2003 - $1.97 2004 - $2.29 2005 – $2.19

advertisement

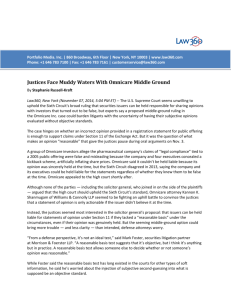

EPS 2003 - $1.97 2004 - $2.29 2005 – $2.19 EPS ESTIMATES 2006 – $3.01 2007 – $3.47 OMNICARE, INC. PROS TICKER: OCR DEMOGRAPHICS STOCK PRICE: $46.39 REVENUE GROWTH TARGET PRICE: $55.52 RECOMMENDATION: BUY CONSENSUS 2006 ESTIMATES HIGH - $2.98 AVG - $2.94 LOW - $2.90 CONSENSUS 2007 ESTIMATES HIGH – $3.80 AVG - $3.54 LOW - $3.35 OMNICARE INCORPORATED (OCR) 97 PRICE 46.37 DATE 08-11-2006 76 Stock Val ® 59 46 46 36 36 28 28 22 22 17 17 13 13 10 10 8 6 5 1996 8 The Ohio State University 6 Fisher College of Business 5 1997 1998 1999 Price Change % Diff SP5 1-Day -0.64 -0.24 1-Week -0.43 0.56 4-Weeks -1.13 -3.60 QTD -2.21 -1.94 YTD -18.96 -20.44 2005 65.28 62.28 2004 -14.29 -23.28 2003 69.49 43.11 FYE Dec 2005 EPS 2.47 2000 2001 First Call Data Mean Estimate Change High Low Total # Up # Down House Estimate PE Ratio 2002 2003 2006 2.94 ↓ +19% 2.98 2.90 13 0 13 15.8 2004 2005 2 0 0 7 2008 3 . 5 4↓ 4 . 2 2↓ + 2 0 % +19% 3.80 4.55 3.35 3.98 13 4 0 0 12 2 13.1 11.0 2006 2007 2008 Data Page # 1 Revenues ($Mil) 6,373 Market Value ($Mil) 5,626 Shares Out (Mil) 121.3 Volume 60-Day Avg (Th) 2,111 Volume 60-Day Avg ($M) 97.9 Dividend Estimate 0.09 Payout Ratio 3% RetentionRate 97% Dividend Yield 0.19% DEFENSIVE SECTOR INDUSTRY PERFORMANCE ASSET GROWTH STRATEGY CONS ANALYST STEVEN KENNEDY 614-354-6011 KENNEDY_366@OSU.EDU SG&A GROWTH FUND MANAGER ROYCE WEST, CFA LITIGATION CONCERNS COURSE FINANCE 824 ACQUISTION DIGESTION DATE 8/15/2006 EARNINGS MISSES GOVERNMENT EXPOSURE TABLE OF CONTENTS COMPANY OVERVIEW 3 ECONOMIC OVERVIEW 4 MARKET OUTLOOK 6 SECTOR ANALYSIS Sector Overview Sector Performance Sector Financial Analysis Sector Valuation 7 7 7 8 8 INDUSTRY ANALYSIS Industry Overview Industry Performance Industry Valuation 10 10 10 11 COMPANY ANALYSIS Financial Statement Analysis Earnings Projections 12 12 15 COMPANY VALUATION Ratio Analysis Price Forecast – Target Multiples Discounted Cash Flow Model 17 17 17 18 SUMMARY & RECOMMENDATION 19 APPENDIX A – Medicare Reimbursement: Recent Changes APPENDIX B – Medicaid Reimbursement: Recent Changes APPENDIX C – Statement of Cash Flows APPENDIX D – Projections APPENDIX E – OCR Ratios APPENDIX F – OCR vs. Health Care Services Industry Ratios APPENDIX G – OCR vs. Health Care Sector Ratios APPENDIX H – OCR vs. S&P 500 Ratios APPENDIX I – DCF Model 20 22 23 24 25 26 27 28 29 2 COMPANY OVERVIEW1 Omnicare, Inc. (the “Company”; “Omnicare”) is a geriatric pharmaceutical services company that provides pharmaceuticals and related ancillary pharmacy services to longterm healthcare institutions primarily in the United States and Canada. The firm was formed in 1981 and is headquartered in Covington, Kentucky. As of 12/31/2005, Omnicare employed 17,900 persons. Omnicare’s FY 2005 net sales totaled $5.3 billion, generating $226 million of net income (4.3% net operating margin). Omnicare operates in two segments: Pharmacy Services and Contract Research Organization Services (CRO Services). Pharmacy Services Pharmacy Services is Omnicare’s primary line of business, accounting for 97% of net sales in FY 2004 and 2005. Pharmacy Services purchases, repackages, and dispenses prescription and nonprescription pharmaceuticals. This segment also provides consultant pharmacist services, including evaluating patient drug therapy, monitoring the drug distribution system within the nursing facility, and assisting in compliance with state and federal regulations, as well as proprietary clinical and health management programs. In addition, Pharmacy Services segment offers ancillary services, such as administering medications and nutrition intravenously, and furnishing dialysis and respiratory services, medical supplies and clinical care planning, and financial software information systems. Further, this segment provides pharmaceutical case management services for retirees, employees, and dependents that have drug benefits under corporate-sponsored healthcare programs. Pharmacy Services segment’s long-term care facilities comprise approximately 1,452,000 beds in 47 states in the U.S., the District of Columbia, and Canada. CRO Services CRO Services segment provides product development and research services to client companies in the pharmaceutical, biotechnology, medical device, and diagnostics industries. This segment provides support services for the design of regulatory strategy and clinical development of pharmaceuticals by offering integrated clinical, quality assurance, data management, medical writing, and regulatory support for its client’s drug development programs. 1 http://finance.yahoo.com 3 ECONOMIC OVERVIEW Demographics - Elderly Population Omnicare’s business model is almost exclusively focused on the provision of pharmacy related services to individuals residing in long-term care facilities. Long-term care facilities are largely occupied by elderly individuals. For example, the average age of nursing home residents is 812, while the average age of assisted living residents is 80. 3 Thus, Omnicare’s current and future business prospects are heavily influenced by U.S. aging trends. The U.S. elderly population, broadly defined as persons 65 years or older, numbered 36.3 million in 2004, representing 12.4% of the U.S. population. By 2030, there is projected to be 71.5 million persons 65 years or older, 20% of the forecasted population. 4 This growth in the U.S.’s senior population is evidenced by the growth in nursing homes. In 1987, there were 14,050 nursing homes with a total of 1.48 million beds, compared to 16,840 nursing homes and 1.76 million beds in 1996. The number of nursing homes and the number of nursing home beds both increased nearly 20% during this period. However, growth in the elderly population has outpaced growth in the supply of nursing home beds. The supply of nursing home beds for people 75 years and over dropped 8% from 1987 to 1996, from 127 to 117 beds per 1,000 people this age. 5 Government Reimbursement Omnicare receives nearly half of its revenue from government payer sources. Specifically, in FY 2005, Omnicare’s payor mix (by revenue) consisted of 46% Medicaid and 1% Medicare. Therefore, Omnicare’s earnings and financial condition are highly correlated with changes in government reimbursement policies and procedures. Medicaid 6 Title XIX of the Social Security Act is a Federal/State entitlement program that pays for medical assistance for certain individuals and families with low incomes and resources. This program, known as Medicaid, became law in 1965 as a cooperative venture jointly funded by the Federal and State governments to assist States in furnishing medical