Berkshire Hathaway Inc. NYSE: BRKA Recommendation: Buy Current Price: $123,970

advertisement

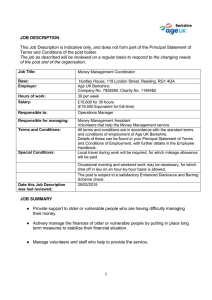

Berkshire Hathaway Inc. NYSE: BRKA Recommendation: Buy Current Price: $123,970 Target Price: $145,000 Analyst Information: Investment Thesis Berkshire Hathaway is a holding company headquartered in Omaha, Nebraska. Berkshire’s subsidiaries engage in various lines of business including property and casualty insurance and reinsurance, utilities and energy, finance, manufacturing, services, and retailing. Berkshire has consistently demonstrated an ability to generate exceptional returns on capital. In addition, the company has thrived in prior periods of economic turmoil and has created tremendous value for its shareholders as a result. Berkshire’s constant focus on prudent capital allocation and acquiring businesses that possess sustainable competitive advantages will allow the company to prosper for decades to come. When shares of this type of company are trading at a discount to intrinsic value, as Berkshire’s shares currently are, it is a tremendous opportunity for the long-term investor to purchase a stake in a company that will generate a consistent and reasonable return for decades to come. Berkshire Hathaway’s strengths include: • $35.6 billion in cash that will allow the company to capitalize on opportunities presented by the current economic climate. • Minimal leverage, a AAA credit rating, and consistent generation of sizeable free cash flow. • Zero “Buffett premium” built into the current price, and potentially even a “Buffett discount.” • The opportunity to capitalize on the eventual turnarounds of the financial and housing sectors without assuming the risks associated with pure-play companies in these sectors. Earnings Per Share In dollars per share $9,000 $8,548 $8,000 $7,144 $7,000 $6,000 $5,538 $5,309 $4,753 $4,000 $3,000 $2,795 $2,000 $1,000 $0 2002 2003 Contact: 614.599.6017 E-mail: Palmer.298@osu.edu Updated: May 26, 2008 Fund: OSU SIM (BUS FIN 824) Manager: Royce West, CFA Stock Information: Summary $5,000 Analyst: Nate Palmer Fisher College of Business The Ohio State University Columbus, Ohio 2004 2005 2006 2007 Sector: Industry: Financial Insurance Market Cap: $192.004 billion Shares Outstanding: 1.5 million 52 Week High: 52 Week Low: YTD Return: Beta: $151,650 $107,200 -12.45% 0.30 Table of Contents1 Investment Thesis……………………………………………………………………………………….…1 Summary…………………………………………………………………………………………………...1 Company Overview………………………………………………………………………………………..3 Macroeconomic Analysis and Outlook…………………………………………………………………....4 Financial Sector Analysis and Outlook……………………………………………………………………5 Financial Sector Valuation………………………………………………………………………………...6 Berkshire Relative to Financial Sector…………………………………………………………………….7 Berkshire Absolute Valuation……………………………………………………………………………..8 How Buffett Values Berkshire…………………………………………………………………………….8 Investment Portfolio……………………………………………………………………………………….9 Operating Businesses……………………………………………………………………………………..10 Comparative Analysis: Berkshire Relative to Conglomerates…………………………………………....12 Comparative Analysis: Berkshire Relative to Insurers………………………………………………...…13 Discounted Cash Flow Analysis………………………………………………………………………….14 Income Statement Projection……………………………………………………………………………..14 Discounted Cash Flow Model………………………………………………………………………….....14 Risks and Concerns……………………………………………………………………………………….15 Key Manager Risk .. …………………………………………………………………………….………..15 Insurance Industry……………………………………………………………………………...…………16 Derivatives………………………………………………………………………………………....…...…17 Conclusions………………………………………………………………………………………………..17 Appendix 1: Berkshire Hathaway Financial Statements from Company10-K…………………….……...19 Appendix 2: Berkshire Hathaway Income Statement Forecast and Discounted Cash Flow Model………22 1 Data in all absolute and relative valuation tables was provided by StockVal 2 Company Overview2 Headquartered in Omaha, Nebraska, Berkshire Hathaway Inc. is a holding company owning subsidiaries that engage in a number of diverse business activities including property and casualty insurance and reinsurance, utilities and energy, finance, manufacturing, services, and retailing. Included in the group of subsidiaries that underwrite property and casualty insurance and reinsurance is GEICO, one of the four largest auto insurers in the United States. This group also includes two of the largest reinsurers in the world, General Re and the Berkshire Hathaway Reinsurance Group. Other subsidiaries that underwrite property and casualty insurance include National Indemnity Company, Medical Protective Company, Applied Underwriters, U.S. Liability Insurance Company, Central States Indemnity Company, Kansas Bankers Surety, Cypress Insurance Company, BoatU.S., and several other subsidiaries referred to as the “Homestate Companies.” MidAmerican Energy Holdings Company (“MidAmerican”) is an international energy holding company owning a wide variety of operating companies engaged in the generation, transmission and distribution of energy. Among MidAmerican’s operating energy companies are Northern Electric, Yorkshire Electricity, MidAmerican Energy Company, Pacific Power, Rocky Mountain Power, Kern River Gas Transmission Company, and Northern Natural Gas. In addition, MidAmerican owns HomeServices of America, a real estate brokerage firm. Berkshire’s finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation and Clayton Homes), and transportation equipment and furniture leasing (XTRA and CORT). Shaw Industries is the world’s largest manufacturer of tufted broadloom carpet. McLane Company is a wholesale distributor of groceries and nonfood items to convenience stores, wholesale clubs, mass merchandisers, quick service restaurants and others. Numerous business activities are conducted through Berkshire’s other manufacturing, service, and retailing subsidiaries. Benjamin Moore is a formulator, manufacturer, and retailer of architectural and industrial coatings. Johns Manville is a leading manufacturer of insulation and building products. Acme Building Brands is a manufacturer of face brick and concrete masonry products. MiTek Inc. produces steel connector products and engineering software for the building components market. Fruit of the Loom, Russell, Vanity Fair, Garan, Fechheimer, H.H. Brown Shoe Group, and Justin Brands manufacture, license, and distribute apparel and footwear under a variety of brand names. FlightSafety International provides training to aircraft and ship operators. NetJets provides fractional ownership programs for general aviation aircrafts. Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture, and Jordan’s Furniture are retailers of home furnishings. Borsheims, Helzberg Diamond Shops, and Ben Bridge Jeweler are retailers of fine jewelry. 2 Adapted from Berkshire Hathaway 2007 10-K 3 In addition, other manufacturing, service and retail businesses include: Buffalo News, a publisher of a daily and Sunday newspaper; See’s Candies, a manufacturer and seller of boxed chocolates and other confectionery products; Scott Fetzer, a diversified manufacturer and distributor of commercial and industrial products, the principal products of which are sold under the Kirby and Campbell Hausfeld brand names; Albecca, a designer, manufacturer, and distributor of high-quality picture framing products; CTB International, a manufacturer of equipment for the livestock and agricultural industries; International Dairy Queen, a licensor and service provider to approximately 6,000 stores that offer prepared dairy treats and food; The Pampered Chef, the premier direct seller of kitchen tools in the U.S.; Forest River, a leading manufacturer of leisure vehicles in the U.S.; Business Wire, the leading global distributor of corporate news, multimedia, and regulatory filings; Iscar Metalworking Companies, an industry leader in the metal cutting tools business; TTI, Inc., a leading distributor of electronic components, and Richline Group, a leading jewelry manufacturer. Operating decisions for the various Berkshire businesses are made by managers of the business units. Investment decisions and all other capital allocation decisions are made for Berkshire and its subsidiaries by Warren E. Buffett, in consultation with Charles T. Munger. Mr. Buffett is Chairman and Mr. Munger is Vice Chairman of Berkshire’s Board of Directors. Macroeconomic Analysis and Outlook The macroeconomic outlook for 2008 has weakened significantly in the past 6 months as the effects of the global credit crunch and current housing crisis are being felt throughout the entire domestic and global economy. Although a recession seems eminent, consensus seems to be that the recession will be relatively short and shallow in nature. I disagree with the consensus and believe that the recession will be both longer and more severe than consensus estimates. Both George Soros and Warren Buffett, two of the greatest macroeconomic minds of their generation, are on record saying that they believe the recession will be longer and deeper than most people are currently forecasting. Soros has even called this “the worst economic crisis in 75 years.”3 I agree with these individuals that the collapse of housing prices in combination with the large-scale contraction in lending will prove detrimental to the overall economy in 2008. I currently forecast single digit negative GDP growth in 2008. Because this outlook is significantly below the consensus, if it materializes, there could be sizeable declines in stock prices as investors adjust their expectations. Macroeconomic Impact on Berkshire Hathaway Because Berkshire Hathaway’s operating businesses and investment portfolio are diversified over numerous industries and lines of business, the risk of a downturn in any single sector of the economy 3 Schurenberg, Eric. "Big-Picture Guy." Money June 2008: 114. 4 having a major impact on Berkshire is minimal. Due to its size and diversification, Berkshire is a defensive play for most investors. Nonetheless, Berkshire has significant exposure to both the financial and housing sectors. With 2007 earnings per share of $8,548, a 19.7% increase from 2006 EPS, it would seem that Berkshire was running on all cylinders. However, as detailed in the Company Overview above, the performance of several of Berkshire’s operating businesses is directly tied to the housing sector. Acme Brick Co., Clayton Homes, Jordan’s Furniture, RC Wiley Home Furnishings, Shaw Industries, and Star Furniture were all adversely affected in 2007 by the downturn in the housing sector. In addition, Berkshire’s investment portfolio was hurt by significant exposure to financials as well as slight exposure to the housing sector. The market value of investments in American Express, Moody’s Corporation, U.S. Bancorp, and Wells Fargo declined notably as a result of the current credit situation. In addition, the market value of Berkshire’s investment in USG, which manufactures and distributes building materials and gypsum wallboard, declined significantly due to the lack of new construction in the homebuilding industry. So although Berkshire posted strong earnings figures in 2007, this was despite the struggles of its businesses and investments related to the housing and financial sectors. When economic conditions improve, it is reasonable to assume that these businesses will be able to revert to normalized earnings, and Berkshire’s bottom line will benefit further. Thus, although its sector diversification prevented Berkshire from being as adversely affected by the current housing and credit situation as many of its competitors, the company will still realize substantial benefit from the eventual turnaround in the housing and financial sectors. Financial Sector Analysis and Outlook The financial sector is in the mature phase of the life cycle, but will continue to grow with the overall economy since financial institutions serve as the major source of capital for economic expansion. As the figure to the right4 illustrates, financials perform best late in bear markets and early in bull markets. Thus, there is significant upside in financials when the current economic downturn begins to subside, but in order to profit in the sector, investors may need to be patient. The financial sector was severely battered in 2007, and the carnage has continued thus far in 2008. While the sector as a whole has rebounded slightly from its trough earlier in 2008, significant pessimism remains. Although bargains do exist in 4 Stovall, Sam. The S&P Guide to Sector Investing. New York: McGraw Hill, 1995. 