Document 11015683

advertisement

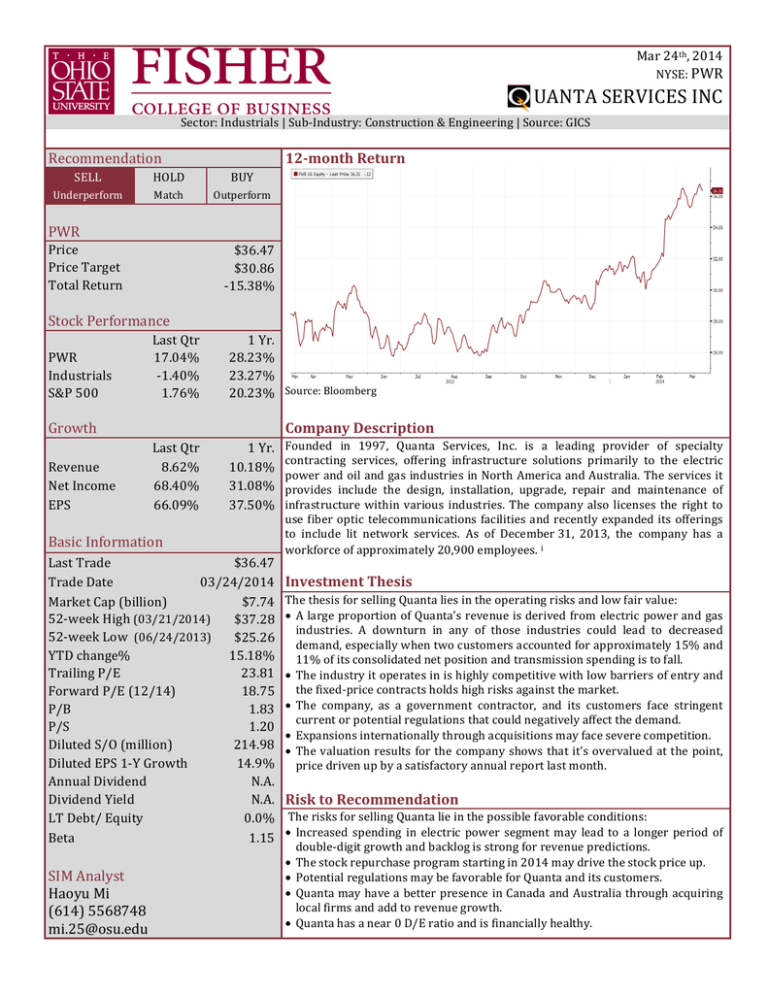

Mar 24th, 2014 NYSE: PWR UANTA SERVICES INC Sector: Industrials | Sub-­‐Industry: Construction & Engineering | Source: GICS Recommendation SELL HOLD BUY Underperform Match Outperform PWR Price Price Target Total Return $36.47 $30.86 -­‐15.38% Stock Performance Last Qtr PWR Industrials S&P 500 Growth Revenue Net Income EPS 17.04% -­‐1.40% 1.76% Last Qtr 8.62% 68.40% 66.09% Basic Information Last Trade 1 Yr. 28.23% 23.27% 20.23% 1 Yr. 10.18% 31.08% 37.50% $36.47 Trade Date 03/24/2014 Market Cap (billion) $7.74 52-­‐week High (03/21/2014) $37.28 52-­‐week Low (06/24/2013) $25.26 YTD change% 15.18% Trailing P/E 23.81 Forward P/E (12/14) 18.75 P/B 1.83 P/S 1.20 Diluted S/O (million) 214.98 Diluted EPS 1-­‐Y Growth 14.9% Annual Dividend N.A. Dividend Yield N.A. LT Debt/ Equity 0.0% Beta 1.15 SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu 12-­‐month Return Source: Bloomberg Company Description Founded in 1997, Quanta Services, Inc. is a leading provider of specialty contracting services, offering infrastructure solutions primarily to the electric power and oil and gas industries in North America and Australia. The services it provides include the design, installation, upgrade, repair and maintenance of infrastructure within various industries. The company also licenses the right to use fiber optic telecommunications facilities and recently expanded its offerings to include lit network services. As of December 31, 2013, the company has a workforce of approximately 20,900 employees. i Investment Thesis The thesis for selling Quanta lies in the operating risks and low fair value: • A large proportion of Quanta’s revenue is derived from electric power and gas industries. A downturn in any of those industries could lead to decreased demand, especially when two customers accounted for approximately 15% and 11% of its consolidated net position and transmission spending is to fall. • The industry it operates in is highly competitive with low barriers of entry and the fixed-­‐price contracts holds high risks against the market. • The company, as a government contractor, and its customers face stringent current or potential regulations that could negatively affect the demand. • Expansions internationally through acquisitions may face severe competition. • The valuation results for the company shows that it’s overvalued at the point, price driven up by a satisfactory annual report last month. Risk to Recommendation The risks for selling Quanta lie in the possible favorable conditions: • Increased spending in electric power segment may lead to a longer period of double-­‐digit growth and backlog is strong for revenue predictions. • The stock repurchase program starting in 2014 may drive the stock price up. • Potential regulations may be favorable for Quanta and its customers. • Quanta may have a better presence in Canada and Australia through acquiring local firms and add to revenue growth. • Quanta has a near 0 D/E ratio and is financially healthy. Mar 24th, 2014 NYSE: PWR 2 UANTA SERVICES INC Company Overview 80% Canada Australia Canada: As the largest and fast-­‐growing foreign market, Canada has similar drivers and conditions with the US, such as the need for transportation of crude oil and other liquids from unconventional shale formations, which contain significant reserves. 7-­‐Y Foreign Revenue % Australia: Quanta hopes to expand further in Australia, as it sees similar characteristics and opportunities with Canada. Quanta is now targeting pipeline infrastructure needs for coal seam gas and LNG export facilities. US Geographically, Quanta has operations in the United States, Canada and Australia. Since 2010, growth in these foreign markets began to take off. The United States: As the primary operating market, US revenues have seen steady growth due to new pipeline safety rules but quarterly variations are bigger because of economic and weather conditions. 17% Company Geographic Overview FY2013 Revenue by Country 3% 25% 20% 15% 10% 5% 0% 2007 2008 2009 2010 2011 2012 2013 Revenue % Foreign FY2013 Revenue b y S egment 2% 29% 69% Electric Power Oil a nd G as I nfrastructure Fiber Optic Licensing and Other Source: Quanta Services 10-­‐K 5-­‐Y Net Sale growth by Segment (%) Electric Oil & Gas Fiber Optic Total 2013 2012 2011 6.5 39.2 49.0 2010 2009 -­‐1.9 -­‐10.2 21.8 51.8 -­‐27.4 77.5 -­‐10.8 -­‐3.6 12.0 -­‐23.1 -­‐55.4 -­‐22.3 10.2 41.2 9.4 -­‐12.2 Source: Quanta Services 10-­‐K SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu 15.5 Advantages ·Expand operations, establish global presence and increase revenue ·Foreign markets have smoother quarterly results that can offset US market’s fluctuations to some extent Disadvantages ·Risk regarding foreign countries’ regulations and policies ·Foreign currency exchange risk and interest risk or cost of forward contracts used in hedging Company Segment Overview Quanta’s results are reported under three reportable segments: Electric Power Infrastructure Services Segment This segment provides comprehensive network solutions to customers in the electric power industry. Services include the design, installation, upgrade, repair and maintenance of electric power transmission and distribution infrastructure and substation facilities along with other engineering and technical services. This segment also provides emergency restoration services and the installation of “smart grid” technologies on electric power networks. In addition, it also designs, installs and maintains renewable energy generation facilities. i Drivers Risks ·The need to replace aging power ·Extreme weather conditions may infrastructure lead to more emergency services ·Demand for electricity is expected to but actually more delay in projects grow over the long term ·Transmission spending could be ·Technological advancements that peaking according to EEI survey leads to improvement in