Contents

advertisement

1

Export Figures

3

Chairman’s Statement

7

Chief Executive’s Review

30

Corporate Statement

35

Board Membership

39

Organisation Structure

41

Report of the Comptroller and Auditor General

42

Statement of Accounting Policies

44

Income and Expenditure Account

45

Balance Sheet

46

Cashflow Statement

47

Notes Forming part of the Financial Statements

56

Marketing Finance Grant Payments 2003

Contents

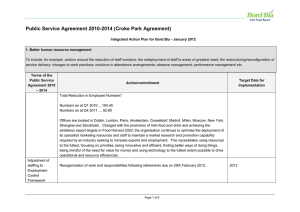

Presentation to the Minister for Agricuture and Food

In accordance with Section 22 of An Bord Bia Act 1994, the Board is pleased to submit to the

Minister its Annual Report and Accounts for the 12-month period ended 31 December 2003.

Philip Lynch

Chairman

Annual Report and Financial Statements 2003

www.bordbia.ie

Exports

2003

Irish Food & Drink Exports (€m)

2003(e)

Fish

Live Animals

2002(p)

350

380

140

105

180

170

Poultry

180

186

Ed. Horticulture

Sheepmeat

145

165

250

Pigmeat

270

1,020

Beverages

948

Beef

1,280

1,190

Prepared Foods

1,520

1,598

Dairy & Ingredients

1,600

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Exports by Sector (Value in €m)

2002(p)

€m

2003(e)

€m

% Change 2003

%

Fish

380

350

-8%

Live Animals

105

140

+33%

Poultry

170

180

+6%

Edible Horticulture & Cereals

186

180

-3%

Sheepmeat

165

145

-12%

Pigmeat

270

250

-7%

Beverages

948

1,020

+8%

Beef (1)

1,190

1,280

+8%

Prepared Foods

1,598

1,520

-5%

Dairy Products & Ingredients (1)

1,527

1,600

+5%

Total value of Irish food and drink exports

6,539

6,665

+2%

Annual Report and Financial Statements 2003

1,527

(1) Including refunds

Source: Figures are Bord Bia estimates based on CSO provisional figures

1

Given the changes facing rural Ireland, it is vital

for the well-being of the rural economy that the

agri-food and drink industry is nurtured & developed.

Chairman’s

Statement

I am pleased to report

marketplace is one of the most demanding it has faced.

that given the prevailing

Success will determine the nature and future scale of

marketplace conditions,

Irish agriculture and the Irish food industry. In May 2004,

the Irish food and drink

ten new countries will join the European Union.

industry turned in a

This major development will pose both challenges

robust performance

and opportunities. Bord Bia’s strategy for these markets

in 2003.

is to increase awareness of Irish food and drink products

at trade level initially through targeted research, market

Adverse exchange rate

movements during the year coupled with intense price

and product competition in all main export markets

visits and buyer introductions. In the early stages of

export development opportunities are envisaged in

the beef, dairy and drinks sectors.

tested the inventiveness and resilience of the industry.

The value of a diversified industry was shown once more

Looking forward to a post CAP review environment,

with gains in a number of sectors offsetting difficulties

cost competitiveness will continue to be an imperative.

experienced in others.

The majority of companies are facing up to this changed

truly indigenous sectors of the Irish economy. It has low

import content, very high value added and low levels of

profit repatriation.

competitive. This must be matched by investment in the

marketplace. A clear understanding of consumer needs

and the drive towards convenience, product innovation

and effective marketing are, together, the elements,

It is the only indigenous industry that has managed to

which will support market penetration for Irish exporters

create sufficient scale and expertise to compete on the

in the future.

world stage and it accounts for over 55% of exports by

Irish owned companies. Given the changes facing rural

Ireland, it is vital for the well-being of the rural economy

that the agri-food and drink industry is nurtured and

At a global level the food and drink industry is going

through a process of significant change that is presenting

challenges and opportunities to all involved from the

producer to the retailer.

developed. Whilst it is a very important sector in the

overall Irish economic context, it still faces many of the

There are many different forces driving these changes,

same threats as other Irish industries, including increased

but the key ones revolve around changing consumer

foreign competition from low cost producers, a loss of

behaviour with an emphasis on convenience foods,

domestic cost competitiveness, a serious exchange rate

functional food and speciality products. This in turn,

risk and a need to move up the value chain. If the

is driven by factors such as lifestyle, demographics and

industry is to maintain its position as a key indigenous

global retail trends. Success will depend on our ability

driver of the Irish economy, it will have to react to these

to anticipate and respond to emerging market

challenges in a very aggressive and effective manner. It will

opportunities. Bord Bia must also be in a position

also have to deal effectively with major structural changes

to respond to these challenges on behalf of its

occurring in 2004 and 2005.

stakeholders and above all it must deploy its

Annual Report and Financial Statements 2003

trading environment and are taking measures to be cost

The food and drink industry is one of the few remaining

resources effectively so as to return maximum

The latest reform of the CAP is the most fundamental

yet. Combined with the prospect of further liberalisation

of the international trading regime under WTO, it sets

the stage for a highly competitive world food market.

The challenge for the Irish food industry to compete

advantage to the stakeholders. This is the ethos

within which Bord Bia operates and to which we

are committed. Organisation and staff development

processes are geared accordingly, led by the Chief

Executive and a dedicated management team.

successfully in this more open and competitive

3

Chairman’s

Statement

I am satisfied that we have developed the strategies and

I would like to thank my Board colleagues for their

the services to meet these challenges. Bord Bia, through a

support to me personally, for their dedication and for

comprehensive range of initiatives is working closely with

the wealth of experience and skills they bring to Bord Bia.

companies in all segments of the industry to help them

achieve that vital edge which will sustain and develop

their business in the demanding markets in which they

must compete.

I thank also the members of the Subsidiary Boards

who bring further expertise to Bord Bia and who

assist the Board in the implementation of the Sectoral

Programmes. Corporate governance requirements have

As an organisation, there are two major structural

expanded considerably in the last few years and this has

changes to be addressed in 2004, namely the

brought a much expanded workload for the Board Audit

amalgamation of Bord Glas with Bord Bia and

Committee, the members of which I would like to thank

responding to the Government’s decentralisation

for their important contribution.

plan. I have no doubt that the amalgamation of

Bord Glas with Bord Bia will be beneficial and that

both organisations will make a major contribution

Annual Report and Financial Statements 2003

to a new and expanded Bord Bia. In relation to

decentralisation, we are working closely with our

parent Department regarding implementation of

this Government decision.

management and staff for their quite exceptional loyalty

and dedication and on whom the Board relies “ to

champion the success of Irish food and drink” on

a daily basis and to ensure that Bord Bia’s strategic

objectives are achieved.

I would like to take this opportunity to publicly thank

Philip Lynch

those who contribute to our success. We continue to

Chairman

benefit from the support and encouragement of the

Minister for Agriculture and Food, Mr. Joe Walsh T.D.,

and from his active participation in major marketplace

activities. I wish to thank the Minister of State, Noel

Treacy T.D., Minister of State, Liam Aylward T.D. and

Secretary General, John Malone, and the officials of the

Department of Agriculture and Food for all their support,

assistance and encouragement.

I would like to thank our stakeholder organisations

with which we have a very close and fruitful working

relationship. We also work closely with our Ambassadors

and the Irish Embassies in overseas markets who support

us and add considerable value to our activities.