5 Financial Sector Returns the sector, it is also full of value traps. Recent capital infusions at Washington Mutual, National City, Wachovia, and others have illustrated how quickly shareholders can be diluted when financial institutions are desperate to raise capital. In addition, the near-collapse of Bear Stearns illustrated the inherent danger of highly leveraged financial institutions. YTD 2007 2006 2005 Return -16.05% -20.82% 17.02% 5.12% Difference Relative to S&P500 -9.76% -24.35% +3.41% +2.12% Further write-downs at many financial institutions may pose the risk of insolvency, which carries with it the potential that existing equity holders could be completely wiped out. Due to the risk of financials in the current economic environment, this sector as a whole is not for the short-term investor or overly risk averse investor. However, careful selection of financial institutions that were fearful while their peers were greedy and are now poised to be greedy while others are fearful, could produce significant returns for the long-term oriented investor. Nonetheless, investors in financials must realize that if economic conditions continue to worsen, things could get worse in the financial sector before they get better. Financial Sector Valuation Financial Sector Valuation - Absolute - 10 years Forward PE Trailing PE Price to EBITDA Price to Sales Price to Book Price to Cash Flow PEG Ratio Return on Equity High 24.40 21.60 4.50 29.50 3.40 14.20 1.40 19.20 Low 10.30 10.50 2.20 13.76 1.30 9.20 0.80 8.30 Mean 14.20 14.30 3.50 20.09 2.10 11.80 1.10 15.90 Current 13.20 15.90 2.50 18.92 1.30 12.60 1.20 8.30 Percent From Mean -7.0% 11.2% -28.6% -5.8% -38.1% 6.8% 9.1% -47.8% Financial Sector Valuation - Relative to S&P 500 - 10 years Percent From Mean High Low Mean Current Forward PE 1.35 0.52 0.71 0.91 28.2% Trailing PE 1.05 0.49 0.71 0.96 35.2% Price to EBITDA 0.64 0.38 0.51 0.40 -21.6% Price to Sales 19.07 6.67 11.64 14.58 25.3% Price to Book 0.77 0.48 0.69 0.50 -27.5% Price to Cash Flow 1.28 0.79 1.01 1.17 15.8% PEG Ratio 1.09 0.68 0.85 1.01 18.8% Return on Equity 1.11 0.52 0.93 0.52 -44.1% On an absolute basis, despite appearing to be fairly valued in comparison to the multiples at which the sector has traded over the past 10 years, financials may in fact be undervalued. Because the earnings of financial institutions are currently at cyclical lows due to the recent write-downs in the sector, 6 as earnings revert to the mean, the current multiples will likely appear cheap. The challenge for investors is determining how long it will take for earnings in the financial sector to revert to the mean. The three metrics that stand out in the absolute valuation are the price to EBITDA multiple, the price to book multiple, and return on equity. All three of these metrics are impacted by the recent write-downs that financial institutions have been forced to take. Because of the applicable accounting principles for financial institutions, EBITDA excludes write-downs at most of these institutions. Therefore, current price to EBITDA multiples are artificially low for institutions that have been burdened by major writedowns in recent quarters since EBITDA excludes these write-downs (and thus EBITDA is artificially high). The seemingly low price to book value multiple is also a function of write-downs in the financial sector. In anticipation of future write-downs, investors have discounted book value and are willing to pay a much lower multiple to stated book values because of the high probability that many financial institutions will be forced to take additional write-downs. Finally, the low return on equity is a direct result of write-downs as well. Write-downs have decimated net income for financial institutions, and therefore return on equity is unusually low. Over the long-term, it is reasonable to expect net income and return on equity to revert to the mean in the financial sector as economic conditions improve and these institutions are able to move past the effects of the sub-prime lending crisis. Because of the unusually low current net income figures at financial institutions as a result of write-downs, the financial sector will likely prove to be relatively cheap despite current multiples seeming to indicate that it is fairly valued. Relative to the S&P 500, financials appear to be expensive on the basis of price to forward and trailing earnings, but this is the result of write-downs as discussed previously. Because many of these write-downs are non-recurring items, financials again appear cheap on the basis of price to EBITDA. The price to book ratio also indicates that financials may be cheap, but this is largely the result of investor anticipation of future write-downs. Although the current turmoil in the financial sector makes it difficult to definitively determine whether the sector is cheap relative to the S&P 500, it is apparent that there is significantly more uncertainty in the financial sector than in the overall market. Investors will have to determine whether the discounts in the sector are sufficient compensation for bearing the additional risk associated with financials. Berkshire Relative to Financial Sector BRKA Relative to Financial Sector - 10 years Percent From Mean High Low Mean Current Forward PE 6.24 0.75 1.98 1.64 -17.2% Trailing PE 4.76 1.13 2.09 1.29 -38.3% Price to EBITDA 4.12 1.69 2.51 3.89 55.0% Price to Sales 0.47 0.05 0.13 0.09 -30.8% Price to Book 1.32 0.41 0.76 1.21 59.2% Price to Cash Flow 1.95 1.17 1.45 1.29 -11.0% PEG Ratio 99.90 1.05 1.45 1.17 -19.3% Return on Equity 0.95 0.11 0.38 0.95 150.0% 7 Although multiples in the financial sector are distorted by recent and anticipated future writedowns as addressed previously, Berkshire appears cheap relative to financials based upon several metrics. Forward earnings, trailing earnings, sales, cash flow, and the PEG ratio all indicate that Berkshire is cheap relative to the financial sector. However, Berkshire appears expensive relative to the sector on the basis of EBITDA and book value. Despite the lack of a consensus valuation for Berkshire relative to the financial sector, because a majority of the fundamental multiples indicate that it is cheap relative to the sector, it is reasonable to conclude that Berkshire is currently trading at a discount to its historical multiples relative to the financial sector. Berkshire Absolute Valuation Forward PE Trailing PE Price to EBITDA Price to Sales Price to Book Price to Cash Flow High 99.9 82.5 10.6 8.5 2.9 20.0 BRKA