A R & F S

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

Irish Food Board

To the Minister for Agriculture and Food

In accordance with Section 22 of An Bord Bia

Act 1994, the Board is pleased to submit to the Minister its Annual Report and Accounts for the 12-month period ended 31 December 1998.

Philip Lynch

Chairman

Michael Duffy

Chief Executive

Don Aire Talmhaíochta agus Bia

De réir Alt 22 den Acht um an mBord Bia 1994, tá áthas ar an mBord a Thuarascáil Bhliantúil don bhliain dar críoch 31 Nollaig 1998 a chur faoi bhráid an Aire.

Philib Ó Loingsigh

An Cathaoirleach

Micheál Ó Dufaigh

An Príomhfheidhmeannach

Contents

Overview of the Irish

Food & Drink Industry

Chairman’s Statement

Aitheasc an Chathaoirligh

Chief Executive’s Review

Corporate Statement

Board Membership

Subsidiary Board Membership

Organisation Structure

The Organisation

European Union

Report of the Comptroller

& Auditor General

Statement of Accounting Policies

Income & Expenditure Account

Balance Sheet

Cash Flow Statement

Notes forming part of the

Financial Statements

29

30

32

33

34

35

20

23

24

26

27

28

1

2

6

8

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

1

•

The total value of the Irish food & drink industry in 1998 was £10 billion

(

6

12.6 billion) or 6.5 per cent of national output (17 per cent GDP).

•

Irish food and drink exports exceeded £5 billion (

6

6.3 billion) in 1998, which accounts for 13 per cent of total exports.

•

80 per cent of the top 10 Irish-owned exporters are food and drink companies.

•

8 of the top 20 Irish-owned companies are in the food and drinks business.

•

There are 700 Irish food & drink companies, over half employ fewer than

50 people.

•

176,000 people are employed in the agriculture and food industry, with an additional 280,000 indirect jobs.

•

Food & drink companies provide 20 per cent of industrial employment.

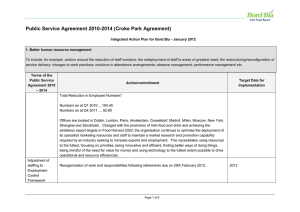

Irish Food & Drink Exports (IR£m)

1997 1998

Dairy & Ingredients

Beef

Prepared

Consumer Foods

Beverages

Pigmeat, Poultry

Mariculture

Lamb

Edible Horticulture

148

143

113

122

305

287

221

227

550

616

733

894

974

1012

Export by Sector 1998

1659

1660

Dairy & Ingredients 33%

Lamb 3%

Poultry & Other Meats 2%

Pigmeat 4%

Beef 21%

Edible Horticulture 2%

Mariculture 5%

Beverages 12%

Prepared Consumer Foods 18%

2

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

C h a i r m a n ’ s S t a t e m e n t

1998 was a striking year in different respects.

A major milestone was reached when, fuelled by strong growth particularly in the prepared consumer food sector, Ireland’s food and drink exports exceeded IR£5 billion (

6

6.3 billion) for the first time. At the same time, livestock producers experienced very difficult market conditions, and a fall in returns, which affected the three meat categories of beef, pigmeat and lamb. Financial market difficulties outside

Europe affected a number of food sectors. The collapse of the Russian economy impacted on beef and dairy exports and indirectly reduced lamb prices. The economic slowdown in Asia has constrained beverage, pigmeat and food ingredient exports.

The growth in overall export earnings is thus all the more remarkable and is a testament to the capability and dynamism of the people in the industry. The result is a successful and growing food and drinks industry that plays a major part in the Irish economy and in the lives of all who depend on it. Future growth and success will continue to depend on informed and vigorous industry leadership, supported by a skilled and highly trained workforce at all levels from production through processing, distribution and marketing. It will also depend on the continuing perception of Ireland as a green environment, producing high quality, safe and healthy food that our customers and consumers can trust. Our policies and priorities must continue to be guided by an overriding concern to protect the integrity of our products.

Globalisation

The impact of world financial crises on the food and drinks industry confirmed, yet again, that we are well and truly part of the global economy. The advent of the Euro will mean even greater integration with Europe while the progressive implementation of Agenda 2000 and the World Trade Organisation negotiations will extend the reach of the globalisation process. This will result in a more competitive market environment and also one where there will be an ever-growing consumer interest in food safety and sourcing. It all adds up to a most challenging scenario that will pose questions for everyone in the industry.

Continued success will require the right decisions about investment and the best use of human and financial resources, including resourcing of marketing development and promotional activities.

As the market development and promotional agency for food and drink, Bord Bia will continue to play its part in these developments by identifying market opportunities with Irish companies and then assisting them in their development. We are now coming to the close of our Market Development Strategy 1995-

1999 and we are actively engaged in

Our policies and priorities must continue to be guided by an overriding concern to protect the integrity of our products.

formulating our next Organisation Plan, which will coincide with the next National

Development Plan. Broadening the industry’s market base will be an important goal together with focusing resources in those areas likely to yield greatest returns. For example, the objective in the beef sector will be to increase the percentage of exports to the European market, while ensuring a balanced position in

International markets.

Food Safety

Consumer concerns about food safety are an important reality that must be properly understood and addressed to maintain success.

The responses to recent developments in genetically modified foods have shown how

European consumers are questioning benefits as they evaluate risks. Quality Assurance schemes are an important part of the consumer information process, complementing the comprehensive food safety regulatory structure.

The next stage in the development of Bord Bia’s

Quality Assurance Programme will be the introduction of certification under the

International Benchmark Standard EN45011.

As always, successful implementation will require the active support of industry.

Speciality Food Symposium, Kinsale 1998

Success in the UK, especially in consumer and speciality foods, must be built on and extended to other European markets. The Plan will provide for targeted market development and promotional programmes aimed at all product sectors under Bord Bia’s remit.

Conclusion

The Irish food industry has achieved significant growth in the past five years. I am confident that this will be sustained and I am proud of

Bord Bia’s contribution to it. We will continue to play our part by working closely with

Government and industry and with our customers in the marketplace. The overall goal is to realise the fullest potential of this important industry. Achievement of the desired level of progress will make demands on all of

us. In particular, we must recognise the reality of a vastly more competitive and demanding marketing environment and we must plan and prepare accordingly. The rewards for success are likely to be substantial indeed.

Appreciation and Acknowledgements

Bord Bia’s success and its ability to contribute to the development of the Irish food and drink industry is dependent on many people and organisations.

I would like to express particular thanks to the

Minister for Agriculture and Food, Mr Joe

Walsh, TD, and the Minister of State, Mr Ned

O’Keeffe, TD, and the officials of the

Department of Agriculture and Food for their continued support. In addition, I would like to thank all Government Departments with whom we work, and the Irish Ambassadors and their staffs for their valuable support and assistance in overseas markets.

I am pleased to record again our appreciation for the support and assistance we receive from the EU Commission and its officials.

I thank the industry representative organisations – producers, processors, retailers, butchers, consumers, employers and exporters – for their continued contribution to Bord Bia. I would particularly like to express my gratitude to the members of the Meat and Livestock and

Consumer Foods subsidiary boards for their invaluable assistance.

I would like to thank Mary Quinn, who has left the Board since the last Report, for her valued contribution to the work of Bord Bia. I would like to congratulate Michael Dowling, Denis

Lucey and Sara White on their appointments for a further term and to congratulate and welcome Joseph O’Sullivan as a new member of the Board. I wish to thank my fellow Board members for their support and for giving so generously of their time and expertise which I greatly appreciate and value.

Most of all we depend on the commitment and professionalism of our Chief Executive,

Management and Staff, without whom the progress described in this Report would not be possible. I am delighted to record our thanks to all of them.