assistance to eligible needy persons. Medicaid is the largest source of funding for medical and health-related services for America's poorest people. Medicare7 2 National Center for Health Statistics; www.theseniorsource.org National Center for Assisted Living; www.ncal.org 4 Administration on Aging; www.aoa.gov 5 Agency for Healthcare Research and Quality; www.meps.ahcpr.org 6 US Department of Health & Human Services: Centers for Medicare & Medicaid Services; www.cms.hhs.gov 7 US Department of Health & Human Services: Centers for Medicare & Medicaid Services; www.cms.hhs.gov 3 4 Medicare is a health insurance program for people age 65 or older, people under age 65 with certain disabilities, and people of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant). Medicare reimbursement is provided through Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and Prescription Drug Coverage. The majority of independent living facilities and assisted living facilities are ineligible to be licensed for Medicaid or Medicare reimbursement, and therefore, Omnicare mitigates its exposure to government reimbursement for clients operating in these sectors. However, government reimbursement through the Medicare and Medicaid programs provides funding for approximately 70% of residents in nursing facilities.8 Furthermore, the proportion of nursing homes certified by both Medicare and Medicaid (dually certified) rose from 28% in 1987 to 73% in 1996. 9 Omnicare has significant exposure to government reimbursement policies via its nursing clientele. Omnicare anticipates that some of its Medicaid exposure will be transferred to Medicare exposure as a result of the passage and implementation of Medicare Part D (Prescription Drug Program). While this will result in slightly decreased reliance on state reimbursement in favor of increased reliance on federal reimbursement, there is not predicted to be a significant net change to government payer exposure. See Appendix A and B for more information regarding recent changes to the Medicare and Medicaid reimbursement programs, and how those changes may impact Omnicare. 8 9 The Department of Housing & Urban Development; www.hud.gov Agency for Healthcare Research and Quality; www.meps.ahcpr.org 5 MARKET OUTLOOK10 The US Federal Reserve’s decision to hold short-term interest rates steady at its August meeting (following 17 consecutive rate increases since June 2004) provides more evidence of the difference in opinion among economists as to whether the economy is on the verge of slowing or picking up speed. The Dow Jones Industrial Average has remained volatile over the past 12 months, ranging from 10,100 to 11,700, and currently priced near 11,100. For the year so far, the Dow is up 3.5 percent and the S&P 500 is up 1.5 percent, while the Nasdaq is down 6.7 percent. Investors will continue to keep a sharp eye on inflation data, with Wall Street anxious for any indication of whether the Federal Reserve will remain paused at its September meeting or resume raising rates. Other factors likely to impact future stock market performance include geopolitical relations, oil prices, and the housing market. Geopolitical developments still have the potential to weigh on markets, as mounting fighting between Israel and Lebanon only adds to the insecurity of an already unstable Middle East region. Crude oil prices should continue to be a strong influence on stocks, especially with hurricane season in full swing. One area of the economy that most analysts agree is showing sure signs of slowing is the housing market. The forecast calls for July housing starts to slow to an annual pace of 1.805 million units from 1.850 million in June. July building permits are pegged at a slower pace of 1.840 million units, down from 1.869 million in June. 10 http://finance.yahoo.com 6 SECTOR ANALYSIS Sector Overview The health care sector accounts for approximately 12% of the S&P 500. The entire health care sector is made up of roughly 1,050 publicly traded companies. Health care companies are broadly broken down into two organization types: 1) Provide health care equipment and supplies, or health care related services 2) Research, development production, and marketing of pharmaceuticals and biotechnology. The health care sector can be broken down into eight industries, including: biotechnology, health care distributors, health care equipment, health care facilities, health care services, health care supplies, managed health care, and pharmaceuticals. Pharmaceutical companies make up nearly half of the sector (48%), followed by health care equipment (14%), managed health care (11%), and biotechnology firms (10%). 10% 4% 14% 48% 3% 5% 1% 1% 11% Biotechnology Health Care Equipment Health Care Services Health Care Techonology Managed Health Care 3% Health Care Distributors Health Care Facilities Health Care Supplies Life Sciences Tools & Services Pharmaceuticals The healthcare sector is defensive and growth oriented, performing independently of economic cycles. The sector is impacted by external factors including demographics, government regulation, and the product development cycle. Specifically, the demographic variables have favored the health care sector, as baby boomers age and approach retirement and the average life expectancy continues to lengthen. By 2010, individuals 50 and up will make up 40% of the US population, compared to accounting for 34% in 2000. Additionally, worldwide demographics boost the sector’s prospects, as the world’s population grows older and wealthier, increasing spending in on health care products. In the US alone, healthcare spending has continued to steadily rise, currently accounting for roughly 16% of GDP. Sector risks include earnings vulnerability due to liability lawsuits, patent expirations, and product development costs, which are rising faster than sales in recent years. Pharmaceutical development and manufacturing is expensive with little guarantee for success. The cost of drug development averages roughly $1.8 billion, and the ROI for large pharmaceutical companies is down from 9% in the late 1990’s to roughly 5% today. Pharmaceutical companies face long investment periods, which total anywhere from 2 to 12 years from discovery to market, as well as slim odds of introducing a blockbuster drug (only 1 in 10,000 compounds reach market). Additionally, patent expiration threatens ROI, as generic substitutions are poised to enter into the market. A Porter’s Five Forces analysis shows that the sector is relatively favorable for existing participants. Barriers to entry are high, supplier power is low, and substitutes are low. However, buyer power is neutral and competition is