PPL Corporation

advertisement

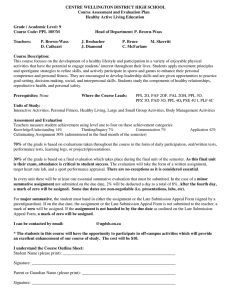

PPL Corporation [NYSE: PPL] Recommendation: Last Price: 1 yr. Price Target: Implied Upside: Total 1 yr. Return: Sell $28.57 $30.59 7.1% 12.1% The Ohio State University SIM Fund Analyst: Geno Frissora Phone: 614-270-2807 Email: frissora.25@osu.edu Utilities | Electric Utilities | February 31, 2012 Presentation PPL Corporation acts as a holding company that generates and sells electricity and delivers natural gas mostly from the northeastern to northwestern United States. It is the 9th largest electrical utility by market cap (February 22, 2012). PPL has grown dramatically over the years helped by many acquisitions. The Utility Sector as a whole has experienced a major period of consolidation over the last century and PPL has been a big part of this secular trend. Currently PPL faces a period of heavy regulation and high capital expenditures in order to get their aging power generation facilities up to date and more environmentally friendly to accommodate the ever changing regulatory environment. Investment Thesis When I began this report I thought PPL was a buy based on price and some valuation metrics. However, after further analysis it appears PPL Corp. is a bit of a value trap. The company has experienced serious share dilution from acquisitions and faces high capital expenditures over the coming years, in order to update an older power generation fleet. I believe in the long term prospects of the company but think the lack of free cash flow over the next few years could be problematic and therefore represents a risk to the stock. PPL has underperformed other utility companies recently and I believe this will continue. An ambitious but conservative discounted cash flow analysis shows that PPL stock has an intrinsic value of $30.59. This would offer an implied upside of 7.1% or 12.1% including the annual dividend with a one year holding period. I believe this is a limited upside and there are better opportunities currently being offered by the market so I therefore have a sell on PPL stock. Price: $28.57 1 yr Price Target: $30.59 Beta: 0.32 52 wk Range: $24.10-$30.37 Diluted Shares: 579,347,000 Avg. Vol (3m): 4,889,390 Market Cap: $16.52B P/E (ttm): 10.53 EPS (ttm): $2.71 Div & Yield: $1.44 (5.00%) All data from 03/01/2012 close PPL Corporation February 21, 2012 Table of Contents Company Overview Business History Stock Performance Business Segments Kentucky Regulated International Regulated Pennsylvania Regulated Supply Segment Summary Business Environment Regulation Competition Market Share & Growth Current Positives LGE & KU Acquisition UK Midlands Acquisition Pennsylvania Removal of Rate Caps Current Negatives High Capital Expenditures LGE & KU Acquisition UK Midlands Acquisition Earnings Dilution Departure of CEO Projections Income Statement Revenue Projections Income Statement Expense Projections Investment Thesis Fundamental Environment Financial Analysis Multiple Analysis Technical Analysis Discounted Cash Flows Risks & Concerns Risks to Company Conclusion Recommendation Appendix Exhibit 1: PPL Discounted Cash Flows Exhibit 2: Projected Income Statement Exhibit 3: Projected Growth Rates Exhibit 4: Dupont and Ratio Analysis 3 3 4 4 5 5 5 6 7 7 8 8 8 8 9 9 10 10 10 11 12 13 14 15 16 17 17 18 19 20 20 2|Page PPL Corporation February 21, 2012 Company Overview Business History PPL was founded in 1920 when eight utilities serving central eastern Pennsylvania merged to form Pennsylvania Power & Light Company headquartered in Allentown, Pennsylvania. PPL expanded its system fairly quickly by acquiring 62 companies between 1928 and 1938. Additionally, the company purchased stock in 12 other companies between 1928 and 1930, all of which were fully integrated by 1938. By the 1930’s PPL is the largest single user of Anthracite coal and adds natural gas to its lines of business. In the early 1970’s PPL announced it would build its first nuclear power plant. But do to problems with many of the early reactors in the U.S. it took PPL until 1983 before the plant was opened. The 1990’s brought an era of more consolidation and deregulation. PPL forms Power Markets Development Company, later named PPL Global, to enter the worldwide unregulated market, investing in power projects domestically and overseas. In 1996, PPL Global buys a 25% stake in a regional British electric company named South Western Electricity. In 1997, PPL continues its vertical integration by beginning to acquire mechanical contracting and engineering companies. The company now generates, distributes, and services the utility market. By 1999 PPL Global increases its British presence, now owning 50% of South Western Electricity known currently as Western Power Distribution (WPD). The company diversifies across the United States as well, acquiring 13 Montana power generation plants. In 2000, PPL expands its UK operations by acquiring South Wales Electricity. In 2010, PPL acquires Kentucky’s two major utilities Louisville Gas and Electric Company and Kentucky Utilities Company providing entrance into the Kentucky regulated market. On April 1, 2011 PPL acquires Central Networks, known as the UK Midlands, electric distribution business in central England expanding its European presence and making it a dominant provider in the UK. Stock Performance PPL stock has performed really well through the 2000’s peaking at $54.07 in January of 2008. But the stock fell hard during the financial crisis hitting $29.33 by October. The stock really hasn’t recovered since this time and has been trading in a range, shown in Figure 1. This could be due to the high amount of leverage PPL has been operating with. Total debt has increased by Figure 1 PPL 10 Year Chart _________________________________________________________________________________________________________________ PPL Company History - company website (pplweb.com) 3|Page PPL Corporation February 21, 2012 $11.425 billion since year end 2009, representing an increase of 147% over the last two years The chart to the right shows Debt/EBITDA for PPL over the last 5 years with the current level of 4.639, shown in Figure 2 The chart shows clearly how the level of debt has increased dramatically during this period. Although this money was spent to better the future growth opportunities of PPL, I believe it has kept the stock in a range since 2009. Figure 2 PPL Debt/EBITDA Business Segments PPL operates in four main business segments: Kentucky