2 0 0 0

advertisement

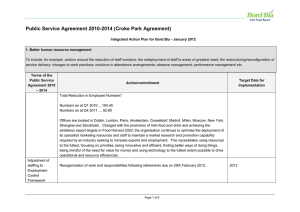

annual repor t & financial statement 2 0 0 0 www.bordbia.ie | info@bordbia.ie To the Minister for Agriculture, Food and Don Aire Talmhaiochta, Bia agus Forbatha Tuaithe Rural Development De réir Alt 22 den Acht um an mBord Bia 1994, In accordance with Section 22 of An Bord Bia Act tá áthas ar an mBord a Thuarascáil Bhliantúil don 1994, the Board is pleased to submit to the Minister bhliain dar críoch 31 Nollaig 2000 a chur faoi its Annual Report and Accounts for the 12-month bhráid an Aire. period ended 31 December 2000. Philib Ó Loinsigh Micheál Ó Dufaigh Philip Lynch Michael Duffy An Cathaoirleach An Príomhfheidmeannach Chairman Chief Executive contents annual repor t & financial statement 2000 Chairman’s Statement 2 Aitheasc an Cathaoirligh 6 Chief Executive’s Review 10 Corporate Statement 20 Board Membership 23 Organisation Structure 27 The Organisation 28 European Union 29 Report of the Comptroller & Auditor General 30 Statement of Accounting Policies 31 Income & Expenditure Account 33 Balance Sheet 34 Cash Flow Statement 35 Notes forming part of the Financial Statements 36 Exports By Sector (Value in IR£m) Animal Foods Fish Dairy Products Edible Horticulture & Cereals Beverages Prepared Foods Poultry Lamb Pigmeat Beef Live Cattle Total Value Of Irish Food & Drink Exports 1999 2000 % of 2000 exports Animal Foods 1% Fish 4% Dairy Products 24% Edible Horticulture & Cereal 2% Beverages 12% Prepared Foods 24% Poultry 2% Lamb 3% Pig Meat 4% Beef 21% Live Cattle 3% 99 00 0% 2000 71 227 1,245 121 572 1,189 110 137 200 1,150 150 78 227 1,306 130 630 1,281 125 145 220 1,110 160 1 4 24 2 12 24 2 3 4 21 3 5,172 5,412 100 Irish Food & Drink Exports (IR£m) % of 2000 Exports exports / / / / / / / / / / / 1999 71 78 227 227 1,245 1,306 121 130 572 630 1,189 1,281 110 125 137 145 200 220 1,150 1,110 150 160 1 c h a i r m a n ’s statement annual repor t & financial statement 2000 Philip Lynch | Chairman The year 2000 was a successful one for the Irish food and drink industry with total exports up 4.4 per cent to IR£5.4/€6.9 billion. Export earnings increased in every sector, apart from beef which suffered from renewed concerns about BSE in European and International Markets in the last quarter. Demonstrating Ireland’s stringent beef production controls will remain the key priority in this sector for the medium-term. The focus must be on securing our position in commercial markets. The food industr y is dynamic and operates in a challenging and changing environment. In every industry, businesses must transform themselves to survive and flourish. Change and development must always be based on the foundation of an absolute and uncompromising commitment to our very high animal health, welfare and environmental standards. In the food industry, innovation is crucial, not alone to satisfy the relentless demands for new products from increasingly sophisticated and time-pressed consumers but also to deal with the continuous competitive demands of the food industr y. Innovation must be applied to production methods, quality control, marketing, distribution and the adaptation to new routes to market such as the development of grocery e-tailing. A key requirement for Irish companies to achieve this is through an in-depth understanding of the market and close relationships with buyers. 2 Irish food and drink companies are sources of high quality and price competitive products. Production, quality and logistics are excellent. Buyers want suppliers to take a strategic approach to finding solutions for their business and to play a greater role in business development. Irish companies will benefit from an increased focus on how to manage their business effectively and on building partnerships with their customers based on market knowledge. This is essential in sustaining and securing stable business in the highly competitive environment we face. The UK is perhaps the most sophisticated retail market in Europe. A survey of UK buyers, carried out by Bord Bia in 2000, showed that their perceptions of and satisfaction with Irish companies continues to grow strongly. Ninety per cent rate the quality of Irish food and drink as good or very good compared to 62 per cent in 1996. The fact that Irish companies are well-regarded by buyers – allied to the continuing growth in expor ts – shows that they can succeed in the most demanding environment. It also reflects Bord Bia’s work in the aggressive promotion of Irish food and drink since its establishment in 1994. Bord Bia’s mission is to deliver effective and innovative market development, promotion and information services to secure new business for our clients. Companies must innovate to succeed and Bord Bia itself is no different. In 2000, Bord Bia secured additional resources from Government.These will be channelled in 2001 into 3 annual repor t & financial statement 2000 providing in-depth market information and analysis to Irish food and drink companies; expansion of services to the consumer food and drink sector and the further development of small business activities. Consultation with the industry, and feedback from buyers, indicates that these enhanced resources will greatly suppor t Irish companies, par ticularly those targeting continental European markets. Bord Bia is also responding to changes in Irish retailing by developing programmes for the home market. The ongoing evolution of the food industry guarantees an exciting time over the coming years. I am confident that by the completion of Bord Bia’s current Market Development Plan in 2006, the beef sector will have achieved an enhanced position in its key commercial markets. In the fast growing Consumer Food and Drink sector Britain will continue as our most important export market, with an increased number of consumer food and drink companies established on the continent. I also expect to see the Speciality Food sector continue to play an important role in our promotional efforts in overseas markets, adding to the diversity of our product range, and reaching their full growth potential. I, with my Board and the staff of Bord Bia, am enthusiastic about the future and we are looking forward to championing and suppor ting Ireland’s most impor tant indigenous industry in these challenging and important developments. APPRECIATION AND ACKNOWLEDGMENTS I am satisfied that Bord Bia is an effective organisation with a clear vision and fully committed to its mission on behalf of the Irish food and drinks industry. It is a dynamic organisation, highly regarded by clients, customers and stakeholders, and I am delighted to be associated with it, particularly at this time of unprecedented change and challenge for the industry. The work of the organisation could not be carried out successfully without the inputs of a great many people and organisations.To all I extend sincere appreciation. 4 The Minister for Agriculture, Food & Rural Development, Mr Joe Walsh, TD, and his Ministers of State and officials have been unfailing in their support and their commitment to the achievement of our objectives (and I extend particular thanks to them). Our Irish embassies in overseas markets continue to assist us and I thank the Ambassador s and their staff. I also thank other Government Depar tments, State Bodies and industry organisations with whom we work closely and who assist us in so many valuable ways. I extend our thanks and good wishes to Michael Hanrahan and Tom O’Dwyer, whose terms of office on the Board have expired since the last Report, for their contributions to Bord Bia. I congratulate my colleagues who were re-appointed to the Board (Noel Cawley, Billy O’Kane and Mary White) and I congratulate and welcome the new members (Dan Browne and Pat O’Rourke) with whom I look forward to working. Our successes and the positioning of the organisation going forward owe a great deal to the commitment of the Chief Executive, Michael Duffy, and the Management and Staff of Bord Bia and I would like to thank them for their continued hard work, dedication and professionalism in what have been, and will continue to be, challenging times. Finally, it is my great pleasure once again to thank my fellow Board and Subsidiary Board members for giving so generously of their time, expertise and commitment and whose support I greatly appreciate and value. Philip Lynch | Chairman 5 annual repor t & financial statement 2000 Bliain rathúil a bhí ag an tionscal bia agus dí sa bhliain 2000, d’ardaigh onnmhaire aitheasc an chathaoirligh iomlán ó 4.4 faoin gcéad go dtí ÉIR£5.4/€6.9 billiún. D’ardaigh tuilleamh onnmhairí i ngach earnáil, cé is moite de mhairteoil de bharr imnithe maidir le BSE i Margaí na hEorpa agus i Margaí Idirnáisiúta sa ráithe dheireanach. Beidh sé mar phríomhthosaíocht ag an earnáil seo rialuithe táirgíochta mair teola ghéar na hÉireann a léiriú go meántéarmach. Caithfaimid díriú ar ár seasamh i margaí tráchtála agus caithfear dul chun cinn a bhunú ar thiomantas diongbháilte dár nardchaighdeán sláinte ainmhí agus leas agus comhshaoil. Feidhmíonn an tionscal bia i dtimpeallacht dhúshlánach agus athraitheach. I ngach tionscal caithfidh gach gnó iad féin a athrú chun maireachtáil agus fás. Tá nuálacht riachtannach, ní hamháin chun an t-éileamh le haghaidh táirgí nua ó thomhaltóirí atá ag éirí níos sofaisticiúla agus atá faoi bhrú ama a shásamh, ach chun teacht i gcabhair ar na héilimh iomaíochta leanúnacha a