Bord Bia’s Brand Forum Cases in Brand Excellence

advertisement

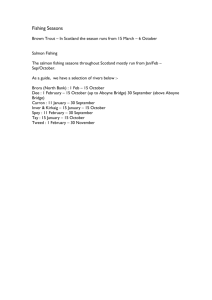

Bord Bia’s Brand Forum Cases in Brand Excellence Lossie Seafoods: The Pride of Scotland New Opportunities In July 2011, Associated Seafoods announced the friendly acquisition of Lossie Seafoods, one of Scotland's premier smoked salmon specialists for an undisclosed sum. It was a proud day for directors John Cowe and Charlie Devin, both of whom had been instrumental in developing an international business around the company's core brand Pride of Scotland. As of 2011, Lossie Seafoods (Lossie) exported its products to 24 countries and was considering further expansion into India, Sweden, Saudi Arabia, Qatar, Oman, Thailand, the Caribbean and Norway. Employing 55 personnel including a small administrative and executive staff, the company had sales of £8 million, over 80% of which was generated from exports in 2010. The original business, a white-fish processor and retailer, founded by Cowe's grandfather had pioneered the development of many new and emerging markets for premium quality Scottish farmed and smoked salmon around the world beginning in the 1990's. As a result of the acquisition, it appeared there was potential to further diversify Lossie Seafoods' core skills and brand harnessing the expertise of its larger parent, Associated Seafoods. Seizing that opportunity was not without its challenges, however. Among others, threats included international competition from Norwegian and Chilean producers that dominated global supply combined with price sensitivity and a quagmire of branding issues. These all conspired to distract an SME from its core objectives in export markets. Until that point Lossie Seafoods had managed well due to a blend of strategic foresight, good fortune and Scottish salmon's positive reputation, but it remained to be seen how Lossie Seafoods would address these and other issues in the medium-term future as such pressures only increased. Background Based in Lossiemouth Scotland, Lossie Seafoods Ltd started out processing white-fish and smoking wild salmon caught in local rivers. Over time the firm built up an expertise in smoking salmon which proved fortuitous as the white-fish sector subsequently collapsed under pressure from international competition and fluctuating supply. Lossie had invested in a state-of-the-art purpose built facility in 1988 upgraded to EU food hygiene standards in 1993. Consequently, management evaluated the prospect of entering the salmon processing business as their only real alternative for longer-term survival. At the time salmon aquaculture was rapidly taking-off to meet the boom in demand for fish that wild fisheries simply could not satisfy. Fortunately, the company had three key ingredients for success; it was an established Scottish business with expertise in salmon smoking and it had recently hired the right talent to help transform the business. The next task was figuring how to harness these resources and create a new business from them. In 1995, Charles Devin, joined Lossie Seafoods from Orkney Seafoods to work as sales and marketing director. Devin had built a career working with local companies later moving on to manage Orkney's smoked salmon export business. His experience in exporting, sales and branding would prove invaluable in fast-tracking Lossie's entry to international salmon markets and in pinpointing Lossie's value proposition. It was clear that despite the local industry's export orientation and Scotland's reputation as the original home of smoked salmon, no business was really exploiting their Scottish roots. Certain they had identified a real market opportunity, the switch was made. By 1999 the company had ceased all white-fish operations, moved to bigger premises in nearby Buckie, making the strategic decision to focus on smoking salmon and exporting the finest Scottish oak-smoked salmon, initially in whole sides, sliced sides and retail packs. Building a Brand From the very beginning of operations as a smoked-salmon producer, Lossie was clear about its value proposition, its route to market and where sales growth would come from. Products would be made to order, fresh without reliance on stock and branded under the name Pride of Scotland. The name and branding was chosen to leverage the associations with Scotland as the origin of smoked salmon and as a producer of a quality of salmon distinct from Norwegian, Alaskan or Chilean salmon, being ruddier and leaner. The salmon was cured using dry salt in the traditional manner and then oak smoked or smoked over beechwood chips while some product lines were marinated in local single malt whiskies as well. Additionally, Lossie produced gravadlax available in whole sides, sliced sides and retail packs. Gravadlax was cured using spices and herbs instead of smoking. Focused on superior quality, management deliberately avoided producing own-brand products for UK supermarkets eager to take advantage of the growing interest in and availability of the renowned pinky-red fish typically associated with celebratory occasions. Reflecting on the decision Cowe commented, “we decided we weren't in the business of buy one get one free”. Management reasoned it could not supply both ends of the value spectrum and were convinced that despite supermarket pressures on price, discerning customers would still value quality, provenance and taste. Instead, Lossie decided to build a brand and deal more directly with trusted business-tobusiness customers. As such it began by targeting restaurants, small hotels, fish shops and small distributors in the UK and building contacts abroad, supported by local trade bodies. In export markets it concentrated on small family-owned distributors with whom it could generate a rapport and relationship about its products. The aim was to develop sales through higher-end retailers, delicatessens and restaurants. As such, relationships were critical as Devin observed, “we pride ourselves on not selling from stock and providing fresh products to customers' own specifications”. Exporting While UK sales continued to grow management's focus was primarily on export markets. Given the size, proximity and levels of demand of the EU market, it seemed logical to focus efforts there; but Lossie decided to pursue any and all high-value market niches around the world. Part of the rationale was to 'de-seasonalise' the product while part was to develop untapped demand in the emerging upper-middle and middle-classes of developing economies. Commenting on the plan Cowe observed, "traditionally, smoked salmon makes money from August to December and for the rest of year struggles to break even. Now we make profits all year round". In Europe, price sensitivities among mainstream consumers only helped to differentiate Pride of Scotland further. As the largest markets for salmon products in Europe, both France and Germany had established traditions of eating salmon regularly throughout the year but they