Document 11015038

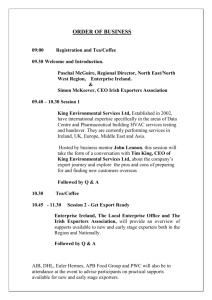

advertisement