The Future of Irish Whiskey

advertisement

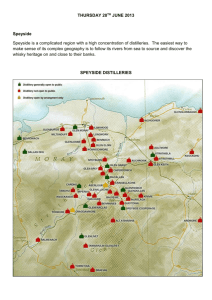

The Future of Irish Whiskey About this report This report has been produced in association with The Futures Company and it will explore the opportunities and challenges for the Irish Whiskey category over the next two to five years. This report is based on our analysis of macro-, meso- and microlevel trends shaping consumer behaviour and the future of the Irish Whiskey category. Our understanding of these trends has been informed by expert interviews, consumer and market data and qualitative insight. Futures techniques have been used to identify and explore potential opportunities as drivers of change, and to see how they combine to influence the whiskey category in different ways. This report focuses on emerging opportunities for the whiskey category and distillers in Ireland specifically. However, given the long-term nature of the category, we have also referenced other longer term drivers of change that may disrupt or shift the category in the next five to 10 years. This report will refer to ‘whiskey’ when indicating produce made in Ireland, and ‘whisky’ for all other varieties produced outside of Ireland, as well as when referring to the category as a whole. © 2013 Bord Bia, The Futures Company Building on The Future of Alcoholic Drinks The Future of Alcoholic Drinks, produced by The Futures Company for Bord Bia in 2011, explored how the alcoholic drinks industry could evolve to 2025, and emerging opportunities for Irish manufacturers. Eight forces of change were highlighted in this previous report, and three of these forces are of particular relevance for the future of the whiskey category: Competition for Provenance, Mainstreaming of Connoisseurship and New Forces of Global Demand. “Competition for Provenance” highlights how consumers have become sceptical towards near identical stories of authenticity and copy-cat provenance claims. Instead, they are looking for more local provenance rather than national, to differentiate the local identity of products. This report will demonstrate how a local anchoring of whiskey is crucial for developing overall whiskey character and differentiation. “Mainstreaming of Connoisseurship” illustrates how a more discerning attitude towards alcoholic drinks will become mainstream. There will be an emphasis on ingredients and production and the overall sensory profile of a product will be much more important. This report will outline the vast range of future opportunities within whiskey taste profiles. “New Forces of Global Demand” outlines the future influence of emerging markets in securing growth. It also highlights the potential for smaller manufacturers to partner with larger players to enter new markets. This, we will argue, will be an essential step to ensure future growth in the whiskey category. © 2013 Bord Bia, The Futures Company Competition for Provenance Mainstreaming of Connoisseurship New Forces of Global Demand Setting the scene The global success of spirits has continued despite the uncertain economic times Spirits have continued to outpace other alcohol categories globally, proving resilient in the face of on-going economic uncertainty. The stellar success of the whisky category sits within the context of a broader boom in spirits. Despite the global economic crisis, the spirits industry has demonstrated strong growth in terms of volume and value. Global brandy and whisky sales increased in volume by 7.1% and 2.8%1 respectively from 2011 to 2012 compared to global beer consumption increasing by less than 2%2 and wine showing no change.3 There has been a mixture of positive and more negative stories across dark and white spirits, which is evident in the table below. Spirit Consumption % Chg 201120121 Whisky +2.8 Gin -3.5 Vodka +0.3 Tequila +4.8 Rum -0.5 Brandy +7.1 Global Consumption by product category: ‘000s 9-litre cases Source: 1) IWSR Data 2013; 2) International Organisation of Vine and Wine, 2013; 3) Canadean Consulting, 2013; 4) IWSR Data, 2013; 5) Euromonitor International, 2013; 6) IWSR Data Volume 000s 9 LC, 2013 © 2013 Bord Bia, The Futures Company The success of spirits globally has been underpinned by two key drivers. Firstly, premiumisation, driving value as well as volume growth and secondly, the rise of the middle-class consumer in emerging markets, increasing global demand for spirits. In mature spirits markets (and to a lesser extent, emerging markets) increasing consumer sophistication is driving a trend towards premiumisation. There is a rising trend amongst wealthier consumers in established spirit markets to seek out interesting and new premium products and to trade up to drinks of a niche variety (with high production value). As a result the volume of the premium spirits category increased by 5.5% from 2011 to 2012, while standard spirits only grew by 1.4%.4 Emerging middle-class consumers, with rising incomes and burgeoning aspirations, are fuelling the growth in consumption of many spirit categories. The global economic crisis has taken its toll on certain markets more than others. For those experiencing a positive economic trajectory and a rapidly growing emerging middle-class – such as China, Taiwan, South Korea and Vietnam – the social transformations emerging from rising disposable incomes are significant. Consumer expenditure on alcoholic drinks is expected to increase from 2012-2013 by 16% in Vietnam and by 10% in both India and China.5 Furthermore, although the consumption of gin and vodka has decreased globally (see table), there has been dramatic growth of these white spirits in emerging markets, such as China, South Korea, Indonesia and Malaysia. Vodka and gin consumption have grown 56% and 62%, respectively, in South Korea from 2011 to 2012.6 In recent years whisky has been taking centre stage amongst spirits globally The hugely positive global outlook for whisky is supported by the core drivers underpinning the broader spirits boom. Whisky has been winning against other players in the sprit category globally. This is a trend that is expected to continue, as total whisky volume growth will outpace key dark and white spirits such as rum, tequila and gin to 2016.1 Indeed, amidst the markets worst affected by the recent financial crisis, whisky has gained an almost recession-proof status. Global consumption of whisky grew 2.8% CAGR from 2011 to 2012, compared to -0. 