access to ·Fewer large project award natural gas resources and supply activity in 2013 versus 2012 ·Certain EPA, FERC regulations ·Uncertain ongoing regulations Oil and Gas Infrastructure Services Segment This segment provides comprehensive network solutions to customers involved in the development and transportation of natural gas, oil and other pipeline products. Services generally include the design, Mar 24th, 2014 NYSE: PWR 3 UANTA SERVICES INC Company Overview Operating Margin by Segment* 40% 20% 10% 30% 0% -­‐10% 2009 2010 2011 Electric Power 2012 Oil and Gas Infrastructure 2013 *Excludes corporate and non-­‐allocated costs Fiber Optic Licensing and Other Source: Quanta Services 10-­‐K Company Competitive Analysis Competitive Advantages · Recognized market leader in electric power and oil and gas pipeline construction in North America · Industry leading safety performance · Growth opportunities through organic growth and acquisitions · Really strong balance sheet with nearly zero long-­‐term debt. Competitive Disadvantages · New players into foreign markets, especially Australia · Low barriers of entry in established North America Markets may impair Quanta’s ability in bidding contracts · High dependence on customer relation. Largest customer accounted for 9% of the revenue in 2013. installation, repair and maintenance of pipeline transmission and distribution systems, gathering systems, production systems and compressor and pump stations, as well as related trenching, directional boring and automatic welding services. In addition, the segment’s services include pipeline protection, integrity testing, rehabilitation and replacement and fabrication of pipeline support systems and related structures and facilities. In 2013, the company expanded into the offshore and inland water energy markets. i Drivers ·Insufficient existing pipeline and gathering system infrastructure for natural gas, oil and other liquids Risks ·Pipeline construction industry capacity is currently tight. ·Whether the company holds the ·Demand for increased natural gas ability to carry on offshore usage stimulated by abundant gas services as good as services on land and maintain similar safety supply and lower gas prices ·Increased development of liquefied records. natural gas (LNG) export facilities ·Nature gas prices internationally Fiber Optic Licensing and Other Segment This segment designs, procures, constructs, maintains and owns fiber optic telecommunications infrastructure in select markets and licenses the right to use these point-­‐to-­‐point fiber optic telecommunications facilities to customers pursuant to licensing agreements, typically with terms from five to twenty-­‐five years, inclusive of certain renewal options. The company is also expanding fiber optic service offerings to provide lit services. This segment also provides services to communication carriers as well as education, financial services, healthcare and other business enterprises with high bandwidth telecommunication needs and various telecommunication infrastructure services on a limited and ancillary basis, primarily to customers in the electric power industry. i Drivers Risks ·Continued investment in dark fiber ·Capital intensive and recently network experiencing negative growth ·Demand for fiber optic bandwidth ·Ongoing CAPEX needs to driven by data intensive services maximize asset value, revenue and ·Demand for metro market fiber cash flow potential optic networks · Uncertainty into lit fiber services · High turnover within the company. Though the company has good employee welfare, it has problems Company Strategy due to less humane management. · Establish programs to improve safety and operational performance Recently, US federal and state regulatory agencies are implementing new pipeline safety rules and increasing enforcement activities to better SIM Analyst prevent pipeline incidents. Quanta’s safety record has been quite good, Haoyu Mi with total injury & illness rates below the industry rate for years in a line. (614) 5568748 With customers’ increasing focus on safety, Quanta hopes to take this mi.25@osu.edu advantage one-­‐step further by investing in the latest technology to Mar 24th, 2014 NYSE: PWR 4 UANTA SERVICES INC Company Strategy 7-­‐Y Injury & Illness Rate Comparison improve safety and productivity of field employees, develop training facility and leadership training programs. ii · Expand in existing markets and penetrate new ones Quanta’s expansion in the US market is mainly emphasizing its presence geographically. As for foreign markets, Quanta is doing great with the Canadian market and new to Australia market. The recent focus is establishing a position in Australia, and other countries haven’t popped up the list. As for individual segments, the Oil and Gas Infrastructure Services segment is expanding to offshore services and Fiber Optic Licensing and Other segment is expanding to lite services. The strategy in achieving this goal is through acquisitions and strategic investments. Acquisitions enhance the company’s leadership position in existing markets or strength in new markets and eliminate redundant Source: Quanta Services 2014 Investor Day costs. They can also bring unique service or technology to Quanta. Presentation Strategic investments also enable Quanta to partner with customers on projects that provides backlog for Quanta. The company also benefits Total Debt to Quanta 10-­‐Y from the cross-­‐selling opportunities. However, there are sure risks (%) Asset Ratio regarding whether Quanta can successfully integrate the acquired 35 32.2329 business with existing operations. It seems that Quanta has certain 30 29.0936 business control over this problem and the acquired business are 27.3674 25 generating revenue. 