Regulated, International Regulated, Pennsylvania Regulated, and the Supply business. Kentucky Regulated The Kentucky Regulated segment operates in regulated electricity and natural gas delivery and regulated electricity generation. These activities are done primarily through the subsidiary Louisville Gas and Electric and Kentucky Utilities which was acquired on November 1, 2010. The LGE & KU acquisition makes PPL a dominant provider of electricity in Kentucky’s regulated market. The exposure to a new regulated market provides a new reliable stream of earnings with a limited retun on equity due to regulatory price caps. This segment has 97% of its current generating fleet running from coal The Kentucky Regulated segment is expected to have lower earnings this year due to higher maintenance and operating costs and increased depreciation. However, these costs are expected to be offset partially by increased margins International Regulated The International Regulated segment is composed of PPL’s UK regulated electricity delivery business, named Western Power Distribution, which serves Southwest and Central England and South Wales. PPL completed the acquisition of the WPD Midlands operations of the UK on April 1, 2011, expanding its International Regulated operations dramatically. Earnings from this segment increased $0.34 per share year over year with only a portion of a year coming from the newly acquired Midlands operation. This segment now has the largest customer base of all of PPL’s regulated segments with 7.6 million customers. Growth in this area of the business has been _________________________________________________________________________________________________________________ PPL Annual Reports - PPL company website (pplweb.com) Bloomberg Terminal - PPL US Equity Reuters - http://www.reuters.com/article/2011/09/16/us-utilities-ppl-kentuckyidUSTRE78F5KS20110916 PPL Corp. 2011 Earnings - PPL company website (pplweb.com) 4|Page PPL Corporation February 21, 2012 strong and should continue to be strong as the company capitalizes on its strong presence in this region. Some risks to earnings in this area are increasing income taxes, less favorable currency exchange rate, increasing operation and maintenance expenses, higher financing costs, and increases in depreciation Pennsylvania Regulated The Pennsylvania Regulated segment is essentially the original PPL business composed of the regulated electric delivery operations in Pennsylvania. Pennsylvanian regulators recently lifted the cap on delivery rates in 2010 and this segment has experienced high earnings growth since then. PPL’s January 2011 rate increases and a decrease in income taxes helped record earnings growth of 33.5% year over year in the recent annual report The planned, optimistic increase in rates over the coming years will offset some of the expected increases in depreciation, income taxes, and operation and maintenance expenses. However, the increase in revenue is not expected to cover all of these increased costs and earnings for this segment are therefore expected to decline in 2012 Supply The last segment of PPL’s operations is the Supply segment. This segment provides domestic wholesale electricity generation and marketing. PPL essentially generates and sells the electricity they produce to itself or other companies who deliver the electricity to consumers. This segment expanded dramatically due to the deregulation instituted in the 1990’s. Its earnings declined by $1.13 per share from 2010 to 2011 The main reason for this decline was lower energy margins in the eastern US, higher coal prices, lower coal generation, and turbine outages at the Susquehanna power plant These increased costs were offset somewhat by higher margins in trading and marketing This segment shows some concerns going forward. If commodity costs increase substantially this segment good see a good deal of margin compression which could negatively affect earnings estimates. However PPL has decreased their exposure to this segment as shown in Figure 3 and Figure 4 below. Segment Summary Figure 3 2010 Earnings by Segment Supply 72% Kentucky Regulated Pennsylvania Regulated Kentucky Regulated 2% Int'l Regulated 17% Figure 4 2011 Earnings by Segment Int'l Regulated 23% Supply 50% Penn. Regulated International Regulated 9% Supply Kentucky Regulated 15% Kentucky Regulated International Regulated Penn. Regulated 12% _________________________________________________________________________________________________________________ PPL Corp. 2011 Earnings - PPL company website (pplweb.com) 5|Page PPL Corporation February 21, 2012 Figure 5 All in all the segments are all pretty 2009 PPL Capacity and Production strong. PPL is moving towards the regulated side with 70% of assets now belonging to the regulated segments This move will provide more geographic diversification of earnings with less exposure to commodity price fluctuations. The Supply segment is the one that is worrisome and could lead to lower earnings estimates. However the company is well hedged to avoid exposure to large commodity price swings. The infrastructure and inputs for their energy generation are fairly diversified, shown to the right in Figure 5 This diversification will continue to increase as the company updates power plants with more environmentally friendly energy sources to meet regulatory guidelines and improve efficiency. Business Environment Regulation The utility sector is a heavily regulated one. Some state regulatory agencies control the return on equity of utility of power delivery companies through price caps. Any returns above this level must be given to consumers in the form of rate savings. The fact that these rate changes need to be evaluated by government agencies also makes it difficult for the company to change price to keep up with volatility in fuel costs. However, in 2010 Pennsylvania rate caps were lifted and PPL has begun raising rates. In order to cover current expansion and environmental updates PPL is expecting to raise rates dramatically over the coming years which could be problematic because of the need for government approval. Rates in UK operations are still tightly regulated, under proposed review every 5 years, making it very difficult to mitigate volatility in fuel costs. However, PPL does maintain a reasonably cheap and diverse mixture of power generation sources. On the positive side there is a program called the Environmental Cost Recovery (ECR) program instituted by the federal