Stock Report CAH: 66.70 (5/21/04) Chris Pribisko

advertisement

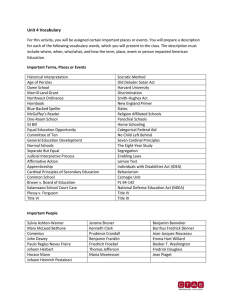

Stock Report CAH: 66.70 (5/21/04) Chris Pribisko May 21, 2004 2 Recommendation Shares of Cardinal Health have reacted negatively to the recent news of an SEC investigation and the acquisition of Alaris. All of the positive news has been swallowed up by the current market situation and the fear of rising oil prices and interest rates. On that note, Cardinal is a good play because the economic factors should not have a great effect on Cardinal’s business and the negative news has been priced in too high into Cardinal’s stock. Therefore, I have given Cardinal Health a BUY rating and a price target of $75.00 based on the following factors: Cardinal’s core drug distribution business is going through a transition that has eliminated profits from buying in bulk. The transition is changing the business to negotiating with drug manufacturers through a fee for service agreement. I feel this change has been overpriced into the stock price, because Cardinal is more diversified than its competitors, relying less on its distribution business. The SEC has announced a formal investigation on Cardinal’s accounting treatment of $22 million received from vitamin manufacturers because Cardinal was overcharged. The stock fell after the news, but it does not appear anything major will affect Cardinal as the company already began an internal investigation in April 2003. Cardinal is cooperating with the SEC and providing them with all the necessary information. Cardinal has also agreed to make any modifications that are necessary. Cardinal’s free cash flow is one of its greatest strengths. It allows Cardinal to continue its diversification strategy by acquiring companies that fit into its growth segments. Cardinal plans to use this cash to buy Alaris for $2B, which it has agreed to do on June 30, 2004. This acquisition expands its Medical-Surgical Products and Services segment, and adds a new product line to Cardinal’s business. Cardinal also announced a share repurchase agreement of $500 million in February 2004, which has recently been completed. With strategic uses of this large amount of free cash flow, Cardinal will continue to grow making its shares more valuable. Cardinal has many impressive products, services, and technologies that are continuing to benefit the health care industry. One key product is the Pyxis SupplyStation 30, which is a medical supply storage system that is expected to revolutionize hospitals and make the distribution of drugs to patients much more efficient and safe. Cardinal also has bar code technology on its pharmaceutical packaging that is expected to be a requirement in the industry by the FDA in the next two years. 3 Company Description Cardinal Health, Inc. (www.cardinal.com) is the leading provider of products and services supporting the health care industry. Cardinal Health develops, manufactures, packages and markets products for patient care; develops drug-delivery technologies; distributes pharmaceuticals and medical, surgical and laboratory supplies; and offers consulting and other services that improve quality and efficiency in health care. Headquartered in Dublin, Ohio, Cardinal Health employs more than 50,000 people on five continents and produces annual revenues of more than $50 billion. Cardinal Health is ranked No.17 on the current Fortune 500 list and named one of the best U.S. companies by Forbes magazine for 2004.1 Cardinal is made up of four business segments: Pharmaceutical Distribution and Provider Services, Medical Products and Services, Pharmaceutical Technologies and Services and Automation and Information Services. Cardinal identifies its position in the health care arena in the following way: Cardinal Health serves manufacturers of pharmaceuticals and medical products, as well as those who care for patients. For health care manufacturers, we offer product development, manufacturing and packaging services; distribution services; and marketing and sales services. For health care providers, we offer similar services along with an array of products and services that help improve operational and clinical performance.2 Serving Health Care Manufacturers We work in partnership with pharmaceutical and biotechnology companies to develop unique dosage forms for their drugs. We offer contract manufacturing and custom packaging to enhance brand awareness and patient compliance with drug therapy. Our distribution services include warehousing and distribution of drugs, medical-surgical and 1 2 www.cardinal.com www.cardinal.com/content/about/opoverview.asp 4 laboratory products to hospitals, retail pharmacies, surgery centers, physician practices and other points of care, and specialized inventory management, and logistics services. Our marketing and sales services include contract sales and marketing, specialized