Philip Lynch

Chairman

6

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

A i t h e a s c a n C h a t h a o i r l i g h

An-bhliain ab ea 1998 ar mhórán slite. Baineadh mórsprioc stairiúil amach nuair a sháraigh easpórtálacha bia agus dí na hÉireann £5 billiún (6.3

bill. Euro) don chéad uair agus fás láidir in Earnáil an Bhia Ullmhaithe do Thomhaltóirí ina mhórchabhair aige sin. Ag an am céanna, bhí deacrachtaí ó thaobh an mhargaidh agus titim i bhfáltais ag táirgeoirí beostoic agus bhí éifeacht aige sin ar na trí chatagóir feola mar atá mairteoil, feoil mhuice agus uaineoil. Bhí éifeacht ag deacrachtaí airgeadais sna margaí lasmuigh den

Eoraip ar roinnt earnálacha bia. Bhí tionchar ag titim eacnamaíochta na Rúise ar easpórtálacha mairteola agus déiríochta agus laghdaigh an titim sin praghsanna na n-uan go neamhdhíreach. Tá an moilliú eacnamaíochta san Áis tar éis srian a chur le heaspórtálacha dí, feoil mhuice agus comhábhair bhia.

Dá bhrí sin is údar suntais an fás atá tagtha ar thuillimh iomlána easpórtála agus is teistiméireacht

é ar chumas agus ar fhuinniúlacht lucht an tionscail. Is é atá mar thoradh air sin ar fad ná tionscal bia agus dí a bhfuil éirithe go maith leis agus atá ag fás agus a bhfuil ról mór aige in eacnamaíocht na hÉireann agus i saol na ndaoine uile sin a bhraitheann air. Braithfidh an fás agus an rath amach anseo, mar a bhraitheann i gcónaí, ar cheannaireacht atá bríomhar agus eolasach a bheith sa tionscal agus cúnamh a bheith ag an tionscal ó fhoireann oibre ardoilte ag gach leibhéal ó chéim na táirgíochta go céim na próiseála agus ar aghaidh go céim an imdháilte agus na margaíochta. Braithfidh an fás leanúnach freisin ar an tuiscint gur comhshaol glas atá ar fáil in Éirinn, comhshaol a tháirgíonn bia atá ar ardchaighdeán, bia atá sláintiúil agus sábháilte agus bia ar féidir lenár gcuid custaiméirí a bheith muinníneach as. Agus polasaithe agus tosaíochtaí á leagan amach againn caithfimid leanúint orainn ag cinntiú gur lánpháirtíocht ár gcuid táirgí an príomhshlat tomhais a bheidh againn.

Dheimhnigh an tionchar a bhí ag géarchéimeanna airgeadais an domhain ar thionscal an bhia agus na dí, uair amháin eile, gur cuid muid go cinnte d'eacnamaíocht dhomhanda. Ciallóidh teacht an

Euro níos mó lánpháirtíochta san Eoraip ó thaobh sinne de agus leathnóidh feidhmiú Agenda 2000 agus comhchainteanna na hEagraíochta Trádála

Domhanda tionchar phróiseas an domhandaithe.

Beidh níos mó iomaíochta sa mhargadh eacnamaíoch mar thoradh air sin agus beidh suim, a bheidh ag síorfhás, ag na tomhaltóirí i sábháilteacht agus i bhfoinsiú bia. Cruthaíonn sé sin ar fad andúshlán agus beidh ceisteanna dá bharr le freagairt ar gach duine a bheidh bainteach leis an tionscal.

Chun a chinntiú go n-éireoidh le cúrsaí beidh cinní maidir le hinfheistíocht agus an úsáid is fhearr a d'fhéadfaí a bhaint as acmhainní daonna agus airgeadais de dhíth lena n-áirítear gníomhaíochtaí chur chun cinn agus fhorbairt mhargaíochta a fhoinsiú.

Leanfaidh An Bord Bia, an ghníomhaireacht chur chun cinn agus mhargaíochta do bhia agus do dheoch, ag glacadh páirte sna forbairtí sin trí dheiseanna margaí le comhlachtaí Éireannacha a aithint agus trí chabhair a thabhairt dóibh na deiseanna sin a fhorbairt ansin. Táimid faoi láthair ag teacht an-ghar do dheireadh Straitéis Fhorbartha

Mhargaidh 1995-1999 agus táimíd an-ghníomhach ag cur ár gcéad Phlean Eagraíochta eile le chéile, a thiocfaidh chun cinn san am céanna leis an gcéad

Phlean Forbartha Náisiúnta eile. Is sprioc tábhachtach bonn margaidh an tionscail a leathnú mar aon le hacmhainní a dhíriú ar na réimsí sin a thabharfaidh na fáltais is fearr. Mar shampla, is é an sprioc a bheidh ag earnáil na mairteola ná céatadán na n-easpórtálacha chuig margadh na hEorpa a mhéadú agus ag an am céanna ag cinntiú go mbeidh áit mheáite ar na margaí Idirnáisiúnta.

Caithfear tógáil ar chomh maith is atá ag éirí linn sa Ríocht Aontaithe, go háirithe ó thaobh bhia tomhaltóirí agus bia speisialta agus caithfear leathnú amach go dtí margaí Eorpacha eile.

Déanfaidh an Plean cúram de spriocfhorbairt an mhargaidh agus de chláir thionscnaimh a bheidh dírithe ar gach earnáil táirgí atá faoi chúram an

Bhord Bia.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

7

Caithfear aird mhór a thabhairt ar imní na dtomhaltóirí faoi shábháilteacht bia agus caithfear an imní a thuiscint go hiomlán agus aghaidh a thabhairt uirthi chun a chinntiú go leanfar le chomh maith is a d'éirigh linn go dtí seo. Léiríonn an dearcadh a léirigh tomhaltóirí le déanaí faoi bhia a bheadh athchóirithe go géineolaíoch go bhfuil tomhaltóirí na hEorpa ag meá buntáistí an bhia sin in aghaidh aon chontúirtí a bhainfeadh leis. Is cuid an-tábhachtach den phróiseas le faisnéis a thabhairt do thomhaltóirí iad na scéimeanna

Deimhnithe Cáilíochta agus cuidíonn siad le struchtúr rialaithe shábhailteacht bia. Uair dá raibh bhíodar ina ngnéithe "breise" luachmhara, anois caithfidh siad a bheith i gceist chun aon ghnó a dhéanamh. Tá Scéimeanna Deimhnithe Cáilíochta de chuid an Bhord Bia tar éis cur go suntasach le margaíocht a dhéanamh ar fheoil na hÉireann. Is í an chéad chéim eile san fhorbairt ná teastasú faoin

Marc-Chaighdeán Idirnáisiúnta EN45011 a thabhairt isteach. Mar is gnách beidh tacaíocht ghníomhach an tionscail de dhíth le go gcuirfear an fhorbairt i bhfeidhm ar shlí go n-éireoidh léi.

Tá an-fhorbairt agus an-fhás tagtha ar thionscal an bhia in Éirinn le 5 bliana anuas. Táim cinnte go leanfaidh an fás sin agus táim an-bhródúil as an ról a ghlac An Bord Bia sna nithe sin. Leanfaimid orainn ag déanamh ár ndíchill, trí oibriú go dlúth leis an rialtas agus leis an tionscal agus lena gcuid custaiméirí sa mhargadh. Is é an mórsprioc cumas iomlán an tionscail thábhachtaigh seo a thuiscint.

Má bhaintear amach an dul chun cinn atá uainn cruthóidh sé sin dúshlán dúinn ar fad. Caithfimid go háirithe a thuiscint go bhfuil timpeallacht mhargaidh ann atá i bhfad níos iomaíche agus a mbaineann níos mó dúshláin léi agus caithfimid réiteach agus pleanáil dá réir. Is mór an luach saothair a bheidh ann go cinnte má éiríonn linn. agus Bia as ucht a gcuid tacaíocht go leanúnach.

Ina theannta sin, ba mhaith liom mo bhuíochas a ghabháil le gach Roinn Rialtais lena mbímid ag obair agus le hAmbasadóirí na hÉireann agus a gcuid foirne as ucht a gcuid cúnaimh agus tacaíochta atá chomh luachmhar sin maidir leis na margaí thar lear.

Cuireann sé áthas orm buíochas a ghabháil leis an gCoimisiún Eorpach agus a chuid oifigeach as ucht na tacaíochta agus an chúnaimh a fhaighimid uathu.