government which helps utility companies recover some of the costs associated with capital expenditures of power plant updates. Funds are provided in order to give companies incentives to retire older coal fired power plants and update with more environmentally friendly ones with a lighter carbon footprint. As mentioned before, 3 of the older coal fired plants in the Kentucky Regulated segment are being retired and will be replaced by a large new natural gas plant. Last year PPL was authorized $2.3 billion in ECR funds which will help provide assistance for this project over the period 2012-2016 Although the recovery act will help with the costs it is a requirement that projects using ECR funds have a limited ROE, 10.1% in this instance This is just one example of some of the tax benefits that utility corporations receive due to the high level of capital expenditures needed to keep up with environmental regulations in the industry. _________________________________________________________________________________________________________________ Summary of PPL 10k - http://biz.yahoo.com/e/120228/ppl10-k.html?.tsrc=sprint?date=2090209022 6|Page PPL Corporation Competitive Advantages February 21, 2012 Figure 6 PPL Service and Generation Areas PPL has been a major producer and transmitter of electricity in the northeast US for years. PPL is vertically integrated and generates its own power therefore low inputs costs are definitely a competitive advantage. As stated earlier, electric delivery is a low margin business with ROE often capped by regulatory agencies. PPL’s generation business also offsets the low margin delivery business by providing diversification of earnings. PPL also has a temporary competitive advantage of having a fleet of old, low cost coal generation facilities that provides cheap power. However, this competitive advantage is only temporary because the company will likely be forced to retire many of these facilities over the coming years due to stricter government regulations. PPL has tremendous economies of scale because of its size and infrastructure. The company also has many competitive advantages that enable them to continue to grow. PPL has grown mostly through acquisition over the years, as is common with companies in the utilities sector. The company has good access to the debt and equity markets due to its size and has been able to use these markets to provide capital for acquisitions. PPL through this continuous phase of consolidation has learned how to integrate these acquisitions close to seamlessly, as was shown by the recent acquisitions of LGE & KU and the UK Midlands operations. These acquisitions expanded its business into the northwest US and the UK helping to provide more geographic diversification, as shown in Figure 6. Management has a good track record of making profitable investments and capitalizing on them by incorporating efficiencies between the companies involved. Market Share & Future Growth PPL has few competitors on the transmission or delivery side of the business, as they are the main player in most of the markets their regulated businesses participate in. Due to the high costs of infrastructure PPL has somewhat of a natural monopoly over the distribution of retail electricity in the areas that they operate. There is more competition in the generation and unregulated space but overall PPL’s main competitors include: Duke Energy, American Electric Power, National Grid Transco, Edison International, Great Plains Energy, Excelon Energy, and TECO Energy. However, with PPL moving a higher percentage of earnings towards its regulated businesses this competition should not be a major factor in the analysis of the company. The new idea of self generated power such as solar and geothermal does pose a threat in the future as these technologies become more readily available. On the other hand, the supply or energy generation business does face serious competition and its success is based solely on PPL’s ability to market and promote its power in a competitive market. There are many competitors in this market including industrial supply companies, regulated utilities, and non-utility electricity generators. PPL’s future growth opportunities are good but there are many risks to this growth. The fact that future earnings estimates are based on high rate increases over the coming years could pose a problem if regulation changes and these rate hikes are blocked. 7|Page PPL Corporation February 21, 2012 Current Positives LGE & KU Acquisition PPL Corporation has several things going for it. To start the recent acquisitions of LGE & KU and the UK Midlands operations will be highly accretive to earnings. These two deals provide major exposure to new areas for PPL. They now have a dominant presence in Kentucky serving 1.2 million customers through their operations of LGE & KU The Kentucky regulated segment brought earnings of $0.40 in its first full year of operations This is a whole new stream of earnings to PPL and will provide stable cash flow going forward. However, in 2012 the average earnings estimate is $0.34, representing a decline of 1.5% year over year UK Midlands Acquisition PPL’s purchase of the UK Midlands operation brings added exposure to the UK. PPL now serves 7.6 million people in the UK making it the second largest delivery business in the UK With this added exposure PPL has decreased the risks associated with its supply business dramatically. PPL expects 75% of 2013 EBITDA to come from its regulated businesses This acquisition will also serve to decrease cost of operations in the UK due to the synergies from the UK Midlands and Western Power Distribution operations. The International segment containing both UK businesses had earnings of $0.59 last year and is expected to have earnings of $1.04 next year with the first full year of earnings from the UK Midlands operations Removal of Pennsylvania Rate Caps As previously stated the rate cap in Pennsylvania was removed in 2010 as a move towards further deregulation to help establish a more competitive market. This will enable PPL to raise rates to keep up with increases in capital expenditures. The company expects to raise rates as much as 2030% over the coming years in order to cover high capital expenditures for power plant upgrades. This would definitely be a good driver of growth as the regulated segment has now become the majority of earnings. However, this could pose a problem in the fact that an increase this drastic