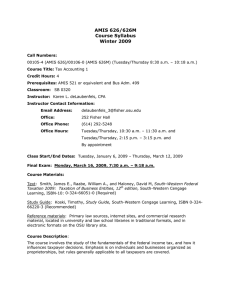

Accounting and MIS 7420: Tax Accounting III

Accounting and MIS 7420: Tax Accounting III

Course Syllabus – Fall 2013

Tue. and Thur. 10:15 – 11:45 pm – Gerlach Hall 315

Alan J. Lacko Office: 052 Fisher Hall Instructors

Phone: 614-205-6365 E-mail: lacko.2@osu.edu

Office Hours: Tuesdays and Thursdays 12:30 to 1:30 pm

Course Materials:

Required - Hoffman, Raabe, Smith, Maloney, 2014 ed. South-Western Federal Taxation:

Corporations, Partnerships, Estates and Trusts , ISBN 1-285-42448-4

Reference - Primary law sources, internet sites, and commercial research material, located in university and law school libraries in traditional formats, and in electronic formats on the OSU library site.

Course Description:

This course involves intensive study of the federal income tax treatment of business corporations, with particular attention devoted to tax planning by these businesses and their owners.

Prerequisite: AMIS 3400 (626), AMIS 7400, enrollment in the Master of Accounting program, or equivalent. Completion of AMIS 7410 is highly recommended as many concepts are a continuation from that class.

Course Objectives:

This course is designed to acquaint the student with the workings and concepts of the federal tax law, especially as it pertains to complex transactions of business entities, cross-border transactions, and family tax planning.

Students are assumed to be interested in becoming business advisors, with an emphasis on financial and accounting subject matters. Previous tax education is assumed to entail one previous course focused on individual taxation as well as one previous course covering corporate taxation.

The course will not turn the student into a “tax expert,” nor is it designed to prepare one for the taking of professional examinations. The concepts and work habits acquired, though, will form a solid foundation for further study and practice.

Course Methods:

AMIS 7420 will be conducted in a lecture/discussion format along with the completion of various case studies. My job is to help you understand key concepts and issues. I will explain and illustrate important concepts in a lecture-like format and will engage you in dialogue through answering questions and working through problems in class. Your job is to be prepared for every class by reading (in advance) the relevant chapter and completing the assigned problems. You are encouraged to ask questions and be actively involved in class discussions.

Case Studies can be submitted individually or by a team of two. Regular class attendance will improve your chances of meeting the course objectives.

OSU’s policies as to academic integrity, and the MAcc Code of Ethics and Responsibilities, are incorporated herein by reference.

Academic Misconduct:

Academic misconduct will not be tolerated. According to University Rule 3335-31-02, all suspected cases of academic misconduct will be reported to the Committee on Academic

Misconduct.

Disability Services:

The Office of Disability Services verifies students with specific disabilities and develops strategies to meet the needs of those students. Students requiring accommodations based on identified disabilities should contact the instructor at the beginning of the quarter to discuss his or her individual needs. All students with a specific disability are encouraged to contact the Office of Disability Services to explore the potential accommodations available to them.

Course Communications:

Course information and assignments will be communicated via Carmen and university e-mail, so it is important that you regularly check your accounts.

Professionalism/Participation:

Attendance and being actively engaged is expected in the business world and it is expected in this course. Questions will routinely be asked of the class. Responding with the “right” answer is not the objective, but rather being prepared for and engaged in class is what is important.

Homework:

Homework assignments will not be collected and will generally not be reviewed in class.

Recommended homework problems will be posted on Carmen throughout the semester, and the solutions to these problems will also be posted on Carmen. These assignments are designed to help you perform well on the graded cases/problems to be completed in class, as well as on the exam.

2

Cases / Problem Sets:

Students will work through a variety of problems and cases pertaining to topics covered in the course. Students may work in groups of two or three and these cases will generally be completed during class in a workshop setting. The use of the textbook and class notes is permitted to assist working through these assignments. Collaboration with individuals outside of your own group is not permitted and constitutes academic misconduct. I will not answer questions about the assignment (except to clarify any unclear wording), as these are designed to help you develop your skills of applying tax rules/law to specific scenarios. No make-up assignments will be given.