Fundamental Multiple-Based Valuation - 10 years Current Normalized Metric Per Multiple Share Low Mean Current 13.0 26.5 21.7 26 5,713 15.6 27.7 20.5 27 6,047 7.3 9.0 9.9 9 12,522 1.5 2.4 1.8 2.3 69,646 1.1 1.6 1.6 1.6 77,481 13.8 16.7 16.3 16.7 7,606 Implied Target Price $148,535.48 $163,277.56 $112,700.00 $160,185.96 $123,970.00 $127,012.21 Absolute valuation of Berkshire Hathaway produces a relatively wide range of target prices. While the forward PE ratio, trailing PE ratio, and the price to sales ratio indicate that Berkshire is significantly undervalued, the price to book and price to cash flow ratios indicate that it is fairly valued. Finally, the price to EBITDA ratio indicates that Berkshire is overvalued at its current price. Overall, it appears that Berkshire may be undervalued on an absolute basis, and at worst, it is fairly valued. The forward PE multiple, trailing PE multiple, and price to sales ratios all produce target prices that are above my target price of $145,000. However, since none of the historical multiple-based valuation methods provide a definitive valuation for Berkshire, it is necessary to examine other valuation methods to establish a framework within which the target price of $145,000 can be evaluated. How Buffett Values Berkshire Berkshire’s 1997 10-K provides the following guidance on valuation: “In our last two annual reports, we furnished you a table that Charlie and I believe is central to estimating Berkshire’s intrinsic value…In effect, the columns show what Berkshire would look like were it split into two parts, with one entity holding our investments and the other operating all of our businesses and bearing all corporate costs.” Berkshire’s investments per share and pre-tax earnings per share excluding all investment income are displayed to the right. Since 1993, Year 2007 Investments Per Share $90,343 8 Pre-Tax Earnings Per Share Excluding All Investment Income $4,093 applying a 13 multiple to the pre-tax earnings per share generated by the operating businesses and adding this figure to investments per share has provided a reliable approximation of Berkshire’s intrinsic value. This valuation method provides an intrinsic value of $143,552 per share based on figures provided in the 2007 10-K. This target price is 15.6% above the May 23, 2008 closing price, and is very close to my target price of $145,000. While this would seem to imply a reasonable margin of safety at the current market price, examination of Berkshire’s investment portfolio and its collection of operating businesses is necessary to affirm that this valuation method does provide a reasonable proxy for intrinsic value. Investment Portfolio Since 1964, Berkshire has constantly sought to build and grow an equity portfolio of publiclytraded businesses that possess “wide moats” and are selling at a discount to intrinsic value at the time of purchase. A business with a “wide moat” is one that possesses a sustainable competitive advantage that will endure both economic and societal changes. This competitive advantage allows these businesses to generate abnormally high returns on capital, and thus should consistently provide reasonable returns to Year 1965 1979 1993 2007 Investments per Share Over Time - 1965 - 2007 Compound Annual Gain in Per Share Investments Per Share Investments Years $4 $577 1965 - 1979 42.8% $13,961 1979 - 1993 25.6 $90,343 1993 - 2007 14.3% shareholders over the long-term if the shares can be purchased at a reasonable price. However, by purchasing shares in these businesses when they are selling at a discount to intrinsic value, Berkshire has been able to generate exceptionally high returns in its equity portfolio. Because emphasis is placed on the long-term sustainability of the business’ competitive advantage, Berkshire often intends to hold these shares forever, leading to Berkshire Hathaway Investment Portfolio - 12/31/2007 the mantra that the company’s “favorite time to sell is never.” The free cash flow provided by Berkshire’s operating businesses, coupled with the float provided by its insurance businesses, has served as a constant source of capital for new equity investments in the investment portfolio. The Shares 151,610,700 35,563,200 60,828,818 200,000,000 17,508,700 64,271,948 124,393,800 48,000,000 3,486,006 101,472,000 17,170,953 227,307,000 75,176,026 17,072,192 19,944,300 1,727,765 303,407,068 17,242,000 Percentage of Cost Company Owned (in millions) Company American Express Company 13.10% $1,287 Anheuser-Busch Companies, Inc. 4.80% $1,718 Burlington Northern Santa Fe 17.50% $4,731 The Coca-Cola Company 8.60% $1,299 Conoco Phillips 1.10% $1,039 Johnson & Johnson 2.20% $3,943 Kraft Foods Inc. 8.10% $4,152 Moody's Corporation 19.10% $499 POSCO 4.50% $572 The Procter & Gamble Company 3.30% $1,030 Sanofi-Aventis 1.30% $1,466 Tesco plc 2.90% $1,326 U.S. Bancorp 4.40% $2,417 USG Corp 17.20% $536 Wal-Mart Stores, Inc. 0.50% $942 The Washington Post Company 18.20% $11 Wells Fargo & Company 9.20% $6,677 White Mountains Insurance Group Ltd. 16.30% $369 Others $5,238 Total Common Stocks $39,252 9 Market Value as of 12/31/07 (in millions) $7,887 $1,861 $5,063 $12,274 $1,546 $4,287 $4,059 $1,714 $2,136 $7,450 $1,575 $2,156 $2,386 $611 $948 1,367 $9,160 $886 $7,633 $74,999 current market value of the common stock held in Berkshire’s investment portfolio is $74.999 billion. Although the size of Berkshire has limited the company’s investment universe to primarily other large-capitalization companies, Berkshire has consistently exhibited the ability to generate above-market returns in the portfolio. Over the period from 1993 to 2007, the portfolio grew at a rate of 14.3% per year, which surpassed the return of every major index over that period. So while Berkshire’s current size will almost certainly prevent it from ever repeating the 42.8% annualized growth of the investment portfolio that was generated from 1965 to 1979, it is not unreasonable to expect at least market returns from the portfolio, and recent history would seem to indicate that market outperformance is a very realistic expectation. The notion that Berkshire is too big to grow its investment portfolio at an abovemarket rate certainly has not held true over the past 15 years. At a minimum, the portfolio will almost assuredly generate steady returns over the long-term regardless of economic conditions. Operating