Táim buíoch de na heagraíochtaí ionadaíochta tionscail - na táirgeoirí, na próiseálaithe, na miondíoltóirí, na búistéirí, na tomhaltóirí, na fostaitheoirí agus na heaspórtálaithe - as ucht a ndéanann siad don Bhord Bia. Ba mhaith liom buíochas ar leith a ghabháil le comhaltaí na bhfobhord a bhaineann le Feoil agus Beostoic agus Bia

Tomhaltóirí as ucht a gcúnaimh atá chomh luachmhar sin.Ba mhaith liom mo bhuíochas a ghabháil le Mary Quinn, a d’fhág an Bord ó eisíodh an Tuarascáil dheiridh, as ucht a ndearna sí don

Bhord Bia. Ba mhaith comhghairdeas a dhéanamh le

Michael Dowling, le Denis Lucy agus le Sara White toisc iad a bheith ceaptha i gcomhair téarma eile agus ba mhaith liom comhghairdeas a dhéanamh leis an Uas. Joseph O’Sullivan atá ceaptha mar chomhalta nua ar an mBord agus fáilte a chur roimhe. Ba mhaith liom mo bhuíochas a ghabháil le mo chomhghleacaithe ar an mBord as ucht a gcuid tacaíochta agus as ucht a gcuid ama agus taithí a sholáthar go flaithiúil, rud is mór agam agus a bhfuilim an bhuíoch as.

Thar aon ní eile braithimid ar ghairmiúlacht agus ar dhúthracht ár bPríomh Fheidhmeannaigh, ár gcuid

Bainistíochta agus ár gcuid Foirne. Murach iad ní bheadh an dul chun cinn atá leagtha amach sa

Tuarascáil seo indéanta. Cuireann sé an-áthas orm mó bhuíochas a ghabháil leo siúd go léir.

Buíochas agus Admhálacha

Braitheann rath An Bhord Bia agus a chumas chun cur le forbairt thionscal bia agus dí na hÉireann ar mhórán daoine agus ar mhórán eagraíochtaí.

Ba mhaith liom buíochas ar leith a gabháil leis an

Aire Talmhaíochta agus Bia, an tUasal Joe Walsh, TD, agus leis an Aire Stáit, an tUasal Ned O'Keeffe, TD, agus lena gcuid oifigeach sa Roinn Talmhaíochta

Philip Lynch

Cathaoirleach

8

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

C h i e f E x e c u t i v e ’ s R e v i e w

In 1998, Bord Bia continued to develop and extend its programmes and activities with considerable success. We implemented specifically targeted programmes to identify and develop new routes to market in retail food service and ingredients. Continued growth in an increasingly competitive marketing environment will depend on industry capacity to effectively exploit opportunities in these different routes to market.

Industry Performance

Turning to the development of the industry in 1998, growth of food and drink exports doubled to six per cent. For the first time, export earnings reached IR£5 billion (

6

6.3

billion). This is particularly encouraging as weak commodity prices and difficult trading environments were experienced for some sectors for much of the year, for example beef, sheepmeat and pigmeat. Strong growth was exhibited in prepared consumer foods, edible horticulture and drinks while dairy and food ingredient exports were largely unchanged.

International financial developments, such as the collapse of the Russian economy, had a dramatic and sudden impact on commodity exports in particular.

Consumer Foods

Prepared consumer foods performed very strongly with a growth rate of 22 per cent, accounting for IR£894 million (

6

1.13 billion) in export earnings. The sector was very effective in maintaining and growing its supply position with UK multiple retailers, including those active on the Irish market. Irish companies have recognised opportunities in the private label arena and in the growth of the foodservice sector in the UK. In 1998, 30 companies participated in the UK Food Service

Programme, while 23 took part in the

European Private Label Programme.

Dairy

Dairy exports were largely unchanged in 1998.

Including food ingredients, they amounted to

IR£1.66 billion (

6

2.11 billion). Milk output declined slightly due to weather conditions.

Butter markets were strong while returns for skimmed milk powder were weak. Production of whole milk powder and cheese increased during the year. Irish dairy processors continue to seek opportunities for added value in consumer products and ingredients, with innovation becoming increasingly important.

Meat

The value of beef exports increased by just under four per cent in 1998 to IR£1.0 billion

(

6

1.28 billion). It was a record year for cattle disposals and export volume increased by

10 per cent to 500,000 tonnes. Sales to intervention fell by two-thirds. However, the effective closure of the Russian market caused

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

9

Growth of food and drink exports doubled to six per cent. For the first time, export earnings reached

IR£5 billion (

6

6.3 billion).

prices to drop significantly. More positively, sales of Irish beef to Continental EU markets recovered strongly throughout 1998, growing by over 40 per cent. Exports to the UK were adversely affected by the decision of some multiples to stock only British beef. Irish companies compensated by growing business in the wholesale sector, thus the reduction was limited to an 11 per cent drop.

Ireland contributes one-third of all EU exports outside the Community. Beef exports to

International markets rose eight per cent to

285,000 tonnes. The value of live cattle exports more than doubled to almost IR£70 million

( 6 88 million), and exports to EU and

International markets (the Lebanon) increased, although shipments to the EU accounted for over 80 per cent of the total numbers exported.

This was due to an increase in shipping capacity.

Sheep supplies increased 12 per cent during

1998, although the value of IR£143 million

(

6

182 million) was slightly under 1997’s performance. This was due to weaker returns from our principal export market, France, which accounts for over 70 per cent of total exports.

Spain has become a significant exporter and has reduced its own import requirements.

The worldwide pig industry had one of its most difficult years ever in 1998. Strong rises in production and weaker demand in International markets meant lower returns for Irish producers with exports totalling just IR£204 million

(

6

259 million). Pig supplies were 12 per cent ahead of 1997 and exports rose 15 per cent in volume terms, especially to the UK and

Continental Europe.

Drinks

In value terms, beverage exports grew by 12 per cent in 1998 to IR£616 million

(

6

782 million), and the strong Irish economy continued to fuel sales on the home market.

The beer, cream liqueur, spirits, carbonated soft drinks and mineral water sectors all experienced growth. Companies targeting emerging markets such as Eastern Europe and Latin America had positive results.

Sales of premium spirits have risen significantly, including that of traditional brown spirits – a sluggish market in past decades. In recent years a number of smaller

Irish companies have entered the industry and are doing well particularly in private label in Europe.

Horticulture

In 1998 exports of edible horticulture rose eight per cent in value to IR£122 million (

6

155 million). Fresh mushrooms continue to be

Ireland’s main edible horticulture export, with a

50 per cent share of the UK retail market. Irish mushroom companies have acquired British companies, and as consumption appears static, the sector must now turn to marketing activities to stimulate sales at consumer level.

Bord Bia’s ultimate objective is to see more

Irish food and drink consumed in export markets. To achieve this, we identify and exploit opportunities in different marketplaces, communicate information on these opportunities back to companies and vigorously promote food and drink products.

1 2

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

Bord Bia’s goal is to assist in generating business that is new to Ireland and our network of offices are continually engaged in researching opportunities for Irish food and drink, and in making presentations to key trade buyers. We adopt a business development approach to the routes to market: retail, food service and food ingredients.

Market Development

In 1998 Bord Bia strengthened its focus on

European markets with the expansion of the

Private Label Programme in France, Germany and Spain. Over 30 Irish companies were involved. This programme provides support to companies interested in the growing potential of private label in European multiple retailers.

Bord Bia holds in-depth meetings with each company to determine their objectives and then undertakes research on their specific product category. Assistance in tailoring the product to market demands is provided. Bord

Bia also works closely with highly sought after retailers participating in this programme.

Finally, a show-case is organised in the market and buyers from the participating retailers attend. This affords companies a unique opportunity to engage with a number of priority buyers in a planned and cost-effective way. Buyers appreciate the format as it is more targeted than a trade fair, and the companies have already put in considerable work with

Bord Bia to understand retailer requirements.

