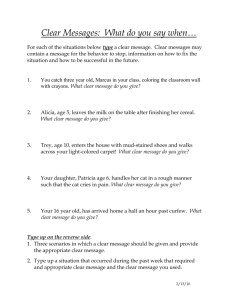

Caterpillar Inc. (CAT) Fisher College of Business Equity

advertisement

CaterpillarInc.(CAT) CompanyDescription: Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines,anddiesel‐electriclocomotives.Thecompanyalsoisaleading services provider through Caterpillar Financial Services, Caterpillar RemanufacturingServices,andProgressRailServices. InvestmentThesis: I believe U.S. and global economies will continue to see slow growth. Coming out of a severely deep recession in combination with central banks exerting aggressive monetary policy, this cycle may stretch out longer than historic norms. Mining sales will be down through 2014 duetoadecreaseinmininginvestmentworldwide.Thiswillbeoffset byincreasedconstructionactivity.TherecoveringU.S.housingmarket should provide a boost in construction as well as to the overall U.S. economy.Emergingmarketeconomicgrowthwillcontinuetooutpace developedeconomies,expandingtheglobalmiddleclass.Chinaandthe Asia Pacific region provide the greatest growth opportunity for all segmentsofCATbusiness.Wewillcontinuetoseemacro‐environment volatility in the near‐term. CAT stock price will likely remain inexpensive, yet volatile through the first quarter of 2013 until Fiscal Cliffuncertaintyisresolvedandtheconstructionseasonbeginsagain. Risks: SlowingU.S.andglobalGDPgrowth WorseningofEuropeanSovereignDebtCrisis SlowdowninemergingmarketeconomiessuchasChina,India,and Brazil EconomicVolatility Decreaseinminingindustryinvestmentintheshort‐term Highinventorylevels Opportunities: ContinuedU.S.andglobalGDPgrowth Emerging markets (especially Asia‐Pacific) and an expanding middleclass New technology demands as emissions standards and environmentalregulationsareraised U.S.,Chinese,andotheremergingmarketconstructionintheshort‐ term Mininginthelong‐term U.S.housingmarket Domesticenergyproduction FisherCollegeof BusinessEquity Research November20,2012 Overweight–BUY CAT Price:$81.93 PriceTarget:$103.00 Industrials MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu 12‐MonthStockPerformance _____________________________________________ CompanyData Price: $81.93 DateofPrice: 16Nov12 52‐WeekRange($): 78.25–116.95 MarketCap($bn): 53.58 FiscalYearEnd: Dec31 SharesO/S(mn): 669 PriceTarget($): $103.00 UpsidePotential: 26% Dividend&Yield 2.08(2.50%) _____________________________________________ MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY TableofContents 1.CompanyOverview.........................................................................................................................................................................2 a.MachineryandPowerSystems..................................................................................................................................................2 i.ConstructionIndustries............................................................................................................................................................2 ii.ResourceIndustries..................................................................................................................................................................2 iii.PowerIndustries......................................................................................................................................................................3 b.FinancialProducts..........................................................................................................................................................................3 c.DealersandDistributors..............................................................................................................................................................3 2.EconomicAnalysis...........................................................................................................................................................................4 3.IndustrialSectorAnalysis...........................................................................................................................................................4 4.CompanyAnalysis...........................................................................................................................................................................7 a.Strategy................................................................................................................................................................................................8 b.CompetitiveAnalysis.....................................................................................................................................................................8 c.CompetitiveLandscape.................................................................................................................................................................9 d.ThirdQuarterEarningsResults.............................................................................................................................................12 e.TrendAnalysis...............................................................................................................................................................................13 f.EquityValuation:ComparativeMultiples...........................................................................................................................15 i.AbsoluteValuation...................................................................................................................................................................15 ii.RelativeValuation:CATvs.S&P500,IndustrialSector,andMachineryIndustry.......................................15 5.SummaryandRecommendations.........................................................................................................................................16 6.Appendix............................................................................................................................................................................................17 a.IncomeStatementForecast.....................................................................................................................................................17 b.BusinessSegmentForecast......................................................................................................................................................18 c.DiscountedCashFlowsValuation..........................................................................................................................................19 1 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY 1. CompanyOverview Originally organized as Caterpillar Tractor Co. in 1925 in the State of California, the company was reorganized as Caterpillar Inc. in 1986 in the State of Delaware. Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel‐electric locomotives. The company also is a leading services provider through CaterpillarFinancialServices,CaterpillarRemanufacturingServices,andProgressRailServices1. a. MachineryandPowerSystems i. ConstructionIndustries Construction industries products are primarily used in infrastructure and building construction applications. Much of the growth in the construction industries segment has occurred in developing countries. In many instances, construction machinery sales have been at or above record levels set pre‐ recession. Sales have also increased in developed countries driven by the need for existing construction machineryusersupgrading/replacingexistingmachinery.CAT’sconstructionmachineryinvestmentshave primarilybeenoccurringintheU.S.,Brazil,andAsiasinceclimbingoutoftherecession. ConstructionIndustriesproductportfolioincludesthefollowingmachinesandrelatedparts: Backhoeloaders Miniexcavators Mediumwheelloaders Smallwheelloaders Compactwheelloaders Mediumtrack‐typetractors Smalltrack‐typetractors Selectworktools Track‐typeloaders Skidsteerloaders Wheelexcavators Motorgraders Multi‐terrainloaders Small,mediumandlargetrack Pipelayers excavators 2 ii. ResourceIndustries Cat’s Resources Industries segment primarily supports customers using machinery in mining and quarry applications.Thissegmentalsoservesforestry,tunneling,andpavingcustomers.Recentlyin2010,CAT acquired Bucyrus International, one of the largest underground mining machinery manufacturers in the world.CATnowhasthebroadestlineofminingmachineryandequipmentofanycompanyglobally.CATis investingheavilyinitsminingmachinerybusinessintheU.S.andAsia.CAT’slargestglobalcompetitorin miningmachineryisJoyGlobal,thoughCAThasanumberofothercompetitorswithothermachinerytypes intheirResourcesIndustrysegment.JoyglobalhasasmallerlineofproductofferingsthanCAT. 1www.caterpillar.com 22011Caterpillar10‐K 2 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY ResourceIndustriesproductportfolioincludesthefollowingmachinesandrelatedparts: Electricropeshovels Largeminingtrucks Wheeldozers Largeelectricdrivemining Draglines trucks Compactors Hydraulicshovels Tunnelboringequipment Selectworktools Drills Largewheelloaders Forestryproducts Highwallminers Off‐highwaytrucks Pavingproducts Undergroundmining equipment Articulatedtrucks Machinerycomponents Electronicsandcontrol Largetrack‐typetractors Wheeltractorscrapers systems iii. PowerIndustries CAT’sPowerIndustriessegmentservescustomersusingreciprocatingengines,turbinesandrelatedparts forindustriesservingelectricpower,Industrial,petroleumandmarineapplicationsaswellasrail‐related businesses.Muchofthegrowthinthissegment,asinCAT’sothersegments,isoccurringindeveloping countries.CAT’smaincompetitorsgloballyinthissegmentincludeGEEnergyinfrastructure,Siemens Energy,andWartsilaCorp. PowerSystemsportfolioincludes: Reciprocatingenginepoweredgeneratorsets Integratedsystemsusedintheelectricpowergenerationindustry Reciprocatingenginesandintegratedsystemsandsolutionsforthemarineandpetroleum industries ReciprocatingenginessuppliedtotheindustrialindustryaswellasCaterpillarmachinery Turbinesandturbine‐relatedservices Diesel‐electriclocomotivesandcomponentsandotherrail‐relatedproductsandservices. 3 b. FinancialProducts CAT Financial’s primary business is to provide retail and wholesale customers financing options to help purchaseCATproducts.CATusesitsfinancingbusinesstohelpdrivedemandforitsproductsalloverthe world,butespeciallyindevelopingcountrieswherecredittomakesuchlargepurchasesismuchharderto come by4. In addition to increasing sales opportunities for CAT products, CAT Financial also generates financing income. CAT Financial’s major competitors include commercial banks and other financial institutions. c. DealersandDistributors CAT’sproductsaresold throughaworldwidenetworkofdealerships,50 ofwhicharelocatedintheU.S. and141outsideoftheU.S.CATdealersservemorethan180countries5withCATandCATrelatedfacilities 32011Caterpillar10‐K 4AnneDuignan,JPMorganMachineryAnalyst,Interview,September7,2012 52011Caterpillar10‐K 3 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY spanningmorethan500locationsworldwide.ThisallowsCATtobeclosetotheirglobalcustomerbase. CAToffersmorethan300products6. 2. EconomicAnalysis Both CAT management and analyst consensus forecast positive GDP growth around the world through 2014.Analystconsensusforecastsalsopredictslowlydecliningunemploymentaroundtheworldthrough 20147. The U.S. Housing market has been seeing growth in construction, inventory has continued to tighten, and residential home prices have experienced their 7th straight month of appreciation8. An abnormal characteristic of the current housing recovery is that it is occurring very late in the economic recovery.Thusfar,theeconomicrecoveryhasbeendrivenprimarilybymonetarypolicyandinvestment. IftheU.S.housingmarketcontinuesonitscurrentrecoverytrack,thiswilllikelyhelpeconomicgrowthin theU.S,creatingjobs,increasingdomesticspending,andboostingconsumerconfidence. As central banks the world over have been trying to prevent deflation, encourage inflation, provide liquidity, and generally prevent another worldwide recession, they have been taking very aggressive actionswithmonetarypolicytoachievethesegoals.Becauseofthis,Ibelievewemayexperiencehigher