information systems, consulting and promotional programs with community pharmacies and acute-care providers.3 Serving Providers of Patient Care For hospitals and other health care providers, we develop and manufacture a broad range of leading medical and surgical products, as well as automated supply and pharmaceutical dispensing systems. We repackage bulk pharmaceuticals into smaller volumes for more efficient use by hospital and retail pharmacies. We are one of the largest distributors of pharmaceuticals and other medical products, and we provide systems to help customers streamline purchasing and inventory management. We help retail pharmacies market themselves in their communities through Internet-based programs and patient-education activities, and we provide systems to help them maximize reimbursement from third-party payers. We also provide franchise opportunities and other services to retail pharmacies. Our operations and clinical improvement services include unique consulting and information systems to help health care providers reduce supply costs, improve operational efficiencies and enhance clinical outcomes.4 3 4 www.cardinal.com/content/about/opoverview.asp www.cardinal.com/content/about/opoverview.asp 5 Economic/Capital Market Analysis The economy appears to be in a recovery phase. One of the signs has been the release of the monthly employment reports. April and May reports both beat estimates for new jobs created by large amounts. But, because he economy seems to be improving, inflation is becoming a fear. Oil prices have surged past $40/barrel, which hit an all time high. To combat inflation worries, the Fed is going to raise interest rates. This is not a surprise because rates cannot really fall below 1% or stay there forever. Although a rate hike is expected, there are still worries as to how it will affect the equity market. Equity markets usually under-perform when rates rise. It is expected that Greenspan will raise rates by at least 25-50 bp by August. As for the health care industry, this economic environment should not hurt. The health care sector usually is one of the better performers during a rate hike environment. The sector does poorly right around the first rate hike, but has the highest return by the end of the year. The pharmaceutical sub-sector is the best performer, but this should also benefit Cardinal because of how closely it is associated with the pharmaceutical business. Looking historically at how the industries respond to an initial rate hike, Ned Davis Research shows that the pharmaceutical sub-sector has a return of –7.96% after 13 weeks and 28.88% after 52 weeks, while the S&P 500 has a return of –3.85% and 5.92% respectively. The health care sector is also defensive in nature so it is not as adversely affected as other sectors when the market is in a downturn. So, the health care industry would be a good play in the current economic environment with the inevitability of a rate hike. Industry Analysis The health care sector is still in the growth phase and may continue to grow for a long period of time because of the expanding U.S. population over the age of 65. From the chart below, it is clear that the upward trend in older population is expected to continue for another 70 years. With more and more end consumers relying on the health care industry, Cardinal has put itself into a good position by continually expanding its product base. Cardinal’s distribution business is actually not growing as fast as it used to, but the company has diversified and expanded into areas that better meet the needs of the end consumers and continued to grow. Cardinal has had an overall growth of 15% for more than 10 years, which has only been made possible by an industry that continues to grow. 6 Catalysts Cardinal Health’s main strategy for growth has always been through acquisition. The company has acquired more than 35 companies since 1995. Every acquisition was strategic, as Cardinal looks for companies that will add value to one of its segments, but also have the synergies to fit the Cardinal way of business. This type of growth has allowed Cardinal to expand outside of its main drug distribution business, which has paid off tremendously because of the changes made in this segment. By diversifying, Cardinal has set itself apart from its two main competitors: McKesson (MCK) and Amerisource Bergen (ABC), who rely more heavily on the drug distribution business for revenue and earnings. Cardinal also has the ability to cross-sell its products and services now that it is more diverse, which is more appealing to customers because all your needs can be filled through one place, and Cardinal benefits by obtaining more revenue. It is evident that Cardinal is succeeding at growth by acquisition when one looks at its market share. Cardinal is dominating the competitors, and does not look to be stopping anytime soon with another