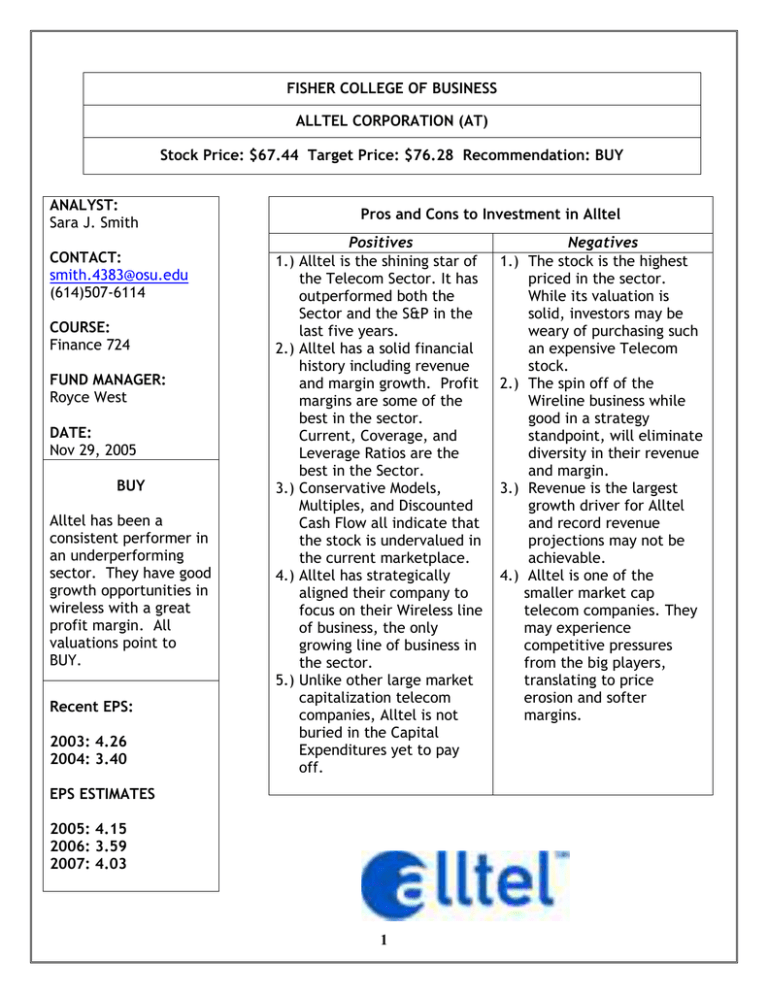

FISHER COLLEGE OF BUSINESS ALLTEL CORPORATION (AT)

advertisement

FISHER COLLEGE OF BUSINESS

ALLTEL CORPORATION (AT)

Stock Price: $67.44 Target Price: $76.28 Recommendation: BUY

ANALYST:

Sara J. Smith

CONTACT:

smith.4383@osu.edu

(614)507-6114

COURSE:

Finance 724

Pros and Cons to Investment in Alltel

1.)

2.)

FUND MANAGER:

Royce West

DATE:

Nov 29, 2005

BUY

Alltel has been a

consistent performer in

an underperforming

sector. They have good

growth opportunities in

wireless with a great

profit margin. All

valuations point to

BUY.

3.)

4.)

5.)

Recent EPS:

2003: 4.26

2004: 3.40

Positives

Alltel is the shining star of

the Telecom Sector. It has

outperformed both the

Sector and the S&P in the

last five years.

Alltel has a solid financial

history including revenue

and margin growth. Profit

margins are some of the

best in the sector.

Current, Coverage, and

Leverage Ratios are the

best in the Sector.

Conservative Models,

Multiples, and Discounted

Cash Flow all indicate that

the stock is undervalued in

the current marketplace.

Alltel has strategically

aligned their company to

focus on their Wireless line

of business, the only

growing line of business in

the sector.

Unlike other large market

capitalization telecom

companies, Alltel is not

buried in the Capital

Expenditures yet to pay

off.

EPS ESTIMATES

2005: 4.15

2006: 3.59

2007: 4.03

1

1.)

2.)

3.)

4.)

Negatives

The stock is the highest

priced in the sector.

While its valuation is

solid, investors may be

weary of purchasing such

an expensive Telecom

stock.

The spin off of the

Wireline business while

good in a strategy

standpoint, will eliminate

diversity in their revenue

and margin.

Revenue is the largest

growth driver for Alltel

and record revenue

projections may not be

achievable.

Alltel is one of the

smaller market cap

telecom companies. They

may experience

competitive pressures

from the big players,

translating to price

erosion and softer

margins.

COMPANY OVERVIEW1

Alltel Corporation is a customer-focused communications company. Alltel owns

subsidiaries that provide wireless and wireline local, long-distance, network access

and Internet services. Telecommunications products are warehoused and sold by

Alltel’s distribution subsidiary. A subsidiary also publishes telephone directories for

affiliates and other independent telephone companies. In addition, a subsidiary

provides billing, customer care and other data processing and outsourcing services to

telecommunications companies. Alltel is incorporated in the state of Delaware. Alltel

was founded in 1943 as Allied Telephone in Little Rock, Arkansas.

Alltel operates its communications businesses as a single operation capable of

delivering to customers one-stop shopping for a full range of communications products

and services. In addition to its wireless, wireline and long-distance service offerings,

Alltel also provides Internet, high-speed data transport services (''DSL''), paging and

cable television services in select markets.

Alltel is organized based on the products and services that it offers. Under this

organizational structure, Alltel’s communications operations consist of three

segments: 1.) Wireless, 2.) Wireline, and 3.) Communications support services

segments.

The following table is the breakdown of revenues and net income in 2004 per Alltel’s

three segments. As you can see, wireless drives revenue and net income, but is less

profitable than the wireline segment when comparing net income as a percent of

sales.

Figure 1: 2004 Results of Operations

2004 Results of

Operations

Sales

$M

Wireless

5,078.1

Wireline

2,419.8

Support Services 923.8

TOTAL

8,421.7

2

% of Total

Sales

60.3%

28.7%

11%

100%

Net Income

$M

% of Total

Net Income

Net Income

as a% of

Sales

1,020.2

926

62.7

2,008.9

50.8%

46.1%

3.1%

100%

20.1%

38.3%

6.8%

Wireless

Alltel’s wireless segment consists of Alltel’s cellular, PCS and paging operations. As

of December 31, 2004, Alltel provided wireless communications service to more than

8.6 million customers in 24 states. Alltel’s penetration rate (number of customers as

a percentage of the total population in Alltel’s service areas) was 13.8 percent. This

1

2

Alltel 2004 10-K Report

Data from StockVal

2

potential for growth can be seen as a competitive advantage of Alltel, as is has

perhaps become “one of the best wireless carriers in the United States” 3.

In addition, Alltel supplements its wireless service coverage area through roaming

agreements with other wireless service providers that allow Alltel’s customers to

obtain wireless services in those U.S. regions in which Alltel does not maintain a

network presence. Through these roaming agreements, Alltel is able to offer its

customers wireless services covering approximately 95 percent of the U.S. population.

Alltel continues to increase its network capacity and coverage area through new

network construction, strategic acquisitions and affiliations with other wireless

service providers. While these national rate plans provide Alltel the ability to

compete effectively for the high volume, roaming customer, retail roaming revenues

will continue to decline to the extent customers migrate to these national rate plans.

In the current wireless market, Alltel’s ability to compete also depends on its ability

to offer regional and national calling plans to its customers. As previously noted,

Alltel depends on roaming agreements with other wireless carriers to provide roaming

capabilities in areas not covered by Alltel’s network. These agreements are subject to

renewal and termination if certain events occur, including if network quality

standards are not maintained. If Alltel were unable to maintain or renew these

agreements, Alltel’s ability to continue to provide competitive regional and

nationwide wireless service to its customers could be impaired, which, in turn, would

have an adverse effect on its wireless operations.

Wireless revenues are derived primarily from monthly access and airtime charges,

roaming and long-distance charges and charges for custom calling and other enhanced

service features. Wireless revenues comprised 60 percent of Alltel’s total operating

revenues from business segments in 2004, compared to 58 percent in 2003 and

57 percent in 2002. With the acquisition of another rural wireless carrier, Western

Wireless, which was completed in the third quarter of 2005, Alltel is looking at

wireless revenues to comprise 70% of the operating revenue mix.

