Consumer Discretionary Stock Presentation June 2, 2009 Diego Benavente, Matthew Berkowitz,

advertisement

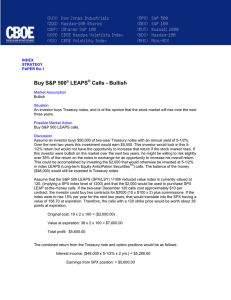

Consumer Discretionary Stock Presentation June 2, 2009 Diego Benavente, Matthew Berkowitz, Conrad Bowman, Julie McGrover Agenda Sector & Stock Allocation Overview Recommendation Sector Allocation Overview Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Telecommunication Services Utilities S&P 500 Weight SIM Weight 9.52% 7.93% -1.59% +/- 12.04% 13.06% 1.02% 12.51% 12.19% 11.31% -1.20% 8.14% -4.05% 13.83% 17.74% 3.90% 10.44% 9.44% -1.00% 18.40% 19.92% 1.52% 3.37% 3.88% 0.52% 3.71% 2.40% -1.32% 3.98% 2.50% -1.49% Class agreed to add 59 bps to sector Continue to have sector underweight Current Stock Holdings Security Comcast Best Buy McDonalds GameStop Ticker CMCSA BBY MCD GME % Allocation Shares Assets within Sector Outstanding 2.71% 34% 2061.0 2.23% 28% 416.3 1.70% 21% 1113.6 1.28% 16% 164.5 7.93% 100% Beta 1.14 1.32 0.70 1.20 Upside (DCF) 22% 24% 12% 20% Trailing P/E by Industry CONSUMER ELECTRONICS RETAIL-INTERNET HOMEFURNISHING RETL SPECIALTY STORES EDUCATION SERVICES AUTOMOTIVE RETAIL HOME FURNISHINGS RESTAURANTS AUTO PARTS & EQUIP DEPARTMENT STORES GENERAL MERCHANDISE CABLE & SATELLITE RETAIL-HOME IMPROVE LEISURE PRODUCTS FOOTWEAR CASINOS & GAMING RETAIL-COMP/ELECTRN DISTRIBUTORS RETAIL-APPAREL APPAREL & ACCESSORY ADVERTISING SPECIAL CONSM SERV HOTEL/RESORT/CRUISE HOUSEWARES & SPECS MOVIES & ENTMT HOUSEHOLD APPLIANCES PUBLISHING MOTORCYCLE MFRS BROADCASTING AUTOMOBILE MFRS HOMEBUILDING PHOTOGRAPHIC PRODS TIRES & RUBBER •Harman Int’l •Amazon.com(54), Expedia (11) •McDonalds •Comcast •Best Buy •GameStop •GM, Ford •Centex, Horton, KB Home, Lennar, Pulte •Eastman Kodak •Goodyear 4.400177001 -10 0 10 20 30 40 50 60 70 80 90 100 110 Selection Criteria Universe: S&P 1500 Consumer Discretionary Cos (263 stocks) Eliminated Cos without full information (-63 stocks) Key Factors: Pricing: FWD P/E & P/E (2010) < 15 P/E relative to S&P500 <1 P/S <1 Price growth vs. SPX: 3mos: (-5%/20%); 6mos: (-30%/30%) Solvency: LT Debt / Capital: < 50% Size: Market Cap > 500M 30 Stocks Selection Criteria: 30 stocks P/E (FWD & 2010) <15 5/22/09 INDUSTRY HOUSEHOLD APPLIANCES FOOTWEAR LEISURE PRODUCTS ADVERTISING DISTRIBUTORS SPECIALTY STORES HOUSEHOLD APPLIANCES FOOTWEAR RETAIL-COMP/ELECTRN HOMEFURNISHING RETL