20 · Leverage and grow leadership position Quanta has a extremely clean balance sheet with nearly no debt. When we 15 12.2427 take a look at its historical Debt to Asset ratios, we can see that from 10 2010, Quanta nearly has zero debt. In 2013, this ratio stopped dropping, 3.4689 3.1585 but a D/A ratio of 0.04% is still significantly low. There are signs however 5 0.0306 0.0012 0.0002 that Quanta is hoping to take on more leverage. 0.0386 0 2004 2006 2008 2010 2012 2014 Quanta increased capacity under senior secured revolving credit facility from $700 million to $1.325 billion and extended maturity from August 2, Source: Quanta Services 10-­‐K 2016 to October 30, 2018. Quanta will need lots of cash to complete its more aggressive acquisitions this year and may take on more leverage to Quanta’s Representative Customers support these growth initiatives. It also possible that the company wants ·Suncor Energy Inc. to take advantage of favorable terms and rates in foreign currencies. ·Southern California Edison Co. ·Exelon Corporation Recent Developments ·PG&E Corporation ·2014 The company announced that it is now expanding its offerings to ·Enterprise Products Partners L.P. include lit services. Under the lit services model, not only does the ·American Electric Power Company, Inc. company provide access to the extensive fiber networks that it owns, it ·TransCanada Corporation also provides advanced networking equipment and are responsible for Source: Bloomberg network management and service quality. ii Comment: Since the fiber business is capital intensive and the company is new to the lit services, it would need heavy initial investment and this SIM Analyst would hurt the margins of the segment for at least two or three years. But lit services are still a market the company should pursue in its expansion. Haoyu Mi · Effective December 31, 2013, Quanta’s Natural Gas and Pipeline (614) 5568748 Infrastructure Services segment was renamed the Oil and Gas mi.25@osu.edu Mar 24th, 2014 NYSE: PWR 5 UANTA SERVICES INC Recent Developments Recent Acquisitions 2014 Q1 Fields Payment 2013 Fields Payment 2012 Fields Payment 2011 Fields Payment # Infrastructure Services segment. i 5 Comment: This is just to better align the name with this segment’s service Electric Power & General offerings and end-­‐customer markets. The services offered and the Engineering and Construction financial results in this segment are unchanged. Cash Stock (0.4 m) $79.9 m · Q4 2013, Quanta announced a stock repurchase program to purchase, $36.6 m from time to time, up to $500 million of its outstanding common stock 6 through December 31, 2016. As of Dec 31, 2013, no purchase occurred. i Electric Power & Oil and Gas Comment: This plan may show manager’s confidence, but may also intend Cash $341.1 m to use treasury stocks for acquisitions and maintain a smooth number of C.S. (3. 5m) $88.9 m outstanding common stock. 4 · Dec 6, 2013, the company sold all the equity ownership interest in Electric Power & Oil and Gas Howard Midstream Energy Partners, LLC (HEP) proceeds of $220.9 Cash $57.5 m million in cash, which resulted in a pre-­‐tax gain of $112.7 million. i C.S. & Repay D $48.3 m Comment: This gain contributed a lot to Quanta’s earnings for the year, 5 resulting in an EPS of $1.87, which beat consensus of $1.5. Without it, the Electric Power & Oil and Gas EPS would only have been $1.62, with an effective tax rate of 34%. Cash $80.8 m · In 2013, Quanta expanded into the offshore and inland water energy C.S. & Repay D $35.8 m markets, primarily providing services to oil and gas exploration including mechanical installation, electrical and instrumentation, pre-­‐commissioning and commissioning, coatings, fabrication, pipeline construction, integrity services and marine asset Revenue From Acquired Companies repair. i vs. Price of Acquisition Comment: Quanta feels that the regulations that are out to comply with pipeline safety as well as platform safety is a significant opportunity for Revenue Price 2013 $357.7 m $430.0 m Quanta to provide an engineering program management with technology 2012 $201.3 m $105.8 m solution to its pipeline identification, remediation of pipelines. 2011 $235.4 m $116.6 m · On December 3, 2012, Quanta sold substantially its entire domestic Source: Quanta Services 10-­‐K telecommunications infrastructure services operations and related subsidiaries. i 1-­‐Y Stock Price against S&P 500 Comment: The company wanted to focus on the energy infrastructure markets, which it believes will undergo substantial development in the coming years. This incentive may be driven by the high growth of the electric segment in 2011 and 2012, but the growth slowed down in 2013. Recent Event Influencing Stock Price Recent stock price really went up because of the satisfying fourth quarter results. The price went up 7.6% the day Quanta announced its earnings. But as we can see from the chart on the left (grey line is S&P 500), most of the time Quanta underperformed the market and just caught up and outperformed lately. As mentioned earlier, the sale of HEP really helped Source: Bloomberg out and it is a good time to sell. Quanta is also acquiring at a much higher speed this year than the past. Just the first quarter, there have been five deals made. From past records, SIM Analyst we can see that the newly acquired companies are doing quite well in Haoyu Mi generating revenue. But overall, Quanta became overvalued after the (614) 5568748 price rose. mi.25@osu.edu Source: Quanta Services 10-­‐K platforms, Mar 24th, 2014 NYSE: PWR 6 UANTA SERVICES INC Economic Analysis 10-­‐Y Sector Performance vs. S&P500 Sector Overview Quanta is from the Industrials sector. The industrials sector comprises companies engaged in the provision of various products and services to other industries and businesses. Recent years, the sector is experiencing a growth of around 1.3%, indicating a slow recovery from the crisis. From the chart to the left we can see that the S&P industrials sector index (red line) closely tracked the S&P 500 index (grey line). But due to the fact that the sector