5% for rum and 0.3% for vodka (‘000s 9-litre cases).2 The same forces of change underpinning spirits combined with the increasing accessibility of the category, are fuelling whisky's strong growth. Consumers have become more engaged with an increasingly accessible category. Global brands like Jameson, well-known for their smoothness on the palette, are becoming a gateway into the category. In addition to this, the portrayal of whisky in popular culture has helped shift the image Source: 1) IWSR Database, 2011; 2) IWSR Data, 2013; 3) Ipsos, 2013; 4) Just Drinks, 2012 © 2013 Bord Bia, The Futures Company of the category away from an ‘old man’s drink’ and opened it up to new audiences. The category is being expanded in value and volume terms, by premiumisation and more sophisticated value offerings. The category has expanded to meet the needs of a more sophisticated and demanding consumer. The top two premium spirit brands, in terms of sales value in 2012, were whiskies: Johnnie Walker and Jack Daniels.3 New producers from a wide variety of markets are emerging, many from non-traditional whisky markets, such as Wales, Croatia and Taiwan, making whisky a truly ‘global drink’.4 There is also an expansion of the category at the value end of the spectrum. Own-label offerings have improved their quality and compete with established brands; and in some cases perform better than them. Aldi’s private label, Highland Earl Black Label Scotch, was awarded Gold at the International Wine and Spirits competition in 2013. The world economy is shifting to the South and East; and with this, emerging markets are becoming key drivers of export growth. Emerging consumers associate whisky with aspirational value. The high social cachet around Scotch single-malt has fuelled its global demand to such an extent that demand is now outstripping supply in some markets. “It seems to me like there is almost an insatiable demand for high quality whisky and I don’t see that changing in the next 5 or 10 years” Steve Uri, US Whisky Expert An increasingly sophisticated consumer is fuelling a long-term premiumisation trend in established whisky markets A more sophisticated and demanding consumer is emerging in mature spirit markets, as well as in established whisky markets. As consumers in established whisky drinking markets become more knowledgeable about the category, they are demanding more complex and sophisticated propositions and taste profiles. For example, 88% of consumers now consider spirits an affordable luxury.1 This is driving producers towards more premium and super-premium offerings. South Korea is the world’s top consumer of super-premium whisky (aged 17 years or over) and it has repeatedly ranked in poll position for 11 consecutive years.2 In the US, super and ultra-premium whisky brands increased Brown-Forman’s net sales by 11% throughout the 2013 fiscal year and future growth is predicted to continue from the premium elements of its portfolio.3 There has also been strong growth for distillers who have been extending their portfolio through super-premium varieties. Isle of Arran Distillers has promoted fastselling limited-edition labels from singleSource: 1) Ipsos & Neilsen 2009-Present, 2013; 2) The Marmot’s Hole Blog, 2012; 3) Kentucky.com, 2013; 4) Just Drinks, 2012 © 2013 Bord Bia, The Futures Company cask varieties4, such as their Devil’s Punch offering (see box), which is driving interest into the company. In the established vodka belt countries of Central and Eastern Europe there has been an emerging shift from white to dark spirits. This is partly due to a fatigue with white spirits and partly due to the excitement around discovering something new and interesting, with a more masculine feel and distinctive flavour; whether that be rum, cognac or whisky. In other markets, the micro trend of craft distilling and artisanal varieties, particularly in the US, is driving the demand for unique and bespoke varieties. Their local roots and niche scale makes these products appealing to consumers who are looking for something nobody else has a more premium variety (see box). “ [Consumers] want something to show to their friends that is unique and not available in every supermarket in the world Euan Mitchell, Isle of Arran MD ” Isle of Arran’s second edition, Devil’s Punch Bowl, had already allocated it’s 6,000 bottles a month after release. The Brora single malt Scotch distillery closed in 1983, adding to the rarity value of the whisky and creating a ‘cult status’ amongst connoisseurs. The world’s focus is still shifting to the South and East, and their aspirational middle-class consumers continue to trade-up Emerging middle-class consumers in the markets least affected by the financial crisis are increasingly able to afford more premium whisky products. As disposable incomes continue to increase on a relative scale not seen before, the aspirational middle-class segment is looking to trade up and purchase better quality products that were not previously affordable. This is specifically relevant to the younger demographic who have relatively more income than their parents did at the same age, especially in urban areas.1 The social cachet surrounding the heritage and tradition of whisky, especially Scotch single malt, is extremely strong in markets such as China, South Korea and Taiwan. In Latin America and Eastern Europe it is the blended Scotch brands which are seen as a significant trade up from local spirits.2 These aspirational perceptions are fuelled through the exclusivity of whisky clubs and festivals, as well as increased visibility in specific types of on-trade venues. Single malt Scotch dominates in emerging markets and category dynamics are working to increase its cachet even further. Source: 1) BBC News Online, 2012; 2) Euromonitor Report, 2012 © 2013 Bord Bia, The Futures Company The shortage of malt and long lead times are causing malt producers to hold on to stocks rather than use them in blended malt Scotch products. This is because there is a high value market for the single malt Scotch. As a result, the blended malt Scotch category has been perceived as less premium than single malt Scotch and the category is slowly declining. Diageo, for example, has withdrawn its blended malt Scotch, Johnnie Walker Green label, from the US and Taiwan (see box). As a result, demand exceeding supply is actually increasing the perceptions of rarity in certain parts of the category. “ Scotch symbolises the international Western style spirit and the whole lifestyle that goes with it. If you ask a Chinese consumer to choose an international spirit, they will choose Scotch Eric Benoist, Chivas Brothers MD ” Johnnie Walker Green label is being discontinued as the blended malt Scotch category is in decline. Heavily demanded single malts are being prioritised over blended malts. The appeal and accessibility of whisky is expanding its reach The whisky category has opened its doors to new audiences, occasions and rituals. The established stereotypes of typical whisky drinkers are shifting. Whisky was once nicknamed the ‘old man’s’ drink, but a number of factors have been disrupting this dated stereotype. Media and popular culture have been key influencers. Mad Men and Boardwalk Empire have made an ‘old-fashioned’ attractive again and celebrities like Lady Gaga have endorsed whisky brands across all types of media globally.1 A number of whisky producers have demonstrated dynamism through embracing new formats, flavours and occasions. From Japanese highballs to cherry flavoured Bourbon, the accessibility of the category is attracting consumer attention. However, the premium end of the category is likely to be wary of eroding brand equity or quality perceptions through these types of format. The competitive set is also widening and although new varieties are still niche, they are beginning to challenge the premium offerings of established global brands. New Source: 