This was the second year of the Food Service

Programme in the UK. It focused on key segments that hold most potential for Irish suppliers. These were contract catering, wholesaling, pubs and restaurants. Activities included research, seminars, buyer contact events, and over 20 presentations to leading operators. Bord Bia’s Food Service

Buyer’s Guide was sent to the top 70 companies

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

1 3 as part of our direct marketing campaign in the

UK and a special edition of the Mardek Guide

(UK Catering Industry 1998-1999) was produced. This Programme will continue in

1999 with a particular emphasis on relationship building and networking.

A successful innovation in 1998 was the first

International Speciality Food Symposium in

Kinsale in April. It was attended by over 500 trade participants and our objectives were to provide a high quality networking opportunity which would lead to new business and to demonstrate Ireland’s lead in the area of niche food marketing. Evaluation has shown that these objectives were more than fulfilled. Half of the supplier companies which responded to a post-Symposium questionnaire had secured orders while almost 95 per cent of buyers were satisfied that their objectives in participating had been met. The Symposium quickly generated follow-on activity including a month long promotion of Irish speciality foods with

70 member stores of the Guild of Fine Food

Retailers in the UK. Its success has provided a solid base for our small business programmes in 1999.

An important aspect of market research and development is the undertaking of market missions to examine underlying demand. In

1998 market visits included major existing and emerging new International markets in the

Middle East, Asia, Gulf States and Eastern

Europe. Bord Bia organised Ministerial visits to key multiple retailers in the UK and France.

Two hundred trade visitors came to Ireland on planned itineraries focusing on new business opportunities.

In 1998 Bord Bia developed a five year market development and promotional strategy for the beef sector. The fundamental thrust of the strategy is to recognise that the future of the beef industry will be in Europe’s stable higher-priced markets. It is also predicated on Ireland remaining a leading supplier to a balanced portfolio of International markets.

BSE continues to have an impact on beef markets in Europe. Although beef sales are recovering, it has made quality assurance essential particularly in the context of food safety and traceability; it has also meant that

European consumers have opted to buy domestically-produced beef. In addition, it has made International markets less certain.

Bord Bia’s strategy takes account of this new climate.

Winning a greater share of the European market, and as a consequence returning better prices is the challenge. The aim is to increase the percentage of steers exported to the EU from 25 to 40 per cent of our total, or from

240,000 to nearly 400,000 head. We believe that total beef exports to the EU can be increased by over 40 per cent by the year

2002 – resulting in over half of all beef exports being sold in EU markets.

Bord Bia has identified four key markets – UK, Italy,

France and the

Netherlands. Each demands a different approach as does the achievement of a balanced situation in

International markets so that over-reliance on one or two larger volume markets will be avoided.

Lamb Promotion, Fr ance

UK Retail Contact

1 4

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

Bord Bia’s

Touch Scr een Kiosk used at Bor d Bia Trade Fair s

ultimate objective is to see more Irish food and drink consumed in export markets.

A

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

1 5

Top European Chefs viewing quality assur

Bord Bia’ s Food Advisory Centr e ed beef at

A major development in September 1998 was the formation of the Beef Task Force by the

Minister for Agriculture and Food to which

Bord Bia’s market development and promotional strategy is an important input.

The Terms of Reference of the Task Force are:

To devise an action plan for the development of the beef industry governing the whole sector from primary production through to processing and marketing with a view to enabling the sector to overcome the obstacles impeding its development and to generate better returns from the markets.

Market information and knowledge is critical to commercial success. Bord Bia’s information services continued to supply quality information to Irish companies and overseas buyers on a daily basis. In 1998 we serviced over 3,600 inquiries from a wide variety of sources including food and drink manufacturers, entrepreneurs evaluating the formation of a food manufacturing enterprise and trade buyers sourcing food and drink products from Ireland.

In 1998 Bord Bia launched its website, targeted at professional buyers. An important feature is a database profiling 600 Irish food and drink companies. It can be searched by product or company name and it allows enquirers to send a fax directly to any company on the database to elicit more information about the company or its product range. It has been promoted at

Bord Bia trade fairs featuring a touch-screen kiosk so that visitors to the show could have ready access to this information also.

Bord Bia operates the Marketing Improvement

Assistance (MIA) Programme which aims to improve the marketing capability of Irish food and drink companies. The Programme offers grant support based on the submission of an annual marketing plan. It assists companies to implement an agreed market development plan and provides support for a range of activities including participation at trade shows, packaging, design for new products, market research, recruiting additional marketing personnel and achieving quality standards.

Grant payments in 1998 amounted to

IR£4.1 million (

6

5.2 million).

1 6

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

In-store promotion.

Promotion

Food promotion is a central element in Bord

Bia’s strategy to increase the profile and enhance the image of our food and drink. The promotional mix includes merchandising, pointof-sale promotions, public relations, advertising and food demonstrations.

Working with top chefs is seen as an important way to strengthen the reputation of Irish food.

Accordingly, last year over 60 of Europe’s leading chefs were brought to Ireland to learn about our natural beef production systems and traceability in a promotional project entitled

“The Essence of Irish Beef”. They were accompanied by 10 European journalists. In addition, gourmet chefs were targeted for specific activity in France and on the home market, and the successful Gaelic Chefs Club in

Dubai entered its second year. Our promotions on the home market were again strongly supported by top Irish chefs in 1998.

Bord Bia’s involvement in the Tour de France in

Ireland was applied to maximum advantage to enhance the image of Irish food and drink in key export markets and further our existing promotional strategies. Press relations were a large part of this, with selected food and trade journalists from France and the UK brought to

Ireland for the event, as well as the 1,200 press already accompanying the Tour. In particular, the French press were encouraged to focus on companies participating in SIAL in October.

Surveys on awareness of and attitudes to Irish food and drink among the international media were carried out on the first and last days of the Tour in Ireland. Over 70 per cent said they would definitely consider recommending Irish food to others. Over 90 per cent said they considered the event to be a good marketing vehicle to showcase Irish food and drink.

Buyers from Russia, Switzerland, the

Netherlands, Belgium, Denmark and France visited Ireland to coincide with the Tour and Irish companies were able to avail of a corporate hospitality package. The

Tour also tied in with Bord Bia’s lamb promotional activities.

Bord Bia recognises the importance of the Irish market as a platform for success in exports.

Our promotional campaigns for beef, pigmeat and sheepmeat included print, broadcast and outdoor advertising supported by pointof-sale material provided to butchers and retailers. In 1998, we ran a number of new campaigns. In

March, a television and print media campaign was developed for pork mince, a new product on the Irish market. In the summer, an information and product guide was developed to promote Quality Assured bacon to the catering sector. In the autumn we introduced the first promotion for mountain lamb in association with 50 of

Ireland’s premium restaurants.

Promotional campaigns for beef and Easter lamb were also carried out during the year.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

1 7

As part of the continuing programme of consumer education on the home market, food demonstrations were organised at about 100 schools, 30 regional food fairs and at 10 summer shows. These events communicate positive messages to Irish consumers and underpin and emphasise Bord Bia’s home market campaigns. Two leaflets on the importance of iron in the diet were produced, and over 50,000 of each were disseminated widely through health care professionals. An in-depth guide to iron nutrition for young children was produced especially for dieticians.

Highlights of promotional activities conducted across all target markets included an extensive advertising campaign for Irish beef carried out in Italy, while an important information programme on Ireland’s beef traceability system was held at the Rungis market in Paris. Ven, a leading Dutch wholesaler to the catering trade, held an “Irish Week” at four of its outlets highlighting meat, speciality foods, cheeses and fish. A brochure on Irish food and drink was mailed to 13,000 Ven customers. A number of promotions for Irish farmhouse cheeses were held with leading UK retailers. Lamb was promoted in Spain and in France with launches to mark the beginning of the Irish lamb season, and for the first time, Irish lamb was identified in a leading French supermarket. In the USA

St. Patrick’s Day has become an important focus for promotional activities, with 100 supermarkets organising special displays of

Irish products.