Your lowest case score will be dropped to compensate for one unexpected absence during the quarter.

Quizzes:

Six quizzes will be administered during the academic term. These will be given at beginning of the class period and will typically last no longer than 10 minutes. Your lowest quiz grade will be dropped. If you are absent from class (excused or unexcused), you will receive zero points for that quiz. Quizzes are closed-book, closed- note and will consist of True/False, fill-in-the-blank, and multiple choice questions.

Quizzes will contain questions from the prior class session. To enhance your chances of doing well on the quizzes, you should review your class notes from the prior class session (including posted solutions to the in-class problem sets). Quizzes must be completed and submitted individually.

Exams:

A comprehensive final exam will be given on the date the University has scheduled. The exam may consist of multiple choice, essay questions, and problems. The exam will test the application of knowledge acquired from class lectures, reading assignments, homework assignments and class discussions. You may bring a set of notes to the exam; requirements related to the note sheet/card will be conveyed to the class at least one week prior to the exam date.

If you miss the exam for a university-excused absence (e.g., sickness, death in immediate family) and provide sufficient documentation to support your situation, you will receive an excused absence.

Course Grade:

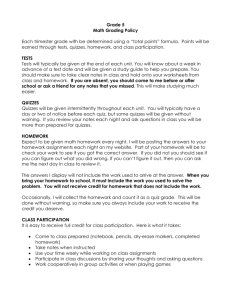

Your final grade in this course will be determined by the total points you earn. The maximum points you can earn from each are as follows:

Professionalism/Participation

Cases

Quizzes

Final exam

Total

50 points

350 points

200 points

400 points

1,000 points

Final grades will be determined based upon a student’s relative performance to his or her peer group and without regard to the percentage of total points earned.

3

Grade Disputes:

It is your responsibility to ensure grades posted on Carmen reflect your score on any particular assignment. Any concerns or questions about grading on a quiz or exam must be resolved within one week after the graded quiz, case or exam is returned in class. Individual grading issues will be handled outside of normal class time.

Notification of Scores and Final Grades:

The results of any graded materials, including final grades, will not be given by the instructor to individual students via phone, e-mail or prior to the initial returning of the assignment in class.

Final grades will be available online from the Registrar within one week following the final exam.

Disenrollment :

University Rule 3335-8-33 provides that a student may be disenrolled after the third instructional day of the quarter, the first Friday of the quarter, or the student’s second class session of the course, whichever occurs first, if the student fails to attend the scheduled course without giving prior notification to the instructor.

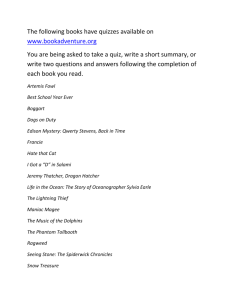

Teaching Plan and Assignment Schedule:

The following schedule is subject to change; changes will be announced in class and posted on

Carmen. Reading Assignments should be completed before the class on the assigned day .

Date(s)

10/15/13 Comparative Forms of Doing Business

Reading

Assignment Cases & Quizzes

10/17/13 Comparative Forms of Doing Business (continued) Ch 13

10/22/13 Corporate Redemptions and Liquidations

10/24/13

Chapter/Topic

Corporate Redemptions and Liquidations

(continued)

10/29/13 Capital Restructurings

10/31/13 Capital Restructurings (continued)

11/5/13 Consolidated Tax Returns

Ch 6

Ch 7

Ch 8

11/7/13 Consolidated Tax Returns (continued)

11/12/13 Consolidated Tax Returns and International Taxation Ch 9

11/14/13 International Taxation (continued)

11/19/13 International Taxation (continued)

11/21/13 Multistate Taxation

11/26/13 Multistate Taxation (continued)

11/28/13 Thanksgiving Break

12/3/13 Review - Discussion

Ch 16

Case Study

Ch 13 Quiz

Case Study

Ch 6 Quiz

Case Study

Ch 7 Quiz

Case Study

Ch 8 Quiz

Case Study

Ch 9 Quiz

Case Study

Ch 16 Quiz

4

5