bhíonn ar an tionscal bia. Caithfear é a chur i bhfeidhm ar mhodhanna táirgíochta, ar rialú caighdeáin, ar mhargaíocht, ar dháileadh agus ar oiriúnacht do bhealaí nua chun margaíocht a dhéanamh, mar fhorbairt ar ríomhdhíolachán grósaeirí. Caithfear leanúint le héilimh thábhachtacha mar thuiscint shonrach ar an margadh agus caidrimh mhaithe le ceannaitheoirí chun rathúlacht a bhaint amach. Is foinsí de tháirgí ardchaighdeáin agus praghsanna iomaíocha iad na cuideachtaí bia agus dí in Éirinn. Tá ceannaitheoirí ag iarraidh go nglacfaidh soláthraithe cur chuige straitéiseach maidir le fadhbanna gnó a réiteach agus ról níos mó a ghlacadh i bhforbair t an ghnó. Bainfidh cuideachtaí Éireannacha leas as fócas méadaithe ar bhealaí chun a ngnó a bhainistiú go héifeachtach agus ar chomhpháirtíochtaí a bhunú lena gcustaiméirí bunaithe ar thuiscint ar an margadh. Tá sé seo riachtanach chun gnó seasmhach a choimeád agus a dhaingniú sa timpeallacht ardiomaíochta atá romhainn amach. Tá an Ríocht Aontaithe ar cheann de na margaí miondíolacháin is sofais san Eoraip. Léirigh suirbhé de chuid Bhord Bia sa bhliain 2000 ar cheannaitheoirí na 6 Ríochta Aontaithe go bhfuil borradh láidir leanúnach ag teacht ar a ndearcadh deimhneach agus ar a sásamh le cuideachtaí Éireannacha. Tugann nócha faoin gcéad acu ráta “go maith” nó “an-mhaith” do chaighdeán bia agus dí na hÉireann i gcomparáid le 62% i 1996. Ós rud é go bhfuil dearcadh maith ag ceannaitheoirí ar chuideachtaí Éireannacha – i dteannta an borr tha leanúnigh in onnmhaire – léiríonn sé go n-éireoidh leo sa timpeallacht ar a mbíonn an tóir is mó. Léiríonn sé seo obair Bhord Bia i gcur chun cinn seasta ar bhia agus ar dheoch na hÉireann ó bunaíodh é i 1994. Tá sé mar mhisean ag Bord Bia forbairt margaíochta, cur chun cinn agus seirbhísí eolais núalaigh agus éifeachtaigh a chur ar fáil chun gnó nua a dhaingniú dár gcliaint. Caithfidh cuideachtaí a bheith nuálach chun go n-éireoidh leo agus baineann an scéal céanna le Bord Bia. Sa bhliain 2000, fuair Bord Bia acmhainní sa bhreis ón Rialtas. Bainfear úsáid as na hacmhainní sin sa bhliain 2001 chun eolas agus anailís shonrach a dhéanamh ar an margadh maidir le cuideachtaí bia agus dí na hÉireann agus maidir le leathnú a dhéanamh ar sheirbhísí d’earnáil bia agus dí an tomhaltóra agus maidir le forbair t sa bhreis ar ghníomhaíochtaí ghnónna beaga a chur ar fáil. Léiríonn comhchomhairle leis an tionscal agus aiseolas ó ceannaitheoirí go dtabharfaidh na seirbhísí sin tacaíocht fiúntasach do chuideachtaí Éireannacha go mór mór iad sin a bhíonn ag díriú ar mhargaí Mhór-Roinn na hEorpa. Tá Bord Bia ag freagair t 7 annual repor t & financial statement 2000 d’athruithe i miondíolachán na hÉireann trí fhorbairt a dhéanamh ar chlár le haghaidh an mhargaidh sa bhaile. Geallann na hathruithe seasta i dtionscal an bhia tréimhse bhisúil sna blianta amach romhainn. I dtaobh feola de, rachaidh mé i mbannaí go n-éireoidh leis an earnáil mhairteola seasamh níos fearr a bhaint amach ina phríomhmargaí tráchtála, faoin am a chuirfear críoch le Plean Forbartha Margaidh reatha Bhord Bia i 2006. Beidh an Bhreatain ar an margadh onnmhaire is tábhachtaí dúinn faoi mar a bhí sí go dtí seo maidir le hearnáil Bhia agus Dí an Tomhaltóra atá ag borradh go tapa agus chomh maith leis sin beidh ardú ar líon na gcuideachtaí bia agus dí Éireannacha a bheidh ag déanamh gnó ar mhargaí Mhór-Roinn na hEorpa. Táim ag súil freisin go mbeidh ról níos tábhachtaí ag an earnáil Bia Speisialta inár ngníomhaíochtaí cur chun cinn thar sáile faoi mar a bhí go dtí seo, rud a chuirfidh le héagsúlacht an réimse táirgíochta de réir mar a bhaineann an earnáil a cumas borrtha iomláin amach. Tabharfaidh Bord Bia tacaíocht do na forbairtí sin agus seasfaidh sé le rathúlacht bhia agus dí na hÉireann faoi mar a rinne sé go dtí seo – dúshláin lena bhfuil mo chuid comhghleacaithe agus mé féin ag súil le díograis agus le muinín. BUÍOCHAS Is eagraíocht éifeachtach é Bord Bia a bhfuil fís shoiléir agus tiomantas iomlán aige dá mhisean thar ceann an tionscail bia agus dí in Éirinn. Táim an-sásta a bheith bainteach leis, go mór mór ag tráth seo na n-athruithe agus na ndúshlán gan fasach. Ní fhéadfaimid ár gcuid oibre a dhéanamh go rathúil gan ionchur go leor daoine agus go leor eagraíochtaí. Gabhaim buíochas ó chroí leo sin uile. Gabhaim buíochas mór leis an Aire Talmhaíochta, Bia agus Forbartha Tuaithe, Joe Walsh, T.D., agus lena Airí Stáit agus oifigigh as ucht a gcuid tacaíochta agus a dtiomantas maidir lenár n-aidhmeanna a bhaint amach. Cuidíonn na hAmbasáidí Éireannacha i margaí thar sáile linn go leanúnach agus gabhaim buíochas leis na hAmbasadóirí agus a bhfoirne oibre. Gabhaim buíochas freisin le Ranna Rialtais 8 eile, Comhlachtaí Stáit agus eagraíochtaí tionscail lena n-oibrímid go dlúth agus a chuidíonn linn ar go leor bealaí fiúntacha. Chomh maith leis sin, ag leibhéal Eorpach, tá áthas orm buíochas a ghabháil arís as an gcuidiú a fhaighimid ó Choimisiún an AE agus a chuid oifigigh. Gabhaim buíochas agus beannachtaí le Michael Hanrahan agus Tom O’Dwyer, a bhfuil deireadh tagtha lena dtéarmaí oifige ar an mBord ón uair a rinneadh an Tuarascáil dheireanach, as ucht an méid a rinne siad do Bhord Bia. Déanaim comhghairdeas le mo chuid comhghleacaithe a athcheapadh ar an mBord (Noel Cawley, Billy O’Kane agus Mary White) agus fáiltíonn agus déanaim comhghairdeas leis na comhaltaí nua (Dan Browne agus Pat O’Rourke) agus táim ag súil go mór le hoibriú leo. Tá baint mhór ag tiomantas an Phríomhfheidhmeannaigh, Michael Duffy, agus ag lucht Bainistíochta agus Foireann Bhord Bia lenár rathúlacht agus leis an mbealach ina bhfuil an eagraíocht ag dul chun cinn agus ba mhaith liom buíochas a ghabháil leo as ucht a gcuid oibre crua, a gcuid tiomantais agus a gcuid gairmiúlachta i rith amanna a bhí dúshlánach agus i rith amanna a bheidh dúshlánach. Ar deireadh, tá an-áthas orm buíochas a ghabháil arís le mo chomhghleacaithe ar an mBord agus ar Fho-Bhoird as ucht a gcuid flaithiúlachta ó thaobh ama de, as ucht a gcuid saintaithí agus a dtiomantas agus táim an-bhuíoch as a gcuid tacaíochta. Philip Lynch | Cathaoirleach 9 c h i e f e xe c u t i v e ’s review annual repor t & financial statement 2000 The year 2000 saw both a number of new projects and a focus on undertaking core activities in new ways by Bord Bia at home and abroad. Irish exports reached a record IR£5.4/€6.9 billion in a year of reduced output but improved prices in beef, pork & bacon, lamb and poultry, while consumer foods cemented their position as the drivers of growth in the Irish food and drink sector. The strength of ster ling enhanced Ireland’s competitiveness in our main market, Britain. New initiatives in 2000 included a ‘Meet the Markets’ Day in September. Eighty Irish companies from the consumer foods, dairy, drinks and speciality sectors attended. The format included workshops on meeting buyers’ expectations, including advice on presentations and preparation, and the results of Bord Bia’s study on e-tailing.The purpose was to enable every company to discuss business development opportunities with Bord Bia overseas marketing executives.The number of enquiries from Irish companies to Bord Bia’s European offices trebled in the month following the event. In 2000, the first all-island trade exhibition was organised at the Fancy Food Show in New York. Bord Bia and Trade International Northern Ireland came together to help companies from both parts of the island exploit opportunities in the US, where there is an increasing interest in ethnic foods. Food and drink exports from Northern Ireland and the Republic are worth approximately IR£208 million/€265 million, with beverages accounting for 75 per cent of the total. Manufacturers on both sides of the border face similar challenges but also both benefit from a clean, green environment and the development of innovative and natural products. Companies participated at the Fancy Food Show under a new Ireland The Food Island identity which was specifically developed for the US market and the visit concluded with a three-day workshop on food marketing in Philadelphia. The EU Directive on country of origin labelling for beef came into effect in September 2000. As a consequence Irish beef will be clearly identified on supermarket shelves. The general consumer preference for domestically produced beef, particularly in our export markets, can be tackled through strong promotional and information campaigns. The Irish beef proposition – extensively produced in a green environment with its unique flavour – must continue to be promoted. The BSE crisis which started in the last quarter of 2000 has made this task more difficult but it must remain a goal for Bord Bia and the industry as a whole. Bord Bia anticipated this development and is using this oppor tunity to communicate the natural grass-based feeding of Irish beef. In Britain the roll-out of the new Irish beef mark was continued. The mark was carried on retail packs of Irish beef from February and suppor ted with outdoor campaigns and retail promotions. Over 15,000 tonnes of Irish beef was sold in Britain under this “Irish beef ” mark during the year. 10 The accompanying slogan ‘Beautiful grass makes beautiful beef ’ was introduced to the trade at a Meat Market seminar in January attended by the leading beef, lamb, pork and bacon companies. The developments concerning country of origin labelling and the key trends in major export markets were the focus of the