heavy. Sector Performance 7 The health care sector performed relatively well in 2005, with the sector up 6.03% for the year, compared with the S&P 500 index up only 3.00%. However, YTD 2006 has been disappointing, with the sector down 2.49%, nearly 2.00% off S&P 500 YTD performance, making it the third worst performing sector in 2006. However, the sector has rebounded in the third quarter, up 2.33%, easily outpacing the market’s bearish -2.36% quarterly returns. Sector Financial Analysis S&P HEALTH CARE SECTOR COMP ADJ (SP-35) Price 40.74 Stock Val The sector’s financial performance remains strong, although momentum has waned in recent years. After tremendous revenue growth during the 1990’s, growth has slowed every year from 2001 through 2005, reigning in ROE from 30% to 20%. However, the sector’s corporations have succeeded in retaining cash on their balance sheets while decreasing inventories and leaving debt levels steady. This has resulted in a jump in dividend yields from roughly 1.1% in the late 1990’s to 1.7% in 2006. Corporate balance sheets show strengthened capital structures, with LTD/Capitalization declining from near 28% in 1997 to below 22% in 2006, ensuring that the sector has the capacity to reinvest in product development when appropriate. ® 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 30 28 HI LO ME CU 26 24 22 28.9 20.2 23.4 20.2 09-30-1996 03-31-2006 20 RETURN ON EQUITY % 2.0 1.8 HI LO ME CU 1.6 1.4 1.9 0.9 1.4 1.7 1.2 1.0 07-19-1996 07-21-2006 0.8 DIVIDEND YIELD % 28 HI LO ME CU 26 24 27.3 21.5 25.5 21.5 22 12-31-1996 12-31-2005 20 LONG-TERM DEBT / CAPITAL % Sector Valuation The health care sector’s PE ratio has declined from roughly 20x in 2002 to 16x in 2006. While this trend was similar to other income statement related measures, like Price/Sales and Price/CF, Price/Book StockVal S&P HEALTH CARE SECTOR COMP ADJ (SP-35) Price 40.74 Value witnessed even more of a decrease as corporate balance sheets paid down debt and built equity. 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 HI LO ME CU 1.2 0.9 ® 2007 1.37 0.53 1.09 0.98 0.6 07-19-1996 07-21-2006 0.3 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO SP-5 E-Wtd The maturation of the health care sector is evidenced when compared relative to the market. Relative price measures illustrate that the health care sector has reached relative trading values similar to the overall S&P 500 index. This is in clear contrast to the higher relative valuations during the late 1990’s. Given that industry revenue and earnings per share continue to evidence steady gains HI LO ME CU 2.4 1.8 2.43 1.03 1.85 1.11 1.2 07-19-1996 07-21-2006 0.6 PRICE / SALES RELATIVE TO SP-5 E-Wtd HI LO ME CU 1.8 1.5 2.09 1.17 1.51 1.26 1.2 07-19-1996 07-21-2006 0.9 PRICE / CASH FLOW ADJUSTED RELATIVE TO SP-5 E-Wtd HI LO ME CU 2.5 2.0 2.69 1.07 1.90 1.15 1.5 07-19-1996 07-21-2006 1.0 PRICE / BOOK VALUE RELATIVE TO SP-5 E-Wtd 8 in 2006, 2006 relative valuations appear to be somewhat low. While the health care sector has performed relatively in line with the S&P 500 over the past couple years, 3rd quarter 2006 growth appears promising based on solid earnings fundamentals. Revenue and earnings per share continue to experience growth, and balance sheets have built equity. Based on solid fundamentals and a divided market outlook, the health care sector appears to be a solid defensive play that may be priced somewhat cheap. 9 INDUSTRY ANALYSIS Industry Overview11 The U.S. health care services market, the world's largest, is worth about $1.7 trillion, while the European market is worth about $700 billion. A problem, and an opportunity, is the rising demand for services. People are living longer and need more care. The rise and fall of long-term care centers in the U.S. is an example of the peril. Such firms as Kindred Healthcare, Sun Healthcare, and Beverly Enterprises, which once built and bought nursing homes and opened home care and other specialized care units, are now hurting. Taking care of patients requiring expensive drugs and other care drains budgets. Cutbacks prescribed in the 1997 Balanced Budget Act did not help: Starting in 1998, providers were reimbursed based on per-day cost caps, not on the total cost of care. However, the landscape for senior care services and prescription drug benefits is expected to improve in the U.S. with the initiation, in January 2006, of the Medicare Part D prescription drug program, a program which is a direct result of the Medicare Prescription Drug, Improvement and Modernization Act (MMA) of 2003. In most nations, though, the government controls health care, but many of those are also suffering as costs rise and demand exceeds capacity. The UK National Health Service has announced it will team with such private sector providers as BUPA to help clear crowded waiting rooms. Slashed budgets create a domino effect. The competition among health care supply distributors, including Alliance UniChem, McKesson, and Owens & Minor, has heated up as facilities look to cut their number of vendors and the costs of their supplies. These distributors are among the industry's leaders in adopting new technology to help cut costs. Technology may not be the industry's panacea. Loading patient and payor information, supply orders, and other administrative red tape onto computers organizes information and helps reduce costly errors, but many doctors are reluctant; after all, learning the system takes time -- time that could be spent providing care to patients. Technology solutions are also pricey and do not often fit into budgets. Industry Performance Health care services has been far and away the strongest performer among all health care sector industries over the past 12 months. Industry returns have totaled 16.2% over that period, compared with 12-mo sector returns down 1.2% and market returns up 2.3%. 11 http://finance.yahoo.com 10 Industry Valuation The below “Kendex” evaluates the strength of the industry relative to its health care sector peers. The “Kendex” equally weights five different valuation and fundamental metrics, gauging the overall strength of each industry. Health care services ranks 4th out of the sector’s eight primary industries. Biotechnology Health Care Distributors Health Care Equipment Health Care Facilities Health Care Services Health Care Supplies Managed Health Care Pharmaceuticals 12 Mo Performance Actual Rank -7.2% 6 9.6% 2 -7.9% 8 -7.5% 7 17.4% 1 -2.9% 5 7.7% 3 -1.8% 4 12 Mo Profit Margin Actual Rank 16.3% 1.2% 11.6% 3.8% 3.7% 8.0% 5.9% 16.3% 1 8 3 6 7 4 5 2 ROE Actual Rank 9.78% 8 12.46% 5 14.54% 3 12.40% 6 13.43% 4 10.71% 7 16.05% 2 19.32% 1 Debt to Equity Actual Rank 0.9 5.1 4.3 30.5 6.9 6.9 3.2 2.9 1 5 4 8 6 6 3 2 EPS Growth 5 Yr Actual Rank 19.16% 13.94% 15.72% 13.92% 17.26% 16.44% 15.53% 9.22% Final Total 1 6 4 7 2 3 5 8 Final Rank 17 26 22 34 20 25 18 17 1 7 5 8 4 6 3 1 Health care services is strengthened by valuation measures, including its 12-mo stock price performance (1st ) and 5 Yr EPS growth (2nd). However, fundamental measures, especially 12-mo profit margin (7th) and debt to equity (6th), negatively impact the industry’s ranking. With top tier fundamentals, pharmaceuticals and biotechnology are tops in the sector, while health care facilities clearly rounds out the bottom. 