thannormallevelsofinflationintheyearstocome,addingtonominalgrowth,makingitadvantageousto be invested in physical assets that have real value, whether that be real estate companies that produce physicalproductssuchasCAT.Becauseofthiscombinationofaggressivemonetarypoliciesandthelate recoveryintheU.S.housingmarket,thiseconomiccyclewilllikelystretchoutlongerthanhistoricnorms. Emergingmarketsarelikelytocontinueoutpacingdevelopedcountriesineconomicgrowth,thusgrowing the global middle class (esp. China), which will result in greater demand for infrastructure development and consumer goods; both drivers for natural resource consumption which should lead to a continued increaseinminingactivityoverthelong‐term9. Lastly, the increase in domestic energy production resulting in lower domestic energy prices and higher energyexportswillcontinuetosupportlocalmanufacturing,attractoverseemanufacturingtotheU.S.,and overallstrengthentheU.S.economy. Takingallofthisintoaccount,IbelievewewillcontinuetoseeslowbutpositiveU.S.andglobaleconomic growthoverthenextfewyears.Likewise,Ibelievethiscurrenteconomiccyclewillbestretchedoutlonger thanhistoricnorms.Thereforepastcyclesareprobablynotagoodindicatorofthecurrentcycle.Thiscan be translated into CAT also experiencing moderate growth for the next few years as CAT’s stock price moveswiththeU.S.andglobaleconomiesandthefactorslistedabove. 3. IndustrialsSectorAnalysis TheIndustrialsectorislargelycomprisedofstocksthatrelatetotheproductionanddistributionofgoods used in construction and manufacturing. Companies in the industrials sector are involved with (but not limited to) aerospace and defense, machinery, tools, lumber production, construction, metal fabrication, anddistribution/shipping/transport.CATresidesinthemachineryindustry. 6www.caterpillar.com 7BloombergProfessional 8JeffriesFixedIncome,MonthlyU.S.HousingMonitor,November7,2012. 9AnneDuignan,JPMorganMachineryAnalyst,Interview,September7,2012 4 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY Aerospace&Defense BuildingProducts ConstructionandEngineering ElectricalEquipment IndustrialsSector IndustrialConglomerates Machinery TradingCompanies&Distributors CommercialServices&Supplies AirFreight&Couriers Airlines Marine Road&Rail 10 Performanceintheindustrialssectorislargelydrivenbysupplyanddemandforbuildingconstructionand manufactured products11. As such, the industrial sector closely tracks the U.S. and global economies; its performance closely correlated to the S&P 500. As explained in the Economic Analysis section above, I believe we will continue to experience economic growth, albeit slow growth. Therefore, the industrials sectorshouldfairmoderatelywelloverthenext 2‐3years.TheIndustrialssectorcurrentlyaccountsfor 10%ofS&P500,comprisedof62companies.TheIndustrialSector’stotalmarketcapis$1.311Trillion12. With such a diverse array of industries within the sector, there’s a great deal of flexibility in creating an investmentstrategydependingonwhereweareintheeconomiccycle.Subsequently,industrialcompanies haveawiderangeofbetasandperformancepatternsrelativetoeconomiccycles. Based on historical data, the industrials sector should be mid‐cycle, approaching late cycle; however, as mentionedabove,aswecomeoutofaverydeepglobalrecessionwithcentralbanksbeingveryaggressive withmonetarypolicy,thiscyclewilllikelystretchoutlongerthanthehistoricnorm.Instead,Ibelievewe arestillapproachingmid‐cycle. PurchasingManagers ArchitecturalBilling Two leading indicators of industrial sector Index(PMI) Index(ABI) performance,theArchitecturalBillingIndex(ABI), 9/30/2012 51.5 9/30/2012 51.6 and the Purchasing Managers Index (PMI), are 8/31/2012 49.6 8/31/2012 50.2 bothtrendingpositively.Thesearebothverygood 7/31/2012 49.8 7/31/2012 48.7 indicators for the direction of CAT’s performance 6/30/2012 49.7 6/30/2012 45.9 as CAT is a machinery manufacturer with a very 5/31/2012 53.5 5/31/2012 45.8 large part of its business dependent on the construction industry. The ABI is a leading 4/30/2012 54.8 4/30/2012 48.4 indicator of construction activity. A score above 3/31/2012 53.4 3/31/2012 50.4 50 indicates an increase in architectural billings. 2/29/2012 52.4 2/29/2012 51.0 ConstructionactivitytypicallylagstheABIby9‐12 1/31/2012 54.1 1/31/2012 50.9 months. For the last year and a half, the ABI has 12/31/2011 53.1 12/31/2011 51.0 been hovering just above or just below 50 as 11/30/2011 52.2 11/30/2011 51.3 indicated in the ABI chart. With the two recent scoresjustabove50,thisindicatespositivethough 10/31/2011 51.8 10/31/2011 49.4 slowconstructiongrowthinthefuture13.ThePMI 9/30/2011 52.5 9/30/2011 47.3 is an indicator of the health of the manufacturing 8/31/2011 52.5 8/31/2011 50.5 sector.Itisbasedonneworders,inventorylevels, 7/31/2011 51.4 7/31/2011 45.9 production, supplier deliveries, and the 6/30/2011 55.8 6/30/2011 46.8 employment environment. Similar to the ABI, a score above 50 indicates an expansion of the 102012Russel2000Index 11www.investopedia.com 12S&PDowJonesIndices.www.us.spindices.com/indices/equity/sp‐500 13ArchitecturalBillingIndex,September2012 5 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY manufacturing sector over the prior month. Excluding June, July, and August of 2012, in which the PMI scorewasjustbelow50,thePMIindexhasbeenabove50forthelastyearandahalf14. IndustrialSector’sperformance: Industrialssectorreturnshavelagged AnnualizedReturns(11/16/2012) theS&P500inaggregateovera5‐year 1Year 3Year 5Year periodaswellasforthelast12months; TotalReturnsS&P however,forthepast3‐yearperiod,the 10.20% 10.52% ‐0.13% 500Industrials industrialssectorhasoutperformedthe PriceReturnsS&P S&P500.Theindustrialssectorhas 7.49% 7.93% ‐2.67% 500Industrials alsounderperformedtheS&P500year‐ to‐date;however,recentlywiththe TotalReturnsS&P 12.44% 9.30% 0.82% pull‐backinglobaleconomies,the 500 industrialssectorhaslostlessthanthe PriceReturnsS&P S&P500;arelativelypositiveindication 9.94% 7.02% ‐1.39% 500 ofinvestorsentimenttowardsthe sector. DailyReturns(11/16/2012) IndexLevel 1Day MTD QTD YTD TotalReturnsS&P 