seminar. A new style of television advertising for meat products was developed for the home market, focusing on taste and convenience. The advertisements are designed to engender an ‘I can do that’ response from the viewer. The ads show step-by-step recipes for beef, lamb and bacon, backed by point of sale material and public relations activities. Since its establishment, Bord Bia has sought to develop each route to market for Irish food and drink companies, be it food ingredients, foodservice, or retail – private label or branded products. A Brand Development Group was established to protect and promote the branded route to market, par ticularly within retail in Britain and Ireland. Thir ty companies attended the Brand Forum in November. Bord Bia also reviewed its own brand, ‘Ireland the Food Island’ and while the associations with this brand are very positive, a new visual identity was required to increase visibility and impact at key trade events. Irish companies put a high importance on the ‘Food Island’ umbrella identity at trade shows. New ‘Ireland the Food Island’ branding will be introduced in 2001.To strengthen the ‘Food Island’ branding, Bord Bia’s website was split in 2000, with www.bordbia.ie, a corporate information site on Bord Bia and www.foodisland.com informing buyers and including a revised and upgraded database of every food and drink company in the country. A new subsidiary Board for Quality Assurance was established in 2000. This has overall responsibility for the design, development and implementation of Quality Assurance within Bord Bia and includes representatives from consumer bodies as well as primary producers, processors and the industry. The Quality Assurance Board is also in the process of seeking accreditation to the European standard EN45011. A key task is to develop internal structures and procedures that will enable it to carry out the functions of a certification body in accordance with the EN45011 accreditation terms of the National Accreditation Board. A crucial role for Bord Bia is to establish and nurture close links with overseas retail and foodservice buyers. An overview of activities across sectors and markets shows that European offices made 171 presentations to buyers, from which 17 selected inward buyer visits were organised. More than 500 buyer meetings were held and European staff handled 766 buyer enquiries. Bord Bia organised participation at 17 international trade shows for 113 Irish companies. Companies routinely report high levels of satisfaction with 11 annual repor t & financial statement 2000 the turn-key service Bord Bia’s exhibitions department provides. Thirty market visits to non-EU countries were undertaken during the year to ensure continued market access and business development for Irish food and drink companies in all sectors. To communicate the values and raise the profile of Irish food and drink overseas, media contact resulted in almost 120 press articles on Irish food and drink being published in European consumer and trade press during the year. On the Irish market, 111 food demonstrations were held around the country and a new interactive programme was developed for secondary school students to communicate nutrition information and to promote cooking skills. BEEF Irish beef exports were worth IR£1.1/€1.4 billion in 2000 – reflecting a volume reduction of over 12 per cent at an estimated 495,000 tonnes and because of higher cattle prices, a four per cent reduction in the value of exports on 1999. The background to these figures was a 14 per cent drop in Irish beef production on 1999. This was due to the strong level of live exports of young cattle in the second half of 1998 and early 1999, which reduced the availability of finished cattle throughout 2000. Also, towards the end of the year, BSE problems on the continent adversely affected the level of demand for beef in general and in turn Irish beef exports. This will continue to dominate the sector in the medium-term with trade flows dramatically altered and serious challenges facing Irish beef marketing. Almost 50 per cent of Irish beef exports went to European markets compared to 44 per cent in 1999. This change in the balance between markets was in line with Bord Bia’s strategy for the sector. Exports to Britain were 16 per cent higher at 110,000 tonnes with trade helped by an increased import requirement and the continuing strength of sterling. Exports to Continental EU markets were 10 per cent lower during 2000 at 130,000 tonnes.Trade was affected by the disruption in Irish beef supplies during January 2000 and the reduced import requirement in key markets such as France and Italy towards the end of the year as the BSE issue dominated the market. France remains Ireland’s main Continental EU beef market at 40,000 tonnes followed by Italy and Holland at 30,000 tonnes. Thirty Michelin-starred chefs attended an Irish beef dinner in the Irish Embassy in Paris and Irish beef was vigorously promoted at trade level throughout the year. Extensive consumer adver tising campaigns were also conducted in nor thern Italy with 1,400 outdoor posters making a strong impact in the Milan region. 12 Beef exports to International markets were affected by the lower cattle supplies in Ireland with export volumes falling by 20 per cent to 255,000 tonnes. Egypt remained the main destination accounting for over 60 per cent of exports to non-EU markets. Bord Bia was instrumental in the setting up of the Ireland/Egypt Business Association. Bord Bia focused on market development and maximising market entry along with intelligence reporting. Public relations programmes were carried out in sensitive markets to improve the image of Irish beef in the national media. Bord Bia’s intensive marketing work included working with industry to gain new retail customers for Irish beef and to increase sales to existing retail accounts, as well as activity within the foodservice sector. As the BSE crisis unfolded towards the year-end, the focus of attention shifted towards intensified liaison with the trade to address the key issues particularly in France and Italy. The BSE crisis necessitated a re-focusing of Bord Bia’s activities in November and December which concentrated on constant contact with buyers in order to clarify issues and reassure them of the controls in place for Irish beef. In addition, there was considerable activity in the areas of media contact and monitoring, and assistance to the Department of Agriculture, Food and Rural Development in their efforts to maintain market access, particularly in international markets. Beef companies were represented at nine trade shows in 2000. On the Irish market, Bord Bia advertised beef on national television for the first time with assistance from the European Quality Beef promotion fund. Membership of the Beef Quality Assurance Scheme was maintained at 42 plants. All plants were audited along with independent random farm inspections. These are designed to verify the results of the year-round inspections carried out by member plants. LIVE CATTLE Exports of live cattle were worth IR£160/€203 million in 2000, an increase of almost seven per cent. Volume was marginally lower than 1999 at an estimated 400,000 head. Spain, Italy and the Netherlands were the main markets accounting for almost 80 per cent of exports. Just over half of the total were weanlings/stores.The strength of sterling helped expor ts to Nor thern Ireland increase 50 per cent to 27,000 head. Live expor ts to International markets was affected by the lower level of export refunds and fell 12 per cent to 65,000 head. 13 annual repor t & financial statement 2000 Bord Bia’s support to the livestock trade focused on identifying customers, collation of a register of livestock buyers and their individual requirements in each market and assisting Irish exporters in making contact with them. Bord Bia also provided information on market demand and organised promotion of Irish livestock at key events such as the Royal Highland Show. PORK AND BACON Irish pigmeat exports were valued at IR£220/€279 million, an increase of 10 per cent on 1999.Volumes fell by 10 per cent in 2000 to 117,000 tonnes due to a drop in production although the value of exports was helped by an increase of 24 per cent in pig prices. In Ireland Bord Bia promoted Quality Assured pork and bacon including intensive work with the foodservice industry with a view to maximising the market position of Irish products. This highlighted the different ways of preparing pork and bacon dishes, through recipe booklets, workshops and seminars for key target groups including caterers, teachers, health professionals and students. Bord Bia television advertising promoted bacon in association with eggs by presenting a complete meal solution in the form of a three minute bacon omelette. The UK remains the main export market for Irish pigmeat accounting for over 55 per cent of the total at 65,000 tonnes. Trade was helped by the strength of sterling and an increased import requirement although stall and tether-free pigmeat obtains premium prices. In Britain, the main focus of Bord Bia activities was on promoting the Quality Assurance Scheme to retail and trade customers. The organisation worked with exporters to carry out market opportunity research on the ingredients and foodservice sectors. Exports to Continental EU markets fell by 20 per cent to 30,000 tonnes due to the lower volume of Irish product available. Germany remains the main market at 15,000 tonnes followed by France and Italy. In Continental EU, the activity focus was mainly on Germany, where Bord Bia targeted key customers through presentations and organising inward buying missions. New business was secured through this activity. In International markets, activities included regular market visits to Japan to establish ongoing market conditions and keep the Irish industr y informed of developments. Bord Bia also undertook a study tour to Hungary to focus on both the processing capabilities and the potential competitive threat of the market. 