acquisition about to take place. Market Share of Health Care Distributors ABC 13% MCK 19% Other 2% CAH 66% 7 Cardinal’s acquisitions and growth strategy into new businesses are also paying off in the stock price. When comparing it to ABC and MCK in the following graph, it is evident that Cardinal’s acquisition strategy is a competitive advantage in the distribution industry. Cardinal has recently agreed to acquire Alaris Medical for $2B. What made Alaris an attractive target for Cardinal was that it was a strategic fit, it has a great management team (good enough that Alaris CEO David Schlotterbeck will join Cardinal’s senior management team to continue running Alaris’ business), and it has shareholder value. The only downfall is that there is a possibility that Cardinal overpaid for Alaris. The company offered to buy Alaris’ shares at $22.35, a premium of 18%. However, the acquisition will continue to expand Cardinal’s business making it more diverse, and if synergies already exist, it will be less costly during the merger, making the 18% premium sound like a deal. Alaris falls under Cardinal’s medical products, as well as automation services. It produces medical safety systems for the delivery of intravenous medications, a product that Cardinal does not currently offer. Alaris also has penetrated international markets with 30% of its revenue coming from overseas. This opens the door for Cardinal to expand more of its businesses internationally, which is a very positive aspect of the deal. Another positive note on Alaris is that the company is still in the growth phase. Alaris launched 19 new products into this market during 2003, and it expects to launch 20 more during 2004. Cardinal is expected to finance the acquisition with cash and short-term debt. Half of the deal will be funded by cash, which means Cardinal’s debt will not increase too much and 8 will keep leverage low. This type of cash financing is possible for Cardinal because of its large amount of free cash flow, which is being put to good use in this instance. By not recklessly spending its fee cash flow, Cardinal is able to acquire companies that will provide earnings to its growing segments and have synergies that will save Cardinal money in the future. Some of Cardinal’s previous acquisitions are starting to pay off by introducing new products that could drive revenues for the company. The first product is the Pyxis SupplyStation 30, which is expected to change the way hospitals administer products to patients. Pyxis SupplyStation 30 offers a revolutionary point-of-use supply storage system that automates distribution, management and control of medical surgical supplies and inventory. Through a secured supply storage cabinet and Touch-to-Take™ technology, Pyxis SupplyStation 30 provides secure, rapid access to patient care inventory, while eliminating unnecessary search and billing steps. Usage, inventory and replenishment information is transmitted electronically, creating an efficient supply management workflow process. The system combines a network of secure storage Stations located throughout the health care facility, including operating rooms, cath labs, trauma areas and nursing units, that are connected to and managed by the Pyxis SupplyCenter™ Console. The Pyxis SupplyCenter Console is a Windows® NT Server that electronically links to a facility's hospital information systems (ADT, billing, materials management) updating census information and transferring supply usage and inventory data to and from each Pyxis SupplyStation in use.5 Key advantages Increases product availability Improves patient safety Eliminates product searches Eliminates stickers and manual data entry Helps increase accuracy Helps increase time spent with patient Helps eliminate billing and inventory errors Creates new efficiencies in the supply management process Easier and more accurate patient billing Supports regulatory compliance 6 5 6 www.pyxis.com/products/supply30.asp# www.pyxis.com/products/supply30.asp# 9 Another of Cardinal’s products that is expected to have positive feedback is the bar code packaging and reading technology in its automation services segment. This technology eliminates the number of errors in presribing, transcribing, dispensing, and administering medication. The FDA is going to establish bar code regulations on most prescription drugs and some OTC drugs within the next two years. Cardinal is the largest provider of this bar code packaging technology, which can help manufacturers comply with the new FDA regulations. Not only will the new regualtions benefit Cardinal, but the health care system will be safer and more efficient. Cardinal has many more products and services that help the health care system, which can be found on the company’s website. There is such a wide range of products that are doing well for Cardinal, but these two mentioned above will draw national