could cause people to move or try to find other ways of getting power, whether it be through other power providers or simply solar panels or geothermal which are now becoming more popular in residential settings. Current Negatives High Capital Expenditure That leads us to the current risks to PPL’s operations. Regulations are becoming increasingly tight _________________________________________________________________________________________________________________ PPL Corp. 2011 Earnings - PPL company website (pplweb.com) PPL News Room http://www.pplweb.com/newsroom/newsroom+quick+links/news+releases/PPL+Corporation+to+acquire +Kentucky+two+major+utilities+042810.htm PPL News Room – LGE & KU acquisition http://pplweb.mediaroom.com/index.php?s=12270&item=26703 EEI Financial Conference – http://www.faqs.org/sec-filings/111107/PPL-CORP_8-K/form8kexhibit99_2.htm 8|Page PPL Corporation February 21, 2012 Millions which will lead to a high level of capital Figure 7 expenditures. PPL has a large amount of their 6000 Capex generation capacity in coal, as stated prior the 4000 Kentucky Regulated segment consists of 97% coal fired generation facilities These power 2000 plant closings will become increasingly relevant over the next five to ten years as coal plants are 0 closed for less carbon generating natural gas plants. PPL estimates capital expenditures for 2012 at $3.84 billion, per the 4th quarter 2011 earnings release This represents 26.5% of revenue in 2012, as shown in the PPL DCF Exhibit 1. But that’s not all capex is expected to increase again in 2013 to $4.3 billion also representing 26.5% of revenue, shown in Exhibit 1. This dramatic increase in capital expenditures is shown in Figure 7 to the left. This percentage is expected to fall in the following years but it will likely remain high, as I have reflected in my DCF, Figure 1. Unexpected events, such as weather damage to infrastructure, can always arise in the utilities industry and require large amounts of capital to fix. High capital expenditures will lead to negative free cash flow over the next three to four years possibly leaving dividend growth stagnant and leading to limited upside in the stock. LGE & KU Acquisition The LG&E and KU acquisition was completed November 1, 2010 at a cost of $7.6 billion PPL offered an oversubscribed late June 2010 stock issuance of $3.5 billion in new shares and paid for the rest of the acquisition with current lines of credit and cash on hand The company accrued $800 million in debt from this acquisition The acquisition, as shown by its oversubscribed status, was seen as a good transaction and has been very beneficial to earnings but has led to a good degree of share dilution which is a serious concern. This acquisition will provide PPL with the majority of the delivery service to the state of Kentucky providing a major new source of revenue. UK Midlands Acquisition Even more recently, PPL purchased the UK Midlands operations of the UK on April 1, 2011, expanding its International Regulated operations. This purchase was financed by PPL with a share issuance equivalent to $2.3276 billion worth of common stock and $977.5 million worth of equity units to cover the underwriting of this issuance PPL also issued another $960 million in debt to help pay for this acquisition This acquisition makes their International Regulated segment one of their largest segments and will provide steady earnings for years to come but was done at a high cost to shareholders. _________________________________________________________________________________________________________________ PPL Annual Reports - PPL company website (pplweb.com) Reuters - http://www.reuters.com/article/2011/09/16/us-utilities-ppl-kentuckyidUSTRE78F5KS20110916 Yahoo SEC Filings - http://biz.yahoo.com/e/120228/151833910-k.html Yahoo SEC Filings - 11http://biz.yahoo.com/e/110419/ppl8-k.html 9|Page PPL Corporation February 21, 2012 Earnings Dilution Millions Figure 8 Although these acquisitions will provide serious earnings growth this sort of Shares Outstanding 600 dilution will cause serious impairment to earnings in the short term as these 400 acquisitions are integrated. The two stock 200 issuances over the last two years represent a serious degree of earnings dilution. The 0 number of shares increased from 483.39 2008 2009 2010 2011 million year end 2010 to 579.3 million year end 2011 and increase of 19.6% in shares outstanding As bad as this sounds, shares outstanding actually increased 53% from year end 2009 to year end 2011, with 377.18 million ending 2009 and 579.3 million ending 2011, shown in Figure 8 I believe that this kind of dilution warrants serious attention from shareholders. On top of this the UK Midlands acquisition was done at a recorded $2.4 billion of goodwill This type of intangible cost is carried as an asset on the balance sheet and is likely to never be recovered, therefore taking away from some of the earnings power the acquisition will bring. Departure of CEO Finally, the CEO James Miller who has headed the company since 2006 has recently decided to step down as of March 31, 2012. He will retire as CEO and resign from the board of directors. Miller has done an excellent job of heading the company and many believe has left the company set up for success over the long haul. However anytime a CEO steps down it presents a time of uncertainty and there is always room for error. William Spence, current COO will take over the role of CEO and should have a good handle on it as he was fairly close with the current CEO in running PPL’s operations. This may not be a risk, however it is a source of uncertainty going forward and could present obstacles involving the implementation of ideas currently in place. Projections Income Statement Revenue Projections My income statement projections are shown in the pro forma income statement in Exhibit 2 and Exhibit 3. I was relatively optimistic with my earnings estimates so as to be prudent with the investment decision of whether to stick with PPL or sell our position. I tried to stick with reasonably high growth estimates so as to give the stock a chance even with the current downside risks. PPL is in a state of transition right now so I took into account the move towards the regulated side of the business. I have growth in utility earnings of 20% for 2012 mostly due to the fact that the UK Midlands acquisition took place in April and therefore was only accretive to _________________________________________________________________________________________________________________ PPL Annual Reports - PPL company website (pplweb.com) Yahoo SEC Filings - http://biz.yahoo.com/e/120228/151833910-k.html Yahoo SEC Filings - 11http://biz.yahoo.com/e/110419/ppl8-k.html RTT News - http://www.rttnews.com/1764133/ppl-corp-ceo-james-miller-to-retire-mar-31-2012william-spence-to-succeed.aspx 10 | P a g e PPL Corporation February 21, 2012 roughly half a year of earnings last year. I have projected growth in this earnings stream as 10% in 2013 and 5% in 2014. The unregulated retail electric and gas sales have grown tremendously over the last few years due to the uncapping of prices in the retail electric market, mostly from the Pennsylvania decision in 2010 to uncap rates. The growth from this portion of earnings has been falling as customers become used to the open market and find power providers that fit them. Unregulated growth was 175% in 2010 and 75% in 2011 I continued this decline in growth to 50% in 2012, 35% in 2013, and 20% in 2014. I felt that this was still an optimistic level of growth for this stream of earnings. Wholesale energy marketing comes from the Supply segment of the business which is currently in a state of decline. 2011 saw the realized sales decline by 21.21% and unrealized decline 274.78% I was not this aggressive with the decline as I believe that earnings from this segment will fall at a decelerating rate over the coming years. I projected growth of -10% in 2012, -5% in 2013, and stabilizing at +5% in 2014 for the realized portion of the Supply segment. For the unrealized activity, which fell a lot harder in 2011, I projected -10% growth over the next three years. I believe these estimates are still fairly optimistic as the decline in this segment could be far worse as shown by last years earnings. Net energy trading margins I have projected to see 0% growth due to the fact that this portion of earnings is not stable and has oscillated between positive and negative earnings over the last few years. Energy-related sales growth also had earning oscillating from positive to negative year to year, therefore I used a very conservative growth rate of a flat 2% for this portion of earnings. In total this puts sales growth at 13.66% in 2012, 11.95% in 2013, and 8.24% in 2014, which I think is a reasonable but optimistic estimate for PPL’s growth. The recent acquisitions will keep growth reasonably high over the next couple year and I believe I have adequately compensated for this. Income Statement Expense Projections PPL has a pretty good handle on their expenses from their tremendous economies of scale. However I believe fuel costs will continue to put pressure on margins and I have set fuel costs as 18% of sales. This is higher than they have been over the past 5 years, high of 15.28% in 2011, but the numbers show a steady increase in fuel costs so I wanted to adequately compensate for secular trend of rising commodity prices Realized and unrealized purchase costs have jumped around substantially over the years moving from positive to negative changes. So I chose slight positive growth in these costs towards the middle to upper end of the spectrum so as to compensate for any uncertainty. As for operation and maintenance expenses, they were pretty high last year and stated as a possible source of dilution to next year’s earnings. Therefore I stuck with the high end of the recent range and set the cost at 20%, which is reasonably modest considering the recent acquisitions and possible maintenance expenses these operations could incur. I set the tax rate at 20% which is below the high that PPL has seen over the last few years but is still towards the high end of the recent range. I believe the tax rate will not be at the highs due to some tax credits likely to be seen from the ECR program involving environmentally friendly upgrades over the coming years. PPL has a considerable amount of debt outstanding most of which does not mature until 2018-2020. So I have interest expense stable at 7.13% as they have a debt issuance maturing in 2013 but I doubt they will issue much more before this time Also, I _________________________________________________________________________________________________________________ PPL Annual Reports - PPL company website (pplweb.com) 11 | P a g e PPL Corporation February 21, 2012 have kept shares outstanding stable thinking that the high degree of earnings dilution over the last few years will keep the company from issuing any new shares anytime soon. Figure 9 PPL Earnings Estimates With all of these assumptions in place I have net sales of $14,476.3 million for 2012 compared to an expected $11,776 million from analysts on the street. For 2013 I have $16,205.8 million compared to the $12,397 expected from Wall Street analysts. Earnings per share come to $2.93 in 2012 and $3.41 in 2013 compared with the consensus estimates of $2.45 and $2.25 per the Thomson Reuters Baseline predictions in Figure 9. Even with predicted earnings above what the street is expecting I see this company to be fairly valued. Investment Thesis Fundamental Environment The utilities sector was once an investor safe haven with stable returns from monopolistic companies. This is no more. Utility companies now compete in an open market and are seeing less stable earnings. Rivalry is a very serious threat to power companies. Since there is no substitute for power and everyone already has it, there is a lot of price cutting in order to get new business. This leads to decreased margins for companies in this space and essentially a less attractive industry to operate in. Because economies of scale are becoming increasingly necessary to compete in the market, companies are using more leverage for industry consolidation and expansion in order to outgrow their competitors. Buyers are gaining more power through the open market structure which will likely become increasingly competitive over the coming years. Commodity costs have been rising over the years squeezing power providers on the supplier side as well. The growth in utilities is not very exciting either. You have new housing starts just now starting to slowly improve and buyers who are moving towards more efficient products that use less power. Along with this, now there are actual substitutes for electric as you can buy you own solar panels or geothermal to provide power without requiring utility companies. On top of this, winter this year has been unusually warm