheets Ground rules: open book, work in teams, all points on content. 5 course points each. Submit by 11pm of due date. The grading scale for the course is likely to be as follows. Pluses and minuses may be used as well. 90A, 80B, 70C, 60D ASSIGNMENTS The course schedule is as follows. Date Read Text Chapter before Class In-Class Materials Graded Items 3/4,6 3/18,20 3/25,27 4/1,3 1, Tax Practice 2, Tax Research Methodology 11, Communicating Tax Research 3, Legislative Sources Slides Slides Slides Slides 4/8,10 4/15,17 4/22,24 4, Administrative Sources 5, Judicial Sources 6, Tax Services Slides Slides Slides 4/8 Submit Assignment 1 4/15 Submit Assignment 2 4/22 Submit Assignment 3 6/4 8, Citators Final Exam Schedule Submit Assignment 4 WILLIAM A RAABE, PhD, CPA, graduated from the University of Illinois. His family moved to Columbus in June 2001. He was the Wisconsin Distinguished Professor of Taxation at the University of Wisconsin-Milwaukee, and Capital University's (OH) only Distinguished Professor. Bill also taught at Arizona State University, Samford University (AL), and the Capital University Law School. He has been active in the tax education functions of the major accounting firms, and he created nationally marketed software for estate and gift planners. His scholarly articles appear in journals for both academics and tax advisors. His books include undergraduate and graduate texts, as well as several professional reference works, the latest of which is published by CCH: Schedule M-3: Book-Tax Differences. Bill testified as to tax matters before legislative committees in two different states, and in the courtroom as an expert witness. He is a faculty advisor to the OSU teams in the Deloitte Tax Case Competition and the PricewaterhouseCoopers Tax Policy Competition (“xTax”), and he founded and coordinates the Fisher/OSU Tax Clinic. Bill’s teaching and research interests include: federal, state and local, and international taxation financial and retirement planning charitable gift techniques taxation and management of exempt organizations electronic learning theory and applications Office hours MW 11:30 - 12:30 pm and by appointment Contacts raabe.12@osu.edu 430 Fisher Hall 614.292.4023 Dr Raabe’s Web Site http://fisher.osu.edu/~raabe_12 Dr Raabe Online BillRaabeTax on Twitter and Youtube