Touch2Talk, which is a walkie-talkie service, data solutions, prepaid alternatives such

as ''Pay-As-You-Go'' and ''Simple Freedom'' a flat rate per minute and does not require

a deposit or service contract. As of December 31, 2004, prepaid customers

represented approximately 9 percent of Alltel’s wireless customer base.

Wireline

The wireline segment consists of Alltel’s incumbent local exchange carrier (''ILEC''),

competitive local exchange carrier (''CLEC'') and Internet access operations. Alltel’s

wireline subsidiaries provide local telephone service to 3.0 million customers

primarily located in rural areas in 15 states. The wireline subsidiaries also offer

facilities for private line, data transmission and other communications services.

Wireline revenues, which consist of local service, network access and long-distance

3

Yahoo Finance Alltel Dials Up Gains, 10/21/05

3

and miscellaneous revenues, comprised 29 percent of Alltel’s total operating revenues

from business segments in 2004, compared to 30 percent in both 2003 and 2002.

Many of Alltel’s ILEC operations have begun to experience competition in their local

service areas. Sources of competition to Alltel’s local exchange business include, but

are not limited to, resellers of local exchange services, interexchange carriers,

satellite transmission services, wireless communications providers, cable television

companies, and competitive access service providers including those utilizing

Unbundled Network Elements-Platform (''UNE-P''), voice-over-internet-protocol

(''VoIP'') providers and providers using other emerging technologies. Through

December 31, 2004, this competition has not had a material adverse effect on the

results of operations of Alltel’s wireline operations, although competition has

adversely affected Alltel’s access line growth rates.

Alltel expects the number of access lines served by its wireline operations to continue

to be adversely affected by wireless and broadband substitution in 2005.

To address competition, Alltel is focusing its efforts on marketing and selling

additional products and services to its customers by bundling together and offering at

competitive rates its various product offerings, including long-distance, Internet and

DSL services.

It is also noteworthy of adding that Alltel is formalizing plans to spin off their wireline

division. According to the Third quarter earnings conference call, Alltel’s Chief

Executive Scott Ford said “Our strategic review process has gone well with significant

interest expressed by several parties, and we are on pace to finalize our review

before the end of the year”. The wireline business is Alltel’s most profitable, but, if

they are able to sell it at a reasonable price, and strategically align their growing

Wireless capabilities the loss of the business line will be a key strategic change to

foster the growing Wireline business.

Communication

Communications support services consist of Alltel’s long-distance and network

management services, product distribution, directory publishing and

telecommunications information services operations. Revenues and sales from

communications support services comprised 11 percent of Alltel’s total operating

revenues from business segments in 2004, compared to 12 percent in 2003 and

13 percent in 2002.

Long-distance and Network Management Services

Long-distance telecommunications services are provided on both a facilities-based

and resale basis by Alltel subsidiaries. During 2004, approximately 73 percent of

Alltel’s long-distance traffic was transported on its own fiber optic networks. Alltel

provides long-distance service in all of the states in which Alltel provides local

exchange service.

4

Product Distribution

Alltel’s product distribution subsidiary, Alltel Communications Products, Inc.

(''Communications Products''), operates four warehouses and four counter-sales

showrooms across the United States. Communications Products is a distributor of

telecommunications equipment and materials. Communications Products supplies

equipment to affiliated and non-affiliated communications companies, business

systems suppliers, railroads, governments, and retail and industrial companies.

Communications Products offers a large variety of telecommunications-related

products for sale. Certain of these products are inventoried including single and

multi-line telephone sets, wireless handsets, local area networks, switching

equipment modules, interior cable, pole line hardware, and various other

telecommunications supply items. Alltel has not encountered any material shortages

or delays in delivery of products from their suppliers.

Communications Products experiences substantial competition throughout its sales

territories from other distribution companies and from direct sales by manufacturers.

Competition is based primarily on quality, product availability, service, price, and

technical assistance. Since other competitors offer similar products, Communications

Products also offers other services including expert technical assistance, maintaining

wide-ranging inventories in strategically located warehouses and counter-sales

showrooms to facilitate single supplier sourcing and ''just-in-time'' delivery,

maintaining a full range of product lines, and by providing staging, assembly and

other services. Alltel periodically evaluates its product and service offerings to meet

customer expectations and position Communications Products in the market as a

quality, customer-focused distributor.

Directory Publishing

Alltel Publishing Corporation (''Alltel Publishing'') coordinates advertising, sales,

printing, and distribution for 395 telephone directory contracts in 37 states. Alltel

Publishing now provides all directory publishing services, except printing. The services

provided by Alltel Publishing includes directory yellow page advertising sales, contract

management, production, billing, and marketing.

ECONOMIC OVERVIEW4

Alltel was a purely domestic company up until the Western Wireless acquisition in the

third quarter of 2005. Western Wireless has operations in the European (Austria and

Ireland) continent that Alltel plans on selling in upcoming year. So, when analyzing

the economic variables that will affect Alltel’s operations, it is only necessary to

examine the US economy.

4

StockVal

5

Economic Data

Starting at the highest level of economic data, GDP growth, we can see that the US

economy is growing at a rate of 5.4%, which boils out to about a 3.4% when adjusted

for inflation. Meanwhile the federal government budget deficit is just beginning to

improve. Fortunately, Alltel, who is serving only domestic customers, will not be

adversely affected as an emphasis on reducing imports and increasing exports will be

a high priority of policy makers. Alltel will also be more or less immune to imminent

fluctuations in the USD/other currency exchange rates once the Western Wireless

operations are sold. Alltel has entered into a forward contract to hedge the currency

risk of the sale.

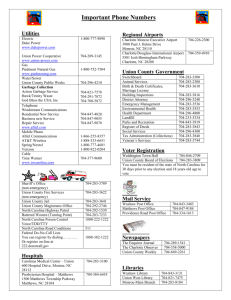

Figure 3: Macro-Economic Data

StockVal®

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

HI 12589.6

LO 7522.5

ME 9907.8

CU 12589.6

GR

5.4%

11500

10000

8500

12-31-1995

09-30-2005

7500

GROSS DOMESTIC PRODUCT ($BIL)

HI

LO

ME

CU

4

2

4.70

-1.10

2.40

-1.10

0

12-31-1995

09-30-2005

-2

PERSONAL SAVINGS RATE %

HI

LO

ME

CU

GR

0

-214

212.70

-456.20

-89.20

-285.60

-4.8%

-428

12-31-1995

06-30-2005

-643

FEDERAL GOVT BUDGET DEFICIT ($BIL)

HI

LO

ME

CU

GR

9000

8250

9405.8

6772.9

8503.8

9208.9

3.2%

7500

11-30-1995

09-30-2005

6750

PERSONAL INCOME:REAL,SAAR ($BIL)

Demographics5

I believe demographics are the most relevant data to consider when looking at macro

data related to growth in the Telecom sector. What may be a foreign technology to

the aging US population of 65 years and over which composes 12.4% of the population,

is a commodity to the rest of the population.

The cohort of the population ranging for 15-64 years in age comprises 67% of the

population, while the remaining 20.6% are 0-14 years in age. It is true that most of

the baby boomers have converted to wireless technology due to the ease of use and

exposure to the technology. The technologically savvy generation is just now

5

CIA: The World Factbook (November 2005)

6

reaching an age where they can afford the cutting edge telecom products for their

personal use. Lastly The youngest cohort of the population ranging from 0-14 years in

age will surely be a generation with a cell phone granted to them as soon as the can

say hello. This means stable to growing demand for Telecom in the coming years.

Another notable trend in the business is the targeting of the family unit. We can see

the rollout of the family share plans, a great idea to capture customers young and

old.

In addition, each and every person of varying socio-economic conditions is a potential

wireless customer due to the various product packaging ranging from long-term

contracts or pay as you go. In all, the young demographic momentum is going to

serve as a positive for the telecom sector.