4

I am proud again to pay tribute to our Chief Executive,

At a global level the food and drink industry is

going through a process of significant change

presenting challenges and opportunities

to all involved from the producer to the retailer.

In 2003 the value of Irish food and drink

exports reached an estimated value of

€6.67 billion.

Chief Executive’s

Review

In 2003 the value of

Irish food and drink

exports reached

an estimated value

of €6.67 billion.

This performance is

set against the backdrop

of weaker demand conditions, adverse currency

movements and intense price competition in all

markets.

The food and drink industry is made up

of a number of distinct and diverse sectors.

Strong performances in beef and livestock,

beverages and dairy were offset by declines in

pigmeat, lamb, prepared foods and horticulture.

In the meat sector, beef exports grew by 8%,

lamb and pigmeat exports were down 12%

and 7% respectively and live exports increased

by 33%. Dairy products and ingredient exports

grew by 5% while prepared foods declined by 5%.

However, beverages exports increased by 8%

with strong performances in key markets

including Britain and the United States.

The Irish food and drink industry has strong

linkages to the domestic economy. It is competing

in a world market that is going through a process

of considerable change at both policy and market

levels. How the industry responds to the new

challenges and opportunities is an important factor

in the overall performance of the Irish economy.

Bord Bia is the food and drink industry's trade

development, information and promotion agency. In

2003 it worked with companies on a number of

initiatives across its key service areas of information,

market development and promotion.

Highlights –

Making a Difference

• Irish beef exports in 2003 were valued

at almost €1.28bn, which represents an increase

of 8% on the previous year. A record 85% of

beef exports were within the EU. This is in line

with Bord Bia’s five-year strategy for Irish beef to

secure access to markets within Europe.

• Bord Bia, IBEC and AIB joined forces for the

first Ireland The Food Island Food & Drink Industry

Awards to reward excellence and promote best

practice in the Food and Drink industry. 196

applications were received from120 companies

across six categories.

• Bord Bia signed a two-year agreement with

Bank of Ireland Business Banking to partner

the Brand Forum until 2005. The Brand Forum

provides a centre of excellence for brand

marketing which delivers new skills to the

industry and promotes the long term success

of food and drink brands. The quarterly Brand

Fora will now be supported by two regional

events, a publication featuring all the Brand

Forum members, practical brand development

services, access to exclusive market research &

insight and food & drink brand promotion.

• Bord Bia was involved in the organisation

and co-ordination of 80 trade fairs and

events this year. Of these, 12 were trade fairs,

15 conferences/seminars, 35 inward buyer visits

(206 visitors), 12 Embassy promotions and a

number of corporate events including the

Ireland The Food Island Champion Stakes,

Anuga Reception, National Ploughing

Championships and the China Trade Mission.

Annual Report and Financial Statements 2003

Introduction

*Michael Duffy resigned on 7th May 2004 and Patrick Moore was appointed Interim Chief Executive.

The Annual Report had been submitted to the Minister in March 2004 as required by An Bord Bia Act

1994 and the Accounts were signed in June 2004 by the Chairman and the Interim Chief Executive,

following Board approval.

7

Chief Executive’s

Annual Report and Financial Statements 2003

Review

8

• Following a major drive to extend Féile Bia

membership numbers during the year, the total

membership at the end of 2003 climbed to

1,290 outlets. This includes new members

from the restaurant, pub and in-house catering

companies. Products covered under the

programme are beef, lamb, pigmeat, chicken

and eggs.

• Bord Bia and the Western Development

Commission in association with the

Department of Agriculture and Food

organised the first National Organics

Conference in Co. Galway. Themed The

Irish Organic Industry, Present Challenges

and Future Prospects, the event was attended

by over 200 organic producers, processors,

retailers and representatives of organic bodies

and State agencies.

• As part of its promotional strategy for Irish

beef in the Italian market, Bord Bia launched

a major consumer campaign. The campaign

was designed to raise awareness and

promote sales with existing Italian customers.

Research demonstrated that Irish beef had

the right appearance and was the preferred

choice on taste. Exports of prime Irish beef

to Italy grew by a significant 75% to a new

high of 35,000 tonnes.

• Bord Bia facilitated the establishment and

operation of the TASTE Council. The purpose is

to encourage the strategic development of the

speciality food sector.

• The Bord Bia Extranet was launched mid-year

to provide electronic access to Bord Bia

material that is largely available in printed form

as well. Client companies can now access

material around the clock, seven days a week.

Bord Bia received a total of 4,560 enquiries

along with almost 100,000 hits to its website

in 2003.

• Bord Bia supported the development of

Farmers’ Markets with the launch of a webbased advice and assistance programme for

companies looking to establish a Farmers’

Market for their produce. All Farmers’ Markets,

are listed on the website which is accessible by

consumers. Bord Bia also sponsored the

Farmers’ Market at Farmleigh in September

in co-operation with the OPW.

• The Beef Quality Assurance Scheme has been

revised to bring it in line with the benchmark

standard EN45011. Quality Assurance is a

market necessity and the EN45011 beef

scheme will facilitate the continued

competitiveness of the beef sector.

Chief Executive’s

Review

A Chicken Quality Assurance Scheme

was also developed.

• Representatives from more than one hundred

of Ireland’s food, drink and ingredients

manufacturing companies attended Bord Bia’s

Consumer Foods and Drink Industry Day.

Themed Paths to Growth, the conference

provided market information and insight on

retailer and foodservice trends in Ireland, the

U.K. and continental Europe. Staff from Bord

Bia’s overseas offices held a total of 150

meetings with companies over the two

days to discuss export sales opportunities.

• One hundred and thirty nine companies applied

for funds under Bord Bia’s marketing finance

schemes. Eighty-five companies received grants

to the value of Ä973,000.

• A tailored working strategy with the key

industry players on the U.K. mushroom market

was enhanced by the development of a newly

formed Task Force on the Mushroom Industry.

This Task Force was set up by Minister Noel

Treacy to examine the critical issues facing the

sector and to draw up a co-ordinated action

plan to ensure the future of the industry.

• Thirty companies participated on the UK food

service programme. Activities in the foodservice

sector in the U.K. included original consumer

research, 66 buyer meetings, 5 buyer contact

events, 12 newsletters, 4 workshops and 7

bespoke projects.

• A marketing campaign to promote Irish beef to

the premium retail segment in France covering

three targeted regions, involved store managers

and head butchers from over 1,400

supermarkets in six retail chains.

• Bord Bia's Irish Beef Recipe Calendar promotion

in Britain featured competition details on 2.6

million individual packs of Irish beef over a fourweek period in Tesco, Sainsbury’s, Safeway,

Somerfield and Aldi stores. The recipe calendar

featured 14 Irish beef recipes including

traditional favourites and more contemporary

ones. It was delivered to over 200,000 British

homes.

Annual Report and Financial Statements 2003

• Bord Bia worked in conjunction with the

Department of Agriculture and Food on all

international market access activities. The Irish

beef trade recommenced with Egypt in the final

quarter of 2003. Beef exports to international

markets were valued at €200 million.