is cyclical with a beta of 1.2, it underperformed the market at the time of the crisis and outperformed when the economy picked up. The industrials sector is closely related to many economic indicators such as GDP, Industrial Production, Capacity Utilization Percentage, Purchasing Correlations with economic indicators Managers Index, Capital Spending, Durable New Goods Orders, Sector Quanta Manufacturing Trade Inventory, US Manufacturing Sales, Natural Gas S&P 500* 0.93 0.49 Price, Crude Oil Price and Unemployment Rate and Housing Starts. Source: Bloomberg GDP IP CUP PMI CS DGNO MTI USMS NGA** CL1 USUR HS 0.39 0.51 0.50 0.59 0.47 0.41 -­‐0.54 0.58 0.07 0.40 -­‐0.47 0.48 0.35 0.14 0.08 0.32 -­‐0.04 0.14 -­‐0.45 0.44 0.78 0.38 -­‐0.25 0.41 Economic Analysis The industrials sector includes 14 industries and Quanta belongs to General Construction. Since the industries are quite different from each other, Quanta is not as closely related to these indicators as the sector does. As we can see from the table to the left, Quanta has a much lower correlation with the market. And has really low correlation with Industrial Production, Capacity Utilization Percentage, Purchasing Managers Index, Capital Spending, Durable New Goods Orders and Unemployment Rate. But on the other hand, Quanta has a really high correlation with Natural Gas Prices, while the whole sector is not correlated with NGA. *Calculated on a monthly basis back 10 years. So in all, Quanta is closely related to the following indicators: **Only available quarterly basis back 6 years. · Overall Market. Quanta’s performance is certainly related to the overall Others calculated quarterly back 10 years. condition of the market. Quanta is cyclical with a beta of around 1.15. Source: Bloomberg Unpleasant business conditions can result in declines or delays in new 6-­‐Y Correlation with $ Natural Gas projects. If customers’ financial ability is harmed, both the volume of projects and receivables can be questioned. And Quanta has to face the —— PWR risk of the health of foreign markets. —— NGA · US Manufacturing Sales. Quanta’s high correlation with this index is another way to demonstrate that the industry is cyclical. When the economy is doing great and Quanta is expanding more aggressively, the company is purchasing more equipment from equipment manufactures. It already committed capital for the expansion of tis vehicle fleet for 2014. · Natural Gas Price. Quanta has a extremely high correlation with natural gas price, which is not surprising since a significant proportion of its Source: Bloomberg services is related to natural gas price. The graph on the left shows the SIM Analyst relationship between Quanta’s stock price and natural gas price. Quanta Haoyu Mi has been providing natural gas generation facilities and transportation (614) 5568748 pipelines for some time, especially when natural gas is an important type mi.25@osu.edu of renewable energy. The improvement of technology to access natural Mar 24th, 2014 NYSE: PWR 7 UANTA SERVICES INC Financial Analysis 10-­‐Y Correlation with Housing Starts gas in unconventional shale formations and discovery of two large shale fields can guarantee the near-­‐term may result in increased supply and —— PWR reduced natural gas prices. Lower natural gas price may result in —— HS decreased capital spending by customers, even though that demand for pipeline infrastructure will increase, we can see that the overall effect is still positively correlated. Oil prices follow the similar logistic. · Housing Starts. Quanta is moderately correlated with housing starts. The improvement in the housing market will lead to more demand for electricity distribution services. As housing starts began to pick up this year, it may be a good sign for the company. Source: Bloomberg · Transmission Spending. Even though Quanta is not correlated with overall Capital Spending, transmission spending plays a important role in Transmission Spending Survey influencing Quanta’s Electric Power segment. From 2011, the US has been experiencing sluggish electricity demand. The line mile additions are also expected to decline from 2014. From the graph to the left, we can see that transmission investment peaks at 2013 and then start to decline. This reflects the cyclic nature of major infrastructure spending. The decline may affect the demand for Quanta’s US Electric Power segment, which is now the largest part of Quanta’s revenue. Source: Edison Electric Institute (EEI) 12 5-­‐Y Operating Margin (%) 6 4 2 0 2009 2010 2011 2012 2013 -­‐2 5-­‐Y Return on Equity (%) 30 25 20 15 10 5 0 2010 2011 2012 2013 -­‐5 2009 -­‐10 10 8 PWR MYRG Source: Bloomberg SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu CBI PIKE MTZ Financial Analysis The financial analysis for Quanta is delivered through comparison with previous years and with peers. The peer group identified for 2013 includes Chicago Bridge & Iron Company N.V. (CBI), EMCOR Group Inc. (EME), Fluor Corporation (FLR), Jacobs Engineering Group Inc. (JEC), MasTec Inc. (MTZ), MYR Group Inc.