Bord Bia organised Irish representation at 13 food and drink trade shows during 1998, which were attended overall by almost half a million trade visitors. Three more consumer-oriented shows bring the total audience for the ‘Ireland

- The Food Island’ stand to over one million

1 8

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8 people. We are constantly looking for new promotional platforms and in 1998 Ireland was represented for the first time at two drinks shows – the Wine and Spirits Wholesalers

Association in San Francisco and the London

Wine and Spirits Fair. It was also the first year that we had company representation at Food

Ingredients Asia in Shanghai.

Gaelic Chefs Club Dubai

The objective of Bord Bia’s Quality Assurance programmes is to enable Irish meat companies gain a competitive edge in the marketplace by giving consumers added assurances about the origin, integrity and wholesomeness of the product. Forty export plants and in excess of

20,000 farmers are now members of the Beef

Quality Assurance Scheme, while 12 plants are members of the revised Pigmeat Quality

Assurance Scheme which had its first year of operation in 1998. Traceability has become increasingly important in the lamb sector due to the emerging requirements in the French market for information about origin and identification. In 1998 Bord Bia and the lamb industry established a technical committee to examine the parameters for operating a Quality

Assurance Scheme in the sector that would address the needs of the marketplace and provide a platform on which Irish lamb could be successfully promoted. Also in 1998, a

Quality Assurance Scheme for Eggs was developed for implementation in early 1999.

Michael Duffy

Chief Executive

Organisational Development

Our people are our most important resource and I am very pleased indeed to record the commitment of the staff of Bord Bia to organisational and personal development. Key organisational objectives are to have the highest possible standards of client servicing and to strive always for the highest level of operational efficiency. Our Performance

Management and Staff Development

Programme, in which there is an exceptionally high level of participation, supports the achievement of these objects.

There were important developments in the area of communications in 1998. We introduced

Bord Bia News, a twice-yearly newsletter sent to every food and drink company in Ireland. In addition, a newsletter entitled Bord Bia Meat

News, specifically for producers, was developed in 1998 for circulation in early 1999. These are part of our continuing commitment to ensure effective communications with our constituencies.

Bord Bia is a results-driven organisation and

I am pleased to report that 1998 was another productive year with solid results and progress stemming from it. I am confident that 1999 will build on these advances to the benefit of the entire Irish food and drinks industry.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

1 9

2 0

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

C o r p o r a t e S t a t e m e n t

Statement of Board Responsibilities

Section 21 of An Bord Bia Act 1994 requires the Board to “keep in such form and in respect of such accounting periods as may be approved by the Minister, with the consent of the Minister for Finance, all proper and usual accounts of monies received or expended by it, including an Income and Expenditure

Account, a Cash Flow Statement and a

Balance Sheet, and, in particular, shall keep in such form as aforesaid all such special accounts as the Minister may, or at the request of the Minister for Finance shall, from time to time direct and the Board shall ensure that separate accounts shall be kept and presented to the Board by any Subsidiary

Board that may be established by the Board under this Act and these accounts shall be incorporated in the general statement of account of the Board.”

In preparing these financial statements the

Board is required to:

1. Select suitable accounting policies and then apply them consistently

2. Make judgements and estimates that are reasonable and prudent

3. Prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Board will continue in operation.

The Board has overall responsibility for the organisation’s system of internal controls and has delegated responsibility for implementation of this to Executive

Management. This system includes financial controls which enable the Board to meet its responsibilities for the integrity and accuracy of the organisation’s accounting records, which disclose, with reasonable accuracy at any time, the financial position of Bord Bia.

The Board’s system of internal controls is designed to provide reasonable assurance that transactions are executed in accordance with

Board policy and management authorisation and within statutory parameters and guidelines. The Board is also responsible for safeguarding the assets of the organisation and hence for taking reasonable steps for the prevention and detection of fraud or other irregularities.

There is an Audit Committee of the Board to which the internal auditor and the external auditor have full and unrestricted access.

Corporate Governance

The Board is committed to maintaining the highest standards of corporate governance and best practice, especially in relation to the

Government Guidelines for State Bodies and the Ethics in Public Office Act 1995. The Act’s provisions are being implemented in Bord Bia, and the Board monitors this implementation.

The Secretary is responsible to the Board for ensuring that procedures are implemented and that relevant legislation, regulations and guidelines are complied with.

Equal Oppor tunities

Bord Bia is an equal opportunities employer.

It is committed to ensuring equality of opportunity and its personnel and staff development programmes are geared towards this objective. Bord Bia is also committed to the implementation of Government policy in relation to the employment of disabled people in the public service.

Safety, Health and Welfare at Work

Bord Bia is committed to implementing the provisions of the Safety, Health and Welfare at Work Act 1989. The organisation’s Safety

Statement and Policy Document was reviewed and updated during the year as part of the

Board’s on-going policy in this area.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

2 1

Implementation of State Policy on

Extending Bilingualism in the Public

Sector

Bord Bia is committed to making every effort possible to implement the Guidelines for

Action Programmes in the State Sector in relation to the use of Irish.

Prompt Payment of Accounts

Bord Bia has systems and procedures to ensure full implementation of the provisions of the Prompt Payment of Accounts Act 1997.

Specific procedures are in place to enable the tracking of all transactions and payments in accordance with the terms of the Act and the relevant outputs from the accounting system are kept under continuous review. The Board’s procedures which conform to accepted best practice provide reasonable, but not absolute, assurance against non-compliance; it is also

Bord Bia’s practice to review and to take appropriate action in relation to any instances of non-compliance that might arise. Under

Bord Bia’s terms, payment is made within 45 days of receipt of invoice, or of date of supply, subject to a Tax Clearance Certificate

(if appropriate) being furnished in advance of the invoice and subject to stated conditions in relation to the invoicing process being met; during the period under review all payment transactions were governed by these conditions. The total number of late payments in the year ended 31 December 1998 was 20.

The value of these payments was £33,159. The average number of days by which payments were late was 18 days.

The overall proportion which late payments constituted of total payments made by Bord

Bia was 0.29 per cent. The amount of interest payable in respect of the year ended

31 December 1998 was £83.

Philip Lynch

Chairman

Michael Dowling

Board Member

Report of Comptroller and Auditor

General pursuant to Section 13 of the Prompt Payment of Accounts Act,

1997

Responsibilities of the Board and of the

Comptroller and Auditor General

The Board is obliged to comply with the Act and, in particular, is required to ensure that it

• pays its suppliers within the payment periods specified in the Act

• pays penalty interest on late payments and furnishes information on such interest to suppliers as laid down in the Act

• submits a report on its payment practice as set out in Section 12 of the Act.

Under Section 13 of the Act, it is my responsibility, as Auditor of An Bord Bia, to report on whether, in all material respects, the Board has complied with the provisions of the Act.

Basis of Opinion

My examination included a review of the payment systems and procedures in place and checking, on a test basis, evidence relating to the operation of the Act by the

Board during the year.

I obtained all the information and explanations which I considered necessary for the exercise of my function under

Section 13 of the Act.

Opinion

Nothing came to my attention which in my opinion indicated that the Agency had not complied in all material respects with the provisions of the Act during the year ended

31 December 1998.

John Purcell

Comptroller and Auditor General

5 July 1999

Swedish Buyer s Visiting Ir eland.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

2 3

B o a r d M e m b e r s a t 31 D e c e m b e r 1 9 9 8

Chairman

Mr Philip Lynch

Chief Executive, IAWS Group

Michael Duffy

Chief Executive

Seamus Kenny

Secretary

Members

Ms Agnes Aylward

Principal Officer, Department of

Tourism, Sport & Recreation

Ms Jean Cahill

The Food Product

Development Centre

Dr Noel Cawley

Managing Director

The Irish Dairy Board

Mr John Duggan

Chairman, Glanbia

Mr Michael Hanrahan

Chairman, Kerry Group

Ms Maura Nolan

Head of Food Division

Department of Agriculture & Food

Mr Tom O’Dwyer

Irish Creamery Milk Suppliers’

Association (ICMSA)

Mr William O’Kane

Managing Director

O’Kane Poultry Ltd

Mr Tom Parlon

President, Irish Farmers’

Association (IFA)

Ms Mary White

Joint Managing Director

Lir Chocolates Ltd

Changes during 1998

Resigned 3 March 1998:

