2001 Irish Food Board

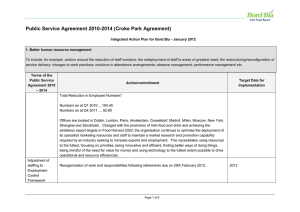

advertisement