(MYRG), Pike Electric Corporation (PIKE), URS Corp. (URS) and Willbros Group, Inc. (WG). i Among which, CBI, MTZ, MYRG and PIKE are selected for 5-­‐year comparisons due to the fact that they have been peers for Quanta since 2009. Profitability Analysis ·Operating Profit Margin Operating profit margin is operating income as a percentage of revenues. Operating margin can be affected due to many reasons. Seasonal patterns and geographical characteristics can impact margins. Weather conditions can affect productivity and volume of emergency restoration service work, which affect margins. Revenue mix is relevant since in this case, the Fiber Optic segment has higher margin. The amount of subcontract work matters since these works generally yields lower margins. Quanta has decent operating margins and the ratio is increasing since 2011. This upward trend seems to be slowing down and it may stable around 8% in the near-­‐term. Quanta is doing decent among its peers. Till 2013, it’s the highest operating margin in the five companies. But from a 5-­‐year perspective, Quanta’s performance is similar with CBI and MTZ. ·Return on Equity Quanta’s return on equity seems to underperform its peers. With a ROE of around 5%~10%, Quanta continuously underperformed CBI, MTZ and Mar 24th, 2014 NYSE: PWR 120 100 Revenue Growth (%) FY2013 Peer Comparison 80 60 40 20 0 0 EME WG FLR 2 4 -­‐20 CBI PIKE MTZ PWR JEC URS 6 MYRG 8 10 Operating Margin (%) Source: Bloomberg 3.5 3 2.5 2 1.5 1 0.5 0 2009 Ratio 5-­‐Y Current 2010 PWR MYRG Source: Bloomberg 2011 CBI PIKE Asset Turnover Ratio* 2013 Accounts Receivable Turnover Ratio* Inventory Turnover Ratio* *Calculated using the above 10 companies. Source: Bloomberg SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu UANTA SERVICES INC Financial Analysis MYRG. By 2013, Quanta’s ROE is the lowest among the five even though the ratio is improving in recent years. This may due to Quanta’s low leverage since Quanta has a pretty good ROA. But ROE works in the perspective of shareholders. ·Two-­‐metric Comparison Instead of looking one metric at a time, we can get a better look at the positions of the 10 companies right now. The two metrics selected are revenue growth and operating margin for FY2013. As we can see, though PWR has a higher margin, its revenue growth is just around the middle. CBI is high in the favorable area due to its extraordinary revenue growth of 102.26%, while Quanta’s growth for 2013 is around 10%. From this graph we can tell that Quanta isn’t the most favorable company, but can still beat more than half of the companies in the peer group. Liquidity Analysis ·Current Ratio Current Ratio represents the liquidity of a firm’s assets. Except for CBI, other companies all have a ratio above 1. Quanta’s ratio came number two in 2013 with a decent 2.2. The overall trend for Quanta is dropping since Quanta need to use more cash for acquisitions. In the near future, this ratio is expected to drop further, but should still be above 1. So there shouldn’t be problems regarding Quanta’s liquidity in the near-­‐term. 2012 MTZ 8 Efficiency Analysis The graph to the left calculated the three efficiency ratios from Quanta and its 9 peer group companies’ FY2013 data. JEC is excluded when calculating inventory turnover ratio since the company doesn’t have inventory. ·Asset Turnover Ratio Quanta has the lowest asset turnover ratio among its peers. Looking historically, this ratio dropped to a low of 0.86 in 2009 and gradually picked up and returned to the level of 1.2. But as Quanta’s revenue growth becomes steady, its ability to generate sales from assets still lags. ·Accounts Receivable Turnover Ratio Quanta’s Accounts Receivable Turnover Ratio is still below average. This result isn’t surprising since some of Quanta’s projects have a longer life span and Quanta do give customers credit. This may be kind of risky since sometimes costs related to the work, such as labor, equipment and subcontracts need to be paid before receivables are billed. And two customers accounted for 15% and 11% of the consolidated net position, which includes accounts receivable less billings in excess of costs and unearned revenue. But Quanta’s allowance ratio of 0.4% is pretty good. ·Inventory Turnover Ratio Quanta’s inventory turnover ratio actually ranked fourth among the 8 companies. The quite high inventory turnover ratio owes credit to its low Mar 24th, 2014 NYSE: PWR 9 UANTA SERVICES INC Financial Analysis FY2013 Financial Leverage Comparison inventory levels. Since Quanta gets most of the materials needed for operations from its customers so it doesn’t have much inventory on hand. Debt to Interest Asset Ratio Coverage Ratio PWR 0.039% 197.50 Financial Leverage Analysis CBI 19.60% 8.64 ·Debt to Asset Ratio EME 10.23% 25.32 Quanta has a really low Debt to Asset ratio as we have mentioned. It turns FLR 6.32% 44.26 out MYRG has a even lower ratio of 0. Besides, FLR and JEC also has low JEC 6.02% 51.83 debt to asset ratios of around 6%. Overall, the companies in the peer MTZ 27.98% 6.11 group all have a ratio that’s financially healthy. MYRG 0.00% 75.27 ·Interest Coverage Ratio PIKE 35.43% 9.70 Quanta has the highest interest coverage ratio due to its little debt. Other URS 19.63% 6.77 companies, except for WG all has ratios that are significantly above 1, WG 31.84% 0.71 indicating that they have no concern paying off their debt. WG, on the other hand has to pay attention to its financial position. Source: Bloomberg & companies’ 10-­‐K FY2013 Dividend Payout Policy CBI EME FLR URS Dividend Yield 0.30% 0.60% 0.90% 1.80% Source: Yahoo Finance Payout Ratio 5% 10% 16% 25% Payout Policy Analysis Among the 10 companies, only the left 4 pay dividends. Quanta has never paid a dividend since it still thinks of itself as a growing company. The companies that pay a dividend has a relatively low dividend payout ratio. Since Quanta won’t be paying dividend for some time into the future, investors have to focus on capital gain. DuPont Analysis When we break down ROE to get a better look at what’s driving the ratio, Quanta’s DuPont Breakdown 2011 2012 2013 we get the following equation: 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡 3.93% 8.58% 10.0% ROE 𝑅𝑂𝐸 = 𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 𝑀𝑎𝑟𝑔𝑖𝑛×𝐴𝑠𝑠𝑒𝑡 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟× 𝑇𝑜𝑡𝑎𝑙 𝐸𝑞𝑢𝑖𝑡𝑦 Net Profit Margin 3.16% 5.18% 6.16% Asset Turnover Total A/ Total E 0.89 1.15 1.12 1.39 1.44 1.45 Source: Bloomberg 5 4 3 2 1 5-­‐Y Trailing 12M EPS ($) 2010 2011 PWR CBI MYRG PIKE Source: Bloomberg SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu 0 2009 -­‐1 2012 2013 MTZ From the chart on the left, we know that Quanta’s ROE has been growing in the past three years and so is its net profit margin and total asset to total equity ratio. From 2011 