Mr John Donnelly

IFA

Appointed 23 April 1998:

Mr Tom Parlon

Term of Office expired

15 November 1998:

Mr Philip Lynch

(re-appointed 16 November 1998)

Term of Office expired

30 November 1998:

Mr Michael Dowling

Company Director &

Visiting Professor, UCC

Mr Denis Lucey

Chief Executive, Dairygold

Co-Operative Society Ltd

Ms Mary Quinn

Business Consultant

Ms Sara White

Assistant Secretary

Department of the Marine

& Natural Resources

Changes during 1999

Appointed with effect from

26 January 1999:

Mr Michael Dowling

(re-appointed)

Mr Denis Lucey

(re-appointed)

Mr Joseph O’Sullivan

Chief Executive, Drinagh

Co-Operative Society Ltd

Ms Sara White

(re-appointed)

2 4

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

M e a t a n d L i v e s t o c k S u b s i d i a r y B o a r d a t 31 D e c e m b e r 1 9 9 8

Chairman

Denis Lucey

Chief Executive

Dairygold Co-operative Society

Members

Mr Paul Clarke

National Executive of the Livestock Trade

Mr Michael Holmes

Chairman

National Sheep Committee, IFA

Mr Eddie Keane

IFA

Mr Eugene Kierans

Associated Craft Butchers of Ireland

Mr Tom McAndrew

Chairman IMA and Managing Director

Eurowest Foods Ltd

Mr Liam McGreal

Managing Director

Kepak

Dr Pat Mulvehill

Director General, Irish Poultry

Processors Association

Ms Brid O’Connor

Office of the Director of Consumer Affairs

Mr Raymond O’Malley

IFA Chairman National Livestock

Committee

Mr Edward Power

Chairman

Irish Pigmeat Processors’ Association

Mr Liam Ryan

Chairman

National Pigs Committee IFA

Mr Nicholas Ryan

ICMSA

Changes during 1998

Resigned 5 February 1998:

Mr Peter Smith

IFA

Appointed 11 March 1998:

Mr Eddie Keane

IFA

Term of Office expired

25 April 1998:

Mr Paul Clarke

Dr Roger McCarrick

Mr Alo McGrath

Appointed with effect from

5 June 1998:

Mr Paul Clarke

(re-appointed)

Mr Tom McAndrew

Dr Pat Mulvehill

Term of Office on Board expired 30 November 1998:

Mr Denis Lucey

Changes during 1999

Mr Denis Lucey,

Chief Executive, Dairygold

Co-Operative Society

Re-appointed 17 February 1999

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

2 5

C o n s u m e r F o o d s S u b s i d i a r y B o a r d a t 31 D e c e m b e r 1 9 9 8

Chairman

Michael Dowling

Company Director and

Visiting Professor UCC

Members

Ms Darina Allen

Ballymaloe Cookery School

Ms Carol Buckley

Lecturer in Home Economics

Ms Jean Cahill

The Food Product

Development Centre

Mr Peter Cullen

Managing Director

Aran Candy Ltd

Mr Pat Doyle

Managing Director

Rye Valley Foods Ltd

Mr Con Lucey

Marketing Director

Cheese & Spread, Golden Vale plc

Mr Tommy Murray

Managing Director

Operations, UDV Ireland Ltd

Mr Larry Murrin

Managing Director

Dawn Farm Foods

Ms Maura O’Donovan

Rural Home Economics Teacher

Mr Joe O’Flynn

Marketing Development Director

The Irish Dairy Board

Mr Brendan Smyth

Milk Advisory Manager

Glanbia

Mr Pat Walsh

Managing Director

Walsh Mushrooms Ltd

Changes during 1998

Appointed 11 March 1998:

Mr Con Lucey

Marketing Director

Cheese & Spreads

Golden Vale plc

Mr Larry Murrin

General Manager

Dawn Farm Foods

Mr Brendan Smyth

Milk Advisory Manager

Glanbia

Term expired 1 June 1998:

Ms Bernie Butler

Director, Platter Foods Ltd

Ms Kay Caball

Managing Director

Caragh Catering

Appointed 15 July 1998:

Mr Tommy Murray

Ms Maura O’Donovan

Term expired 30 November 1998:

Mr Michael Dowling

Company Director and Visiting Professor UCC

Changes during 1999

Mr Michael Dowling

Re-appointed with effect from

17 February 1999

2 6

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

O r g a n i s a t i o n S t r u c t u r e

Financial Controller

G. Bailey

Director

International Markets

O. Brooks

Chief Executive

Michael Duffy

Director Operations

A. Cotter

Director Client Services

M. Kennedy

Secretary/Director

S. Kenny

Director Marketing

& Communications

J. McGrath

Manager Consumer

Foods Ingredients

J. McGough

Manager Meat

G. Brickley

Manager Quality

J. Keane

European/Home

Markets

Manager

Marketing Finance

D. Walsh

Small Firms

Manager

Information Services

J. Smith

Manager Exhibitions

L. Williams

Manager

Corporate Communications

E. Headon

Manager

International Media Relations

M. Bracken

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

2 7

T h e O r g a n i s a t i o n

The organisation structure of Bord Bia is comprised of the Board, two Subsidiary

Boards, the Chief Executive and the Executive, which provide the range of operational and corporate services required to implement

Board policy and programmes.

The Board is comprised of a Chairman and 14 ordinary members appointed by the Minister for Agriculture & Food. There are two

Subsidiary Boards (Meat & Livestock and

Consumer Foods) comprised of a Chairman and 12 ordinary members, who are appointed by the Board with the consent of the Minister.

The Chairman of each Subsidiary Board is a member of the Board.

The following Board Committees are in place:

Audit Committee, Evaluation Committee;

Quality Assurance Committee, Remuneration and Pension Committee and Strategy

Committee. The Executive is comprised of staff based in the Board’s head office and overseas.

Board

Meat & Livestock

Board

Consumer Foods

& Ingredients Board

Chief

Executive

Administration

Operations

Directorate

Client Services

Directorate

Marketing &

Communications

2 8

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

Bord Bia’s marketing finance programmes are supported to a considerable extent by funding from the European Union. Most of this comes from the European Agricultural Guidance and

Guarantee Fund under the Food Sub-

Programme of the Operation for Industrial

Development. Funding is also received under the European Quality Beef Scheme for the promotion of beef consumption.

The support and financial assistance of the

European Union enables Bord Bia to make available a range and level of support to the

Irish food and drink industry which would not otherwise be possible.

A n t Ao n t a s E o r p a c h

Faigheann cláracha margaíochta, tionscnaimh agus dreasachtaí airgeadais an Bhoird Bia cuid mhór tacaíochta maoinithe ón Aontas

Eorpach. Tagann a bhunáite seo ó Chiste

Treorach agus Ráthaíochta na hEorpa faoi

Fhochlár an Chláir Feidhme le haghaidh

Forbairt Thionslaíoch. Faightear maoiniú freisin ón Scéim Togha Mairteola faoi choinne chur chun cinn an tomhaltais mhairteola.

Mar gheall ar thachaíocht agus cúnamh airgid an Aontais Eorpaigh is féidir leis an mBord Bia réimse agus leibhéil tacaíochta a chur ar fáil do thionscal bia agus dí na hÉireann nach mbeadh ar fáil dá n-uireasa.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

2 9

R e p o r t o f t h e C o m p t r o l l e r a n d A u d i t o r G e n e r a l

I have audited the financial statements on pages 30 to 41.

Responsibilities of the Board and of the Comptroller and Auditor General

enable me to fulfil my function as Comptroller and Auditor General and in forming my opinion, I also evaluated the overall adequacy of the presentation of information in the financial statements.

The accounting responsibilities of the Board are set out in the Board’s Corporate Statement on pages 20 and 21. It is my responsibility, under section 21(2) of An Bord Bia Act 1994 to audit the financial statements presented to me by the Board and to report on them. As the result of my audit I form an independent opinion on the financial statements.