1) Euromonitor Report, 2012 © 2013 Bord Bia, The Futures Company whisky producers are emerging all over the world in Japan, Croatia, Spain, Sweden, Taiwan, Romania, New Zealand and China. These new competitors are also stretching the value spectrum. As a result, the increasing number of varieties are appealing to a wider range of palettes (see box). “ [We] have seen a democratisation of whisky – it has had an image shift from being seen as an ‘old man’s drink and it has recruited many younger drinkers. Implicit sophistication, which was once off-putting, is now quite appealing ” Brendan Buckley, Innovation and Category Development, Pernod Ricard Swedish Mackmyra whisky casks are saturated with cloudberry wine, appealing to different palettes. Long-term trends Despite a positive outlook, there are some long-term trends that may impact the ability to realise new opportunities Despite the overwhelmingly positive outlook for whisky globally, there are a number of emerging social, environmental and political macro forces which could influence the category over the next five to 10 years. Given the forward-facing nature of the category and the need to make decisions today that will impact production in the next 10 to 15 years, it is important to bear in mind these shifts when taking a longer term view. “ It's the foresight of my great-grandfather, grandfather and father that means we can now sell a 70-year-old malt… At the time, everyone else thought it was absurd. But it does feel odd to think that some of what we're doing now may not see the light of day until after I've retired Neil Urquhart, Gordon & MacPhail, Whisky Specialist © 2013 Bord Bia, The Futures Company ” Long-term health concerns could impact alcohol consumption and accessibility Although pure alcohol consumption levels have remained stable worldwide, in some markets consumers are choosing to drink less, mainly for health reasons. Increased health concerns mean that consumers are more conscious about their drinking behaviours. The long-term trend will focus on both governments and consumers increasingly clamping down on the health and social impacts of excessive alcohol consumption. There may also be a renewed interest on the part of consumers to pair food with whisky in order to reduce the negative effects of alcohol. There is increasing awareness of the social costs of alcohol misuse to individuals, communities and governments. These include costs for healthcare associated with binge drinking, associated social work, public safety (fire and rescue), motor accidents, criminal justice and employment absenteeism. The Irish Department of Health estimated the cost of alcohol-related harm to society at €3.7 billion annually.1 Alcohol control policy is firmly on the WHO agenda. negative impacts of excessive alcohol consumption in certain markets. In Russia the government is raising taxes on beer and making efforts to limit venues where it can be sold3 and minimum alcohol pricing4 has been set in Scotland. Another key concern for governments is the rising cost of lifestyle diseases, such as obesity. There is an increasing focus on legislation around calorie labelling on food and drink and the Irish government recently took a decision to prepare legislation requiring the inclusion of calorie content on alcohol labels. “ New legislation is restricting alcohol consumption in order to negate the Source: 1) http://www.dohc.ie/publications/pdf/Steering_Group_Report_NSMS.pdf?dir ect=1 © 2013 Bord Bia, The Futures Company People are lobbying around alcohol globally because of health risks associated with it… It will become more of an issue with regards to labelling and taxing on spirits. It has to be concern for our 40% bottle of whisky or full fat cream liquor. It will definitely be more of an issue in the next 5, 10, 20+ years Jack Teeling, The Teeling Whiskey Company ” The slowing BRIC economies could reduce the global demand for whisky The BRIC markets are beginning to experience a slow down in their economies. Home to a large population of aspiring middle-class consumers, lower GDP growth could lead to a reduction in the export demand for whisky from these nations. The economies of Brazil, Russia, India and China have started to slow down. This has been driven by high inflation, particularly in India1 and Brazil,2 and the impact of a slowing global economy overall.3 China’s government in particular is aiming to rebalance the economy away from an over-reliance on exports and investment towards domestic consumer spending.4 This change also echoes a longer term value shift in emerging markets, from material to non-material wealth. For example, in China there has been a rising backlash against the ostentatious demonstration of wealth and the rise of the anti-corruption movement.5 A large percentage of whisky consumption in China is through corporate gifting by wealthy state entities and officials and this social shift could have an impact on the overall volumes of whisky consumed. Source: 1) Times of India, 2012; 2) Bloomberg, 2013; 3) BBC News, 2013; 4) BBC News, 2013; 5) Newsmax, 2011 © 2013 Bord Bia, The Futures Company The growth still taking place in the BRICs is significant when compared to much of the developed world, but this economic slow down marks a potential threat to absolute volume growth for whisky. Although these markets are not specific destinations for Irish Whiskey at present, this highlights that future growth in these markets may be a challenge. “ “Brazil is going through a period of slow growth and fast inflation – a period of stagflation…The weak data on consumption will spark debate that this could be more prolonged than expected ” Marcelo Salomon, co-head for Latin America Economics at Barclays Plc. Increasing pressure on natural resources could impact some of whiskey’s key ingredients and production processes Environmental concerns over climate change and land use could create future sustainability challenges around supply chains and cost structures. The on-going irregularities in climate change are impacting local crop harvests, which are increasingly subject to extreme drought and also erratic flooding. This will obviously impact the crop supplies available for whiskey production, and therefore affect the overall supply chain. There are also on-going discussions between governments and alcohol distillers concerning the use of precious land space to grow what is considered a non-essential consumer product. Any impact on crop areas will influence the overall supply of grains, which will therefore have an affect on crop price. Increased scarcity of certain crops are already pushing grain prices higher. Any rise in price of the grains used in whisky production will therefore impact overall production costs, which could create cost challengers for distillers. Source: 1) Whisky News, 2012 © 2013 Bord Bia, The Futures Company “ With the crops being poor in Scotland in 2012, the price of malted barley was expected to increase from £300/tonne to around £350 in 20131 ” This shows how environmental issues and concerns could come to bear on the industry and could potentially disrupt the future of whisky production. However, there