Businesses As Berkshire has grown, so has the importance of its collection of operating businesses. While Berkshire’s size now prevents it from taking meaningful partial stakes in small-capitalization and most mid-capitalization companies, it can acquire entire small and mid-size businesses, in addition to large businesses. In acquiring entire Operating Businesses Over Time - 1965 - 2007 businesses, Berkshire seeks the same type of “moat” that it seeks in its investment portfolio. Although it is much more difficult to acquire an entire business at a Year 1965 1979 1993 2007 Per Share Pre-Tax Earnings $4 $18 $212 $4,093 Years Compound Annual Gain in Per Share Pre-Tax Earnings 1965 - 1979 1979 - 1993 1993 - 2007 11.1% 19.1% 23.5% deep-discount price than it is to acquire a portion of a business at this type of price, Berkshire has consistently demonstrated the ability to identify businesses that possess sustainable competitive advantages and has been able to acquire these businesses at a reasonable price. For many Berkshire subsidiaries, the sustainable competitive advantage amounts to a combination of a brand name that Distribution of 2007 Non-Insurance Earnings promises quality, coupled with a price that is the best for that level of quality. Other Services 14% Financial 15% McLane 3% Nebraska Furniture Mart serves as a prime example of how it and Financial Other Manufacturing 31% McLane MidAm erican Shaw Retail Retail 4% many other Berkshire 10 Shaw 6% MidAm erican 27% Other Manufacturing Other Services Berkshire Hathaway Operating Businesses subsidiaries are able to prosper in both favorable and unfavorable economic conditions. During favorable economic periods, their customer base has a sizeable amount of discretionary income and purchases luxury items and high-end electronics for their homes. Price is not as much of a concern for many customers during these periods, and high-end and high margin products are quite popular. During unfavorable economic periods, price becomes more of a concern, and customers are attracted to Nebraska Furniture Mart for the value lines of furniture carried in the store. In addition to the usual customer base, the stores thrive during economic downturns by attracting customers from other furniture and electronic chains that cannot compete with the prices offered on Nebraska Furniture Mart’s value lines. The ability to appeal to customers in all economic conditions allowed Nebraska Furniture Mart to have a record year in 2007 while many of its competitors struggled mightily. Management has indicated that both sales and margins have remained strong at the chain thus far in 2008. Prudent capital allocation among the operating businesses has served as another source of competitive advantage for Berkshire’s operating businesses. Each of the businesses retains cash needed to operate and expand the business, but excess capital is returned to Omaha to be strategically allocated by Buffett and Munger. This emphasis on putting excess capital to use in the most effective manner has been one significant factor in Berkshire’s ability to continue to generate high returns on capital despite its enormous size. A final source of competitive advantage for Berkshire with respect to its operating businesses is that Berkshire is the buyer of choice for certain privately held businesses. It is well documented that Berkshire does not become involved in bidding wars when acquiring an operating business because of the company’s focus on never overpaying. While this does limit the company’s universe of acquisition candidates, it also ensures that Berkshire only acquires operating businesses at what it judges to be a reasonable price. The culture of Berkshire makes it the ideal acquirer for many privately held or family owned businesses when the founder wants to ensure that his or her business thrives into the future. The seller has the 11 - Acme Brick Company - Applied Underwriters - Ben Bridge Jeweler - Benjamin Moore & Co. - Berkshire Hathaway Group - Berkshire Hathaway Homestates Companies - BoatU.S. - Borsheims Fine Jewelry - Buffalo NEWS, Buffalo NY - Business Wire - Central States Indemnity Co. - Clayton Homes - CORT Business Services - CTB Inc. - Fechheimer Brothers Co. - FlightSafety - Forest River - Fruit of the Loom - Garan Incorporated - Gateway Underwriters Agency - GEICO Auto Insurance - General Re - Helzberg Diamonds - H.H. Brown Shoe Group - HomeServices of America, a subsidiary of MidAmerican Energy Holdings Company - International Dairy Queen, Inc. - Iscar Metalworking Co. - Johns Manville - Jordan's Furniture - Justin Brands - Larson-Juhl - Marmon Holdings, Inc. - McLane Company - Medical Protective - MidAmerican Energy Holdings Co. - MiTek Inc. - National Indemnity Company - Nebraska Furniture Mart - NetJets - The Pampered Chef - Precision Steel Warehouse, Inc. - RC Willey Home Furnishings - Scott Fetzer Companies - See's Candies - Shaw Industries - Star Furniture - TTI, Inc. - United States Liability Insurance Group - Wesco Financial Corporation - XTRA Corporation option of selling his or her business to a private equity firm and may not recognize the business a few years later, or selling it to Berkshire and receiving assurance that it will still be essentially the same business decades into the future. Certain sellers are willing to give Berkshire a more reasonable price in exchange for the assurance that the business that an individual or family spent their lives creating will continue to run in its current capacity long into the future. This opportunity to purchase at reasonable prices entire privately held businesses that generate exceptional returns on capital will give Berkshire the opportunity to continue to grow its portfolio of operating businesses well into the future. Comparative Analysis: Berkshire Relative to Conglomerates Evaluating Berkshire relative to other conglomerates will serve as another piece of the framework within which Berkshire’s target price can be evaluated. The conglomerates chosen for comparison were Leucadia National Corp. (LUK), Markel Corp. (MKL), Otter Tail Corp. (OTTR), Alleghany Corp. (Y), and General Electric Co. (GE). Berkshire, Markel, and Alleghany all have significant exposure to the financial sector, and specifically, the insurance industry. General Electric has limited exposure to the financial sector through its