TILEC-AFM ANNUAL REPORT 2007 Research Network on Financial Market Regulation

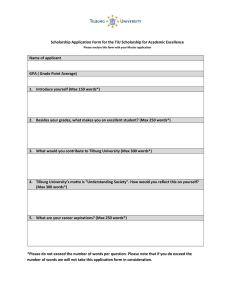

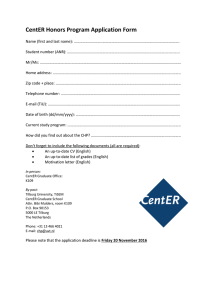

advertisement