9

Chief Executive’s

Annual Report and Financial Statements 2003

Review

10

Meat and Livestock

Beef Exports

2003 was a challenging but successful year for the

Irish livestock and meat industry. Exports were up

5% to almost €2 billion despite declines

in both lamb and pigmeat exports. This was largely

due to the strong performance by beef and live

animal exports with Irish beef exports to

continental Europe increasing by almost 30%

to 150,000 tonnes.

Irish beef exports in 2003 were valued at €1.28

billion, which represents an increase of 8% on the

previous year. A record 85% of beef exports were

within the EU, which compares with 50% in 2000.

Irish beef exports to continental European markets

increased by almost 30% to 150,000 tonnes, due

largely to the fact that the EU market was less than

self sufficient for the first time in almost 25 years.

The principal growth was evident in Italy, France and

Holland.

Meat demand in the Irish market is estimated

to have grown by 4% in volume terms but the

value of these sales was static. Beef was

the main beneficiary with a 10% volume growth

followed by lamb at 8%. Poultry sales showed

marginal growth and pigmeat sales declined slightly.

Total Irish cattle disposals showed a rise of 8%

during 2003 to reach 2.08 million head. This reflects

an increase of almost 6% in export meat plant

disposals at 1.76 million and a jump of 50% in live

cattle exports to 220,000 head. The rise in export

meat plant supplies was largely due to an 8%

increase in male cattle disposals during the year.

The principal factors leading to the higher male

cattle availability were lower calf/weanling exports

in 2001 and specialised beef production including

young bull beef production aimed at supplying

premium customers on the continent, particularly

the Italian market.

The United Kingdom remained the most important

market for Irish beef, accounting for over half of

total exports at 265,000 tonnes. This represents

a rise of 4% on 2002 levels and was achieved

despite the euro strengthening by almost 10%

against sterling during the year. In line with Bord

Bia’s strategy for developing the market, increased

volumes were sold direct to retail outlets with an

estimated one third of total exports now sold

through this channel. Significant progress continued

to be made in penetrating the value added and

premium foodservice segments of the market. Bord

Bia activities in the U.K. in 2003 focused on building

consumer awareness of Irish beef at both retail and

foodservice level.

This approach is proving very effective as was

evidenced in the exceptional response to Bord Bia’s

‘Irish Beef Calendar’ promotion.

Chief Executive’s

Review

Irish beef to the premium retail segment in three

regions covering 1,400 supermarkets. The campaign

is a key element in a drive to double Irish beef

exports to France.

The Irish beef industry has made significant progress

in developing specialised beef production systems

that produce beef to the exact specification

required by premium customers.

Bord Bia’s promotional strategy for Irish beef in the

Italian market involved a major consumer campaign,

designed to raise awareness and promote sales

with existing Italian customers in the target areas

by capitalising on the positive response to Irish beef

from Italian consumers in research carried out

earlier in the year. The results clearly demonstrated

that Irish beef had the right appearance and was

the preferred choice on taste. These findings

provided Italian retailers with further evidence

that their customers considered Irish beef worth

the premium price.

Irish beef exports to Sweden performed strongly

during 2003 to reach an estimated 24,000 tonnes,

valued at around €40 million, representing a rise of

20% on 2002 levels and accounting for over 25% of

imports. Irish beef is well positioned in the Spanish

retail sector and is currently stocked in seven of the

top 10 retail chains.

Beef exports to International markets were

marginally lower at 85,000 tonnes and valued at

almost €200 million, reflecting an increasingly

competitive global market for beef. The substantial

appreciation of the euro against the dollar did not

help the competitiveness of Irish beef on these

markets. Trade levels were also affected by the

Annual Report and Financial Statements 2003

Exports of prime Irish beef to Italy grew by an

impressive 75% to a new high of 35,000 tonnes.

This growth was achieved while returning a

premium of between 10 and 20% to producers,

a remarkable achievement by the industry and

a testament to the value of close relationships

between producers and processors to meet

the needs of specific market segments.

The Netherlands continued to represent a priority

market for Irish steer beef with trade levels

increasing to 32,000 tonnes, reflecting a good retail

demand. The priority in the Dutch market is to

consolidate and grow the reputation of Irish beef

and ultimately generate a consumer premium.

To this end, a Meat Trade Marketing Specialist,

based in Amsterdam, was appointed by Bord Bia

during the year.

Irish beef exports to France recovered by a third

to reach 24,000 tonnes with a value of some

€65 million. The rise in trade levels reflects the

increased interest in Irish beef evident among

French beef importers during 2003. Bord Bia

launched a trade marketing campaign to promote

11

Chief Executive’s

Review

introduction of import quotas in Russia. On the

positive side, the Egyptian market re-opened for

Irish beef and the beef trade recommenced in the

last two months of 2003 when the first import

licenses were taken out.

Annual Report and Financial Statements 2003

Bord Bia worked in conjunction with the

Department of Agriculture and Food on

all market access activities. Promotional

activity included the organisation of exhibits

at important food fairs and participation in

trade promotions that supported export sales

to the major markets with particular emphasis

on markets expected to re-open.

12

Enlargement of the EU will create some

opportunities for Irish beef in CEEC markets.

Bord Bia undertook field research and study

visits in targeted markets in the region.

Opportunities with retailers in Poland, the Czech

Republic and Hungary are being actively pursued.

Another desirable trend in 2003 was the continuing

move up the value chain with opportunities

emerging for ready to cook, ready to heat and

ready to eat products.

Bord Bia undertook two US study tours

investigating retail trends, which were strongly

supported by the Irish industry. During the year,

Irish meat companies launched “heat and serve”

ranges, a category that is enjoying strong growth

in the US.

Live Animals

The value of live animal exports from Ireland

increased by 33% during 2003 to reach €140

million. This comprised a 50% increase in the

number of live cattle exports to 220,000 head and

a rise of 25% in live pig exports to 380,000 head.

Increased demand for veal calves in Holland and

a strong recovery in other markets such as Spain

and to a lesser extent Italy, gave a good boost to

live cattle exports. Growth in exports of live pigs

to Northern Ireland was helped by the reduced

slaughter capacity in Ireland and a relatively tight

supply situation in the U.K.

Bord Bia’s programme of activities in support of

the livestock trade during the year continued to

focus on keeping livestock exporters informed on

the developments taking place in terms of demand

for live animals in our key markets. Additionally,

Irish exporters were assisted in making contact

with potential customers in the marketplace.

Pork and Bacon

2003 was another very challenging year for the Irish

pigmeat sector. The difficulties emanated from the

appreciation of the euro, the release of APS stocks

and increased competition on global markets.

The net result was a decline of 6% in pig prices

across the EU. The value of Irish pigmeat exports

declined by 7% during the year to €250 million.

This fall was comprised of a decline of 4% in

export volumes and a 3% decline in pig prices.

Chief Executive’s

Review

Bord Bia disseminated information to pig producers

through participation in a number of producer

meetings and events during the year. The usage

of pork and bacon in the foodservice sector was

encouraged through a pork competition targeting

Chefs at Catex, the specialised catering exhibition

at the RDS, in association with the Irish Farmers’

Association and the Irish Association of Pigmeat

Processors. In tandem with a number of pigmeat

processing plants, a pork competition for student

chefs was launched in nine Catering Colleges

(Institutes of Technology) in November.

An industry study tour to Brazil was organised

in March to look at large scale production and

processing facilities.