11 COMPANY ANALYSIS12 For Omnicare, the year 2005 was one of strong growth and development, owing largely to the success of its acquisition and integration model. During the year, the Company made three strategically important acquisitions that, together, increased the size of the Company by more than one-third and broadened its breadth of services and future growth platform. In addition, the Company successfully completed a major refinancing, undertook the integration of current year acquisitions, prepared the organization for the implementation of the Medicare Part D benefit, and continued to generate solid growth and enhancements in the cost structure of its core pharmacy business. On July 28, 2005, the Company completed the acquisition of NeighborCare, Inc. (“NeighborCare”), which represented the largest acquisition made in the Company’s history. This acquisition significantly expanded the Company’s presence in the long-term care pharmacy market and at the time of the acquisition, increased the number of beds served by Omnicare by approximately 27% and increased annualized revenues by approximately 36%. At the time of the acquisition, NeighborCare was an institutional pharmacy provider serving long-term care and skilled nursing facilities, specialty hospitals and assisted and independent living communities comprising approximately 295,000 beds in 34 states and the District of Columbia. NeighborCare also provided infusion therapy services, home medical equipment, respiratory therapy services, community-based retail pharmacies and group purchasing. The NeighborCare acquisition provides opportunities to achieve economies of scale and cost synergies. The Company has implemented an integration plan under which the processes have been put in place to achieve such savings in the purchasing of pharmaceuticals, the elimination of redundant functions and the consolidation of facilities in overlapping geographic territories. During August 2005, the Company completed the acquisitions of excelleRx, Inc. (“excelleRx”) and RxCrossroads, LLC (“RxCrossroads”). At the time of the acquisition, excelleRx provided pharmaceutical products and care services to approximately 400 hospice programs with approximately 48,000 patients in 46 states. At the time of the acquisition, RxCrossroads provided specialty distribution, product support and mail order pharmacy services for pharmaceutical manufacturers and biotechnology companies, generally for high-cost drugs used in the treatment of chronic disease states. Financial Statement Analysis The following financial statement analysis is based on audited statements for fiscal years ended December 31, 2001 – 2005. Income Statement Sales averaged 25% annual growth over the period reviewed, ranging from a high of 33% from 2002-2003 to a low of 18% from 2003-2004. However, increases in cost of sales slightly outpaced sales growth in all years, capping net operating margins at an 12 Omnicare 2005 Annual Report 12 average of 4.1%. Net income growth actually decreased each subsequent year, dropping from a 70% rise from 2001-2002, to a 4% drop from 2004-2005. Omnicare, Inc. - Income Statement Actual ($ Millions) Sales Reimbursable out-of-pockets Total net sales 2001 2002 2003 2004 2005 2,159 99% 2,606 99% 3,474 99% 4,101 100% 5,264 99% 24 1% 26 1% 25 1% 19 0% 28 1% 2,183 100% 2,632 100% 3,499 100% 4,120 100% 5,292 100% Cost of sales Reimbursed out-of-pocket expenses Total direct costs 1,580 24 1,604 72% 1,915 1% 26 73% 1,941 73% 2,577 1% 25 74% 2,602 74% 3,071 1% 19 74% 3,090 75% 3,965 0% 28 75% 3,993 75% 1% 75% Gross profit 579 27% 691 26% 897 26% 1,030 25% 1,299 25% SG&A Goodwill amortization Restructuring & other related charges Other expense Operating income 350 33 18 5 173 16% 2% 1% 0% 8% 411 23 257 16% 0% 1% 0% 10% 510 387 15% 0% 0% 0% 11% 588 442 14% 0% 0% 0% 11% 759 19 521 14% 0% 0% 0% 10% Investment income Interest expense Income before income taxes 3 (56) 120 0% -3% 5% 3 (57) 203 0% -2% 8% 4 (81) 310 0% -2% 9% 3 (70) 375 0% -2% 9% 6 (166) 361 0% -3% 7% 46 74 2% 3% 77 126 3% 5% 116 194 3% 6% 139 236 3% 6% 135 226 3% 4% Income taxes Net income Management attributes the 2005 decline in net income primarily to the Company’s asset growth strategy, which resulted in 18 acquisitions. Management is optimistic that it will realize benefits from the acquisitions in terms of economies of scale and cost synergies in coming years, more than offsetting any short-term opportunity cost. Balance Sheet Balance sheet growth has been significantly driven by acquisition activity. Omnicare has utilized balance sheet leverage to finance the purchase of several companies, boosting liabilities from 50% of total assets to 59%. Correspondingly, equity, as a percentage of total assets has decreased from 50% to 41%. However, nominal equity has jumped 156% since 2001, fueling earnings per share growth. 13 Omnicare, Inc. - Balance Sheet Actual ($ Millions) 2001 Assets 2002 2003 2004 2005 Current assets Cash & cash equivalents Restricted cash Deposits with drug wholesalers Accounts receivable (less allowances) Unbilled receivables Inventories Deferred income tax benefits Other current assets Total current assets 168 3 478 24 149 28 77 927 7% 0% 0% 21% 1% 7% 1% 3% 40% 138 3 523 25 190 19 103 1,001 6% 0% 0% 22% 1% 8% 1% 4% 41% 187 1 678 15 327 53 122 1,383 6% 0% 0% 20% 0% 10% 2% 4% 41% 84 44 839 14 331 95 143 1,550 2% 0% 1% 22% 0% 8% 2% 4% 40% 215 3 83 1,261 17 474 108 200 2,361 3% 0% 1% 18% 0% 7% 2% 3% 33% Noncurrent assets Properties & Equipment (less AD) Goodwill Identifiable intangible assets (less AD) Other noncurrent assets Total noncurrent assets 155 1,124 84 1,363 7% 49% 0% 4% 60% 140 1,189 97 1,426 6% 49% 0% 4% 59% 148 1,691 173 2,012 4% 50% 0% 5% 59% 142 2,003 68 136 2,349 4% 51% 2% 3% 60% 232 4,029 339 196 4,796 3% 56% 5% 3% 67% Total assets 2,290 100% 2,427 100% 3,899 100% 7,157 100% 3,395 100% Liabilities/Equity Current liabilities Accounts payable Accrued employee compensation Deferred revenue Current debt Other current liability and income taxes payable Total current liabilities 140 25 39 64 268 