500Industrials 436.68 0.31% ‐2.79% ‐3.32% 7.54% PriceReturnsS&P 500Industrials 307.80 0.28% ‐2.97% ‐3.60% 5.30% TotalReturnsS&P 500 2381.02 0.49% ‐3.51% ‐5.29% 10.29% PriceReturnsS&P 500 1359.88 0.48% ‐3.70% ‐5.61% 8.13% 14PurchasingManagersIndex,September2012 6 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY Asillustratedinthefirstpanelofthegraphsabove,theindustrialsectorhashistoricallycloselytrackedthe S&P500.Illustratedinthe2ndpanelofthegraphsabove,theindustrialsectorhasperformedrelativelyflat comparedtotheS&P500,thoughwithahighdegreeofvolatility15. Industrials High Low Median Current In absolute terms, Industrials Sector multiples are trading below their 10‐year AbsoluteBasis historicalmedian.AstheGreatRecessionis EV/EBITDA 12.1 7.9 10.8 9.6 priced into the median multiples and I Price/CF 14 6 10.7 9.5 believe we have not yet hit peak in this TrailingP/E 24 7.1 17.7 13.9 cycle, the industrials sector appears to be ForwardP/E 20.9 9.2 16.3 13.3 undervalued. Industrials High Low Median Current Relative to the S&P 500, the Industrials RelativetoS&P Sector multiples are trading slightly below 500 their 10‐year medians. Relative to the S&P EV/EBITDA 1.7 1.3 1.4 1.3 500, the industrials sector appears more Price/CF 1.2 0.8 1.1 1 fairlyvalued. TrailingP/E 1.2 0.66 1.1 0.99 ForwardP/E 1.2 0.84 1 0.97 4. CompanyAnalysis More than 70% of CAT’s sales occur outside of the United States. Backlog at the end of 2011, 2010, and 2009 was approximately $29.8 billion, $18.7 billion and $9.6 billion respectively16. Backlog as of 3rd 15BloombergProfessional. 162011Caterpillar10‐K 7 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY quarter2012isat$23.1billionandfalling17.Withtheworldwidedecreaseinmininginvestmentandthe beginningoftheconstructionseasonafewmonthsoff,backlogwillremainrelativelylowinthenear‐term. a. Strategy CATisacyclicalcompany,thoughmanagementhasbeenattemptingtodampencyclicalitythroughproduct andgeographicdiversification.Earlycycleactivitytypicallyoccursinresidentialconstruction,thoughwith the late recovery of the housing market, this could be indicative of growth in the near term for CAT. Governmentspendingonroadandhighwayconstructionalsotypicallyoccursearlyinthecycle;however withtheU.S.passingthe$105billionhighwayandinfrastructurebillinJuly,2012,andChinaannouncinga $158 billion infrastructure stimulus package in September, 2012, this could also provide growth opportunitiesforCAToverthenextcoupleofyears.Miningactivitytypicallyoccursmid‐latecycleandis expectedtoslowdownthrough2014beforepickingupagain.Engineactivitytypicallyoccurslatecycle. CAT’s services and aftermarket business help to smooth out volatility throughout the economic cycle18. Relative to economic activity and CAT business activity, if we were to analyze this cycle starting at this pointintime,itappearstomimictheearlypartofacyclecomingoutofamildrecession. With the acquisition of Bucyrus in 2010, one of the world’s largest underground mining machinery manufacturers,thiscurrentcycleforCATcouldbelessvolatilethanpastcycles.This,coupledwithwhat maybeanextendedeconomiccyclecouldmakethiscycleforCATaveryuniqueone,anddifficulttopredict basedonpastcycles.Theresourcesindustriessegmentrevenuesincreasedby$7.2billionfrom2010to 2011withtheBucyrusacquisition,a16.4%increaseinoverallrevenuesfromthisacquisitionalone19. Much of CAT’s global expansion occurs through acquisitions as well as through organic growth. The primary drivers of CAT’s organic growth and acquisition targets are through construction machinery, mining machinery, and associated aftermarket services. Throughout the world, CAT sells its products to CAT dealerships who in turn sell to construction contractors and machinery and equipment rental companies. CAT continues building its distribution network throughout the world, often leveraging the existing dealership networks inherited through acquired companies, and strategically locating dealers in the right places. This is an ongoing process and one which is extremely important to CAT’s aftermarket service business. As such, CAT revenues are also driven by its high margin aftermarket services which providesupportformachinerythroughmaintenance,parts,andtechnicalsupport20. b. CompetitiveAnalysis PortersFiveForces+ComplementaryProducts+Government/Regulation IntensityofCompetition MODERATE – CAT competes on a global scale with a small number of global competitors. However, intensity of competition may increase as Chinese construction equipment manufacturers expand internationallyandentertheglobalarena;namelySanyHeavyIndustriesandLuiGong. 17WallStreetJournal.www.wsj.com 18MacquarieCapital(USA),December2010 19 2011 Caterpillar 10‐K 20AnneDuignan,JPMorganMachineryAnalyst,Interview,September7,2012 8 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY ThreatofNewEntrants LOW–Achievingscaleandwinningordersfromglobalcompaniesisunlikelyfromanewentrant,though possibleasbeingprovenbysomeChineseconstructionequipmentmanufacturers. BargainingPowerofBuyers MODERATE – Globally, CAT’s customers are generally large and have buying power, but the technology required to meet customers’ needs can only be met by a limited number of heavy machinery manufacturers. BargainingPowerofSuppliers LOW–CAThasbeenactivelycuttingitssupplierbasefromapeakof10,000tobelow5,000asof2012. ThreatofSubstituteProducts LOW–Manuallaborinsomeeconomiesmaybeanoption. ImportanceofComplementaryProducts HIGH–Serviceandsupporttoensuremachineuptimeisimportant.CATdealersstockover80%ofparts neededandareabletofulfillaround98%ofneedswithin24hours.ThisisimportanttoCAT’saftermarket business. Government&PressureGroups HIGH – Caterpillar’s most important end market is roadway construction which is fueled by government legislation21.IntheU.S.,congressrecentlypassedthe$105billionHighwayandInfrastructureBillandin China,theChinesegovernmentrecentlyannounceda$158billioninfrastructurestimuluspackage. c. CompetitiveLandscape CAT’s largest competitors globally for construction and mining machinery are Komatsu, Hitachi, Volvo HeavyMachinery,andSanyforconstructionmachinery;andJoyGlobalforminingmachinery.Thefigure