Commercial Finance and GE Money segments. Leucadia and Otter Tail have very little exposure to the financial sector, but serve as useful comparisons since they are conglomerates like Berkshire. Forward PE Trailing PE Price to EBITDA Price to Sales Price to Book Price to Cash Flow PEG Ratio Return on Equity BRKA 21.7 20.5 9.9 1.8 1.6 16.3 1.4 7.9 BRKA Relative to Conglomerates OTTR LUK MKL 33.6 15.3 18.4 33.6 11.6 21.6 99.9 7.5 7.1 9.2 1.7 0.9 2.2 1.5 2.1 30.0 11.2 10.6 7.6 1.2 3.1 7.1 13.5 9.9 Y 14.9 14.9 6.2 2.2 1.1 14.0 3.5 8.0 GE 13.3 14.2 5.5 1.8 2.6 9.7 1.2 18.8 On the basis of earnings, Berkshire is near the expensive end of the group. Using this metric, it is cheaper than only Leucadia and is very similarly valued to Otter Tail. General Electric, Markel, and Alleghany all appear cheaper than Berkshire on the basis of earnings. However, when using the price to book value metric, which is often used when evaluating conglomerates, Berkshire appears to be among the cheaper conglomerates. While it is still more expensive than Alleghany, it is only slightly more expensive than Markel on the basis of price to book value. Using this metric, it appears cheaper than Otter Tail, Leucadia, and General Electric. It seems reasonable to conclude that Berkshire’s current price places it in the middle of the group of conglomerates with respect to valuation. The financial stability of Berkshire is unmatched by any of the other conglomerates, but aggressive investors may prefer a small 12 conglomerate such as Markel if they desire the potential for the types of return that Berkshire was able to generate in the 1970s and 1980s. These investors must realize however, that in choosing Markel over Berkshire, they would be trading a steady 10% to 15% return for significantly greater uncertainty. Given Berkshire’s financial stability and the predictability of its earnings over the long-term, Berkshire seems to be fairly valued relative to other conglomerates. Comparative Analysis: Berkshire Relative to Insurers Although Berkshire is a conglomerate, insurance premiums generated by its various insurance businesses accounted for 26.9% of Berkshire’s revenue in 2007. Because Berkshire has such large exposure to the insurance industry, evaluating its current valuation relative to major insurers will also be a valuable piece of the investment framework within which Berkshire’s target price can be evaluated. A diverse set of insurers was chosen since Berkshire has insurance businesses in each segment of the insurance industry. The insurers chosen for comparison were American International Group (AIG), Allstate Corp. (ALL), AXA (AXA), Allianz SE (AZ), ING Groep NV (ING), and Progressive Corp (PGR). Forward PE Trailing PE Price to EBITDA Price to Sales Price to Book Price to Cash Flow PEG Ratio Return on Equity BRKA 21.7 20.5 9.9 1.8 1.6 16.3 1.4 7.9 AIG 10.7 20.4 21.5 1.0 1.2 12.8 0.7 4.9 BRKA Relative to Insurers AXA ALL 8.7 8.3 8.4 11.4 5.3 6.4 0.8 0.5 1.4 1.2 7.2 11.4 1.1 1.4 16.2 10.1 AZ 7.4 18.4 3.6 0.6 1.2 14.3 1.8 6.7 ING 7.4 6.3 4.8 0.8 1.5 5.6 1.5 24.7 PGR 15.7 13.4 7.5 0.9 2.7 10.0 2.3 18.1 On the basis of earnings, Berkshire is the most expensive of the group of insurers. On the basis of price to book value, Berkshire is the second most expensive insurer, with only Progressive being more expensive. However, the PEG ratio places Berkshire in the middle of the pack of insurers, primarily due to Berkshire’s higher projected earnings growth in 2008. The primary reason for Berkshire being more expensive than its peers in the insurance industry is because of its exposure to industries outside of insurance. As is discussed in the subsequent Risks and Concerns section of the paper, the outlook for insurers in 2008 is quite unfavorable. Value Line describes the industry as “fiercely competitive”5 and notes that this competition will place pressure on insurance premiums, margins, and profits in 2008. Because Berkshire possesses unmatched financial stability in the insurance industry, is known for its underwriting standards, has not suffered major write-downs like many of its insurance peers, and has 5 Gendler, Ian. "Berkshire Hathaway." Value Line. 15 Apr. 2008 <www.valueline.com>. 13 exposure to numerous industries outside of insurance, it deserves to trade at a premium to its peers in the insurance industry. Discounted Cash Flow Analysis Income Statement Projection Appendix 2 contains the income statement forecast and discounted cash flow model for Berkshire Hathaway, yet another important piece of the framework within which Berkshire’s target price can be evaluated. An emphasis was placed on conservatism in choosing estimates for 2008, 2009, and 2010, and therefore, estimates were chosen that were conservative relative to their averages over the prior 5 years. Key assumptions are listed below: • Operating Revenue: Historic growth rates of individual business segments were used with an emphasis placed on risks to sustaining these levels of growth. • Insurance Losses & Loss Adjustment Expense: 19% was used for 2008, 2009, and 2010, which is higher than the actual rates in 2007, 2006, and 2005 (17.77%, 13.26%, and 18.26% respectively) to account for the possibility of large-scale natural disasters that would result in a significant increase in the number of claims. • Tax Rate: Assumed a 32.75% tax rate. • Minority Interest and Growth in Average Common Shares Outstanding: Projected based upon prior 5 years’ growth rates. • All other items were based on a percentage of revenue over the prior five years, with emphasis placed on the likelihood of sustainability of recent growth rates. These assumptions resulted in 2008 earnings per share of $7,525, relative to consensus of $6,851, 2009 earnings per share of $7,861, relative to consensus of $7,376, and 2010 earnings per share of $9,133, relative to consensus of $12,300. It is notable that only one analyst has projected 2010 earnings per share according to data provided by StockVal. Discounted Cash Flow Model Key Assumptions in the DCF model are listed below: • Terminal discount rate: 10% • Terminal free cash flow growth rate: 5% • Revenue growth: Faded to 5% by 2018 • Operating margin: Remained at 13.50% through 2018 • Tax Rate: Remained at 32.75% through 2018 • Depreciation/Amortization and Capital Expenditures: Faded to offset by 2015 14 Although the DCF Model generates