Opinion

In my opinion, proper books of account have been kept by the Board and the financial statements, which are in agreement with them, give a true and fair view of the state of the affairs of An Bord Bia at 31 December 1998 and of its income and expenditure and cash flow for the year then ended.

Basis of Audit

In the exercise of my function as Comptroller and Auditor General, I plan and perform my audit in a way which takes account of the special considerations which attach to State bodies in relation to their management and operation.

An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements. It also includes an assessment of the significant estimates and judgments made in the preparation of the financial statements, and of whether the accounting policies are appropriate, consistently applied and adequately disclosed.

John Purcell

Comptroller and Auditor General

5 July 1999

My audit was conducted in accordance with auditing standards which embrace the standards issued by the Auditing Practices

Board and in order to provide sufficient evidence to give reasonable assurance that the financial statements are free from material misstatement whether caused by fraud or other irregularity or error. I obtained all the information and explanations that I required to

3 0

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

S t a t e m e n t o f Ac c o u n t i n g Po l i c i e s

(a) Basis of Accounting

These financial statements are prepared on an historical cost basis.

(b) Keeping of Accounts

Subsidiary Boards

Under the terms of the An Bord Bia Act, 1994, the Board is assisted by two Subsidiary Boards in respect of Meat & Livestock and Consumer

Foods & Ingredients. All income and expenditure relating to these Subsidiary Boards is reflected in these financial statements.

Subsidiary Company

The Board operates a wholly-owned subsidiary company which does not trade. Due to the nature of the company, it is not considered appropriate to prepare consolidated financial statements.

(e) Marketing Finance

Expenditure on Marketing Finance is charged to the income and expenditure account.

However, under the terms of the Targeted

Marketing Consultancy (TMC) Programme, which was transferred from An Board Tráchtála in 1995, a proportion of the expenditure is recoverable over a 24 to 60 month period by way of a royalty based on sales achieved by this expenditure. Income arising on the TMC

Programme is accounted for on the basis of actual cash receipts.

(f) Superannuation

Superannuation costs are funded over the employee’s period of service by way of contributions to a fund managed by trustees.

The Board’s annual contributions are based on actuarial advice and are charged to the income and expenditure account in the period to which they relate.

(c) Income

Income shown in the accounts under

Oireachtas Grant-in-Aid represents the actual receipts from this source in the period.

Income shown in the accounts under the EU

Structural Funds and the Quality Beef

Promotion Fund is released to revenue in line with related expenditure and any unexpended balance is included in Creditors.

(g) Leasing

The rentals under operating leases are dealt with in the accounts as they fall due.

Tangible assets acquired under finance leases are capitalised and depreciated as set out in note (d) above.

(d) Fixed Assets and Depreciation

Fixed assets are stated at cost less accumulated depreciation. Depreciation is calculated to write off the original cost less the estimated residual value of tangible assets on a straight line basis at the following annual rates:

Leasehold improvements

Furniture & fittings

Office equipment

Motor vehicles

10%

12.5%

20%

20%

(h) Tangible Assets

Tangible assets are financed out of revenue.

Provision is made in the income and expenditure account for a transfer to the capital account of amounts allocated for such capital purposes less credits to revenue over the life of the related assets.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

3 1

(i) Stocks

Stocks of stationery are stated at cost.

(j) Provision for Bad and Doubtful

Debts

Known bad debts are written off and specific provision is made for any amounts the collection of which is considered doubtful.

(k) Foreign Currencies

Foreign currency balances are translated at the rates ruling at the balance sheet date.

(l) Taxation

Provision has been made in respect of all VAT liabilities and the PRSI contributions of Irish persons attached to overseas offices.

3 2

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

I n c o m e & E x p e n d i t u r e Ac c o u n t y e a r e n d e d 31 D e c e m b e r 1 9 9 8

Notes

1998

IR£

Income

Oireachtas Grant-in-Aid

EU Quality Beef Promotion Fund

EU Structural Funds

Statutory Levy

Project & Other Income

Transfer from Capital Account

Total Income

1a

1b

1c

2

6,530,000

377,560

5,027,000

4,379,649

2,067,176

18,381,385

96,986

18,478,371

1997

IR£

6,719,000

–

7,366,217

3,984,866

2,431,784

20,501,867

13,886

20,515,753

Expenditure

Marketing & Promotional Expenditure

Marketing Finance

Operating Expenditure

Total Expenditure

Surplus/(Deficit) for Period

Balance at 1 January

Balance at 31 December

3

4

5

9,551,992

4,096,845

4,818,574

18,467,411

10,960

3,377

14,337

9,602,177

5,507,683

5,415,389

20,525,249

(9,496)

12,873

3,377

The Statement of Accounting Policies and Notes 1 to 18 form part of these financial statements

Philip Lynch

Chairman

Michael Duffy

Chief Executive

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

3 3

B a l a n c e S h e e t a s a t 31 D e c e m b e r 1 9 9 8

Notes

1998

IR£

1997

IR£

Assets Employed

Fixed Assets

Tangible Assets

Financial Assets

6

7

885,632

6,003

891,635

983,564

5,568

989,132

Current Assets

Stocks

Debtors

Cash at bank and in hand

8

5,000

1,625,004

66,897

1,696,901

7,389

1,340,149

71,957

1,419,495

Creditors

(amounts falling due within one year)

Net Current Assets/(Liabilities)

Total Assets less Current Liabilities

9 1,688,567

8,334

899,969

1,422,632

(3,137)

985,995

Financed by

Capital and Reserves

Capital account

Income and expenditure account

2 885,632

14,337

899,969

982,618

3,377

985,995

The Statement of Accounting Policies and Notes 1 to 18 form part of these financial statements

Philip Lynch

Chairman

Michael Duffy

Chief Executive

3 4

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

C a s h F l o w S t a t e m e n t y e a r e n d e d 31 D e c e m b e r 1 9 9 8

Net cash inflow from operating activites

Notes

15

IR£

1998

IR£

37,822

IR£

1997

IR£

101,087

Returns on investment and servicing of finance:

Bank interest received

Interest on finance leases

Net current inflow of funds

Capital expenditure:

Payments to acquire tangible assets

Capital element of finance lease payments

(Decrease)/increase in cash

17

16

(123,420)

(946) (124,366)

(5,060)

(181,158)

(9,540) (190,698)

15,122

The Statement of Accounting Policies and Notes 1 to 18 form part of these financial statements

Philip Lynch

Chairman

Michael Duffy

Chief Executive

82,343

(859) 81,484

119,306

105,304

(571) 104,733

205,820

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

3 5

N o t e s f o r m i n g p a r t o f t h e

F i n a n c i a l S t a t e m e n t s y e a r e n d e d 31 D e c e m b e r 1 9 9 8 a1 Income

(a) EU Structural Funds have been made available to Bord Bia under Measure 4 of the Food

Sub-Programme which is part of the Operational Programme for Industrial Development and which is jointly funded by the EU and the State.

EU Structural Funds are presented net of State contributions which are reflected in Oireachtas

Grant-in-Aid. Comparative figures for 1997 have been re-stated following the classification of all State grants as Oireachtas Grant-in-Aid.

(b) The An Bord Bia Act, 1994, provides for payment to the Board of a levy per head on slaughtered or exported livestock. Under section 37 of the Act, the rates were set at IR£1.50

per head for cattle, 20p per head for sheep and 20p per head for pigs.

(c) Project and other income includes industry contributions to joint promotions, steak bar sales at trade fairs and seminar and conference fees. Also included is income arising under the Targeted

Marketing Consultancy (TMC) Programme.