is an opportunity for the whisky production process to embrace more sustainable practices, but also to give back to the local environment. For example, there is growing interest in converting whisky by-products into biofuel energy, as a way of creating a renewable energy source and therefore create a closed-loop production process. A commitment to sustainable whiskey production processes in Ireland will connect well with Origin Green; “making Ireland a world leader in sustainably produced food and drink” Regulatory control could drive category growth, but too many rules could also stifle it While strengthening industry regulation is required to safeguard the integrity of whisky coming from designated regions, such as Scottish and Irish, there are concerns that protection could stifle innovation. If the Irish Whiskey category is going to grow and expand, consistent quality will be key. There is an opportunity for strengthening existing legislation to ensure that all distillers are producing Irish Whiskey according to set specifications (specific % amount of grain, etc.). This is what the Scottish Whisky Association (SWA) has done in Scotland. Furthermore, recent legislation will mean that Scotch whisky producers will soon be expected to apply to the UK Government to have their brands verified as originating from Scotland1 The Irish Whiskey Act of 1980 does not actually contain a definition of the terms “single malt Irish Whiskey” or “single grain Irish Whiskey” or specific rules governing production. In addition, the new Irish Whiskey Association (IWA) is a lobbying body without any authority to enforce regulation. Therefore, the legislator has a Source: 1) Just Drinks, 2013 © 2013 Bord Bia, The Futures Company role to strengthen the existing legislation around whiskey production. However, there will be a need to find the right balance between strengthening regulation and allowing the category to have the freedom to create its own rules. “ As an industry we need to be very clear on quality and observation of the rules of what makes an Irish Whiskey ” Brendan Buckley, Innovation and Category Development, Pernod Ricard Establishing a role for Irish Whiskey Despite potential future challenges, there is an opportunity for Irish Whiskey to tap into the category’s overall growth Irish Whiskey is the fastest growing subsection of the entire whisky category globally. Global consumption of Irish Whiskey increased by 10.5% from 2011 to 2012 compared to the whole whisky category growth of 2.8%.1 Having moved on from a turbulent past of technology challenges, political struggle and the infamous prohibition era (which left the spirit dwarfed by the success of its Scotch cousin), Irish Whiskey is beginning to experience a renaissance. Jameson has played a critical role in this success. It is seen as the engine behind the growth, generating excitement through its shot formats and driving exposure through significant exporting to the US. Jameson is Ireland’s strongest export brand, accounting for around 3.4 million of the five million cases exported annually.2 At the same time, independent producers, such as The Teeling Whiskey company, are reinvigorating the Irish category by creating new and innovative varieties of Irish Whiskey. The category is expanding from a small base. Irish Whiskey accounts for only 2% of Source: 1) IWSR Data, 2013; 2) Irish Examiner, 2012; 3) IWSR Database, 2013; 4) IWSR Database, 2011 © 2013 Bord Bia, The Futures Company global whiskey volume, compared to 26% from Scotch.3 There is significant potential to expand the category by those willing to invest. Indeed, the future looks positive; Irish Whiskey has the highest predicted volume growth rates of global spirits, outpacing even vodka to 2016.4 Lessons can be learnt from whisky drinking markets around the world when it comes to establishing a role for Irish Whiskey. The next section will examine key whisky drinking markets to understand the key learnings for success in these different locations. “ Jameson is indisputably the engine of this train, with 76% of Irish Whiskey sales in the US, representing about 86% of growth ” Hannah O’Leary, brand ambassador for Jameson The US: Home of the accessible Bourbon variety The US is the biggest export market for Irish Whiskey, largely driven by the deeprooted connection of the Irish diaspora community living in the US. There has been a recent re-birth of bourbon, the locally-produced whisky in the US. The beginning of this resurgence can be traced back to Japan in the 1980s. At that time, the first single-barrel bourbon was only available in Japan and as a new generation of young Japanese drinkers wanted to try something different from the Scotch preferred by their parents, its popularity began to increase. Young consumers wanted to find a premium drink of their own. Bourbon sales in the US had been fairly low before the 80s, so a lot of bourbon sitting in barrels in Kentucky warehouses was slowly ageing. When Beam released its small batch specialty bourbons in 1992, Japanese consumers bought large amounts and the trend for bourbon trickled back to the US where there was still a good supply. • Bourbon is currently experiencing a rejuvenation due to new marketing efforts from Jack Daniels, but also due to the mixology • influence sweeping the US, spurred on by the increasing presence of whisky cocktails in popular culture, as well as the emergence of leading edge bars. This is making whisky more © 2013 Bord Bia, The Futures Company accessible to new audiences. Bourbon distillers have also embraced new flavours – honey, cherry, maple and cinnamon – have become the most recognised in connecting to new audiences and are strong examples of bourbon's accessibility. The demand for authentic, locally produced goods, for which bourbon connects strongly, is also another key factor for growth. Recent years have seen the rise of American craft whisky. Craft distilleries are experimenting with certain types of techniques – from stills to barrel sizes – and craft whiskies are often priced higher than older whiskies from major distillers. KEY LEARNINGS FOR SUCCESS Reinvigorating a declining category by appealing to a new generation of drinkers with new formats can significantly drive volume growth and exposure. Tapping into broader consumer trends around authenticity and craft production, and leading edge culture can buoy volume growth. THE REJUVENATION OF BOURBON Bourbon’s growth over the last five years has been significant. The category has refocused on high quality products and variety as a way of premiumising the product. The mixology wave has fuelled the accessibility of the spirit, making it topof-mind and a key ingredient in the fashionable whisky cocktail. Also the increasing demand for local, authentic products has supported growth of the category. Japan: The innovative single malt The last decade has seen Japanese whisky explode onto the global stage and challenge Scotch’s dominance in the category. Japanese whisky is similar to the Scotch single malt variety. Historically, Japanese distillers travelled to Scotland to learn the Scotch distilling practice, and took this