INDUSTRY OVERVIEW

Nature of Telecom Industry

Alltel is part of the Telecommunications Industry which tends to be defensive in

nature. Telecom does not experience fluctuations in revenues and earnings during

particular seasons of the year. Although, it appears that Telecom is not counterdefensive in such a way that it rallies when the market is underperforming. It

appears that when the S&P underperforms, Telecom is right there with it. Refer to

the following graph depicting total returns for the Telecom sector (SP-50), the S&P

500 (SP5A), Verizon Wireless (VZ) and Alltel (AT). In the four year period depicted,

Alltel has outperformed both the sector and the S&P.

7

Figure 4: Five Year Total Return

6

Federal Communications Commission (FCC)

A governing body to be aware of when talking about the Telecom sector is the Federal

Communications Commission (FCC). The FCC is an independent United States

government agency, directly responsible to Congress. The FCC was established by the

Communications Act of 1934 and is charged with regulating interstate and

international communications by radio, television, wire, satellite and cable. The FCC's

jurisdiction covers the 50 states, the District of Columbia, and U.S. possessions. The

FCC will be mentioned at various times throughout this paper.7

Telecom Life Cycle Phase

It is becoming evident that different lines of business included in the Telecom sector

are in different phases of the industry life cycle.

For instance, the wireline and communication /directory publishing lines of businesses

are both in the late mature phases. Companies in the Telecom sector are spinning off

or selling these underperforming lines of business. The reason these lines of business

are underperforming is due to the decreasing demand for these products. According

to the FCC, there are now more wireless carriers than wireline carriers. Consumers

no longer see the need for having a traditional copper wire land-line phone when all

6

7

StockVal

FCC Official Website

8

of their communication needs are bundled in a wireless phone that can go anywhere

with them. These same customers are abandoning there Digital Subscriber Line (DSL)

which utilizes the same copper wire for their data access, for other broadband

alternatives like cable modem (bundled with their cable TV), wireless access, satellite

access, fiber to the home (high speed fiber optic cable providing all communication

and data services), and power line broadband (delivery of data communications over

the existing electric power distribution network). Competition among wireline

providers is fierce another indication that this line of business is no longer at a

growing stage.

On the other hand, the wireless line of business is still experiencing the growth phase

of the industry life cycle on the cusp of entering into a more mature stage. In the

sense that wireless has growth potential, new customers still exist for wireless

technologies. In the sense that wireless is becoming more mature, competition is

tough among wireless providers. This competition is evident from the price erosion of

wireless services. The competitors in the wireless business are now huge companies

capable of consolidating costs and providing lower prices to the consumers. The

trend of mergers and acquisitions in the Telecom industry is likely to continue as

wireless capabilities extend to the rural areas still utilizing land line phones.

On a similar note of M&A, another factor in the Telecom industry is cannibalization.

Mergers and acquisitions in the sector are the direct cause for cannibalization of

business. We can see large companies like Verizon Wireless and SBC with the highest

market capitalizations in the industry just recently participating in exactly this

activity. Verizon purchased MCI and SBC took over AT&T in deals that were finalized

and approved by the FCC in late November. We see large companies merging

together as well purchasing small companies no longer able to compete.

Cannibalization is present because the merging of companies is not an additive game.

There appears to be some overlapping of services, and therefore the acquisition of a

company does not equate to turning over all of their previous revenue. Evidence of

this is Telecoms shrinking sales volume and earnings; meanwhile all the major players

are reporting increases. Refer to the table below, where we can see a steady decline

of revenues and net income in the Telecom sector.

9

Figure 5: Income Statement of Telecom Sector8

Income Statement

S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

FYE Dec

StockVal ®

2004

% Chg

2003

% Chg

2002

% Chg

2001

% Chg

2000

Revenues ($ Mil)

37858.1

-4

39457.2

-3

Cost of Goods & Services

15811.1

-2

16097.6

2

40818.4

-3

42187.3

-2

43178.3

15857.0

-16

18801.1

Gross Profit

22593.7

-5

23881.7

-6

25431.0

4

24472.5

S G & A Expense

9817.3

-11

11007.1

2

10753.6

8

9994.4

1550.0

-18

1889.2

-10

2089.2

-1

2120.6

5

2014.4

1784.0

-54

3909.9

310

954.6

-69

3114.3

-65

9000.4

439.9

-65

1255.7

22

1029.4

-38

1658.1

-52

3482.3

Net Income Reported ($ Mil)

1844.7

-54

4019.3

2148.5

-60

5335.7

Net Income Adjusted

3076.7

-11

3441.2

3991.6

-31

5825.2

EPS Reported

0.83

-56

1.87

1.19

-52

2.46

EPS Adjusted

1.38

-13

1.59

-34

2.83

2234920

1

0.98

-3

R&D Expense

Interest Expense

Pre-Tax Income

Taxes

Shares Outstanding (Thou)

Dividends Common (Per Shr)

3903.8

-2

-3.24

-13

1.82

-2

1.86

2219071

0

2220575

0

2231286

2

2190218

1.01

13

0.90

1

0.89

-19

1.09

Dividends Preferred ($ Mil)

8

-7260.8

-12

StockVal

10

Figure 6: Income Statement Individual Companies of Telecom Sector9

Income Statement

StockVal ®

VERIZON COMMUNICATIONS CORP (VZ)

FYE Dec

2004

% Chg

2003

% Chg

2002

% Chg

2001

% Chg

2000

Revenues ($ Mil)

71283.0

6

67468.0

1

67056.0

1

66513.0

4

64093.0

Cost of Goods & Services

23168.0

7

21701.0

9

19866.0

Gross Profit

48115.0

5

45767.0

-3

47190.0

S G & A Expense

21088.0

-15

24894.0

14

21778.0

R&D Expense

Interest Expense

2384.0

-15

2797.0

-11

3130.0

-4

3276.0

-6

3490.0

10112.0

116

4673.0

-24

6130.0

124

2731.0

-85

17819.0

Taxes

2851.0

135

1213.0

-21

1539.0

-28

2147.0

-69

7009.0

Net Income Reported ($ Mil)

7831.0

155

3077.0

-25

4079.0

949

389.0

-97

11797.0

Net Income Adjusted

6981.0

-3

7234.0

-14

8379.0

-2

8547.0

1

8457.0

EPS Reported

2.79

151

1.11

-26

1.49

964

0.14

-97

4.31

EPS Adjusted

2.49

-5

2.62

-14

3.03

-3

3.13

1

3.09

SPRINT

NEXTEL (Thou)

CORPORATION (S)

Shares

Outstanding

2831000

2

2789000

0

2789000

2

2730000

0

1.54

0

1.54

0

1.54

0

1.54

0

2004

0.0

% Chg

2003

0.0

% Chg

Revenues ($ Mil)

27428.0

5

26197.0

-2

26679.0

4

25562.0

10

23166.0

Cost of Goods & Services

12656.0

9

11658.0

-3

12076.0

-6

12811.0

10

11620.0

Gross Profit

14772.0

2

14539.0

0

14603.0

15

12751.0

10

11546.0

S G & A Expense

6624.0

0

6608.0

-9

7228.0

-1

7272.0

6

6862.0

-2

1434.0

15

Pre-Tax Income

Income Statement

FYE Dec

Dividends Common (Per Shr)

Dividends Preferred ($ Mil)

2002

0.0

% Chg

2001

0.0 % Chg

StockVal ®

2737000

1.54

2000

0.0

*Meanwhile,

Alltel, Sprint,

Verizon,

Bellsouth,

and SBC

have reported

increases in

revenues.