below shows the global market share for construction machinery sales among construction machinery manufacturers.CAThasthelargestglobalmarketshareat15.1% 212010STRSResearch 9 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY The Asia Pacific region presents the greatest regional opportunity for CAT but is an increasingly competitivemarketthatisstartingtospillintothelargerglobalcompetitivestage.TheAsiaPacificregion isthehighestgrowthregionintheworldforconstructionandminingmachinery,currentlyaccountingfor 48%ofconstructionmachinerysales.Assuch,globalcompetitioninconstructionandminingmachinery salesareheavilyconcentratedintheAsiaPacificregion.China,mostnotably,hasbeendrivingconstruction equipmentsales22andisexpectedtoincreasinglydriveminingmachinerysales. OneofthemostimportantreasonsforCATtoexpandintoChinaistolearnhowtoworkwithandcompete against Chinese heavy machinery manufacturers on their own turf to be better positioned to compete againstthemgloballyandwhentheyexpandintotheU.S.MarketshareinChinaissecondaryandCATis more likely to lose market share in China rather than gain regarding construction machinery23, however revenuesarestillexpectedtogrowastheChineseconstructionmachineryindustrycontinuestoexpand. Komatsu,Hitachi,andVolvohavetraditionallybeenCAT’slargestcompetitorsinAsia(KomatsuandSany lead CAT in market share for heavy machinery in the Asia Pacific region) and three of CAT’s largest competitors globally; however the emergence of Chinese construction machinery manufacturers, most notably Sany Heavy Industries and LuiGong, are making the competitive landscape even more challenging24. These Chinese machinery manufacturers are no longer concentrating their businesses domestically, but aggressively expanding regionally and globally. Sany for instance recently acquired Putzmeister,aGermanmanufacturerofhigh‐techconcretepumps.Thisisanexampleofhowtheup‐and‐ coming Chinese construction machinery manufacturers are rapidly acquiring technology in addition to expandingtheirglobalreach25.Becauseofthisacquisition,SanyHeavyIndustrieshasleapfroggedHitachi intotheNo.4spotforglobalmarketshareofconstructionmachinerysales26. Though China is the largest construction site in the world as well as the biggest driver for construction machinery sales, CAT sales in China only account for 5% of CAT’s total sales. However, the Asia Pacific marketaccountsfor30%ofCATsales.ThetwoconstructionmachineryproductsthatdrivemostofCAT’s 22InternationalStrategyandInvestmentGroup.IndustrialResearch:Machinery.DavidRaso. 23AnneDuignan,JPMorganMachineryAnalyst,Interview,September14,2012 24InternationalStrategyandInvestmentGroup.IndustrialResearch:Machinery.DavidRaso. 25China’sSanytoacquirePutzmeister.AccessedSeptember7,2012. http://www.ft.com/cms/s/0/7aecad0a‐4a5e‐11e1‐a11e‐00144feabdc0.html#axzz28XeZo4dX 26InternationalStrategyandInvestmentGroup.IndustrialResearch:Machinery.DavidRaso. 10 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY business in the Asia Pacific are wheeled loaders and hydraulic excavators; the construction machines in highestdemand.CATcurrentlymanufacturesmostlyconstructionmachineryinChina27.Thiswillchange soonasCATacquiresERAMining Machinery,aChineseundergroundminingmachinerymanufacturer to be discussed in more detail below. There are currently 16 CAT manufacturing plants in China. Additionally, there are 3 research and development centers, 6 office branches, and 3 logistics and parts centers28. CAT currently enjoys the largest global market share among construction machinery manufacturers at 15.1%.TheAsiaPacificregionmakesup48%oftheconstructionmachinerymarketfornewsales.China comprises68.1%oftheAsiapacificconstructionmachinerymarket.Therefore,Chinamakesup32.7%of the global construction machinery market. Both the Asia Pacific construction machinery market and China’sshareofthatmarketaregrowingfasterthananyotherregionoftheworld29.CAT’smarketshareof construction machinery sales (9.2%) in the Asia Pacific region is third behind Komatsu (13.3%) and the Chineseconstructionmachinerymanufacturingcompany,Sany(9.3%). TheAsiaPacificregionisalreadyveryimportanttoCATregardingminingmachinerysales;howeveritwill become more important soon as CAT gains a greater foothold in the mining machinery manufacturing marketinChina. MiningmachinerypresentsthelargestbusinessopportunityforCATtoexpandsalesglobally,especiallyin theAsiaPacificRegion;mostnotablyinChina.Theglobalminingmachineryindustryisexpectedtogrow toa$92billionindustryby2015.Itisapproximatelya$61billionindustrycurrently.TheChinesemarket isexpectedtomakeup57%oftheminingmachineryindustry30. Withtherecent2010acquisitionofBucyrusInternational,CAT’sonlymajorglobalcompetitionregarding miningmachineryisJoyGlobalwhosehighestsellingproductiselectricshovels.Globaldemandforelectric shovels is declining as mining companies are increasingly adopting hydraulic shovels, which CAT manufactures. This is one of the strategic advantages CAT has relative to its largest mining machinery competitor. The largest issue regarding mining has been the recent decrease in mining investment around the world which is expected to continue to slow through 2014, especially in Australia. This will have negative implicationsforCATminingmachinerysalesintheAsiaPacificregionintheshort‐term.Alargepartofthe recent mining boom has been a result of China’s consumption of natural resource. With China’s future growth uncertain, and the possibility that its future growth will not be as resource intensive, the flow throughtominingmachinerysalescouldnegativelyimpactCATsalesthrough201431;however,withthe acquisitionofERAMiningMachinery,CATwillgainminingmachinerymarketshareinChina. CATandJoyGlobalareinaracetoacquireChineseminingmachinerymanufacturerstogainafootholdand expand operations into China. CAT is in the process of completing the acquisition of ERA Mining Machinery, while last year, Joy Global acquired International Mining Machinery, another Chinese mining 27AnneDuignan,JPMorganMachineryAnalyst,Interview,September7,2012 28www.china.cat.com 29InternationalStrategyandInvestmentGroup.IndustrialResearch:Machinery.DavidRaso. 