RETAIL-COMP/ELECTRN APPAREL & ACCESSORY BROADCASTING LEISURE PRODUCTS RESTAURANTS HOUSEHOLD APPLIANCES APPAREL & ACCESSORY MOVIES & ENTMT APPAREL & ACCESSORY MOVIES & ENTMT RETAIL-COMP/ELECTRN RETAIL-APPAREL RETAIL-APPAREL RETAIL-APPAREL SPECIALTY STORES CABLE & SATELLITE ADVERTISING HOMEFURNISHING RETL GENERAL MERCHANDISE RETAIL-HOME IMPROVE COMPANY NAME SNAP-ON WOLVERINE WORLD WIDE MATTEL OMNICOM GROUP GENUINE PARTS TRACTOR SUPPLY STANLEY WORKS DECKERS OUTDOOR GAMESTOP RENT-A-CENTER RADIOSHACK WARNACO GROUP (THE) CBS HASBRO JACK IN THE BOX HELEN OF TROY V.F. TIME WARNER PHILLIPS-VAN HEUSEN NEWS CLASS A BEST BUY TJX COMPANIES AEROPOSTALE GAP (THE) PETSMART COMCAST 'A' INTERPUBLIC GROUP AARONS FAMILY DOLLAR STORES SHERWIN-WILLIAMS 4 QTRS 4 QTRS P/E P/E P/E LATEST FWD 2010 7.4 10.2 8.7 9.8 11.3 10.1 13.4 11.4 10.3 9.9 11.6 11.3 11.8 13.5 12.6 15.2 13.9 12.5 10.6 14.1 12.2 6.9 6.8 6.4 9.2 7.8 7.2 8.7 8.4 7.6 8.5 9.7 9.9 10.1 9.9 9.4 6.3 10.6 9.0 12.0 10.6 10.2 12.7 10.7 10.4 11.0 11.0 11.0 10.5 11.1 10.1 8.2 11.2 10.3 10.4 11.6 10.7 10.1 11.7 10.7 12.3 12.6 12.6 13.8 12.8 12.0 13.8 12.9 12.3 12.4 13.2 12.5 13.0 13.4 12.6 14.4 13.9 12.4 12.3 14.0 10.8 16.1 14.2 13.0 16.1 14.5 13.8 13.4 14.9 12.9 P/E 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 P/E <1 P/S <1 P/E 2009 P/E 2010 P/S REL TO REL TO LATEST P/S P/S P/S SPX SPX Rel P/E 4 QTRS 2009 2010 2011 P/S 0.7 0.7 1 0.61 0.70 0.66 0.64 1 0.7 0.8 1 0.75 0.82 0.79 0.74 1 0.8 0.8 1 0.87 0.89 0.85 0.87 1 0.8 0.9 1 0.73 0.80 0.79 0.77 1 0.9 1.0 1 0.48 0.51 0.51 0.48 1 0.9 1.0 1 0.44 0.41 0.38 0.36 1 1.0 1.0 1 0.64 0.70 0.70 0.68 1 0.5 0.5 1 0.95 0.86 0.80 0.70 1 0.5 0.6 1 0.41 0.38 0.37 0.38 1 0.6 0.6 1 0.43 0.44 0.42 0.42 1 0.6 0.8 1 0.39 0.39 0.40 0.42 1 0.7 0.8 1 0.63 0.68 0.65 0.63 1 0.9 0.7 1 0.35 0.37 0.37 0.36 1 0.7 0.8 1 0.80 0.79 0.78 0.75 1 0.8 0.8 1 0.54 0.57 0.56 0.58 1 0.7 0.9 1 0.92 0.92 0.88 0.86 1 0.8 0.8 1 0.80 0.84 0.80 0.73 1 0.8 0.8 1 0.64 0.94 0.92 0.90 1 0.8 0.9 1 0.57 0.60 0.59 0.58 1 0.9 0.9 1 0.74 0.76 0.75 0.71 1 0.8 1.0 1 0.32 0.32 0.30 0.29 1 0.9 1.0 1 0.62 0.62 0.59 0.57 1 0.9 1.0 1 1.15 1.07 0.99 0.95 1 0.9 1.0 1 0.81 0.84 0.86 0.85 1 0.9 1.0 1 0.50 0.48 0.47 0.46 1 0.9 1.0 1 1.18 1.15 1.11 1.07 0 0.9 0.9 1 0.35 0.38 0.38 0.37 1 1.0 1.1 0 0.93 0.87 0.80 0.74 1 1.0 1.1 0 0.58 0.56 0.54 0.51 1 1.0 1.1 0 0.81 0.86 0.84 0.81 1 PRICE VS SPX 3 MTHS 3.2% -0.6% 