knowledge back to Japan. Whisky production in Japan started around 1870, but the first distillery opened for commercial production in 1924. There are now 10 whisky distilleries in Japan and the most well known producers are Suntory and Nikka. Suntory is a three-time winner of “Distiller of the Year” award at the International Spirits Challenge. Some of the subtle differences between Japanese and Scotch, such as the water used and its compatibility with Japanese food, are being emphasised as strong selling points for Japanese single malt. Japan is now the second greatest producer of single malt whisky in the world after Scotland, and it is starting to gain exposure in Europe – France, Sweden and Norway – as well as winning prestigious international awards. However, 95% of what is produced is still domestically consumed.1 Source: 1) Euromonitor Report, Whiskies: Growth opportunities in all markets, 2012 © 2013 Bord Bia, The Futures Company The main drivers behind its domestic popularity are the increasing demand from a younger Japanese demographic and format innovation. A new audience of young, male urbanites has been embracing the ‘highball’ whisky and soda cocktail format . One of the key advantages that Japanese whisky has over Scotch, looking into the future, is that there is a large supply to meet a rising demand; something which the Scotch market is struggling to create. KEY LEARNINGS FOR SUCCESS • • • Innovation within the single malt category can turn the traditional Scotch format on its head – unique and local differences of a whisky profile can be celebrated – such as the water used in production. New formats, such as the ‘highball cocktail”, can drive significant volume growth and reinvigorate the category. Investing in quality control and waiting for the right moment to release high quality whisky when demand is high can generate high value growth. A RISING STAR AMONGST SINGLE MALTS Although investment in Japanese single malt began in the 1920s, it has only recently started to attract attention in the last decade, mainly due to the commercial efforts of Suntory. For example, they were one of the first Asian companies to employ American celebrities to market their products, they operate two museums in Japan to promote social and cultural programmes across the country. The slogan of Suntory’s whisky division is “The art of Japanese whisky since 1923” Russia: Slowly shifting from vodka to whisky Whisky is the fastest growing spirit in Russia – it grew by 48% in 2012.1 The significant upheaval in the spirits category is creating new opportunities for whisky producers. hosting golf events and tastings at yacht clubs to win attention with its target clientele. Premium elite-class retail grocery chains are on the rise in Russia, such as Globus Gourmet in Moscow. Globus has focused on amplifying the physical appearance of whisky and placed it centre stage, while shelves of vodka have been relegated to the sides. These are the outlets where people with higher disposable incomes shop.3 Russia is traditionally a spirit-drinking nation, but there is an emerging fatigue with vodka. As Russians try to sever all connections with its Soviet past and move into a more Western world, premium whiskies and tequila are winning.2 Despite the government’s recent focus on reducing alcohol consumption for health reasons, whisky producer Beam has expanded into Russia with success.2 Beam has targeted aspirational drinkers whose taste buds are favouring whisky over vodka and who also have an appreciation for Western culture, so are more likely to purchase imported varieties. The alcohol legislation that is emerging is also more focused at the most affordable end of the spectrum and is therefore having less of an impact on higher-end, imported spirits. Beam is also creating more unconventional methods of gaining brand exposure. ‘Blind taste tests’ are set up in bars to compare Jack Daniel’s and Beam, and Beam is also Source: 1) IWSR Database, 2012; 2) BusinessWeek, 2012; 3) Ostoenko, N., 2010 © 2013 Bord Bia, The Futures Company CHANGING WHISKY RETAIL KEY LEARNINGS FOR SUCCESS • • • There is an opportunity to connect with increasingly sophisticated consumers who are looking to try something new and different. The shift from white to dark spirits in some markets creates an export opportunity for the category. Below-the-line marketing can effectively target consumers. India: Moving from domestic demand to imported premium India has a strong history of producing and consuming Indian-made ‘whisky’, but rising incomes are leading middleclass consumers to spend more on the imported luxury and premium whiskies. The domestic ‘whisky’ made in India does not meet the European definition of whisky, and cannot carry the category name if imported to the EU. As a result a comparison between the Indian liquor and imported whiskies is not possible. However, the history of consuming this Indian-made liquor helps to explain the accustomed taste to whisky, and therefore the rising demand for imported whisky. were 27.6 million. 3 A potential barrier to growth in the future is import tariffs, which are higher in India than in other emerging markets. The World Trade Organization’s efforts to decrease taxes on imported alcohol from 550% to 40% in India is still in process.1 This means that only the very top echelons the middleclass can currently consider buying Scotch whisky. Indian consumers are aspiring to imported whisky varieties, such as Teacher’s and Whyte & Mackay, which are seen as premium and aspirational varieties.1 KEY LEARNINGS FOR SUCCESS Premium and super-premium brands have seen a growth rate of around seven percent in 2012.2 • Additionally, a number of foreign producers are promoting consumer education of imported whisky through Scotch tasting sessions in Mumbai and Delhi. • In 2012 the single malt category grew 20% in India.2 In 2012, Scotch exports to India Source: 1) Euromonitor Report, Whiskies: Growth opportunities in all markets, 2012; 2) Livemint, 2012; 3) Business Insider, 2013 © 2013 Bord Bia, The Futures Company Premium and super-premium positionings are likely to win in emerging markets where increasingly sophisticated consumers are looking to trade up. Events to promote expose to the category, such as whisky tasting, can dramatically increase volume growth. LAUNCHING PREMIUM VARIETIES The whisky producer Beam launched Teacher’s single malt at about Rs 4,000 (around £40) a bottle in India. The category is growing at 30% for the company in India. Around the same time, it also launched Teacher’s 25 year old, a blended Scotch priced at Rs 26,230 (around £260) in Delhi. Irish Whiskey can learn from other markets in order to create its own point of differentiation Case studies into different whisky markets can identify key learnings to consider when thinking about the future of the Irish Whiskey category. They can also highlight how each type of whisk(e)y leverages its own point of differentiation within varying markets. In the US, Bourbon whisky is differentiated by its accessibility. It has embraced the mixology trend and its wide variety of flavour combinations makes the whisky accessible to new audiences. In