30AnneDuignan,JPMorganMachineryAnalyst,Interview,September14,2012 31“Miningboomtopeak,slowdownahead–DeloitteAccess”.AccessedOctober7th,2012. http://www.mineweb.com/mineweb/view/mineweb/en/page67?oid=155550&sn=Detail 11 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY machinerymanufacturer.TheMinistryofCommerceinChinarecentlygaveitsapprovalforCATtomove forwardwiththecompleteacquisitionofERA32. As competition in construction machinery increases globally, in the Asia Pacific region and in China especially,miningmachinerypresentsanenormousopportunityforCAT’scontinuedgrowthasithasmuch less competition and a competitive advantage in scale, product offering, and technology over its next largestminingmachinerycompetitor,JoyGlobal. d. ThirdQuarterEarningsResults CAT beat earnings at $2.54 versus consensus of $2.22. Revenues reported were in line at $16.5 billion versus consensus of 16.7 billion. CAT experienced the highest sales and profit in 3rd quarter history. A portionoftheirgainscamefromthesaleoftheirlogisticsdivisionandlessfromtheBucyrusacquisition from2010.Despitethis,CATloweredrevenueguidanceto$66billionfrom$68‐$70billionaswellasEPS guidanceto$9.25from$9.60for2012.Thetwomaindriversbehindloweringguidancearehighinventory levelsandaslow‐downinthesaleofminingmachineryduetodeclininginvestmentintheminingindustry. Inventorylevelshavebeenelevatedduetoarecentlackofdemandfrompurchasersofconstructionand miningmachinery.CATdealershipshavenotbeenabletoadequatelyreducetheirinventorylevelsthrough salesandhavethereforeslowedtheirpurchasingofequipmentandmachineryfromCAT.Asaresult,CAT has reduced production of its machinery to the tune of $3.0 billion through the end of 2012 and will continuethisreductioninproductionintothefirstquarterof2013untilinventoriescomedowntonormal levels. Once demand begins to outstrip supply and dealerships begin ordering machinery in larger quantitiesfromCAT,CATwillthenincreaseproductiononceagain.Thisisnotexpectedtooccuruntil2nd quarter of 2013 when construction machinery sales pick up due to the beginning of the construction season. Miningactivityisexpectedtoslowdownthrough2014andapproaching2015.Caterpillarexpectsmining machinerysalestodecreaseby5‐10%overthatsametimeperiod.Theyalsoexpectthislossinsalestobe offset by construction machinery sales, largely driven by a strengthening construction industry in the United States and continued construction activity in emerging markets such as China and Brazil. CAT managementdoesnotexpecteconomicgrowthuntilhalfwaythrough2013. Despitesomeheadwinds,CATmanagementhasapositiveoutlookfor2013andexpectsCATtobe“steady asshegoes”in2013withslowgrowth,butgrowthnonetheless33.Inthemeantime,CATstockisdepressed andwilllikelystarttoexperienceafairlysignificantupsideintothe2ndand3rdquartersof2013. 32“CaterpillartobuyChinaminingmachinerygroup”.AccessedSeptember8th,2012. http://www.ft.com/cms/s/0/00c93a62‐0bfb‐11e1‐9310‐00144feabdc0.html#axzz28dV20KEl 33CaterpillarInc.3Q2012EarningsRelease&Caterpillar3QEarningsCall 12 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY e. TrendAnalysis: CAT10YearPerformance 34 CAThasseenpositivegrowthoverthelastdecade,thoughtheyhaveexperiencedagreatdealofvolatility. AstheycloselytracktheU.S.andglobaleconomies,whentheGreatRecessionhit,CATplungedtolevelsnot seensince2001;however,sincethe beginningoftherecovery,CAThasoutperformedatadramaticrate throughthe1stquarterof2012.Duetotheeconomicuncertaintywithfirst,theU.S.presidentialelection, nowthefiscalcliff,andslowingglobaleconomies,amongsomelessermacrofactors,CAThaslargelybeen tradingflatsincethe2ndquarterof2012.AsIbelievethiswillbeaprolongedcycle,andthiscurrentpull‐ backinglobaleconomiesislikelyahiccupbeforewemoveupagain,CATappearstobeunderpriced. 34BloombergProfessional 13 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY CATvs.S&P500 As illustrated in the graphs above, CAT has outperformed the S&P 500 the majority of the time over the pastfiveyears.StartingaroundthebeginningofMarch,2012,CAThasunderperformedtheS&P500on newsofadeclineininvestmentintheminingindustryaswellasageneralslowdowninworldeconomies. CATiscurrentlynearingits52‐weeklowof$78.25.AsofFriday,November16th,2012,CATisat$81.93. CATvs.S&P500IndustrialsSector 14 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY As the Industrials Sector closely tracks the S&P 500, CAT’s performance versus the S&P 500 industrials indextellsmuchthesamestoryasCAT’sperformanceversustheS&P500above,thoughwithinathinner spread.Again,IbelievethisisindicativeofCATbeingundervaluedratherthanonthedownsideofitscycle. f. EquityValuation:ComparativeMultiplies i. AbsoluteValuation Absolute High Low Median Current In absolute terms, CAT is currently trading below its 10‐year historic median. Given the Basis trends above, this could be due to CAT EV/EBITDA 18.3 7.7 11.2 7.7 underperforming the S&P 500 and/or many Price/CF 13.2 2.8 9.7 6.3 investors may view CAT as already coming off TrailingP/E 31 4.4 15.9 9.1 its peak in the cycle. I believe we are ForwardP/E 40.1 7.3 13.3 10.5 experiencing a lull before we continue economicgrowthandthereforeCATseemstobeundervalued. ii. RelativeValuation:CATvs.S&P500,IndustrialSector,andMachineryIndustry Relative to High Low Median Current Predictably, with the S&P 500 and S&P 500 S&P500 Industrials index outperforming CAT since March,2012,CATmultiplesarebelowtheir10‐ EV/EBITDA 2.2 1.1 1.7 1.1 yearhistoricmedians.Again,asIbelieveglobal Price/CF 1.4 0.4 0.9 0.7 economies will pick up again rather than TrailingP/E 2.1 0.41 0.97 0.66 continue downward in the short term, these ForwardP/E 2.6 0.61 0.89 0.78 ratios seem to indicate that CAT is currently Relative to High Low Median Current undervalued. Industrials EV/EBITDA 1.7 0.8 1.1 0.8 Price/CF 1.3 0.5 0.9 0.6 TrailingP/E 1.8 0.6 0.9 0.7 ForwardP/E 2.4 0.6 0.9 0.8 Relative to High Low Median Current Machinery Price/EBITDA 1.31 0.85 1.02 0.88 Price/CF 1.3 0.5 0.9 0.8 TrailingP/E 1.1 0.81 0.96 0.89 ForwardP/E 1.5 0.74 0.98 0.96 15 