Pork promotional campaigns were organised in

April, July, August and November to encourage

consumers to discover the tastiness, variety of

recipes, convenience and great value of pork as a

meal solution whether for summer barbecuing or

winter nourishment. Additionally, the sampling of

Roast Suckling Pig was a feature of the National

Ploughing Championships in Kinnegad in September.

Lamb

The value of Irish sheepmeat exports declined

by 12% in 2003 to an estimated €145 million.

This decline was comprised of an 8% fall in volume

and a 4% fall in price. The domestic market was

relatively firm during the year, but the export

markets were made more difficult as a result of

weaker demand in France, which still accounts

for over 70% of total lamb exports from Ireland.

The EU market continued to re-adjust following

the historically high prices that prevailed in 2001

and 2002. However, prices are still well ahead

of the levels that prevailed prior to the outbreak

of Foot & Mouth (FMD) disease. In Ireland for

example, prices during 2003 were still 18%

ahead of pre-FMD levels. The domestic market

now accounts for over one third of all Irish

sheepmeat output, compared to just 29% in 1995.

Domestic lamb consumption increased by 8% in

2003 to reach 21,500 tonnes.

Annual Report and Financial Statements 2003

The U.K. continued to account for around 55% of

Irish pigmeat exports at 65,000 tonnes product

weight. This represented a decline of 4% on 2002.

Continental EU markets are estimated to have

accounted for 27% of Irish exports, at 32,000

tonnes. This was equivalent to a decline of 6% on

the previous year, reflective of more competitive

market conditions. Exports to International markets

were broadly unchanged at around 21,000 tonnes.

Increased volumes to Japan and the U.S. offset

lower export volumes to other markets.

13

Chief Executive’s

Review

Exports to France fell in line with overall exports

to 31,000 tonnes. The U.K. continued to provide

a solid market for manufacturing meat. Exports

to Germany also increased, but sales to the

Mediterranean were at best maintained.

Annual Report and Financial Statements 2003

Promotional activity overseas centred on the

premium French market where the main focus

was on the continued regional development of

consumer awareness and identification of Irish lamb

in retail outlets, under the “L’Agneau de la St. Jean”

label. The emphasis in 2003 was on the Paris and

North Eastern region.

14

On the domestic market, press and PR campaigns

were undertaken in the summer and autumn to

encourage consumers to cook lamb as a tasty

and delicious option for ‘meals in minutes’.

Both campaigns were designed to broaden the

appeal of lamb particularly to younger consumers.

During September and October, a promotion was

organised in association with Féile Bia Chefs to

increase the usage of lamb in restaurants.

Poultry and Eggs

The poultry sector refers to all fresh and processed

poultry products. Irish poultry meat exports in

2003 were valued at €180 million indicating a small

growth in volume exports over the year when

compared to 2002 levels. Exports of processed

poultry meats and prepared products accounted

for nearly two thirds of the total poultry exports

during the year. The U.K. continues to be the main

market for Irish poultry exports, accounting for

approximately 80% of total sales.

Bord Bia launched a major new TV and poster

advertising campaign for eggs produced under

the Bord Bia Quality Assurance Scheme.

The campaign, themed ‘Real Good Fast Food’,

is part of a three year advertising, promotion

and PR campaign that targets 18-34 year olds

and it is designed to bring eggs firmly into the

21st century and position them as a cool

convenience food that is healthy, delicious and

highly versatile. The campaign is organised in cooperation with the Irish Egg Producers Association.

Organic Products

The concept of ‘traceability’ is becoming deeply

ingrained in the consumer psyche, following recent

real or perceived threats to the food chain. The

origin of food products is becoming increasingly

more important. Ireland, with its clean green image

and generally extensive system of farming, is well

positioned to attract large-scale commercially

minded farmers to organic production.

Organic products can command a premium price

that certain segments of the consumer market are

prepared to pay. In 2003, sales of organic products

in Ireland reached an estimated retail level of

€38 million.

A record 85% of beef exports were within the

EU, which compares with 50% in 2000.

Chief Executive’s

Review

Research undertaken by Bord Bia of Irish consumer

attitudes to organic food has delivered an extensive

profile of today’s multi-faceted organic consumer.

Annual Report and Financial Statements 2003

In October, Bord Bia and the Western

Development Commission in association

with the Department of Agriculture and Food

organised the first National Organics Conference

in Co. Galway. Themed the Irish Organic Industry,

Present Challenges and Future Prospects, the event

was attended by over 200 organic producers,

processors, retailers and representatives of organic

bodies and State agencies who discussed and

debated policy, consumer research, marketing

and branding challenges and new opportunities

for organic farmers.

16

Bord Bia was invited to chair the Organic Marketing

Development Sub-Group of the newly established

National Organic Steering Group, set up by the

Department of Agriculture and Food in 2003.

Féile Bia

The Féile Bia programme is a joint venture between

Bord Bia and the Restaurants Association of Ireland

and is supported by the Irish Hotels Federation and

the farming community. Products covered under

the programme are fresh, unprocessed beef, lamb,

pork, bacon, chicken and eggs. The aims of the

programme are: to enable businesses within the

food service sector source meat and eggs from

quality assured sources; to allow consumers make

informed choices based on a transparent and

verifiable system of product sourcing and

information on origin and to assist members to

promote this unique advantage to their customers.

Féile Bia Membership is on a voluntary basis and is

open to hotels, restaurants, pubs and catering

outlets nationwide. Following a major initiative

undertaken to extend Féile Bia membership

numbers during the year, the total membership at

the end of 2003 had reached 1290 outlets.

Consumer Food,

Dairy and Drinks

The consumer food, dairy, ingredients, drinks and

horticulture sectors accounted for a combined

€4.32billion in exports in 2003. The dairy sector

saw a return to growth with estimated sales

of €1.61billion up 5% and the drinks sector

exceeded €1billion in exports, an increase of 8%,

However, the prepared foods sector recorded a fall

of 5% and edible horticulture exports, primarily

mushrooms, fell by 3%.

The rise in exports of dairy products and beverages

is encouraging. The decline in exports by the

prepared food sector marks a break in the growth

trend of recent years and points to an extremely

competitive marketplace for Irish companies.

The challenge ahead involves relentless cost

reduction combined with investment in

consumer-led new product development to move

up the value chain. Similarly the mushroom sector

has to address its cost base, maintain its retail sales

and diversify into new segments of the market

such as foodservice and ingredients.

Chief Executive’s

Review

Prepared Consumer Foods can be defined as ‘food

products that have undergone secondary

processing.’ Included in the sector are prepared

ready foods such as frozen and chilled ready meals,

pizzas, snacks, ice cream, confectionery products

and ambient grocery products. The sector is a

significant part of the food industry with sales of

€1.52billion. The fall in sales in 2003 occurred

against the background of adverse currency

movements, retail price deflation in the U.K. market

and increased competition from Eurozone

companies.

If the currency change is factored in, export

volumes actually grew by 4%. The overall challenge

for the sector is to increase competitiveness, focus

on innovation and develop new routes to market.