Japan, the single malt whisky can be associated with innovation. It has taken the traditional Scotch model and molded it to its unique climate and geography, using its distinguished taste profile as a key differentiator from the original Scotch variety. In Russia, whisky is seen as a more exciting choice amidst a saturated vodka market. It is associated with complexity and sophistication by aspirational consumers. In India, Scotch imported whisky is strongly connected to premiumisation and meeting the needs of wealthier and more knowledgeable consumers. © 2013 Bord Bia, The Futures Company Irish Whiskey therefore needs to identify its unique point of differentiation, and this should align on an emotional level, with the Irish culture and temperament. When thinking about Irish identity, one of the elements that stands out is versatility. The Irish population is one that has had to adapt to the peaks and troughs throughout its history; from the early potato famines, the English occupation of Ireland and the most recent boom and bust of the Celtic economy - versatility is an important way of life. Versatility is also a credible entry point for Irish Whiskey due to its liquid profile and smoothness on the palette, which enables it to be accompanied by many flavours and occasions. This more fluid personality connects with the down-to-earth and open-minded attitude of Irish people. These flexible qualities permit Irish Whiskey to set itself apart from the more traditional and stoic characteristics of Scotch whisky. Accessibility Sophistication Innovation WHISKY POINT OF DIFFERENCE Premiumisation The future of Irish Whiskey There are a number of important foundation blocks that the Irish Whiskey category must address in order to secure its future growth In the face of emerging competition and to secure growth in new markets, Irish Whiskey must create and communicate a clear, distinctive and inimitable USP for the category. emotional connection with the category. ‘Monkey Shoulder’ whisky (see box) is a good example of this, where stories of the past link the whisky back to its historical roots. The enduring strength of Scotch’s category image and the emergence of new players to the category could potentially limit Irish Whiskey’s expansion if it is not able to create a compelling identity that sets it apart from other whiskies. Portfolio plays a key role in supporting and building this affiliation to the the category. To build affiliation, the category needs to consider what captivating stories can be told that will set Irish Whiskey apart, as well as the most compelling ways to tell the stories. This affiliation could come from two places: the tangible linking of the production process to the unique characteristics of Irish Whiskey and/or the intangible mystique of the category and its historical origins. Midleton’s positioning around ‘Redbreast’ pot still Irish Whiskey (see box) clearly demonstrates a more tangible connection. It is not celebrating the tradition of the process for tradition’s sake, but for the unique depth of flavour that pot still distilling gives Irish Whiskey. On the less tangible side of building affiliation, stories can create a deeper © 2013 Bord Bia, The Futures Company As drinkers become more sophisticated and new whiskey audiences emerge, increasing the variety, interest and complexity of the category will be a key focus for distillers (see box). The role of the portfolio will be increasingly important - rather than focusing on one single product, a wider offering of products will keep existing drinkers engaged and also build a connection with new drinkers. Future growth of the category will depend on a ‘co-operative’ relationship between larger and independent distillers. Independent distillers can complement the volume growth and category exposure that can be achieved through larger distillers and their economies of scale, by adding character to the Irish category. As a result, a synergistic relationship of ‘co-opetition’ is needed between the larger and independent whiskey distillers in Ireland to build the category fit for the future. The name of the whisky ‘Monkey Shoulder’ relates to the injury suffered by workers as a result of turning the malt during production. The Scotch brand is one of the last in the world to still use this technique, and the name evokes this historical connection and story. Midleton’s ‘Redbreast’ positioning focuses on rejuvenating the traditional spirit of Irish pot still distilling. Pot still is unique to Ireland and stands apart from other whiskeys with a unique taste profile. The Teeling Whiskey company’s Poitín is a niche product with the aim to add variety and character into the portfolio, through celebrating an ancient Irish spirit and recognising the history of Ireland. There are three potential growth platforms to secure a role for Irish Whiskey now and in the future Native personality Maturity Matters Flavour Complexity © 2013 Bord Bia, The Futures Company Native Personality Leveraging ingredient origin and distillation environment to create a unique whiskey flavour profile There is a significant opportunity to leverage the ingredients and distillation environment specific to geographical location in Ireland in order to build unique flavour profiles for whiskey. In Scotch whisky, flavour profiles are already attached to designated regions, such as the peaty notes from the Isle of Islay, for example. This opportunity remains largely untapped for Irish Whiskey, where there are only five distilleries in the country, compared to around 100 in Scotland. To classify as ‘Irish’, whiskey must be matured on the island of Ireland for at least three years, exposing it to a unique climate. The raw Irish ingredients, such as water and grain, as well as the climate and distillation process, provide an opportunity for brands to stand apart from other whiskies and be famous for a certain personality or taste profile derived from the place of origin. As the Irish Whiskey category grows and develops, flavour and character profiles will distinguish one brand from another. Native personality will permit Irish Whiskey to stand out from other whiskeys and be famous for unique taste profiles designated to Irish origin. “ If you build a replica Irish Whiskey distillery in Scotland and used the same ingredients to produce the same spirit, it would more than likely taste the same. But after leaving it in Ireland for three years to mature I can guarantee the whiskey would taste different. Jack Teeling, The Teeling Whiskey Company © 2013 Bord Bia, The Futures Company ” Early Indicators Nine Leaves distillery, in Japan, draws water from the natural spring deep underground that runs off the Biwako tributary. The water has a low PH and is very pure - qualities which transform the unique taste of the whisky. Penderyn single malt whisky promotes its geographical location in Wales. It celebrates that it is produced in a UNESCO region of geological heritage, with specific reference to the unique type of water and wood used; and has created the series ‘icons of Wales’ where each bottle commemorates a person, milestone or event from Welsh history. Slane