to 2012, both net profit margin and asset turnover ratio contributed a lot to the leap of ROE. From 2012 to 2013, the increase was mainly due to net profit margin. So Quanta’s ROE was mainly driven by profitability abilities. The increase in margins may due to the reduction of costs from acquisitions. Valuation Analysis Relative Valuation ·Earnings Per share The five companies have similar trend when we look at the change of EPS. When it comes to absolute value, Quanta doesn’t stand out among its peers. CBI has an EPS that’s more than 2.7 times Quanta’s in terms of Trailing 12 month EPS from continuing operations. ·P/E Ratio Quanta’s Price to Trailing 12M EPS is 23.81, which is quite high at this point with a lower forward P/E of 17.31. When comparing its P/E to the Mar 24th, 2014 NYSE: PWR 10 UANTA SERVICES INC Valuation Analysis Current P/E Ratio Comparison industry and S&P 500, we can see that Quanta’s ratio is higher than both Quanta S&P500 Sector Industry the benchmarks. But when we look at the P/E of the General Construction 23.81 17.21 17.69 20.31 industry, they kind of match. So this industry overall might be overpriced. Source: Bloomberg PWR Current Price $36.47 Current EBITDA $688.55 m The four ratios P/E, P/S, P/B and EV/EBITDA are the most commonly used multiples when doing relative valuation across peer companies. The following analysis excluded WG from the 10 companies since it had a loss last year. Also excluded is PIKE since its P/E ratio is 32.25, much higher than the other remaining 8 companies and is considered an outlier. Shares Outstanding 214.929 m Current Peers Target Target % Chg from Multiple CBI FLR MYRG JEC EME URS MTZ Multiple* Price Current Price P/E 23.81 20.25 18.05 15.06 20.03 21.54 14.18 23.79 18.99 29.08 -­‐20.3% P/S 1.20 0.81 0.45 0.57 0.68 0.49 0.32 0.77 0.58 17.74 -­‐51.4% P/B 1.83 3.87 3.25 1.77 1.94 2.14 0.87 3.27 2.45 48.78 33.7% EV/EBITDA 10.92 11.50 7.40 5.29 11.30 10.83 6.34 9.55 8.89 28.46 -­‐22.0% Average 31.01 -­‐15.0% * The target multiples are calculated averaging the multiples from the 7 peer companies. Source: Bloomberg PEG Model Assumptions ·PWR: The actual EPS for 2013 used the trailing 12M EPS and the estimated EPS used the projection results from the DCF model later stated in this report. ·Peers: The actual EPS for 2013 used the trailing 12M EPS and the estimated EPS used consensus from Bloomberg. ·Annualized EPS growth calculated using geometric average. 2013 Actual EPS ($) 2014 Estimated EPS ($) 2015 Estimated EPS ($) 2016 Estimated EPS ($) Annualized EPS growth Current P/E Ratio PEG Ratio Source: Bloomberg SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu PWR 1.53 1.82 2.14 2.31 14.65% 23.81 1.63 From the multiples valuation above, we can see that the peer valuation is below the current price by around 15%. So the stock is overvalued according to this method. ·PEG Ratio The P/E to growth ratio is calculated by P/E ratio divided by the estimated annual EPS growth rate. This ratio takes the company’s growth into consideration and is often times a more favorable indicator of the stock’s fair value than P/E ratio. And this works for Quanta since it’s still at the growth stage. The PEG ratios calculated below are based on a 3-­‐Y or 2-­‐Y forward-­‐looking basis, based on availability of data. CBI 4.23 5.14 5.86 6.21 13.64% 20.25 1.48 FLR 4.06 4.36 5.14 5.94 13.52% 18.05 1.33 MYRG 1.58 1.54 1.70 -­‐ 3.75% 15.06 4.01 Peers JEC 3.23 3.67 4.29 5.26 17.67% 20.03 1.13 EME 2.23 2.54 2.98 -­‐ 15.66% 21.54 1.38 URS 3.31 3.26 3.61 -­‐ 11.59% 14.18 1.22 MTZ 1.80 2.25 2.74 -­‐ 23.49% 23.79 1.01 Since a PEG ratio of around 1 is usually regarded as fairly valued. Most of the companies, except for MTZ seem to be a little bit overpriced. MYRG has a really high PEG ratio due to a small EPS growth rate. Other than MYRG, Quanta has the highest PEG ratio. Actually, based on the EPS implied from the DCF model in the report, Quanta’s 5-­‐Y PEG ratio is as high as 2.21. The relatively high P/E ratio contributes to the result. So based on the PEG ratio, Quanta is overvalued. Mar 24th, 2014 NYSE: PWR 11 UANTA SERVICES INC Valuation Analysis 5-­‐Y Change in Quanta’s WACC 10-­‐Y Terminal Growth Projection Source: Bloomberg 12.5% 10.0% 7.5% 5.0% 2.5% 0.0% 2014 9.5% 2016 2024 8.0% 7.5% 2022 2016 2018 2020 2022 2024 10-­‐Y CAPEX & Depreciation/ Amortization Projection 4.0% 3.5% 3.0% 2.5% 2.0% 2014 2016 2018 2020 2022 2024 Depreciation/Amortization CAPEX SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu 7.0% 2014 2020 10-­‐Y Operating Margin Projection 8.5% ·Terminal Growth Rate This report chose 4.5% as the terminal growth rate for Quanta. Although that Quanta’s growth in 2011 and 2012 are very good, but in 2013 it slowed down. According to consensus, the growth rate by 2016 may drop to 5.6%. This may be considering its aggressive expansion through acquisitions in the near future. Overall, considering that Quanta is still in its growth period, this paper gave a terminal growth rate of 4.5%, which is relatively high. Similarly, the sensitivity analysis will provide a whole picture. 