14 The Pigmeat Quality Assurance Scheme continues to meet the needs of customers across a range of criteria. Membership of the scheme was maintained at 24 member plants and were audited along with routine spot inspections. LAMB As in all meat sectors in 2000, lamb production declined from 1999 but producer prices were higher. The value of Irish exports increased nearly six per cent to an estimated IR£145/€184 million with volume down 11 per cent to 49,000 tonnes. During 2000, Bord Bia directed lamb promotions at younger consumers on foot of consumer research carried out on both the Irish and overseas markets. France is the main market for Irish sheepmeat exports, accounting for almost 80 per cent of the total. Irish lamb was launched in a number of multiple retailers under the “Agneau de St. Jean” label to coincide with the period of maximum Irish quality lamb production. The objective is to establish an Irish lamb season over time. The St Jean feast-day has strong rural associations in France and is not yet associated with any particular dish. Extensive in-store promotion and targeted radio advertising throughout France were the main elements of the campaign. The promotion succeeded in significantly increasing the spontaneous and prompted recognition of Irish lamb, while raising awareness of its positive image and sales penetration. There were increased purchases of Irish lamb from 18 per cent who previously bought to 33 per cent who had purchased during the campaign.Two thirds of these had bought for the first time. Bord Bia activity in France and in Mediterranean markets included ongoing trade liaison and marketing including promotions in-store and at the SIAL food fair in October. Among Bord Bia’s activities in Ireland were a TV, radio and print media advertising campaign as well as point of sale material aimed at promoting the ease of preparing and the quality of Irish lamb and hill lamb.These took place at Easter and through the summer. Bord Bia also organised domestic catering seminars aimed at highlighting lamb’s versatility to make it more attractive to younger consumers. Bord Bia was represented on a monitoring committee established to implement the recommendations of the sheepmeat forum report including the development of a Lamb Quality Assurance Scheme. 15 annual repor t & financial statement 2000 POULTRY Irish poultry exports were worth IR£125/€159 million in 2000 - an increase of 14 per cent on last year.This was due to an increase in export values for both chicken and turkey parts, particularly in the second half of the year although this was not spread evenly on all products. For example, there was little increase for frozen birds but chicken leg quarters doubled in value. The volume of turkey exports increased by 10 per cent while earnings were up 25 per cent to over IR£40/€51 million. On the Irish market, imports from international sources pose a challenge to domestic production and returns to producers. Bord Bia is assisting the industry in developing a Poultry Quality Assurance Scheme. The year 2000 was the first full year of the operation of the Egg Quality Assurance Scheme and membership expanded to include 22 packing centres. A total of 25 audits were carried out along with 280 laying farm inspections. The scheme has been widely adopted by the egg sector and has facilitated the industry in obtaining new business. PREPARED CONSUMER FOOD The prepared consumer foods sector maintained its well-established growth pattern achieving growth of almost eight per cent in 2000, bringing total export sales for the sector to IR£1.2/€1.5 billion, and outperforming beef for the first time. Most of the increase in volume and value has come from companies supplying British multiples. This market will continue to be highly competitive as the major multiples compete for customer loyalty. Both retail and foodservice customers are demanding higher product specifications and increased levels of technical auditing. The development of sales into continental European retail markets is an impor tant medium term strategic objective for this sector. Europe offers opportunities for well positioned brands as penetration of own label still lags significantly behind Britain. Irish companies can translate their learning experience in Britain into oppor tunities in continental Europe. However, it is crucial that the very different market characteristics and requirements on product, logistics and overall competitiveness are built into market entry strategies at the outset. Bord Bia programmes for the sector in 2000 included a mix of information and market development activities. Consumer food companies were represented at 13 food fairs, which are often the first stage in developing new business in new markets and sectors.The first programme for frozen food companies targeting Germany was initiated with a study 16 visit to the Intercool trade fair in Düsseldorf. The German frozen food market is worth IR£5.5/€6.9 billion. In addition, participation was organised at a number of relevant ‘route to market’ and international trade fairs, including the first Irish participation at In Flight Catering Association (IFCA) and continued participation at Private Label Manufacturers Association (PLMA) and SIAL. Sector specific shows included the International Sweets and Biscuits Fair (ISM) and the first Ireland the Food Island Stand at the Total Sandwich Show. Bord Bia was a host sponsor to the annual congress of CIES, The Food Business Forum which was held in Ireland for the first time and attended by 600 CEOs and senior managers of the world’s largest retailers and food companies. DAIRY AND FOOD INGREDIENTS A rise in dairy prices, driven by the strength of the US dollar, resulted in a five per cent increase to IR£1.3/€1.66 billion. Irish dairy products have established themselves in markets all over the world and sold as branded and private label products in the UK and Europe. Dairy ingredients are sold to food manufacturers in Europe, the United States and Asia. Irish companies benefit from the information and promotional programmes operating in the Consumer Food Division, as well as through participation on the Food Island stands at trade shows. The Asia Pacific Strategy Committee, of which Bord Bia is a member, will target growth markets for Irish bulk dairy and value-added food ingredients. BEVERAGES The year 2000 proved a successful one for the Irish beverages sector with a 10 per cent increase bringing expor t sales to IR£630/€800 million. Products showing par ticular growth in export markets were beer, cream liqueurs, spirits and mineral water – all assisted by strong economies in the key markets of UK, USA and Europe. Companies producing cream liqueurs, white spirits, malt whiskey and premium packaged spirits developed new markets, introduced new innovative products and improved packaging and design. Many companies also invested heavily in advertising and promotion to drive their products’ growth in international markets. Bord Bia implemented programmes for the retail and foodservice sectors including route to market-specific trade fairs such as the London International Wine Trade Fair, IFCA (In Flight Catering Association), WSWA (Wine & Spirit Wholesalers Association, USA). A first market visit to Sweden was organised for 14 drinks companies to meet with the State monopoly Systembolaget and to investigate opportunities. 17 annual repor t & financial statement 2000 EDIBLE HORTICULTURE & CEREALS The value of exports in the edible horticulture and cereals sector increased by just over seven per cent in 2000 to IR£130/€165 million.The key product in the edible horticulture sector is fresh mushrooms with Irish growers supplying almost half of the fresh mushrooms sold in UK supermarkets. In 2000, British retailers continued to price cut aggressively, leaving small margins for producers. However, the market is stronger than in previous years with supply and demand in better balance and with little surplus product. Irish companies are also developing more business opportunities to supply mushroom as an ingredient and this, as well as convenience products, continues to be a growth area. SPECIALITY FOODS AND SMALL BUSINESS Bord Bia continued to support Ireland’s thriving small food businesses in 2000. A review of the programme showed that exports of the 60 or so speciality food companies Bord Bia works with doubled between 1996 and 1999 with turnover growing 35 per cent to about IR£100/€127 million. The significance of the sector is not alone its contribution to rural development and export earnings but importantly, the high quality image they impart to the entire Irish food and drink industry. A good example of this is Bord Bia’s project with Irish premium chocolate companies. Irish chocolate makers were brought together to determine how best to represent their ‘Irishness’ in export markets, particularly Britain. Research found that consumers did accept the proposition of premium chocolates from Ireland, based on the country’s reputation for crafting and quality ingredients. In 2000, different positionings were developed which reflect the best of Irish chocolate – its rural and poetic tradition, its high quality and its modernity. Thirty journalists attended a press event in the UK on the project and products and public relations will remain an important aspect in developing a shared identity for Irish chocolates. In 2000, a Guide to Irish Farmhouse Cheeses was published with the objective of targeting the foodservice sector and highlighting the personality behind Irish cheeses as a point of difference. In a major step forward, Irish farmhouse cheeses were on the Ireland the Food Island stand at SIAL, the world’s largest food fair in Paris. A second guide to the speciality food sector was published and circulated to 100 buyers in the UK and Ireland. Thirty speciality and organic food and drink companies were represented on the Bord Bia stand at IFEX Trade Show in Dublin. IFEX also saw the first joint trade reception with LEDU, Local Enterprise Development Unit in Northern Ireland which was attended by key buyers from the north and south of Ireland. 