Castle Irish Whiskey is set to be released in 2015, and will use barley from the castle estate and water from the river Boyne – ingredients unique to the area. It also promotes a closed-loop production cycle, where byproducts of the production process are used for on-site energy generation, as well as animal feed. Native Personality Implications for Irish Whiskey brands • Distilleries need to identify from the area of production the unique personality characteristics of Irish Whiskey that allow it to stand apart from other whiskies. • Brands need to understand and effectively communicate the link between place of origin and the unique taste and character profile by building it into the story and soul of their brand. • Through the distillery location and the local sourcing of ingredients, brands can create something that is inimitable. © 2013 Bord Bia, The Futures Company Flavour Complexity Looking to casks and processes to naturally expand the flavour complexity of the category There is an opportunity to build affiliation with sophisticated whisky drinkers, as well as new audiences, by meeting the demand for new and interesting flavour profiles. Different levers can be pulled to tap into this opportunity: • Filtering and distillation – experimenting with chill filtering to balance the ‘impurities’ that impart flavour for example • Cask materials – types of wood and casks coated with other spirits As whiskey producers continue to experiment with these levers, the result can shift the depth and breadth of flavour profiles. This expansion of flavours will make the whiskey category more creative and, as a result, more accessible to new and existing whisky drinkers. Flavour complexity will give Irish Whiskey the opportunity to show off its versatility and creativity, increasing its exposure in the category with both existing and new audiences. “ I think there is a way to do more interesting flavouring as innovation Steve Uri, US Whisky Blogger © 2013 Bord Bia, The Futures Company ” Early Indicators Compass Box created a limited edition whisky called “The Entertainer” with a more sophisticated blend. It connects back to the 20th century when blends contained higher proportions of malt whisky and where the whiskies were more peaty in flavour. Chivas Regal Mizunara uses the famous Japanese oak (mizunara) casks, which impart hints of incense, appealing specifically to Japanese palettes. This is the first time a Scotch blended whisky has incorporated mizunara to create a deeper taste profile. Bruichladdich is made from 100% Scottishgrown organic chalice barley and is non-chill filtered and uncolored, to develop extra flavour and texture. Maturity Matters Rethinking the rules around ageing and maturity As the demand for whisky around the world increases beyond the supply available, attitudes towards accepting No Age Statement (NAS) will continue to shift. This highlights an opportunity to shift consumer perception and education that is rooted to only ‘the benefits of age statements’. As age becomes a more interesting dimension, innovations that move towards the NAS arena will continue to emerge, as well as the education around the age concept in whisky. In some ways, this will make ageing and rarity a more compelling proposition. However, it will also create the opportunity to develop more complex whiskey where maturity matters, not age. This will place the art of the blender at the core of the production process. Maturity Matters gives Irish Whiskey the green light to be experimental away from traditional and expected formats - to meet current consumer taste preferences. “ At a product level there is a knowledge that age doesn’t guarantee quality…Bottling a whiskey when it is ready is as valid an approach as bottling a whiskey when it’s 20 years old. A lot comes down to the art of the blender. Brendan Buckley, Innovation and Category Development, Pernod Ricard © 2013 Bord Bia, The Futures Company ” Early Indicators Maker’s Mark diluted its bourbon from 90 proof to 84 proof in order to meet demand, without telling its consumers. As a result the brand lost equity from loyal consumers who were disappointed to discover the content had changed, even though Maker’s Mark later reversed their decision. Macallan has launched a range of no-age statement malts whereby their natural colour will be the indicator of age. This is shifting the consumer perception around age statements. Glenrothes malt whisky has created the tagline “Our whisky is ready when it tastes perfect. Not when it’s reached a certain age.” Showing the importance of maturity over age. New roles for Irish Whiskey brands The three platforms converge to create three opportunity spaces for Irish Whiskey brands Native personality Timeless Character Sophisticated Origins Maturity Matters Inventive Flavours Flavour Complexity © 2013 Bord Bia, The Futures Company Timeless character Where origin of ingredients and the personality developed from locality can establish new markers of quality where age statements once stood High quality wood Rather than prioritising the age of a whiskey, the individual whiskey characteristics are sufficient to stand alone, creating a new language in the category. The main facilitator of this shift away from the age focus is the awareness of high quality ingredients to achieve maturity. This will provide an opportunity for brands to build their character and quality from their local environment and ingredients, rather than how long they have been aged (see box). Local ingredients and locality (village, region, river etc.) will become the shortcuts to quality. This timeless identity places the focus on the highest quality ingredients, but also the personality that can be developed from the production process. A number of creative distillers already invite consumers to create their own bespoke whiskey, as well as experience the production process for themselves, which further drives the focus away from the length of ageing, but places more emphasis on the core ingredients that the consumer selects – the cask size, wood type and grain variety (see box). Irish Whiskey brands have permission to leverage ingredients and production processes unique to Ireland to craft new overarching quality statements. © 2013 Bord Bia, The Futures Company Kilchoman, which opened on Islay in 2005, removed the age statements and its Machir whisky uses high quality wood instead to achieve maturity. Bespoke character The London Distillery Company offers consumers the opportunity to design their own bespoke whisky. They can select their cask size, wood type and barley variety, as well as shadow a distiller for a day to gain an insight into the whisky production process. The focus is on the character derived from ingredients. Timeless character THINGS TO CONSIDER • Which Irish ingredients, unique to an area, could be used to communicate and act as new markers of superior quality? • How can Irish brands educate consumers around the importance of maturity and character, to sit alongside the importance of age statements? • What technological innovation could help shift the consumer mindset from age to the quality of ingredients used? © 2013 Bord