were also dominated by Norwegian brands that could and did compete on value for money as opposed to taste or meat quality. Lossie adhered to its marketing strategy carving a niche at the higher end of the market, taking pride in its commitment to tailor products according to customers' needs. On one occasion for example, the company worked round the clock to prepare and supply 450 kilos of smoked salmon for Russian president, Vladimir Putin who was so impressed with the quality of the fish he wrote a letter of thanks. The publicity and the endorsement were invaluable to management as they considered developing the Russian market further as a result. Having undertaken its research Lossie found potential demand in many emerging markets where smoked salmon was perceived as a luxury and where, although the customer base was relatively small compared to the mass markets of Europe and Asia, an information gap persisted and consumers clearly valued the qualities that a brand like Pride of Scotland offered. In short, Lossie targeted discerning consumers in markets as disparate as Hong Kong, Austria, Lebanon, Kuwait, Jordan and Mexico. In many of these cases it pioneered the market for premium brands of Scottish farmed and smoked in Scotland. In fact as of 2010, it claimed to be the only Scottish salmon-smoker exporting to Moscow, Copenhagen, Beirut, Mexico City and Amman in Jordan. Branding Issues Key to the success of Lossie Seafoods' Pride of Scotland brand was its relationship based marketing strategy. In that way it could control the messages about its product, gain valuable feedback and market information and protect the brand from competitive forces. With growth in the smoked salmon industry branding had become increasingly complex for Scottish salmon producers. On the one hand, benefiting all Scottish salmon producers, Scottish salmon was the first fish and the first foreign product to obtain the prestigious Label Rouge quality mark granted by the French Ministry for Agriculture. The mark acted as dual recognition of the superior quality and the origin of Label Rouge Scottish salmon. This was a major boon in particular for differentiating fresh Scottish salmon from its lighterhued Norwegian counterparts for example. At the product level several non-Scottish products had entered UK, US and European markets using branding, product names and packaging claiming Scottish origins either through packaging designs or confusing terminology. The result was that lower quality products, trading on Scottish associations were eroding brand equity for reputable brands such as Pride of Scotland which guaranteed traceability and authenticity. Eventually in 2010 the industry as represented by the Scottish Salmon Producers Organisation (SSPO) secured Protected Geographical Indication (PGI) Status from the EU for all 'Scottish farmed salmon smoked in Scotland'. The industry had secured PGI status for all Scottish farmed salmon in 2004 but this further qualification offered companies like Lossie the specific protection required in the EU at least. In 2006, Lossie Seafoods entered into a strategic partnership with leading Irish smokedsalmon processor, Nolans. Domestic and export sales growth had been continuing rapidlyat rates approaching 40% with sales nearing £4 million, more than 80% of which were generated abroad. The partnership allowed both Lossie to streamline some operations such as filleting and reduce costs associated with waste and boxing products. Commenting on the relationship Devin asserted, “it has been a great partnership. We wanted somebody on board with knowledge of the smoked salmon business, so it has been a good move for us and a good move for them”. The partnership also began paying dividends in terms of official recognition. In 2007 Lossie collected three industry awards including the prestigious Food From Britain Food and Drink Export Awards 2007. It marked the beginning of a slew of awards over the following years including Scotland's Food and Drink Excellence Award, the SCDI Excellence in International Business Award and the SCDI Outstanding Achievements in Exports Award among others. Future Prospects In general Lossie's future seemed extremely bright. Sales were booming – in Mexico for example sales were growing at 35% per year and the partnership with Nolans had helped streamline costs while bringing additional expertise to the business. In the medium-term, management was focused on more immediate and accessible growth markets across two regions- Europe and the Middle East. In the latter Lossie had already developed connections in Kuwait, Bahrain and Jordan. Meanwhile in Europe it had eventually broken into the Danish market, supplying some of the country's most exclusive stores. From there it hoped to penetrate Iceland, Sweden and even Norway. Commenting on the prospect of penetrating the Norwegian market, Devin acknowledged that “if we can do that, it would be like taking coals to Newcastle. It would be the ultimate deal.” But looking to long-term future growth management knew Asia was calling. It was estimated that by 2030, two-thirds of the the world's middle classes would be living in Asia – a massive market for seafood products considering the cultural affinities to fish and seafood across the region. The opening of new markets such as China represented a tantalising prospect for all Scottish salmon producers. China consumed almost 220,000 tonnes of salmon in 2009 and the portion of that from Atlantic salmon was growing steadily each year. Although Norway dominated supply to the Chinese market, opportunities remained for premium priced products to tap into China's burgeoning middle-classes and taste for affluence. It seemed Lossie's relationship based marketing strategy was well suited to penetrating pockets of demand in China's urban centres targeting affluent Chinese consumers but other challenges would surely arise in branding, packaging, labeling, pricing, human resources and distribution. The acquisition by Associated Foods represented another major transition in the company's growth trajectory, bolstering its international outlook while at the same time presenting management with decisions about how to market Pride of Scotland as a brand in a larger portfolio of Scottish seafood products. Key Learnings For Irish Brands 1. Aligning country-of-origin-effects with marketplace perceptions can pay off if supported by an effective marketing mix. Lossie Seafoods used a marketing mix that afforded them optimal control of message, distribution and pricing to support their premium quality position and market niche as the Scottish smoked salmon brand 2. Certain trends endure the world over – provenance and quality for example- a brand that can deliver on adds value tot he core product and may command a price premium. 3. Lateral thinking can help bypass business challenges such as seasonal demand, thereby opening up previously unseen market opportunities Annexes Annex 1: Selection of Pride of Scotland Products