attention and could have the greatest positive impact on Cardinal’s revenues. Risks/Concerns The one major concern deals with the changing environment in the pharmaceutical distribution segment. Cardinal used to buy drugs in bulk, getting them at a much cheaper price. The company would hold the drugs in inventory until the price went high enough that the drugs could be sold under cost and still make a profit. This is a direct loss on operating revenue for the segment, however excess cash flow will now be free to invest in other areas of the company because inventory will shrink dramatically. But, the effects of this decrease in inventory will not be seen for a few years, while the loss in profit is immediate. The effect this transition has had on the pharmaceutical distribution can be seen in the following graphs, basically showing the lack of earnings growth in the segment compared to Cardinal’s other segments. The one worrisome point is that 81% of Cardinal’s total revenue/46% of operating profit come from this segment. However, the good news is that Cardinal is more diversified than its two major competitors: MCK and ABC. It is also noteworthy that Cardinal continues to diversify ( i.e. the acquisition of Alaris), which further reduces Cardinal’s reliance on its main distribution business. 10 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 Automation and Info Services Pharma. Tech. & Services Medical Products & Services Growth Rate Segment Revenue Pharma. Distribution & Services Percent Revenue by Segment for First Nine Months of FY2004 Operating Earnings by Segment for First Nine Months of FY2004 0.5 0.4 Percent 0.3 Growth Rate 0.2 Segment Earnings 0.1 0 Pharma. Medical Distribution & Products & -0.1 Services Services Pharma. Tech. & Services Automation and Info Services 11 The new way of doing business is to negotiate contracts with drug manufacturers. These distribution agreements follow a fee for service model, and it is expected that distributors will no longer have control over the price, so competition will be fierce. With the bulk revenue stream gone, the best measurement for growth in this segment is through the increase of direct store door (DSD) sales. DSD sales reveals the demand for the company’s distribution business. Over the past quarter, DSD sales increased 23% through new customer agreements with Anthem and Publix. Cardinal also renewed a multi-year exclusive contract with Express Scripts and is in negotiations with close to 50 other manufacturers. Cardinal may never have the same margins in the pharmaceutical distribution as it did with bulk revenue, but its business can still be profitable through these distribution agreements. With lower margins, it now becomes a battle of market share rather than when to buy/sell drugs in bulk. With a good overall reputation and the ability to provide a wider array of services than its competitors, Cardinal is still in good position to control the pharmaceutical distribution business. Another concern is the formal SEC investigation that was announced on May 14, 2004. The SEC is inquiring Cardinal about the accounting treatment of $22 million received from vitamin manufacturers because Cardinal had been overcharged. Cardinal has collected around $135 million since 2001 from the manufacturers on the basis that they fixed prices. The SEC is investigating whether these charges affected Cardinal’s statements of quarterly earnings. Cardinal has cooperated with the SEC and provided all the material they needed to go on with the investigation. As of right now, nothing has been revealed, but Cardinal said they would make any modifications the SEC deems necessary. On a positive note, Cardinal has been proactive by starting its own internal investigation during April 2004 because issues were discovered during the gathering of information for the SEC. Finally, in response to the SEC’s formal investigation announcement, Cardinal announced its intentions to acquire Alaris 5 days later; as if to announce to the financial world that Cardinal was going to continue to go about its business and grow. The last concern deals with Medicare legislation. It is an election year and the government plays a major role in health care spending. Depending on who wins the presidential election will have some effect on the health care legislation. But, the government is usually slow to change, but it is always something to keep in mind knowing Cardinal will be somewhat affected by government legislation. 