The prepared food sector is typically dominated

by small to medium sized manufacturers operating

in different channels including retail, foodservice,

co-packing and supply to manufacturing across a

number of markets. Predominantly companies in

this sector are building their business in Ireland

and Britain. The combined Irish and British retail

markets are valued at over €170billion. The major

issues facing companies exporting to the British

market are the increasing price-based competition

driven by the retail trade and the risk of sterling

depreciation. Scale is another issue as retailers look

to partner with larger manufacturers. For smaller

Irish companies the choice is either to focus on

well-chosen, highly targeted niche segments or to

actively pursue an expansion programme through

the introduction of new products or through

strategic partnerships.

Bord Bia has a medium term objective to

assist companies sell into continental EU

markets. Most companies in this sector have

little experience of selling outside of Ireland

and Britain. Continental Europe remains a very

diverse market subdivided both geographically

and by national characteristics. A single European

food market or a European consumer has yet to

emerge in food. There is a perception among many

Irish suppliers that Europe is too difficult to crack,

that continued opportunity exists in Britain and that

they do not have the resources available to mount

a sustained export sales drive into continental EU

markets. However, the advent of the euro and in

particular the sterling exchange rate in 2003 has

re-ignited interest in developing new customers in

selected markets in Europe.

Bord Bia believes that success in these markets

will emerge from working closely with individual

companies to identify niches or gaps in the

marketplace and matching these to the supply

capability of interested, capable and competitive

Irish suppliers.

Annual Report and Financial Statements 2003

Prepared Foods

17

Chief Executive’s

Review

Annual Report and Financial Statements 2003

Frozen Food

Britain is the main export market for the frozen

food sub-sector, which consists mainly of ready

prepared meals and pizzas. The frozen foods

market in the U.K. grew by just 2% in 2003,

with the ready prepared segment estimated

to have declined by 3%. Poor performances

and failed product launches by many of the

international brands operating in the category

also contributed to retailers transferring shelf

space to chilled product. The appreciation of

the euro against sterling, the entry of a number

of continental competitors combined with the

heavy use of price promotion by the main retailers

resulted in considerable pressure on margins for

Irish manufacturers operating in the sector.

Confectionery

The confectionery sub-sector is made up of

companies producing chocolate, sugar, snack foods

and bakery products. Chocolate value sales are

predicted to be 5% ahead of last year due to the

cost of cocoa decreasing, a number of new product

launches during 2003 and increasing distribution to

multiples and forecourts. For the confectionery

sector, there is an increasing consumer trend

towards price promotions driven by the multiples

in the British market. The challenge going forward

will be to bring new products to market, which

will exploit increased consumer demand for

convenience, snacking, indulgence and authenticity.

Key to continued success for prepared food

companies in these markets is the provision of

up-to-date market information and intelligence.

During 2003 Bord Bia’s Consumer Foods Division

further developed its strategy of providing

customised or company specific services to

this diverse client base. Information based services

are a key component of this. The Gap Analysis

service remained a firm favourite with companies,

delivering new business opportunities and resulting

in listings for many clients. Gap Analysis is a

consumer-led approach, providing category

solutions to the buyer and is aimed at meeting

consumer needs more effectively. It ensures that

new product development is driven by market and

consumer requirements increasing the chance of

success. A number of new services were added in

2003 including a Brand Audit, Brand Creation and

Brand Design service.

The Brand Forum

Complementing the company specific approach,

The Brand Forum has the objective of promoting

the importance and the advantages of the branded

route to market. The Brand Forum is exclusive to

18

The challenge going forward will be to bring

new products to market, which will exploit

increased consumer demand for convenience,

snacking, indulgence and authenticity.

Chief Executive’s

Review

food and drink companies and members range

in size from multinationals to small enterprises.

The programme provides a centre of excellence

for branding, which delivers new skills to the

industry and promotes the long-term success

of food and drink brands.

Annual Report and Financial Statements 2003

The Brand Forum met four times in 2003,

worked with 15 companies on specific brand

development projects and published the fourth

in a series of practical marketing publications

entitled “A Guide to Marketing Planning”.

20

In late 2003 Bord Bia signed a two-year agreement

with Bank of Ireland Business Banking to partner

the Brand Forum until 2005. The quarterly Brand

Fora can now be supported with practical brand

services, access to exclusive market research and

insight and food and drink brand promotion.

Representatives from more than one hundred

of Ireland’s food, drink and ingredients

manufacturing companies attended Bord Bia’s

Consumer Foods and Drink Industry Day held

in Dublin in September 2003. Themed, Paths

to Growth, the conference provided market

information and insight on retailer and foodservice

trends in Ireland, the U.K. and continental Europe.

Featuring prominent speakers from the U.K. retail

and foodservice sector, the opportunities for

Irish suppliers to grow their business within both

these trade channels featured prominently

throughout the seminar. Representatives from

Bord Bia’s overseas offices held a total of 150

meetings with companies over the two days

to discuss export sales opportunities.

Europe

Bord Bia provided a range of market intelligence

and information during 2003 to improve market

awareness and key account strategy understanding.

These included seminars, retail market reports,

market visits to continental markets and conference

reports. A newsletter was launched from Bord Bia’s

Paris office designed to make Irish companies aware

of developments in the French market. In addition,

25 companies participated on two market study

visits to Britain. The itineraries involved visits to

retail outlets, presentations on the British market

structure and visits to regional distribution centres.

A specific series of market development

programmes for the British market included

market study visits, retailer networking events,

St. Patrick’s Day promotions, inward buyer visits

and ethnic promotions. The Tesco promotion built

on the success in previous years and involved the

in-store promotion of products from 15 companies

in 100 Tesco stores.

Chief Executive’s

Review

As a result of the dramatic changes that typified

the structure of the convenience food retailing

sector in the U.K. in 2003 a seminar focused on

this topic was organised to inform Irish suppliers on

the developments in this segment of the market

and best strategies to apply to access this market.

This was attended by representatives from 60

companies and featured speakers from Nisa Today,

Kerry Direct and Budgens.

On the promotion front, Irish prepared food

companies participated at a number of sector and

channel specific trade shows in continental Europe

including ISM (Confectionery), IFCA (In-flight

Catering Exhibition) TFWA (Tax Free World

Association) and the Speciality and Fine Food Fair,

London.

USA

With exports valued at over €300m in 2003, the

United States is an important market for Irish food

and drink exports. Despite a weak dollar and

increased regulatory environment this year saw a

strong performance in exports from both the

drinks and consumer foods sectors.

An extensive programme of market development

and promotional activities designed to assist Irish

companies develop their market potential was

delivered through the Chicago office. Consumer

food companies participated in a year-long

programme aimed at introducing Irish food

products to the West Coast. In-store promotions

were carried out with key upscale retail accounts.

The programme included over 100 in-store

demonstrations in addition to advertising in retailer

magazines. Business in the eastern half of America,

which has traditionally been the market for Irish

speciality foods, was expanded using similar activity

with new retail accounts.

Annual Report and Financial Statements 2003

Bord Bia’s PERIscope study exploring consumer

attitudes to eating, cooking and shopping in Ireland

was updated to include the U.K. market in 2003,

which highlighted differences between Irish and

British consumer behaviour. The study shows that

there have been significant changes in attitudes

to cooking and shopping in Ireland including

an increased emphasis on price awareness.

In conjunction with five drink sector companies

Bord Bia participated at WSWA, the key wine and

liquor event in the US in the spring. This was

followed up with extensive research on the

opportunities for these companies in the food

service sector. This led to a group visit to the

Bennigan’s chain, which is the largest Irish themed

restaurant group in the US with over 300 outlets.