18 Bord Bia published the first in-depth report on organic food in Ireland. Consumer and trade research showed that domestic demand is running ahead of supply and a consistent supply base needs to develop before export potential can be examined. It found that consumers had overwhelmingly positive attitudes towards organic food and were prepared to pay a premium of up to 20 per cent for such products. In 2000 Bord Bia finalised and launched its new marketing finance programme for 2000-2006. The new programme is funded by the National Development Plan and comprises two elements - the Marketing Improvement Assistance Programme and a new Market Participation Programme.The schemes are targeted at smaller companies and will assist them in developing their marketing capability, supporting e-commerce initiatives, participation in trade fairs, undertaking market research and developing designs for new products. It is anticipated that up to 200 Irish companies will avail of the programme. ORGANISATIONAL DEVELOPMENT An in-depth review of Bord Bia’s information systems resulted in a new IT strategy for the organisation. This fits with the objective of enhancing the use of technology in food marketing within the industry as a whole and increasing the effectiveness of Bord Bia’s own work. This will increase the organisation’s technical capability and enable a more efficient response to client needs in an increasingly dynamic environment. A report was published on the prospects for e-tailing in the British market and the potential it may offer Irish food and drink companies. In keeping with the evolution and change apparent in 2000, there was a higher than usual level of external recruitment, internal promotions and transfers. In addition, the Department of Agriculture, Food and Rural Development approved new positions in Information Services, Consumer Foods & Beverages, Small Business and Speciality Foods and Marketing Finance. Going forward, Bord Bia will continue to evaluate new ideas and means of better serving the Irish food and drink industry, applying our resources to greatest effectiveness and always seeking maximum return on investment. Michael Duffy | Chief Executive 19 annual repor t & financial statement 2000 corporate statement STATEMENT OF BOARD RESPONSIBILITIES Section 21 of An Bord Bia Act 1994 requires the Board to "keep in such form and in respect of such accounting periods as may be approved by the Minister, with the consent of the Minister for Finance, all proper and usual accounts of monies received or expended by it, including an Income and Expenditure Account, a Cash Flow Statement and a Balance Sheet, and, in particular, shall keep in such form as aforesaid all such special accounts as the Minister may, or at the request of the Minister for Finance shall, from time to time direct and the Board shall ensure that separate accounts shall be kept and presented to the Board by any Subsidiary Board that may be established by the Board under this Act and these accounts shall be incorporated in the general statement of account of the Board." In preparing these financial statements the Board is required to: 1 Select suitable accounting policies and then apply them consistently 2 Make judgements and estimates that are reasonable and prudent 3 Prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Board will continue in operation 4 State whether applicable accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements. The Board has overall responsibility for the organisation’s system of internal controls and has delegated responsibility for implementation of this to Executive Management. This system includes financial controls which enable the Board to meet its responsibilities for the integrity and accuracy of the organisation’s accounting records, which disclose, with reasonable accuracy at any time, the financial position of Bord Bia. The Board’s system of internal controls is designed to provide reasonable assurance that transactions are executed in accordance with Board policy and management authorisation and within statutory parameters and guidelines. The Board is also responsible for safeguarding the assets of the company and hence for taking reasonable steps for the prevention and detection of fraud or other irregularities. There is an Audit Committee of the Board to which the internal auditor and the external auditor have full and unrestricted access. CORPORATE GOVERNANCE The Board is committed to maintaining the highest standards of corporate governance and best practice, including in relation to the Government Guidelines for State Bodies and 20 the Ethics in Public Office Act 1995. The Act’s provisions are being implemented in Bord Bia, and the Board monitors this implementation. The Secretary is responsible to the Board for ensuring that procedures are implemented and that relevant legislation, regulations and guidelines are complied with. EQUAL OPPORTUNITIES Bord Bia is an equal opportunities employer. It is committed to ensuring equality of opportunity and its personnel and staff development programmes are geared towards this objective. Bord Bia is also committed to the implementation of Government policy in relation to the employment of disabled people in the public service. SAFETY, HEALTH AND WELFARE AT WORK Bord Bia is committed to implementing the provisions of the Safety, Health and Welfare at Work Act 1989. The company’s Safety Statement and Policy Document was reviewed and updated during the year as part of the Board’s on-going policy in this area. IMPLEMENTATION OF STATE POLICY ON EXTENDING BILINGUALISM IN THE PUBLIC SECTOR Bord Bia is committed to making every effort possible to implement the Guidelines for Action Programmes in the State Sector in relation to the use of Irish. Philip Lynch | Chairman Michael Duffy | Chief Executive 21 corporate statement PROMPT PAYMENT OF ACCOUNTS Bord Bia is included as a listed purchaser of goods in the schedule to the Prompt Payment of Accounts Act, 1997. Since 2 January 1998 the Act has come into operation and Bord Bia has complied with the provisions of the Act. In accordance with the Act and guidelines issued by the Department of Enterprise,Trade and Employment, the following information is provided. Procedures established to ensure compliance with the Act Bord Bia has procedures in place to ensure that all invoices received are paid within the time limits specified on the invoices or the statutory time limit if no period is specified. While the procedures are designed to ensure compliance with the Act, they can only provide reasonable and not absolute assurance against material non-compliance with the Act. These procedures operated in the financial period under review and in the case of late payments, the relevant suppliers were notified and interest was paid to them. In accordance with the Prompt Payments of Accounts Act, 1997, the following information is provided for the financial period ending 31 December, 2000. a) payment practices Bord Bia makes payments to suppliers in accordance with the terms stated on the invoices or terms specified in individual contracts if appropriate.The standard terms are 45 days. b) late payments in excess of £250 Number of invoices 77 Average period of Delay 11 days. c) overall percentage of late payments of total payments and total interest paid The overall percentage of late payments to total payments was 1.5%. The total amount of interest paid with respect to late payments was IR£662. Philip Lynch | Chairman Joseph O’Sullivan | Board Member REPORT OF COMPTROLLER AND AUDITOR GENERAL PURSUANT TO SECTION 13 OF THE PROMPT PAYMENT OF ACCOUNTS ACT, 1997 Responsibilities of the Board and of the Comptroller and Auditor General The Board is obliged to comply with the Act and, in particular, is required to • Pay its suppliers by the appropriate payment date • If payment to a supplier is late, include the appropriate penalty interest with the payment together with the information required by Section 6 • Disclose its payment practices in the period in the appropriate way Under Section 13 of the Act, it is my responsibility, as