which could lead to lower earnings throughout the year because utilities often accrue a lot of their annual revenue during the winter months. This is an industry with increasing regulatory uncertainty, margins squeezing on both sides, and companies taking on more debt to try to outgrow one another, therefore the fundamentals aren’t exactly good. For these reasons the utilities sector is in a period of stagnant growth with limited upside potential. _______________________________________________________________________________________________________________________________________ Morningstar – PPL Debt - http://quicktake.morningstar.com/stocknet/bonds.aspx?symbol=ppl 12 | P a g e PPL Corporation February 21, 2012 Fundamental analysis PPL is a strong company with easy access to capital markets which has provided them the ability to lever the balance sheet in order to provide future long term growth. PPL has good growth opportunities because of this leverage but for now it has created a good deal of risk. The company has a total debt to equity ratio of 1.724, shown in the ratio analysis in Exhibit 4, this is much higher than the industry average of 1.06. The interest burden, shown in Exhibit 4, shows that a little more than 30% of the earnings before interest and tax (EBIT) in 2011 will go towards paying interest on the debt PPL currently has outstanding. This high degree of leverage could be problematic over the coming years as the company continues to increase capital expenditures. PPL’s level of assets (blue), liabilities (red), and equity (green) are shown annually from 2006 to 2011 in Figure 10 to the right. The utilities Figure 10 business is one that is always uncertain. Power outages and equipment destruction from weather and aging infrastructure are always an issue and could pose serious problems when the company is already carry high amounts of debt. On top of this there are currency risks due to PPL’s exposure to UK that could lead to unexpected destruction of earnings. PPL also has a good degree of Intangibles on its balance sheet. Because the company operates in an industry that has few patents and copyrights, these intangible assets must mostly be accrued goodwill. As stated prior, the Midlands acquisition was done at a whopping $2.4 billion of goodwill bringing the total amount of intangibles on the balance sheet to $5.179 billion and the percentage of assets that are intangibles from 8.3% in 2010 to 12.1% in 2011, Exhibit 4. But this is not the shocking part The fact is that PPL had only $1.359 billion in goodwill in 2008 meaning that there was an increase of 281% in goodwill being carried on the balance sheet over the last 3 years Goodwill is essentially a worthless asset as there is really no way to sell an intangible like this unless it is a patent or copyright, which are not prevalent with utility companies. This large amount of goodwill clearly came from the two major acquisitions over the last couple years, which will likely be very profitable, but this will limit the near term earnings from these operations as this money is basically an overpayment for the takeovers. As stated prior, shares outstanding have increased dramatically over the last two years mostly due to the recent acquisitions in Kentucky and the UK. PPL has little cash and therefore has to access capital markets in order to get enough capital for major projects. The amount and debt and equity outstanding has skyrocketed because of the two recent acquisitions. This could mean future projects, including infrastructure updates, could lead to further leverage or worse dilution of shares. If this happens the earnings per share will drop and share price will likely follow. This is a major concern because utility companies often incur sudden functional expenses in order to keep _________________________________________________________________________________________________________________ PPL Annual Reports - PPL company website - pplweb.com 13 | P a g e PPL Corporation February 21, 2012 providing power when something ceases to work, is damaged, or simply does not comply with current regulations. Multiples Analysis The valuation analysis I have done has shown that PPL is pretty fairly valued. Compared to the industry PPL is near the low end of many of the valuation metrics. Price to book, price to sales, and price to cash flow are all at the lows relative to the industry. Price to forward earnings is below the median but not currently at the lows, all shown in Figure 10. Even the Price to Earnings multiple is currently low. These are the reasons that I first thought PPL was a buy when I started this report. However, I believe the reasons for these multiples being towards the low end of the range are the recent share issuances and high level of debt. Figure 10 Relative to Industry P/Trailing E High Low Median Current 1.5 .68 1.1 .79 P/Forward E 1.5 .63 .95 .88 P/B 1.6 1.0 1.3 1.0 P/S 1.7 .9 1.1 .9 P/CF 1.8 .8 1.5 .8 The metrics compared to the S&P show that the stock looks relatively cheap but this again could be because investors are currently shying away from the company due to all the current uncertainty. The metrics relative to the S&P are all near the low end of the historical range, shown in Figure 11. These types of metrics can be very deceiving sometimes though due to underlying issues like some of the issues mentioned above. If a company has fundamental problems then of course it would underperform the S&P or the other stocks in the industry. I’m not saying that PPL has major fundamental issues but some of the fundamental risk I have just outlined could be the cause for these numbers being towards the lower end of the range. Figure 11 Relative to S&P 500 P/Trailing E High Low Median Current 1.3 .53 .95 .78 P/Forward E 1.7 .49 .99 .91 P/B 1.5 .6 1.0 .7 P/S 2.6 .9 1.4 1.0 P/CF 1.4 .6 1.0 .6 14 | P a g e PPL Corporation Figure 12 Absolute Valuation February 21, 2012 High A. Low B. Median C. Current D. #Your Target Multiple E. F. *Your Target Your Target Price G. H. P/Forward E 21.6 7.4 12.3 12.2 12.3 $2.33 $28.66 P/S 3.0 1.1 1.5 1.3 1.4 $21.89 $30.65 P/B 3.9 1.4 2.1 1.5 1.7 $18.97 $32.25 P/EBITDA 9.41 3.32 6.37 3.71 5.0 $7.67 $38.35 P/CF 15.0 5.1 9.0 5.9 6.5 $4.82 $31.33 However, the company appears to be reasonably valued according to the absolute metrics I have estimated, Figure 12. Price to EBITDA makes the company look cheap, but as I have talked about this is a company that is currently carrying a high debt load therefore