Bia, The Futures Company Sophisticated origins By tapping into the emotional connection to Irish people and geography, and by celebrating the flavour profiles originating from locally sourced ingredients and materials, brands can create inimitable offerings that appeal to the sophisticated drinker. Brands can build unique personalities that combine the complex flavour derived from Irish terrain and local ingredients, with evocative stories that relate to the traditional production process and history of Ireland. The traditional Irish pot still whiskey, for example, is experiencing a renaissance (see box). The distillation method imparts a complex taste profile, likely to resonate strongly with sophisticated single malt whiskey drinkers, and which is unique to Ireland. Furthermore, its history linked to the production process conjures a powerful emotional attachment to place, as this specific process does not exist anywhere else in the world. Sophisticated flavours can also be further enhanced by local origins. This can be seen with cross category food and whiskey pairings (see box). It is said, for example, that a Laphroaig whisky from Scotland will enhance the flavour in seafood because of the sea air the whisky is exposed to during distillation. This synergistic combination of sophisticated flavour and origin builds an emotional connection between the drinker, the whiskey and the land which will deepen the overall whisky experience . Irish Whiskey brands have access to local ingredients and history to celebrate sophisticated flavours from the land to deepen emotional connections with consumers. © 2013 Bord Bia, The Futures Company Traditional reinvented Pot still is unique to Ireland and the most recent marketing campaigns has focused on the ‘rediscovery’ of Irish Whiskey. This adds character to the type of whiskey and how it is distilled. The taste profile is also suggested to appeal to consumers who like the complex taste of single malt. Cross category synergies Whisky food pairing is becoming a popular activity, which increases the accessibility of the category. Scotch Broth Events promote new ways of enjoying whisky, and pair whisky tasting with sampling artisan Scottish food. Sophisticated origins THINGS TO CONSIDER • Which local ingredients and materials should be used to create complex and unique flavour profiles? • Can Irish distilling methods create complex flavours to rival the sophistication of Scotch single malts? • Are there new occasions or events which can simultaneously enhance the flavours and origins of Irish Whiskey? © 2013 Bord Bia, The Futures Company Inventive flavours Brands can create innovative propositions to challenge the role of age statements through the four levers that enhance flavour complexity. Innovative ageing Altering the distilling and filtering process, changing the cask materials and experimenting with more sophisticated blends are inventive techniques to produce creative and complex flavours. These flavour innovations can move the focus away from age statements and in turn expand the category. For example, changing the cask materials can account for around 75% of a whisky’s flavour.1 American oak can offer sweet, silky, vanilla and coconut flavours; European oak can produce spicy and fruity notes and French oak’s tighter grain can allow for a more gradual integration of flavours, which is favoured by winemakers. This opens up a number of flavour options to create a taste profile where complexity dominates, instead of age. At the same time different production techniques can be used to modify the ageing process itself. How a cask behaves will depend on its age, size and local climate - ageing takes place three times faster in the tropics. Ardberg has experimented with the local climate element through producing the first whisky aged in space (see box). Irish Whiskey brands have the versatility and momentum from the recent interest in the category to be creative with flavours and develop mature taste profiles that are not constricted by age. Source: 1) The Sunday Times Magazine, 2013 © 2013 Bord Bia, The Futures Company Ardberg sent whisky molecules to age in space in 2012 in charred-oak casks amidst a near zero-gravity environment and the result was Ardberg’s Galileo. It was named the best whisky in the world at the annual World Whiskies Awards. Vintage concept Glenrothes is one of the distilleries that has rejected age statements in favour of single-year vintages. The ‘vintage concept’ increases the flavour options whilst removing the need for age statements. Inventive flavours THINGS TO CONSIDER • In what ways could the cask temperature and atmosphere be altered to change the ageing process? • How can young and aged blends create innovative and surprising flavours that attract new whiskey drinkers and excite established ones? © 2013 Bord Bia, The Futures Company Final thoughts Final Thoughts It is essential that Irish Whiskey identifies its key point of difference. Irish Whiskey needs to create a clear USP for it to stand out in the whisky category, when compared to other whisky varieties. Versatility is a credible entry point, due to Irish Whiskey’s smooth texture, which bestows it with adaptability to different flavours and occasions. This quality also connects emotionally with the Irish culture and temperament. Strengthened regulation will ensure quality control and consistency for longterm future growth. As Irish Whiskey continues to grow in volume and value, existing legislation in the category will be strengthened to ensure that the quality of Irish Whiskey and its reputation is maintained for the long-term future. Category growth will rely on smaller and larger players working together - ‘coopetition’. Larger whiskey producers will be able to create significant category volume growth due to their economies of scale and their access to resources and distribution networks. They are likely to achieve significant growth © 2013 Bord Bia, The Futures Company by focusing on a concentrated portfolio of Smaller distillers will then be able to ride the positive wave of increased exposure and consumer awareness. They will then be the ones who are able to add creativity to the category, by adding portfolio variety through small batch innovations. In turn larger distillers will benefit from the energy injected into the category by smaller distillers’. For this reason, larger players should support smaller whiskey producers with difficult business challenges - such as limited access to capital, succession issues and resource shortages - as it is in their best interest to secure overall growth in the category. Irish Whiskey investment and planning needs to have a long-term focus in mind. Due to the long-term nature of the category, whereby whiskeys may take 20 years plus to be released, emerging social, technological, economical, environmental and political considerations should be taken into account when making any future investment plans. This is to ensure the long-term survival and growth of the category. --THE END-- “Too much of anything is bad, but too much of good whiskey is barely enough.” --Mark Twain-- © 2013 Bord Bia, The Futures Company