Auditor of An Bord Bia, to report on whether, in all material respects, the Board has complied with the provisions of the Act. Basis of Opinion My examination included a review of the payment systems and procedures in place and checking, on a test basis, evidence relating to the operation of the Act by the Board during the year. I obtained all the information and explanations which I considered necessary for the exercise of my function under Section 13 of the Act. Opinion It is my opinion that the Board complied in all material aspects with the provisions of the Act during the year ended 31 December 2000. John Purcell | Comptroller and Auditor General 27 November 2001 22 board membership as at 31 | 12 | 00 Chairman Chief Executive Secretary Mr Philip Lynch Chief Executive, IAWS Group Michael Duffy Seamus Kenny Members Mr Dan Browne | Managing Director, Dawn Meats, Grannagh,Waterford Ms Maura Nolan | Head of Food Division, Department of Agriculture, Food & Rural Development Dr Noel Cawley | Managing Director, The Irish Dairy Board Mr William O’Kane | Managing Director, O’Kane Poultry Ltd. Mr Michael Dowling | Company Director & Visiting Professor, UCC Mr Pat O’Rourke Mr John Duggan | Director, Glanbia | President, Irish Creamery Milk Suppliers’ Association (ICMSA) Mr Joseph O’Sullivan | Chief Executive, Drinagh Co-Operative Society Ltd. Mr Tom Parlon | President, Irish Farmers’ Association (IFA) Ms Mary White | Joint Managing Director, Lir Chocolates Ltd. Ms Sara White | Assistant Secretary, Department of the Marine & Natural Resources Mr Michael Kilcoyne | Chairman, Consumers’ Association of Ireland Mr Denis Lucey | Chief Executive, Dairygold Co-Operative Society Ltd. Ms Margo Monaghan | Principal Officer, Department of Enterprise, Trade & Employment Changes during 2000 Term Expired 31 May, 2000 | Mr Noel Cawley – (re-appointed 1 July, 2000) Term Expired 15 November, 2000 | Mr Tom O’Dwyer, Irish Creamery Milk Suppliers’ Association (ICMSA) Term Expired 1 December, 2000 | Mr Michael Hanrahan, Chairman Kerry Group Mr William O’Kane – (re-appointed 14 December, 2000) Ms Mary White – (re-appointed 14 December, 2000) Appointed 14 December, 2000 | Mr Dan Browne Mr Pat O’Rourke 23 meat & livestock subsidiary board as at 31 | 12 | 00 Chairman Mr Denis Lucey Chief Executive, Dairygold Co-Operative Society Ltd. Members Mr Sean Buckley | President, Associated Craft Butchers of Ireland Mr Paul Clarke | National Executive of the Livestock Trade Mr Frank Corcoran | Chairman, National Sheep Committee, IFA Mr Derek Deane | Chairman, National Livestock Committee, IFA Mr Eddie Keane | National Poultry Committee, IFA Mr John Madden | Chief Executive, Glanbia Meats Dr Pat Mulvehill | Director General, Irish Poultry Processors’ Association Mr Tom McAndrew | Managing Director, Eurowest Foods Ltd. Mr Liam McGreal | Director, Dunnes Stores Mr Jimmy O’Brien | Chairman, National Pigs & Pigmeat Committee, IFA Ms Brid O’Connor | Assistant Director, Office of the Director of Consumer Affairs Mr Nicholas Ryan | National Council Irish Creamery Milk Suppliers’ Association (ICMSA) Changes during 2000 24 Term Expired 24 April, 2000 | Mr Michael Kenny, Glanbia Mr Raymond O’Malley, IFA Mr Nicholas Ryan Resigned 29 June, 2000 | Mr Liam Ryan, IFA Appointed 23 June, 2000 | Mr Derek Deane Mr John Madden Mr Nicholas Ryan (re-appointment) Appointed 8 August, 2000 | Mr Jimmy O’Brien consumer foods subsidiary board as at 31 | 12 | 00 Chairman Mr Michael Dowling Company Director & Visiting Professor, UCC Members Ms Darina Allen | Ballymaloe Cookery School Mr Larry Murrin Mr Pat Doyle | Managing Director, Rye Valley Foods Ltd. Ms Maura O’Donovan | Poultry Instructress Mr Pat Given | Managing Director, UDV Operations, UDV Ireland Ltd. Ms Eilis Gough Mr Con Lucey Ms Celine Murrin | Managing Director, Mileeven Fine Foods | Marketing Director, Cheese & Spreads, Golden Vale plc. | Managing Director, Dawn Farm Foods Mr Joe O’Flynn | Marketing Development, Director, Irish Dairy Board Ms Gina Quin | Chief Executive, Dublin Chamber of Commerce Mr Brendan Smyth | Milk Advisory Manager, Glanbia Mr Paddy Walsh | Managing Director, Walsh Family Foods | Consumers’ Association of Ireland Changes during 2000 Appointed 10 April, 2000 | Ms Celine Murrin Term Expired 1 June, 2000 | Ms Carol Buckley, Lecturer in Home Economics Mr Pat Doyle Mr Larry Murrin Appointed 18 July, 2000 | Mr Pat Doyle (re-appointment) Ms Eilis Gough Mr Larry Murrin (re-appointment) 25 quality assurance subsidiary board as at 31 | 12 | 00 the quality assurance subsidiary board was established on 6 july, 2000 Chairman Vacant Members Professor Joe Buckley | Lecturer in Food Science and Technology, UCC Mr Kevin Cassidy | Department of Agriculture, Food & Rural Development Mr John Cunningham | General Manager, Dairygold Meats Mr Derek Deane Mr Dermott Jewell | Chairman, National Livestock Committee, IFA Mr Paul Nolan | General Manager, Dawn Meats, Grannagh,Waterford Mr Eamon Quinn | Marketing Director, Superquinn Ms Brid O’Connor | Assistant Director, Office of the Director of Consumer Affairs Dr Pat Wall | Chief Executive, Food Safety Authority of Ireland | Chief Executive, Consumers’ Association of Ireland Changes during 2000 Term Expired 15 November, 2000 26 | Mr Tom O’Dwyer (Chairman) organisation structure as at 30 | 06 | 01 Russia CEEC Vacant Director International Markets O. Brooks Manager Meat G. Brickley Manager Quality J. Keane Director Operations A. Cotter European/Home Market Manager Information Services J. Smith Senior Business Analyst Information Services P. Brennan Chief Executive Michael Duffy Manager Marketing Finance J. Bracken Director Client Services M. Kennedy Manager Promotions & Exhibitions L.Williams North America J. O’Donnell Asia F. Murray Cairo, Middle East & North Africa Vacant Dusseldorf Office L. O’Riordan Madrid Office C. Ruiz London Office M. Murphy Milan Office P. McSweeney Paris Office J. O’Toole Home Market G. O’Sullivan Secretary/Director S. Kenny Small Business Financial Controller G. Bailey Director Consumer Foods & Marketing J. McGrath Manager Consumer Foods Ingredients T. McCarthy Manager International Media M. Bracken 27 the organisation The organisation structure of Bord Bia is comprised of the Board, three Subsidiary Boards, the Chief Executive and the Executive, which provide the range of operational and corporate services required to implement Board policy and programmes. The Board is comprised of a Chairman and 14 ordinary members appointed by the Minister for Agriculture, Food and Rural Development. There are three Subsidiary Boards (Meat & Livestock, Consumer Foods and Quality Assurance) comprised of a Chairman and 12 ordinary members, who are appointed by the Board with the consent of the Minister.The Chairman of each Subsidiary Board is a member of the Board. The following Board Committees are in place: Audit Committee, Evaluation Committee, Remuneration and Pensions Committee and Strategy Committee. The Executive is comprised of staff based in the Board’s head office and overseas. Board Quality Assurance Board Meat & Livestock Board Consumer Foods Board Board Committees Client Services Directorate Marketing & Communications Chief Executive Administration 28 Operations Directorate european union | an t-aontas eorpach Bord Bia’s marketing finance programmes were supported to a considerable extent by funding from the European Union. Most of this came from the European Agricultural Guidance and Guarantee Fund under the Food Sub-Programme of the Operation for Industrial Development. Funding was also received under the European Quality Beef Scheme for the promotion of beef consumption. The support and financial assistance of the European Union enabled Bord Bia to make available a range and level of support to the Irish food and drink industry which would not otherwise have been possible. Fuair cláir airgeadais mhargaíochta Bhord Bia roinnt mhaith tacaíochta ó mhaoiniú de chuid an Aontais Eorpaigh. Tháinig an chuid is mó de seo ó chiste Treorach agus Rathaíochta Talmhaíochta na hEorpa agus faoi Fhochlár Bia de chuid Oibríocht d’Fhorbairt Tionscail. Fuarthas maoiniú freisin faoi Scéim Mairteola Ardchaigdeáin na hEorpa chun tomhaltas mairteola a chur chun cinn. Chuir tacaíocht agus cúnaimh airgeadais an Aontais Eorpaigh ar chumas Bord Bia réimse agus leibhéal tacaíochta a chur ar fáil do thionscal bia agus dí na hÉireann a bheadh dodhéanta dá uireasa. 