a target price of $170,300, I believe that my target price of $145,000 is more reliable given the challenging economic conditions in which Berkshire will be operating. In addition, because of the “conglomerate discount,” the tendency for conglomerates to trade at a discount to the sum of the value of their parts, using a target price that is significantly below that generated by a DCF analysis is conservative and appropriate. Risks and Concerns Key Manager Risk The age of Buffett and Munger is a primary concern of many investors considering an investment in Berkshire Hathaway. Buffett is currently 77 years old and will turn 78 on August 30, 2008. Munger turned 84 on January 1, 2008. While both are in exceptional health by all accounts, it is apparent that they cannot run Berkshire forever. They have assured investors that a succession plan is in place and three top-notch individuals hand-picked by Buffett and Munger have indicated that they would be willing to move to Omaha and run Berkshire whenever they are given the opportunity. Buffett’s current position will be separated into two separate positions, Chief Executive Officer (CEO) and Chief Investment Officer (CIO), to ensure that Berkshire has a specialist in each capacity. While Buffett and Munger are undoubtedly irreplaceable, they have established a culture and mentality at Berkshire that will last for decades after they are gone. Buffett has always said that he likes to buy businesses that are “so good even an idiot can run them,” and to an extent, he has created such a business in Berkshire Hathaway. Even when Buffett and Munger are no longer at the helm, Berkshire’s operating businesses will continue to be run in a decentralized fashion as they are now. In addition, the investment portfolio of stocks that Berkshire intends to hold forever will continue to consistently generate solid returns for decades to come. The primary concern under new management will be allocation of new capital, which is no small concern given the enormous amount of cash that Berkshire generates each year, but just as the size of Berkshire prevents Buffett from producing the enormous returns of the 1960s and 1970s, the size would also make it difficult for even a series of poor capital allocation or investment decisions to have a significant impact on Berkshire. Given the current discount at which Berkshire is trading in the market, it seems apparent that there is zero “Buffett premium” built into the current price. In fact, if the ages of Buffett and Munger are partially responsible for the current discount, there may in fact be a “Buffett discount” built into the current price. The proposition of actually receiving a discount to have the greatest investment team ever manage an investment portfolio for the rest of their lives seems like quite a favorable scenario for the 15 investor. Nonetheless, many investors are concerned that Berkshire’s shares will decline significantly when Buffett or Munger passes away. Buffett has said on multiple occasions that he believes the deaths of he and Charlie will present a buying opportunity for long-term investors. In addition, the $35.6 billion of cash on Berkshire’s balance sheet as of March 31, 20086 serves as a sort of put option to a significant share price decline in the event of Buffett and/or Munger being unable to lead the company. If the stock declines as many investors expect it to when one or both of the managers pass away, Berkshire is likely to utilize some of its $35.6 billion in cash to repurchase shares at the bargain price, which would create significant long-term value for remaining shareholders. If Berkshire’s shares were to decline to a level that the board judged to be unreasonably cheap, the company could also use its AAA credit rating to borrow capital at a very low interest rate and repurchase shares at the sizeable discount from intrinsic value, again creating tremendous value for remaining shareholders. Insurance Industry The lack of major natural disasters over the past few years has made the insurance industry extremely competitive and has placed pressure on insurance premiums, margins, and profits. Because Berkshire is known for having very strict underwriting standards, it is possible that revenues and earnings generated by Berkshire’s insurance businesses could suffer in the short-term. However, Berkshire’s strategy of only writing policies if it can profit on the policy itself, in addition to the float, is a prudent long-term approach, and will prove beneficial to shareholders in the long run. Another inherent risk in the insurance industry is the potential for large-scale natural disasters that would be a significant drag on earnings in a given year. Because of Berkshire’s unmatched capital structure, it is not at risk of these sorts of claims having a significant long-term impact on the company. In fact, although natural disasters would be a short-term drag on Berkshire’s earnings, they would also decrease the competition in the insurance industry and would allow Berkshire to realize greater premiums, margins, and profits in subsequent years. Even if Berkshire’s insurance businesses do experience challenges in the next few years, the economics of the insurance industry are highly beneficial for a company with the capital structure of Berkshire. The float on insurance policies equates to interest-free capital for Berkshire’s management to strategically invest. When management is given capital at no cost, it has a very low bar that it must step over to create additional value for shareholders. Assuming that the insurance businesses are able to maintain their stringent underwriting policies, the float from insurance policies will serve as a constant source of value creation for Berkshire shareholders. 