R&D Expense

Interest Expense

Pre-Tax Income

1248.0

-11

1401.0

-1603.0

-218

-504.0

-591.0

-131

-256.0

-574

-38.0

1290.0

111

610.0

-1447.0

924.0

64

564.0

-118.0

2.16

59

1.36

1.45

7

1.36

27

1.07

-38

1.73

903200

1

893300

1

886800

-1

892400

0.50

0

0.50

0

0.50

0

0

7.0

0

7.0

0

Taxes

Net Income Reported ($ Mil)

Net Income Adjusted

-1012.0

1358.2

47

401.0

95

1244.0

26

989.0

-2350.0

-144

-963.0

-724.0

-213

-231.0

77

-520.0

93.0

EPS Reported

-0.71

EPS Adjusted

0.94

-35

1443400

60

0.50

0

7.0

0

7.0

2004

% Chg

2003

% Chg

2002

% Chg

2001

% Chg

2000

20300.0

0

20341.0

1

20207.0

-5

21211.0

-9

23245.0

7520.0

8

6991.0

5

6670.0

Gross Profit

12780.0

-4

13350.0

-1

13537.0

S G & A Expense

3816.0

1

3777.0

-3

3891.0

Shares Outstanding (Thou)

Dividends Common (Per Shr)

BELLSOUTH CORPORATION (BLS)

Dividends

FYE DecPreferred ($ Mil)

Revenues ($ Mil)

Cost of Goods & Services

Income Statement

-0.16

2.21

0.50

StockVal ®

7.0

R&D Expense

Interest Expense

916.0

-3

947.0

-11

1066.0

-19

1315.0

-1

1328.0

5186.0

-4

5424.0

1

5367.0

41

3814.0

-42

6598.0

Taxes

1792.0

-7

1936.0

2

1892.0

38

1367.0

-43

2378.0

Net Income Reported ($ Mil)

4758.0

22

3904.0

195

1323.0

-46

2447.0

-41

4118.0

Net Income Adjusted

3359.0

-7

3616.0

11

3251.0

-28

4517.0

7

4229.0

EPS Reported

2.59

23

2.11

197

0.71

-45

1.30

-40

2.18

EPS Adjusted

1.83

-6

1.95

13

1.73

-28

2.39

7

2.24

1836000

-1

1852000

-1

1876000

-1

1887000

0

1891000

1.06

15

0.92

16

0.79

4

0.76

0

0.76

Pre-Tax Income

Shares Outstanding (Thou)

Dividends Common (Per Shr)

Another

indication

that the overall Telecom sector is about to enter into a more

Dividends Preferred

($ Mil)

mature stage is the fact that their recent EPS and future EPS estimates are

decelerating. Refer to Figure 7.

9

StockVal

11

Figure 7: Prospective Growth and Margin of the Telecom Sector10

StockVal ®

Prospective Growth & Margin Check

M-Wtd (SP-50)

Price 25.032 11/25/05

Percent Change

Quarter

Revenue

REV

RPS

EARN

Actual

Year

Profit

EPS

Ago

Margin %

EPS

EPS

9,313.0

-3

-3

-33

-33

0.34

0.50

8.4

-1

-3

-39

Mar 04

8,875.4

-3

-5

-17

-19

0.33

0.41

8.9

0

-3

-20

Jun 04

9,087.4

-2

-2

-11

-12

0.36

0.41

9.3

0

-2

-13

Sep 04

9,206.3

-2

-2

-1

-1

0.37

0.38

9.4

0

-2

-1

+2

04

9,169.3

-2

-2

3

2

0.35

0.34

8.8

-1

-2

Mar 05

9,108.9

3

4

5

7

0.36

0.33

9.1

+1

+3

+6

Jun 05

9,255.9

2

2

12

12

0.41

0.36

10.3

+2

+2

+12

Sep 05

9,519.9

3

0

18

13

0.42

0.37

10.7

+1

+3

+13

T4Q

37,053.9

2

1

10

9

1.53

Dec 05 E

17

13

0.39

0.35

+12

Mar 06 E

23

18

0.42

0.36

+16

9.7

Jun 06 E

12

8

0.44

0.41

+8

Sep 06 E

9

9

0.46

0.42

+9

F4Q E

15

12

1.71

Point-to-Point Growth Rates (%)

Years

REV

RPS

2

1

EARN

1

Long-Term Growth Rate Estimates (%)

-1

Median Estimate

EPS

10

9

11

-4

-4

Figure 8: Telecom Sector Performance

-1

3

6.4%

Number of Estimates

10

Standard Deviation

4

-2

-2

-7

-7

5

S&P TELECOM

SERVICES

SECTOR

(S50)Default GRE Estimate

3.9%

470

2

2

10

PRICE 116.1

DATE 10-28-2005

3.9%

405

StockVal15®

-1

0

EPS Lagged 1-Year

20

300

3

2

3

2

3

3

3

2

Analyst GRE Estimate

350

Expected Report Date

300

260

260

225

225

195

195

170

170

145

145

125

125

110

110

95

95

80

80

70

60

1995

The Ohio State University

Fisher College of Business

1996

1997

1998

Price Change

%

Diff SP5

1-Day

1.83

0.18

1-Week

3.49

1.90

4-Weeks

-2.19

0.28

QTD

-2.19

0.28

YTD

-10.05

-8.94

2004

15.97

6.98

2003

3.28

-23.10

2002

-35.89

-12.52

FYE Dec 2004 EPS 3.49

1999

2000

First Call Data

Mean Estimate

Change

High

Low

Total

# Up

# Down

House Estimate

PE Ratio

2001

2002

2005

NE

NE

SECTOR VALUATION

11

REV

Dec 03

Dec

10

Momentum %

SF

StockVal

StockVal

12

2003

2006

NE

NE

2004

2007

NE

NE

2005

2006

70

60

2007

Data Page # 1

Revenues ($Mil)

Market Value ($Mil)

Shares Out (Mil)

Daily Volume (Thou)

Daily Volume ($Mil)

Dividend Estimate

Payout Ratio

Retention Rate

Dividend Yield

80

116

0

0.0

4.29

3.70%

Absolute Valuation

Figure 9: Absolute Valuation and Multiples of Telecom Sector12

S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) Price 23.6

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

StockVal®

2005

2006

HI

LO

ME

CU

25

20

29.4

11.8

17.4

13.7

15

10-27-1995

10-28-2005

10

PRICE / YEAR-FORWARD EARNINGS

HI

LO

ME

CU

8

6

9.0

3.1

5.8

4.2

4

10-27-1995

10-28-2005

2

PRICE / EBITDA

HI

LO

ME

CU

3

3.58

1.14

1.99

1.36

2

10-27-1995

10-28-2005

1

PRICE / SALES

HI

LO

ME

CU

12

9

12.4

3.9

7.5

5.0

6

10-27-1995

10-28-2005

3

PRICE / CASH FLOW ADJUSTED

According to the graphs above, the Telecom sector is trading below the mean in all

categories, an indication that the sector is undervalued. Investor confidence in the

performance of Telecom companies is lacking due to the less than great earnings of

most of the Telecom companies.

The Telecom Industry is flattening out in terms of pricing over the past three years,

yet another indication that while the Telecom is still experiencing growth, it is

entering into the mature stage. Penetration of the market is fairly high. It is no

longer a matter of who can get to the customers first, but, instead who can offer the

most comprehensive products at the lowest price. From performance standpoint,

those providers who are able to offer customers low prices with the highest level of

cost efficiencies are able to provide shareholders with positive returns, and thus drive

up the price of their stock. It just so happens that Alltel is a diamond in the rough

among the Telecommunications providers- doing just that. Most other companies

have invested huge amounts into capital projects that have yet to pay off, and in the

meantime are drowning in the cost.

12

StockVal

13

Relative Valuation to the S&P 500

Figure 10: Telecom Sector Valuation Relative to the S&P 50013

S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) Price 23.9 StockVal®

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

1.4

HI

LO

ME

CU

1.2

1.0

1.22

0.69

0.91

0.92

0.8

11-10-1995

11-11-2005

0.6

PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

1.4

HI

LO

ME

CU

1.0

0.8

1.40

0.41

0.76

0.55

0.6

11-10-1995

11-11-2005

0.4

PRICE / EBITDA RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

2.0

HI

LO

ME

CU

1.6

1.88

0.81

1.19

1.00

1.2

11-10-1995

11-11-2005

0.8

PRICE / SALES RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

2.0

HI

LO

ME

CU

1.6

1.2

1.85

0.42

0.82

0.66

0.8

11-10-1995

11-11-2005

0.4

PRICE / BOOK VALUE RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

The graph above examines the relative value of the Price/EPS estimates,

Price/EBITDA, Price/Sales, and Price/Book value of Telecom sector when compared to

the S&P 500 over the past ten years.