29 report of the comptroller and auditor general I have audited the financial statements on pages 31 to 42. Responsibilities of the Board and of the Comptroller and Auditor General The accounting responsibilities of the Board are set out in the Board’s Corporate Statement on pages 20 and 21. It is my responsibility, under section 21 of An Bord Bia Act 1994 to audit the financial statements presented to me by the Board and to report on them. As the result of my audit I form an independent opinion on the financial statements. Basis of Opinion In the exercise of my function as Comptroller and Auditor General, I plan and perform my audit in a way which takes account of the special considerations which attach to State bodies in relation to their management and operation. An audit includes examination, on a test basis, of evidence relevant to amounts and disclosures in the financial statements. It also includes an assessment of the significant estimates and judgements made in preparation of the financial statements, and of whether the accounting policies are appropriate, consistently applied and adequately disclosed. My audit was conducted in accordance with auditing standards which embrace the standards issued by the Auditing Practices Board and in order to provide sufficient evidence to give reasonable assurance that the financial statements are free from material misstatement whether caused by fraud or other irregularity or error. I obtained all the information and explanations that I required to enable me to fulfil my function as Comptroller and Auditor General and in forming my opinion, I also evaluated the overall adequacy of the presentation of information in the financial statements. Opinion In my opinion, proper books of account have been kept by the Board and the financial statements, which are in agreement with them, give a true and fair view of the state of the affairs of An Bord Bia at 31 December 2000 and of its income and expenditure and cash flow for the year then ended. John Purcell | Comptroller and Auditor General 27 November 2001 30 statement of accounting policies a) basis of accounting These financial statements are prepared under the accruals method of accounting, except as indicated below, and in accordance with generally accepted accounting principles under the historical cost convention. Financial Repor ting Standards recommended by the accountancy bodies are adopted as they become operative.The unit of currency is the Irish Pound. Comparative figures for 2000 and 1999 are displayed in Euro. b) keeping of accounts subsidiary Boards Under the terms of the An Bord Bia Act, 1994, the Board is assisted by three Subsidiary Boards in respect of Meat and Livestock, Consumer Foods and Ingredients, and Quality Assurance. All income and expenditure relating to these Subsidiary Boards is reflected in these financial statements. subsidiary company: The Board operates a wholly-owned subsidiary company which does not trade. Due to the nature of the company, it is not considered appropriate to prepare consolidated financial statements. c) income Income shown in the financial statements under Oireachtas Grant-in-Aid represents the actual receipts from this source in the period. Income from EU Structural Funds and the EU Quality Beef Promotion Fund is released to revenue in line with related expenditure and any unexpended balance is included in Creditors. Income from the Statutory Levy is accounted for on a cash receivable basis. d) fixed assets and depreciation Fixed assets are stated at cost less accumulated depreciation. Depreciation is calculated to write off the original cost less the estimated residual value of tangible assets on a straight line basis at the following annual rates: Leasehold improvements Furniture and fittings Office equipment Computer equipment Motor vehicles 10% 12.5% 20% 331/3% 20% 31 statement of accounting policies e) marketing finance Expenditure was incurred on the Targeted Marketing Consultancy (TMC) Programme in previous years. Under the terms of the programme, a propor tion of the expenditure is recoverable over a 24 to 60 month period by way of a royalty based on sales achieved by this expenditure. Income arising under the TMC Programme from amounts reimbursed is accounted for on the basis of cash receipts. f) superannuation Superannuation costs are funded over the employee’s period of service by way of contributions to a fund managed by trustees. The Board’s annual contributions are based on actuarial advice and are charged to the income and expenditure account in the period to which they relate. g) leasing The rentals under operating leases are dealt with in the financial statements as they fall due. Tangible assets acquired under finance leases are capitalised and depreciated as set out in note (d) above. h) tangible assets Tangible assets are financed out of revenue. Provision is made in the income and expenditure account for a transfer to the capital account of amounts allocated for such capital purposes less credits to revenue over the life of the related assets. i) stocks Stocks of stationery are stated at cost. j) provision for bad and doubtful debts Known bad debts are written off and specific provision is made for any amounts the collection of which is considered doubtful. k) foreign currencies: Foreign currency balances are translated at the rates ruling at the balance sheet date. l) taxation Provision has been made in respect of all VAT liabilities and the PRSI contributions of Irish persons attached to overseas offices. 32 income and expenditure account year ended 31 | 12 | 00 2000 1999 2000 1999 Notes IR£’000 IR£’000 €’000 €’000 1a 10,126 7,911 12,858 10,045 434 200 551 254 Income Oireachtas Grant-in-Aid EU Quality Beef Promotion Fund EU Structural Funds 1b 967 6,342 1,228 8,053 Statutory Levy 1c 4,675 5,363 5,936 6,809 Project and Other Income 1d 1,913 2,186 2,429 2,775 18,115 22,002 23,002 27,936 89 55 113 70 18,204 22,057 23,115 28,006 Transfer from Capital Account 2 Total Income Expenditure Marketing and Promotional Expenditure 3 11,814 11,791 15,001 14,971 Marketing Finance 4 405 3,993 514 5,070 Operating Expenditure 5 5,691 6,268 7,226 7,959 17,910 22,052 22,741 28,000 294 5 374 6 19 14 24 18 313 19 398 24 Total Expenditure Surplus for Year Balance at 1 January Balance at 31 December The Board has no gains or losses in the financial year or the preceding financial year other than those dealt with in the Income and Expenditure Account. The results for the year relate to continuing operations. The Statement of Accounting Policies and Notes 1 to 16 form part of these financial statements. Philip Lynch | Chairman Michael Duffy | Chief Executive 33 balance sheet year ended 31 | 12 | 00 Notes 2000 1999 2000 1999 IR£'000 IR£'000 €'000 €'000 Fixed Assets Tangible Assets 6 742 831 942 1,055 Financial Assets 7 6 6 8 8 748 837 950 1,063 5 6 6 7 1,718 1,846 2,182 2,344 398 40 505 51 2,121 1,892 2,693 2,402 1,814 1,879 2,303 2,386 307 13 390 16 1,055 850 1,340 1,079 742 831 942 1,055 313 19 398 24 1,055 850 1,340 1,079 Current Assets Stocks Debtors 8 Cash at bank and in hand Creditors (amounts falling due within one year) 9 Net Current Assets Total Assets less Current Liabilities Financed by Capital and reserves Capital account Income and expenditure account 2 The Statement of Accounting Policies and Notes 1 to 16 form part of these financial statements. Philip Lynch | Chairman 34 Michael Duffy | Chief Executive cash flow statement year ended 31 | 12 | 00 2000 1999 2000 1999 IR£'000 IR£'000 €'000 €'000 Surplus for year 294 5 374 6 Net interest receivable (57) (52) (72) (66) Depreciation 254 220 323 279 Capital account transfer (89) (55) (113) (70) 4 25 5 32 128 (221) 162 (281) 1 (1) 1 (1) (488) 414 (620) 526 5 2 6 3 Increase/(decrease) in accruals and deferred income 418 (226) 531 (287) Net cash inflow from operating activities 470 111 597 141 470 111 597 141 57 52 72 66 527 163 669 207 (169) (190) (215) (241) 358 (27) 454 (34) 358 (27) 454 (34) 40 67 51 85 398 40 505 51 Reconciliation of Surplus to Net Cash Inflow from Operating Activities Loss on disposal of tangible fixed assets Decrease/(increase) in debtors Decrease/(increase) in stock (Decrease)/increase in trade creditors Increase in taxation and PRSI CASHFLOW STATEMENT Net cash inflow from operating activities Returns on investment and servicing of finance Bank interest received Net current inflow of funds Capital expenditure Payments to acquire tangible assets Increase/(decrease) in cash Reconciliation of net cash flow to movement in net funds Increase/(decrease) in cash Net funds at 1 January Net funds at 31 December The Statement of Accounting Policies and Notes 1 to 16 form part of these financial statements. Philip Lynch | Chairman Michael Duffy | Chief Executive 35 notes forming part of the financial statements year ended 31 | 12 | 00 1) income (a) Included in Oireachtas Grant in Aid is IR£4,857,000 which has been made available to An Bord Bia under the Marketing Sub Programme of the Productive Sector Operational Programme of the National Development Plan 2000-2006. (b) EU Structural Funds have been made available to Bord Bia under Measure 4 of the Food SubProgramme of the Operational Programme for Industrial Development 1994-99 which is jointly funded by the EU and the State. (c) The An Bord Bia Act, 1994, provides for payment to the Board of a levy per head on slaughtered or exported livestock. Under section 37 of the Act, the rates were set at IR£1.50 per head for cattle, 20p per head for sheep and 20p per head for pigs. (d) Project and other income includes industry contributions to joint promotions, steak bar sales at trade fairs, and seminar and conference fees. Also included is income arising under the Targeted Marketing Consultancy (TMC) Programme. 