using earnings without taking out the interest expense of 7% leads to inflated estimates. Price to book also looks fairly cheap but again we have talked about the high amount of goodwill being carried on the balance sheet as an asset and how that con distort the difference of assets to liabilities which represents total equity. Therefore this metric is not a good measure either. The other metrics seem to be fairly in line with the results of my discounted cash flow model making me fairly confident that this is a fair value for the company. Technical Analysis PPL stock has never really recovered from the fall in price during the Financial Crisis of 2008. The stock price fell roughly 54% from its highs of $54.07 to the low of $24.94, as shown by the 5 year chart to the right. Since this time the stock has been trading in a fairly tight range with $30 seeming to be pretty good resistance. It has flirted with this level a few times recently, pushing through it once, but there is not enough conviction to keep it above this level. This year the price fell below the 200 day moving average, a bearish sign, for a short period. But since then, partly because of a good earnings release, it has broken back above the 200 day. The 15 | P a g e PPL Corporation February 21, 2012 stock continued to rally until just below $29 and has since fallen again. Currently the 50 day moving average has crossed below the 100 day moving average, a bearish indicator. This is shown in the 6 month PPL chart below. I believe based on this price action that there is considerable resistance at $30 and the stock is unlikely to break through this level. This limits the upside in the stock considerably and therefore indicates a good time to move out of this stock and into a better performing one. Discounted Cash Flows The discounted cash flow model, Exhibit 1, I have assembled has taken into account many of the estimated amounts PPL has forecasted over the coming years. Because I think the stock is fairly valued I have used some optimistic levels of sales as I previously talked about. With earnings estimates outpacing the consensus by a fair amount as shown by my $3.41 estimate for 2013 compared to the $2.25 the street is expecting. I have forecast 13.66% growth in 2012, 11.95% growth in 2013, and 8.24% growth in 2014. The following years I began to ratchet down growth to more normalized levels. I have 7% revenue growth in 2015 and 2016, 6% growth from 20172019, 5% growth in 2020 and 2021, and 4% growth in 2022. I used a terminal growth rate of 3% because utilities usually have reasonably low growth rates and this seemed appropriate to me. For the discount rate I used 9.5% because utilities are generally pretty safe companies and PPL is moving more towards the regulated side of business which involves much less risk. Figure 13 Capital Expenditures The historical operating margins, shown in Exhibit 3, were between 12% and 25% so I used estimates around 21.5 for 2012-2014 and 20% flat for the remaining years, in order to stay on the optimistic end of earnings estimates. My estimates for depreciation are around 7% 2012 and slowly increase as the capital expenditures decrease over the years with both evening out in the terminal year so as to represent the depreciation of the previous capital expenditures. Depreciation increases one percent most year finishing at 14% in the final year. Capital expenditures move the opposite way starting at the 16 | P a g e PPL Corporation February 21, 2012 $3,840 million that PPL has forecasted, Figure 13. This number represents 26.5% of my forecasted revenues and this percentage falls to 14% in the terminal year. Using these number PPL’s free cash flow is negative all the way through 2015. With these assumptions in place the terminal value of PPL using this DCF model is $36,889, a free cash flow yield of 6.31%, a terminal P/E of 14.2, and a terminal EV/EBITDA of 5.8. The stock is currently priced at $28.56 and my DCF gives an implied value of $30.59. This represents a 7.1% upside that with the dividend is equivalent to 12.1%. Risks & Concerns Risks to the Company Highly regulated industry with ever changing standards Limited profitability on some operations due to rate caps Utilities sector is in a state of decline due to increased product efficiencies Buyer have more power due to open market structure Commodity costs continue to increase High amount of goodwill on balance sheet (12% of assets) High capital expenditures High debt burden Shares dilution (53% new shares issued since 2009) Conclusion Recommendation My recommendation is to sell PPL stock. I believe the company has good long term prospects but will face near term headwinds with an old fleet of mostly coal power generation. Capital expenditure will remain high and earnings will remain weak due to margin compression and operating costs. I believe PPL does have some upside to it and I think my analysis is justified and I have solid conviction about my $30.59 price target. This price target implies a 7.1% upside that along with the dividend gives you a decent 12.1% gain which I believe is reasonable. Because we are in uncertain times right now this is not a bad value. However, I do believe in mispricing in the market and therefore think there are better opportunities currently being offered. I think the SIM portfolio should sell PPL Corp. and purchase another stock with more upside. 17 | P a g e PPL Corporation February 21, 2012 Exhibit 1: Discounted Cash Flows PPL Corp. Geno Frissora Date: 01/13/2012 Terminal Discount Rate = 9.5% Terminal FCF Growth = 3.0% (all data in millions) Year 2012E Revenue 14,476 % Grow th 2013E 16,206 11.9% Operating Income 3,122 Operating Margin 21.6% Interest Expense 1,032 Interest % of Sales Taxes Tax Rate Net Income 3,480 21.5% 1,155 Free Cash Flow 20.0% 1,338 4,016 20.0% 1,432 6.0% 4,257 20.0% 1,532 6.0% 4,513 20.0% 1,639 25,114 6.0% 5.0% 4,784 5,023 20.0% 20.0% 1,754 1,877 5,274 20.0% 2,008 4.0% 5,485 20.0% 2,149 569 600 632 667 692 718 734 22.0% 22.0% 22.0% 22.0% 22.0% 22.0% 1,200 1,400 1,689 7.0% 2,008 2,126 5.4% 2,342 2,241 5.4% 2,482 2,363 2,454 5.4% 3.8% 2,870 3,014 7.0% 27,425 22.0% 2,016 7.0% 5.0% 531 -5.8% 7.0% 26,370 22.0% 1,884 7.0% 23,918 2.9% 6.5% 7.0% 22,565 2022E 509 2,000 7.0% 21,287 2021E 2.9% 1,878 7.0% 7.0% 2020E 467 2,547 3.8% 3,428 7.0% 2,602 2.2% 3,839 7.4% 8.0% 9.0% 10.0% 11.0% 11.0% 12.0% 12.0% 13.0% 14.0% (667) (93) (124) (188) (201) (213) (226) (239) (251) (264) (274) -4.6% -0.6% -0.7% -1.0% -1.0% -1.0% -1.0% -1.0% -1.0% -1.0% -1.0% 