12 Financial Analysis The one major change that is expected on Cardinal’s balance sheet deals with the size of inventory. Since, the pharmaceutical distribution business environment changed, it is expected to see this reduction in the growth rate of inventory. By 2004, inventory should not be growing at all because of the major reductions that are taking place. The reduction in inventory will also free up more cash, which will enable Cardinal to invest in acquisitions to grow its higher margin segments. The rest of the balance sheet appears to be in line with previous years except for shortterm debt, but that is the result of having an acquisition strategy and using this debt to help finance the mergers when Cardinal needs extra support. Short-term debt is higher when acquisitions are occurring and lower when nothing is on the table. 13 Free cash flow is one of the major strengths of Cardinal. Some people call Cardinal’s FCF its fifth business segment. FCF’s growth rate decreased by a substantial amount, but the majority of that decline is due to the accounting adjustment made in 2002. But, having over $1B in FCF is nothing to scoff at. Cardinal has also used its FCF wisely and not spending it on any acquisition. Cardinal makes sure all of its acquisition have synergy and fit into one of its growth segments. Cardinal also announced a $500 million share repurchase that shows investors that management believes the company shares are undervalued. These projects are adding shareholder value and also improving the company as a whole. If FCF continues to grow, so will Cardinal’s acquisitions, making the company more diverse, as well as maintaining its leadership in the industry. To see if the company is using FCF wisely, it is good to check the growth rates and margins, which are shown in the following graph. 14 StockVal ® Growth & Margin Check CARDINAL HEALTH INCORPORATED (CAH) Price 66.700 05/21/04 Percent Change Quarter Revenue REV RPS EARN EPS Default Growth Rate Estimate 13.0% Analyst Growth Rate Estimate 13.0% Actual Year Profit EPS Ago Margin % Momentum % SF REV EPS Jun 02 13,028.2 5 5 22 21 0.74 0.61 2.6 0 +5 +21 Sep 02 13,086.1 11 13 18 20 0.66 0.55 2.3 0 +10 +17 Dec 02 14,091.0 8 10 16 19 0.76 0.64 2.4 0 +8 +17 Mar 03 14,371.3 9 9 20 21 0.86 0.71 2.7 0 +8 +21 Jun 03 15,188.6 17 18 17 19 0.88 0.74 2.6 0 +16 +19 Sep 03 13,288.3 2 3 13 15 0.76 0.66 2.6 0 +1 +13 Dec 03 14,093.6 0 3 10 13 0.86 0.76 2.7 0 0 +12 Mar 04 14,638.9 2 6 11 15 0.99 0.86 3.0 0 +2 +15 T4Q 57,209.4 5 7 13 16 3.49 Mean Estimate Next Quarter 18 1.04 High Estimate 20 1.06 Median Estimate Low Estimate 15 1.01 Number of Estimates Number of Estimates 16 Jun 04 1 REV RPS 5 EARN Long-Term Growth Rate Estimates 15.0% 11 Standard Deviation Point-to-Point Growth Rates (%) Years 2.7 2 Least Squares Growth Rates (%) EPS Years 7 13 16 1 REV RPS 1 EARN EPS 4 11 14 3 7 8 18 19 3 7 8 18 19 5 12 13 22 22 5 13 13 22 21 7 14 13 24 23 7 15 14 23 22 10 10 15 15 20 20 EPS is maintaining a steady growth rate and is expected to continue into the future. Last quarter also had the highest profit margin of any quarter in the past three years, showing Cardinal’s ability to shift from the lower margin pharmaceutical distribution business to its higher margin segments. EPS momentum is keeping a steady pace, which is positive for a growth company. It appears that Cardinal is using its FCF properly and really adding value to the business. With no down quarters, it is expected for Cardinal to keep growing at this pace in the near future, despite the changing business environment in its pharmaceutical distribution segment. 15 (Insert Dupont Analytics graph from powerpoint attachment) ROE is actually pretty good and just barely lower than 2002, because of a higher accounting adjustment. Margin is higher, and asset turnover and leverage are a little lower, which is important for ROE. Cardinal should improve its ROE even more throughout the next year because margins continue to improve through acquisitions like Alaris that will strengthen its higher margin segments. Cardinal has also improved its asset management. In the third quarter results of 2004, inventory on hand decreased form 58 days to 51 days compared with the third quarter of 2003. Receivable days also lowered slightly meaning asset turnover should be even lower in 2004. This increasing ROE again shows that Cardinal management is making the right decisions with its FCF and adding value to the company. 16 Valuation Analysis There are so many different ways in which to value a company, but I am going to use the forward PE, P/S, and P/B along with an overall price comparison. The more valuations one looks at, the better one can see the overall picture of the stock. CARDINAL HEALTH INCORPORATED (CAH) Price 66.7 1999 2000 2001 2002 80 2003 StockVal® 2004 2005 HI LO ME CU GR 60 40 76 27 62 67 9.7% 30 05-21-1999 05-21-2004 20 PRICE 30 HI LO ME CU 25 20 15 29.8 13.6 20.6 16.2 05-21-1999 05-21-2004 10 PRICE / YEAR-FORWARD EARNINGS 0.8 HI LO ME CU 0.6 0.74 0.34 0.56 0.52 0.4 05-21-1999 05-21-2004 0.2 PRICE / SALES 8 HI LO ME CU 6 7.2 2.7 4.5 3.8 4 05-21-1999 05-21-2004 2 PRICE / BOOK VALUE When looking directly at Cardinal’s history, the current stock price is slightly undervalued by all three measures, and this rating would point to a buying opportunity especially since the graphs seem to be on a slight upward trend. Based on its history, Cardinal’s stock price should be a little higher than it stands presently. 