21

Chief Executive’s

Review

The IFT (Institute of Food Technologists) provided

a platform at their annual meeting to promote

Ireland’s strengths in the food ingredient market.

Four companies joined with Bord Bia on the Irish

Pavilion at the four-day event.

Wal*Mart, the world’s largest retailer, was also a key

target for Bord Bia in 2003. Following on from a

visit to Ireland by the Wal*Mart global sourcing

team in 2002, Bord Bia visited Wal*Mart

headquarters in Bentonville with a group of eight

companies interested in supplying the retailer in the

US. A number of products succeeded in being listed

and follow-up is ongoing.

Annual Report and Financial Statements 2003

Foodservice

As consumers increasingly lead a 24/7 lifestyle,

there is an ever-burgeoning demand for fast and

frequent foodservice options. Consumers eat out

more frequently and there is a consequent growth

in the mid-range and lower-to-mid spend outlets

such as fast casual, sandwiches and coffee bars.

Amongst the changes evident in the foodservice

sector has been the impact of low-carb dietary

formats. This trend will be monitored in 2004

for its sustainability. Eating out is now viewed as

a matter of fact, everyday occurrence rather than

a special event. A large proportion of the public

no longer differentiates between eating out and

eating in. In fact eating in for a special occasion is

increasing. Meals are getting lighter and fewer meals

now include a starter or dessert.

Well-established foodservice brands are increasingly

rolling out their brand in retail environments.

The boundaries between retail and foodservice

continue to blur as deli-cum supermarket concepts

become out-of-home options. Consumers are

looking for a comfortable ‘third space’ in which

to socialise, relax and dine out. The trend towards

the gastro pub is reflective of the new emphasis on

22

couple friendly outlets with comfortable interiors.

The U.K. foodservice market is valued at £24billion

and has recovered well from the recent effects

of September 11th, war with Iraq, SARS and slight

economic downturn.

In 2003, as part of the foodservice programme,

Bord Bia held 66 meetings with U.K. buyers to

present the Irish food industry; organised five buyer

contact events with leading companies including

Whitbread and Scottish and Newcastle; facilitated

four ‘workshops’ for companies looking to enter

the market; produced 12 newsletters providing

an update on market trends and developments;

published two market directories comprising

information on routes to market and key operators

in the major market segments; and worked on

seven individual client projects.

In Ireland, the foodservice market is valued at

€3.5billion and has proven robust following a

period of strong growth in the latter part of the

nineties.

In the Irish market, Bord Bia organised two

seminars attended by over 60 companies,

which focused on distribution into foodservice

and original consumer research. An all-Ireland

directory for foodservice was also launched.

Chief Executive’s

Review

This category comprises basic dairy products

such as butter and cheese as well as ingredients

for further manufacturing such as casein. 2003 saw

a rise of 5% in the value of Irish dairy/ingredients

exports to almost €1.6billion. The poor

performance in the first half of 2003 was a

continuation of the weak worldwide demand in

2002. However, with the exception of whey, the

second half of the year saw a strong increase in

demand for ingredients resulting in increased sales

to third countries.

The improvement in demand worldwide led to

a general increase in exports of all dairy products,

although returns for EU exporters were eroded

somewhat by the adverse euro/sterling/dollar

exchange rates and the reductions in refunds.

With Irish dairy production geared towards

maximising the return from quota-controlled

milk production, the product mix in 2003 saw

some considerable variations compared to 2002.

Overall Irish milk production showed an increase

of some 2% over 2002. Butter increased by around

1.5%, casein by some 7% and WMP by

approximately10%. SMP and chocolate

crumb reduced by around 5% in each case,

cheese production by around 2% and butteroil

by some 14%.

Although EU prices for butter and SMP did

improve, the weighted average returns for

these products remained unchanged in 2003.

Cheese prices in the EU market did not strengthen

mainly due to the 2002 excess stock situation,

which was further exacerbated by increased

production from the Netherlands and Germany.

Irish cheese production reduced by approximately

2% for the year mainly as a direct reaction to

the overstock situation that prevailed in the U.K.

market. Despite a fall of around 9% in U.K. cheddar

production, prices remained weak until the last

quarter of the year which, combined with the

sterling/euro exchange rate, weakened the returns

for Irish producers.

Exports to international markets increased in the

latter part of the year reflecting a strengthening

global market for dairy/ingredients. However,

exports were affected by the appreciation

of the euro against the dollar.

SMP sales to third countries more than doubled

over the same period in 2002, with WMP seeing

an increase of 33%. The demand for casein in the

first half of 2003 was low though prices lifted in the

second half of the year supporting the 7% increase

in Irish casein production. Increased demand from

markets such as Iran, Syria, Nigeria and Mexico

helped bring the stock/supply/demand balance

back into a healthier cycle.

Annual Report and Financial Statements 2003

Dairy & Food Ingredients

Given the diversity within the sector of both

companies and products and given the variable

internal and external influences on it including the

implementation of the changes in CAP, Bord Bia

assistance in 2003 focused on providing market

knowledge and access to buyers in new markets.

The changes in consumer awareness and demand

for health, nutritional and functional foods provided

23

Chief Executive’s

Review

Annual Report and Financial Statements 2003

an opportunity for dairy/ingredient companies to

increase their returns through added value exports.

While convenience has become more important,

it is no longer enough in itself to satisfy changing

consumer demands.

Consequently there is now a growing demand for

convenience foods that are perceived to be good

for one’s general health as well as suiting the new,

faster lifestyles. Functional food can be an answer

to this trend and ingredient companies are to the

forefront in this development. This has led to

increasing usage of Bord Bia as an information

source and coordinator of information and insight

on behalf of the sector. In 2003 Bord Bia organised

the first syndicated purchase of market research for

five of the main value-added ingredient producers

in the sector.

The 2003 programme of events included a seminar

entitled Health & Nutrition: Hearts & Minds, with EU

Commissioner David Byrne as keynote speaker,

supported by experts from the legislative, retail

marketing and research fields. Bord Bia organised

three market study visits to cover the sectors’

geographical and niche market interests, centred

around relevant trade exhibitions and conferences.

These were Food Ingredients China, Shanghai in

March,Vitafoods International, Geneva in May and

Food Ingredients Europe, Frankfurt in November.

Two major ingredient trade exhibitions were

organised with five companies showing at the

Institute of Food Technologists Food Expo, Chicago,

July under the ‘Ireland The Food Island’ banner

with an additional three independent exhibitors.

A total of 11 Irish companies participated at Food

Ingredients Europe, Frankfurt in November.

Beverages

The beverage sector in Ireland includes both

multinational and indigenous, Irish owned

companies involved in the production and

marketing of spirits, liqueur’s, beers, carbonates,

fruit juices and bottled water. Exports of beverages

(including all alcoholic and non-alcoholic beverages

and juices) increased by 8% in 2003 to reach a total

value of €1.02 billion. This increase was primarily

due to strong performances in key markets

such as the U.K., U.S. and continental Europe.

Cream liqueur’s, spirits and malt beer were the

principal product categories.

Consumer lifestyle changes and a move towards

lighter alcohol products and concerns around

‘sensible drinking’ were the main trends during

the year. All the multinational companies market

and promote their products on a global basis and

many new brands are now positioned to sell on

this basis. This remains a challenge for indigenous

suppliers as they build their international

distribution networks.