0.7% 6.6% -3.5% -2.9% 4.9% -28.0% -30.7% -11.3% 0.7% 14.7% 28.2% -17.2% 7.3% 71.7% -12.6% 25.1% 36.1% 31.0% 10.9% 17.6% 37.4% 26.7% -8.0% -4.4% 40.8% 6.5% -4.5% 1.1% PRICE VS SPX 6 MTHS -12.3% -6.3% 4.4% 18.9% -28.1% -7.4% 18.2% -13.8% 11.0% 36.1% 43.0% 100.2% 37.5% -17.0% 86.6% 18.6% 18.8% 28.0% 79.8% 43.5% 84.1% 35.2% 139.2% 54.5% 19.6% -11.0% 45.2% 16.8% 1.4% -11.2% PRICE VS SPX YTD -21.4% -9.9% -11.0% 14.8% -13.1% 2.9% 3.1% -35.3% 5.9% 7.3% 11.1% 42.2% -12.6% -20.2% 15.4% 11.7% 1.5% 4.3% 35.7% -1.1% 27.0% 39.3% 111.3% 24.2% 12.4% -14.0% 29.1% 11.6% 16.5% -8.6% PRICE VS SPX 5 YRS 12.0% 29.0% 1.0% -3.0% 3.0% 19.0% 1.0% 126.0% 210.0% -14.0% -35.0% 59.0% -55.0% 40.0% 96.0% -21.0% 37.0% -19.0% 66.0% -27.0% 22.0% 32.0% 101.0% -13.0% -12.0% -5.0% -43.0% 65.0% 13.0% 59.0% 3Mo: 5%/20%; D/C 6Mo: <50% >500 30%/30% % OF LT MRKT CAP DEBT TO (MILS) P_SPX CAPITAL D/C 5/22/09 MktCap 1 36% 1 1,737 1 1 0% 1 920 1 1 27% 1 5,004 1 1 45% 1 9,455 1 1 18% 1 5,139 1 1 6% 1 1,315 1 1 45% 1 2,725 1 0 0% 1 657 1 0 19% 1 3,693 1 0 45% 1 1,229 1 0 42% 1 1,632 1 0 17% 1 1,285 1 0 46% 1 4,760 1 0 34% 1 3,167 1 0 49% 1 1,427 1 0 18% 1 575 1 0 24% 1 6,018 1 0 30% 1 27,339 1 0 29% 1 1,387 1 0 35% 1 23,080 1 0 20% 1 14,544 1 0 15% 1 11,774 1 0 0% 1 2,254 1 0 0% 1 11,579 1 0 33% 1 2,593 1 1 42% 1 40,963 1 0 46% 1 2,401 1 1 9% 1 1,568 1 1 15% 1 4,183 1 1 16% 1 6,276 1 Recommendation: Aéropostale Back to pre-crisis value Recommendation: Aéropostale Forward P/E relative to: Relatively “cheap” @ 12.6 vs. • • • • S&P500 at 13.9 Industry @ 15.1 Guess (GES) @ 16.3 Abercrombie&Fitch (ANF) @ 24.8 Recommendation: Aéropostale Liquidity not an issue; Quick Ratio: 1.3 (+ no LT Debt) Better Margins than Industry Continuous Growth Better & Still Improving Margins Current Holdings: FWD P/E Relative to S&P500 Current Holdings: P/CF Relative to S&P500 Final Recommendation(s) Current Holdings Security Comcast Best Buy McDonalds GameStop Ticker CMCSA BBY MCD GME % Allocation Shares Assets within Sector Outstanding 2.71% 34% 2061.0 2.23% 28% 416.3 1.70% 21% 1113.6 1.28% 16% 164.5 7.93% 100% Beta 1.14 1.32 0.70 1.20 Upside (DCF) 22% 24% 12% 20% Recommendation: Aeropostle (ARO) Upside 35% Only have 59bps available Because of upside in current holdings, recommend class provide another 41bps to purchase ARO to provide diversification to portfolio. Alternative: use 59bps to purchase more BBY