17 CARDINAL HEALTH INCORPORATED (CAH) Price 66.7 1999 2000 2001 2002 2003 StockVal® 2004 2005 1.3 HI LO ME CU 1.2 1.1 1.29 0.99 1.16 1.18 1.0 05-21-1999 05-21-2004 0.9 PRICE RELATIVE TO SP5 HEALTH CARE DISTRIBUTORS (35102010A) M-Wtd 1.2 HI LO ME CU 1.1 1.0 0.9 0.8 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO SP5 HEALTH CARE DISTRIBUTORS (35102010A) M-Wtd 2.1 05-21-1999 05-21-2004 HI LO ME CU 1.8 1.16 0.86 1.05 1.01 2.09 1.34 1.61 2.00 1.5 05-21-1999 05-21-2004 1.2 PRICE / SALES RELATIVE TO SP5 HEALTH CARE DISTRIBUTORS (35102010A) M-Wtd 1.6 HI LO ME CU 1.4 1.49 1.06 1.33 1.42 1.2 05-21-1999 05-21-2004 1.0 PRICE / BOOK VALUE RELATIVE TO SP5 HEALTH CARE DISTRIBUTORS (35102010A) M-Wtd Cardinal’s valuation in comparison to its main competitors is a little less unclear. It is slightly undervalued in the forward PE and a great deal overvalued in P/S and P/B. But, investors should expect a premium when buying Cardinal because it is the class of the health care distributors. No other company matches its diversity in its products and segments, and has been continually improving by diminishing its reliance on its main pharmaceutical distribution business. With this in mind, and still being undervalued in the forward PE metric, Cardinal is still a company worth buying. 18 CARDINAL HEALTH INCORPORATED (CAH) Price 66.7 1999 2000 2001 2002 2003 StockVal® 2004 2005 2.0 HI LO ME CU 1.4 1.0 0.8 1.87 0.67 1.45 1.60 05-21-1999 05-21-2004 0.6 PRICE RELATIVE TO S&P HEALTH CARE SECTOR COMPOSITE ADJ (SP-35) M-Wtd 1.2 HI LO ME CU 1.0 0.8 0.6 0.4 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P HEALTH CARE SECTOR COMPOSITE ADJ (SP-35) M-Wtd 0.30 05-21-1999 05-21-2004 HI LO ME CU 0.25 0.20 0.15 1.07 0.51 0.87 0.89 0.27 0.10 0.20 0.24 05-21-1999 05-21-2004 0.10 PRICE / SALES RELATIVE TO S&P HEALTH CARE SECTOR COMPOSITE ADJ (SP-35) M-Wtd 1.0 HI LO ME CU 0.8 0.6 0.4 0.97 0.32 0.70 0.89 05-21-1999 05-21-2004 0.2 PRICE / BOOK VALUE RELATIVE TO S&P HEALTH CARE SECTOR COMPOSITE ADJ (SP-35) M-Wtd Finally, when comparing Cardinal to the S&P Health Care Sector, the company is slightly overvalued. This makes sense as many pharmaceutical and biotech companies are also good plays in the current interest rate economic environment. The graphs also do not point to a downward trend, showing that Cardinal may still be a good play. So, knowing that the health care sector is a good buy, and Cardinal is the best buy out of the distributors, I am maintaining the company’s Buy rating. 19 Conclusion I am giving Cardinal Health an OVERWEIGHT rating with a price target of $75.00, which is a little lower than its recent 52 week high. I feel this target is reasonable because the negative news regarding the SEC formal investigation on Cardinal caused too much reaction by investors. The stock dropped more than 10% over a five-day period. Cardinal has addressed this issue already internally and has stated they will make any changes the SEC deems necessary. Cardinal continued its downward trend with the announcement of the acquisition of Alaris. Although the buyer usually has a drop in stock price, I do not think it was necessary, since the stock had just gone down because of the SEC investigation. These two major events overshadowed all of the positives that Cardinal has to offer and therefore the stock is undervalued. Alaris is actually an excellent acquisition for Cardinal as it shifts more revenue responsibility to the higher margin segments that are providing Cardinal with its greatest growth. It also has products and services new to Cardinal and has a presence internationally that will Cardinal grow into untapped markets overseas. With many synergies already in place and a large amount of FCF being used to finance the deal, this acquisition was a good value for Cardinal. With more and more acquisitions, Cardinal is becoming very diverse in its products and services making it the leader in the distribution industry. Competitors are having a hard time keeping up with Cardinal’s growth, so many new products are going to be successful and add value to the company. As Cardinal’s reputation grows, it will also be able to win the pharmaceutical distribution contracts that will increase its market share, and maintain its lead over competitors in its highest grossing revenue and operating profit segment. Finally, Cardinal’s financial statements continue to get stronger and stronger. Lowering inventories, improving asset management, improving margins, and having such large amounts of FCF will continue to produce higher ROE and add shareholder value. With such strong financials, some undervalued valuation metrics, and management’s continued success at its acquisition strategy; Cardinal Health is not going anywhere but up in the near future.