At a quick glance, we can see that the Telecom industry is selling significantly below

the mean in Price/EBITDA, Price/Sales, and Price/Book value. Meanwhile, the

Price/EPS estimate is right in line with the mean. This suggests that the Telecom

sector is relatively undervalued at the moment. This is more than likely due to

Telecom companies failing to meet Wall Streets expectations over the past few

quarters. It appears that it is a strategically inexpensive time to purchase Telecom

stocks. Using the current multiples and projected target multiples, the target price

of Telecom stock is $26.31, with a projected total return of 15.16%. Refer to Figure

11.

13

StockVal

14

Figure 11: Telecom Sector Target Price Calculation

Absolute

Valuation

Current

Multiple

Target

Multiple

Data

Target

Price

P/Forward E

13.7

14

1.72

24.08

P/EBITDA

4.2

5.5

5.62

30.91

P/Sales

1.36

1.4

17.35

24.29

P/CF

5

5.5

4.72

25.96

Mean

26.31

Current Sector Price- 23.60

Target Sector Price- (26.31/23.6)-1=11.4+3.76= 15.16% Total Return

POSITIVES

Growth potential

Growth potential is one if the most important things to consider when investing in

Alltel. Alltel’s penetration rate in the markets it served was only 13.8% in 2004

compared to 13.3% in 2003 and 12.9% in 200214. This leaves a huge margin for growth.

Also, it is important to consider that Alltel is taking part in talks about selling its

wireline division. As mentioned earlier, while the wireline division provides the

highest margin, it is a dying line of business as consumers lean toward a wireless

communication package. I see this as strategically smart move for Alltel. They have

collected the high margins for the past couple of years, and have used those proceeds

to buy Western Wireless, aligning them as one of the strongest wireless providers.

It is also worthy of mentioning that Alltel has invested a great deal into a marketing

campaign focusing on catering to the customer. “The new campaign includes

television, print, radio and outdoor advertising that will convey Alltel's commitment

to treat customers fairly and with respect”.

The campaign is threefold including three brand promises, which are all wireless

industry firsts. Essentially, no other wireless provider has offered their customers

these services.15

14

Alltel Corporation 10-K Report

15

1.) Automatic Minute Back - An automatic one-minute credit for any call dropped on

the Alltel network. This promise is a both a statement of confidence in the superior

quality of Alltel's network and a commitment to accountability.

2.) Anytime Plan Changes - The freedom to change rate plans at any time without

changing contracts. This promise means Alltel customers will be able to take

advantage of the best rate plan for their changing needs without penalty.

3.) Unlimited Calls Home - The ability to call home free from a wireless phone on

select plans. This promise emphasizes Alltel's commitment to families.

This campaign is targeting wireless customers. Alltel is strategically aligned to be at

the forefront of wireless services, and appears to have allocated their resources

appropriately.

Competitive Pressure-Pricing

With the consideration that Alltel is going to be a primarily a wireless provider in the

very near future, they will be able to offer rate plans and contracts at a lower price

than it’s competitors with a more complex mix of services. I assume that Alltel it

expecting a mix of higher volume and lower prices to drive growth in their revenues.

Acquisitions

The Telecom sector is one of continuous mergers and acquisitions, and Alltel is no

exception. It has been Alltel’s strategy to essentially buy more customers and

translate those new customers into revenue growth and margin. The following is a

brief overview of the purchases Alltel has made in the last five years:

Figure 12: Alltel Acquisitions since 200016

2000

Alltel acquires wireless properties in New Orleans and Baton Rouge

from SBC Communications Inc.

2002

Alltel acquires Verizon local access lines in Kentucky for $1.9 billion.

2003

2004

Alltel acquires 700,000 wireless customers from CenturyTel, Inc. in

Arkansas, Louisiana, Michigan, Mississippi, Texas and Wisconsin for

$1.5 billion.

Alltel purchases wireless properties in southern Mississippi from

Cellular XL.

Alltel acquires wireless assets from U.S. Cellular and TDS Telecom.

2005

Alltel announces acquisition of Western Wireless

Alltel acquires wireless assets from Cingular

Alltel acquires wireless properties from PSC

As previously stated Alltel recently purchased the rural carrier Western Wireless for

$4.5 b and sealed the deal in the third quarter 2005. Alltel has capitalized on these

16

Alltel Official Website

16

new wireless customers, and reported a 20% increase in revenues over last years third

quarter.

In a November 18th, 2005 news release, it was announced that Alltel reached a

definitive agreement to purchase Midwest Wireless for $1.075 billion in cash.

“Midwest Wireless is a leading regional wireless services provider with more than

400,000 customers in Minnesota, Iowa and Wisconsin.”17 It appears that this purchase

will strengthen Alltel’s presence in the region and provide growth in revenues with

the substantial addition of new customers.

The acquisition Alltel has made in the last several years enables them to report

growth in revenue and margin. It is apparent that acquiring customers by means of

purchasing them is there strategic focus as a way to grow their customer base. The

specifically target rural areas where the larger carriers are not as prevalent.

Technologies

Another repetitive buzzword in the telecom sector is technology. I do not intend to

explain the capabilities of all the new technologies in the market. However, it is

worth acknowledging that these products exist and that a demand exists. It is

apparent to see that demand exists because of the visible trend that Americans want

the latest and greatest when it comes to cell phone, data access, and accessories.

We seem to have an insatiable appetite for information and electronics.

For instance, new products being carried in Alltel stores in the last few months

include: BlackBerry 7250ê handheld device with Handango InHand software

applications, UTStarcom Pocket PC 6700, its first Windows Mobile device, DISH

Network TV, Samsung handsets with VibeTonzª touch sensation, picture and video

sharing through wireless phones, and the list goes on.18

Management

I think it is worth acknowledging Alltel’s management when relaying the company’s

success. Alltel has been a consistent performer in a consistently underperforming

sector; it’s not just luck, and it is not just me who noticed. For instance, Forbes

named Alltel the "Best Managed Company in Telecom" in January 2005. 19

As Alltel continues down the path of acquiring other carriers in an effort to grow

revenue and become the leading wireless carrier, it is safe assume that they are

executing due diligence in their purchases and aligning the additions to create

shareholder wealth.

17

Alltel Official Website

Alltel Official Website

19

Yahoo Finance

18

17

NEGATIVES

Verizon and SBC

It is true that while Alltel is aligned to be at the forefront of wireless providers, they

face competition from companies with a larger coverage areas and market

capitalization.

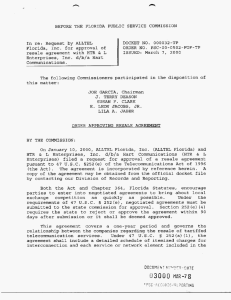

Figure 13: Top Five Leaders and Market Capitalization in the Telecom Sector20

COMPANY

MARKET CAPITALIZATION

VERIZON COMMUN [VZ]

$88.4 B

AT&T INC. [SBC]

$81.3 B

BELLSOUTH CP [BLS]

$50.5 B

ALLTEL CP [AT]

$25.8 B

B C E INC [BCE]

$23.1 B

As you can tell from the chart above, Verizon and SBC dwarf Alltel in market

capitalization. Alltel does not have the ability to move the market in the same way

Verizon and AT&T. They have to offer a competitive rate based off the rates of their

larger competitors.

Also, it is apparent that Verizon has a much larger coverage area than Alltel. Refer to

coverage maps below:

Figure 14: Alltel Wireless Coverage Map21

*Alltel

coverage

area

20

21

Yahoo Finance

Alltel Official Website

18

Figure 14: Verizon Wireless Coverage Map22

* Verizon

coverage

area

Alltel has little to no coverage in 12 states (Alltel serves more than 15 million

subscribers in 36 states). That is an obvious disadvantage when customers are looking

for flexibility in their coverage area, and trying to avoid roaming charges. Companies

like Verizon and SBC are able to offer their customers this all-inclusive advantage. I

expect that Alltel will continue to acquire small, rural companies much like Western

Wireless, as well as purchasing licenses and customers from the big players to fill this

gap.