Great Britain remains the largest export market

for Irish beverages, accounting for 41% of total

exports. However, this market is becoming

increasingly competitive and suppliers are likely

to experience continued price pressure from U.K.

retailers. The U.S. is the second largest market and

accounts for around 18% of total exports.

Spirit sales on the domestic market fell by 20%

in 2003 due to weaker consumer spending and

increased excise duties. Exports of Irish whiskey

expanded by around 8% in 2003 due to the

24

Chief Executive’s

Review

The production of cream liqueurs is the largest

segment of beverage exports and accounts for

approximately 48% of total exports in the sector.

The increase in exports is in double-digit figures

with very strong performances from the U.K. and

U.S. markets.

In 2003, Bord Bia continued to assist Irish beverage

companies with a variety of customised activities

and services specifically designed for the drinks

industry. Building international distribution networks

and developing buyer relationships are key success

factors for the industry. The Bord Bia programme

of activities was developed in cooperation with the

industry and included in the programme was the

organisation of participation at international trade

shows such as Vinexpo in Bordeaux, Tax Free World

Association, Cannes and WSWA, Orlando, USA.

Bord Bia also organised trade missions to the

emerging markets of Czech Republic, Hungary

and Poland during the year.

Edible Horticulture

Irish exports of edible horticulture fell by

approximately 3% in 2003 to €180 million.

The sector is dominated by exports of fresh

mushrooms to the U.K. retail trade. Approximately

75% of all mushroom production in Ireland is

exported to the U.K. retail market, with Irish

producers now supplying nearly 45% of their

total fresh mushroom requirements. Intense price

pressure continues from the U.K. retailers through

Internet auctions and aggressive pricing structures.

The opportunity for any price increases is very

unlikely and margins in the business have been

squeezed considerably in 2003. There has been

increased activity from both Dutch and Polish

producers on the U.K. market and this has also

added to price pressure within the U.K. market.

The Task Force on the Mushroom Industry

was set up by Mr. Noel Treacy, Minister of State,

Department of Agriculture & Food, to examine

the critical issues facing the sector and to draw

up a coordinated action plan to ensure the future

of the industry. Bord Bia, in co-operation with the

major Irish mushroom marketing companies, jointly

funds a quarterly U.K. market information report

provided by Taylor Nelson Sofres providing up-todate data on sales, trends and buying patterns.

Irish companies will seek to take costs out of their

business to help offset the margin squeezing effect

of the continuing downward price pressures and

the increasing activity from EU-based competitors.

One area that is showing some growth for the

industry is the foodservice and food ingredients

sectors in the U.K. Companies will continue to

target new market opportunities as well as

maintaining their share of the retail sector.

Bord Bia is working with the key industry players on

the U.K. market on an individual basis.

Annual Report and Financial Statements 2003

opening and development of new markets and

continued investment in marketing and promotional

campaigns. Exports of stout declined, which is

consistent with the downturn in the overall beer

market, however, good growth was achieved in the

export of a key-brewing component manufactured

in Ireland.

25

Chief Executive’s

Review

Small Business &

Speciality Food

Smaller Irish companies in the speciality food

sector have seen strong sales growth over the

past year targeting the two core markets of Ireland

and Britain.

Annual Report and Financial Statements 2003

Growth is being driven by increased consumer

demand for variety, convenience and pleasure,

which authentic speciality food can offer.

Ireland's small food producers have increased

trade listings and their distribution in Ireland

and Britain has broadened.

It is estimated that speciality foods now have a

total value of €450m at retail prices. The sector

continues to expand and Bord Bia works with

over 300 small food producers assisting them

in successfully marketing their products to

independent and multiple retailers. The sector

has increased trade listings and distribution to

reach an expanding consumer base in line with

a broadening of premium food sales generally

in both Irish and British markets.

Bord Bia delivered services in distribution

improvement, trade and consumer public

relations, marketing competency development,

buyer relationship management and promotions

specifically for the speciality and small business

sector in 2003.

Bord Bia specifically supported Farmers’ Markets

as a new route to market for speciality food to

consumers in Ireland, including web-based advice

* Traditional Artisan Speciality Trade Expertise in Food

26

and assistance for people looking to establish a

market, web-based promotion of 32 farmers’

markets country wide and the set up and

marketing of a farmers’ market at Farmleigh

in conjunction with the OPW.

Bord Bia facilitated the establishment of the

TASTE* Council launched by the Minister for

Agriculture and Food, Mr. Joe Walsh T.D., in

October 2003. This is a representative group

of fine food operators set up to encourage the

strategic development of the speciality food sector.

Bord Bia is the official coordinator for the group

assisting them in designing and agreeing strategic

objectives for the sector’s development.

The goals of the TASTE Council are to raise

the profile of the sector, to provide a vehicle to

represent the strategic development of the sector

in a cohesive manner and to develop practical

outputs for change in order to empower and

enable the development of the sector.

North South Programme

Bord Bia continued its joint North South

programme with Invest Northern Ireland focusing

on developing the marketing capabilities of

speciality food companies. The projects included

joint participation at the Fine Food Fair in London

Chief Executive’s

Review

Ireland The Food Island

One of the main ways in which Bord Bia assists the

Irish food and drink industry is in the promotion

of the capability of the industry to trade buyers

and through the development of the image of

‘Ireland The Food Island’. This is an umbrella brand,

which captures the naturalness, traceability and

confidence in production that customers desire.

The campaign mix includes trade show

participation, direct mail, trade advertising

and selected sponsorships. In 2003 the major

focus of sponsorship activity was the Ireland The

Food Island Champion Stakes. This sponsorship

concluded in 2003 as it had successfully achieved

its original objectives.

Bord Bia will focus its sponsorship resources

from now to 2006 to maximise the benefit to

the food and drink industry from its sponsorship

of the Ryder Cup match that takes place in Ireland

in 2006.

In 2003, Bord Bia in association with the Food and

Drink Federation of IBEC and AIB, launched the

inaugural Ireland The Food Island Food & Drink

Industry Awards to reward best practice in this

important industry. The response from companies

was extremely positive with 196 applications

received across the six categories from 120

companies. The winners were announced at

a Gala Dinner and Awards ceremony attended

by 400 guests. €30,000 was raised for the two

benefiting charities Self Help and Barnardos.

Quality Assurance

Bord Bia has been operating quality assurance

schemes for a number of years. Currently schemes

are operating in the beef, pigmeat and egg sectors

and a scheme in the chicken sector will be formally

issued in 2004. Expert groups representing

producers, processors and the regulatory

authorities developed the schemes. The purpose

of the quality assurance schemes is to facilitate

member companies’ gain a competitive edge in the

marketplace by giving consumers added assurance

about the origin, integrity and wholesomeness of

the product.

In 2003 a key quality assurance activity involved the

revision of the beef quality assurance scheme to

bring it into line with the requirements of the

benchmark standard EN45011. One of the key

requirements of the EN45011 standard relates to

administrative structures and requires that the

body providing the certification is structured so

that it is impartial and allows all interests to

participate without any single interest

predominating. The revised beef scheme, due in

2004, will involve independent auditing and

certification of producers and processors.