2018 9.0% DCF Valuation The DCF valuation presented below is another way to determine the fair value of Quanta’s stock. There are many assumptions associated with this method and overall were easy on the stock. The result of the DCF model is 30.81, which is significantly lower than what the stock is trading at. So it’s a clear sell. Please see the DCF model on the following page. ·WACC To the left is a chart showing Bloomberg’s estimation of Quanta’s WACC over the five years. Right now, with a 0% debt, Quanta’s WACC consists of mainly cost of equity. The cost of equity is calculated by the CAPM model as 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐸𝑞𝑢𝑖𝑡𝑦 = 𝑅! + 𝛽×(𝐸 𝑟 − 𝑅! ). Bloomberg has estimated the Expected Market Return to be around 10%, a beta of 1.15 and a risk free rate of 2.74%, which gives a result of 11.11%. However, The risk free rate and the market premium changes everyday and a choosing a discount rate from one single day is subjective. To be conservative, this report chose a lower rate of 10% in recent years and discussed higher rates in the sensitivity analysis. ·Operating Margin Quanta’s operating margin is already high within its peer group. In the short term, it’s still expected to grow due to the development of the fiber optic segment. But after a few years, competition will be fiercer within the industry and Quanta’s margin may gradually drop. This report assumed that its margin would drop to 7.5% in ten years, which is still a high number when comparing across companies in the same industry. ·Depreciation / Amortization & CAPEX Since Quanta is acquiring more and more companies, the assets that company owns will go up and so will depreciation. So there’s an upward trend in this item. CAPEX historically has a downward trend and this kind of make sense for this to go on due to the cost savings from acquisitions. ·Terminal P/E The terminal P/E implied in the model is 17. This is appropriate since this complies with the market and sector and the trend of forward P/E. Mar 24th, 2014 NYSE: PWR 12 UANTA SERVICES INC DCF Model Revenue % Growth 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 7,535 10.18% 8,289 10.0% 8,752 5.6% 9,234 5.5% 9,741 5.5% 10,277 5.5% 10,791 5.0% 11,331 5.0% 11,897 5.0% 12,432 12,992 4.5% 4.5% 629 8.4% 734 8.9% 788 9.0% 831 9.0% 877 9.0% 874 8.5% 917 8.5% 906 8.0% 952 8.0% (3) -0.04% (2) -0.03% (3) -0.03% (3) -0.03% (3) -0.03% (3) -0.03% (3) -0.03% (3) -0.03% (4) -0.03% (4) (4) -0.03% -0.03% 216 34.5% 252 34.5% 271 34.5% 290 35.0% 306 35.0% 305 35.0% 320 35.0% 316 35.0% 332 35.0% 325 340 35.0% 35.0% 391 460 17.7% 496 7.7% 519 4.8% 549 5.7% 547 -0.4% 575 5.2% 568 -1.2% 597 5.2% 585 -2.1% 612 4.6% 179 2.4% (70) -0.9% 268 3.6% 187 2.3% (57) -0.7% 274 3.3% 201 2.3% (44) -0.5% 280 3.2% 222 2.4% (46) -0.5% 295 3.2% 234 2.4% (49) -0.5% 302 3.1% 257 2.5% (51) -0.5% 319 3.1% 270 2.5% (54) -0.5% 324 3.0% 283 2.5% (57) -0.5% 340 3.0% 309 2.6% (59) -0.5% 345 2.9% 336 2.7% (62) -0.5% 348 2.8% 351 2.7% (65) -0.5% 351 2.7% 233 316 36.0% 40% 60% 100% 372 17.7% 399 7.2% 432 8.2% 434 0.4% 467 7.7% 455 -2.7% 502 10.4% 510 1.6% 547 7.2% Operating Income Operating Margin Interest and Other Interest % of Sales Taxes Tax Rate Net Income % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow % Growth NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 2,618 4,006 6,624 3.00% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 19.8 16.9 9.6 8.2 Shares Outstanding 215 Current Price Implied equity value/share Upside/(Downside) to DCF $36.47 $30.81 -15.5% Debt Cash Cash/share SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu 510 489 2.27 932 7.5% 974 7.5% Terminal Value 10,390 Free Cash Yield 5.26% 16.9 14.4 8.4 7.2 15.7 13.4 7.9 6.7 Terminal P/E 17.0 Terminal EV/EBITDA 7.9 Terminal Growth Rate Sensitivity Analysis WACC Year 30.81 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 8.50% 9.00% 9.50% 10.00% 10.50% 11.00% 11.50% 34.15 31.22 28.74 26.61 24.77 23.16 36.37 32.99 30.18 27.80 25.76 23.99 39.08 35.12 31.88 29.18 26.90 24.94 42.47 37.72 33.92 30.81 28.22 26.03 46.83 40.98 36.42 32.78 29.79 27.31 52.65 45.16 39.54 35.17 31.68 28.81 60.79 50.74 43.56 38.17 33.98 30.62 21.75 22.45 23.24 24.15 25.20 26.43 27.88 As we can see from the result and the sensitivity analysis. If we choose the WACC presented by Bloomberg now, which is around 11%, the prices will almost all drop below $30. So the price now is undoubtedly over valued. Mar 24th, 2014 NYSE: PWR 13 UANTA SERVICES INC Recommendation Recommendation – Sell DCF Price Target Weighed Result of Price Target Multiples Price 30.81 The price result from multiples valuation and DCF valuation are very 31.01 Weight 0.75 close. After weighing the two, the price target for Quanta is $30.86, 0.25 Final Price Target 30.86 suggesting a 16% downside. So the recommendation is a sell given the recent upward in the stock. Risks to Recommendation Overall, Quanta is still a good company with decent growth rate and operational margin. It’s just overpriced and it’s a good time to sell. The risks associated with the recommendation are as follows: • Increased spending in electric power segment may lead to a longer period of double-­‐digit growth and backlog is strong for revenue predictions. As the strongest segment in the company, if it can gain or maintain a fast growth, it may contribute to an overall higher growth than projected. • The stock repurchase program starting in 2014 may drive the stock price up. Investors may feel that it shows management’s confidence in the future growth of the company. Potential regulations may be favorable for Quanta and its customers. The government may carry out safety regulations that may increase Quanta’s projects in replacing aged infrastructure. Quanta may have a better presence in Canada and Australia through acquiring local firms and add to revenue growth. Quanta’s acquisitions in Australia may go smoother and encounter less competition than projected. Quanta has a near 0 D/E ratio and is financially healthy. Quanta may take on more leverage to amplify its earnings and achieve higher return on equity. • • • Conclusion The recommendation is to sell Quanta Services now. The main reasons are as follows: • According to valuation results from multiples valuation and the DCF model, Quanta is overpriced by around 15%, especially when the assumptions of the DCF model is quite conservative. • Quanta’s high EPS in 2013 is mainly contributed by its selling of an investment. Its trailing 12m EPS is only $1.53, which is close to consensus of $1.54. • A large proportion of Quanta’s revenue is derived from electric power and gas industries. A downturn in any of those industries could lead to decreased demand, especially when two customers accounted for approximately 15% and 11% of its consolidated net