6% 1% 2% 0% 3% 12% 176 23 25 73 297 7% 1% 1% 0% 3% 12% 296 31 22 21 93 463 9% 1% 1% 1% 3% 14% 283 20 24 25 115 467 7% 1% 1% 1% 3% 12% 397 56 25 356 166 1,000 6% 1% 0% 5% 2% 14% Noncurrent liabilities Long-term debt 5.0% convertible sub debentures, due 2007 8.125% sr sub notes, due 2011 6.125% sr sub notes, net, due 2013 6.75% sr sub notes, due 2013 6.875% sr sub notes, due 2015 4.00% jr sub convertible debentures, due 2033 3.25% convertible sr debentures, due 2035 Deferred income tax liabilities Other noncurrent liabilities Total noncurrent liabilities 31 345 375 81 39 871 1% 15% 16% 0% 0% 0% 0% 0% 4% 2% 38% 345 375 84 52 856 0% 14% 15% 0% 0% 0% 0% 0% 3% 2% 35% 136 375 227 345 51 123 1,257 4% 0% 11% 7% 0% 0% 10% 0% 2% 4% 37% 282 375 233 345 138 133 1,506 7% 0% 10% 6% 0% 0% 9% 0% 4% 3% 39% 753 9 230 225 525 978 249 246 3,215 11% 0% 0% 3% 3% 7% 0% 14% 3% 3% 45% Total liabilities 1,139 50% 1,153 48% 1,720 51% 1,973 51% 4,215 59% Stockholders' equity Preferred stock Common stock Paid-in capital Retained earnings Treasury stock Deferred compensation Accumulated other comprehensive income Total stockholders' equity 95 723 381 (20) (24) (5) 1,150 0% 4% 32% 17% -1% -1% 0% 50% 95 737 499 (24) (29) (4) 1,274 0% 4% 30% 21% -1% -1% 0% 52% 105 986 684 (46) (50) (4) 1,675 0% 3% 29% 20% -1% -1% 0% 49% 107 1,039 911 (55) (66) (9) 1,927 0% 3% 27% 23% -1% -2% 0% 49% 123 1,861 1,128 (78) (77) (15) 2,942 Total liabilities and stockholders' equity 2,289 100% 2,427 100% 0% 2% 26% 16% -1% -1% 0% 41% 0% 100% 3,395 100% 3,899 100% 7,157 Omnicare’s total assets grew from $2.3B to $7.2B in only four years. Management was able to decrease AR as a percentage of total assets during this period, despite an average annual asset growth rate of 36%. Ratio Analysis Inventory management performance has declined, as inventory turns have slowed by 23% since 2001. Additionally, working capital has suffered as management has tried to 14 absorb and integrate newly acquired businesses as efficiently as possible. Collections slowed by 19% since 2003, only partially offset by a corresponding slowdown in payables, slowing by 15% since 2003. Omnicare, Inc. - Ratios Items 2001 2002 2003 2004 2005 Current Ratio Total current assets Total current liabilities Current Ratio 927 268 3.5 1,001 297 3.4 1,383 463 3.0 1,550 467 3.3 2,361 1,000 2.4 Inventory Turnover Sales Inventories Inventory Turnover Ratio 2,159 149 14.5 2,606 190 13.7 3,474 327 10.6 4,101 331 12.4 5,264 474 11.1 Payables Turnover Cost of sales Accounts payable Payables Turnover Ratio 1,580 140 11.3 1,915 176 10.9 2,577 296 8.7 3,071 283 10.9 3,965 397 10.0 Receivables Turnover Sales Accounts receivable (less allowances) Receivables Turnover Ratio 2,159 478 4.5 2,606 523 5.0 3,474 678 5.1 4,101 839 4.9 5,264 1,261 4.2 Statement of Cash Flows Net cash flows from financing and investing activities increased by about 6x in 2005, reflecting Omnicare’s embrace of its heightened acquisition growth strategy. However, cash flow concerns are somewhat mitigated given the Company’s relatively stable operating margins, which have consistently averaged nearly 10% per year over the past five years. See Appendix C for Statement of Cash Flows. Earnings Projections An earnings model was developed for Omnicare based on historical operations (see Appendix D). FY 2006 projected earnings totaled $3.01, while FY 2007 projections yielded $3.47. Omnicare, Inc. - Project Earnings ($) 2007E 2006E 2005 Projected 3.47 3.01 2.19 Analysts - Avg 3.54 2.94 Analysts - Low 3.35 2.90 Analysts - High 3.80 2.98 15 As evidenced above, FY 2006 projected earnings are $0.07 greater than average analyst expectations. However, FY 2007 projected earnings are $0.07 below average analyst expectations. Sales growth estimates were conservative on a historical basis. Specifically, sales growth was estimated at 15% per annum during 2006 and 2007, significantly below Omnicare’s 2001-2005 average of 25% (18% - 33% per annum range). However, earnings expectations were negatively impacted when Omnicare recently (August 9, 2006) announced it was revising its second-quarter earnings to include a charge of $22 million, or 18 cents per share. The company said the charge is related to an investigation by the Michigan attorney general into its Medicaid billing practices. The charge reduces second-quarter net income to $8.4 million, or 7 cents per share, from $30.4 million, or 25 cents per share. Omnicare has faced investigations from officials in several states for its practices. In mid-January, the Ohio Attorney General's office raided Omnicare's Dublin office, and seized information related to suspected Medicaid fraud. Two days later, a subpoena was issued regarding a Massachusetts investigation claiming that Omnicare substituted three generic drugs for prescribed brand-name medications. And on Jan. 26, a raid by the Michigan Attorney General's office took place at the company's billing center in Livonia, Michigan. The investigations also provoked a spate of lawsuits from shareholders. When it originally stated its second-quarter earnings, Omnicare included $64 million in charges to cover reserves for the inquiries and litigation. It also revised its first-quarter earnings in May, taking a $34.1 million charge. Cost of sales, accounting for between 72%-75% of total net sales, was calculated based on a 25.8% annual gross margin, the Company’s average historical gross margin from 2001-2005 (24.7% - 26.8% per annum range). SG&A growth was projected based on the historical SG&A to Sales average (15.1%), and the tax rate assumed totaled 37.6%, equal to the Company’s five-year historical average tax rate. In sum, given the above noted conservative revenue growth assumptions coupled with the historically-based expense growth assumptions, analysts appear to be applying a significant discount to future earnings. This likely reflects Omnicare’s recent earnings misses, prospects for continued litigation expenses, and a slowdown in the Company’s aggressive acquisition strategy. 