2 Capital Account 1998

IR£

982,618 Balance at 1 January 1998

Amount capitalised in respect of purchased tangible assets

Net amount realised on disposals

Amortisation in line with asset depreciation

Capital element of lease payments

123,420

(15,340)

(206,012)

946

Net transfer to income and expenditure account (96,986)

Balance at 31 December 1998

3 Marketing & Promotional Expenditure

Market Development Programmes

Trade Fairs and Exhibitions

Information Services

Quality Assurance

Trade Services

Strategic Marketing Programme

Marketing Services

Communications

Nutritional Advisory Services

1998

IR£

5,329,059

2,086,762

590,205

290,981

590,187

33,348

134,803

249,411

247,236

9,551,992

885,632

1997

IR£

4,411,751

2,778,782

581,697

339,764

750,926

–

375,415

173,422

190,420

9,602,177

3 6

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

N o t e s f o r m i n g p a r t o f t h e

F i n a n c i a l S t a t e m e n t s y e a r e n d e d 31 D e c e m b e r 1 9 9 8

4 Marketing Finance

Marketing Improvement Assistance Programme

Strategic Marketing Development Programme

Marketing Agency Support Agreements

1998

IR£

3,453,287

643,558

–

4,096,845

5 Operating Expenditure

Board and Sub-Board Members’ fees and expenses

Staff costs

Rent, rates and insurance

Telecommunications costs

General business expenses

Depreciation (Note 6 )

Loss on disposal of tangible assets

141,179

2,953,210

527,313

213,556

761,964

206,012

15,340

4,818,574

Operating expenditure includes the full cost of staff and office expenses in head office departments and in the overseas offices. Staff costs are comprised of:

1997

IR£

3,646,220

1,798,963

62,500

5,507,683ˆ

126,759

2,768,362

509,066

207,975

1,598,643

200,277

4,307

5,415,389

Wages and salaries

Social welfare costs

Pension costs

2,508,987

143,860

300,363

2,953,210

2,333,089

150,787

284,486

2,768,362

The total number of employees (including part-time persons) at 31 December 1998 was 68

(1997:68). The cost of certain part-time employees is included in Marketing & Promotional

Expenditure.

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

3 7

N o t e s f o r m i n g p a r t o f t h e

F i n a n c i a l S t a t e m e n t s y e a r e n d e d 31 D e c e m b e r 1 9 9 8

6 Tangible Fixed

Assets

Leasehold

Improvements

IR£

Motor

Fittings Equipment Vehicles

IR£ IR£ IR£

Cost

At 1 January 1998

Additions in year

Disposals

At 31 December 1998

Total

IR£

576,562 450,340

5,472 30,825

(6,368)

582,034 474,797

707,253

87,123

(59,845)

734,531

50,518 1,784,673

123,420

(66,213)

50,518 1,841,880

Depreciation

At 1 January 1998

Charged in year

Disposals

At 31 December 1998

Net Book Amounts

At 31 December 1998

At 31 December 1997

108,178

58,203

197,865

48,961

(3,930)

166,381 242,896

466,272

89,250

(46,943)

508,579

28,794 801,109

9,598 206,012

(50,873)

38,392 956,248

415,653 231,901

468,384 252,475

225,952

240,981

12,126 885,632

21,724 983,564

The total cost of motor vehicles held under finance leases was IR£26,518 and total depreciation on those vehicles was IR£20,158. Depreciation for 1998 on leased motor vehicles was IR£5,038.

The classification of certain figures in relation to 1997 has been re-stated.

7 Financial Fixed Assets

The Irish Food Board (An Bord Bia) France SARL is wholly-owned by An Bord Bia and its transactions are fully reflected in these financial statements.

8 Debtors

Amounts falling due within one year:

Debtors

Prepayments and accrued income

1998

IR£

904,362

720,642

1,625,004

1997

IR£

1,019,547

320,602

1,340,149

3 8

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

N o t e s f o r m i n g p a r t o f t h e

F i n a n c i a l S t a t e m e n t s y e a r e n d e d 31 D e c e m b e r 1 9 9 8

9 Creditors

(amounts falling due within one year)

Trade creditors

Taxation and social welfare (Note 10)

EU Structural Funds

Accruals and deferred income

Obligations under finance leases

1998

IR£

589,054

79,230

390,000

630,283

–

1,688,567

10 Taxation and Social Welfare

Taxation and social welfare creditors comprise the following:

Income Tax

P.R.S.I.

61,440

17,790

79,230

1997

IR£

528,746

78,343

–

814,597

946

1,422,632

61,979

16,364

78,343

It is not possible to ascertain whether and to what extent any potential liability to tax in the various overseas jurisdictions within which the Board operates may arise. Accordingly, no provision has been made in this regard.

11 Commitments

(a) Capital Commitments

An Bord Bia had no capital commitments at the year end.

(b) Financial Incentives

There were no commitments in respect of Marketing Finance Programmes at the year end.

(c) Operating Leases

Operating Leases comprise leases on premises. Leasing commitments payable during the next twelve months amounted to IR£350,322 made up as follows:

Payable on leases on which the commitment expires:

Within one year

Within two to five years

Within six to nine years

22,000

67,011

261,311

350,322

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

3 9

N o t e s f o r m i n g p a r t o f t h e

F i n a n c i a l S t a t e m e n t s y e a r e n d e d 31 D e c e m b e r 1 9 9 8

12 Contingent Liabilities

Contingent liabilities amounting to IR£5,949,215 exist in respect of amounts approved but unclaimed at the year end under the terms of the following Marketing Finance programmes operated by An Bord Bia:

Marketing Improvement Assistance Programme

Strategic Marketing Development Programme

Targeted Marketing Consultancy Programme

1998

IR£

5,515,346

349,381

84,488

5,949,215

1997

IR£

4,832,287

1,430,181

462,823

6,725,291

13 Recoverable Incentives

Under the terms of the Targeted Marketing Consultancy (TMC) Programme, a total of

IR£539,914 was due to be recovered in 1999 and subsequent years from participating companies:

Estimated amount recoverable at start of year

Repayments during year

Unrecoverable amounts

Estimated amount recoverable at end of year

1998

IR£

1,206,871

(533,729)

( 133,228)

539,914

1997

IR£

2,019,258

(735,620)

(76,767)

1,206,871

Recoverable incentives are accounted for on a cash receipts basis and accordingly are not included in debtors.

14 Superannuation

The Board operates a defined benefits superannuation scheme for certain eligible employees, for which the approval of the Minister for Agriculture and Food has been sought in accordance with the An Bord Bia Act, 1994. The contributions of employees and An Bord Bia are paid into a fund managed by the trustees and the total funding rate is in accordance with actuarial recommendations. The last actuarial review took place as at 1 January 1998, and the funding was deemed adequate, on a discontinuance basis, to meet liabilities arising under the scheme.

In 1995, a number of personnel transferred from An Bord Tráchtála and contributions are being paid into the fund in respect of these individuals. However, the estimated underfunding in respect of the past service of personnel who transferred from An Bord Tráchtála amounted to approximately IR£838,578 at 31 December 1998.

4 0

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

N o t e s f o r m i n g p a r t o f t h e

F i n a n c i a l S t a t e m e n t s y e a r e n d e d 31 D e c e m b e r 1 9 9 8

15 Reconciliation of Surplus/(Deficit) to Net Cash Inflow from Operating Activities

Surplus/(deficit) for year

Increase in Investment

Net interest receivable

Depreciation

Capital account transfer

Loss on disposal of tangible fixed assets

(Increase)/decrease in debtors

Decrease in stock

Increase in trade creditors

Increase in taxation and social welfare

Increase/(decrease) in accruals and deferred income

Net cash inflow from operating activities

1998

IR£

10,960

(435)

(81,484)

206,012

(96,986)

15,340

(284,855)

2,389

60,308

887

205,686

37,822

16 Reconciliation of Net Cash Flow to Movement in Net Funds

Cash at bank and in hand

At 1 January

Net cash (outflow)/inflow

At 31 December

71,957

(5,060)

66,897

17 Finance Leases

Obligations under finance leases

At 1 January

In creditors due within one year

In creditors due after more than one year

Total obligations

Lease payments

At 31 December

In creditors due within one year

946

–

946

(946)

–

–

1997

IR£

(9,496)

–

(104,733)

200,277

(13,886)

4,307

786,739

–

230,736

7,137

(999,994)

101,087

56,835

15,122

71,957

9,540

946

10,486

(9,540)

946

946

A

N N U A L

R

E P O R T

& F

I N A N C I A L

S

T A T E M E N T S

1 9 9 8

4 1

N o t e s f o r m i n g p a r t o f t h e