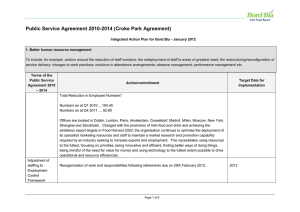

Office Network

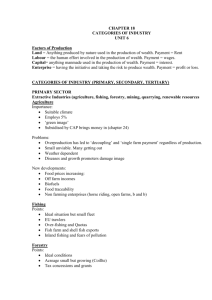

advertisement