16 COMPANY VALUATION13 Ratio Analysis A detailed ratio analysis was completed to determine if Omnicare was cheap or expensive versus its long-term and short-term historical averages. In addition, Omnicare valuation metrics were compared with the S&P 500, the health care sector, and the health care services industry over various time frames. Price / EPS Price / Sales Price / CF Price / Book Current 14.20 0.85 14.10 1.80 OCR Values 1-Yr 5-Yr 18.60 15.30 1.20 1.02 18.00 13.50 2.30 2.10 10-Yr 17.30 1.08 13.70 2.10 Indication Undervalued Undervalued In Line Undervalued Price / EPS Price / Sales Price / CF Price / Book Current 0.75 0.39 0.74 0.55 OCR to Industry 1-Yr 5-Yr 0.83 0.49 0.49 0.48 0.83 0.60 0.63 0.59 10-Yr 0.16 0.49 0.25 0.59 Indication In Line Undervalued In Line Undervalued Price / EPS Price / Sales Price / CF Price / Book Current 0.89 0.50 1.01 0.50 OCR to Sector 1-Yr 5-Yr 1.09 0.75 0.63 0.47 1.19 0.84 0.59 0.48 10-Yr 1.09 0.63 1.19 0.59 Indication In Line In Line In Line In Line Price / EPS Price / Sales Price / CF Price / Book Current 0.85 0.53 1.23 0.62 OCR to Market 1-Yr 5-Yr 1.17 0.81 0.73 0.70 1.49 1.06 0.74 0.71 10-Yr 0.84 0.70 1.04 0.70 Indication In Line Undervalued In Line Undervalued *Median Values used for 1-Yr, 5-Yr, & 10-Yr Overall, Omnicare appears to be undervalued, or cheap, relative to its historical averages. The Company is most significantly undervalued on a stand-alone historical basis, and somewhat undervalued on a relative basis to the industry and the market. However, Omnicare appears roughly in line with sector valuation. See respective valuation graphs in Appendix E, F, G, & H. Price Forecast – Target Multiples 13 The Company Valuation section was based off of Doug Harvey’s Schlumberger Limited Analyst Report; OSU Fisher College of Business; May 2005 17 Target multiples were estimated in order to produce price forecasts based on the above noted ratios. The table below presents current ratios and the historical averages, along with target multiples and price forecasts based on these targets. The average price based on the four target multiples is $52.22. Price / EPS Price / Sales Price / CF Price / Book Current 14.20 0.85 14.10 1.80 OCR Values 1-Yr 5-Yr 18.60 15.30 1.20 1.02 18.00 13.50 2.30 2.10 10-Yr 17.30 1.08 13.70 2.10 Target Multiple 14.8 0.9 13.8 2.0 Price Estimate 44.40 54.85 54.02 55.59 A sensitivity analysis was completed to quantify the change in Omnicare’s stock price based upon various PE ratios and EPS estimates. The price ranged from $35 - $56. EPS Estimate $2.90 $3.00 $3.10 Target Price / EPS Estimates Multiple 12 14 16 18 $34.80 $40.60 $46.40 $52.20 $36.00 $42.00 $48.00 $54.00 $37.20 $43.40 $49.60 $55.80 Discounted Cash Flow Model A discounted cash flow model was completed to quantify the intrinsic value of Omnicare’s share price given projected cash flows. See Appendix I for the Omnicare DCF model. The Company’s revenue growth rate declined from 15% to its 5% terminal FCF growth rate from 2006 to 2015. Both operating margin and tax rates remained constant over the time period, at 10.5% and 37.6%, respectively; both consistent with historical averages. Based on a terminal discount rate of 12%, Omnicare’s terminal value totaled $11.3 B, yielding a 10.5x PE, 10.4x EV/EBTDA, and 6.7% free cash yield. With an NPV of free cash flows totaling $2.8B and an NP V of terminal value totaling $2.9B, Omnicare’s projected equity value totaled over $5.7B. The value yielded an implied equity value per share of $55.52 on 103.2 MM shares. In sum, according to the DCF model, Omnicare’s current share price of $46.39 is undervalued, resulting in approximately 19.7% upside based on intrinsic valuation. 18 SUMMARY & RECOMMENDATION Omnicare’s business prospects are bolstered by aging demographics and impressive revenue growth. Additionally, the Company operates in a defensive sector and favorably valued industry, compelling given the uncertain future growth prospects of the economy as a whole. However, Omnicare is inherently threatened by heavy exposure to government reimbursement and regulation. Additionally, it is critical for management to curb continued litigation problems, as well as realize economies of scale and cost synergies born from the Company’s aggressive growth strategy. Relative valuation via target multiples reveals a target stock price of roughly $52. Similarly, intrinsic valuation via the discounted cash flow method calculates a stock price of approximately $56. Given Omnicare’s current price of $46.39, the final recommendation is to BUY Omnicare. 19 APPENIDX A - Medicare Reimbursement: Recent Changes14 The Balanced Budget Act of 1997 (BBA) sought to achieve a balanced federal budget by, among other things, changing the reimbursement policies applicable to various healthcare providers. In an important change for the Skilled Nursing Facility (SNF) industry, the BBA provided for the introduction in 1998 of the prospective payment system (“PPS”) for Medicare-eligible residents of SNFs. Prior to PPS, SNFs under Medicare received cost-based reimbursement. Under PPS, Medicare pays SNFs a fixed fee per patient per day based upon the acuity level of the resident, covering substantially all items and services furnished during a Medicare-covered stay, including pharmacy services. PPS resulted in a significant reduction in reimbursement to SNFs. This caused a weakness in Medicare census leading to a significant reduction of overall occupancy in the SNFs Omnicare served. This decline in occupancy and acuity levels adversely impacted Omnicare’s results beginning in 1999, as the Company experienced lower utilization of Omnicare services, coupled with PPS-related pricing pressures from Omnicare’s SNF customers. The BBA also imposed numerous other cost-saving measures affecting Medicare SNF services. In 1999 and 2000, Congress sought to restore some of the reductions in reimbursement resulting from PPS. This legislation improved the financial condition of SNFs and provided incentives to increase occupancy and Medicare admissions, particularly among the more acutely ill. While certain of the payment increases mandated by these laws expired October 1, 2002, one provision gave SNFs a temporary rate increase for certain high-acuity patients, including medically-complex patients with generally higher pharmacy costs, beginning April 1, 2000 and ending when the Centers for Medicare & Medicaid Services (“CMS”) implements a refined Resource Utilization Group (“RUG”) patient classification system that better accounts for medically-complex patients. For several years, CMS did not implement such refinements, thus continuing the additional rate increase for certain high-acuity patients through federal fiscal year 2005. On July 28, 2005 CMS issued, and on August 4, 2005 published in the Federal Register, its final SNF PPS rule for fiscal year 2006. Under the rule, CMS added nine patient classification categories to the PPS patient classification system, thus triggering the expiration of the high-acuity payments add-ons. However, CMS estimates that the rule will have a slightly positive financial impact on SNFs in fiscal year 2006 because the $1.02 billion reduction from the expiration of the add-on payments will be more than offset by a $510 million increase in the nursing case-mix weight for all of the RUG categories and a $530 million increase