Spin-off of Wireline

Alltel is reportedly near a deal to sell its wireline (local-line telephone) assets for as

much as $10 billion in stock. A group comprising Citizens Communications,

CenturyTel, and Valor Communications is in late-stage talks for the assets, the

Financial Times said. In an effort to focus on providing wireless services, the risk

involved in selling its wireline business is that Alltel would lose the high margins of

the wireline business. The proceeds of the sale would temporarily ward off any

financial problems. However, Alltel will need to be even more aggressive in acquiring

wireless companies with the capital they receive from the sale, and growing its

customer base.

22

Verizon Official Website

19

FINANCIALS23

Income Statement Analysis

Figure 15: Alltel’s Income Statement

Income Statement

StockVal ®

ALLTEL CORPORATION (AT)

FYE Dec

2004

% Chg

2003

% Chg

2002

% Chg

2001

% Chg

2000

Revenues ($ Mil)

8246.1

3

7979.9

12

7112.4

8

6615.8

5

6308.9

Cost of Goods & Services

3449.7

4

3317.1

13

2930.3

8

2707.7

Gross Profit

4796.4

3

4662.8

11

4182.1

7

3908.1

S G & A Expense

1524.2

2

1498.1

16

1297.0

8

1201.1

-12

1369.1

R&D Expense

Interest Expense

369.2

-6

393.8

6

371.0

32

281.6

-1

284.3

1592.0

4

1534.1

13

1360.3

-17

1631.0

-49

3208.0

565.3

-3

580.6

14

510.2

-22

653.0

-51

1325.3

Net Income Reported ($ Mil)

1046.2

-21

1330.1

44

924.3

-13

1067.0

-45

1928.8

Net Income Adjusted

1038.1

9

954.4

5

906.9

-1

913.3

31

699.1

EPS Reported

3.39

-20

4.25

44

2.96

-13

3.40

-44

6.08

EPS Adjusted

3.37

10

3.05

5

2.90

0

2.91

32

2.20

308400

-1

312800

0

312300

0

313500

-1

317200

1.49

5

1.42

4

1.37

3

1.33

3

1.29

0.1

0

0.1

0

0.1

0

0.1

0

0.1

Pre-Tax Income

Taxes

Shares Outstanding (Thou)

Dividends Common (Per Shr)

Dividends Preferred ($ Mil)

Alltel’s income statement, shown above, is a positive attribute of the company. Over

the past five years, Alltel has managed to report increases Revenue, Net Income

adjusted, and subsequently EPS. Refer to Figure 16 for the Trends in Revenue, and

Net Profit Margin. As you can see, they have delivered steady increases in revenue

with each year being a record one, along with on of the highest profit margins in the

sector. Note, this data does not include Alltel’s third quarter earnings release, which

reported an 18% increase in Net Income.

23

All Financial Data pulled from StockVal

20

Figure 16: Alltel’s Revenue and Net Profit Margin Trend

ALLTEL CORPORATION (AT) Price 67.4

ALLTEL

(AT) Price

67.4

1996 CORPORATION

1997

1998

1999

2000

2001

1996

7500

1.0

6300

0.8

5200

0.6

4300

0.4

1997

1998

1999

2000

2001

StockVal®

2002

2002

2003

2003

2004

2004

2005 StockVal

2006

2005

2006

HI

LO

HI

ME

LO

CU

ME

GR

CU

9045

4302

1.17

6194

0.58

9045

0.79

7.9%

0.92

12-31-1995

09-30-2005

12-31-1995

09-30-2005

REVENUES

RETURN ON EQUITY RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

HI

HI

LO

LO

ME

ME

CU

CU

18

1.2

15

0.9

12

0.6

®

RETURN ON EQUITY %

NET PROFIT MARGIN ADJUSTED RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

21.0

1.41

12.9

0.66

16.3

1.10

12.9

1.30

12-31-1995

12-31-1995

09-30-2005

09-30-2005

220.0

The main

drivers in Alltel’s earnings growth appear to be a combination ofHI

sales

230

HI

3.20

LO

-4.6

3

LO

0.38

CU 172.2

growth

appear

170 and a very modest repurchase of shares of stock. Operating expenses

ME

1.05

GR 10.5%

2

0.90

to increase

at a slightly lower rate than that of the sales growth. In orderCUto report

120

1

11-24-1995

disproportionately

higher increases in EPS (than net income), Alltel maintains

the

11-24-1995

11-25-2005

90

11-25-2005

0

same or slightly

few shares outstanding.

TOTAL RETURN %

GROWTH RATE ESTIMATE RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

HI

16.30

HI

2.35

4.70

While16

2005 is not shown in the chart above, it is no exception to the rule LO

of growth

in

1.8

LO 10.50

0.90

ME

ME

1.22

12

CU

5.70

revenues,

net income, and EPS. For the third quarter of 2005, Alltel reported

a

19%

1.4

CU

2.33

8

increase

in

Revenue

over

last

year.

A

good

deal

of

this

increase

can

be

attributed

to

1.0

11-24-1995

11-24-1995

11-25-2005

4

the Western

Wireless

acquisition.

11-25-2005

0.8

GROWTH RATE ESTIMATE

PRICE RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

Balance Sheet Analysis

Figure 17: Alltel’s Balance Sheet Ratios

Balance Sheet Ratios

StockVal ®

ALLTEL CORPORATION (AT)

FYE Dec

2004

2003

2002

2001

2000

1999

1998

1997

Cash Items/Total Capital (%)

3.89

5.22

1.11

0.90

0.69

0.22

1.22

0.28

Quick Ratio

0.96

1.04

0.64

1.03

0.88

0.79

0.72

0.74

Current Ratio

1.11

1.16

1.04

1.38

1.17

0.98

0.85

0.94

Net Working Capital ($000)

157

236

78

483

265

-27

-199

-63

Long-Term Debt/Equity (%)

75.08

79.48

102.46

69.38

90.51

89.20

101.17

126.09

Long-Term Debt / Capital (%)

42.88

44.28

50.61

40.96

47.51

47.15

50.29

55.77

Total Debt/Common Equity (%)

78.24

83.43

110.71

70.31

91.86

91.14

103.38

128.04

Total Debt/Capital (%)

44.69

46.48

54.68

41.51

48.21

48.16

51.26

56.46

Total Debt/Total Assets (%)

33.59

35.16

40.88

31.30

38.72

35.57

36.97

42.33

Days Inventory

16.59

13.44

17.25

22.08

Days Receivable

40.40

40.71

52.26

68.48

73.68

59.73

62.40

52.06

Days Payable

47.42

52.80

51.53

70.38

Asset Turnover

0.50

0.49

0.49

0.54

0.55

0.54

0.51

0.56

Plant & Equipment Turnover

1.09

1.05

0.99

0.99

1.03

1.02

1.01

1.18

21

Alltel’s Balance sheet ratios have a few key highlights. First, they appear to have cut

their days receivable in a substantial way. The industry average is at 46.69 days. In

the meantime, Alltel has maintained a stretched out payable schedule.

Other positive highlights of these ratios are Alltel’s high Quick and Current Ratios.

When compared to the industry, of .56 and .76 respectively, Alltel seems to have a

much healthier capital structure and liquidity.

Cash Flow Analysis

Figure 18: Alltel’s Cash Flow Analysis

Cash Flow Analysis

StockVal ®

ALLTEL CORPORATION (AT)

FYE Dec

Net Income Reported ($ Mil)

Accounting Adjustment

Net Income Adjusted

Depreciation & Amort

Cash Flow Adjusted

2004

% Chg

2003

% Chg

2002

% Chg

2001

% Chg

1046.2

-21

-8.1

98

1038.1

9

954.4

1299.7

4

1247.7

2337.8

6

2202.1

2000

1330.1

44

924.3

-13

1067.0

-45

1928.8

-375.7

-2056

-17.4

89

-153.7

88

-1229.7

5

906.9

-1

913.3

31

699.1

14

1095.5

1

1082.0

9

988.4

10

2002.4

0

1995.3

18

1687.5

Capital Expenditures

1157.7

-3

1194.4

-2

1213.2

-3

1250.6

7

1164.7

Free Cash Flow Adjusted

1180.1

17

1007.7

28

789.2

6

744.7

42

522.8

Dividends Common ($ Mil)

459.5

3

444.2

4

427.9

3

417.0

2

409.2

Free Cash Flow After Dividends

720.6

28

563.5

56

361.3

10

327.7

188

113.6

Net Cash From Operations

2466.8

0

2474.7

3

2392.2

27

1882.1

26

1496.3

Net Cash From Investing

-1258.4

1

-1265.9

72

-4494.6

-953

-427.0

66

-1264.3

Net Cash From Financing

-1381.2

-13

-1218.2

-183.4

Other Cash Flows

Change In Cash & Equiv

-1479.5

-707

-0.1

532.6

465

2079.5

94.3

91

49.3

4830

1.0

-172.9

523.2

633

71.4

187

24.9

-50

49.6

There are several positive items to examine in Alltel’s Cash Flow. First, Alltel has

generated an increasing free cash flow over the past five years. Second, Alltel’s Net

Cash from Operations, a measure of sustainable growth had steadily increased for four

years with a little stagnation in 2004. This can be explained by a somewhat flat

increase in net income due to restructuring charges, and a large gain on the

discontinued operations in 2003.

