Skinner, Sureka, Yan 1

advertisement

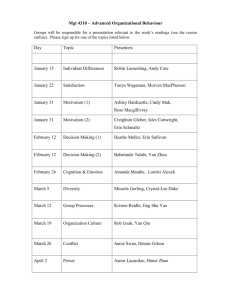

Skinner, Sureka, Yan 1 S&P500 Sector Weighting • Information Technology Largest Sector : 18.6% • Telecommunication Services Smallest Sector: 3.0% • Financials Second largest sector 15.1% Source: S&P Source: Seeking Alpha Skinner, Sureka, Yan 2 Sector Weighting S&P 500 Weight SIM Weight Consumer Discretionary Consumer Staples Consumer Discretionary Consumer Staples Energy Financials Energy Financials Health Care Industrials Health Care Industrials Information Technology Materials Information Technology Materials Telecommunication Services Utilities Telecommunication Services Utilities 3% 3% 4% 4% 3% 8% 9% 5% 12% 12% 19% 20% 12% 12% 10% 9% 13% 15% 13% 14% Financials are underweighted by 610 BPs Skinner, Sureka, Yan 3 Various Industries in Sector Banks Consumer Finance Diversified Financial Services Insurance-Brokers Insurance-Life/Health Insurance-Multi–Line Insurance-Property/Casualty Multi-sector Hldgs Real Estate Investment Trusts Skinner, Sureka, Yan 4 Largest Companies by Market Cap American Express Bank of America Citigroup Goldman Sachs JP Morgan Chase Metlife Travelers Wells Fargo Skinner, Sureka, Yan 5 Current Holdings in Financials Berkshire Hathaway Inc. (BRK/A) Goldman Sachs Group Inc. (GS) Hudson City Bancorp Inc. (HCBK) JP Morgan Chase & Co. (JPM) Visa Inc. (V) Skinner, Sureka, Yan 6 Financial Sector Layout Financial are in the mature phase. Skinner, Sureka, Yan Cyclical in Nature 7 Sector Performance Financial Sector S&P 500 Year to Date - 20.30% Quarter to Date - .93% Year to Date – 19.52% Quarter to Date – 2.13 Skinner, Sureka, Yan 8 Demand GDP Interest Rates Business Profitability Investor Confidence Investible Assets Skinner, Sureka, Yan 9 Supply Market Saturation Consolidation in industry since 1990s Government forced consolidation during financial crisis Consumer and commercial credit losses Future Government regulations Strict lending standards Skinner, Sureka, Yan 10 Sector Attractiveness High barriers to entry Well established brands Economies of scale Economies of scope Relationships Customer Loyalty Skinner, Sureka, Yan 11 Unattractiveness Intense Rivalry Substitute products Government Regulations on capital requirements and wages Lack of consumer confidence Highly cyclical Skinner, Sureka, Yan 12 Regression Analysis Skinner, Sureka, Yan 13 Skinner, Sureka, Yan 14 Skinner, Sureka, Yan 15 Skinner, Sureka, Yan 16 Absolute Basis High Low Median Current P/Trailing E 136.5 10.5 14.6 136.5 P/Forward E 21.6 10.6 12.7 20.8 P/B 3.4 .5 2.1 1.1 P/S 3.7 .6 2.5 1.4 P/CF 47.1 7.2 10.3 24.8 EntValue/EBITDA n/a n/a n/a n/a Relative to SP500 High Low Median Current P/Trailing E 7.8 .51 .75 7.6 P/Forward E 1.4 .53 .75 1.3 P/B .9 .3 .7 .5 P/S 1.9 .9 1.6 1.2 P/CF 4.2 .6 .9 2.4 EntValue/EBITDA n/a n/a n/a n/a Skinner, Sureka, Yan 17 Sector P/E P/E close to High end Relatively expensive but may vary by industry Skinner, Sureka, Yan 18 Ratios Across Sector Forward P/E Cheap: Regional Banks 7 6 Expensive: 5 Diversified financial services4 3 Insurance-life/health 2 1 0 Banks High Skinner, Sureka, Yan Diverce Fianacial Services Median Low Insurance-Life/Health Current 19 Market value lower than book value 1.2 Regional banks drop the most 1 0.8 Insurance is almost even P/B 0.6 0.4 0.2 0 High Skinner, Sureka, Yan Median Low Current 20 P/S looks good so far Not the whole story P/S 3.5 3 2.5 2 1.5 1 0.5 0 High Skinner, Sureka, Yan Median Low Current 21 Sector EBITDA Worse than S&P 500 No sign for a break Skinner, Sureka, Yan 22 Industries reflect the Big picture EBITDA 4 3.5 3 2.5 2 1.5 1 0.5 0 Regional Banks High Skinner, Sureka, Yan Diverce Fianacial Services Median Low Insurance-Life/Health Current 23 Recommendation Increase SIM Holdings by 400BPs But, still keep it underweight relative to S&P500 We are bullish for long run and bearish for short run Real Estate-Avoid; Regional Bankstrading at attractive multiples Regional Banks will benefit from long term growth Skinner, Sureka, Yan 24