Future of the Global Seafood Industry Sector November 2014

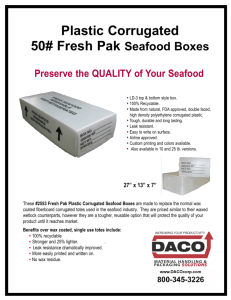

advertisement