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY 5. SummaryandRecommendations MyrecommendationistoBUYCAT. Opportunities ContinuedU.S.andglobalGDPgrowth Emergingmarkets(especiallyAsia‐Pacific) andanexpandingmiddleclass Risks SlowingU.S.andglobalGDPgrowth WorseningofEuropeanSovereignDebt Crisis Newtechnologydemandsasemissions standardsandenvironmentalregulations areraised U.S.,Chinese,andotheremergingmarket constructionintheshortterm Slowdowninemergingmarketeconomies suchasChina,India,andBrazil EconomicVolatility Mininginthelong‐term U.S.housingmarket Domesticenergyproduction Decreaseinminingindustryinvestmentin theshortterm Highinventorylevels JustificationtoBUYCAT: DCFAnalysis–CATisundervaluedwithanUpsideof26%andtargetpriceof$103. MultiplesAnalysis–CATappearsundervalued PurchasingManagersIndex(PMI)scoreshaveapositivetrend,monthlyscores>50 ArchitecturalBillingIndex(ABI)scoreshavebeguntrendingpositivelyagain,monthlyscores>50 CAT will not likely see much of a sustainable improvement in price for a few months; however I believeCATwillexperiencesignificantgainsintothe2ndand3rdquartersof2013.Factorsinclude: o Recent slow‐down in global economies. CAT stock price moves with U.S. and Global economies. o Equipment purchases for construction season will not pick up again until February time‐ frame. o FiscalCliffuncertaintywillcontributetokeepingCATstockpriceatdepressedlevels. o Slow‐downinmininginvestmentintheshortterm. o Inventory levels are currently abnormally high though are expected to be right‐sized into the2ndquarterof2013. o Volatilityduetothemacroenvironment. U.S.,Chinese,andotheremergingmarketconstructionoutlooksaregoodintheshort‐term. Miningoutlookisgreatlong‐term,thoughlaggingintheshortshort‐term. 16 MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY 6. Appendix a. IncomeStatementForecast CAT (mill$) Revenue Concensus Guidance Operating Costs: COGS SG&A R&D Interest expense of financial products Other operating (income) expenses Total FY 2014E 76,378.3 69,959.6 FY 2013E 71,673.0 65,393.3 FY 2012E 66,400.8 65,566.7 66,000.0 2Q12 17,374.0 1Q12 15,981.0 FY 2011 60,138.0 FY 2010 42,588.0 FY 2009 32,396.0 FY 2008 51,324.0 FY 2007 44,958.0 FY 2006 41,517.0 11,639.0 12,280.0 1,471.0 1,517.0 634.0 632.0 197.0 198.0 (92.0) 131.0 13,849.0 14,758.0 11,237.0 1,340.0 587.0 204.0 290.0 13,658.0 43,578.0 5,203.0 2,297.0 826.0 1,081.0 52,985.0 30,367.0 4,248.0 1,905.0 914.0 1,191.0 38,625.0 23,886.0 3,645.0 1,421.0 1,045.0 1,822.0 31,819.0 38,415.0 4,399.0 1,728.0 1,153.0 1,181.0 46,876.0 32,626.0 3,821.0 1,404.0 1,132.0 1,054.0 40,037.0 29,549.0 3,706.0 1,347.0 1,023.0 971.0 36,596.0 2,616.0 2,323.0 7,153.0 3,963.0 577.0 4,448.0 4,921.0 4,921.0 110.0 70.0 113.0 88.0 343.0 130.0 389.0 381.0 274.0 299.0 288.0 320.0 274.0 214.0 3Q12 16,445.0 0.0 0.0 0.0 10,114.6 9,941.5 9,172.0 8,787.7 9,879.5 8,970.2 504.1 381.9 473.0 358.4 438.2 332.0 Consolidated profit before taxes 9,992.4 9,057.4 9,773.3 2,450.0 2,576.0 2,298.0 6,725.0 3,750.0 569.0 4,473.0 4,953.0 4,861.0 Provision (benefit) for income taxes Profit of consolidated companies 3,197.6 6,794.8 2,898.4 6,159.0 3,127.5 6,645.8 753.0 1,697.0 872.0 1,704.0 689.0 1,609.0 1,720.0 5,005.0 968.0 2,782.0 (270.0) 839.0 953.0 3,520.0 1,485.0 3,468.0 1,405.0 3,456.0 15.3 14.3 13.3 5.0 5.0 2.0 (12.0) 37.0 73.0 81.0 Profit of consolidated and affiliated comp 6,810.1 6,173.3 6,659.1 1,702.0 1,709.0 1,611.0 4,981.0 2,758.0 3,557.0 3,541.0 3,537.0 Less: Profit (loss) attributable to noncontrollin 76.4 71.7 66.4 3.0 10.0 25.0 53.0 58.0 0.0 0.0 0.0 6,733.7 6,101.7 6,592.7 1,699.0 1,699.0 1,586.0 4,928.0 2,700.0 895.0 3,557.0 3,541.0 3,537.0 Basic Shares Diluted Shares 653.6 668.7 653.6 668.7 653.6 668.7 653.6 668.7 652.9 669.6 650.0 670.2 645.0 666.1 631.5 650.4 615.2 626.0 610.5 627.9 638.2 659.5 658.7 683.8 Basic EPS Diluted EPS Concensus Guidance 10.3 10.1 10.0 9.3 9.1 8.8 2.6 2.5 2.6 2.5 2.4 2.4 7.6 7.4 4.3 4.2 1.5 1.4 5.8 5.7 5.5 5.4 5.4 5.2 Incremental Sales Growth 4,705.2 5,272.3 10.1 9.9 9.1 9.0-9.25 9.13 6,262.8 729.0 3,144.0 3,032.0 17,550.0 6,366.0 3,441.0 5,178.0 D&A % of Sales 3,207.9 4.2% 3,010.3 4.2% 2,788.8 4.2% 720.0 4.4% 689.0 4.0% 661.0 4.1% 2,527.0 4.2% 2,296.0 5.4% 2,336.0 7.2% 1,980.0 3.9% 1,797.0 4.0% 1,602.0 3.9% CapEx % of Sales 4,582.7 6.0% 4,658.7 6.5% 4,648.1 7.0% 1,231.0 7.5% 1,166.0 6.7% 1,129.0 7.1% 3,924.0 6.5% 2,586.0 6.1% 2,472.0 7.6% 4,011.0 7.8% 3,040.0 6.8% 2,675.0 6.4% 26,732.4 35.0% 19,094.6 25.0% 9165.4 12.0% -1541.8 -32.8% 25,085.6 35.0% 18,635.0 26.0% 8600.8 12.0% -5903.4 -112.0% 19,920.2 30.0% 17,928.2 27.0% 8632.1 13.0% -4880.3 -77.9% Effective Tax Rate 32.0% 32.0% 32.0% 30.7% 33.9% 30.0% 25.6% 25.8% -47.5% 21.3% 30.0% 28.9% Interest expense excluding financial products Other income (expense) 0.66% 0.50% 0.66% 0.50% 0.66% 0.50% 0.78% -0.10% 0.63% 0.40% 0.71% 0.55% 0.66% -0.05% 0.81% 0.31% 1.20% 1.18% 0.53% 0.58% 0.64% 0.71% 0.66% 0.52% Equity in profit (loss) of unconsolidated affiliate 0.02% 0.02% 0.02% 0.03% 0.03% 0.01% -0.04% -0.06% -0.04% 0.07% 0.16% 0.20% Less: Profit (loss) attributable to noncontrollin 0.10% 0.10% 0.10% 0.02% 0.06% 0.16% 0.09% 0.14% -0.21% 0.00% 0.00% 0.00% Operating Profit Concensus Guidance Interest expense excluding financial products Other income (expense) Equity in profit (loss) of unconsolidated affiliate Profit Receivables % of Sales Inventory % of Sales Payables % of Sales Change in WC Incremental Working Capital Change per % of Sales Growth 2,596.0 129.0 (17.0) (24.0) (24.0) 827.0 (68.0) 10,192.0 (18,928.0) 18,679.0 18,826.0 18,301.0 17,953.0 16,792.0 13,912.0 18,128.0 15,752.0 15,411.0 113.6% 108.4% 114.5% 29.9% 39.4% 42.9% 35.3% 35.0% 37.1% 17,550.0 17,344.0 16,511.0 14,544.0 6,360.0 8,781.0 7,204.0 6,351.0 9,587.0 106.7% 99.8% 103.3% 24.2% 22.5% 19.6% 17.1% 16.0% 15.3% 7978.0 8470.0 8360.0 8161.0 5856.0 2993.0 4827.0 4723.0 4085.0 48.5% 48.8% 52.3% 13.6% 13.8% 9.2% 9.4% 10.5% 9.8% 17 396.0 (32.0) MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY b. BusinessSegmentForecast CAT (mill$) Revenue: Machinery and Power Systems Power Systems Resource Industries Construction Industries All