Autumn 2013 Han Cao Nick Summe Yujie Yuan

advertisement

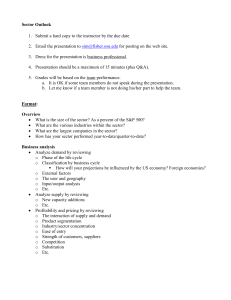

Autumn 2013 Han Cao Nick Summe Yujie Yuan Chengyuan Zhang Agenda Sector Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Market Size S&P 500 Sector Weights Materials, 3.51% Telecommuni cation Services, Utilities, 2.42% 3.14% SIM Sector Weights Consumer Discretionary , 12.46% Information Technology, 17.89% Consumer Staples, 10.09% Health Care, 12.97% Industrials, 10.73% Financials, 16.30% Telecommuni cation Services, Materials, Utilities, 2.11% 2.90% 3.84% Information Technology, 19.10% Energy, 10.49% Consumer Staples, 8.47% Energy, 14.39% Financials, 13.48% Industrials, 8.95% Health Care, 11.90% SIM – Overweight Information Technology Sector 1.21% *As of September 30, 2013 Consumer Discretionary , 14.33% Industry Segments Information Technology Sector Technology, Hardware & Equipment Software & Services Semiconductors & Semiconductor Equipment Internet Software & Services Communications Equipment Electronic Equipment & Components IT Services Computers & Peripherals Office Electronics Software (Application & Systems) *Global Industry Classification Standard Representative Companies Internet Software & Services Google, eBay, Salesforce.com, Visa, Western Union IT Services IBM, Xerox Software Adobe, Oracle, Symantec, Electronic Arts, Microsoft Communications Equipment Cisco Systems, Juniper Networks, Motorola Solutions Computers & Peripherals Apple, Dell, HP, SanDisk, Western Digital Electronic Equipment, Instruments & Components Molex Inc. Semiconductors & Semiconductor Equipment Intel, QUALCOMM, Texas Instruments, LAM Research, Teradyne Inc. Company & Sector Performance Market Cap1 Price QTD YTD Top 10 Companies by Market Cap Ticker (in $billions) (10/14/13) Return (%) Return (%) Apple Inc. 2 AAPL $450.3 $496.08 4.1% (5.0%) Google Inc 2 GOOG $291.1 $873.97 (0.2%) 23.6% Microsoft Corp MSFT $288.9 $34.45 3.5% 31.9% Intl Business Machines Corp IBM $204.2 $186.45 0.7% (1.3%) Oracle Corp ORCL $151.4 $32.23 (2.5%) (2.5%) Visa Inc V $124.6 $193.10 1.0% 28.1% Cisco Systems Inc CSCO $124.6 $23.23 (0.1%) 20.9% Intel Corp INTC $116.7 $23.43 2.2% 17.1% QUALCOMM Inc 2 QCOM $116.4 $67.84 0.8% 11.3% Mastercard Inc A MA $82.9 $687.32 2.3% 40.4% Average: 1.2% 16.4% S&P 500 Information Technology Sector SP500-45 527.31 1.6% 13.7% S&P 500 ^GSPC 1710.28 1.7% 19.9% Over/(Under) Performance (0.2%) (6.2%) 1. Market Capitalization as of 10/14/13 2. Companies included in SIM Portfolio Demand – Life Cycle Internet, Software & Services Growth Stage – Emerging Markets Opportunity for efficiencies & cost savings Technology Hardware and Equipment Mature Life Cycle Is Becoming Shorter Rapid pace of innovation Cyclical Essential for businesses Volatile for consumer luxury items Demand External Factors Sensitive to global downturns Technology adoption in emerging markets Users and Geography Both businesses and consumers High penetration in developed countries (internet, smartphones, etc.) Software piracy is a concern Supply Increasing capacity Greater demand brings new suppliers More commoditized electronic components pressure margin Exception: luxury products, brand name, or operating systems/software Patents & IP Provide leverage over competitors Ex: Google’s acquisition of Motorola Mobility was purchased for it’s patent portfolio; Motorola is still unprofitable Profitability & Pricing Product Segmentation High end vs. Low end consumer products (ex: iPhone 5s vs. 5c) Large company presence in North America & Asia- Pacific Region Barriers to Entry Switching Costs & “Lock-in” Software – Microsoft Product Suite for businesses Customer loyalty and Brand Name Regulations Google in China & Russia Profitability & Pricing Threat of Substitutes Very high for products; more defensible for some software/services Constant innovation and short life cycle Leads to expensive acquisitions and high R&D to maintain market position Competition Most intense for products without brand name or distinct advantage Internet: Winner takes most market Google, eBay, Amazon Giveaways (Google Fiber), link-and-leverage Priority on gaining market share before monetization (Facebook, LinkedIn, Twitter) REAL GDP Consumer Spending Disposable Income Computer & Software Exports: Computers Cellular Telephone S&P 500 Financial Analysis Higher R&D, Earnings are more resilient to downturns Income and Expenses per Share SPX Index Sales Sales Growth (YoY) R&D Expense R&D as % of Sales Earnings Earnings Growth (YoY) S5INFT Index Sales Sales Growth (YoY) R&D Expense R&D as % of Sales Earnings Earnings Growth (YoY) CY 2005 CY 2006 CY 2007 CY 2008 CY 2009 CY 2010 CY 2011 CY 2012 Current CY 2013 CY 2014 826.4 7.5% 28.2 3.4% 74.0 12.5% 878.2 6.3% 30.7 3.5% 85.4 15.5% 951.4 992.3 8.3% 4.3% 31.4 32.0 3.3% 3.2% 84.7 58.7 -0.9% -30.7% 902.2 -9.1% 26.2 2.9% 61.2 4.3% 940.9 1,021.0 1,071.1 1,097.2 1,123.3 1,174.0 4.3% 8.5% 4.9% 2.4% 4.9% 4.5% 27.1 27.8 30.0 32.4 2.9% 2.7% 2.8% 2.9% 83.4 98.7 101.1 103.9 110.7 122.9 36.3% 18.3% 2.4% 2.8% 9.5% 11.1% 130.2 8.7% 11.2 8.6% 15.0 15.1% 133.9 2.8% 11.8 8.8% 15.0 -0.1% 146.4 9.3% 12.9 8.8% 17.6 17.1% 140.2 -8.7% 12.7 9.1% 16.5 -7.1% 163.1 16.4% 13.1 8.0% 25.7 56.2% 153.6 4.9% 14.1 9.2% 17.7 0.8% 189.6 16.2% 15.3 8.1% 31.0 20.5% 203.6 7.4% 17.4 8.5% 32.0 3.2% 204.2 0.3% 18.4 9.0% 32.0 0.2% 211.4 3.8% 222.9 5.4% 37.9 18.5% 41.7 10.2% Information Technology Margins vs. S&P500 Information Technology Industry Margins Information Technology Industry Margins Return on Equity Financial Analysis--Information Technology Financial Analysis--Application software Financial Analysis--Microsoft Financial Analysis--Computer Hardware Financial Analysis--Apple Financial Analysis--Semiconductors Financial Analysis--Intel Financial Analysis--Internet Software & SVC Financial Analysis--Google Valuation Analysis -- Sector Valuation Analysis -- Industry Valuation Analysis – Industry Valuation Analysis – Industry Technical Analysis Recommendations Sector Opportunities Potential high earnings growth Earnings are resilient during economic downturn High profit margins Trade below historical average Sector Risks Sustainable growth Services industry overvalued Economic risks Recommendation: Stay at current weight and diversified