3,840 Capex % of sales 1,251 3,754 20,082 2019E 2.9% 6.9% Subtract Cap Ex 21.6% 7.0% 2018E 414 1,000 % of Sales 3,784 18,769 2017E 7.1% 16.5% Plus/(minus) Changes WC 8.2% 2016E 7.1% 1,612 % of Sales 17,541 2015E 7.1% % Grow th Add Depreciation/Amort 2014E 4,300 4,100 26.5% (1,895) (1,314) (823) (368) -30.6% -37.4% -55.3% % Grow th 23.4% 3,754 26.5% 20.0% 3,213 16.0% 610 -265.8% 3,406 3,610 16.0% 16.0% 849 888 39.1% 4.6% 3,349 3,516 14.0% 14.0% 1,646 1,700 85.4% 3.3% 3,692 14.0% 2,020 18.8% 3,839 14.0% 2,328 15.3% . NPV of Cash Flows 2,837 16% NPV of terminal value 14,885 84% Projected Equity Value 17,722 100% Free Cash Flow Yield -11.45% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA Shares Outstanding (millions) Implied equity value/share Upside/(Downside) to DCF Total Debt (2010) Cash and Equivalents (2010) Cash/share Dividend/share (annual) Free Cash Yield 10.3 8.8 8.3 11.0 9.4 8.9 8.2 7.2 6.5 8.5 7.5 6.8 579 Current Price Terminal Value 6.31% Terminal P/E 14.2 Terminal EV/EBITDA 5.8 432 578 actual shares outstanding $28.56 $ 36,889 30.59 7.1% 18,571 1,202 2.07 1.4 18 | P a g e PPL Corporation February 21, 2012 Exhibit 2: Income Statement Projections PPL Year Operating Revenues (Millions) Utility Unregulated Retail Electric and Gas Wholesale Energy Marketing Realized Unrealized Economic Activity Net Energy Trading Margins Energy-Related Net Sales Consensus Fuel 2014 2013 Estimates 10797.1 9815.5 1764.2 1470.2 2012 2011 Estimated 8179.6 6292 1089.0 726 3807 1407 -2 507 12737 2010 2009 2008 2007 2006 3668 415 3902 152 4114 151 4114 102 3855 91 4832 -805 2 409 8521 3184 -229 17 423 7449 2138 1056 -121 519 7857 1617 -145 41 769 6498 1412 120 35 618 6131 906 763 843 3417.7 1025.7 -2.0 538.0 17540.7 12854 3255.0 1139.7 -2.0 527.5 16205.8 12216 3426.3 1266.3 -2.0 517.1 14476.3 11705 3157.33 2917.05 2605.74 1946 1235 920 1057 4385.18 526.22 3508.1 4051.45 486.17 3241.2 3619.09 434.29 2895.3 2130 2773 2625 1624 918 1123 -286 155 553 -198 130 2742 1756 1418 1414 1373 1266 11334 Energy Purchases Realized Unrealized Economic Activity Other Operation and Maintenance Amortization of Recoverable Transition Costs Depreciation Taxes, other than Income Energy-Related Businesses Operating Expenses Operating Income Other Income Other than Temporary Impairments Interest Expense Income before taxes Taxes Income from Continuing Ops after Taxes Income from Discontinued Ops after Taxes Minority Interest Dividends on Perferred Securities Net Income EPS Basic EPS Diluted Consensus Ave Shares Basic (thousands) Ave Shares Diluted (thousands) 0 0 0 0 0 304 293 310 282 1400 280 500 13756.9 1200 280 550 12725.8 1000 280 520 11354.4 960 556 455 444 446 419 326 238 280 288 298 281 484 383 396 481 762 638 9711 6655 6553 6154 4815 4622 3783.8 3480.0 3122.0 3026 1866 896 1703 1683 1509 32 26 21 15 1250.6535 1155.4741 2544.2 2335.5 -12 9 1032.163 2068.8 -12 6 908 2100 -31 47 53 95 62 3 18 36 0 0 593 387 447 474 447 1239 538 1273 1304 1124 508.8 2035.4 -15 20 0 2000.4 467.1 1868.4 32 22 0 1878.4 413.8 1655.0 -23 20 0 1612.0 493.5 1606.5 6 18 0 1594.5 263 976 -17 21 0 938 105 433 -7 19 0 407 396 877 73 20 0 930 270 1034 275 3 18 1288 268 856 26 3 14 865 3.63 3.63 2.25 3.41 3.41 2.45 2.93 2.93 2.34 2.90 2.89 2.63 2.17 2.17 1.08 1.08 2.48 2.47 3.39 3.35 2.27 2.24 550.40 550.95 550.40 550.95 550.40 550.95 550.40 550.95 431.35 431.57 376.08 376.41 373.63 374.90 379.94 384.48 381.06 386.16 19 | P a g e PPL Corporation February 21, 2012 Exhibit 3: Growth Estimates PPL Year Operating Revenues (Millions) 2014 Cash & Equiv % of Sales Accounts Receiv-Net % of Sales Inventories % of Sales Accounts Payable % of Sales Chg in WC Utility Sales Growth Unregulated Retail Electric and Gas Sales Growth Wholesale Energy Marketing Realized Sales Growth Unrealized Economic Activity Sales Growth Net Energy Trading Margins Sales Growth Energy-Related Sales Growth Net Sales Growth Gross Margin Chg YoY Fuel Cost to Sales Chg YoY Realized Energy Purchases to Sales Chg YoY Unrealized Economic Activity Energy Purchases to Sales Chg YoY Operation and Maintenance to Sales Chg YoY Operating Margin Chg YoY Tax Rate Interest Expense 2013 Estimates 2012 2011 Estimated 2010 2009 2008 2007 2006 1754.0722 1620.5808 10.00% 10.00% 1596.0 1520.0 10.00% 10.00% 964.73969 972.34847 5.50% 6.00% 1403.3 1458.5 8.00% 9.00% -123.7 -92.9 1447.634 10.00% 1447.6 10.00% 940.9621 6.50% 1447.6 10.00% -666.9 1202 9.44% 779.1 9.00% 595 4.67% 1100 11.00% 82.9 925 10.86% 742 8.71% 643 7.55% 1028 12.06% -151 801 10.75% 468 6.28% 357 4.79% 619 8.31% -102 1100 14.00% 533 6.78% 337 4.29% 766 9.75% 184 430 6.62% 661 10.17% 316 4.86% 689 10.60% 14 794 12.95% 591 9.64% 378 6.17% 667 10.88% -302 -6.00% 173.03% -5.15% 0.66% 0.00% 48.04% 6.72% 12.09% 10.00% 20.00% 20.00% 35.00% 30.00% 50.00% 71.54% 74.94% 5.00% -10.00% 0.00% 2.00% 8.24% 34.00% 0.00% 18.00% 0.00% 25.00% 0.00% 3.00% 0.00% 20.00% 0.00% 21.57% 0.10% 20.00% 7.13% -5.00% -10.00% 0.00% 2.00% 11.95% 34.00% 0.00% 18.00% 0.00% 25.00% 0.00% 3.00% 0.00% 20.00% 0.00% 21.47% -0.09% 20.00% 7.13% -10.00% -10.00% 0.00% 2.00% 13.66% 34.00% -3.65% 18.00% 2.72% 25.00% 8.28% 3.00% -5.82% 20.00% -1.53% 21.57% -2.19% 20.00% 7.13% -21.21% -274.78% -200.00% 23.96% 49.48% 37.65% 1.94% 15.28% 0.78% 16.72% -15.82% 8.82% 12.17% 21.53% 0.92% 23.76% 1.86% 23.50% 7.13% 51.76% 48.92% 32.22% 14.52% 251.53% -121.69% -828.28% -220.83% -88.24% -114.05% -395.12% 17.14% -3.31% -18.50% -32.51% 24.43% 14.39% -5.19% 20.91% 5.99% 35.71% 31.29% 40.84% 53.85% 4.42% -9.55% -13.00% 2.81% 14.49% 12.35% 13.45% 13.94% 2.14% -1.10% -0.49% 1.50% 32.54% 35.24% 20.67% 14.13% -2.70% 14.57% 6.54% 0.38% -3.36% 2.08% 7.04% -3.05% -5.44% -4.96% 10.09% -5.17% 20.61% 19.04% 18.00% 21.13% 1.57% 1.04% -3.13% 0.48% 21.90% 12.03% 21.67% 25.90% 9.87% -9.65% -4.23% 1.29% 21.23% 19.52% 31.11% 20.71% 6.96% 5.20% 5.69% 7.29% 51.04% 51.04% 12.44% 12.44% 13.75% 13.75% 2.12% 2.12% 20.65% 20.65% 24.61% 24.61% 23.84% 7.29% Exhibit 4: Dupont and Ratio Analysis 2011 2010 Payout Ratio 0.560 0.645 ROA 0.056 0.047 Plowback Ratio Times Interest Earned Net Profit Margin Inventory Turnover Total Debt Ratio Debto Equity 0.440 3.316 0.115 13.610 0.747 1.724 0.355 3.089 0.113 9.485 0.750 1.627 2011 2010 ROE= 0.135 0.117 Tax Burden 0.691 0.774 Interest Burden 0.698 0.676 Profit Margin 0.237 0.215 Asset Turnover 0.299 0.259 2011 2010 MV/BV 2.941 2.243 EV/EBITDA 6.504 9.346 Sust. Growth Rate 0.060 0.041 Current Ratio 1.211 1.187 2011 2010 Leverage 3.958 1728.263 Intangibles/Assets 0.121 0.083 20 | P a g e