Alltel’s Net Cash from Investing and Financing are both consistent outflows, and this

enables Alltel to maintain its’ competitive position in the sector and maintain its

increases in revenues, and continue to pay its solid 2.28% dividend.

For instance, in Net Cash from Investing, Alltel consistently has an outflow in the

acquisition of property, plant, and equipment. This outflow comprises the bulk of the

outflow.

Alltel’s consistently negative flow of Net Cash from Financing is attributable their

consistent payment of a dividend to their shareholders, reduction in long-term debt,

and the repurchase of stock.

22

I am expected Alltel to report an overall 31% increase in Net Income in 2005 which

will translate into a substantial increase in Net Cash from Operations.

ROE Analysis

Figure19: Alltel’s ROE Ratios

DuPont Analytics

StockVal ®

ALLTEL CORPORATION (AT)

Price 63.430 11/11/05 FYE Dec

INT

MARGIN%

TAX

BURDEN

EBIT

EBT

-------

-------

Sales

ASSET

BURDEN%

EBIT

TURN

LEVERAGE

Assets

T

Sales

1 - ----

-------

-------

EBT

Assets

Equity

ROE

Acct

ROE

Rpt%

Adj%

Adj%

2004

23.78

0.81

64.49

0.50

2.35

14.79

-0.11

14.67

2003

24.16

0.80

62.15

0.49

2.53

20.43

-5.77

14.66

2002

24.34

0.79

62.49

0.49

2.49

15.99

-0.30

15.69

2001

28.91

0.85

59.96

0.54

2.31

20.02

-2.88

17.13

2000

55.36

0.92

58.69

0.55

2.46

41.48

-26.44

15.03

1999

25.34

0.83

58.94

0.54

2.67

20.00

-0.20

19.79

1994

19.42

0.66

59.95

0.58

1998 on Equity

24.66

0.80 a similar

54.34

0.38Statements:

18.42

Alltel’s Return

tells

story0.51to that2.90of its 18.05

Financial

1997

26.54

0.81

60.06

0.56

3.05

22.05

-3.71

success in an1996increasingly

competitive

sector.

ROE has

held

steady2.86around18.34

14.7% for

19.10

0.73

60.80

0.58

3.24

16.00

18.86

the past two1995years, 21.22

the industry

is 59.33

at 14% an0.59all time

0.69

3.60 low. 18.27

-0.98

17.30

17.30

While the levers

have

the0.52company appears to be operating with

1993

21.42changes

0.68 modestly,

53.80

1992

19.50

0.61

59.90

competent and

attentive

management.

While the margin lever has decreased in the

1991

19.71

0.53

62.58

increasingly1990

competitive

sector,

Alltel

has smoothed out its cash flows in a way that

19.70

0.53

65.06

taxes are less burdensome.

Consensus Estimates

Figure 20: Alltel’s Consensus Estimates

First Call Consensus Summary

StockVal ®

ALLTEL CORPORATION (AT)

Price 63.430 11/11/05 FYE Dec

Quarterly Mean Estimates

Five-Year Growth Rate Forecast

Growth Rate Est Median

Q1

Q2

Q3

Q4

EPS

Dec

Mar

Jun

Sep

Number of Estimates

Mean

0.82

0.85

0.89

0.93

Standard Deviation

High

0.91

0.90

0.93

0.97

Low

0.75

0.79

0.86

0.89

23

6

6

6

Number of Est

5.70

12

3.10

Mean Estimate History

Revenues

FY1

FY2

FY3

DEC 05

DEC 06

DEC 07

Mean

2589.33

2522.35

2608.29

2650.04

Current

3.46

3.62

3.81

High

2656.00

2568.00

2658.00

2698.00

Last Week

3.46

3.62

3.81

Low

2546.00

2473.51

2584.72

2630.00

4 Weeks Ago

3.42

3.63

3.78

1.19

1.53

1.29

1.22

8 Weeks Ago

3.42

3.65

3.87

13

4

4

4

12 Weeks Ago

3.41

3.66

3.91

FY1

FY2

FY3

FY1

FY2

FY3

DEC 05

DEC 06

DEC 07

DEC 05

DEC 06

DEC 07

Mean

3.46

3.62

3.81

Last Week

0.00

0.00

0.00

High

3.56

3.80

4.16

4 Weeks Ago

1.17

-0.28

0.79

Low

3.37

3.44

3.45

8 Weeks Ago

1.17

-0.82

-1.55

Number of Est

24

24

10

12 Weeks Ago

1.47

-1.09

-2.56

Number Up

18

12

2

3

10

5

Mean

9501.01

10558.54

High

9810.00

11380.00

Low

9413.14

10255.50

0.88

3.24

19

19

Stand Dev %

Number of Est

Annual Mean Estimates

EPS

Number Down

Mean Estimate % Change From

Next Expected Report Date

Revenues

Stand Dev %

Number of Est

23

01/23/06

Alltel’s Consensus estimates changed in a substantial manner after their third quarter

earnings announcement on October 21st. They managed to beat EPS expectations by

twelve cents, and post a previously mentioned 20% increase in revenues over last

year.

Upward revisions were made to forecasted 05’ and 06’ revenues and EPS after the

earnings announcement. The revenue estimates above imply a 15% growth in 2005

and 12.5% growth in 2006. I am more or less in line with mean consensus revenue

estimates. However, in the model I created I have a slight downside in EPS for 2005

and 2006, and a substantial upside for 2007 (more will be said about the model

valuation at the end of the paper). As you can see by the consensus chart above,

there exists quite the parity between the mean and high estimates.

In regards to the median consensus growth rate estimate (GRE) of 5.7%, I feel more

optimistic. I think that achievable five year growth rate estimate is 6.5%. As you can

see there is a 3.1% standard deviation in the consensus GRE indicates that once again,

analysts have very differing opinions on Alltel. With the increasing market

penetration, Alltel is capable of growing their business at a higher rate than 5.7%.

STOCK VALUATION24

Absolute Valuation

Figure 21: Absolute Valuation and Multiples of Alltel

StockVal®

ALLTEL CORPORATION (AT) Price 67.4

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

HI

LO

ME

CU

32

24

37.3

12.1

18.7

18.7

16

11-24-1995

11-25-2005

8

PRICE / YEAR-FORWARD EARNINGS

HI

LO

ME

CU

12

9

12.7

3.4

5.9

6.6

6

11-24-1995

11-25-2005

3

PRICE / EBITDA

HI

LO

ME

CU

4

5.11

1.73

2.28

2.39

2

11-24-1995

11-25-2005

0

PRICE / SALES

HI

LO

ME

CU

6

4

7.0

1.7

3.3

1.9

2

11-24-1995

11-25-2005

0

PRICE / BOOK VALUE

24

All graphs pulled from StockVal

24

Based off of the Figure 21 above, it is apparent that Alltel is trading at above the

mean in all but one category, Price/Book. While a simple assumption would be that

Alltel’s stock is overvalued, I think there is more to the case. For instance, just two

weeks ago these ratios were below their 10 year mean when the stock was trading at

$63.40. Refer to Figure 22.