6 Berkshire Hathaway 1st Quarter 2008 10-Q 16 Derivatives Since reporting a $1.6 billion mark-to-market loss on derivatives in the 1st quarter of 2008, Berkshire has been criticized for investing in what Buffett has referred to as “financial weapons of mass destruction.” Although losses are never good, the $1.6 billion loss reported is merely a paper loss and is unlikely to ever become a true loss. The loss results from put options that Berkshire wrote on four stock indices, the S&P 500 and three foreign indices, in 2007. These put options were written at the money and are not exercisable until expiration, which is between 2019 and 2027. Berkshire received $4.5 billion in premiums for writing these options. Essentially, the company is predicting that come 2019 to 2027, stocks will either be higher than they were in 2007 or at the same level. If this turns out to be the case, Berkshire has made $4.5 billion on the put options despite the paper losses that occurred in the interim periods. Although certain investors may choose to view this transaction as risky because of the interim volatility, it seems like a pretty high probability event that stocks will at worst be flat over the next eleven to nineteen years. If they happen to decline over this period, Berkshire has $4.5 billion in premiums to cover any losses. Conclusions The combination of several factors makes Berkshire Hathaway an appealing investment candidate at its current price of $123,970. This price is 17% below my conservative target price of $145,000 per share and equates to a reasonable margin of safety for an investment in a company that possesses unmatched financial stability and sustainable competitive advantages that characterize its operating businesses and the businesses held in its investment portfolio. Several key aspects of my thesis are summarized below: • The $35.6 billion of cash on Berkshire’s balance sheet as of March 31, 2008 will give the company opportunities to strategically capitalize on the current market turmoil. During prior economic downturns, the company has been able to create significant value for shareholders, and it is not unreasonable to expect that management will be able to repeat this feat under current economic conditions. • The financial stability of Berkshire is unmatched. The cash on its balance sheet, coupled with the company’s minimal leverage, AAA credit rating, and consistent generation of sizeable free cash flow makes Berkshire the ideal defensive investment. • Berkshire is a low-risk investment that will allow investors to profit from the eventual turnarounds of the financial and housing sectors. It is unique to be able to benefit from these turnarounds without assuming the risks that are associated with pure-play financial and homebuilding stocks in the current economic environment. 17 • At its current price, Berkshire has reasonable upside potential with minimal risk of permanent loss of capital for the long-term investor. Berkshire is a very low risk proposition for the longterm investor, and when you don’t lose money, all of the other outcomes are good. The opportunity to purchase Berkshire at a 17% discount to conservative intrinsic value provides a reasonable margin of safety for an investment in a company of the caliber and stability of Berkshire. • There is zero “Buffett premium” built into the current price and there may in fact be a “Buffett discount” due the ages of Buffett and Munger. The proposition of actually receiving a discount to have the greatest investment team ever manage an investment portfolio for the rest of their lives seems like quite a favorable scenario for the investor. • Berkshire is a difficult company to value, which is often advantageous for the sophisticated investor who is willing to work through multiple valuation techniques to establish a framework within which a target price can be evaluated. Investors who are able to evaluate companies or situations that others do not fully understand are often rewarded with healthy profits when other investors later discover the value in a given company or situation. In conclusion, Berkshire is admittedly not a deep-discount purchase at its current price, but it is trading at a 17% discount to my conservative target price of $145,000. Several valuation methods produced valuations that are significantly greater than my target price of $145,000, including the DCF model, which produced a target price of $170,000. However, in the interest of conservatism and acknowledging the conglomerate discount that has been evident in the markets over time, $145,000 seems to be a reasonable target price. At its current price, I believe that an investment in Berkshire offers a very high probability of consistent and reasonable returns to the long-term investor. The sizeable upside potential coupled with minimal downside risk makes Berkshire Hathaway a prime investment for investors with a long investment horizon. 18 Appendix 1: Berkshire Hathaway Financial Statements from Company 10-K 19 20 21 Appendix 2: Berkshire Hathaway Income Statement Forecast and Discounted Cash Flow Model 22 DCF Valuation 5/24/2008 Ticker: BRKA Terminal Discount Rate = Terminal FCF Growth = Year 2008E 2009E 2010E 2011E 2012E 127,993 143,611 12.20% 163,138 13.60% 182,715 12.00% 200,987 10.00% Operating Income Operating Margin 17,919 14.00% 18,885 13.15% 22,024 13.50% 24,667 13.50% Taxes Tax Rate Minority Interest 5,868 32.75% 400 6,185 32.75% 510 7,213 32.75% 625 Net Income % Growth 11,651 12,190 4.6% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 2,560 2.00% (128) -0.10% 5,888 4.60% 8,195 Revenue % Growth Free Cash Flow YOY growth Terminal Value NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 523,729 96,378 166,876 263,254 3.11% Shares Outstanding (mil) $ 123,970.00 Implied equity value/share $ 170,308.23 Upside/(Downside) to DCF 37.38% Cash Debt 44,329 53,472 Forecast 2013E 2014E 2015E 2016E 2017E 2018E 219,075 9.00% 236,601 8.00% 253,163 7.00% 268,353 6.00% 281,771 5.00% 295,859 5.00% 27,133 13.50% 29,575 13.50% 31,941 13.50% 34,177 13.50% 36,228 13.50% 38,039 13.50% 39,941 13.50% 8,078 32.75% 750 8,886 32.75% 875 9,686 32.75% 1,000 10,461 32.75% 1,125 11,193 32.75% 1,250 11,865 32.75% 1,375 12,458 32.75% 1,500 13,081 32.75% 1,625 14,186 16.4% 15,838 11.6% 17,372 9.7% 18,889 8.7% 20,355 7.8% 21,734 6.8% 22,988 5.8% 24,081 4.8% 25,235 4.8% 2,944 2.05% (144) -0.10% 6,750 4.70% 3,344 2.05% (163) -0.10% 7,749 4.50% 4,111 2.25% (183) -0.10% 7,765 4.25% 5,025 2.50% (201) -0.10% 8,039 4.00% 6,025 2.75% (219) -0.10% 8,215 3.75% 7,098 3.00% (237) -0.10% 8,281 3.50% 8,228 3.25% (253) -0.10% 8,228 3.25% 8,721 3.25% (268) -0.10% 8,721 3.25% 9,158 3.25% (282) -0.10% 9,158 3.25% 9,615 3.25% (296) -0.10% 9,615 3.25% 8,241 1% 9,618 17% 12,001 25% 14,156 18% 16,479 16% 18,936 15% 21,481 13% 22,720 6% 23,800 5% 24,939 5% Terminal P/E EV/EBITDA Free Cash Yield 37% 63% 1.545751 Current Price 10.0% 5.0% 23 Terminal Value 523,729.1 20.8 10.75 4.76%