2) capital account 2000 IR£’000 Balance at 1 January 2000 Amount capitalised in respect of purchased tangible assets IR£’000 2000 €’000 831 Net amount realised on disposal of assets Amortisation in line with asset depreciation €’000 1,055 169 215 (4) (5) (254) (323) Net transfer to Income and Expenditure Account (89) (113) Balance at 31 December 2000 742 942 3) marketing and promotional expenditure 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 Marketing Development Programmes 5,695 7,049 7,231 8,950 Trade Fairs and Exhibitions 2,350 2,067 2,984 2,624 Information Services 973 712 1,235 904 Quality Assurance 355 318 451 404 1,215 773 1,543 981 92 36 117 46 Marketing Services 275 218 349 277 Communications 336 286 427 363 Nutritional Advisory Services 523 332 664 422 11,814 11,791 15,001 14,971 Trade Services Strategic Marketing Programme 36 notes forming part of the financial statements year ended 31 | 12 | 00 4) marketing finance Marketing Improvement Assistance Programme 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 405 3,805 514 4,831 Strategic Marketing Development Programme 188 239 405 3,993 514 5,070 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 150 148 190 188 3,062 3,745 3,888 4,755 Rent, rates and insurance 681 529 865 672 Telecommunications costs 163 152 207 193 General business expenses 1,368 1,441 1,737 1,830 9 8 11 10 254 220 323 279 4 25 5 32 5,691 6,268 7,226 7,959 5) operating expenditure Board and Sub-Board Members’ fees and expenses Staff costs Audit fee Depreciation (Note 6) Loss on disposal of tangible assets Operating expenditure includes the full cost of staff and office expenses in head office departments and in the overseas offices. Staff costs are comprised of: Wages and salaries 2,531 2,470 3,214 3,136 Social welfare costs 165 155 209 197 Pension costs 366 1,120 465 1,422 3,062 3,745 3,888 4,755 The total number of employees (including part-time persons) at 31 December 2000 was 68 (1999:68). The cost of certain part-time employees is included in Marketing and Promotional Expenditure. 37 notes forming part of the financial statements year ended 31 | 12 | 00 6) tangible fixed assets Leasehold Furniture improvements and fittings IR£’000 IR£’000 Computer equipment IR£’000 Office equipment IR£’000 Motor vehicles IR£’000 Total IR£’000 64 1,901 Cost At 1 January 2000 582 480 212 563 Additions in year 48 10 84 27 169 (6) (169) (6) (181) 630 484 127 584 64 1,889 At 1 January 2000 225 289 85 441 30 1,070 Charged in year 63 43 112 28 8 254 (5) (168) (4) 288 327 29 465 38 1,147 At 31 December 2000 342 157 98 119 26 742 At 31 December 1999 357 191 127 122 34 831 €’000 €’000 €’000 €’000 €’000 €’000 At 1 January 2000 739 610 269 715 81 2,414 Additions in year 61 13 107 34 215 (8) (215) (8) (231) 800 615 161 741 81 2,398 At 1 January 2000 286 367 108 560 38 1,359 Charged - year 80 55 142 36 10 323 (7) (213) (6) 366 415 37 590 48 1,456 At 31 December 2000 434 200 124 151 33 942 At 31 December 1999 453 243 161 155 43 1,055 Disposals At 31 December 2000 Depreciation Disposals At 31 December 2000 (177) Net book Amounts Cost Disposals At 31 December 2000 Depreciation Disposals At 31 December 2000 (226) Net book Amounts 38 notes forming part of the financial statements year ended 31 | 12 | 00 7) financial fixed assets The Irish Food Board (An Bord Bia) France SARL is wholly-owned by An Bord Bia and its transactions are fully reflected in these financial statements. 8) debtors 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 549 1,140 697 1,448 1,169 706 1,485 896 1,718 1,846 2,182 2,344 517 1,005 656 1,276 86 81 109 103 1,211 793 1,538 1,007 1,814 1,879 2,303 2,386 Amounts falling due within one year: Debtors Prepayments and accrued income 9) creditors (amounts falling due within one year) Trade creditors Taxation and social welfare (Note 10) Accruals and deferred income 39 notes forming part of the financial statements year ended 31 | 12 | 00 10) taxation and social welfare 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 Taxation and social welfare creditors comprise the following: Income Tax 63 61 80 78 P.R.S.I. 23 20 29 25 86 81 109 103 An Bord Bia is not liable to corporate taxes in Ireland or in the countries in which it operates because it is a non-commercial State-sponsored body. It is liable to employer taxes in Ireland and complies with related withholding, reporting and payment obligations. In some other countries in which it operates, an exemption from local taxation has been availed of under the governmental services article of the double taxation agreement. This position is currently under review by Bord Bia which is actively seeking clarification to determine whether overseas employment taxes arise in any of the jurisdictions where this exemption has been availed of. The review may result in a liability to taxes in some jurisdictions, but given that this decision rests with the various jurisdictions in question, there are uncertainties in relation to the amount and timing of any liabilities, if any. At the balance sheet date it was not possible to make a reliable estimate of these possible contingent liabilities and, consequently, no provision has been made in the financial statements for the year ended 31 December 2000. 11) provisions for liabilities and charges At 1 January 2000 Provided during year At 31 December 2000 IR£’000 IR£’000 IR£’000 EU Quality Beef Promotion Fund 105 50 155 Value Added Tax 50 173 223 155 223 378 €’000 €’000 €’000 EU Quality Beef Promotion Fund 133 63 196 Value Added Tax 64 220 284 197 283 480 These provisions are included within Debtors and Creditors respectively. 40 notes forming part of the financial statements year ended 31 | 12 | 00 12) commitments (a) Capital Commitments An Bord Bia had no capital commitments at the year end. (b) Financial Incentives There were no commitments in respect of Marketing Finance Programmes at the year end. (c) Operating Leases Operating leases comprise leases on premises. Leasing commitments payable during the next twelve months amount to IR£362,000 (€460,000) made up as follows: IR£000’s €000’s 85 108 Within two to five years 235 299 Within six to ten years 42 53 362 460 Payable on leases on which the commitment expires: Within one year 13) contingent liabilities (a) No contingent liabilities exist in respect of amounts approved but unclaimed at the year end under the terms of the following Marketing Finance Programmes operated by An Bord Bia: 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 Marketing Improvement Assistance Programme - 407 - 517 Targeted Marketing Consultancy Programme - 84 - 106 - 491 - 623 (b) Litigation is in process against the organisation arising from a dispute in which it is alleged that the former CBF infringed employment rights and in which the plaintiff is seeking IR£150,000 (€190,461). The Board are of the opinion that the claim can be successfully resisted. The information usually required by FRS12 is not disclosed on the grounds that it can be expected to prejudice seriously the outcome of the litigation. 41 notes forming part of the financial statements year ended 31 | 12 | 00 14) recoverable incentives Under the terms of the Targeted Marketing Consultancy (TMC) Programme, a total of IR£2,293 (€2,911) was due to be recovered in 2001 and subsequent years from participating companies: 2000 1999 2000 1999 IR£’000 IR£’000 €’000 €’000 104 540 132 686 Repayments during year (102) (195) (129) (248) Unrecoverable amounts - (241) - (306) Estimated amount recoverable at end of year 2 104 3 132 Estimated amount recoverable at start of year Recoverable incentives are accounted for on a cash receipts basis and accordingly are not included in debtors. Unrecoverable amounts represent amounts due from companies which are either in liquidation or in receivership. 15) superannuation The Board operates a defined benefits superannuation scheme for certain eligible employees, for which the approval of the Minister for Agriculture, Food and Rural Development and the Minister for Finance has been received. The contributions of employees and An Bord Bia are paid into a fund managed by the trustees and the total funding rate is in accordance with actuarial recommendations. The last actuarial review took place as at 1 January 2001, and the funding was deemed adequate, on a discontinuance basis, to meet liabilities arising under the scheme. 16) board members - disclosure of transactions In the normal course of business the Board may approve grants and may also enter into other contractual arrangements with undertakings in which Bord Bia Board Members are employed or otherwise interested. The Board adopted procedures in accordance with the guidelines issued by the Department of Finance in relation to the disclosure of interests by Board Members and these procedures have been adhered to by the Board during the year. No grants were either approved or paid during the year to companies with which Board Members are associated. The Members and the Board complied with Department of Finance guidelines covering situations of personal interest. 42 43 notes www.bordbia.ie marketing promoting informing 44 Ireland Head Office Clanwilliam Court Lower Mount Street Dublin 2 Ireland Milan Via S. Maria Segreta 6 20123 Milano Italy t | + 353 1 668 5155 f | + 353 1 668 7521 t | 39 02 7200 2065 f | 39 02 7200 4062 Düsseldorf RolandStrasse 44 D40476 Düsseldorf Moscow Orlikov per 3B Moscow 107804 Germany Russia t | + 49 211 452 090 f | + 49 211 453 353 t | + 7 095 207 8150 f | + 7 095 207 8460 London 2 Tavistock Place United Kingdom Paris Maison d’Irlande 33 rue de Miromesnil 75008 Paris France London WC1H 9RA t | + 44 207 833 1251 f | + 44 207 278 7193 t | + 33 1 42 66 22 93 f | + 33 1 42 66 22 88 Madrid Casa de Irlanda Paseo de la Castellana 46-planta 3 28046 Madrid Spain Chicago Consulate General of Ireland 400 North Michigan Avenue Suite 911 Chicago Illinois 60611 USA t | + 34 91 435 6572 f | + 34 91 435 6211 t | + 1 773 871 6749 f | + 1 773 528 9954 Ireland Head Office Clanwilliam Court Lower Mount Street Dublin 2 Ireland t | + 353 1 668 5155 f | + 353 1 668 7521 www.bordbia.ie | info@bordbia.ie