associated with various updates to the payment rates (including updates to the wage and market basket indexes), resulting in a $20 million overall increase in payments for fiscal year 2006. The new patient classification refinements became effective January 1, 2006, and the market basket increase became effective October 1, 2005. While the fiscal year 2006 SNF PPS rates will not decrease payments to SNFs, the loss of revenues associated with future changes in SNF payment rates could, in the future, have an adverse effect on the financial condition of Omnicare’s SNF clients which could, in turn, adversely affect the timing or level of their payments to the Company. In that regard, on February 8, 2006, the President signed into law the Deficit Reduction Act (DRA), which will reduce net Medicare and Medicaid spending by approximately $11 billion over five years. Among other things, the legislation reduces 14 Omnicare 2005 Annual Report 20 Medicare SNF bad debt payments by 30 percent for those individuals who are not dually eligible for Medicare and Medicaid. This provision is expected to reduce payments to SNFs by $100 million over 5 years (fiscal years 2006-2010). Congress may consider legislation in the future that would further restrict Medicare funding for SNFs. The MMA includes a major expansion of the Medicare prescription drug benefit under a new Medicare Part D, which became effective on January 1, 2006. Until the Part D benefit became effective, Medicare beneficiaries could receive assistance with their outpatient prescription drug costs through a prescription drug discount card program, which began in June 2004 and has provided enrollees access to negotiated discounted prices for prescription drugs. The drug discount card program ends May 15, 2006. Under the new Part D prescription drug benefit, Medicare beneficiaries may enroll in prescription drug plans offered by private entities (or in a “fallback” plan offered on behalf of the government through a contractor, to the extent private entities fail to offer a plan in a given area), which provide coverage for prescription drugs (collectively, “Part D Plans”). Part D Plans include both plans providing the drug benefit on a stand alone basis (“PDPs”), and Medicare Advantage plans providing drug coverage as a supplement to an existing medical benefit under that Medicare Advantage plan (an “MA-PD”), most commonly a health maintenance organization plan. The deadline for Part D enrollment for 2006 is generally May 15, 2006, although the new benefits became available January 1, 2006 and nursing home residents can enroll at any time. Medicare beneficiaries generally have to pay a premium to enroll in a Part D Plan, with the premium amount varying from plan to plan, although CMS provides various federal subsidies to Part D Plans to reduce the cost to beneficiaries. Medicare beneficiaries who are also entitled to benefits under a state Medicaid program (so-called “dual eligibles”), including the nursing home residents we serve whose drug costs were previously covered by state Medicaid programs, now have their outpatient prescription drug costs covered by the new Medicare drug benefit. (In 2005, approximately 46% of our revenue was derived from beneficiaries covered under state Medicaid programs.) CMS is providing premium and cost-sharing subsidies to Part D Plans with respect to dual eligible residents of nursing homes. Therefore, such dual eligibles are not required to pay a premium for enrollment in a Part D Plan, so long as the premium for the Part D Plan in which they are enrolled is at or below the premium subsidy, nor are they required to meet deductibles or pay co-payment amounts. Further, all dual eligibles who had not affirmatively enrolled in a Part D Plan as of December 31, 2005 were automatically enrolled into a PDP by CMS on a random basis from among those PDPs meeting CMS criteria for low-income premiums in the PDP region. As is the case for any nursing home beneficiary, such dual eligible beneficiaries residing in nursing homes may change Part D Plans at any time through the established Part D enrollment process. In sum, dual eligible residents of nursing homes are entitled to have their prescription drug costs covered by a Part D Plan, provided that the prescription drugs which they are taking are either on the Part D Plan’s formulary, or an exception to the plan’s formulary is granted. CMS has reviewed the formularies of Part D Plans and has required their formularies to include the types of drugs most commonly needed by Medicare beneficiaries and an exceptions process to provide coverage for medically necessary drugs. 21 APPENIDX B - Medicaid Reimbursement: Recent Changes 15 The Balanced Budget Act of 1997 (BBA) repealed the “Boren Am endment” federal payment standard for Medicaid payments to Medicaid nursing facilities (“NFs”) effective October 1, 1997, giving states greater latitude in setting payment rates for such facilities. Some states continue to face budget shortfalls, and most states are taking steps to implement cost controls within their Medicaid programs. The Deficit Reduction Act of 2006 (DRA) includes several changes to the Medicaid program designed to rein in program spending. Certain DRA provisions are expected to reduce Medicaid spending by an estimated $2.4 billion over 5 years. The law also gives states greater flexibility to expand access to home and community based services by allowing states to provide these services as an optional benefit without undergoing the waiver approval process, and includes a new demonstration to encourage states to provide long-term care services in a community setting to individuals who currently receive Medicaid services in nursing homes. Together, these provisions could increase state funding for home and community based services, while prompting states to cut funding for nursing facilities. 