position. • Transmission spending is expected to fall after it peaks at 2013. This decline may affect the demand for Quanta’s US Electric Power segment services. • The industry it operates in is highly competitive with low barriers of entry and fixed-­‐price contracts holds high risks against the market. Despite several large companies who serve as competitors, there are also many small firms competing with Quanta. • The company, as a government contractor, and its customers face stringent current or potential regulations that could negatively affect the demand. • Expansions internationally through acquisitions may face severe competition, especially in Australia. SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu Mar 24th, 2014 NYSE: PWR 14 UANTA SERVICES INC Appendices Appendix 1: DCF Model Income Statement Projection Sheet PWR (Millions) Net Sales Operating Expenses Cost of services (including depreciation) SG&A Amortization of intangible assets Total Operating Income Interst expense and Income Interest Expense Interest Income Total FY 2016E 8,752.1 FY 2015E 8,288.7 FY 2014E 7,534.8 FY 2013 6,522.8 FY 2012 5,920.3 FY 2011 4,193.8 FY 2010 3,629.4 FY 2009 3,318.1 FY 2008 3,780.2 4,982.6 434.9 37.7 5,455.1 3,632.0 337.8 29.0 3,998.9 3,039.9 307.9 37.7 3,385.4 2,724.6 312.4 39.0 3,076.0 3,145.3 309.4 36.3 3,491.0 - - - 5,467.4 501.0 27.5 5,995.9 788 734 629 526.9 465.1 194.8 244.0 242.1 289.2 4 (7) (3) 4 (7) (2) 4 (7) (3) 3 (3) (0.7) 3.7 (1.5) 2.3 1.8 (1.1) 0.7 4.9 (1.4) 3.5 11.3 (2.5) 8.8 32.0 (9.8) 22.2 2.1 (0.4) 464.6 158.9 16.9 16.0 306.6 306.6 (0.6) 193.5 63.1 14.0 11.9 132.5 132.5 (7.1) 0.6 234.0 88.9 10.5 2.4 153.2 153.2 0.4 233.7 70.2 1.4 162.2 162.2 (0.0) 0.3 267.3 109.7 157.6 157.6 Loss on early extinguishment of debt, net Equity in earnings of unconsolidated affiliates Other income (expense), net Income from continuing operations before income taxes Provision for Income taxes Income from discontinued operations, net of taxes Net income attributable to non-controlling Net Income Cumulative effect of acct chng Net Income 786 271 732 252 626 216 19 496 495.6 19 460 460.3 19 391 391.2 113 (1) 639.2 218 19 401.9 401.9 Wtd avg common shs-Basic EPS-Basic (pre acct chnge) Cumul effect of acct change Net Income 214.9 2.31 2.31 214.9 2.14 2.14 214.9 1.82 1.82 214.9 1.87 1.87 212.8 1.36 1.36 212.6 0.56 0.56 210.0 0.73 0.73 200.7 0.81 0.81 178.0 0.89 0.89 Wtd avg common shs-diluted 215.0 215.0 215.0 215.0 212.8 213.2 211.8 201.3 197.0 EPS-diluted Cumul effect of acct change Net Income Consensus Guidance 2.31 2.31 2.34 2.14 2.14 2.14 1.82 1.82 1.82 1.75 1.87 1.87 1.36 1.36 0.56 0.56 0.72 0.72 0.81 0.81 0.87 0.87 - - - - - 488.8 488.8 488.8 1,934.2 22.10% 43.8 0.50% 1,137.8 13.00% (44) 1,831.8 22.10% 41.4 0.50% 1,077.5 13.00% (57) 1,657.7 22.00% 37.7 0.50% 956.9 12.70% (70) 488.8 7.49% 1,439.1 22.06% 31.9 0.49% 802.2 12.30% 394.7 6.67% 1,328.1 22.43% 38.3 0.65% 707.3 11.95% 315.3 7.52% 959.9 22.89% 62.5 1.49% 570.6 13.61% 539.2 14.86% 766.4 21.12% 51.8 1.43% 415.9 11.46% 699.6 21.09% 688.3 20.74% 33.5 1.01% 422.0 12.72% 437.9 11.58% 795.3 21.04% 25.8 0.68% 400.3 10.59% 5.59% 10.01% 27.27% 41.17% 15.84% 2.44% 7.35% -0.71% 7.86% 3.21% 0.06% -0.02% 15.55% 13.39% -2.85% 8.06% -0.43% 4.65% -2.08% 0.04% -0.03% 9.38% -12.22% 16.24% 17.89% -1.64% 1.09% 8.48% 9.42% -0.93% 1.23% 6.72% 7.30% -0.57% -0.35% 0.14% 0.34% -0.04% -0.07% 34.19% 32.61% 37.99% Div per common share Cash & Equiv % of Sales Accounts Receiv-Net % of Sales Inventories % of Sales Accounts payable and accrued expenses % of Sales Chg in WC Sales Growth Gross Margin Chg YoY SG&A to Sales Chg YoY Operating Margin Chg YoY Interest Expense Interest Income 9.01% 0.15% 0.05% -0.08% 8.86% 0.51% 0.05% -0.08% 8.35% 0.49% 0.05% -0.09% 10.18% 16.18% 0.34% 7.68% 0.34% 8.08% 0.22% 0.04% -0.05% Tax Rate 34.50% 34.50% 34.50% 34.09% 30.03% 16.79% 8.18% 7.65% 0.85% -0.26% 41.05% Mar 24th, 2014 NYSE: PWR 15 UANTA SERVICES INC Appendices Appendix 2: DCF Model Segment Projection Sheet PWR Segment (Millions) NET SALES Infrastructure Services Electric Power Oil and Gas Infrastructure Fiber Optic Licensing and Other Total Company Consensus Guidance OPERATING INCOME Infrastructure Services Electric Power Oil and Gas Infrastructure Fiber Optic Licensing and Other Corporate and non-allocated costs Total Company NET SALES GROWTH Infrastructure Services Electric Power Oil and Gas Infrastructure Fiber Optic Licensing and Other Total Company OPERATING MARGIN Electric Power Oil and Gas Infrastructure Fiber Optic Licensing and Other Corporate and non-allocated costs Total Company FY 2016E FY 2015E FY 2014E FY 2013 FY 2012 FY 2011 FY 2010 FY 2009 FY 2008 5,610 2,955 5,395 2,711 5,018 2,337 4,481 1,870 4,207 1,535 3,023 1,011 2,029 1,393 2,068 785 2,302 880 187 8,752 8,788 183 8,289 8,310 179 7,535 7,555 7,600 173 6,523 179 5,920 160 4,194 208 3,629 466 3,318 599 3,780 729 222 56 685 201 57 597 173 57 522 139 55 521 55 61 338 (78) 53 204 119 53 226 63 69 248 76 75 (219) 788 793 (208) 734 743 (198) 629 634 (189) 527 (172) 465 (118) 195 (132) 244 (116) 242 -109 289 4.00% 9.00% 2.00% 5.59% 7.50% 16.00% 2.00% 10.01% 12.00% 25.00% 4.00% 15.51% 6.52% 21.82% -3.61% 10.18% 39.17% 51.76% 12.00% 41.17% 48.99% -27.40% -23.10% 15.55% -1.89% 77.51% -55.36% 9.38% -10.15% -10.79% -22.28% -12.22% 13.00% 0.30% 7.50% 0.10% 30.00% -1.00% 5.00% 0.00% 9.01% 0.15% 12.70% 0.80% 7.40% 0.00% 31.00% -1.00% 5.00% 0.00% 8.86% 0.51% 11.90% 0.25% 7.40% -0.01% 32.00% -0.11% 5.00% -4.55% 8.35% 0.27% 11.65% -0.73% 7.41% 3.80% 32.11% -2.13% 9.55% -36.51% 8.08% 0.22% 12.38% 1.21% 3.61% 11.35% 34.24% 0.78% 46.05% 56.53% 7.86% 3.21% 11.17% 1.11% -7.74% -16.27% 33.45% 7.98% -10.47% -24.02% 4.65% -2.08% 10.06% -0.87% 8.53% 0.54% 25.47% 10.55% 13.54% 7.34% 6.72% -0.57% 10.93% 0.17% 7.99% -0.67% 14.92% 2.46% 6.20% 6.20% 7.30% -0.35% Endnotes: i Quanta Services FY2013 10-­‐K ii Quanta Services FY2013 Earnings Call SIM Analyst Haoyu Mi (614) 5568748 mi.25@osu.edu 10.76% 8.66% 12.47% 7.65%