Other Segments Corporate Items and Elimina Financial Products Financial Products Corporate Items and Elimina Total Concensus Guidance FY 2014E FY 2012E FY 2010 1Q12 5,317.0 5,214.0 4,904.0 318.0 (14.0) 5,511.0 5,390.0 5,340.0 454.0 (11.0) 4,987.0 4,778.0 5,062.0 474.0 (13.0) 20,114.0 15,537.0 13,389.0 19,667.0 13,572.0 8,507.0 15,629.0 8,667.0 5,857.0 2,021.0 2,156.0 1,791.0 (39.0) (65.0) (4.0) 776.0 764.0 761.0 (70.0) (74.0) (68.0) 16,445.0 17,374.0 15,981.0 3,003.0 2,946.0 3,139.0 (257.0) (225.0) (283.0) 60,138.0 42,588.0 32,396.0 21,723.1 23,600.4 16,410.5 1,899.7 (39.0) 3,140.1 (257.0) 76,378.3 70,991.0 3,109.0 (257.0) 71,673.0 65,588.0 3,063.1 (257.0) 66,400.8 65,795.0 66,000.0 3,683.4 2,114.6 1,792.0 835.9 3,367.1 3,304.1 1,641.0 816.9 943.0 1,113.0 459.0 482.0 (512.0) 982.0 1,426.0 688.0 188.0 (778.0) 812.0 1,168.0 616.0 218.0 (617.0) 746.2 750.4 9,172.0 8,787.7 9,879.5 8,970.2 190.0 (9.0) (70.0) 2,596.0 188.0 (4.0) (74.0) 2,616.0 205.0 (11.0) (68.0) 2,323.0 587.0 (4.0) (253.0) 7,153.0 429.0 (42.0) (211.0) 3,963.0 3,053.0 2,288.0 1,660.0 3,334.0 1,789.0 288.0 2,056.0 783.0 (768.0) 837.0 720.0 625.0 (2,457.0) (1,793.0) (1,348.0) 8.0% 8.0% 4.0% 0.0% 8.0% 12.0% 4.0% 0.0% 8.0% 20.0% 5.0% -6.0% 4.8% 13.4% 0.1% -31.0% 16.7% 12.1% 68.1% 8.1% -4.4% 120.0% 12.1% 72.6% 13.2% -19.5% 0.0% 29.5% 44.9% 80.3% -6.3% -40.0% 16.0% 59.5% 48.0% 20.4% 1525.0% 1.0% 1.5% 2.0% 6.6% 7.9% 10.4% 2.5% 9.4% 4.6% 0.0% 7.2% 22.1% 4.2% 17.2% 23.4% 1.9% 14.2% 41.2% -6.1% -20.5% 31.5% 15.8% 0.1% 9.0% 1.0% 11.0% 0.5% 44.0% 0.0% 15.7% 0.2% 8.0% -6.0% 10.5% 0.5% 44.0% 1.0% 15.5% 0.3% 14.0% -3.0% 10.0% -3.2% 43.0% 1.6% 17.7% 2.1% 21.3% 5.1% 9.4% -0.8% 151.6% 100.8% 17.8% 2.9% 26.5% 1.6% 12.9% 3.1% 41.4% 15.7% 16.3% 0.5% 24.4% -4.3% 12.2% 0.0% 46.0% 4.4% 15.2% 0.5% 17.0% 3.8% 13.2% 4.1% 41.4% 8.0% 14.7% 2.3% 13.2% 9.8% 9.0% 22.1% 33.4% -1.5% 24.0% 0.0% 13.2% 24.0% -0.5% 12.8% 24.5% 5.0% 14.9% 24.5% 5.3% 15.8% 24.6% 2.1% 15.1% 26.9% 8.3% 14.5% 19.5% 5.0% 11.9% 14.6% 1.9% 9.3% 18 FY 2009 2Q12 23,461.0 26,432.4 17,066.9 1,899.7 (39.0) Revenue Growth YoY Machinery and Power Systems Power Systems Resource Industries Construction Industries All Other Segments Corporate Items and Eliminations Financial Products Financial Products Corporate Items and Eliminations Total FY 2011 3Q12 25,337.8 28,547.0 17,749.5 1,899.7 (39.0) Operating Income Machinery and Power Systems Power Systems 4,003.4 Resource Industries 2,569.2 Construction Industries 1,952.4 All Other Segments 835.9 Corporate Items and Eliminations Financial Products Financial Products 753.6 Corporate Items and Eliminations Adjustments Total 10,114.6 Concensus 9,941.5 Guidance Operating Income Machinery and Power Systems Power Systems Chg YoY Resource Industries Chg YoY Construction Industries Chg YoY All Other Segments Chg YoY Financial Products Financial Products Chg YoY Total FY 2013E 399.0 (18.0) (261.0) 577.0 12.4% 3.4% -13.1% 34.9% 12.7% 1.8% MatthewJ.Anderson (614)940‐2290 anderson.1110@osu.edu FisherCollegeofBusinessEquityResearch November20,2012 CaterpillarInc.(CAT)‐BUY c. DiscountedCashFlowsValuation Caterpillar Inc. (CAT) Matthew Anderson 11/16/2012 10.5% 3.0% 2013E 2014E 2015E 2016E 66,401 71,673 7.9% 76,378 6.6% 81,392 6.6% 88,718 9.0% 95,815 102,522 108,674 113,564 117,539 121,065 8.0% 7.0% 6.0% 4.5% 3.5% 3.0% Operating Income Operating Margin 9,880 14.9% 9,172 12.8% 10,115 13.2% 10,581 13.0% 11,090 12.5% 11,498 12.0% 11,790 11.5% 11,954 11.0% 11,924 10.5% 11,166 9.5% 10,291 8.5% Interest and Other Interest % of Sales 770 1.2% 831 1.2% 886 1.2% 944 1.2% 1,029 1.2% 1,111 1.2% 1,189 1.2% 1,261 1.2% 1,317 1.2% 1,363 1.2% 1,404 1.2% Taxes Tax Rate 3,127 32.0% 2,898 32.0% 3,198 32.0% 3,688 32.0% 3,878 32.0% 4,035 32.0% 4,153 32.0% 4,229 32.0% 4,237 32.0% 4,009 32.0% 3,742 32.0% Net Income % Growth 6,593 6,102 (0.07) 6,734 0.10 7,837 0.16 8,241 0.05 8,574 0.04 8,826 0.03 8,986 0.02 9,004 0.00 8,520 (0.05) 7,952 (0.07) 2,789 4.2% (4,880) -7.3% 4,648 7.0% 3,010 4.2% (5,903) -8.2% 4,659 6.5% 3,208 4.2% (1,542) -2.0% 4,583 6.0% 3,418 4.2% (1,753) -2.2% 4,721 5.8% 3,726 4.2% (2,619) -3.0% 4,968 5.6% 4,024 4.2% (2,514) -2.6% 5,174 5.4% 4,306 4.2% (2,354) -2.3% 5,331 5.2% 4,564 4.2% (2,139) -2.0% 5,434 5.0% 4,770 4.2% (1,676) -1.5% 5,451 4.8% 4,937 4.2% (1,349) -1.1% 5,172 4.4% 5,085 4.2% (1,191) -1.0% 5,085 4.2% 2,820 1,148 -59.3% 4,496 291.6% 5,554 23.5% 5,533 -0.4% 6,017 8.8% 6,483 7.7% 6,919 6.7% 7,384 6.7% 7,530 2.0% 7,286 -3.2% Revenue % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow % Growth NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA Shares Outstanding Current Price Implied equity value/share Upside/(Downside) to DCF 2012E 32,273 36,865 69,139 5.15% 8.3 10.5 7.0 8.2 $ 81.93 $ 103.39 26.2% 39,852 Cash 5,689 Cash/share 8.51 Total Assets 90,541 Debt/assets 2018E 2019E 2020E 2021E Terminal Value 100,055 Free Cash Yield 9.0 11.3 7.3 8.5 2022E 8.1 10.3 6.7 7.8 7.28% Terminal P/E 12.6 Terminal EV/EBITDA 8.7 669 Debt Incremental Working Capital Change per % of Sales Growth 2017E 47% 53% 100% Terminal Growth Rate Year Terminal Discount Rate = Terminal FCF Growth = Terminal Discount Rate 9.5% 10.0% 10.5% 11.0% 106.57 99.66 93.54 88.06 110.58 103.06 96.43 90.55 115.17 106.91 99.70 93.33 103.3925 1.5% 2.0% 2.5% 3.0% 9.0% 114.41 119.19 124.70 11.5% 83.14 85.29 87.69 12.0% 78.70 80.57 82.64 131.13 120.46 111.31 103.39 96.47 90.36 84.94 3.5% 138.73 126.63 116.39 107.62 100.02 93.37 87.50 4.0% 147.85 133.92 122.31 112.49 104.07 96.78 90.39 4.5% 159.00 142.68 129.32 118.18 108.75 100.67 93.67 26.2% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 9.0% 39.6% 45.5% 52.2% 60.1% 69.3% 80.5% 94.1% 9.5% 30.1% 35.0% 40.6% 47.0% 54.6% 63.5% 74.1% Upside/Downside 10.0% 10.5% 21.6% 14.2% 25.8% 17.7% 30.5% 21.7% 35.9% 26.2% 42.1% 31.4% 49.3% 37.3% 57.8% 44.2% 11.0% 7.5% 10.5% 13.9% 17.7% 22.1% 27.0% 32.7% 11.5% 1.5% 4.1% 7.0% 10.3% 14.0% 18.1% 22.9% 12.0% -3.9% -1.7% 0.9% 3.7% 6.8% 10.3% 14.3% 44.0% 32.8% Accordingtothesensitivityanalysis,CAThasafairamountofupsideinthemajorityofscenarios.The currentstockpriceimpliesthatCATisinexpensiverightnow. 19