15 Omnicare 2005 Annual Report 22 APPENIDX C – Statement of Cash Flows Omnicare, Inc. - Statement of Cash Flows Actual ($ Millions) 2001 2002 2003 2004 2005 74 126 194 236 226 32 42 25 17 3 33 12 31 15 9 35 21 45 58 - 45 36 58 110 8 Operating activities Net income Adjustments to reconcile net income to cash flows from operating activities Depreciation Amortization Provision for doubtful accounts Deferred tax provision Non-cash portion of restructuring charges Write-off of debt issuance costs Changes in assets and liabilities, net of effects from acquistion of businesses Accounts receivable and unbilled receivables Inventories Deposits with drug wholesalers Current and noncurrent assets Accounts payable Accrued employee compensation Deferred revenue Income taxes payable Current and noncurrent liabilities Net cash flows from operating activities - - 38 15 45 44 4 (51) (13) 6 15 (2) 11 (8) 151 (42) (28) (37) 35 1 (14) 18 159 (97) (87) 9 36 1 (3) (7) (17) 175 (154) 13 (44) (29) (16) (18) 2 (8) 27 168 (163) (71) (4) (28) 37 (1) 1 (8) 18 264 Investing activities Acquisition of businesses, net of cash received Capital expenditures Transfer of cash to trusts for employee health and severance costs Other Net cash flows from investing activities (20) (26) (1) (47) (128) (25) (153) (663) (17) 2 (678) (399) (18) (417) (2,620) (24) (2) (2,646) 70 (475) 375 (3) (16) 8 (8) (49) 90 (120) 1 (8) (37) 749 (593) 595 (354) (25) (5) 179 12 (9) 549 835 (686) (1) (5) 10 (9) 144 3,560 (3,165) 1,769 (369) (52) 5 743 33 (10) 2,514 Financing activities Borrowings on line of credit facilities and term A loan Payment on line of credit facilities and term A loan Proceeds from long-term borrowings and obligations Payments on long-term borrowings and obligations Fees paid for financing arrangements Change in cash overdraft balance Proceeds from stock offering net of issuance costs Proceeds from stock awards and exercise of stock options and warrants Dividends paid Other Net cash flows from financing activities Effect of exchange rates on cash - 1 4 (1) (1) Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year 55 112 (30) 168 50 138 (106) 187 131 84 Cash and cash equivalents at end of year 167 138 188 81 215 23 APPENDIX D – Projections Income Statement (Mill$) Sales Reimbursable out-of-pockets Total net sales Omnicare, Inc. - Forecast FY FY FY 2007E 2006E 2005 6,962 6,054 5,264 24 24 28 6,986 6,078 5,292 FY 2004 4,101 19 4,120 FY 2003 3,474 25 3,499 FY 2002 2,606 26 2,632 FY 2001 2,159 24 2,183 Cost of sales Reimbursed out-of-pocket expenses Total direct costs 5,166 24 5,191 4,492 24 4,517 3,965 28 3,993 3,071 19 3,090 2,577 25 2,602 1,915 26 1,941 1,580 24 1,604 Gross Profit 1,795 1,561 1,299 1,030 897 691 579 SG&A Goodwill amortization Restructuring & other related charges Other expense Operating Income 1,050 12 733 913 12 636 759 19 521 588 442 510 387 411 23 257 350 33 18 5 173 8 (167) 574 7 (145) 498 6 (166) 361 3 (70) 375 4 (81) 310 3 (57) 203 3 (56) 120 216 358 187 311 135 226 139 236 116 194 77 126 46 74 Basic EPS Basic shares 3.47 103.2 3.01 103.2 2.19 103.2 2.29 103.1 1.97 98.5 1.34 94.0 0.80 92.5 Diluted EPS Diluted shares 3.33 107.6 2.89 107.6 2.10 107.6 2.17 108.8 1.89 102.6 1.33 94.7 0.79 93.7 Investment income Interest expense Income before income taxes Income taxes Net income 24 APPENDIX E – OCR Valuation StockVal® OMNICARE INCORPORATED (OCR) Price 46.37 1996 19961997 1997 19981998 1999 1999 2000 2000 2001 2001 2002 2002 2003 2003 2004 2004 2005 2005 2006 2006 200720072008 HI LO ME CU 36 24 44.2 7.8 17.3 14.2 12 08-09-1996 08-11-2006 0 PRICE / YEAR-FORWARD EARNINGS HI LO ME CU 4 4.21 0.36 1.08 0.85 2 08-09-1996 08-11-2006 0 PRICE / SALES HI LO ME CU 27 18 47.9 3.8 13.7 14.1 9 08-09-1996 08-11-2006 0 PRICE / CASH FLOW ADJUSTED HI LO ME CU 4 4.2 0.6 2.1 1.8 2 08-09-1996 08-11-2006 0 PRICE / BOOK VALUE 25 APPENDIX F – OCR vs. Industry Valuation StockVal® OMNICARE INCORPORATED (OCR) Price 46.37 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 HI LO ME CU 0.4 0.92 0.00 0.16 0.75 0.2 08-09-1996 08-11-2006 0.0 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO MEDICAL PRODUCTS/SUPPLIES (082A) E-Wtd HI LO ME CU 1.5 1.0 1.82 0.17 0.49 0.39 0.5 08-09-1996 08-11-2006 0.0 PRICE / SALES RELATIVE TO MEDICAL PRODUCTS/SUPPLIES (082A) E-Wtd HI LO ME CU 0.6 0.4 0.98 0.00 0.25 0.74 0.2 08-09-1996 08-11-2006 0.0 PRICE / CASH FLOW ADJUSTED RELATIVE TO MEDICAL PRODUCTS/SUPPLIES (082A) E-Wtd HI LO ME CU 0.9 0.6 1.17 0.17 0.59 0.55 0.3 08-09-1996 08-11-2006 0.0 PRICE / BOOK VALUE RELATIVE TO MEDICAL PRODUCTS/SUPPLIES (082A) E-Wtd 26 APPENDIX G – OCR vs. Sector Valuation StockVal® OMNICARE INCORPORATED (OCR) Price 46.37 1996 19961997 1997 19981998 1999 1999 2000 2000 2001 2001 2002 2002 2003 2003 2004 2004 2005 2005 2006 2006 200720072008 HI LO ME CU 1.5 1.0 1.95 0.27 0.75 0.89 0.5 0.0 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd 08-09-1996 08-11-2006 HI LO ME CU 1.5 1.0 1.66 0.10 0.47 0.50 0.5 08-09-1996 08-11-2006 0.0 PRICE / SALES RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd HI LO ME CU 2 2.60 0.15 0.78 1.01 1 08-09-1996 08-11-2006 0 PRICE / CASH FLOW ADJUSTED RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd HI LO ME CU 0.6 0.4 0.79 0.08 0.43 0.50 0.2 08-09-1996 08-11-2006 0.0 PRICE / BOOK VALUE RELATIVE TO S&P HEALTH CARE SECTOR COMP ADJ (SP-35) M-Wtd 27 APPENDIX H – OCR vs. Market Valuation StockVal® OMNICARE INCORPORATED (OCR) Price 46.37 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 HI LO ME CU 2 2.61 0.21 0.84 0.85 1 08-09-1996 08-11-2006 0 PRICE / YEAR-FORWARD EARNINGS RELATIVE TO SP-5 E-Wtd HI LO ME CU 3 2 3.54 0.19 0.70 0.53 1 08-09-1996 08-11-2006 0 PRICE / SALES RELATIVE TO SP-5 E-Wtd HI LO ME CU 2 4.64 0.24 1.04 1.23 1 08-09-1996 08-11-2006 0 PRICE / CASH FLOW ADJUSTED RELATIVE TO SP-5 E-Wtd HI LO ME CU 1.2 0.8 1.27 0.15 0.70 0.62 0.4 08-09-1996 08-11-2006 0.0 PRICE / BOOK VALUE RELATIVE TO SP-5 E-Wtd 28 APPENDIX I – DCF Model DCF Valuation 8/14/2006 Ticker: OCR Steve Kennedy Terminal Discount Rate = Terminal FCF Growth = 12.0% 5.0% Forecast 2008E 2009E 2010E 6,986 14.94% 7,510 7.50% 8,036 7.00% 8,558 6.50% 11,079 5.00% 636.1 10.47% 733.3 10.50% 788.3 10.50% 843.5 10.50% 898.3 10.50% 1,162.9 10.50% (160.0) -3.02% (138.2) -2.27% (159.0) -2.28% (170.9) -2.28% (182.8) -2.28% (194.7) -2.28% (252.1) -2.28% Taxes Tax Rate Equity Income, net % of sales 135.0 37.6% 0.0% 187.3 37.6% 0.0% 216.1 37.6% 0.0% 232.3 37.6% 0.0% 248.6 37.6% 0.0% 264.7 37.6% 0.0% 342.7 37.6% 0.0% Net Income % Growth 226.0 310.5 37% 358.2 15% 726.8 103% 777.7 7% 828.3 7% 1,072.2 5% Add Depreciation/Amort % of Sales % of Capex Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 81.0 1.53% 0.00% (451.0) -8.5% 24.0 0.45% 93.0 1.53% 0.00% (1.3) 0.0% 93.0 1.53% 106.9 1.53% 0.00% (200.9) -2.9% 106.9 1.53% 114.9 1.53% 0.00% (216.0) -2.9% 114.9 1.53% 123.0 1.53% 0.00% (231.1) -2.9% 123.0 1.53% 131.0 1.53% 0.00% (246.1) -2.9% 131.0 1.53% 169.6 1.53% 0.00% (318.6) -2.9% 169.6 1.53% Free Cash Flow YOY growth (168.0) 309.2 -284% 157.3 -49% 510.9 225% 546.6 7% 582.2 7% 753.7 5% Year 2005 2006E 2007E Revenue % Growth 5,292 6,078 14.85% Operating Income Operating Margin 521.0 9.85% Interest and Other- net Interest % of Sales NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield $2,827.6 $2,901.7 5,729.2 -2.93% Shares Outstanding 103.2 Current Price 46.39 Implied equity value/share 55.52 Upside/(Downside) to DCF 19.7% 49% 51% 2015E Terminal P/E EV/EBITDA Free Cash Yield Terminal Value 11,304.8 10.5 10.4 6.67% 29