Annual Report and Financial Statements 2003

where 14 companies from North and South came

together to exhibit an extended range of products

and meet key independent and retail multiple

buyers. A new marketing best practice programme

was launched with the Northern Ireland Food and

Drink Association (NIFDA) and InterTrade Ireland

to keep food SMEs up-to-date on the scale and

pace of innovation taking place in world food

markets at manufacturing and retail level.

27

Chief Executive’s

Review

Quality assurance is a market necessity and the

EN45011 beef scheme will facilitate the continued

competitiveness of beef in the marketplace.

Annual Report and Financial Statements 2003

Event Services

28

The international trend towards smaller sectoral

shows continued in 2003. Reflecting this trend

and Bord Bia’s focused marketing programmes

Ireland participated at nine sector-focused

exhibitions providing a platform for Irish companies

to promote their capabilities to a targeted

audience. Industry sectors targeted were

ingredients (Food Ingredients Europe and

International Food Technology); confectionery

(ISM); alcoholic beverages (VinExpo); foodservice

(IFCA); speciality food (Maastricht Fine Food Fair

and Fine Food London); travel retail (TFWA);

livestock (Royal Highland Show).

However, the international flagship exhibitions

continued to be of major importance to the meat

and dairy sectors, with participation at Anuga

and World Food Moscow. Exhibitors at Anuga

reported a return in buyer attendance to

pre-2001 levels and all were very satisfied

with the quality of buyers particularly those

from International markets. Over 60 Irish

companies participated under the Ireland

The Food Island banner during 2003.

In addition to trade exhibitions, Bord Bia organised

15 conferences including the National Organics

Conference, Food Safety conference in Cairo

and a seminar on Functional Foods in Dublin

and hosted the Ireland The Food Island Champion

Stakes in Leopardstown. Other major events

coordinated throughout the year included

Bord Bia's participation at the National Ploughing

Championships and in Ireland, The Food Island

Food and Drink industry awards. 35 inward buyer

itineraries were organised in the course of 2003.

Marketing Finance

Throughout the year, two marketing grant

assistance programmes operated. The Marketing

Improvement Assistance Programme (MIAP)

and the Market Participation Programme (MPP)

are both confined to SME food and drink

companies. The MIAP gives assistance to

companies dealing with a range of specific food

products which include bio-yogurts, chilled dairy

products, farmhouse cheeses, jams, preserves

and charcuterie. The MPP deals with companies

manufacturing and marketing other food and

drink products, mainly in the chocolate

confectionery, sauces and alcoholic drink sectors.

In 2003, under Bord Bia’s marketing grants

schemes, one hundred and thirty nine companies

applied. Eighty-five companies received grants

to the value of €973,000.

Chief Executive’s

Review

Information Services

The Client Portal or Extranet was launched

mid-year and provides electronic access to Bord Bia

material that is largely available in printed form as

well. However, companies can access the material

around the clock and the technology will enable

Bord Bia deliver additional services via this medium

that would be prohibitively expensive in traditional

printed form.

Information services published reports on

the domestic market for organic products

and the associations consumers in Europe

attribute to products of Irish origin. An update

of the PERIscope (Purchasing and Eating in the

Republic of Ireland) study was undertaken in 2003,

on this occasion comparing Irish consumers to their

British counterparts.

A number of exploratory papers were produced

which synthesised published material on the topics

included vending and the mature consumer market.

In addition, a research note on the Brazilian beef

industry was published. The Information

department dealt with 4560 direct enquiries from

Irish companies and Bord Bia’s website received in

excess of 98,000 hits.

Annual Report and Financial Statements 2003

During the year, Bord Bia went live with two

extranets that it had been developing throughout

2002. The Producer Portal is an on-line version

of its printed Market Monitor and was offered

to renewing subscribers. As well as offering faster

access to information for readers, it has allowed

a saving on print and postage costs.

Michael Duffy*

Chief Executive

* See note on page 7 regarding Interim Chief Executive from 7th May 2004

29

Corporate

Statement

Governance

Equality

The Board adopted the Code of Practice for the

Governance of State bodies in December 2001 and

the provisions of the Code are being implemented.

The Board is committed to maintaining the highest

standards of Corporate Governance and Best

Practice and monitors compliance on an ongoing

basis. The Secretary is responsible to the Board for

ensuring that procedures are implemented and that

relevant legislation, regulations and guidelines are

complied with.

Bord Bia is committed to ensuring equality

of opportunity and its personnel and staff

development programmes are structured

accordingly. Bord Bia endeavours to assist

staff in relation to career and personal needs

and operates appropriate policies covering such

areas as educational programmes, study leave,

job-sharing and career breaks. Bord Bia is also

committed to implementing government policy

in relation to the employment of disabled people

in the public sector. Specific additional provisions

were made for disabled visitors in the construction

of Bord Bia’s Food Centre. There is a policy on

sexual harassment in operation to support and

protect the dignity of each person.

Annual Report and Financial Statements 2003

Ethics in Public Office

30

The provisions of the Ethics in Public Office Act

1995 and the Standards in Public Office Act 2001

are being implemented.

Freedom of Information

Bord Bia is a prescribed organisation under

the Freedom of Information Act (FOI) 1997.

The Act established three new statutory rights:

• A legal right for each person to access

information held by public bodies;

• A legal right for each person to have official

information held by a public body, relating to

him/herself, amended where it is incomplete,

incorrect, or misleading;

• A legal right to obtain reasons for decisions

affecting oneself taken by a public body.

Safety, Health and

Welfare at Work

Bord Bia is implementing the provisions of Safety,

Health & Welfare at Work legislation, including the

preparation and operation of a Safety Statement

embracing all matters affecting safety, health and

welfare of staff and visitors to Bord Bia’s premises.

Clients’ Charter

Bord Bia has published a Clients’ Charter setting

out its commitment to the Principles of Quality

Customer Service for Customers and Clients of

the Public Sector. The Charter is supported by an

Action Plan and appropriate internal procedures

to give practical effect to this commitment.

Corporate

Statement

Bord Bia is committed to making every effort

possible to be energy-efficient and to operate

appropriate conservation and recycling measures.

Board Responsibilities

Section 21 of An Bord Bia Act 1994 requires the

Board to "keep in such form and in respect of such

accounting periods as may be approved by the

Minister, with the consent of the Minister for

Finance, all proper and usual accounts of monies

received or expended by it, including an Income

and Expenditure Account, a Cash Flow Statement

and a Balance Sheet and, in particular, shall keep in

such form as aforesaid all such special accounts as

the Minister may, or at the request of the Minister

for Finance shall, from time to time direct and the

Board shall ensure that separate accounts shall be

• State whether applicable accounting standards

have been followed, subject to any material

departures disclosed and explained in the

financial statements.

The Board is responsible for keeping proper books

of account, which disclose, with reasonable accuracy

at any time, the financial position of Bord Bia.

The Board is also responsible for safeguarding

the assets of the company and hence for taking

reasonable steps for the prevention and detection

of fraud or other irregularities.

There is an Audit Committee of the Board to which

the internal auditor and the external auditor have

full and unrestricted access.

Philip Lynch

Chairman

kept and presented to the Board by any Subsidiary

Board that may be established by the Board under

this Act and these accounts shall be incorporated

in the general statement of account of the Board."

In preparing these financial statements the Board is

required to:

• Select suitable accounting policies and

then apply them consistently.

• Make judgements and estimates that

are reasonable and prudent.