Figure 22: Absolute Valuation and Multiples of Alltel, 11/14/05

StockVal®

ALLTEL CORPORATION (AT) Price 63.4

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

HI

LO

ME

CU

32

24

37.3

12.1

18.8

17.8

16

11-10-1995

11-11-2005

8

PRICE / YEAR-FORWARD EARNINGS

HI

LO

ME

CU

12

9

12.7

3.4

5.9

6.2

6

11-10-1995

11-11-2005

3

PRICE / EBITDA

HI

LO

ME

CU

4

5.11

1.73

2.28

2.25

2

11-10-1995

11-11-2005

0

PRICE / SALES

HI

LO

ME

CU

6

4

7.0

1.7

3.3

1.8

2

11-10-1995

11-11-2005

0

PRICE / BOOK VALUE

I feel as though these multiples will continue to expand in the following years as Alltel

experiences record revenues, increasing efficiency, and profit margins. It appears

that other analysts feel the same way. One year forward Price/EPS a t18.57 and

Price/Sales at 2.86.25

25

Yahoo Finance, 11/28/05

25

Relative the Telecom Sector

Figure 23: Alltel Relative to the Telecom Sector

StockVal®

ALLTEL CORPORATION (AT) Price 67.4

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

HI

LO

ME

CU

1.5

1.2

1.54

0.77

1.03

1.19

0.9

0.6

PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

11-24-1995

11-25-2005

HI

LO

ME

CU

1.2

1.0

1.54

0.62

1.12

1.47

0.8

11-24-1995

11-25-2005

0.6

PRICE / EBITDA RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

HI

LO

ME

CU

1.5

1.69

0.95

1.23

1.50

1.2

11-24-1995

11-25-2005

0.9

PRICE / SALES RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

HI

LO

ME

CU

1.8

1.5

1.82

1.07

1.36

1.55

1.2

11-24-1995

11-25-2005

0.9

PRICE / CASH FLOW ADJUSTED RELATIVE TO S&P TELECOM SERV. SECTOR COMP ADJ (SP-50) M-Wtd

Relative the S&P 500

Figure 24: Alltel Relative to the S&P 500

StockVal®

ALLTEL CORPORATION (AT) Price 67.4

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

HI

LO

ME

CU

1.5

1.2

1.50

0.64

0.94

1.22

0.9

11-24-1995

11-25-2005

0.6

PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

HI

LO

ME

CU

1.0

0.8

1.30

0.41

0.76

0.86

0.6

11-24-1995

11-25-2005

0.4

PRICE / EBITDA RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

HI

LO

ME

CU

1.8

1.5

2.09

1.08

1.47

1.64

1.2

11-24-1995

11-25-2005

0.9

PRICE / SALES RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

HI

LO

ME

CU

1.2

0.9

1.22

0.55

0.74

0.76

0.6

11-24-1995

11-25-2005

0.3

PRICE / CASH FLOW ADJUSTED RELATIVE TO S&P 500 COMPOSITE ADJUSTED (SP5A) M-Wtd

Once again, these relative ratio multiples shown in Figures 23 and 24 make it appear

that Alltel is overpriced when compared to its mean reversion. However, I feel that

26

these margins will continue to expand as the market rewards Alltel for there

sustained revenue, and margin growth, thus driving up the price of the stock.

Figure 25 uses the current multiples and projected target multiples to calculate a

target price of Alltel’s stock. The projected return totals in a 15.09% using this

valuation technique. The target multiples I used are conservative, and are in line

with consensus estimates.

Figure 25: Alltel Target Price Calculation

Absolute

Valuation

Current

Target

Multiple

Estimates

Target

Price

18.7

19

3.59

68.21

Price/Sales

2.39

2.5

28.21

70.53

Price/Book

1.9

2.3

35.49

82.54

Price /EBITDA

6.6

8

10.22

81.60

Price /Cash Flow

8.7

10

7.75

Price /Forward E

MEAN

77.5

76.08

Current Price- 67.44

Target Price- (76.08/67.44)+ 2.28 DIV YIELD = 15.09% Projected Return

Model Valuation

Appendix A and B are the Model of Forecasted Financial data and Alltel’s Discounted

Cash Flow respectively. The results of the Discounted Cash Flow, whose inputs

include the forecasted results of the model are yet another valuation technique that

recommends purchasing Alltel’s stock. The general theme of the model is that the

estimates are conservative, and still promote a buy of Alltel.

To first explain my financial model, I will first point out the substantial revenue

growth I have mentioned several times throughout this document. As you can see,

Sales Revenue Growth is forecasted to be near 15% for 2005 year end. I have

projected another 12% increase in revenue for both 2006 and 2007. I am assuming

that Alltel will continue to capitalize on Western Wireless capabilities, continue

attracting new customers in their current coverage area with their customer focused

marketing campaign, as well as benefit from the 400,000 new customers from the

Midwest Wireless transaction. Revenue per customer is about $577.5626 per year, so

26

Alltel Corporation 10-K Report

27

those new customers translate into $231 million dollars in revenue per year

(represents 3% growth over 2004). Also, my 2005 and 2006 forecasted revenues are

directly in line with the conservative estimates on StockVal.

I forecasted operating expenses to match historical rates, a conservative estimate,

but, I believe Alltel will manage to continue to increase efficiency as the have proven

to do in so in recent quarters. Another notable piece of information in Alltel’s

Financial Statements, is that they have reported significant amounts in Other Net

Income, and Gain of the disposal of assets. This data is hard to forecast, so I

estimated a low number. I also forecasted that interest expense would increase

slightly. This is the reason Net Income from continuing operations in 2006 does not

increase at the same rate that revenue increases. This is due to the 400 million dollar

gain in those two categories.

The EPS estimates I have calculated are almost directly inline with conservative

consensus estimates.

I forecasted Inventory, Accounts Receivable and Accounts Payable to maintain the

same percentage of sales that the have had in the past.

All of the model inputs were put into the Discounted Cash Flow. Staring at Revenue, I

lowered my estimates for growth as the years extended out. I feel confident about

the 12% in 2006 and 2007, but Alltel will need to make another strategic purchase in

order to maintain that kind of revenue growth. I rounded out my 2011 growth to be

6.5% (an increase over the 5.7% consensus GRE).

I then chose a conservative operating margin to deliver Net Income, and used

historical depreciation rates, and a lofty capital expenditure rate (increasing at the

same rate of sales) to end at Free Cash Flow.

I used the traditional 10% discount rate and a slightly conservative 4% Terminal Free

Cash Flow rate to discount the sum of the cash flows.

My result was a $76.48 stock price. Combined with the price based off of the

multiples valuation technique, I arrive at a final stock price of $76.28

Technique

Model Valuation

Multiples Valuation

MEAN

Price

76.48

76.08

76.28

Projected Return: (76.28/67.44)-1=13.11+2.28= 15.39%

28

CONCLUSION

Based on my valuation results and analysis of the company, my final recommendation

is to buy Alltel’s stock.

The Pros Related to buying Alltel’s Stock:

1.) Alltel is the shining star of the Telecom Sector. It has outperformed both the

Sector and the S&P in the last five years.

2.) Alltel has a solid financial history including revenue and margin growth. Profit

margins are some of the best in the sector. Current, Coverage, and Leverage

Ratios are the best in the Sector.

3.) Conservative Models, Multiples, and Discounted Cash Flow all indicate that the

stock is undervalued in the current marketplace.

4.) Alltel has strategically aligned their company to focus on their Wireless line of

business, the only growing line of business in the sector.

5.) Unlike other large market capitalization telecom companies, Alltel is not buried in

the Capital Expenditures yet to pay off.

The Cons Related to buying Alltel’s stock

1.) The stock is the highest priced in the sector. While its valuation is solid, investors

may be weary of purchasing such an expensive Telecom stock.

2.) The spin off of the Wireline business while good in a strategy standpoint, will

eliminate diversity in their revenue and margin.

3.) Revenue is the largest growth driver for Alltel and record revenue projections

may not be achievable.

4.) Alltel is one of the smaller market cap telecom companies. They may experience

competitive pressures from the big players, translating to price erosion and softer

margins.

29

30

Appendix A: Alltel Model and Forecasted Data

ALLTEL MODEL

(millions)

FY

FY

FY

FY

FY

FY

FY

FY

2007E

2006E

2005E

2004

2003

2002

2001

2000

10,394

9,322